Regarding the legitimacy of NAGM forex brokers, it provides VFSC, FSA and WikiBit, (also has a graphic survey regarding security).

Is NAGM safe?

Software Index

License

Is NAGM markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

NAG MARGETS (PACIFIC) LIMITED

Effective Date:

2023-05-12Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

NAGM(S) Limited

Effective Date:

--Email Address of Licensed Institution:

compliance@nagmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Office 2, Dekk House, Plaisance, Mahe, SeychellesPhone Number of Licensed Institution:

4348088Licensed Institution Certified Documents:

Is NAG Markets Safe or Scam?

Introduction

NAG Markets is a relatively new player in the forex trading arena, having been established in 2024. Positioned as an online broker, it offers a variety of trading instruments, including forex, metals, and indices. With the increasing number of forex brokers entering the market, traders must exercise caution and conduct thorough evaluations before committing their funds. The potential for scams and unreliable platforms is significant, making it essential to assess the legitimacy and safety of brokers like NAG Markets.

This article aims to provide a comprehensive analysis of NAG Markets by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. The evaluation is based on a review of multiple sources, including regulatory filings, user reviews, and expert opinions, to ensure a balanced perspective on whether NAG Markets is a trustworthy broker or a potential scam.

Regulation and Legitimacy

The regulatory framework governing a broker is crucial in determining its legitimacy and safety. NAG Markets operates under the auspices of the Vanuatu Financial Services Commission (VFSC) and the Seychelles Financial Services Authority (FSA). Both of these bodies are considered offshore regulators, which raises questions about the level of oversight and protection they provide to traders.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 41699 | Vanuatu | Verified |

| Seychelles Financial Services Authority | SD 146 | Seychelles | Verified |

While NAG Markets holds licenses from these regulators, it is important to note that offshore regulation is often viewed as less stringent compared to regulations from authorities like the UK's Financial Conduct Authority (FCA) or Australia's Securities and Investments Commission (ASIC). Offshore regulators typically have more lenient requirements for brokers, which can lead to increased risks for traders.

Furthermore, there have been no significant negative regulatory disclosures against NAG Markets during its operational period. However, the offshore nature of its regulation suggests that traders should be cautious, as they may not receive the same level of protection as they would with more reputable regulatory bodies.

Company Background Investigation

NAG Markets was founded in 2024 and is based in Australia, although its regulatory licenses are from Vanuatu and Seychelles. The company's ownership structure is not widely disclosed, which can sometimes be a red flag for potential investors. The management teams backgrounds are also not extensively published, making it challenging to assess their expertise and experience in the financial industry.

The lack of transparency regarding the company's history and management raises concerns about its credibility. A reputable broker typically provides detailed information about its founders, management team, and operational history. In contrast, NAG Markets appears to be somewhat opaque in this regard, which can lead to skepticism among potential clients.

While the broker claims to prioritize customer service and transparency, the absence of publicly available information about its leadership and corporate structure complicates the evaluation of its trustworthiness.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. NAG Markets offers a standard account with a minimum deposit requirement of $500 and claims to provide competitive spreads starting from 1.2 pips. However, the overall cost structure can vary significantly based on trading volume and the specific instruments being traded.

| Cost Type | NAG Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.2 pips | 0.8-1.0 pips |

| Commission Structure | None | Varies (often $5-$10) |

| Overnight Interest Range | Varies | Varies |

While NAG Markets does not charge commissions on trades, the spreads offered are on the higher end compared to industry averages. This could potentially erode profits, especially for high-frequency traders. Furthermore, the broker's overnight interest rates may vary, and traders should be aware of these costs, as they can significantly impact long-term positions.

The lack of clarity regarding any unusual fees or charges is another area of concern. Traders should always read the fine print and understand the complete fee structure before opening an account with any broker.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. NAG Markets claims to prioritize fund security by implementing measures such as segregating client funds from company funds. This means that clients' money is held in separate accounts, ideally providing a layer of protection in case of insolvency.

Additionally, NAG Markets does not explicitly mention whether it offers negative balance protection, a feature that can safeguard traders from losing more than their initial investment. This is an important consideration, especially for those engaging in high-leverage trading.

There have been no reported incidents of fund mismanagement or security breaches at NAG Markets, which is a positive sign. However, the offshore regulatory status means that traders may have limited recourse in the event of a dispute or issue with fund recovery.

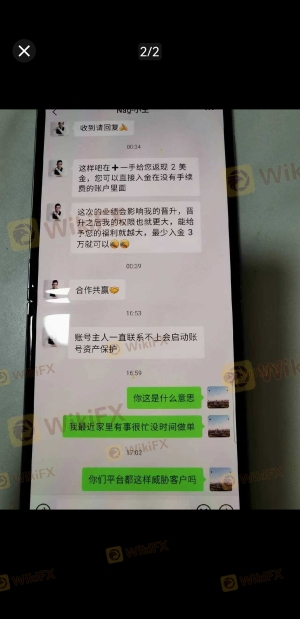

Customer Experience and Complaints

Customer feedback is a critical aspect of evaluating a broker's reliability. Reviews for NAG Markets are mixed, with some users praising the trading platform's speed and ease of use, while others have raised concerns about the quality of customer service and responsiveness to complaints.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow Withdrawal | High | Some users report delays |

| High Spreads | Medium | Acknowledged but defended |

| Lack of Transparency | High | Not adequately addressed |

Common complaints include slow withdrawal processes and high spreads compared to other brokers. Some users have reported experiencing delays in receiving their funds after requesting withdrawals, which can be frustrating and concerning. Additionally, the perceived lack of transparency regarding fees and company practices has led to skepticism among traders.

A few notable cases illustrate these issues. For instance, one user reported that their withdrawal took significantly longer than the promised timeframe, leading to concerns about the broker's reliability. Another trader mentioned that the spreads during high volatility periods were much wider than expected, impacting their trading strategy.

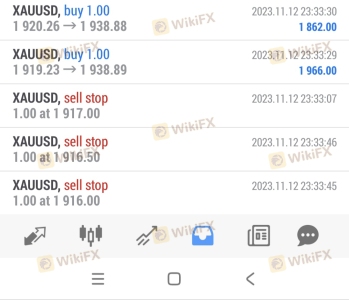

Platform and Trade Execution

The trading platform is a crucial component of any broker's offering. NAG Markets provides access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both of which are known for their robust features and user-friendly interfaces. Users generally report positive experiences with the platform's performance and execution speeds.

However, some traders have raised concerns about slippage and order rejections during high market volatility. While NAG Markets claims to offer competitive execution speeds, any notable instances of slippage could negatively impact trading outcomes.

Overall, while the platforms are reliable, potential traders should be aware of the risks associated with market volatility and ensure they have a clear understanding of the execution policies.

Risk Assessment

When assessing the risks associated with trading through NAG Markets, several factors come into play.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack oversight. |

| Fund Safety | Medium | Segregated accounts, but no clear negative balance protection. |

| Trading Costs | Medium | Higher spreads compared to industry averages. |

| Customer Support | Medium | Mixed reviews on responsiveness and issue resolution. |

Given the offshore regulatory status and mixed customer feedback, the overall risk profile for NAG Markets leans towards the higher end. Traders should be particularly cautious regarding fund safety and the potential for unexpected costs. To mitigate these risks, it is advisable to start with a demo account and thoroughly test the platform before committing significant funds.

Conclusion and Recommendations

In conclusion, while NAG Markets offers a range of trading options and has not been directly implicated in any scams or fraudulent activities, several factors warrant caution. The offshore regulatory status, mixed customer reviews, and higher-than-average trading costs suggest that potential traders should proceed with care.

For traders considering NAG Markets, it is advisable to start with a smaller investment and utilize the demo account to familiarize themselves with the platform. Additionally, evaluating alternative brokers with more robust regulatory oversight and lower fees may provide a safer trading environment.

If you are looking for more established alternatives, consider brokers regulated by top-tier authorities such as FCA or ASIC, which offer greater transparency and investor protection. Always conduct thorough research and ensure that you understand the risks involved before engaging in forex trading.

Is NAGM a scam, or is it legit?

The latest exposure and evaluation content of NAGM brokers.

NAGM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NAGM latest industry rating score is 2.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.