Fusion Markets 2025 Review: Everything You Need to Know

Executive Summary

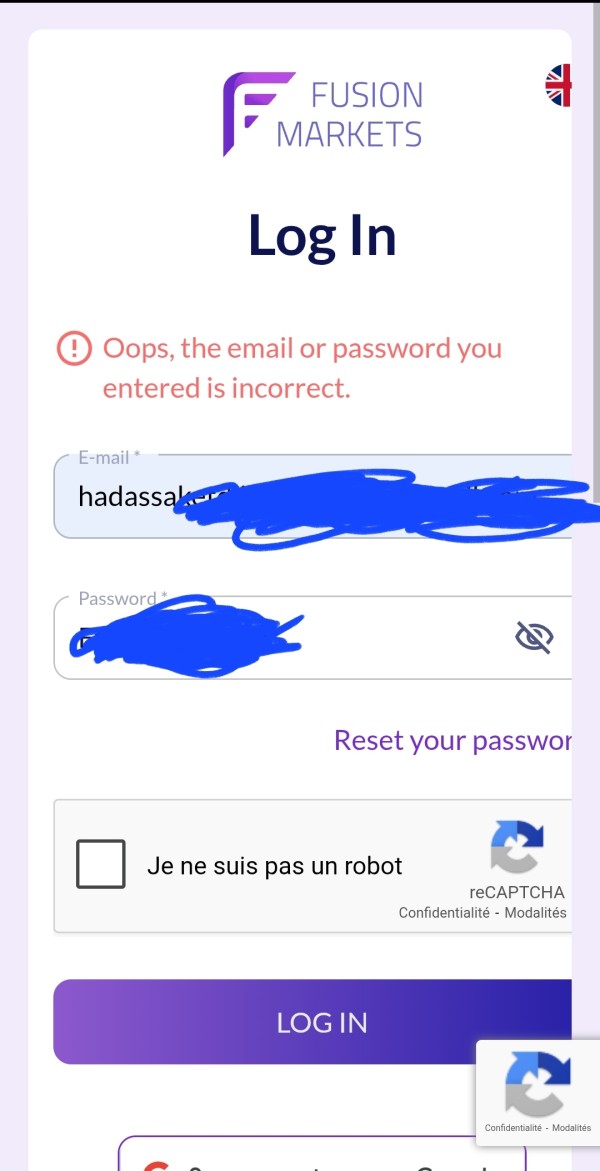

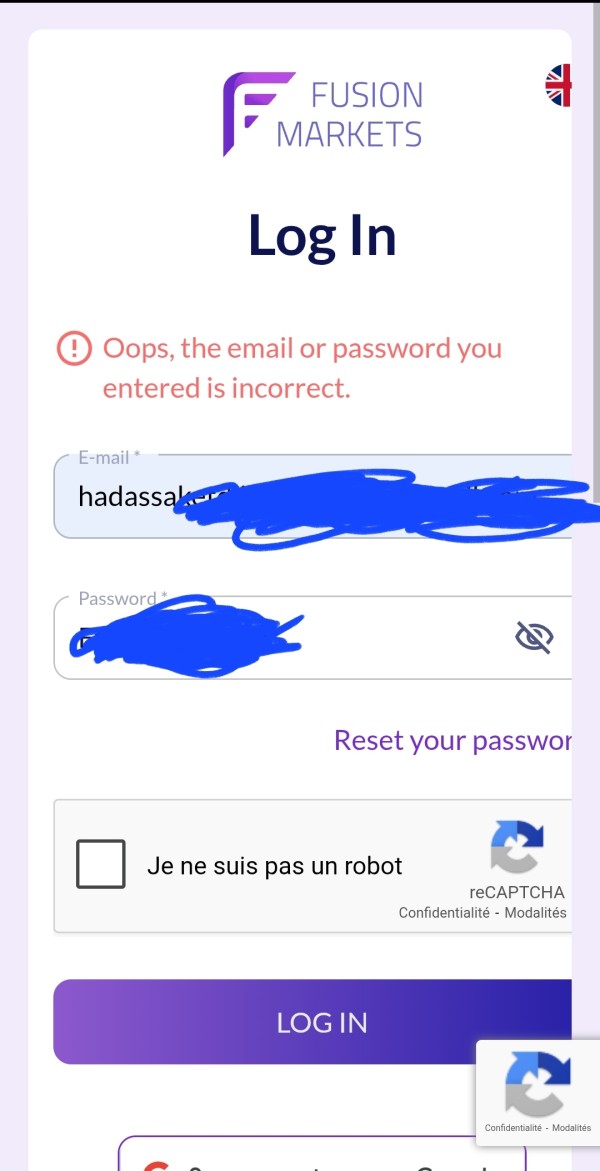

Fusion Markets is an Australian-regulated forex broker. This company has gained significant attention in the trading community since it started in 2017. This fusion markets review shows a broker that works hard to provide low-cost trading solutions with competitive market access. Multiple industry sources confirm that Fusion Markets operates under strict rules from the Australian Securities and Investment Commission (ASIC license 385620), Vanuatu Financial Services Commission (license 40256), and the Financial Services Authority of Seychelles (license SD096).

The broker has several key features that make it stand out. These include very low entry barriers with minimum deposits starting from just $1, competitive spreads from 0.0 pips, and maximum leverage up to 1:500. Fusion Markets supports multiple trading platforms including MetaTrader 4, MetaTrader 5, and their own MetaFX platform. This setup helps traders with different preferences and strategies.

The main customers for Fusion Markets include both new retail traders who want affordable market entry and experienced investors looking for cost-effective trading solutions. They can trade forex, commodities, cryptocurrencies, stocks, and indices. User feedback consistently shows positive trading experiences, with particular praise for the broker's execution speed and platform stability.

Important Notice

Fusion Markets operates through different regulatory entities across various jurisdictions. Each entity follows distinct legal and regulatory frameworks. Australian clients trade under ASIC regulation, while international clients may fall under Vanuatu or Seychelles oversight. Each jurisdiction offers different levels of investor protection and compensation schemes. Prospective traders should carefully review the specific regulatory environment that applies to their jurisdiction before opening an account.

This review uses publicly available information, regulatory filings, and user feedback from multiple sources. The analysis aims to provide an objective assessment of Fusion Markets' services. However, individual trading experiences may vary based on personal circumstances and trading strategies.

Rating Framework

Based on comprehensive analysis of available data and user feedback, here are our ratings across six key dimensions:

Broker Overview

Fusion Markets started in the competitive forex landscape in 2017. The company had a clear mission to make trading easier through low-cost access to global markets. The broker is headquartered in Australia and has built its reputation on providing institutional-grade trading conditions to retail traders. The company operates on a No Dealing Desk (NDD) model, which means client orders go directly to liquidity providers without dealer intervention. This approach can reduce conflicts of interest and ensure more transparent pricing.

The company's business philosophy focuses on removing traditional barriers to market access. They especially target high costs and complex account requirements that often exclude smaller traders. This approach has worked well with the trading community, as shown by generally positive user reviews across multiple platforms including Trustpilot. Users frequently praise the broker's execution speed and cost structure.

Fusion Markets offers comprehensive trading solutions across multiple asset classes. They provide access to over 90 forex pairs, major commodities including gold and oil, popular cryptocurrencies, global stock indices, and individual equity CFDs. The broker supports various trading platforms including the industry-standard MetaTrader 4 and MetaTrader 5, alongside their own MetaFX platform designed for more advanced trading strategies. Regulatory oversight comes from three respected financial authorities: the Australian Securities and Investment Commission (ASIC), the Vanuatu Financial Services Commission (VFSC), and the Financial Services Authority of Seychelles (FSA). This provides multiple layers of client protection and operational oversight.

Regulatory Coverage: Fusion Markets operates under a multi-jurisdictional regulatory framework. Australian operations fall under ASIC oversight (license 385620), which provides strong client fund protection and adherence to strict operational standards. International clients are served through Vanuatu (license 40256) and Seychelles (license SD096) entities. Each offers appropriate regulatory protection for their respective jurisdictions.

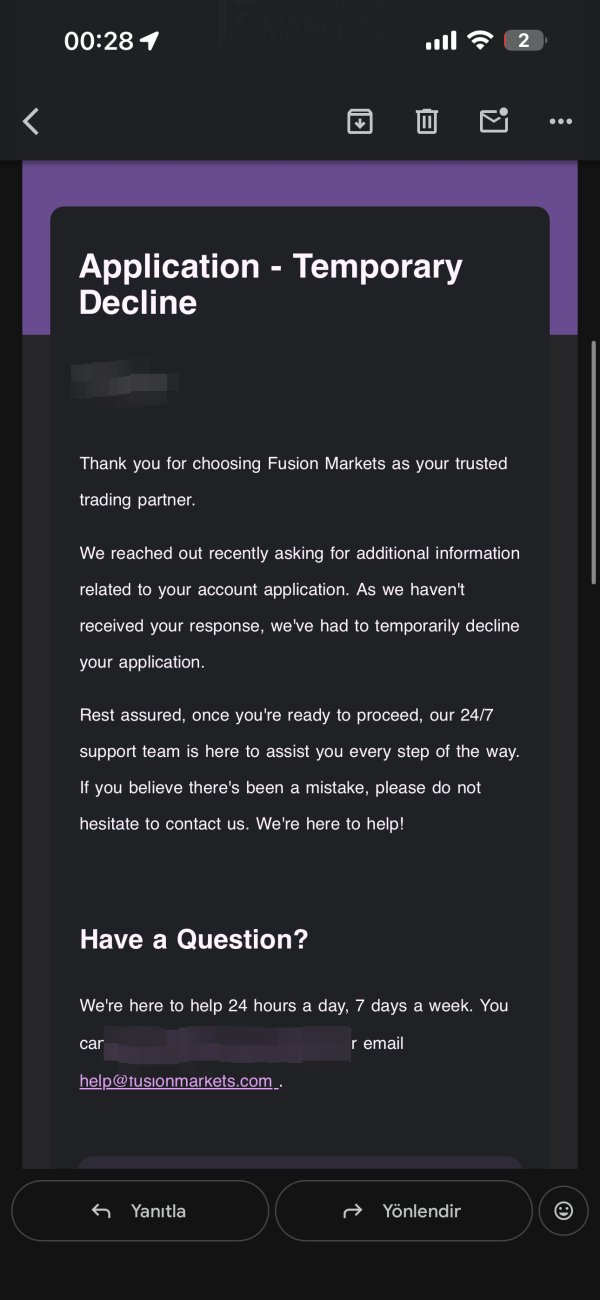

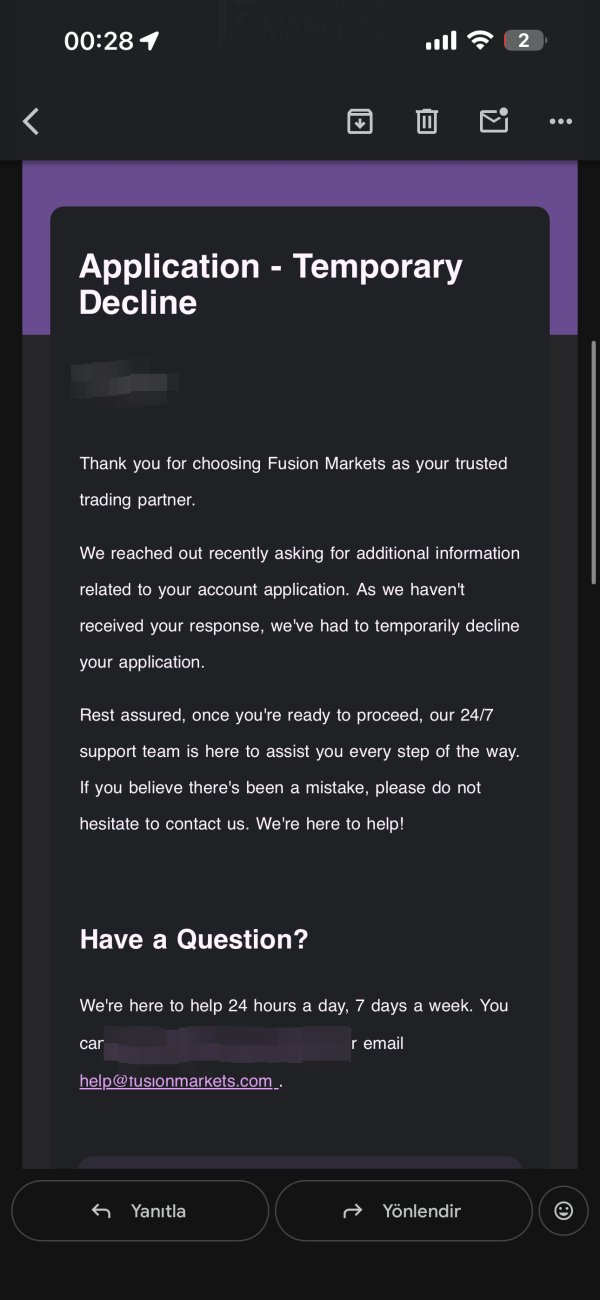

Funding Options: The broker supports various deposit and withdrawal methods. These include bank wire transfers, credit and debit cards, and popular e-wallet solutions, though specific payment processors may vary by region and regulatory entity.

Minimum Deposit: One of Fusion Markets' most attractive features is the exceptionally low $1 minimum deposit requirement. This makes it accessible to traders with limited capital.

Promotional Offers: Current available information does not specify active bonus programs or promotional campaigns. This suggests the broker focuses on competitive trading conditions rather than marketing incentives.

Trading Instruments: The asset universe spans major and minor forex pairs, precious metals, energy commodities, cryptocurrency CFDs, global stock indices, and individual share CFDs. This provides comprehensive market exposure for diversified trading strategies.

Cost Structure: Fusion Markets uses a transparent pricing model with spreads starting from 0.0 pips on major currency pairs and commission rates beginning from $0. However, standard accounts typically feature commission-based pricing for tighter spreads.

Leverage Ratios: Maximum leverage reaches 1:500 for forex trading. However, actual leverage may vary based on account type, instrument category, and regulatory jurisdiction.

Platform Selection: Traders can choose from MetaTrader 4, MetaTrader 5, and the broker's own MetaFX platform. Each offers distinct features for different trading styles and experience levels.

This comprehensive fusion markets review indicates a broker designed for cost-conscious traders seeking professional-grade trading conditions across multiple markets.

Detailed Rating Analysis

Account Conditions Analysis (9/10)

Fusion Markets excels in account accessibility and structure. The company earns top marks for its inclusive approach to trader onboarding. The standout feature remains the $1 minimum deposit requirement, which effectively removes financial barriers for new traders wanting to test live market conditions without significant capital commitment. This approach contrasts sharply with industry competitors who often require hundreds or thousands of dollars for account activation.

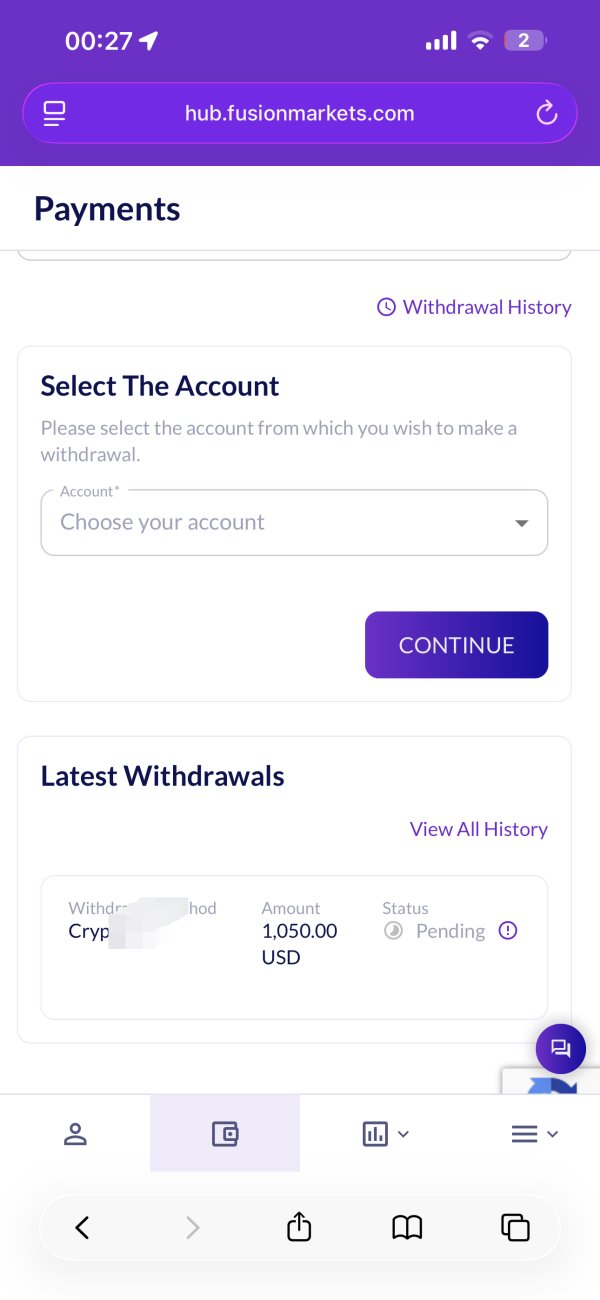

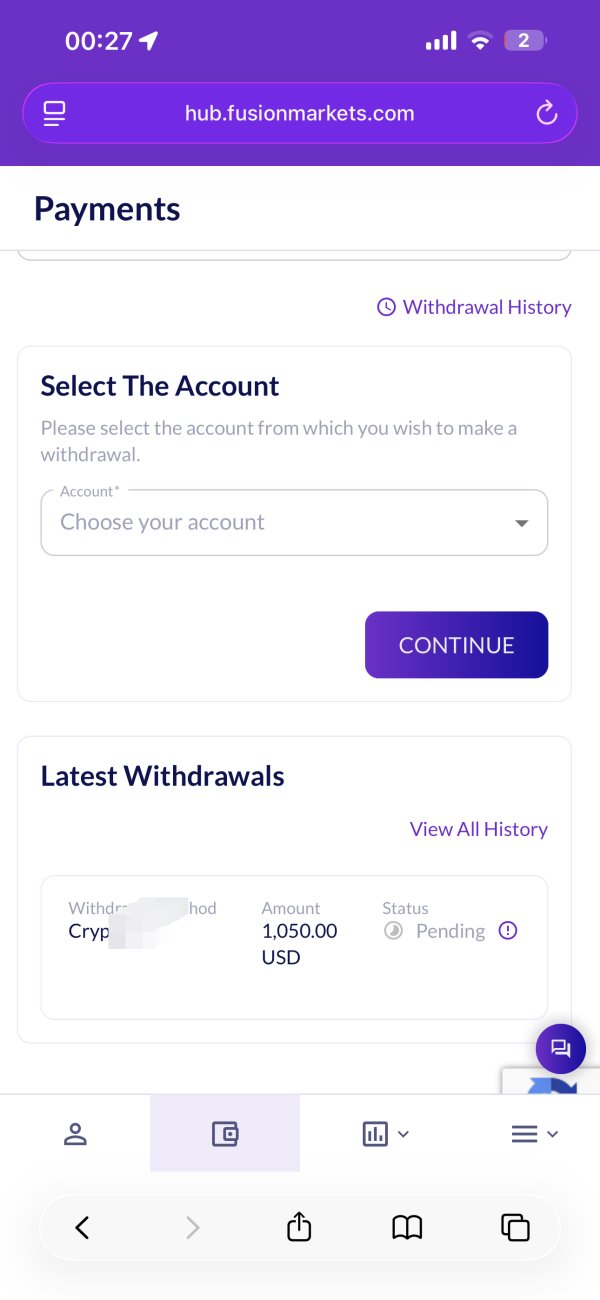

The account opening process receives consistently positive feedback from users. They describe it as streamlined and efficient. According to multiple review sources, the verification procedures are thorough yet not unnecessarily complex, typically completed within standard timeframes. While specific account type variations aren't detailed in available sources, the broker appears to focus on providing uniform access to competitive trading conditions rather than creating artificial tiers that restrict features based on deposit size.

Commission structures starting from $0 demonstrate the broker's commitment to cost transparency. However, traders should note that the most competitive spreads typically come with commission-based pricing models. This structure benefits active traders who can achieve lower overall trading costs compared to spread-only pricing models offered by many competitors.

The lack of detailed information about specialized account features such as Islamic accounts or institutional-grade offerings represents a minor limitation in this fusion markets review. However, the core account conditions remain highly competitive for mainstream retail trading needs.

Fusion Markets provides a solid foundation of trading tools through its multi-platform approach. The company supports MetaTrader 4, MetaTrader 5, and the proprietary MetaFX platform. This diversity allows traders to select platforms that best match their technical analysis preferences and automated trading requirements. MT4 remains popular for its extensive Expert Advisor (EA) support and custom indicator compatibility, while MT5 offers enhanced analytical capabilities and multi-asset trading features.

The MetaFX platform represents the broker's effort to provide a modern trading interface. However, specific feature details aren't extensively documented in available sources. User feedback suggests the platforms maintain good stability and execution speeds, critical factors for active trading strategies. The support for automated trading through Expert Advisors appeals to algorithmic traders seeking to implement systematic trading approaches.

However, this analysis reveals gaps in available information regarding proprietary research resources, market analysis tools, and educational content. Many competitive brokers provide daily market commentary, technical analysis, and educational webinars, but such offerings aren't clearly highlighted in current Fusion Markets documentation. This represents a potential area for improvement, particularly for newer traders who benefit from guided learning resources.

The platform selection covers essential trading needs effectively. However, the apparent lack of comprehensive research and educational resources prevents a higher rating in this category.

Customer Service and Support Analysis (7/10)

Customer support quality receives generally positive mentions in user reviews. However, specific performance metrics and detailed service level information aren't readily available in current sources. The broker appears to offer standard support channels including phone, email, and live chat options, meeting basic accessibility expectations for client communication needs.

User feedback suggests that support quality is satisfactory. No significant negative patterns emerge from available review sources. However, the absence of detailed information about response times, support hours, and multilingual capabilities limits the depth of this analysis. Professional forex brokers increasingly compete on support quality, making comprehensive service level transparency important for trader confidence.

The lack of specific information about support team expertise represents a documentation gap. This particularly affects platform technical issues and trading-related inquiries. Traders often require assistance with platform setup, account verification processes, and trading condition clarifications, making support team knowledge crucial for user satisfaction.

While available feedback doesn't indicate significant support problems, the limited detailed information about service capabilities and performance metrics prevents a higher confidence rating in this critical service area.

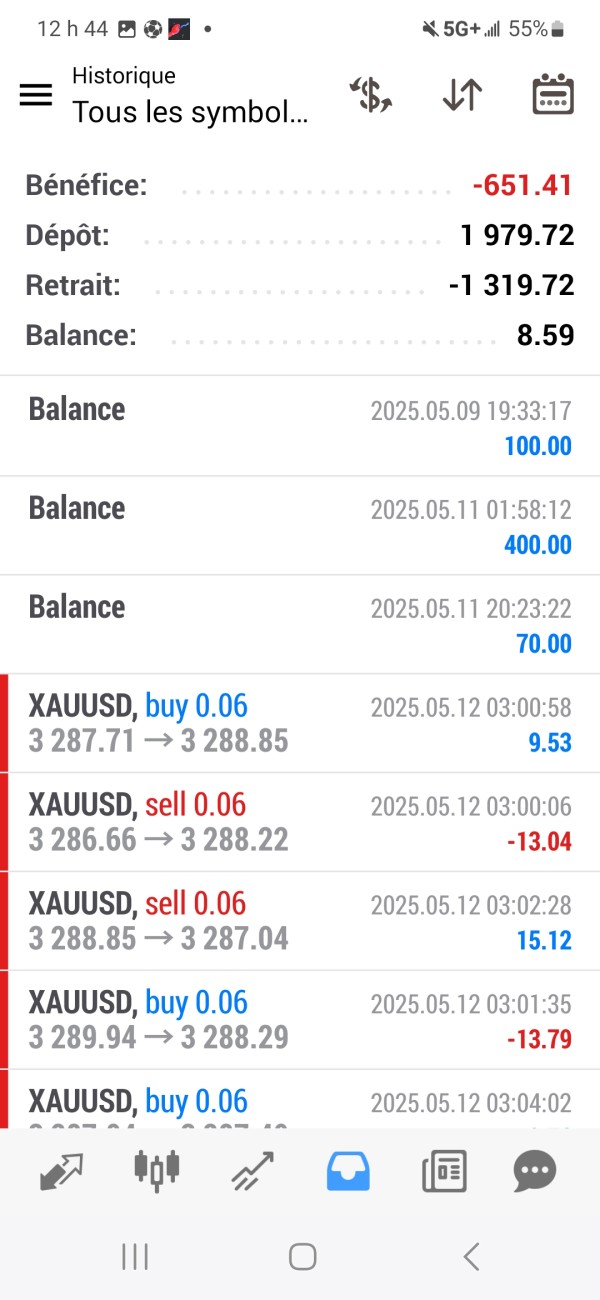

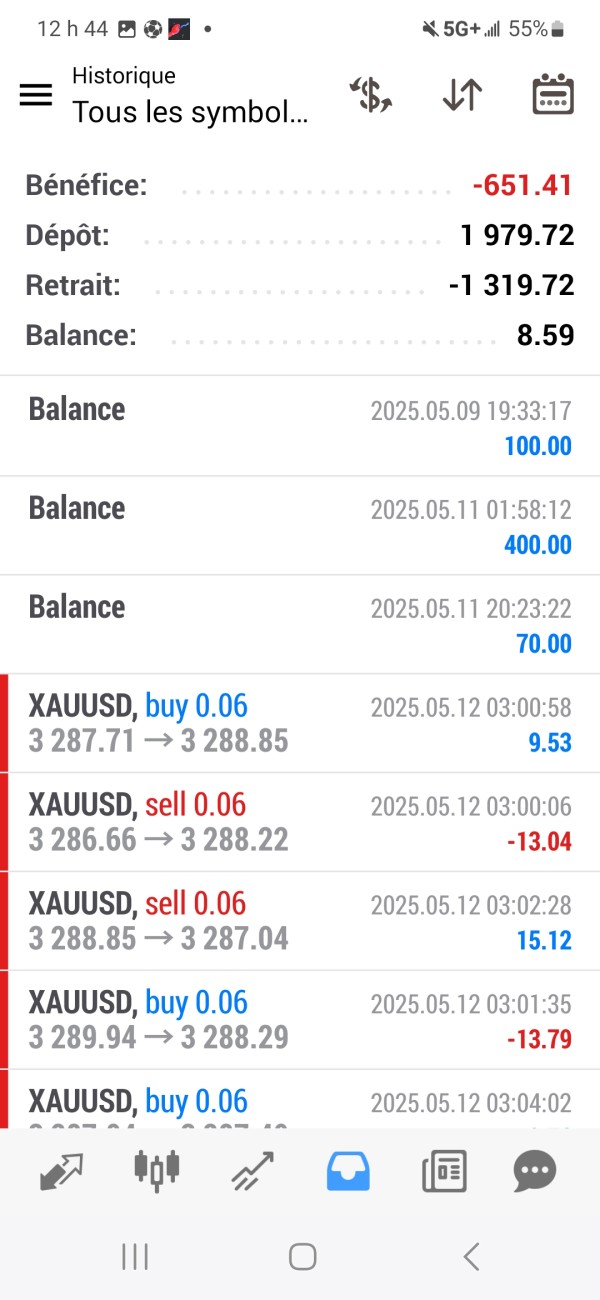

Trading Experience Analysis (8/10)

User feedback consistently highlights positive trading experiences with Fusion Markets. Users particularly mention platform stability and execution quality. Multiple review sources indicate that traders experience reliable order execution without significant slippage issues or requote problems, essential factors for maintaining trading strategy effectiveness.

Platform performance appears robust across the supported MetaTrader and MetaFX options. Users report stable connections and responsive interfaces during active trading sessions. The broker's NDD (No Dealing Desk) model contributes to execution transparency, as orders are passed directly to liquidity providers rather than being processed through dealer intervention that could create conflicts of interest.

Spread stability and competitive pricing receive positive mentions. However, specific performance data during high-volatility periods isn't detailed in available sources. The ability to trade across multiple asset classes from single accounts enhances convenience for diversified trading strategies, allowing position management across forex, commodities, and other instruments without multiple platform logins.

Mobile trading capabilities aren't extensively documented in current sources. This represents a potential information gap given the increasing importance of mobile access for active traders. The overall trading experience rating reflects strong core execution quality while acknowledging areas where more detailed performance information would strengthen this fusion markets review assessment.

Trust and Security Analysis (8/10)

Fusion Markets demonstrates strong regulatory compliance through its multi-jurisdictional licensing approach. The Australian Securities and Investment Commission (ASIC) license 385620 provides the highest level of oversight, with ASIC being recognized as one of the world's most stringent financial regulators. This regulation includes client fund segregation requirements, operational capital standards, and regular compliance monitoring.

The additional licenses from Vanuatu Financial Services Commission (40256) and Financial Services Authority of Seychelles (SD096) extend the broker's ability to serve international clients. They maintain regulatory oversight appropriate to different jurisdictions. This structure allows global market access while ensuring compliance with local regulatory requirements.

However, available sources don't provide detailed information about specific client fund protection measures, insurance coverage, or compensation scheme participation. These details are increasingly important for trader confidence, particularly regarding fund security in adverse scenarios. The transparency of regulatory license numbers and easy verification through respective regulatory websites enhances credibility.

The absence of documented negative regulatory actions or significant compliance issues in available sources supports the positive trust assessment. However, more detailed information about operational security measures and fund protection specifics would strengthen this evaluation.

User Experience Analysis (8/10)

Overall user satisfaction appears consistently positive across multiple review platforms. Users give particular praise for the broker's accessibility and cost structure. The $1 minimum deposit requirement receives frequent positive mentions as removing traditional barriers to live trading experience, allowing new traders to gain market exposure without substantial financial commitment.

Platform usability feedback suggests that both novice and experienced traders find the interface navigation intuitive. However, specific UI/UX details aren't extensively documented. The account opening and verification processes receive positive reviews for efficiency, indicating streamlined onboarding procedures that don't create unnecessary delays for eager traders.

Funding convenience appears adequate based on available feedback. However, specific information about deposit and withdrawal processing times isn't detailed in current sources. The ability to trade multiple asset classes from unified accounts enhances user convenience by reducing the complexity of managing diverse trading strategies.

The absence of significant negative feedback patterns in available sources suggests that Fusion Markets successfully meets mainstream trader expectations. However, the limited detailed information about specific user experience features prevents identification of standout excellence areas that would merit higher ratings.

Conclusion

This comprehensive fusion markets review reveals a broker that effectively serves cost-conscious traders seeking professional-grade trading conditions. The company removes traditional high-cost barriers. The combination of minimal deposit requirements, competitive pricing structures, and solid regulatory oversight creates an attractive proposition for both new and experienced traders.

Fusion Markets appears particularly well-suited for traders prioritizing low-cost access to diverse markets. It also works well for those testing new trading strategies with limited capital, and experienced traders seeking transparent pricing without dealer intervention. The multi-platform support accommodates various trading styles and technical analysis preferences.

The primary strengths include exceptional account accessibility, competitive cost structures, reliable regulatory oversight, and positive user execution experiences. Areas for potential enhancement include more comprehensive educational resources, detailed fund protection information, and expanded documentation of service capabilities to support informed trader decision-making.