Regarding the legitimacy of ATC BROKERS forex brokers, it provides FCA, CIMA and WikiBit, (also has a graphic survey regarding security).

Is ATC BROKERS safe?

Pros

Cons

Is ATC BROKERS markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

ATC Brokers Limited

Effective Date:

2013-08-30Email Address of Licensed Institution:

jack@atcbrokers.com, jclaudio@atcbrokers.comSharing Status:

No SharingWebsite of Licensed Institution:

atcbrokers.co.ukExpiration Time:

--Address of Licensed Institution:

Tower 42 25 Old Broad Street London City Of London EC2N 1HN UNITED KINGDOMPhone Number of Licensed Institution:

+442033181399Licensed Institution Certified Documents:

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ATC Brokers Limited

Effective Date:

2018-11-05Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is ATC Brokers A Scam?

Introduction

ATC Brokers, established in 2005, positions itself as a reliable player in the forex market, offering a range of trading services including forex, CFDs, and commodities. As traders increasingly turn to online platforms for their investment needs, the importance of evaluating the credibility and reliability of these brokers cannot be overstated. The potential for scams in the forex industry necessitates a cautious approach, as traders risk not only their capital but also their financial security. This article aims to provide a thorough analysis of ATC Brokers, examining its regulatory standing, company background, trading conditions, client fund safety, customer experiences, and overall risk profile. The evaluation is based on a combination of qualitative assessments and quantitative data drawn from various reputable sources.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is fundamental to its legitimacy and the protection it offers to clients. ATC Brokers operates under the oversight of two primary regulatory bodies: the Financial Conduct Authority (FCA) in the UK and the Cayman Islands Monetary Authority (CIMA). The FCA is renowned for its stringent regulatory standards, which are designed to protect consumers and ensure fair trading practices. In contrast, while CIMA provides a regulatory framework, it does not hold the same level of international recognition as the FCA.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 591361 | United Kingdom | Verified |

| CIMA | 1448274 | Cayman Islands | Verified |

The presence of the FCA license is particularly significant as it mandates that brokers adhere to strict rules regarding capital adequacy, client fund segregation, and operational transparency. Additionally, clients of FCA-regulated brokers are protected under the Financial Services Compensation Scheme (FSCS), which provides compensation of up to £85,000 in case of insolvency. ATC Brokers has maintained a relatively clean regulatory record, with no major compliance issues reported, further reinforcing its legitimacy in the eyes of potential clients.

Company Background Investigation

ATC Brokers has a rich history that underscores its commitment to providing transparent trading solutions. Founded in 2005, the firm initially operated as an introducing broker in the United States before expanding its services to the UK and other regions. The ownership structure of ATC Brokers is designed to ensure that it operates as a client-centric firm, avoiding conflicts of interest by using an agency model rather than a dealing desk approach. This means that ATC Brokers does not take the opposite side of client trades, thereby aligning its interests with those of its clients.

The management team at ATC Brokers comprises industry veterans with extensive experience in financial markets, trading technologies, and regulatory compliance. This expertise is reflected in the broker's operational practices and customer service. However, while the company does provide some information regarding its management team, there is room for improvement in terms of overall transparency and disclosure of operational details. Potential clients should be aware of the company's ownership and management structure to better understand the broker they are considering.

Trading Conditions Analysis

The trading conditions offered by ATC Brokers are a crucial aspect of its overall appeal. The broker employs an ECN model, which typically results in tighter spreads and lower trading costs. However, the minimum deposit requirement is relatively high, set at $5,000, which may deter beginner traders.

The fee structure is primarily based on a commission model, with competitive spreads starting from 0.3 pips for major currency pairs.

| Fee Type | ATC Brokers | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 0.3 pips | 0.6 pips |

| Commission Model | $6 per standard lot | $10 per standard lot |

| Overnight Interest Range | Varies | Varies |

Despite the competitive spreads, traders should be aware of potential additional costs, such as withdrawal fees and inactivity fees, which can impact overall profitability. For instance, ATC Brokers charges a withdrawal fee of $40 for USD transactions and imposes a $50 inactivity fee after six months of no trading activity. These fees may be considered excessive compared to some competitors, highlighting the need for traders to carefully evaluate the total cost of trading.

Client Funds Security

The security of client funds is paramount in the forex trading environment. ATC Brokers implements several measures to ensure the safety of client deposits. Client funds are held in segregated accounts, which are separate from the broker's operating funds. This segregation is a critical requirement imposed by the FCA, designed to protect clients' money in the event of the broker's insolvency.

Additionally, ATC Brokers offers negative balance protection, ensuring that clients cannot lose more than their account balance, a feature that provides an extra layer of security for traders. Historical records indicate that ATC Brokers has not faced significant security breaches or fund mismanagement issues, further solidifying its reputation as a safe trading platform.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing the reliability of a broker. ATC Brokers has received a mix of reviews, with some clients praising its execution speed and customer service, while others have raised concerns about withdrawal processes and communication issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Addressed promptly |

| Lack of Educational Resources | Low | Acknowledged |

Common complaints include difficulties in withdrawing funds and a perceived lack of educational resources for novice traders. For instance, some users reported delays in processing withdrawals, which can be a significant concern for traders who require immediate access to their funds. However, the company has generally responded well to these complaints, indicating a willingness to improve its services.

Platform and Execution

The trading platform provided by ATC Brokers is primarily the widely-used MetaTrader 4 (MT4), which offers a robust trading environment with various analytical tools. The platform is known for its reliability and user-friendly interface, making it suitable for both novice and experienced traders.

However, there have been reports of occasional slippage and order rejections, which can impact trading performance. While the broker claims to maintain a high execution quality, any signs of manipulation or significant delays in order execution could raise red flags for traders.

Risk Assessment

Using ATC Brokers comes with inherent risks, as with any forex trading platform. The primary risks include the high minimum deposit requirement, potential withdrawal issues, and the overall market volatility associated with forex trading.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Financial Risk | High | Market volatility can lead to significant losses. |

| Operational Risk | Medium | Potential issues with withdrawal processing. |

| Regulatory Risk | Low | Strong regulatory oversight by FCA and CIMA. |

To mitigate these risks, traders are advised to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, maintaining sufficient capital and employing risk management strategies can help protect against significant losses.

Conclusion and Recommendations

In conclusion, ATC Brokers is not a scam but a legitimate broker regulated by reputable authorities such as the FCA and CIMA. While it offers competitive trading conditions and a secure trading environment, potential clients should be cautious of the high minimum deposit requirement and the fees associated with withdrawals and inactivity.

For beginner traders, it may be wise to consider alternative brokers that offer lower entry barriers and more comprehensive educational resources. Established brokers like IG or OANDA may provide more favorable conditions for novice traders. Overall, while ATC Brokers presents a reliable option for experienced traders, those new to forex trading should thoroughly assess their options before committing significant capital.

Is ATC BROKERS a scam, or is it legit?

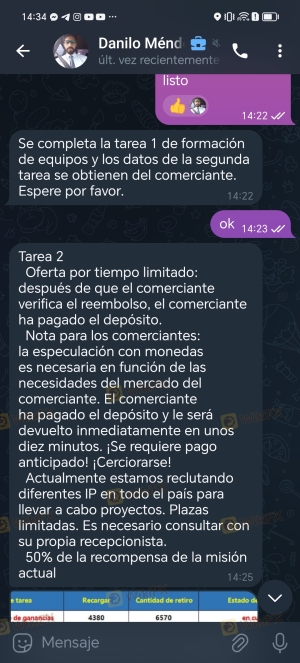

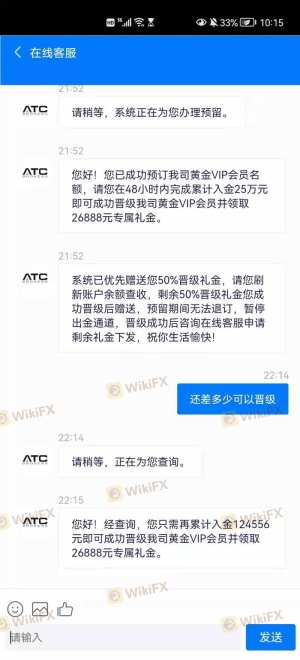

The latest exposure and evaluation content of ATC BROKERS brokers.

ATC BROKERS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ATC BROKERS latest industry rating score is 7.25, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.25 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.