YCHpro 2025 Review: Everything You Need to Know

Executive Summary

This ychpro review gives you a complete look at YCHpro, a trading platform that has caught attention in the forex market despite major regulatory concerns. YCHpro says it is a world-leading online trading platform. It offers 24/7 multilingual real-time trading and investor education across various financial derivatives including forex, precious metals, and indices.

However, our review shows critical concerns about YCHpro's regulatory status. The platform operates without any regulatory oversight. This significantly raises the risk for potential traders. YCHpro offers diverse financial products and educational support, but the absence of regulatory protection makes it suitable mainly for traders with high risk tolerance. These traders must understand the potential for substantial losses.

The platform targets traders seeking high-risk, high-reward opportunities. But the lack of regulatory safeguards means that client funds and trading activities are not protected by established financial authorities. This ychpro review emphasizes the importance of understanding these risks before engaging with the platform.

Important Notice

This review is based on publicly available information and user feedback compiled from various sources. Traders should note that YCHpro's regulatory status remains unclear. There is no mention of supervision by recognized financial authorities. The evaluation presented here reflects the platform's current standing as of 2025, but potential users are strongly advised to conduct their own due diligence before making any investment decisions.

The absence of regulatory information in available materials raises significant concerns about trader protection and fund security. All information presented should be verified independently. Traders should be aware that unregulated brokers carry inherent risks that regulated alternatives do not.

Rating Framework

Broker Overview

YCHpro was established on April 21, 2023. It positions itself as an innovative online trading platform in the competitive forex market. Despite its relatively recent entry into the market, the platform has managed to attract attention from various traders seeking exposure to financial derivatives. The company presents itself as a world-leading trading destination, though this claim requires careful scrutiny given the platform's unregulated status.

The broker operates as an online trading provider offering what it describes as a social investment network. This approach suggests a focus on community-driven trading experiences. However, specific details about the social trading features are not extensively documented in available materials. YCHpro's business model centers on providing access to multiple asset classes while offering educational resources to support trader development.

The platform's asset coverage includes forex pairs, precious metals, and various indices. This provides traders with diversified exposure to different market segments. However, the absence of regulatory oversight from recognized financial authorities represents a significant concern for potential users. This ychpro review emphasizes that while the platform offers multiple trading opportunities, the regulatory gap creates substantial risks. Traders must carefully consider these risks before engaging with the service.

Regulatory Status: Available information does not identify any regulatory supervision for YCHpro. This absence of regulatory oversight represents a critical risk factor. Traders lack the protections typically provided by licensed financial authorities.

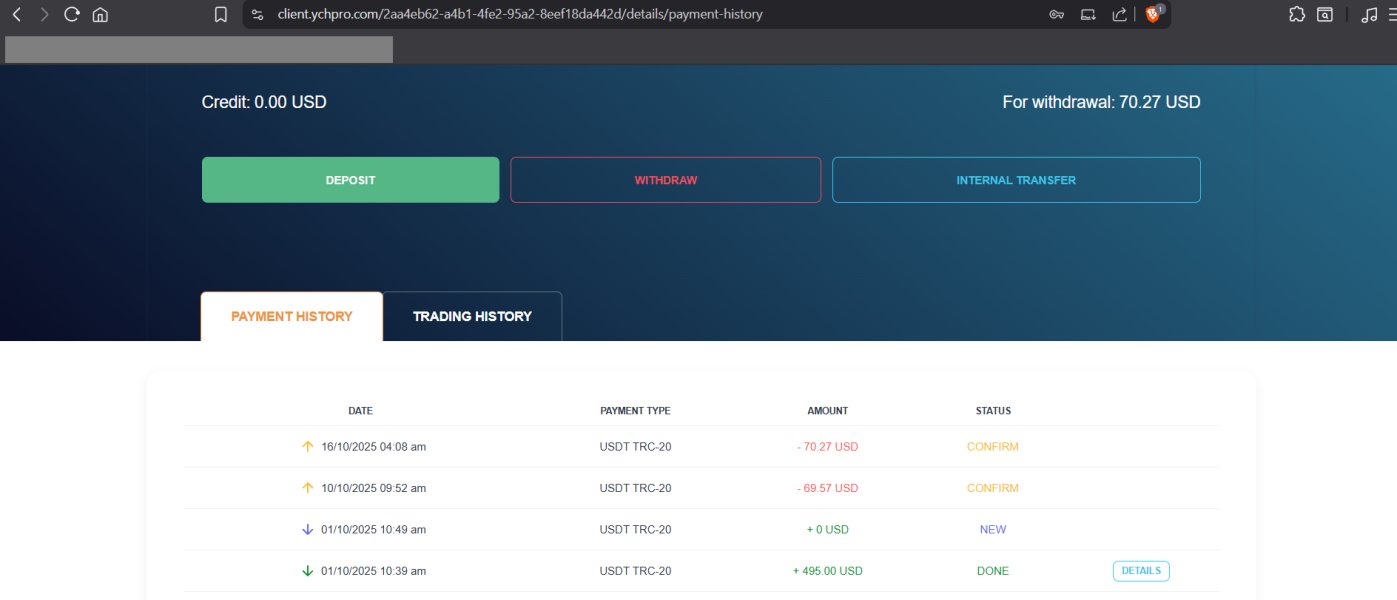

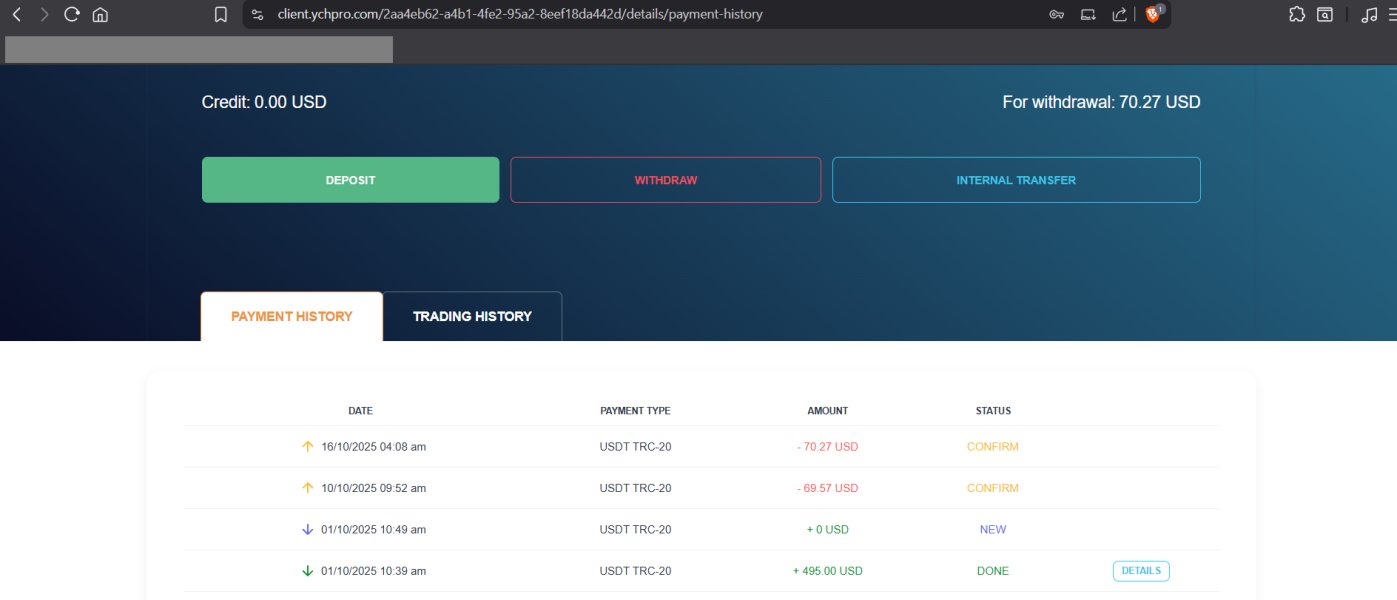

Deposit and Withdrawal Methods: Specific information about funding options is not detailed in available sources. Potential users should inquire directly about available payment methods and associated processing times.

Minimum Deposit Requirements: The platform's entry-level funding requirements are not specified in accessible materials. This makes it difficult to assess accessibility for different trader segments.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not mentioned in the source materials reviewed for this analysis.

Tradeable Assets: YCHpro provides access to forex pairs, precious metals, and indices. This selection covers major market categories. However, the specific number of instruments and market depth are not detailed.

Cost Structure: Information about spreads, commissions, overnight fees, and other trading costs is not available in the reviewed materials. This lack of transparency makes it challenging to assess the platform's competitiveness.

Leverage Options: Specific leverage ratios offered by YCHpro are not mentioned in available documentation. This is crucial information for risk assessment.

Platform Technology: The trading platform type and technology specifications are not detailed in source materials. This makes it difficult to evaluate the technical trading environment.

Geographic Restrictions: Information about regional availability and restrictions is not specified in the materials reviewed for this ychpro review.

Customer Support Languages: The platform offers 24/7 multilingual support. This indicates a commitment to serving an international client base across different time zones.

Comprehensive Rating Analysis

Account Conditions Analysis

The evaluation of YCHpro's account conditions faces significant limitations due to insufficient information in available source materials. Traditional account analysis typically examines factors such as account types, minimum deposit requirements, account opening procedures, and special features like Islamic accounts. However, these fundamental details are not specified in the documentation reviewed.

Without clear information about account tiers, minimum funding requirements, or account-specific benefits, potential traders cannot adequately assess whether YCHpro's offerings align with their trading capital and strategy requirements. The absence of account condition details represents a transparency concern. Reputable brokers typically provide comprehensive information about their account structures.

This information gap makes it impossible to compare YCHpro's account conditions with industry standards or competitor offerings. Traders considering this platform should directly request detailed account information before making any commitments. The lack of publicly available account details in this ychpro review reflects broader transparency concerns that potential users should carefully consider.

YCHpro demonstrates strength in its educational commitment. It offers investor education with multilingual support. This focus on trader development represents a positive aspect of the platform's service offering. The availability of educational resources suggests recognition of the importance of informed trading decisions, particularly given the high-risk nature of forex and CFD trading.

The platform provides access to multiple financial derivatives, including forex, precious metals, and indices. This asset diversity allows traders to explore different market segments and potentially diversify their trading strategies. However, specific details about trading tools, analytical resources, research capabilities, and automated trading support are not detailed in available materials.

The absence of information about advanced trading tools, market analysis resources, and technical indicators limits the ability to fully assess the platform's trading environment. Professional traders typically require sophisticated analytical tools and research resources. YCHpro's specific offerings in these areas remain unclear based on available documentation.

Customer Service and Support Analysis

YCHpro's commitment to 24/7 multilingual support represents a significant positive aspect of their service offering. This round-the-clock availability suggests recognition of the global nature of forex markets and the need for continuous support across different time zones. The multilingual capability indicates efforts to serve an international client base effectively.

However, specific details about customer service channels, response times, service quality metrics, and problem resolution procedures are not available in the reviewed materials. Without information about communication methods such as live chat, email support, phone assistance, or ticket systems, it's difficult to assess the accessibility and effectiveness of the support infrastructure.

The absence of user feedback about customer service experiences in available materials limits the ability to evaluate actual service quality. Professional trading platforms typically provide multiple support channels with documented response time commitments. YCHpro's specific service standards are not detailed in accessible information.

Trading Experience Analysis

The evaluation of YCHpro's trading experience faces significant limitations due to the absence of technical performance data and platform specifications in available materials. Critical factors such as platform stability, execution speeds, order processing quality, and system reliability cannot be assessed based on the information reviewed.

Mobile trading capabilities, which are essential in today's trading environment, are not specifically addressed in available documentation. The lack of information about platform functionality, user interface design, and trading tools makes it impossible to evaluate the actual trading environment that users would experience.

Without user feedback about platform performance, execution quality, or trading conditions, this ychpro review cannot provide meaningful insights into the practical trading experience. The absence of technical specifications and performance metrics represents a significant information gap. Potential users should address this through direct platform testing or additional research.

Trust and Security Analysis

YCHpro's trust and security profile presents significant concerns due to the absence of regulatory oversight. The platform operates without supervision from recognized financial authorities. This eliminates crucial trader protections typically provided by regulated brokers. This regulatory gap represents the most critical risk factor identified in this evaluation.

Without regulatory oversight, traders lack access to compensation schemes, dispute resolution mechanisms, and fund protection measures that regulated brokers must provide. The absence of regulatory supervision also means that YCHpro's business practices, financial stability, and client fund handling are not subject to external oversight and compliance requirements.

The platform's establishment in April 2023 means it has limited operational history. This makes it difficult to assess long-term reliability and stability. The combination of recent establishment and regulatory absence creates a high-risk profile that requires careful consideration by potential users.

User Experience Analysis

The assessment of YCHpro's user experience is limited by the absence of detailed user feedback and interface information in available materials. Key factors such as overall user satisfaction, platform usability, registration processes, and fund management experiences cannot be evaluated based on the reviewed documentation.

Without specific user testimonials, satisfaction ratings, or detailed interface descriptions, it's impossible to determine how well the platform serves different types of traders. The lack of information about common user concerns, platform strengths from a user perspective, and areas for improvement limits the practical value of this analysis.

The absence of user experience data makes it difficult to identify the trader profiles that might find YCHpro most suitable. Professional evaluation of user experience typically relies on actual user feedback and interface testing. Neither of these is available in sufficient detail for this review.

Conclusion

This ychpro review reveals a trading platform with both potential opportunities and significant risks. YCHpro offers access to diverse financial products including forex, precious metals, and indices. It is supported by multilingual customer service and educational resources. These features demonstrate a commitment to serving international traders with varying experience levels.

However, the platform's most critical limitation is its unregulated status. Operating without oversight from recognized financial authorities creates substantial risks for traders. These include lack of fund protection, absence of dispute resolution mechanisms, and no regulatory compliance requirements. This regulatory gap makes YCHpro suitable primarily for high-risk tolerance traders who fully understand the potential for significant losses.

The platform appears most appropriate for experienced traders seeking high-risk, high-reward opportunities. These traders must be comfortable operating in unregulated environments. New or risk-averse traders should carefully consider regulated alternatives that provide greater protection and transparency. The combination of limited operational history and regulatory absence requires exceptional due diligence from potential users.