ATC Brokers 2025 Review: Everything You Need to Know

Below is an in‐depth analysis and evaluation of ATC Brokers for 2025. This review uses publicly available information and user feedback to help potential clients make informed decisions.

Abstract

ATC Brokers is a well-established forex broker that has been operating for over a decade. This comprehensive atc brokers review shows that the broker offers standard features with a neutral overall rating. The firm is regulated by multiple authorities—including the CFTC in the United States, the FCA in the United Kingdom, and CIMA in the Cayman Islands. This regulatory structure provides extra security for investors. One of the highlights of ATC Brokers is its rich variety of trading tools with access to more than 100 different financial instruments. This makes the broker particularly appealing to intermediate traders looking to diversify their investments. However, the broker has some drawbacks including high minimum deposit requirements and average trading conditions that have drawn mixed reviews from clients. According to several user ratings , ATC Brokers offers a balanced but unremarkable trading environment.

Important Notice

It is essential to note that ATC Brokers operates under different regulatory requirements depending on the region. In the United States, the CFTC oversees the broker. In the United Kingdom, the FCA provides regulation, and in the Cayman Islands, CIMA handles oversight. As a result, trading conditions, client protections, and operational procedures may vary significantly depending on the client's location. This review is based on public information and user feedback from various sources to offer a comprehensive analysis of ATC Brokers' services. Potential clients should remember that regional regulatory differences could impact their overall trading experience.

Rating Framework

The following table presents our ratings on six key dimensions evaluated on a scale of 1 to 10:

Broker Overview

ATC Brokers was founded in 2005 and has built a reputation as an established forex broker with over ten years of industry experience. The company operates as an STP broker, which means it provides direct access to the interbank market for its clients. This operational model is designed to offer transparent pricing and a fair trading environment. The broker's background suggests a commitment to offering high-level expertise and industry knowledge, which has been critical in attracting a loyal user base over the years. While some users appreciate the transparency in trade execution, others have noted that the high minimum deposit requirement may deter new or less experienced traders. Despite these mixed views, ATC Brokers has maintained a medium overall rating among its clientele.

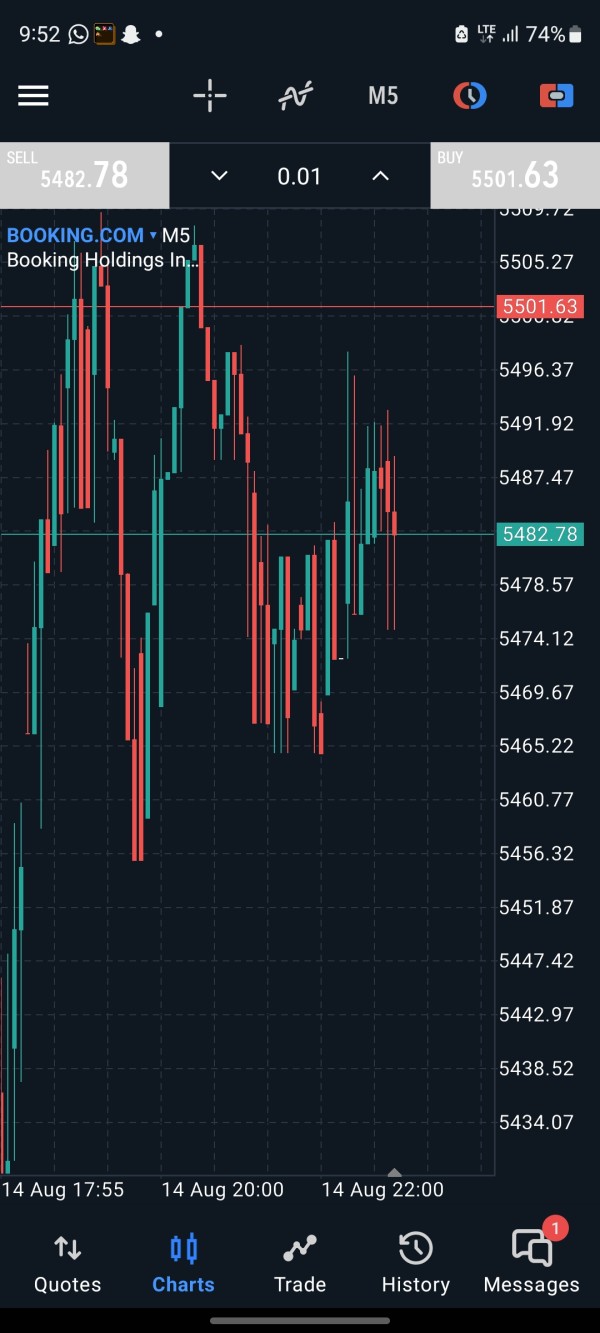

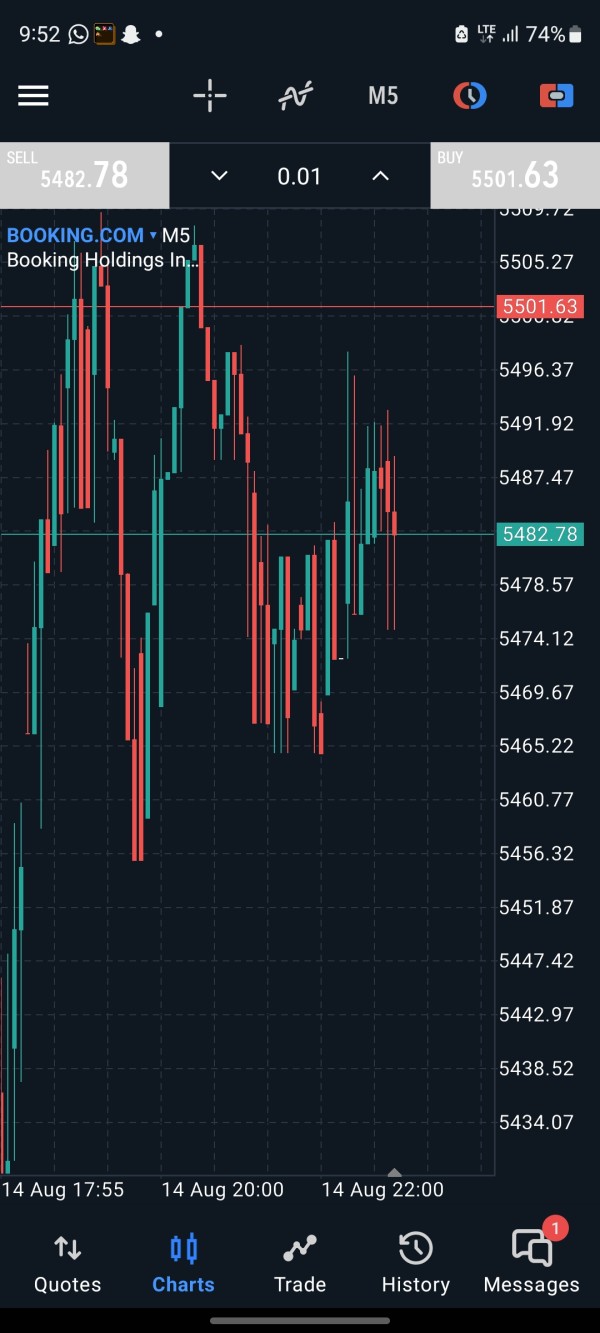

ATC Brokers offers two main trading platforms: MT4 and MT Pro. These platforms provide basic charting tools, technical indicators, and a range of order types suitable for all types of trading strategies. The range of assets available on ATC Brokers is notably broad, including forex pairs, commodities, indices, cryptocurrencies, and more – totaling over 100 instruments. The broker's regulatory status is further strengthened by oversight from the CFTC, FCA, and CIMA, ensuring that it meets a variety of international compliance standards. This multi-regulatory approach instills trust among seasoned traders but also introduces complexity in trading conditions across different markets. Overall, this atc brokers review highlights ATC Brokers as a versatile option for traders looking for a multi-asset platform with a long-standing industry presence, even as it faces challenges with high entry barriers and average user experience.

Regulatory Regions:

ATC Brokers is regulated by multiple authorities, including the CFTC in the United States, the FCA in the United Kingdom, and CIMA in the Cayman Islands. This multi-jurisdictional regulatory framework helps ensure that different markets receive tailored protections and trading conditions. However, differences exist between regions, meaning that the trading experience may vary depending on where the client is based.

Deposit and Withdrawal Methods:

The available deposit and withdrawal methods for ATC Brokers are not clearly detailed in the provided public resources. Clients will need to contact customer support for specific information on which methods—such as bank transfers, credit cards, or e-wallets—are supported for their account.

Minimum Deposit Requirement:

ATC Brokers requires a minimum deposit of 2000 USD to open an account. This relatively high entry point may be a barrier for new traders or those with limited capital, placing ATC Brokers in a more exclusive segment of the market.

Bonus Promotions:

Specific bonus and promotional schemes for ATC Brokers are not detailed in the available materials. At present, information regarding deposit bonuses or loyalty rewards remains limited, suggesting that the broker may not heavily focus on promotional incentives.

Tradable Assets:

ATC Brokers provides a diverse range of tradable assets, including major and minor forex pairs, commodities such as gold and oil, major indices, and a selection of cryptocurrencies. With over 100 assets available, the broker caters to traders with varied interests and investment strategies. This diversity allows clients to build a balanced portfolio, although specifics about each instrument's trading conditions remain general.

Cost Structure:

The cost structure at ATC Brokers shows average trading costs relative to industry standards. There is no detailed disclosure of spreads or commission fees in the available public documents. As such, while some users have reported average execution costs, a comprehensive analysis of fees is not possible based solely on the provided information. Traders should exercise caution and seek clarity regarding hidden fees, if any, before fully committing funds.

Leverage:

ATC Brokers offers leverage up to 1:200, though it is important to note that this figure varies by region. For example, U.S. based clients are limited to a maximum leverage of 1:50, while European clients often experience a cap of 1:30. This regional difference underscores the impact of local regulatory frameworks on trading conditions.

Platform Selection:

Clients of ATC Brokers can choose from two primary trading platforms: the widely favored MT4, known for its reliability and extensive technical analysis tools, and the proprietary MT Pro platform, which is optimized for speed and user customizations. Both platforms are designed to meet the needs of both beginners and experienced traders, offering a comprehensive suite of trading tools.

Regional Restrictions:

There is limited detailed information regarding regional restrictions on the use of ATC Brokers services. It appears that while the broker complies with regional regulatory requirements, some countries may have additional limitations or conditions that affect account eligibility.

Customer Service Languages:

Details regarding the range of languages supported by ATC Brokers' customer service remain unclear. The available materials do not specify whether support is offered in multiple languages beyond English.

In this detailed atc brokers review, we have covered all available aspects regarding the broker's operational details, highlighting both strengths and areas where further clarity is needed.

Detailed Rating Analysis

1. Account Conditions Analysis

In our assessment of ATC Brokers, account conditions pose both promising features and significant challenges. The broker requires a minimum deposit of 2000 USD—considerably higher than many industry alternatives. This requirement restricts access for entry-level traders who may not have substantial capital to begin with. While the high leverage available could appeal to experienced traders looking to maximize returns, such leverage is limited by regional restrictions such as 1:50 for U.S. clients and 1:30 for those in the EU. Additionally, the absence of detailed spread and commission information leaves prospective clients uncertain about ongoing costs. The account opening process, including the verification protocols, has not been explained in publicly accessible materials, which adds another layer of confusion to the process. Some traders have noted that the trading costs associated with their accounts are average and do not offer a significant competitive advantage. Compared to the industry standard, ATC Brokers's account conditions suggest a trade-off between a premium trading environment and the high threshold for initial entry. Overall, while the conditions may be suited for established traders with sufficient capital, the high minimum deposit limits the broader market appeal. This analysis is in line with previous atc brokers review findings and user feedback collected from multiple sources.

ATC Brokers provides a range of trading tools and platforms intended to cater to different trading styles. The broker supports both the popular MT4 and its proprietary MT Pro platform, which are equipped with essential features such as advanced charting, technical indicators, and automated trading capabilities. These platforms are designed to serve not only forex but also commodities, indices, and even cryptocurrencies, showing ATC Brokers' attempt to offer comprehensive market access. However, while the availability of over 100 tradable instruments is good, there is a notable lack of investment in research and educational resources. The absence of detailed information on in-depth market analysis tools or training webinars means that intermediate traders might need to seek third-party resources to supplement their trading strategies. In our evaluation, the tools and resources provided are standard in comparison to competitors who invest heavily in comprehensive educational support. Nonetheless, for traders with a good understanding of market dynamics, the functionality of the trading platforms remains adequate. User feedback generally reflects a neutral stance on the quality of these resources, suggesting that while they are usable, they do not necessarily offer a distinct competitive advantage over similar brokers. Overall, the tools and resources of ATC Brokers, as detailed in this atc brokers review, function sufficiently for active trading but would benefit from expanded educational and analytical offerings.

3. Customer Service and Support Analysis

Customer service remains a critical component in the overall trading experience, and ATC Brokers' support structure appears to be average based on current reports. Clients have noted that the available customer service channels are not extensively detailed—there is little clarity on whether live chat, phone, or email support is readily accessible. Furthermore, feedback indicates that the response times and overall service quality fall into the "average" category. While a multilingual support framework might be expected from an international broker, the available promotional materials do not specify a broad range of language options, potentially limiting the experience for non-English speaking clients. There are no noted instances of effective resolution of issues or excellent customer support experiences recorded in user testimonies. Despite being regulated by reputable institutions, the broker has not been noted for a robust after-hours support service, which can be critical during volatile market periods. The overall picture suggests that while the customer service offered by ATC Brokers meets the basic industry standards, there is significant room for improvement. Enhancing service clarity, response speed, and multilingual support could help elevate this aspect of their operations. This evaluation is consistent with multiple reports and feedback aggregated in our atc brokers review.

4. Trading Experience Analysis

The trading experience with ATC Brokers is seen as a mixed bag, with functionality limited by certain execution details and platform performance variability. On one side, the broker's use of well-known platforms like MT4 and MT Pro provides traders with a familiar setting and access to essential technical tools. However, users have reported average trading execution speeds, with occasional issues like slippage and re-quotes coming to light in various market conditions. The stability of these platforms, which is critical during periods of high volatility, has been noted as acceptable but not exceptional. Moreover, the lack of detailed metrics regarding order execution quality leaves uncertainty among potential clients regarding the cost efficiency of their trades. While leverage options can enhance profit potential, the corresponding risks are magnified without transparent cost structures. As highlighted by several trading reports and user reviews, the overall trading environment is functional for those accustomed to moderate market conditions, yet it does not clearly outperform competitors who provide more rigorous execution quality data. This analysis draws on the insights provided throughout this atc brokers review, reflecting a trading experience that is functional but with identifiable areas in need of improvement.

5. Trust Analysis

Trust in any broker is built on strong regulatory oversight and a transparent operational framework. In the case of ATC Brokers, the presence of multiple regulatory licenses from the CFTC, FCA, and CIMA provides a foundational level of trust and has been positively noted among experienced traders. This multi-regulatory approach suggests that ATC Brokers is committed to adhering to high compliance standards, thus offering client protection and reliability. However, while the regulatory credentials are strong, there is little detailed public information on additional measures such as segregated client funds or risk management practices, which are crucial for building further confidence. Furthermore, the broker's history does not reveal any significant negative incidents or controversies, which can be taken as a positive sign. Nonetheless, many traders express caution due to the absence of in-depth disclosures regarding company financials or a clear breakdown of fee structures. This overall mixed sentiment, while not severely negative, suggests that the broker's trustworthiness is solid yet could be enhanced by greater transparency. Third-party analyses and industry reports reflect similar findings, indicating that while ATC Brokers can be considered trustworthy by regulatory standards, there remains opportunity to improve in showing financial strength and customer safeguards.

6. User Experience Analysis

User experience is a crucial factor when evaluating the overall performance of a broker, and in the case of ATC Brokers, the ratings point to a sufficiently functional, yet improvable, interface. The overall user satisfaction rating of 3/5 indicates that while many clients appreciate the core functionalities—such as a straightforward account setup and the familiar MT4/MT Pro trading platforms—there are persistent issues. Users have cited the high minimum deposit requirement and the lack of detailed information regarding deposit methods as hurdles that affect their overall experience. Moreover, navigation and ease-of-use on the trading platforms appear to be average; while the basic tools are present, advanced customization and seamless mobile experiences are noticeably lacking. Common complaints center on the moderate responsiveness of customer support and the absence of a comprehensive educational system or integrated market research tools. These factors, coupled with inconsistent trading costs and unclear fee structures, dampen the overall customer experience. As a result, while the broker does maintain a working platform appropriate for intermediate traders, significant improvements in interface design and customer guidance would likely boost satisfaction levels. The user feedback compiled for this segment aligns with the broader insights shared throughout this atc brokers review, pointing towards clear areas for future development.

Conclusion

In summary, ATC Brokers is a standard forex and CFD broker with a long history and a multi-regulatory framework. Its broad range of tradable assets and dual-platform offering make it a viable option for intermediate traders aiming for diversification. However, the significant minimum deposit requirement of 2000 USD, average transaction costs, and middling user experience pose notable limitations. This atc brokers review reflects that while the broker is trusted by regulators and presents a competent trading environment, potential users should consider if the high entry threshold aligns with their investment goals. Ultimately, ATC Brokers is best suited for traders with sufficient capital looking to access a wide array of instruments with regulated oversight.

Overall, this review has integrated data from industry sources, user feedback, and regulatory disclosures to present a balanced picture of ATC Brokers as of 2025. With areas identified for improvement alongside robust regulatory credentials and diverse trading tools, prospective clients are encouraged to research further and consider their individual trading needs before proceeding.