Regarding the legitimacy of VENTEZO forex brokers, it provides FSA and WikiBit, .

Is VENTEZO safe?

Business

Risk Control

Is VENTEZO markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Ventezo Global Ltd

Effective Date:

--Email Address of Licensed Institution:

support@ventezo.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Room 3, Office A9, Providence Complex, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4375949Licensed Institution Certified Documents:

Is Ventezo A Scam?

Introduction

Ventezo is a relatively new player in the forex market, positioning itself as an online trading platform that offers a variety of financial instruments, including forex, commodities, and cryptocurrencies. With a low minimum deposit requirement and promises of high leverage, it aims to attract both novice and experienced traders. However, the increasing number of reports and reviews questioning its legitimacy raises concerns for potential investors. In an industry where trust and security are paramount, traders must exercise caution when evaluating forex brokers. This article aims to provide an objective analysis of Ventezo, examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The investigation is based on a thorough review of available online resources, user testimonials, and expert opinions.

Regulatory Status and Legitimacy

The regulatory status of a forex broker is crucial for ensuring the safety of traders' funds and the integrity of the trading environment. A regulated broker is subject to oversight by financial authorities, which helps to protect investors from fraud and malpractice. In the case of Ventezo, it claims to be registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | sd197 | Saint Vincent and the Grenadines | Unverified |

Despite its claims, multiple sources indicate that Ventezo is not regulated by any reputable authority, which raises significant red flags regarding its legitimacy. The lack of oversight from established regulatory bodies such as the UK‘s Financial Conduct Authority (FCA) or Australia’s Australian Securities and Investments Commission (ASIC) diminishes the broker's credibility. Furthermore, the absence of a solid regulatory framework means that traders have limited recourse in the event of disputes or issues with fund withdrawals.

The regulatory quality in offshore jurisdictions is often criticized for being inadequate, allowing many brokers to operate with minimal scrutiny. This has historically led to instances of fraud and mismanagement, making it essential for traders to approach such brokers with extreme caution.

Company Background Investigation

Ventezo was established in 2021, and although it claims to have a team of experienced traders and financial professionals, there is a lack of transparency surrounding its ownership and management structure. The company's official website provides minimal information about its founders or key personnel, which is a common trait among potentially fraudulent brokers.

The absence of detailed information regarding the management team raises concerns about the broker's accountability and operational integrity. A reputable broker typically provides information about its leadership, including their qualifications and experience in the financial sector. This transparency is crucial for building trust with clients, and the lack of it can be a warning sign for potential investors.

Moreover, Ventezo's claims of being a reliable trading platform are contradicted by the numerous negative reviews and complaints from users. Many traders have reported issues related to fund withdrawals and poor customer service, which further highlights the need for thorough due diligence before engaging with this broker.

Trading Conditions Analysis

Ventezo offers a variety of trading accounts with different features, including a low minimum deposit of $10 and leverage options of up to 1:1000. However, the trading conditions provided by the broker have drawn scrutiny.

| Fee Type | Ventezo | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.0 pips | 0.5-1.0 pips |

| Commission Model | $0-$8 per lot | $5-$10 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by Ventezo may appear competitive, it is essential to consider the overall cost structure. Some users have reported hidden fees and unfavorable withdrawal conditions, which can significantly impact profitability. The commission structure, which varies based on account types, may also present challenges for traders looking to maintain low trading costs.

Moreover, the broker's policies regarding withdrawals have been flagged as problematic, with many users experiencing delays or outright denials of their withdrawal requests. Such practices are often indicative of a broker that may not have the best interests of its clients at heart, further emphasizing the need for caution.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. A trustworthy broker should have robust measures in place to protect clients' investments. Ventezo claims to offer segregated accounts and negative balance protection, which are essential features for safeguarding traders' funds.

However, the effectiveness of these measures is questionable given the broker's unregulated status. Without oversight from a reputable financial authority, there is no guarantee that these claims are upheld in practice. Reports of clients experiencing difficulties in withdrawing their funds raise serious concerns about the actual implementation of these safety measures.

Historically, unregulated brokers have been involved in numerous financial scandals, leading to significant losses for traders. The lack of a compensation fund or investor protection mechanisms further exacerbates the risks associated with trading with Ventezo.

Customer Experience and Complaints

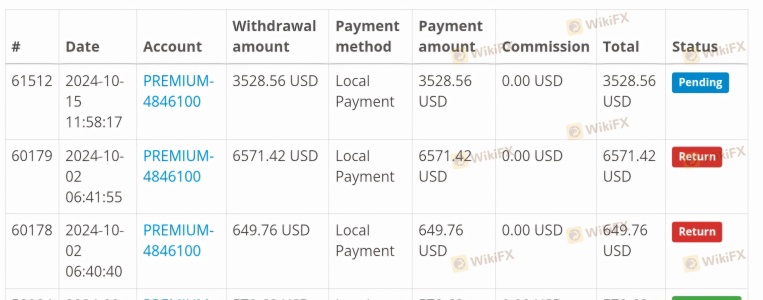

Customer feedback plays a crucial role in assessing the reliability of a forex broker. Unfortunately, the reviews for Ventezo are predominantly negative, with many users expressing frustration over withdrawal issues and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Service | Medium | Inconsistent |

| Misleading Information | High | No Clarification |

Common complaints include prolonged withdrawal processing times, with some traders reporting that their funds were held for weeks without resolution. The company's lack of responsiveness to customer inquiries further aggravates the situation, leading many to label Ventezo as a scam.

For instance, one user reported waiting over a month for a withdrawal request to be processed, only to receive vague responses from customer support. Such experiences are alarming and indicate a potential pattern of neglect and mismanagement within the broker's operations.

Platform and Trade Execution

The trading platform offered by Ventezo is built on MetaTrader 4 (MT4), a popular choice among traders for its user-friendly interface and robust features. However, the platform's performance and execution quality have raised concerns among users.

Issues related to order execution, slippage, and rejections have been reported, which can severely impact trading outcomes. A reliable broker should ensure that trades are executed promptly and at the requested prices. However, traders have noted instances of significant slippage and rejected orders, which are detrimental to their trading strategies.

Furthermore, any signs of platform manipulation or irregularities in trade execution should be taken seriously. Traders must remain vigilant and scrutinize their experiences to identify potential red flags.

Risk Assessment

Engaging with Ventezo presents several risks that potential investors should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Financial Risk | High | Reports of withdrawal issues indicate potential financial instability. |

| Operational Risk | Medium | Poor customer service and execution issues can impact trading success. |

Given the high-risk profile associated with Ventezo, traders are advised to exercise extreme caution. It is essential to conduct thorough research and consider alternative brokers that offer better regulatory oversight and customer support.

Conclusion and Recommendations

In summary, the evidence suggests that Ventezo operates with significant risks and lacks the regulatory oversight necessary to ensure the safety of traders' funds. The numerous complaints and negative reviews highlight a troubling pattern of withdrawal issues and poor customer service.

For traders considering engaging with Ventezo, it is crucial to weigh these risks carefully. If you are a novice trader or someone who values security and regulatory protection, it may be wise to explore alternative brokers that are well-regulated and have a proven track record of reliability.

Some reputable alternatives to consider include brokers regulated by the FCA, ASIC, or CySEC, which offer a more secure trading environment. Always prioritize brokers with transparent operations, solid regulatory frameworks, and positive user feedback to safeguard your investments.

Is VENTEZO a scam, or is it legit?

The latest exposure and evaluation content of VENTEZO brokers.

VENTEZO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VENTEZO latest industry rating score is 2.63, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.63 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.