Tradehall 2025 Review: Everything You Need to Know

Executive Summary

This tradehall review gives you a complete look at a forex broker that has caused major concerns in the trading community. Tradehall started in 2020 and says it operates from Australia, offering forex trading services plus other financial tools like indices, stocks, cryptocurrencies, commodities, and ETFs. Our investigation shows troubling patterns that potential traders must think about carefully.

Multiple regulatory bodies have flagged the broker. The Malaysian Securities Commission gave warnings for unlicensed capital market activities. User feedback shows severe issues with withdrawal processing, with reports of delays up to six months. The lack of clear regulatory information, plus widespread negative user experiences, makes Tradehall a high-risk option for forex traders. Our analysis focuses on the absence of proper licensing and numerous complaints about customer service and fund access.

Important Notice

Regional Entity Differences: Tradehall's regulatory status changes significantly across different areas. The company claims Australian headquarters, but it has received specific warnings from Malaysian regulatory authorities about unauthorized operations. Traders must verify Tradehall's legal status in their regions before considering any engagement.

Review Methodology: This evaluation uses publicly available information, user feedback from multiple platforms, and regulatory notices. We maintain transparency in our assessment process, focusing on objective analysis of available data while noting information limitations where they exist.

Rating Framework

Broker Overview

Tradehall entered the forex brokerage market in 2020. The company positions itself as a comprehensive trading platform based in Australia. Tradehall presents itself as a provider of diverse financial trading opportunities, though significant transparency gaps exist regarding its operational structure and regulatory compliance. According to available information, Tradehall attempts to serve traders interested in multiple asset classes, but regulatory warnings and user complaints have severely compromised the broker's reputation.

The broker's business model focuses on offering access to various financial markets. These include foreign exchange, stock indices, individual equities, digital currencies, commodities, and exchange-traded funds. However, the lack of detailed platform specifications and the absence of clear regulatory authorization raise substantial concerns about the broker's legitimacy and operational capacity. Multiple review platforms and regulatory bodies have issued warnings about Tradehall's practices, particularly regarding withdrawal processing and customer service standards.

The Malaysian Securities Commission has specifically warned the public about Tradehall's involvement in unlicensed capital market activities. This regulatory action, combined with consistent user reports of delayed withdrawals and poor customer service, suggests that Tradehall operates with significant operational and compliance deficiencies. Potential clients should carefully consider these issues.

Regulatory Status: Tradehall has received warnings from the Malaysian Securities Commission for conducting unauthorized securities activities. The broker has not provided transparent regulatory information to support its claimed legitimacy.

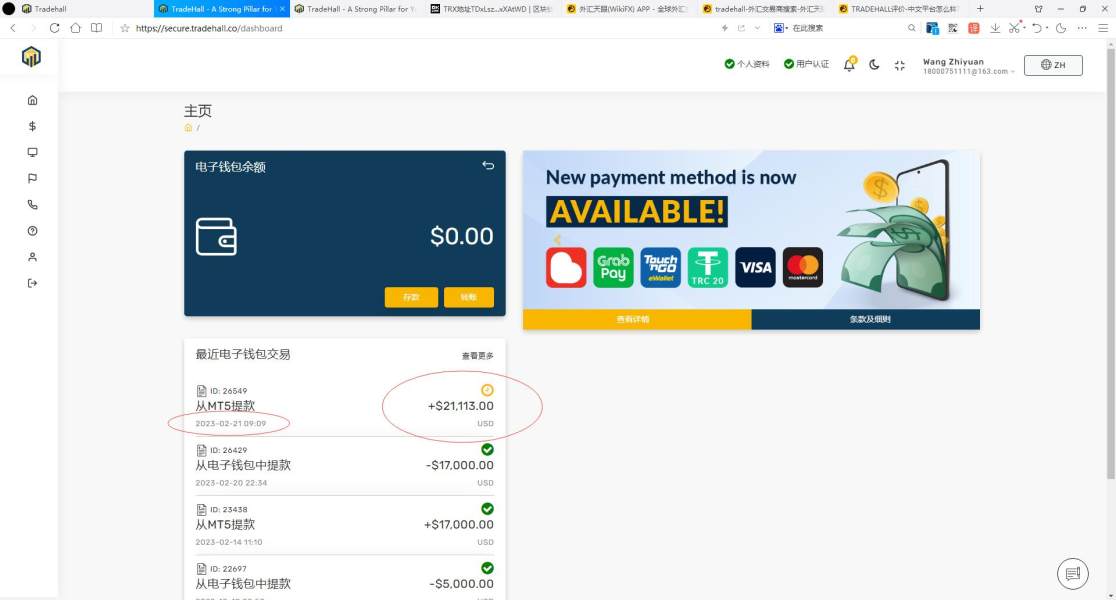

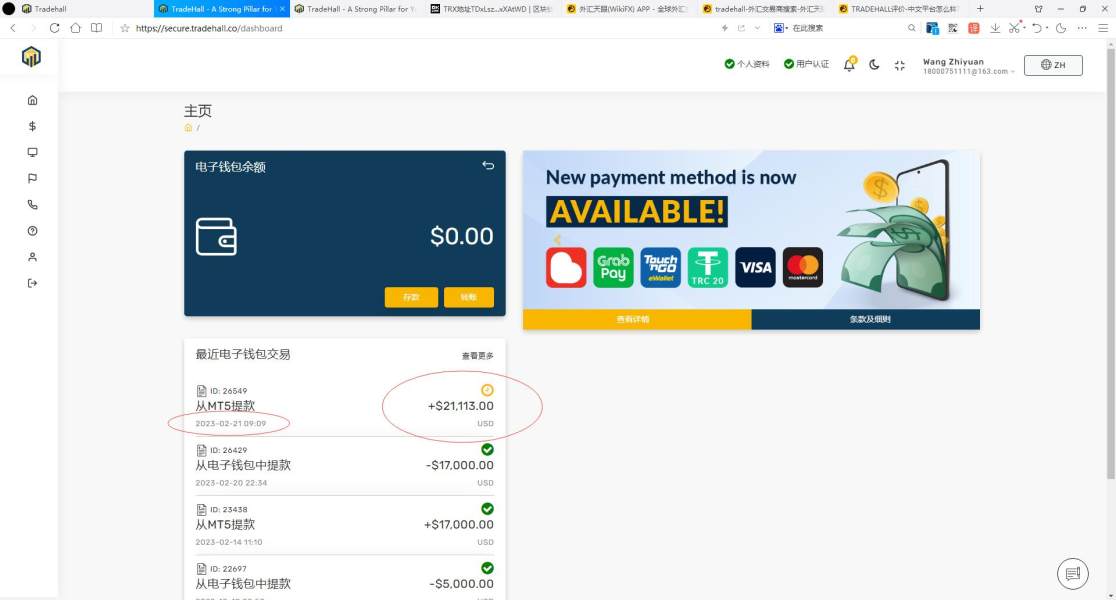

Deposit and Withdrawal Methods: Specific information regarding available deposit and withdrawal methods is not detailed in available sources. User reports consistently highlight significant delays in withdrawal processing.

Minimum Deposit Requirements: Available sources do not specify minimum deposit requirements for opening accounts with Tradehall.

Promotional Offers: Information regarding bonus promotions or special offers is not mentioned in available source materials.

Tradeable Assets: Tradehall offers access to forex pairs, stock indices, individual stocks, cryptocurrencies, commodities, and ETFs. This provides a diverse range of trading opportunities despite other operational concerns.

Cost Structure: Specific information about spreads, commissions, and fee structures is not detailed in the available source materials. This represents a significant transparency gap.

Leverage Options: Available sources do not provide specific information about leverage ratios offered by Tradehall.

Platform Selection: Detailed information about trading platform options is not specified in available source materials.

Geographic Restrictions: Available sources do not mention specific geographic restrictions or limitations for Tradehall's services.

Customer Service Languages: Information about supported customer service languages is not specified in available source materials.

This tradehall review reveals significant information gaps. Potential traders should consider these as red flags when evaluating broker options.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

Tradehall's account conditions present several concerning limitations that significantly impact the trading experience. The broker appears to offer only a single basic account type. This limited account structure contrasts sharply with industry standards where reputable brokers typically provide multiple account tiers with varying features and requirements.

The most significant issue affecting account conditions relates to withdrawal processing. User reports consistently indicate withdrawal delays extending up to six months, which represents an unacceptable timeframe that effectively locks traders' funds. These delays suggest either severe operational inefficiencies or, more concerning, potential issues with fund management and liquidity.

The account opening process details are not transparently provided in available materials. This raises additional concerns about the broker's commitment to regulatory compliance and customer transparency. Industry-standard brokers typically provide clear information about account opening requirements, verification procedures, and fund management protocols.

Compared to established brokers in the forex market, Tradehall's account conditions fall significantly short of acceptable standards. The combination of limited account options and severe withdrawal delays makes this tradehall review particularly critical of the broker's account management capabilities.

Tradehall's tools and resources receive a middle-range score primarily due to the variety of tradeable assets offered. The broker provides access to multiple asset classes including forex, indices, stocks, cryptocurrencies, commodities, and ETFs, which offers traders diversification opportunities across various markets. However, significant concerns exist regarding platform quality and user satisfaction.

The lack of detailed information about specific trading tools, analytical resources, and platform capabilities represents a significant transparency deficit. Professional traders typically require access to advanced charting tools, technical indicators, economic calendars, and market analysis resources. Available information does not confirm the availability or quality of such features.

Educational resources, which are crucial for trader development, are not mentioned in available source materials. Reputable brokers typically provide comprehensive educational content, webinars, tutorials, and market insights to support trader success. Tradehall's commitment to trader education remains unclear.

User feedback regarding tools and resources is generally negative. Complaints focus on overall platform functionality and trading environment quality. The absence of information about automated trading support, API access, or advanced order types further limits the platform's appeal to serious traders.

Customer Service and Support Analysis (Score: 2/10)

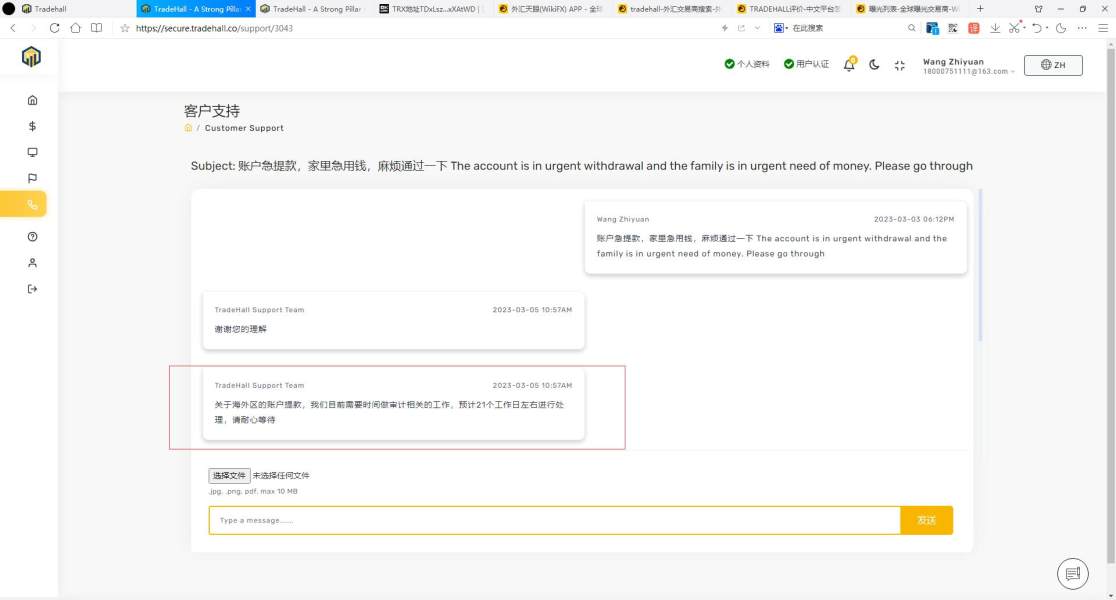

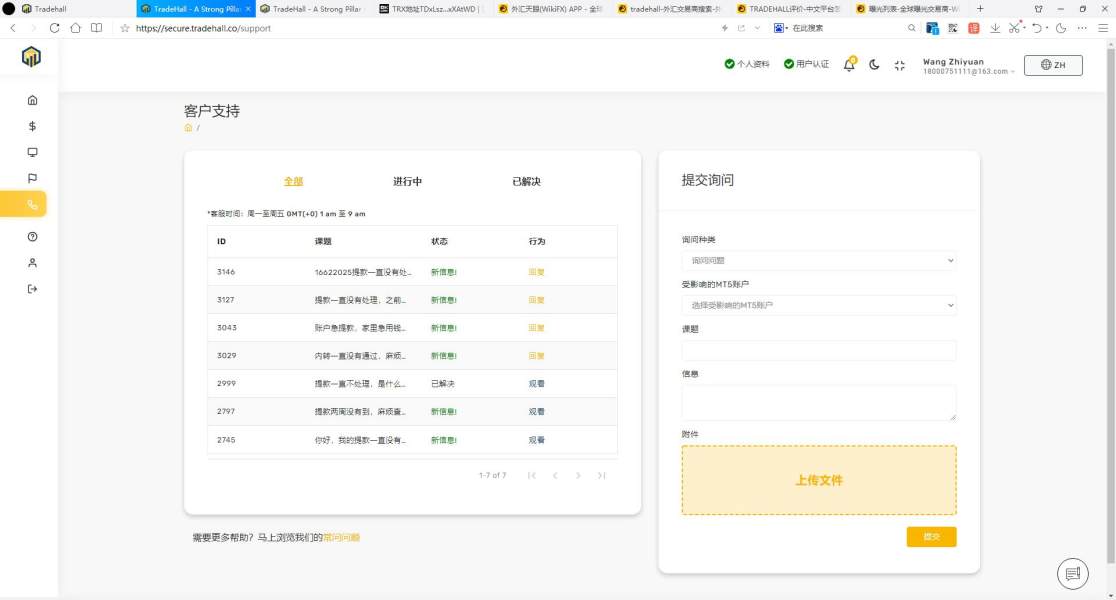

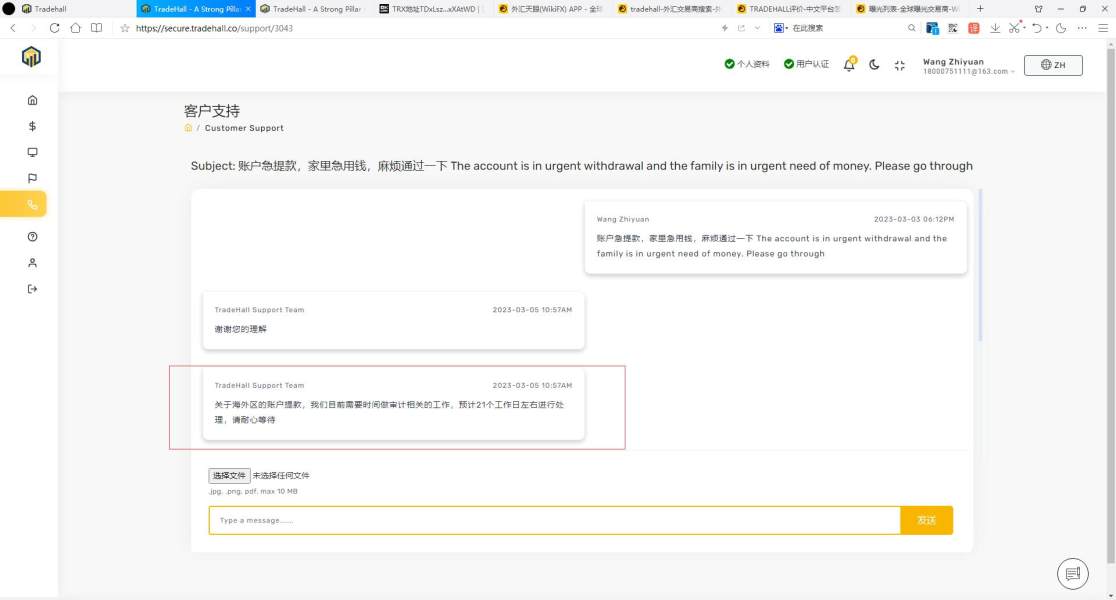

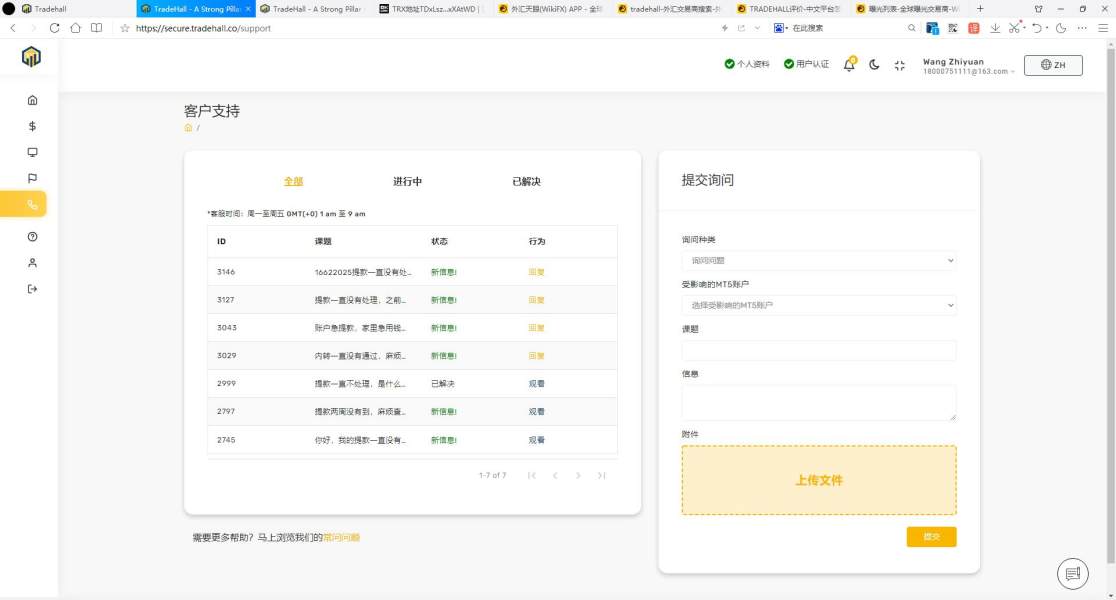

Customer service represents one of Tradehall's most significant weaknesses. It earns the lowest scores in our evaluation framework. User reports consistently highlight unresponsive customer support, with particular emphasis on the broker's failure to address withdrawal requests in a timely manner. The documented withdrawal processing delays of up to six months indicate either severe operational dysfunction or potential fund management issues.

Available information does not specify customer service channels, response time standards, or support availability hours. This represents a fundamental transparency failure. Professional brokers typically provide multiple contact methods including live chat, email, telephone support, and comprehensive FAQ sections, along with clearly stated response time commitments.

The quality of support interactions, based on user feedback, appears to be significantly below industry standards. Traders report difficulty obtaining responses to basic inquiries, particularly regarding fund withdrawals and account management issues. This pattern suggests either inadequate staffing, poor training, or systemic issues with customer service protocols.

Multi-language support availability is not specified in available materials. This may limit accessibility for international traders. The absence of clear customer service information combined with negative user experiences creates substantial concerns about Tradehall's commitment to customer satisfaction and support quality.

Trading Experience Analysis (Score: 4/10)

The trading experience with Tradehall receives a below-average score due to a combination of platform information deficits and negative user feedback. While the broker claims to offer access to multiple asset classes, the lack of specific platform details makes it difficult to assess the actual trading environment quality and functionality.

User reports suggest issues with trade execution quality. Complaints include problems with slippage and requoting, which can significantly impact trading profitability. These execution problems, combined with concerns about platform stability and speed, create an unfavorable trading environment that may not meet professional trader requirements.

The absence of detailed information about platform features, mobile trading capabilities, and advanced order types represents a significant transparency gap. Modern traders expect access to sophisticated trading tools, real-time market data, and reliable execution. Tradehall's platform capabilities remain unclear from available sources.

Mobile trading experience, which is crucial for contemporary forex trading, is not detailed in available materials. The lack of information about mobile app functionality, cross-platform synchronization, and mobile-specific features further limits the broker's appeal. Active traders require flexible trading access.

This tradehall review emphasizes that the combination of execution issues and information gaps creates substantial uncertainty about the overall trading experience quality.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent Tradehall's most critical weakness. They earn the lowest possible score in our evaluation framework. The broker's regulatory status is particularly concerning, with the Malaysian Securities Commission issuing specific warnings about unlicensed capital market activities. This regulatory action indicates that Tradehall operates without proper authorization, which poses significant risks to trader funds and legal protection.

The absence of transparent regulatory information represents a fundamental red flag in forex broker evaluation. Legitimate brokers typically prominently display their regulatory licenses, provide registration numbers, and maintain compliance with established financial authorities. Tradehall's failure to provide clear regulatory credentials suggests either non-compliance or deliberate opacity regarding its legal status.

Fund safety measures, which are crucial for trader protection, are not detailed in available materials. Reputable brokers typically maintain segregated client accounts, provide deposit insurance, and demonstrate financial stability through regular audits and regulatory reporting. The lack of such information raises serious concerns about fund security and broker financial stability.

Industry reputation analysis reveals consistent negative assessments from multiple review platforms and regulatory bodies. The combination of regulatory warnings and widespread negative recommendations indicates systematic issues with Tradehall's business practices and operational standards.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Tradehall is predominantly negative. This reflects serious concerns about service quality and operational reliability. User reviews consistently highlight issues with withdrawal processing, customer service responsiveness, and overall platform functionality, creating a pattern of dissatisfaction that extends across multiple service areas.

Interface design and usability information is not detailed in available source materials. User feedback suggests that platform experience does not meet contemporary standards. Modern traders expect intuitive interfaces, responsive design, and seamless navigation, but Tradehall's platform capabilities remain unclear and potentially inadequate.

Registration and verification processes are not transparently described. This creates uncertainty about account opening requirements and timeline expectations. Professional brokers typically provide clear guidance about documentation requirements, verification procedures, and account activation timelines.

Fund operation experience represents the most significant user concern. Withdrawal delays of up to six months create substantial financial and operational challenges for traders. These delays effectively prevent traders from accessing their funds, which violates fundamental expectations of broker-client relationships.

Common user complaints focus on withdrawal processing delays, unresponsive customer service, and concerns about broker legitimacy. The pattern of negative feedback suggests systematic operational issues. These affect multiple aspects of the trading experience and client relationship management.

Conclusion

This comprehensive tradehall review reveals significant concerns that make the broker unsuitable for most traders. Tradehall's performance across all evaluation criteria falls well below industry standards, with particular weaknesses in trust and reliability, customer service, and user experience. This is especially true for those new to forex trading.

The broker's regulatory status represents the most serious concern. Warnings from the Malaysian Securities Commission about unlicensed operations create substantial legal and financial risks for potential clients. Combined with consistent user reports of withdrawal delays extending up to six months, these issues suggest fundamental operational and compliance problems.

While Tradehall offers access to multiple asset classes, this single advantage is significantly outweighed by numerous operational deficiencies. Regulatory concerns and negative user experiences create additional problems. We strongly recommend that traders consider well-regulated, established brokers with transparent operations and positive user feedback instead of engaging with Tradehall.