Is YCHpro safe?

Business

License

Is YCHPro Safe or Scam?

Introduction

YCHPro is an online trading platform that positions itself as a provider of forex and financial derivatives trading. In an era where the forex market is increasingly accessible to retail investors, it becomes imperative for traders to carefully evaluate the brokers they choose to work with. The potential for scams in the forex industry is significant, with many traders falling victim to unregulated or poorly managed platforms. This article aims to assess the safety and legitimacy of YCHPro by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile. The investigation is based on a comprehensive review of available online resources, user feedback, and regulatory information.

Regulation and Legitimacy

The regulatory status of a forex broker is a crucial factor in determining its safety. YCHPro claims to operate under the jurisdiction of Mauritius and holds a securities license from the Financial Services Commission (FSC) of Mauritius. Regulatory oversight is essential as it provides a level of consumer protection and ensures that the broker adheres to industry standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Commission (FSC) | Not specified | Mauritius | Suspicious clone |

Despite having a license, the FSC has flagged YCHPro as a "suspicious clone," indicating potential concerns over its legitimacy. This classification raises red flags for potential investors, as it suggests that the broker may not be operating in full compliance with regulatory standards. The lack of a clear license number and the designation as a clone further complicate the assessment of YCHPro's regulatory standing. Traders should be wary of engaging with brokers that lack robust regulatory oversight, as this can expose them to significant risks, including the possibility of fraud or loss of funds. Therefore, it is vital to consider these factors when evaluating whether YCHPro is safe.

Company Background Investigation

YCHPro's company history and ownership structure play a significant role in assessing its credibility. Information regarding its founding date, key personnel, and operational history is crucial for understanding the brokers reliability. YCHPro is relatively new to the market, having been established within the last few years. This limited operational history can be a concern, as established brokers typically have a track record that can be scrutinized by potential clients.

The management team‘s background is another important aspect to consider. A team with extensive experience in the financial services industry can inspire confidence among traders. However, details about YCHPro’s management are not readily available, which raises questions about transparency and accountability. Transparency in operations and information disclosure is vital for building trust with clients. A lack of such transparency can lead to skepticism about the broker's intentions and practices.

Trading Conditions Analysis

Understanding the trading conditions offered by YCHPro is essential for evaluating its overall value to traders. The broker claims to provide competitive spreads and various trading instruments, but the specifics of its fee structure warrant closer examination.

| Fee Type | YCHPro | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not specified | 1-2 pips |

| Commission Structure | Not disclosed | Varies by broker |

| Overnight Interest Range | Not specified | 2-3% |

The absence of detailed information regarding spreads, commissions, and overnight interest can be a significant drawback for traders. Typically, reputable brokers provide clear fee structures to ensure traders can make informed decisions. If YCHPro does not disclose its fees transparently, it may indicate a lack of integrity in its operations. Traders should be cautious of any hidden fees or unfavorable trading conditions that could affect their profitability. This lack of clarity raises concerns about whether YCHPro is safe for trading.

Client Fund Security

The security of client funds is a top priority for any forex broker. YCHPro claims to implement various measures to protect client funds, including segregated accounts and investor compensation schemes. However, the effectiveness of these measures is contingent upon the broker's regulatory compliance.

In the case of YCHPro, it is crucial to verify whether the broker utilizes segregated accounts to separate client funds from its operational funds. This practice helps protect clients in the event of the broker's insolvency. Additionally, the presence of an investor compensation scheme can provide an extra layer of security for traders.

However, given the concerns surrounding YCHPro's regulatory status, it is unclear whether these security measures are effectively implemented. Historical issues regarding fund security or client complaints can further complicate the assessment of YCHPro's reliability. Traders should conduct thorough due diligence to ascertain whether YCHPro is safe for their investments.

Customer Experience and Complaints

Understanding customer experiences and complaints is vital in evaluating the overall credibility of YCHPro. User feedback can provide insights into the broker's reliability, quality of service, and responsiveness to issues.

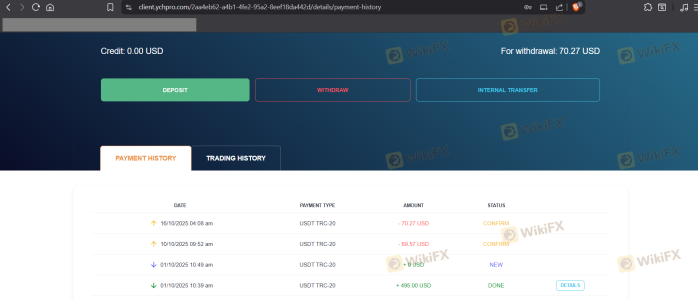

Common complaints against brokers often include withdrawal difficulties, lack of customer support, and unexpected fees. For YCHPro, it is essential to analyze the nature and frequency of complaints filed by users.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Support | Medium | Slow response |

| Fee Transparency | High | No clear answers |

Several users have reported difficulties in withdrawing funds, which is a significant red flag. An unresponsive customer support team can exacerbate these issues, leaving clients feeling frustrated and vulnerable. The lack of clear answers regarding fees further complicates the situation, as it may indicate a lack of transparency in the broker's operations.

These patterns of complaints suggest that potential clients should approach YCHPro with caution, as unresolved issues may indicate a fundamental lack of integrity and reliability. Therefore, it is crucial to consider whether YCHPro is safe for trading.

Platform and Execution

The performance and stability of YCHPro's trading platform are critical factors for traders. A reliable platform should offer seamless execution, minimal slippage, and a user-friendly interface. However, any signs of platform manipulation or poor execution can significantly impact trading performance.

User reviews indicate mixed experiences with YCHPro's platform performance. Some traders have reported issues with order execution, including slippage and rejected orders during volatile market conditions. These issues can lead to significant losses and frustration among traders.

Moreover, the overall user experience on the platform should be assessed. A platform that is difficult to navigate or lacks essential features can hinder traders' ability to make informed decisions. Therefore, it is essential to evaluate whether YCHPro is safe by considering these platform-related factors.

Risk Assessment

Engaging with any forex broker involves inherent risks. For YCHPro, a comprehensive risk assessment is necessary to understand the potential pitfalls of trading with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security Risk | Medium | Lack of clarity on fund protection measures. |

| Customer Service Risk | High | Poor response to complaints and issues. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

Given the high regulatory risk associated with YCHPro, traders should be particularly cautious. The potential for fund security issues and the broker's questionable customer service further elevate the overall risk profile. To mitigate these risks, traders should consider starting with a small investment or exploring alternative, more reputable brokers.

Conclusion and Recommendations

In conclusion, the investigation into YCHPro raises significant concerns regarding its safety and legitimacy. The broker's regulatory status as a "suspicious clone," combined with a lack of transparency in its operations and numerous customer complaints, suggests that potential clients should exercise extreme caution.

For traders seeking a reliable and safe trading environment, it may be prudent to consider alternative brokers with established reputations and robust regulatory oversight. Some reputable options include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer greater security and consumer protection.

Ultimately, whether YCHPro is safe remains a contentious issue, and traders should thoroughly evaluate their options before proceeding with this broker.

Is YCHpro a scam, or is it legit?

The latest exposure and evaluation content of YCHpro brokers.

YCHpro Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YCHpro latest industry rating score is 1.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.