Regarding the legitimacy of Fusion Markets forex brokers, it provides ASIC, FSA and WikiBit, (also has a graphic survey regarding security).

Is Fusion Markets safe?

Pros

Cons

Is Fusion Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

FMGP TRADING GROUP PTY LTD

Effective Date: Change Record

2011-01-05Email Address of Licensed Institution:

jonathan.wine@gleneagle.com.au, david.jiang@globalprime.comSharing Status:

Website of Licensed Institution:

https://www.globalprime.com/Expiration Time:

--Address of Licensed Institution:

L 27 25 BLIGH ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0282776672Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Fusion Markets International Ltd

Effective Date:

--Email Address of Licensed Institution:

phil.horner@fusionmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://fusionmarkets.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 4C, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Fusion Markets A Scam?

Introduction

Fusion Markets, established in 2017 and headquartered in Melbourne, Australia, positions itself as a low-cost forex and CFD broker. The firm aims to provide traders with competitive trading conditions, including low spreads and commissions, while offering a user-friendly trading experience through popular platforms like MetaTrader 4 and 5. However, as the forex market is rife with both legitimate and fraudulent brokers, it is essential for traders to carefully evaluate any broker before committing their funds. This article will assess the credibility of Fusion Markets by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and overall risk factors. The analysis is based on a review of various reputable sources and regulatory information.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy and trustworthiness. Fusion Markets operates under the oversight of several regulatory bodies, which is a positive indicator for potential traders. Below is a summary of Fusion Markets' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 385620 | Australia | Verified |

| VFSC | 40256 | Vanuatu | Verified |

| FSA | SD 096 | Seychelles | Verified |

Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulatory standards. This oversight ensures that the broker adheres to strict guidelines regarding client fund management and transparency. Additionally, the firm is also regulated by the Vanuatu Financial Services Commission (VFSC) and the Seychelles Financial Services Authority (FSA), which provide a degree of operational flexibility but may not offer the same level of investor protection as ASIC.

Historically, Fusion Markets has maintained a clean regulatory record, with no significant compliance issues reported. The presence of multiple regulatory licenses enhances the broker's credibility, although traders should remain cautious about the varying levels of protection offered by different jurisdictions.

Company Background Investigation

Fusion Markets was founded by a group of veterans from the forex industry, leveraging their combined experience to create a broker that prioritizes low-cost trading. The company operates under Gleneagle Asset Management Limited, which is a subsidiary of Gleneagle Securities. This ownership structure provides Fusion Markets with established connections to liquidity providers, enabling them to offer competitive pricing.

The management team consists of experienced professionals with backgrounds in finance and trading, which adds to the broker's credibility. Transparency is a key value for Fusion Markets, as reflected in their clear communication regarding fees and trading conditions. The broker's website provides comprehensive information about its services, including educational resources and customer support options, further enhancing its reputation as a trustworthy entity in the forex market.

Trading Conditions Analysis

Fusion Markets is recognized for its competitive trading conditions, which are a significant draw for potential clients. The broker offers two account types: the Zero account, which features spreads starting from 0.0 pips with a commission of AUD 4.50 per lot, and the Classic account, which incorporates commissions into the spreads, starting from 0.9 pips. The absence of a minimum deposit requirement further lowers the barrier for entry, making it accessible to traders with varying capital levels.

However, it is essential to scrutinize the overall fee structure, as some brokers may have hidden charges that can affect profitability. Below is a comparison of key trading costs at Fusion Markets:

| Fee Type | Fusion Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | AUD 4.50 per lot (Zero account) | AUD 7.00 per lot |

| Overnight Interest Range | Varies | Varies |

The trading costs at Fusion Markets are generally lower than the industry average, making it an attractive option for cost-conscious traders. Nevertheless, potential clients should always read the fine print to ensure they understand the complete fee structure, especially concerning overnight interest charges, which can vary significantly depending on market conditions.

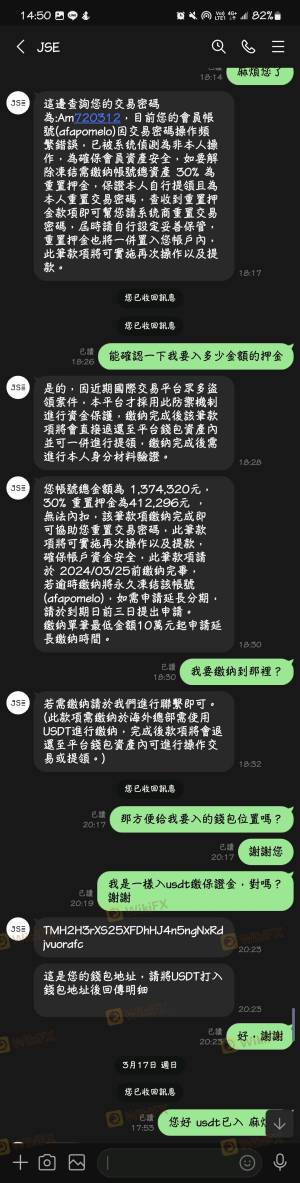

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Fusion Markets employs several measures to protect traders' capital. The broker segregates client funds from its operational funds, ensuring that client money is held in separate accounts at reputable financial institutions. This practice is crucial for maintaining transparency and safeguarding client assets.

Moreover, Fusion Markets offers negative balance protection for clients under its ASIC-regulated entity, meaning that traders cannot lose more than their deposited capital. However, this protection may not apply to clients trading under the VFSC or FSA regulations, which is a consideration for potential clients.

Historically, there have been no significant incidents or controversies regarding the safety of funds at Fusion Markets, reinforcing its reputation as a reliable broker. However, traders should remain vigilant and conduct their due diligence when dealing with any financial institution.

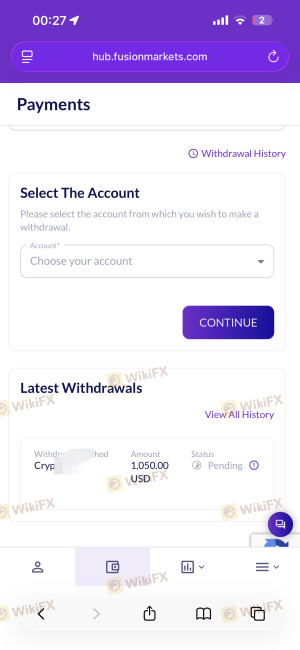

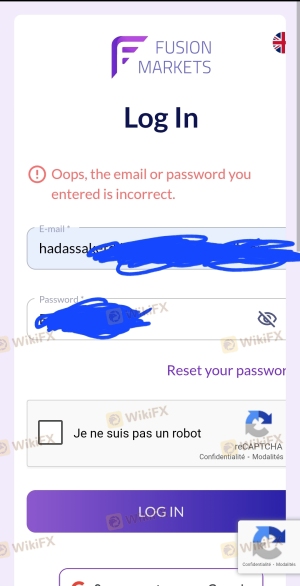

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. Fusion Markets generally receives positive reviews for its customer service and trading conditions. However, like any broker, it has faced some complaints. Common issues reported by clients include delays in account verification and occasional difficulties in withdrawing funds.

Below is a summary of common complaint types associated with Fusion Markets:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Addressed promptly |

| Account Verification | Low | Improved processes |

| Platform Issues | Medium | Ongoing support |

Two notable case studies highlight the broker's responsiveness to client concerns. One client reported a delay in processing a withdrawal request, which was resolved after contacting customer support. Another trader experienced issues with account verification but noted that the broker had streamlined its processes in response to feedback.

Overall, while Fusion Markets has its share of complaints, the majority of customers report satisfactory experiences, particularly regarding the broker's commitment to resolving issues.

Platform and Trade Execution

Fusion Markets offers a robust trading platform experience through MetaTrader 4 and 5, which are well-regarded in the industry for their reliability and user-friendly interfaces. The platforms support various trading styles, including automated trading via Expert Advisors (EAs).

The execution quality on Fusion Markets is generally high, with minimal slippage reported during normal market conditions. However, traders should be aware that execution speeds can vary during periods of high volatility. The absence of a dealing desk model further enhances the broker's appeal, as it allows for direct market access and transparent pricing.

Risk Assessment

Using Fusion Markets comes with inherent risks, as is the case with any trading platform. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Multiple regulations, varying protections |

| Trading Risk | High | Leveraged trading can amplify losses |

| Customer Service Risk | Medium | Complaints about withdrawal delays |

To mitigate these risks, traders should ensure they understand the broker's terms and conditions, maintain a diversified trading portfolio, and only trade with capital they can afford to lose.

Conclusion and Recommendations

In conclusion, Fusion Markets is not a scam; it is a legitimate broker regulated by ASIC, which offers competitive trading conditions and a user-friendly platform. However, traders should remain cautious due to the varying levels of protection offered by its other regulatory bodies, such as the VFSC and FSA. While the broker has received generally positive feedback, it is essential to be aware of potential risks, particularly regarding fund withdrawals and account verification processes.

For novice traders looking for a low-cost entry into the forex and CFD markets, Fusion Markets presents a viable option. However, those seeking comprehensive educational resources or extensive product offerings may want to consider alternative brokers. Overall, Fusion Markets is a trustworthy choice for traders who prioritize low costs and efficient execution.

Is Fusion Markets a scam, or is it legit?

The latest exposure and evaluation content of Fusion Markets brokers.

Fusion Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fusion Markets latest industry rating score is 8.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.