CMS 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive cms review examines the Centers for Medicare & Medicaid Services as a regulatory entity that provides medical insurance and Medicaid services, involving agent and broker agreements. CMS is not a traditional forex broker, but it operates as a crucial regulatory body overseeing healthcare marketplace operations in the United States. The organization offers specialized tools including the CMS Enterprise Portal and Web-broker Operational Readiness Reviews. These tools primarily serve healthcare insurance agents and brokers.

CMS demonstrates strong regulatory authority and institutional credibility within the healthcare sector. However, information regarding traditional trading services remains limited. This entity focuses specifically on Medicare and Medicaid program administration. The primary user base consists of healthcare insurance agents, brokers, and entities operating within the American healthcare marketplace ecosystem.

Important Notice

This evaluation focuses on the Centers for Medicare & Medicaid Services, which primarily serves the United States healthcare market and may not be applicable to international forex traders seeking traditional brokerage services. The services and tools offered by CMS are specifically designed for healthcare insurance professionals rather than financial market participants. Our assessment is based on publicly available information and official documentation.

Due to the specialized nature of CMS operations, traditional user reviews and trading performance data are not available for this evaluation.

Rating Framework

Broker Overview

The Centers for Medicare & Medicaid Services operates as a federal agency within the U.S. Department of Health and Human Services, rather than a traditional financial services broker. The organization's primary mandate involves administering Medicare and Medicaid programs while overseeing health insurance marketplace operations. CMS establishes and maintains agent and broker agreements for healthcare insurance professionals. This provides essential infrastructure for America's healthcare coverage system.

The agency's business model centers on regulatory oversight and operational support for health insurance marketplaces. Through comprehensive guidelines and submission deadlines under 45 CFR 154, CMS ensures proper rate review processes and maintains transparency in healthcare coverage pricing. The organization serves as the authoritative source for healthcare insurance regulations and compliance requirements. CMS operates the Enterprise Portal platform, which serves as the primary interface for agents and brokers accessing healthcare marketplace systems.

The platform facilitates consumer assistance and marketplace navigation for authorized healthcare insurance professionals. Additionally, CMS provides Web-broker Operational Readiness Reviews for both Classic Direct Enrollment and Enhanced Direct Enrollment pathways. This ensures operational compliance across healthcare marketplace participants.

Regulatory Authority: CMS operates under the Centers for Medicare & Medicaid Services regulatory framework, functioning as both regulator and service provider within the U.S. healthcare system.

Deposit and Withdrawal Methods: Specific payment processing information is not detailed in available documentation. CMS primarily handles regulatory and administrative functions rather than direct financial transactions.

Minimum Deposit Requirements: Traditional deposit requirements are not applicable to CMS services. These services focus on regulatory compliance and marketplace administration.

Promotional Offerings: CMS does not offer traditional promotional bonuses. Instead, it provides regulatory guidance and operational support tools for healthcare marketplace participants.

Available Assets: The primary focus involves Medicare and Medicaid services, health insurance marketplace operations, and related regulatory oversight rather than tradeable financial instruments.

Cost Structure: Specific fee structures for CMS services are not detailed in available documentation. The organization primarily provides regulatory oversight and administrative support.

Leverage Options: Leverage ratios are not applicable to CMS operations. These operations center on healthcare insurance administration rather than financial trading.

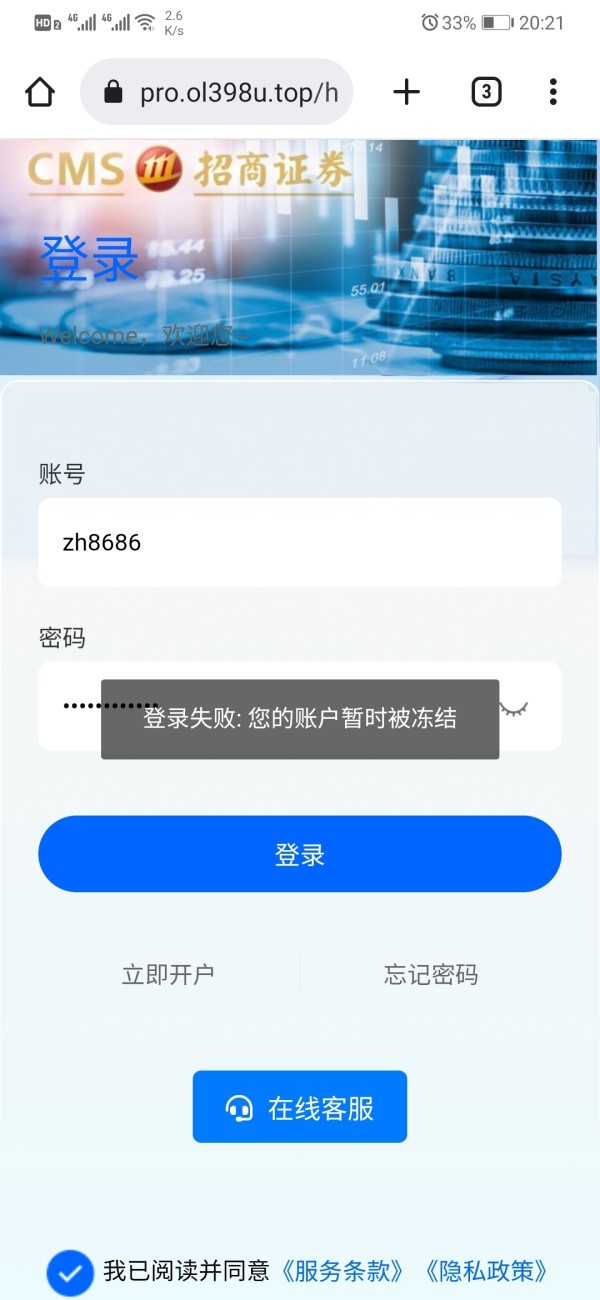

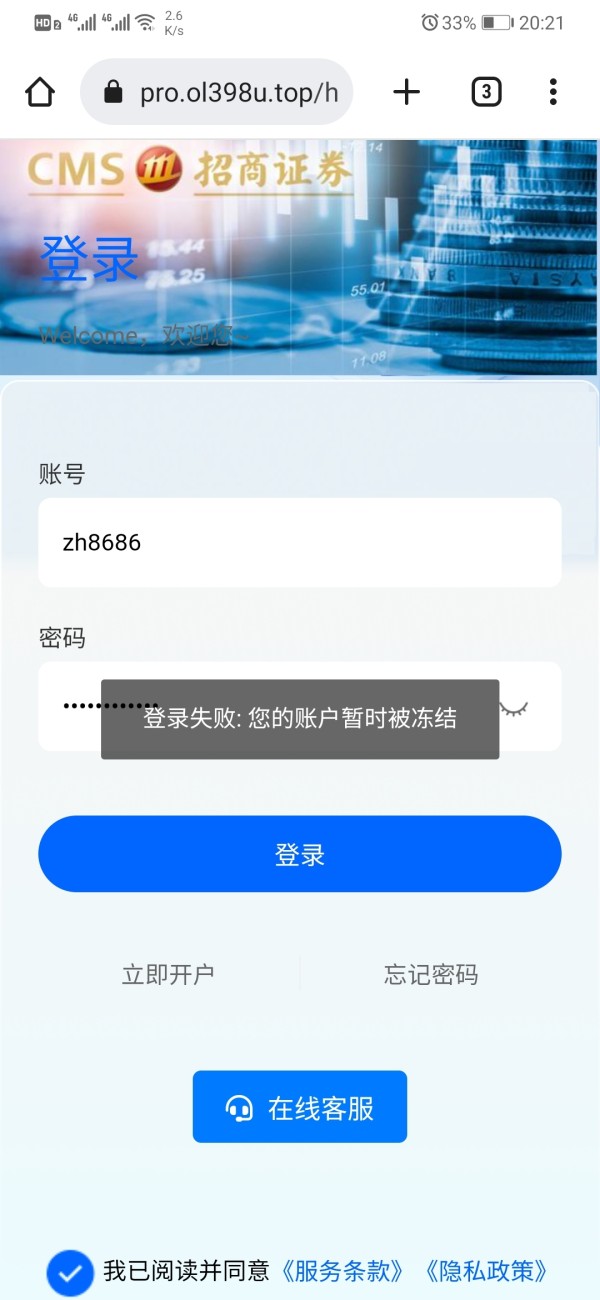

Platform Selection: The CMS Enterprise Portal serves as the main platform for authorized agents and brokers accessing healthcare marketplace systems and consumer assistance tools.

Geographic Restrictions: Services primarily target the United States healthcare market. The focus is specifically on Medicare and Medicaid program participants.

Customer Support Languages: Specific language support information is not detailed in available documentation.

This cms review indicates that while CMS provides robust regulatory oversight and specialized tools, it operates in a distinctly different capacity compared to traditional financial services brokers.

Detailed Rating Analysis

Account Conditions Analysis

The Centers for Medicare & Medicaid Services operates under a fundamentally different model compared to traditional financial brokers. This makes conventional account condition assessments challenging. Rather than offering trading accounts, CMS provides agent and broker agreements for healthcare insurance professionals. These agreements establish the framework for accessing CMS systems and assisting consumers with healthcare coverage decisions.

The registration process involves meeting specific qualification requirements for healthcare insurance agents and brokers. Participants must demonstrate compliance with federal regulations and maintain appropriate licensing for their respective states. The agreement structure focuses on regulatory compliance rather than financial deposit requirements or trading privileges. CMS does not offer traditional account types such as standard, premium, or VIP trading accounts.

Instead, the organization provides access levels based on professional qualifications and regulatory status. The absence of minimum deposit requirements reflects the regulatory nature of CMS operations rather than profit-driven brokerage services. Special account features typically found in financial services, such as Islamic accounts or margin trading capabilities, are not applicable to CMS operations.

The organization's focus remains on healthcare marketplace administration and regulatory oversight rather than accommodating diverse trading preferences or religious considerations. This cms review reveals that traditional account condition metrics cannot be meaningfully applied to CMS operations. This is due to the fundamental difference in service delivery and regulatory focus.

CMS provides specialized tools designed specifically for healthcare insurance marketplace operations. The CMS Enterprise Portal serves as the primary platform for authorized agents and brokers, offering access to consumer assistance tools and marketplace navigation features. This comprehensive system enables healthcare professionals to guide consumers through insurance selection processes and enrollment procedures. The Web-broker Operational Readiness Reviews represent another significant resource offered by CMS.

These reviews ensure compliance with both Classic Direct Enrollment and Enhanced Direct Enrollment pathways, helping marketplace participants maintain operational standards. The review process includes comprehensive assessments of technical capabilities and regulatory compliance measures. Educational resources and training materials are integrated into CMS operations, though specific details regarding comprehensive learning programs are not extensively documented in available materials.

The organization provides ongoing guidance through bulletins and policy updates, ensuring marketplace participants remain informed about regulatory changes and operational requirements. Automation support exists through the CMS Enterprise Portal, enabling streamlined access to marketplace systems and consumer data. However, the automation focuses on administrative efficiency rather than trading algorithm capabilities or market analysis tools commonly found in financial services platforms.

The resource quality demonstrates strong regulatory foundation and institutional support, though the specialized nature of these tools limits their applicability to traditional trading activities.

Customer Service and Support Analysis

Customer service information for CMS operations is not comprehensively detailed in available documentation. As a federal regulatory agency, CMS likely maintains support channels appropriate for government entity operations. However, specific response times and service quality metrics are not publicly documented in the materials reviewed.

The organization's support structure appears designed to serve healthcare insurance professionals rather than individual consumers seeking direct assistance. Agent and broker agreements establish the framework for professional relationships, with CMS providing regulatory guidance and operational support through official channels. Multilingual support capabilities are not specifically addressed in available documentation.

Given the federal nature of CMS operations and the diverse American healthcare marketplace, language support likely exists though specific details remain undocumented in reviewed materials. Service availability and operating hours for CMS support functions are not detailed in accessible documentation. Federal agency operations typically maintain standard business hour availability, though emergency support protocols may exist for critical marketplace operations.

The absence of traditional customer service metrics reflects the regulatory nature of CMS operations rather than commercial service delivery standards. Professional support appears channeled through official agency communications and regulatory guidance rather than direct customer service interactions. Problem resolution processes likely follow federal agency protocols, though specific case studies or resolution timeframes are not documented in available materials.

Trading Experience Analysis

Traditional trading experience metrics are not applicable to CMS operations, as the organization functions as a regulatory agency rather than a financial services provider. The Centers for Medicare & Medicaid Services does not offer trading platforms, market access, or financial instrument execution capabilities. Platform stability and performance relate to the CMS Enterprise Portal's operational reliability for healthcare marketplace functions rather than trading system uptime or execution speed.

The portal's performance impacts agent and broker ability to assist consumers with healthcare coverage decisions rather than financial market participation. Order execution quality, spreads, and slippage metrics are not relevant to CMS operations. Instead, the organization focuses on regulatory compliance, marketplace integrity, and consumer protection within the healthcare insurance sector.

Mobile platform availability for CMS systems is not specifically detailed in available documentation. Healthcare insurance professionals may access CMS resources through various devices, though comprehensive mobile trading applications are not part of the service offering. The trading environment provided by CMS centers on healthcare marketplace navigation rather than financial market analysis or trading strategy implementation.

Professional tools support insurance enrollment processes and regulatory compliance rather than market speculation or investment activities. This cms review emphasizes that traditional trading experience evaluation criteria cannot be meaningfully applied to CMS operations. This is due to the fundamental difference in organizational purpose and service delivery.

Trust and Reliability Analysis

The Centers for Medicare & Medicaid Services enjoys exceptional institutional credibility as a federal regulatory agency within the U.S. Department of Health and Human Services. This official government status provides inherent trustworthiness that surpasses traditional private sector broker reliability considerations. CMS operates under federal oversight and accountability measures that ensure institutional stability and regulatory compliance.

Regulatory qualification for CMS stems from its role as the authoritative body overseeing Medicare and Medicaid programs. The organization establishes and enforces healthcare marketplace regulations rather than seeking external regulatory approval. This unique position as both regulator and service provider creates a distinct trust profile compared to traditional financial services entities. Fund security measures applicable to CMS operations differ significantly from broker client fund protection protocols.

The organization handles healthcare program administration and regulatory oversight rather than client investment funds. Federal agency operational standards and oversight provide institutional security guarantees that exceed private sector protections. Transparency in CMS operations is maintained through federal disclosure requirements and public accountability measures.

The organization publishes regulatory guidance, policy updates, and operational procedures through official channels, ensuring marketplace participants have access to current information and regulatory expectations. Industry reputation for CMS is established through decades of healthcare program administration and regulatory oversight. The organization's standing within the healthcare sector reflects institutional competence and regulatory authority rather than competitive market performance or client satisfaction metrics typically associated with financial services providers.

User Experience Analysis

User experience evaluation for CMS operations requires consideration of the specialized healthcare insurance professional user base rather than general consumer or trader populations. The primary users consist of licensed agents and brokers operating within the American healthcare marketplace system. Interface design and usability for the CMS Enterprise Portal are tailored to healthcare insurance professionals familiar with marketplace operations and regulatory requirements.

The platform prioritizes functional efficiency and regulatory compliance over consumer-friendly design elements typically found in retail trading platforms. Registration and verification processes for CMS access involve professional qualification verification and regulatory compliance confirmation rather than simple account opening procedures. Healthcare insurance agents and brokers must demonstrate appropriate licensing and meet federal requirements before gaining system access.

Fund operation experiences are not applicable to CMS users, as the platform focuses on healthcare marketplace administration rather than financial transactions or investment management. User interactions center on consumer assistance and enrollment processes rather than deposit, withdrawal, or trading activities. Common user concerns likely relate to regulatory compliance, system access, and marketplace operational requirements rather than trading performance or financial service quality.

The specialized nature of CMS operations creates distinct user experience priorities compared to traditional financial services platforms. User demographics for CMS services are limited to qualified healthcare insurance professionals operating within the United States marketplace system. This creates a highly specialized and regulated user community.

Conclusion

This comprehensive cms review reveals that the Centers for Medicare & Medicaid Services operates as a specialized federal regulatory agency rather than a traditional financial services broker. The organization provides essential infrastructure and oversight for America's healthcare marketplace system, serving licensed insurance professionals through specialized tools and regulatory frameworks. CMS demonstrates exceptional institutional credibility and regulatory authority within the healthcare sector.

The organization's strengths include robust regulatory oversight, specialized professional tools like the Enterprise Portal, and comprehensive marketplace administration capabilities. However, the absence of traditional trading services, limited public information about operational metrics, and specialized user base restrictions limit its applicability for general financial market participants. The ideal user profile for CMS services includes licensed healthcare insurance agents, brokers, and related professionals operating within the American healthcare marketplace.

Traditional forex traders or financial market participants would not find relevant services within the CMS operational framework, as the organization focuses exclusively on healthcare insurance administration and regulatory oversight.