Ventezo 2025 Review: Everything You Need to Know

Executive Summary

This ventezo review gives you a complete look at Ventezo, a forex broker from Saint Vincent and the Grenadines. The broker shows mixed results for people who want to trade. Ventezo works with very little oversight since it's only registered in Saint Vincent and the Grenadines, which has weak rules for brokers. Trustpilot gives Ventezo a score of 2.76 out of 5, which means users have serious problems with the company.

The broker says it has a license, but we can't find clear details about this claim. User reviews point out big problems, especially with customer service that doesn't respond to questions. Many people report that support staff ignore them and don't solve their complaints properly.

These issues create a tough situation for traders who want good service and protection. Ventezo seems to target people who can handle high risks and care more about low costs than strong oversight. But the company doesn't share enough details about trading rules, platform features, and fees, so traders can't make smart choices.

This review helps explain what we know about Ventezo while showing where information is missing.

Important Disclaimer

Traders need to know that Ventezo mainly works under Saint Vincent and the Grenadines rules, which give much less protection than major financial areas. The broker doesn't have approval from strong regulatory groups like the FCA, ASIC, or CySEC, which hurts trader protection and options for help. Different countries may have different access to Ventezo's services, so traders should check their local rules before starting.

This review uses public information, user feedback, and industry reports from 2025. The review may not show all user experiences, and individual trading results can be very different. Traders should strongly consider doing their own research and think about their risk comfort before making investment choices with Ventezo or any other broker.

Rating Framework

Broker Overview

Ventezo works as an online forex broker with its main registration in Saint Vincent and the Grenadines. WikiFX and other industry sources say the company offers forex trading services, but we can't find much information about when it started or its company history. The broker's business plan seems focused on giving access to foreign exchange markets, though specific details about account types, trading rules, and services are hard to find in public materials.

The company's regulatory status is one of its biggest problems. Ventezo claims to have licensing, but the specific details and scope of this licensing are unclear from available sources. Registration in Saint Vincent and the Grenadines gives very little regulatory oversight compared to major financial centers, which could leave traders with limited protection and help options.

This regulatory position suggests the broker may target traders who care more about lower costs than strong regulatory protection. Available information shows that Ventezo has problems with transparency and communication, as shown by user complaints and the low TrustScore. The broker's online presence and marketing materials lack the detailed information that people expect from established forex brokers, including specific trading platform details, complete fee schedules, and clear service terms.

This information gap makes it hard for potential clients to fully judge if the broker fits their trading needs.

Regulatory Status

Ventezo's regulatory framework only includes registration in Saint Vincent and the Grenadines, a place known for minimal financial oversight. The broker lacks approval from major regulatory bodies such as the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), or Cyprus Securities and Exchange Commission (CySEC).

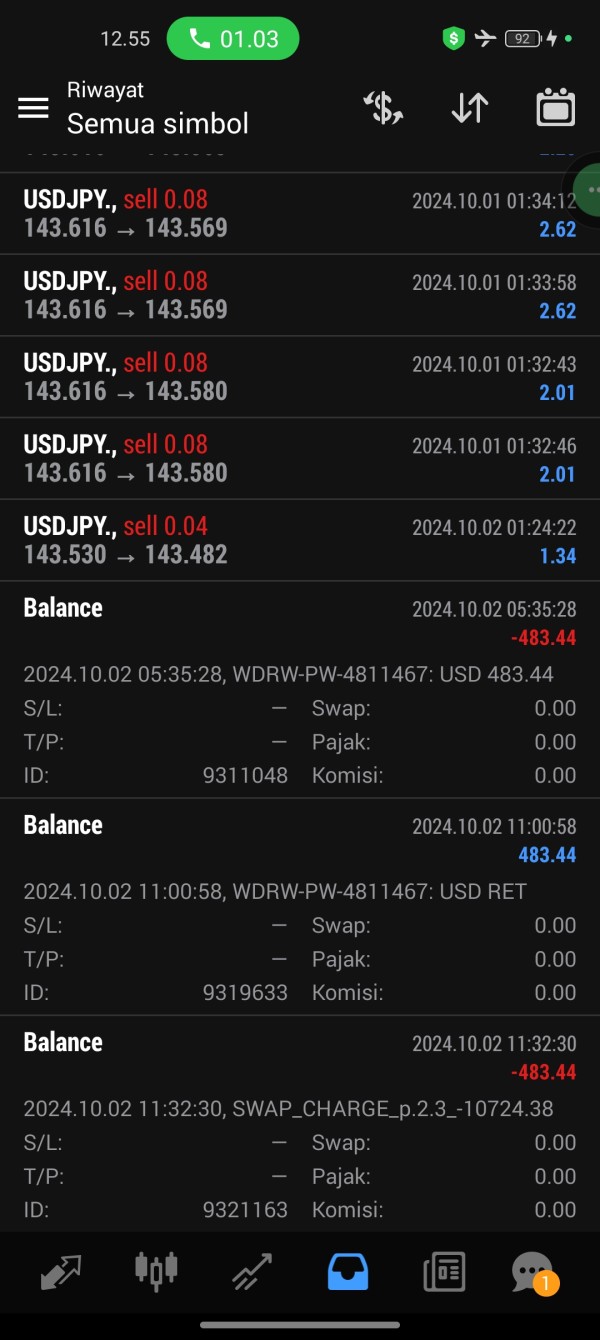

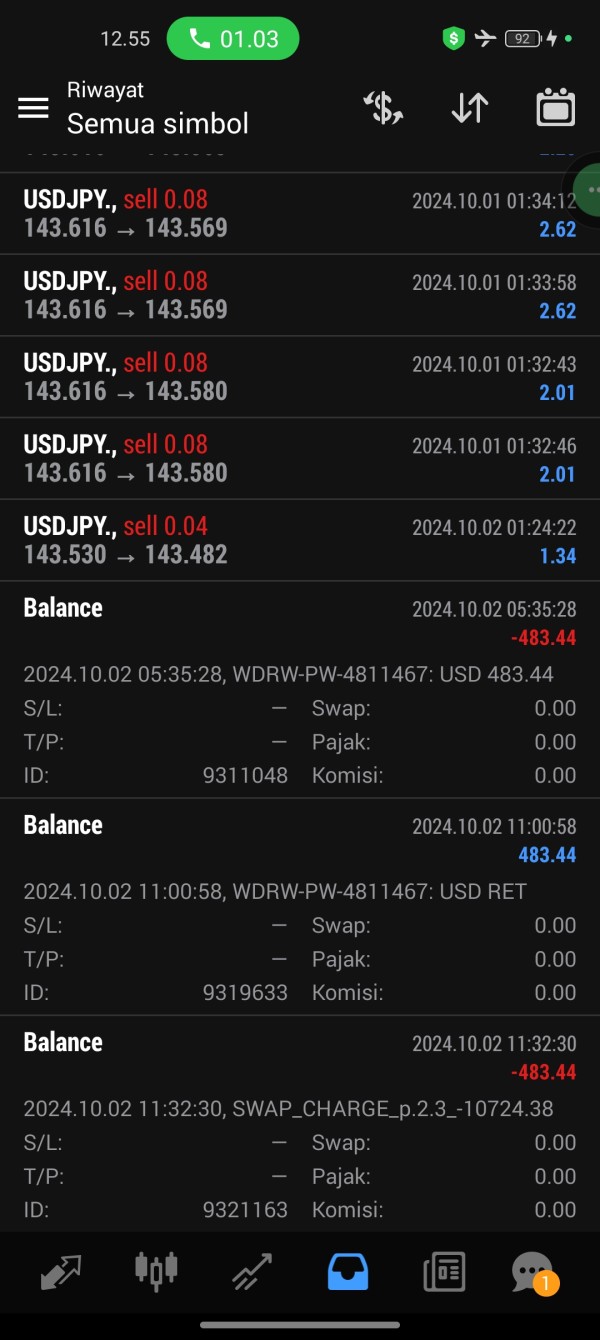

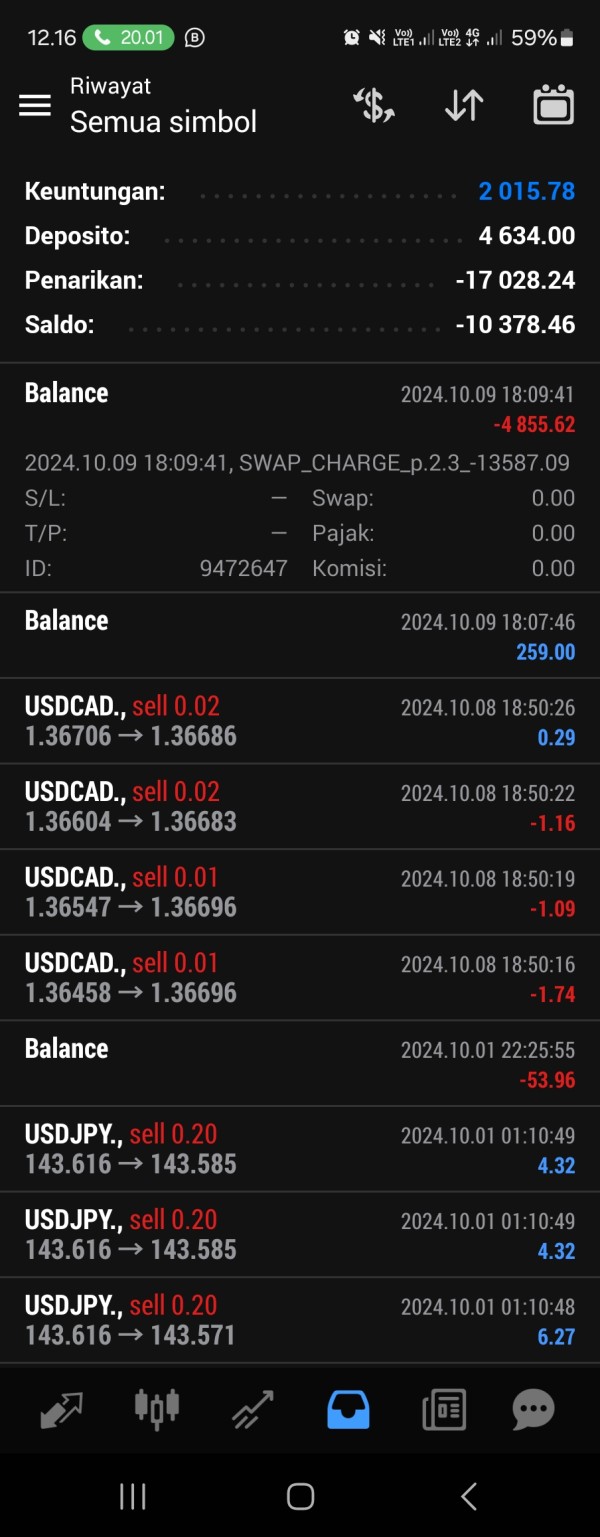

Deposit and Withdrawal Methods

We can't find specific information about deposit and withdrawal methods in available sources. This lack of transparency about payment processing creates a significant information gap for potential traders.

Minimum Deposit Requirements

The minimum deposit requirements for opening an account with Ventezo are not listed in available documentation, making it difficult for traders to assess accessibility.

Available sources don't provide specific information about bonuses, promotions, or special offers that Ventezo may give to new or existing clients.

Available Trading Assets

Details about the range of tradeable assets, including currency pairs, commodities, indices, or other instruments, are not fully covered in available materials.

Cost Structure

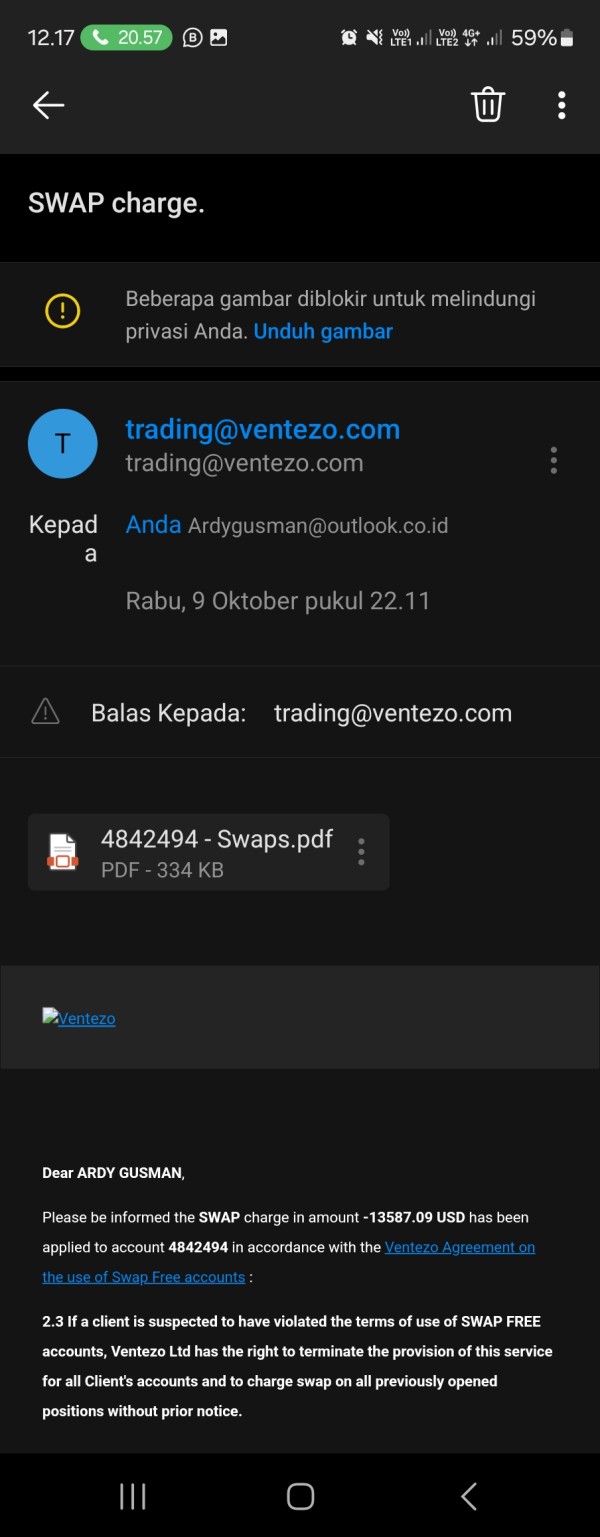

The broker's fee structure, including spreads, commissions, overnight fees, and other charges, lacks detailed documentation in public sources, creating uncertainty about trading costs.

Leverage Ratios

Specific leverage ratios offered by Ventezo are not detailed in available information, which is crucial information for risk management.

Information about trading platforms, whether proprietary or third-party solutions like MetaTrader, is not specified in available sources.

This ventezo review shows significant information gaps that potential traders should consider carefully before making any commitments.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Ventezo's account conditions get a poor rating because of the significant lack of transparency and available information. The broker fails to give clear details about account types, minimum deposit requirements, or specific terms and conditions that would let traders make informed decisions. This lack of openness is particularly concerning in an industry where clarity about account specifications is essential for proper risk management and trading planning.

The absence of detailed information about account opening procedures, verification requirements, and account maintenance fees creates uncertainty for potential clients. Professional traders typically need complete information about account specifications, including any restrictions, limitations, or special features that may apply to different account levels. Ventezo's failure to provide this information publicly suggests either poor communication practices or potentially unfavorable terms that the broker prefers not to share.

The lack of information about special account types, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, shows limited accommodation for diverse client needs. The poor TrustScore of 2.76 suggests that existing clients have had difficulties with account-related issues, though specific details about these problems are not fully documented. This ventezo review finds that the account conditions represent a significant weakness in the broker's overall offering.

The tools and resources category gets the lowest rating because of the virtual absence of information about trading tools, analytical resources, or educational materials. Modern forex trading requires access to sophisticated analytical tools, real-time market data, economic calendars, and technical analysis capabilities. Ventezo's failure to provide clear information about these essential trading resources raises serious concerns about the broker's ability to support effective trading activities.

Educational resources are particularly important for both new and experienced traders seeking to improve their skills and market understanding. The lack of documented educational materials, webinars, tutorials, or market analysis suggests that Ventezo may not prioritize client development and success. This absence is particularly notable when compared to established brokers who typically provide complete educational libraries and ongoing market commentary.

Research capabilities and market analysis tools are fundamental for informed trading decisions. The absence of information about charting tools, technical indicators, automated trading support, or third-party research partnerships shows significant limitations in the broker's resource offering. Without access to professional-grade tools and resources, traders may find themselves at a significant disadvantage in the competitive forex market.

Customer Service and Support Analysis (Score: 4/10)

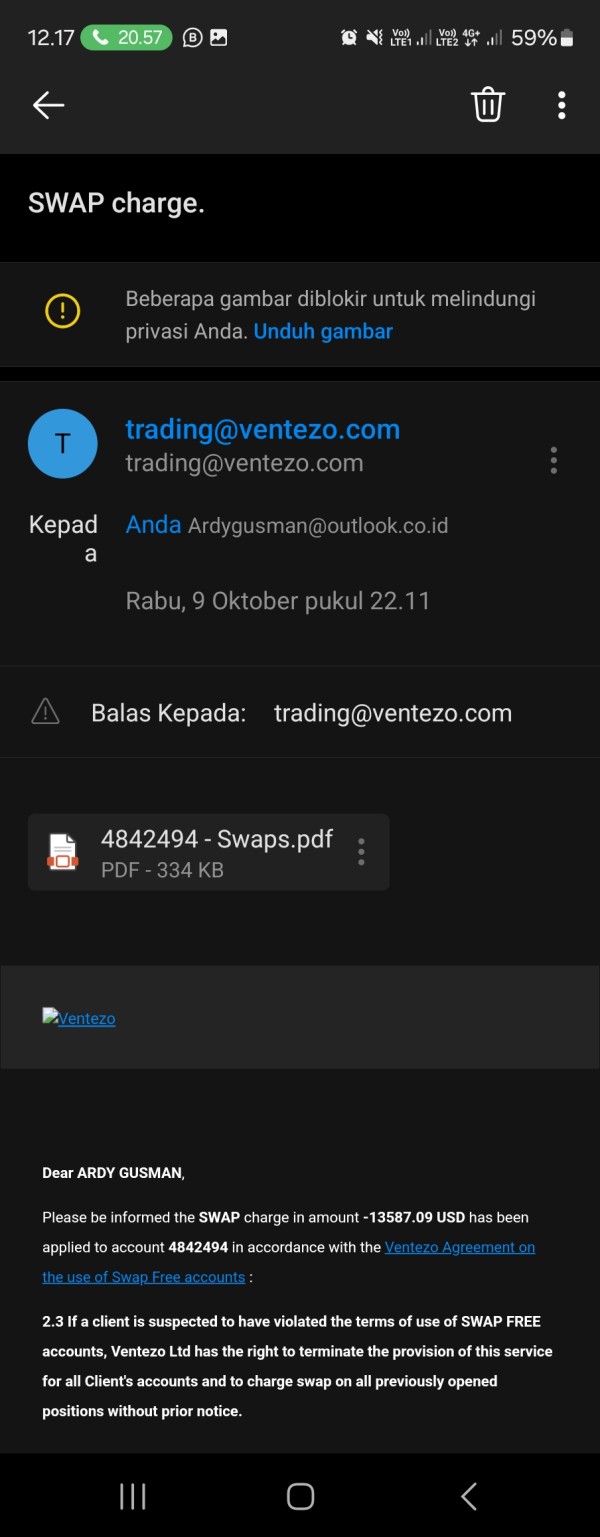

Customer service represents one of Ventezo's most documented weaknesses, with multiple user reports showing unresponsive support staff and incomplete complaint resolution. According to available user feedback, clients have had difficulties reaching customer service representatives and getting timely responses to their questions. This poor responsiveness is particularly problematic in forex trading, where quick resolution of account or trading issues can be crucial for protecting client interests.

The TrustScore of 2.76 partially reflects customer service failures, with users specifically mentioning that support staff do not respond to communications. This lack of responsiveness suggests either inadequate staffing levels, poor training, or systematic issues with the broker's customer service infrastructure. Professional forex brokers typically maintain multiple communication channels and provide prompt responses to client inquiries, making Ventezo's performance in this area particularly concerning.

Complaint resolution processes appear to be incomplete or ineffective based on available user feedback. When clients encounter problems with their accounts, trades, or withdrawals, they expect professional and timely assistance. The documented failures in this area suggest that traders may face significant difficulties if they encounter problems with their accounts or trading activities.

The absence of information about customer service hours, available languages, or escalation procedures further compounds these concerns.

Trading Experience Analysis (Score: 3/10)

The trading experience evaluation is severely hampered by the lack of specific information about trading platforms, execution quality, and overall trading environment. Without clear documentation about the trading platform used by Ventezo, potential clients cannot assess whether the broker provides the technological infrastructure necessary for effective forex trading. Modern traders require stable, fast, and feature-rich platforms that can handle complex trading strategies and provide reliable order execution.

Platform stability and execution speed are crucial factors that directly impact trading profitability and risk management. The absence of performance data, execution statistics, or user testimonials about platform reliability creates uncertainty about Ventezo's ability to provide professional-grade trading conditions. This information gap is particularly concerning for active traders who require consistent platform performance and rapid order execution.

Mobile trading capabilities have become essential in modern forex trading, allowing traders to monitor positions and execute trades while away from their primary workstations. The lack of information about mobile applications or mobile-optimized platforms suggests potential limitations in trading flexibility. Additionally, without details about order types, trading tools, or platform customization options, traders cannot determine whether Ventezo's offering meets their specific trading requirements.

This ventezo review finds the trading experience category significantly limited by information transparency issues.

Trust and Safety Analysis (Score: 2/10)

Trust and safety represent Ventezo's most significant weaknesses, primarily due to limited regulatory oversight and poor user confidence indicators. The broker's registration in Saint Vincent and the Grenadines provides minimal regulatory protection compared to major financial jurisdictions. This regulatory environment typically lacks comprehensive client fund protection schemes, dispute resolution mechanisms, and ongoing oversight that traders expect from reputable brokers.

The TrustScore of 2.76 shows substantial user concerns about the broker's reliability and trustworthiness. This low rating suggests that existing clients have experienced problems that have eroded confidence in the broker's operations. Trust is fundamental in forex trading, where clients must rely on brokers to handle their funds professionally and execute trades fairly.

The documented trust issues represent a significant red flag for potential clients. Fund safety measures and segregation practices are not clearly documented in available materials, creating uncertainty about client fund protection. Established brokers typically provide detailed information about how client funds are protected, including segregation practices, insurance coverage, and banking arrangements.

Ventezo's failure to provide this transparency raises concerns about fund safety and the broker's commitment to client protection. The combination of limited regulatory oversight, poor user confidence, and lack of transparency about safety measures results in a very poor trust and safety rating.

User Experience Analysis (Score: 3/10)

User experience assessment reveals significant challenges across multiple touchpoints. The overall user satisfaction appears low based on available feedback and the poor TrustScore, showing that clients have encountered various issues with the broker's services. User experience encompasses everything from initial account opening through ongoing trading activities and customer service interactions, and Ventezo appears to have deficiencies across these areas.

The registration and verification processes are not clearly documented, potentially creating confusion and delays for new clients. Modern forex brokers typically provide streamlined onboarding experiences with clear guidance about required documentation and verification timelines. The lack of transparency about these processes suggests potential complications for new account holders.

Common user complaints center around unresponsive customer service and incomplete problem resolution, showing systematic issues with client support. These problems significantly impact the overall user experience and suggest that clients may face ongoing difficulties with account management and issue resolution. The absence of detailed information about account management tools, reporting capabilities, and client portal features further limits the assessment of user experience quality.

Based on available evidence, Ventezo's user experience falls well below industry standards for professional forex brokers.

Conclusion

This comprehensive ventezo review reveals a broker with significant limitations and concerns that potential traders should carefully consider. Ventezo's operation under minimal regulatory oversight in Saint Vincent and the Grenadines, combined with a poor TrustScore of 2.76 and documented customer service issues, creates a challenging environment for traders seeking reliable and professional forex trading services.

The broker may appeal to traders with very high risk tolerance who prioritize potentially lower regulatory costs over comprehensive protection and transparency. However, the extensive information gaps, poor customer feedback, and limited regulatory oversight make Ventezo unsuitable for most traders, particularly those seeking professional-grade services and reliable support.

The primary advantages appear limited to potential cost savings associated with lighter regulation, while the disadvantages include poor customer service responsiveness, lack of transparency, limited regulatory protection, and insufficient information about trading conditions. Traders considering Ventezo should carefully weigh these factors against their individual needs and risk tolerance before making any commitment.