CMC Markets Review 1

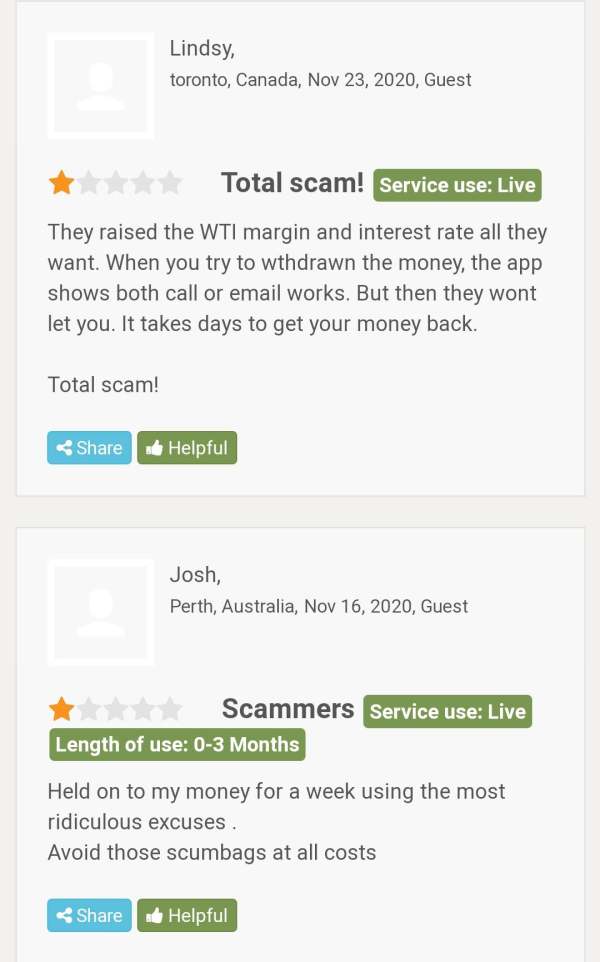

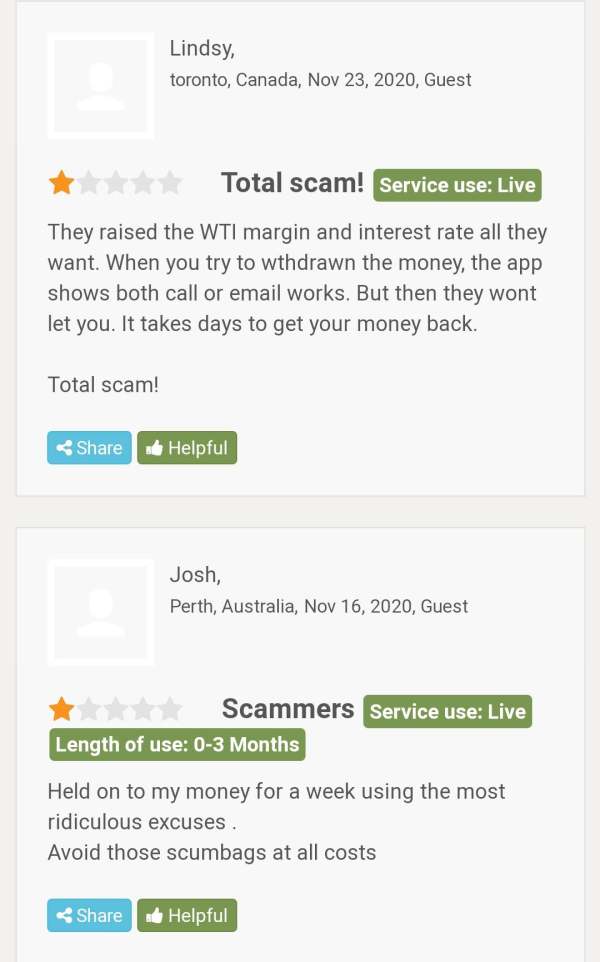

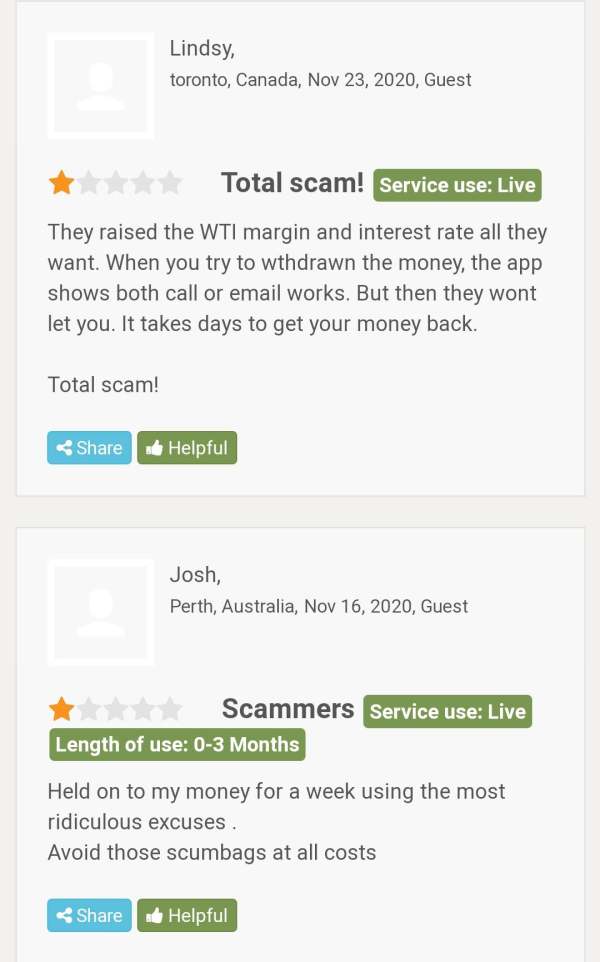

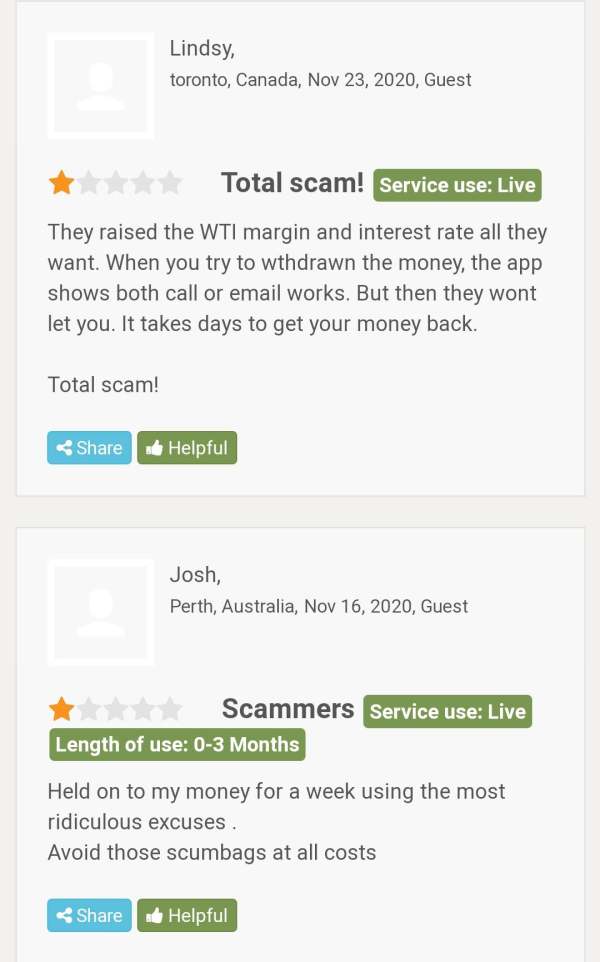

Clients of CMC MARKETS LTD have complained that this broker does not let them withdraw their deposit easily and create problems for them.

CMC Markets Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Clients of CMC MARKETS LTD have complained that this broker does not let them withdraw their deposit easily and create problems for them.

This CMC Markets review gives you a complete look at one of the world's top online trading companies in forex and CFD trading. CMC Markets has become a major player in retail trading by offering services to traders around the world through its own trading platform. Industry reports show that the broker gets praise for good trading conditions, but user feedback tells a mixed story about the overall trading experience.

CMC Markets stands out because of its advanced trading technology and wide range of trading options, including forex pairs and CFDs across many different types of assets. The broker works to serve different types of traders, from beginners who need learning materials to expert traders who want advanced analysis tools. Recent user ratings and feedback show areas where the broker needs to improve, especially when it comes to keeping users happy and making sure the platform works well.

The broker's rules and how open they are about their business matter a lot to potential clients since these things affect how much traders trust them and how safe their money is. This review looks at all the important parts of what CMC Markets offers to give traders the key information they need to make smart choices about picking a trading partner.

This CMC Markets review uses public information, user feedback, market analysis, and industry reports from 2025. Trading conditions, rules, and services might be different between various regional offices of CMC Markets, so future clients should check specific details directly with the broker. The review here shows information from various financial industry sources and user stories.

Readers should know that forex and CFD trading can cause big losses, and past results don't promise future success. All trading choices should be based on personal money situations and how much risk you can handle. This review tries to give fair analysis to help with broker selection but doesn't give investment advice or trading tips.

| Evaluation Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 7/10 | Good |

| Customer Service and Support | 8/10 | Very Good |

| Trading Experience | 5/10 | Average |

| Trust and Reliability | 3/10 | Poor |

| User Experience | 4/10 | Below Average |

CMC Markets works as a global online trading service provider that offers forex and CFD trading services to retail and business clients worldwide. Industry sources say the company has set up operations in multiple countries, giving access to financial markets through its own trading technology. The broker has built its name by delivering complete trading solutions that work for different experience levels and trading styles.

The company's business plan focuses on giving market access through contracts for difference and forex trading, letting clients bet on price changes across various types of assets without owning the actual items. CMC Markets has spent a lot of money developing its trading platform technology, which works as the main connection between traders and global financial markets. The broker's method focuses on giving good trading conditions while keeping up with new technology.

Industry awards have put CMC Markets among well-known forex brokers, especially for middle-level traders looking for balanced features and functions. The broker's services cover multiple types of assets, though specific details about trading conditions and following rules change across different operating areas. Recent market analysis shows that while the broker keeps certain advantages over competitors, overall user happiness numbers point to areas that need better service delivery and client experience.

Regulatory Jurisdictions: Available rule information changes by region, and specific license details should be checked directly with the broker for correct compliance status.

Deposit and Withdrawal Methods: The broker offers multiple funding options, though specific payment methods and processing times may differ based on client location and account type.

Minimum Deposit Requirements: Minimum funding requirements are not listed in available sources and should be confirmed during the account opening process.

Bonuses and Promotions: Current promotional offerings and bonus structures are not detailed in available information and may vary by jurisdiction and account type.

Tradeable Assets: CMC Markets provides access to forex currency pairs and CFDs across multiple asset classes, allowing traders to diversify their portfolios through a single trading account.

Cost Structure: Trading costs including spreads, commissions, and overnight financing charges are implemented according to the broker's fee schedule, though specific rates require direct verification.

Leverage Options: The broker offers leveraged trading options, with maximum leverage ratios subject to regulatory restrictions in different jurisdictions.

Platform Selection: CMC Markets provides its proprietary trading platform, designed to deliver comprehensive trading functionality and market analysis tools.

Geographic Restrictions: Service availability may be limited in certain jurisdictions due to regulatory requirements and licensing restrictions.

Customer Support Languages: Multi-language support availability varies by region and should be confirmed based on specific client requirements.

This CMC Markets review shows that while the broker offers complete trading services, potential clients should do careful research about specific terms and conditions that apply to their area.

The account conditions that CMC Markets offers show mixed results when compared to industry standards. Available information suggests that the broker gives multiple account types, though specific details about minimum deposit requirements, account levels, and related benefits stay unclear from current sources. This lack of clear information about account structure details adds to the below-average rating in this area.

Account opening steps and verification requirements follow standard industry practices, though how efficient and user-friendly these processes are have gotten mixed feedback from users. The lack of clearly defined account benefits and trading condition details makes it hard for potential clients to make informed comparisons with other brokers in the market.

Trading conditions including spreads, commissions, and execution policies are basic factors that greatly affect trading profits. However, the limited availability of specific information about these crucial elements in this CMC Markets review suggests that future clients need to talk directly with the broker to understand the full scope of their trading conditions. This information gap represents a big drawback for traders who want to evaluate how competitive the broker is before committing to opening an account.

CMC Markets shows strength in providing trading tools and resources, earning a good rating in this evaluation category. According to available information, the broker offers guaranteed stop-loss orders, which represent a valuable risk management tool for traders seeking to limit potential losses in volatile market conditions. This feature makes CMC Markets different from many competitors who don't provide guaranteed execution of stop-loss orders.

The broker's own trading platform appears to include complete analytical tools and charting capabilities, supporting traders in their market analysis and decision-making processes. Advanced order types and risk management features add to the platform's functionality, though specific details about the full range of available tools require further investigation through direct broker contact.

Research and educational resources availability stays unclear from current information sources, representing a potential area for improvement in the broker's overall offering. Educational content and market analysis are increasingly important factors for trader success, particularly for intermediate-level traders who represent a key target group for CMC Markets. The broker's investment in platform technology appears substantial, but the supporting educational system requires clearer definition to fully assess its value.

Customer service and support represent one of CMC Markets' strongest areas, receiving a very good rating based on available user feedback. Multiple sources show that users have given highly positive reviews of the broker's support services, suggesting that the company has invested effectively in building responsive and helpful customer service capabilities.

The quality of customer support interactions appears to meet or exceed user expectations, with positive feedback showing that support staff demonstrate skill in addressing client questions and resolving issues efficiently. This strength in customer service provides a significant competitive advantage, particularly in an industry where technical issues and account-related questions require quick resolution to maintain trading continuity.

However, specific details about support channel availability, response times, and multi-language capabilities are not clearly documented in available sources. The lack of complete information about support hours, contact methods, and service level commitments prevents a more detailed assessment of the support infrastructure. Despite this information gap, the consistently positive user feedback about support quality suggests that CMC Markets has established effective customer service protocols that contribute positively to the overall client experience.

The trading experience provided by CMC Markets receives an average rating, reflecting mixed feedback from users and limited detailed information about platform performance characteristics. User ratings suggesting overall dissatisfaction show that while the broker offers functional trading capabilities, the execution and reliability of these services may not consistently meet trader expectations.

Platform stability, order execution speed, and overall trading environment quality are crucial factors that directly impact trading profitability and user satisfaction. The limited availability of specific performance metrics and detailed user experience data makes it challenging to provide a comprehensive assessment of these critical trading elements in this CMC Markets review.

Mobile trading capabilities and cross-platform functionality are increasingly important for modern traders who require flexibility in accessing markets. However, specific information about mobile app performance, feature parity between desktop and mobile platforms, and overall user interface design is not readily available from current sources. This information gap represents a significant limitation in evaluating the broker's ability to meet contemporary trader expectations for seamless multi-device trading experiences.

Trust and reliability represent significant concerns in this CMC Markets review, resulting in a poor rating due to limited transparency about regulatory compliance and safety measures. The absence of clearly documented regulatory information raises questions about the broker's oversight and compliance framework, which are fundamental considerations for trader fund security and operational transparency.

Industry recognition as a preferred broker for intermediate traders provides some positive indication of the company's market standing. However, this recognition must be balanced against the lack of detailed information about regulatory licenses, fund segregation practices, and investor protection measures that typically underpin trader confidence in broker selection decisions.

The broker's operational transparency and public disclosure of business practices appear limited based on available information sources. Clear documentation of regulatory compliance, financial stability indicators, and risk management procedures are essential elements that contribute to broker trustworthiness. The current information gap in these critical areas significantly impacts the overall trust assessment and suggests that potential clients should conduct extensive research before engaging with CMC Markets' services.

User experience evaluation reveals significant challenges, reflected in the poor overall user ratings that contribute to a below-average assessment in this category. According to available feedback, users have assigned low satisfaction ratings to their overall experience with CMC Markets, indicating substantial room for improvement in service delivery and client satisfaction.

The disconnect between positive customer service feedback and poor overall user ratings suggests that while individual support interactions may be satisfactory, the broader trading experience may suffer from systemic issues affecting platform functionality, trading conditions, or service reliability. This pattern shows that isolated strengths in customer service may not be sufficient to overcome weaknesses in other operational areas.

Interface design, account management functionality, and overall service integration appear to present challenges based on user feedback patterns. The lack of detailed information about specific user interface features, account management tools, and service integration capabilities makes it difficult to identify precise areas requiring improvement. However, the consistently low user satisfaction ratings suggest that comprehensive service enhancement initiatives may be necessary to improve the overall client experience and competitive positioning in the market.

This CMC Markets review reveals a broker with mixed strengths and significant areas for improvement. While the company demonstrates competence in customer service delivery and provides useful trading tools such as guaranteed stop-loss orders, overall user satisfaction remains problematically low. The broker's positioning for intermediate traders shows promise, but execution challenges appear to limit its effectiveness in meeting client expectations.

The most significant concerns center on transparency and trust factors, where limited regulatory information and unclear operational details create uncertainty for potential clients. Despite industry recognition and technological capabilities, these fundamental trust issues may deter risk-conscious traders from engaging with the platform.

CMC Markets may be suitable for traders who prioritize customer service quality and specific trading tools, but prospective clients should exercise caution and conduct thorough research. The broker's mixed performance profile suggests that while it offers functional trading services, alternative options may provide more consistent overall experiences for most trader requirements.

FX Broker Capital Trading Markets Review