Regarding the legitimacy of GOFX forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is GOFX safe?

Pros

Cons

Is GOFX markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

TouchStone Markets Limited

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

https://www.gold-touch.ioExpiration Time:

--Address of Licensed Institution:

Room 302(B), House of Francis, Ile Du Port, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4327262Licensed Institution Certified Documents:

Is GOFX A Scam?

Introduction

GOFX is a forex and CFD broker that has emerged in the trading landscape since its establishment in 2020. Positioned primarily to serve traders in Southeast Asia, particularly in Thailand, GOFX offers a range of trading instruments, including forex, commodities, indices, and cryptocurrencies. As with any broker, it is crucial for traders to assess the trustworthiness and reliability of GOFX before committing their funds. This is particularly important in the forex market, where the risk of scams and unregulated entities is prevalent.

In this article, we will conduct a comprehensive analysis of GOFX, focusing on its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risk assessment. Our investigation is based on a review of various online sources, including user reviews, regulatory filings, and expert analyses, to provide a balanced view of whether GOFX is a legitimate broker or potentially a scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. GOFX claims to be regulated by the Seychelles Financial Services Authority (FSA) and is also registered in St. Vincent and the Grenadines. While these jurisdictions provide some level of oversight, they are often considered offshore regulators, which may not offer the same level of investor protection as more reputable authorities like the FCA (UK) or ASIC (Australia).

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD118 | Seychelles | Verified |

| SVG FSA | 25865 BC 2020 | St. Vincent | Verified |

The quality of regulation is paramount; while the Seychelles FSA does impose certain requirements on brokers, it lacks the stringent oversight characteristic of top-tier regulators. This raises concerns about the level of safety and investor protection afforded to clients. Furthermore, GOFX does not offer features such as negative balance protection, which is essential for safeguarding traders from incurring debts greater than their account balance.

Company Background Investigation

GOFX is operated by Touchstone Markets Limited, which is registered in St. Vincent and the Grenadines. The company has positioned itself as a key player in the Southeast Asian trading market, aiming to provide a user-friendly platform for both novice and experienced traders. However, the relatively short history of the broker raises questions about its long-term reliability and stability.

The management team at GOFX comprises professionals with experience in financial technology and trading, although detailed biographies and qualifications are not readily available on their website. This lack of transparency can be a red flag for potential clients who seek to understand the expertise behind the broker's operations.

In terms of information disclosure, GOFX has been criticized for not providing comprehensive details about its operations, including its physical address and contact information. This can lead to skepticism regarding the broker's legitimacy and accountability.

Trading Conditions Analysis

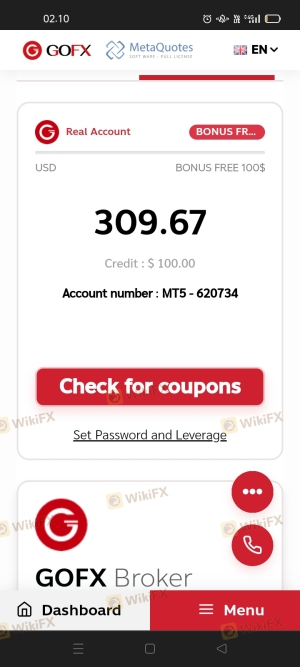

The trading conditions at GOFX are a significant aspect of its offering. The broker provides a variety of account types, all of which require a minimum deposit of just $1, making it accessible for new traders. However, the low minimum deposit may also attract inexperienced traders who may not fully understand the risks involved, especially given the high leverage offered (up to 1:3000).

The overall fee structure is a mix of competitive and concerning elements. While the spreads start from 1 pip for most accounts, there are reports of hidden fees and charges that may apply, particularly for withdrawals and inactivity.

| Fee Type | GOFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 0.5 - 1 pip |

| Commission Model | $3.50/lot | $0 - $3/lot |

| Overnight Interest Range | Not specified | Varies widely |

The lack of clarity regarding fees can potentially lead to unexpected costs for traders, which is a significant concern. Additionally, the absence of detailed information about overnight interest and other charges can complicate the trading experience.

Client Fund Safety

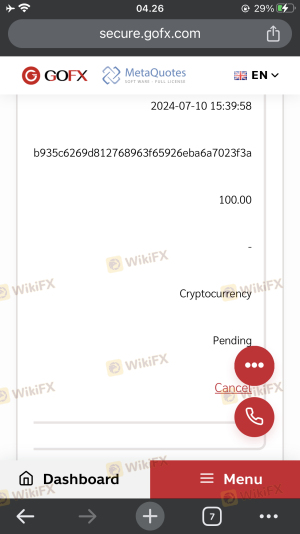

Client fund safety is a critical concern for any trader, and GOFX has implemented several measures to protect traders' funds. The broker claims to keep client funds in segregated accounts, which is a positive aspect. However, the absence of negative balance protection raises alarms, as traders could theoretically lose more than their initial investment.

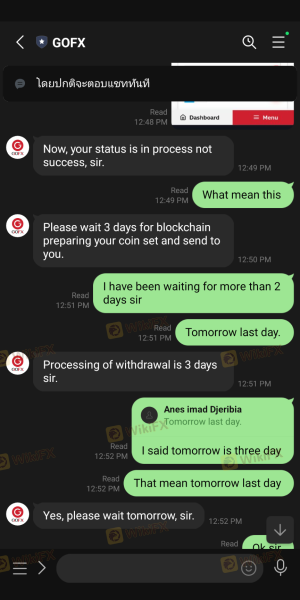

Historically, there have been reports of withdrawal issues from GOFX, where clients have faced difficulties in accessing their funds. Such incidents can severely undermine trust in the broker and highlight the importance of ensuring that a broker has a solid track record in handling client funds.

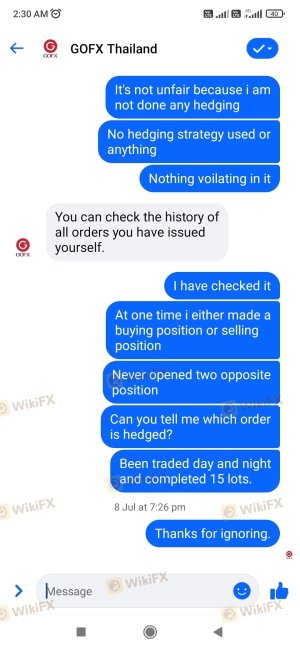

Customer Experience and Complaints

Customer feedback is an invaluable source of information when assessing a broker's reliability. Reviews of GOFX reveal a mixed bag of experiences, with several users reporting issues related to withdrawal processes, customer support responsiveness, and overall satisfaction with the trading platform.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow or unresponsive |

| Poor Customer Support | Medium | Limited options |

| High Leverage Risks | High | Acknowledged but not addressed |

One notable case involved a trader who reported being unable to withdraw funds after multiple requests, leading to significant frustration and loss of trust in the broker. Such recurring complaints can indicate systemic issues within the broker's operations and customer service framework.

Platform and Execution

The trading platform offered by GOFX is MetaTrader 4 (MT4), a widely used platform known for its robust features and user-friendly interface. However, the platform has been criticized for its performance stability, with some users reporting issues related to order execution quality, including slippage and rejections.

The execution quality is a crucial factor for traders, especially in fast-moving markets. Reports of high slippage and rejected orders can be detrimental to trading performance, leading to potential losses.

Risk Assessment

Using GOFX presents several risks that potential traders should be aware of. The combination of high leverage, low minimum deposit requirements, and offshore regulation creates a precarious trading environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight |

| Fund Safety Risk | High | Lack of negative balance protection |

| Execution Risk | Medium | Reports of slippage and order rejections |

To mitigate these risks, traders are advised to conduct thorough research, utilize risk management strategies, and consider starting with a demo account to familiarize themselves with the platform before committing real funds.

Conclusion and Recommendations

In conclusion, while GOFX presents itself as a viable trading option, several red flags warrant caution. The broker's offshore regulatory status, lack of negative balance protection, and mixed customer feedback indicate potential risks for traders.

For those considering trading with GOFX, it is advisable to proceed with caution. New traders, in particular, may want to explore more reputable and well-regulated alternatives, such as brokers licensed by the FCA or ASIC, which offer greater security and transparency.

Overall, while GOFX is not outright labeled a scam, the potential risks and concerns highlighted in this assessment suggest that traders should carefully weigh their options and consider more established brokers for a safer trading experience.

Is GOFX a scam, or is it legit?

The latest exposure and evaluation content of GOFX brokers.

GOFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GOFX latest industry rating score is 4.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.