Regarding the legitimacy of CMS forex brokers, it provides SFC, FCA and WikiBit, (also has a graphic survey regarding security).

Is CMS safe?

Pros

Cons

Is CMS markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

China Merchants Securities (HK) Co., Limited

Effective Date:

2005-01-26Email Address of Licensed Institution:

compliance@cmschina.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.cmschina.com.hkExpiration Time:

--Address of Licensed Institution:

香港中環康樂廣場8號交易廣場一期48樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Inst Deriv Trading License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RevokedLicense Type:

Inst Deriv Trading License (MM)

Licensed Entity:

China Merchants Securities (UK) Limited

Effective Date: Change Record

2014-06-17Email Address of Licensed Institution:

compliance.uk@cmschina.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.cmschina.com.hk/en/Expiration Time:

2025-08-28Address of Licensed Institution:

3rd Floor 50 Bank Street London E14 5NT UNITED KINGDOMPhone Number of Licensed Institution:

+442074234048Licensed Institution Certified Documents:

Is CMS Trader Safe or a Scam?

Introduction

CMS Trader is a forex and CFD broker that has been operating since 2013. Positioned as a platform for both novice and experienced traders, CMS Trader offers a variety of trading instruments, including forex pairs, commodities, and cryptocurrencies. However, the broker's reputation has come under scrutiny, prompting both potential and current traders to question its legitimacy and safety. In the volatile world of forex trading, it is crucial for traders to thoroughly evaluate brokers before committing their funds. This article aims to provide a comprehensive analysis of CMS Trader, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. The investigation is based on a review of multiple sources, including regulatory databases, customer reviews, and industry analyses.

Regulation and Legitimacy

Regulation is a fundamental aspect of any broker's credibility, as it ensures that the broker adheres to specific standards designed to protect investors. CMS Trader operates without oversight from a reputable financial authority, which raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation from a top-tier authority, such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission), indicates a lack of investor protection measures. This situation is compounded by the fact that CMS Trader is registered in offshore jurisdictions, which are known for their lenient regulatory requirements. The quality of oversight is crucial; brokers regulated by stringent authorities are more likely to provide a secure trading environment. The lack of any regulatory oversight for CMS Trader raises red flags, suggesting that investors should be cautious and possibly avoid this broker altogether.

Company Background Investigation

CMS Trader was established in 2013 and is owned by Safe Side Trading Ltd., a company registered in St. Vincent and the Grenadines. The companys offshore registration is often associated with a lack of transparency and accountability, which can be detrimental to traders seeking reliable partners in the financial markets.

The management team behind CMS Trader remains largely anonymous, and there is minimal information available regarding their professional backgrounds. This lack of transparency can be concerning, as a competent management team typically enhances a broker's credibility. Furthermore, the absence of clear information regarding the company's operational history and ownership structure raises additional questions about its reliability. Effective communication and transparency are essential for building trust with clients, and CMS Trader appears to fall short in these areas.

Trading Conditions Analysis

When assessing a broker, understanding the trading conditions—including fees and spreads—is vital. CMS Trader offers several account types, each with different minimum deposit requirements. However, the fee structure is not as competitive as one might expect.

| Fee Type | CMS Trader | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by CMS Trader can be higher than industry averages, particularly for major currency pairs. Additionally, the absence of a transparent commission structure can lead to unexpected costs for traders. The overall fee structure may deter potential clients, especially when compared to more regulated brokers that offer clearer and more competitive pricing.

Customer Funds Security

The security of customer funds is paramount in forex trading. CMS Trader claims to implement certain safety measures; however, the lack of regulation raises concerns about the effectiveness of these measures.

CMS Trader does not provide clear information on whether client funds are held in segregated accounts, which is a standard practice among reputable brokers. Segregation of funds is crucial for protecting clients' investments in case of insolvency. Moreover, there is no mention of investor protection schemes, which can provide additional security for traders. The absence of these protective measures significantly increases the risk associated with trading with CMS Trader. Historical issues related to fund security have also been reported, further highlighting the need for caution.

Customer Experience and Complaints

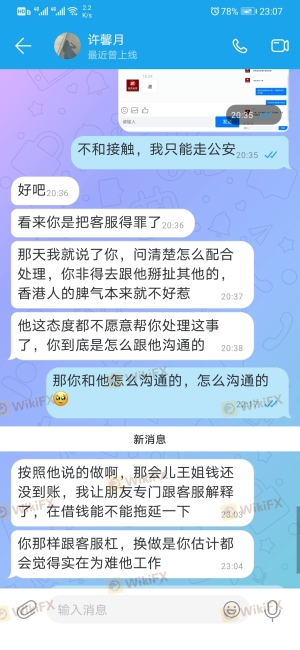

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of CMS Trader reveal a mix of experiences, with many users reporting difficulties in withdrawing funds and a lack of responsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Below Average |

| Platform Stability | Medium | Average |

Common complaints include delayed withdrawal requests and inadequate customer support during critical trading times. For instance, some traders have reported that their requests for withdrawals were met with excuses or prolonged processing times, leading to frustration and financial loss. These issues are concerning and suggest that traders may face significant challenges when dealing with CMS Trader.

Platform and Trade Execution

The trading platform offered by CMS Trader is essential for assessing the overall trading experience. The platform is reported to be user-friendly; however, issues with stability and execution have been noted.

Traders have experienced instances of slippage and order rejections, particularly during volatile market conditions. Such occurrences can lead to significant financial losses, especially for those employing high-frequency trading strategies. If a broker's platform is not reliable, it can severely impact a trader's ability to execute trades effectively. The potential for platform manipulation is another concern that traders should consider when evaluating CMS Trader.

Risk Assessment

Using CMS Trader presents various risks that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from a reputable authority. |

| Fund Security Risk | High | Lack of segregation and investor protection. |

| Operational Risk | Medium | Issues with platform stability and execution. |

Given these risks, traders are advised to exercise extreme caution. It is essential to only invest what one can afford to lose and to consider alternative brokers with better regulatory oversight and customer protection measures.

Conclusion and Recommendations

In conclusion, the evidence suggests that CMS Trader poses significant risks to potential investors. The lack of regulation, transparency, and customer protection raises serious concerns about its legitimacy. While some traders may have had positive experiences, the overall risk profile indicates that caution is warranted.

For traders seeking reliable and safe trading environments, it is advisable to consider alternative brokers that are regulated by reputable authorities such as the FCA or ASIC. These brokers typically offer better security measures, clearer fee structures, and more robust customer support. Ultimately, the question "Is CMS Trader safe?" leans towards a negative answer, and traders should proceed with caution or seek more reputable options.

Is CMS a scam, or is it legit?

The latest exposure and evaluation content of CMS brokers.

CMS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CMS latest industry rating score is 5.63, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.63 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.