Is Tradehall safe?

Pros

Cons

Is Tradehall A Scam?

Introduction

Tradehall is a forex broker that has emerged in the competitive landscape of online trading since its establishment in 2020. With claims of offering a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies, Tradehall positions itself as an innovative and reliable platform for both novice and experienced traders. However, the rise of online trading has also seen a corresponding increase in fraudulent activities, making it crucial for traders to conduct thorough evaluations of any broker they consider. This article aims to provide an objective analysis of Tradehall, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The investigation is based on a review of various credible sources and regulatory databases to present a comprehensive picture of Tradehall's legitimacy.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors that determine its legitimacy. Tradehall claims to be regulated in multiple jurisdictions, including Australia and Canada, but the details surrounding its regulatory compliance are murky.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001282038 | Australia | Revoked |

| FINTRAC | N/A | Canada | Active |

| SVG FSA | N/A | St. Vincent | Not Regulated |

Tradehall asserts that it operates under the auspices of the Australian Securities and Investments Commission (ASIC) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). However, a closer examination reveals that Tradehall's ASIC license has been revoked, raising significant concerns about its operational legitimacy. Moreover, while Tradehall claims to have a presence in Saint Vincent and the Grenadines, this jurisdiction is notorious for lacking proper regulatory oversight, making it an attractive location for dubious brokers. The absence of a valid National Futures Association (NFA) membership in the U.S. further complicates Tradehall's regulatory standing, as it indicates a lack of oversight in one of the world's largest forex markets. Given these discrepancies, potential investors should approach Tradehall with caution, as its regulatory claims appear to be overstated or misleading.

Company Background Investigation

Tradehall's corporate history is relatively brief but warrants scrutiny. The broker is owned by Tradehall Ltd and operates from multiple locations, including Australia and St. Vincent and the Grenadines. However, the actual ownership structure and management team remain vague, with limited public information available about key personnel. This lack of transparency is concerning, as a reputable broker typically provides detailed information about its management team and their qualifications.

The company's website claims to focus on innovation and customer service, yet it lacks essential disclosures about its operational practices and financial health. The absence of comprehensive information regarding ownership and management raises red flags about the broker's commitment to transparency. Investors should be wary of companies that do not provide clear insights into their leadership and operational practices, as this can often signal underlying issues.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is essential for assessing overall cost and accessibility. Tradehall's fee structure is not fully transparent, which can lead to confusion among traders. It offers various account types, but specific details about spreads and commissions are often missing or vague.

| Fee Type | Tradehall | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | Not disclosed | $5-10 per lot |

| Overnight Interest Range | Not disclosed | 0.5%-2.5% |

The lack of clarity surrounding spreads and commissions is concerning, as traders may find themselves facing unexpected costs. Furthermore, the absence of a clearly defined commission structure can lead to disputes over trading costs, particularly for high-frequency traders.

Additionally, Tradehall's offering of high leverage (up to 1:500) may be appealing to some traders but poses significant risks, especially for inexperienced investors. Regulatory bodies in regions like Europe have capped leverage at much lower levels (1:30) to protect traders from excessive risk. This discrepancy suggests that Tradehall may not adhere to best practices in risk management, further complicating its appeal.

Client Fund Security

The security of client funds is paramount in the forex trading environment. Tradehall claims to implement various safeguards for client funds, but the effectiveness of these measures is questionable. The broker does not provide clear information regarding fund segregation, investor protection schemes, or negative balance protection.

The absence of segregated accounts raises concerns about the safety of clients' deposits, particularly in the event of financial difficulties faced by the broker. Furthermore, without a credible regulatory framework, there is no assurance that client funds are protected against loss. Historical complaints and warnings from financial authorities, particularly in Malaysia, indicate that Tradehall has faced scrutiny regarding its operational practices. Such issues can lead to significant losses for traders, especially if the broker fails to uphold its fiduciary responsibilities.

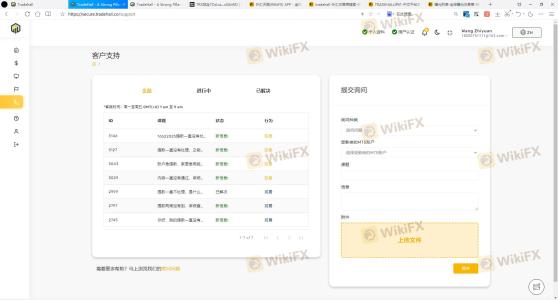

Customer Experience and Complaints

Customer feedback is a vital component of evaluating a broker's reliability. Reviews of Tradehall reveal a mixed bag of experiences, with many users expressing dissatisfaction with the broker's service quality and responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | Inconsistent |

| Customer Support Delays | High | Poor quality |

Common complaints include difficulties with withdrawals, lack of transparency regarding fees, and unresponsive customer support. For instance, some users have reported long delays in processing withdrawal requests, raising concerns about the broker's liquidity and operational integrity. The inability to provide timely and effective support can exacerbate negative experiences, leading to a loss of trust among clients.

Platform and Execution

The trading platform offered by Tradehall is Metatrader 5, which is widely regarded for its robust features and user-friendly interface. However, the performance of the platform can vary significantly based on the broker's execution quality.

Traders have reported issues with slippage and rejected orders, which can severely impact trading outcomes. While Metatrader 5 is a strong platform, the broker's execution practices can diminish its effectiveness. Furthermore, any signs of platform manipulation, such as artificially inflating prices or delaying order execution, should be taken seriously, as they indicate a lack of ethical trading practices.

Risk Assessment

Utilizing Tradehall comes with a range of risks that potential investors should carefully consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of valid oversight and licenses |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Complaints regarding service delivery |

| Market Risk | High | High leverage increases potential loss |

To mitigate these risks, traders should conduct thorough due diligence before engaging with the broker. It is advisable to limit initial investments and to consider using a demo account to familiarize oneself with the platform and its features before committing real funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tradehall exhibits several characteristics commonly associated with untrustworthy brokers. Its regulatory status is questionable, with revoked licenses and a lack of transparency surrounding its operations and management. Additionally, the broker's trading conditions, while potentially appealing due to high leverage, pose significant risks that could lead to substantial losses.

Given these factors, it is prudent for traders to exercise caution when considering Tradehall as a trading partner. For those seeking reliable alternatives, it may be beneficial to explore brokers that are well-regulated and have a proven track record of customer satisfaction and transparency. Trusted options include brokers regulated by the FCA, ASIC, or other reputable authorities, which offer greater security and peace of mind for investors.

Is Tradehall a scam, or is it legit?

The latest exposure and evaluation content of Tradehall brokers.

Tradehall Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradehall latest industry rating score is 2.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.