NAG Markets 2025 Review: Everything You Need to Know

Summary

NAG Markets is a new CFD broker in financial trading. It offers traders access to global markets with good trading conditions. This nag markets review shows a broker that wants to serve intermediate to advanced traders who seek different trading opportunities across multiple asset classes.

The broker has great features like commission-free trading across major currency pairs and leverage up to 1:400. This makes it very attractive for traders who need more buying power. NAG Markets works under the Vanuatu Financial Services Commission (VFSC), which provides basic regulatory protection for client funds and trading activities.

User feedback and platform analysis show that NAG Markets performs well in trading execution and platform functionality. It earns an overall user satisfaction rating of 8 out of 10. The broker mainly targets intermediate to advanced traders, especially those who value high leverage options and complete trading tools. However, some people worry about customer service quality, which needs attention for better client experience.

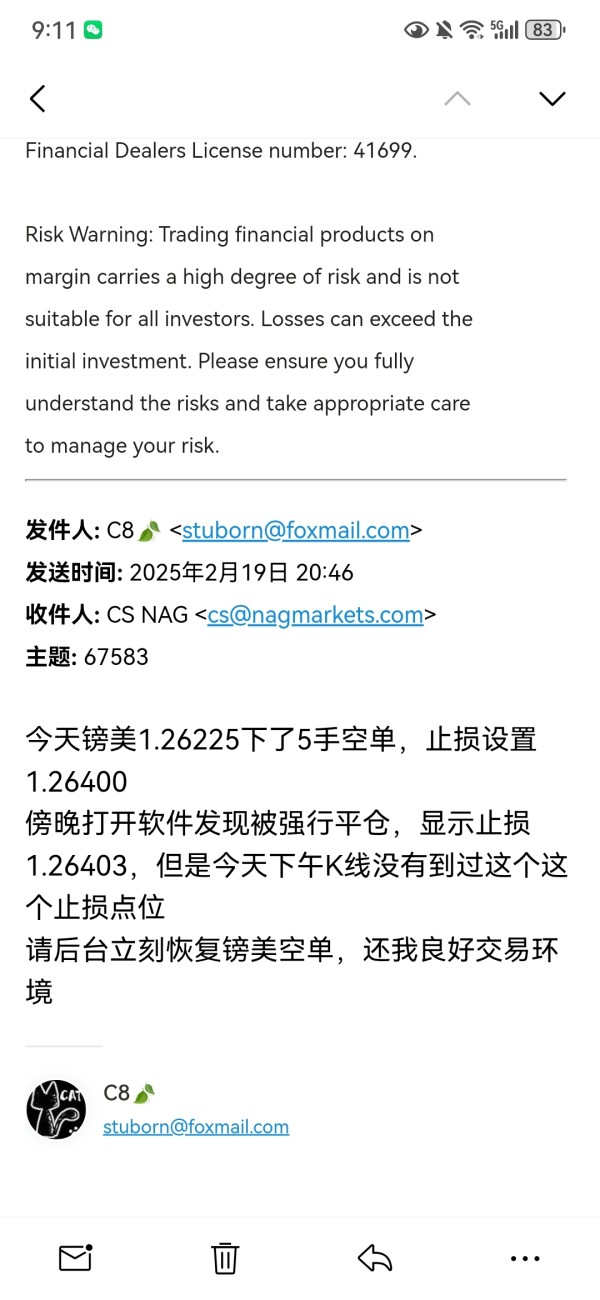

The broker's regulatory status under VFSC license number 41699 ensures it follows international financial standards. Traders should know about the legal implications of Vanuatu-based regulation compared to other major financial centers.

Important Notice

NAG Markets operates under Vanuatu jurisdiction through its registration with the Vanuatu Financial Services Commission. Traders should understand that Vanuatu's regulatory environment and legal framework may be very different from their local financial regulations and consumer protection standards. The regulatory protections available may vary compared to brokers licensed in major financial centers such as the UK, EU, or Australia.

This nag markets review uses publicly available information, official broker documentation, and user feedback from various trading communities and review platforms. Our evaluation method focuses on objective analysis of trading conditions, platform functionality, regulatory compliance, and user experience factors. All information presented reflects the current state of services as of 2025 and may change as the broker evolves its offerings.

Rating Framework

Broker Overview

NAG Markets entered the competitive CFD brokerage market in 2021. It established itself as a subsidiary of DBG Group with headquarters operations based in Australia. The company has positioned itself as a technology-forward broker, focusing on providing complete trading solutions for forex and multi-asset CFD trading. Despite its recent establishment, NAG Markets has used the strategic resources and regulatory framework of its parent group to build a strong trading infrastructure.

The broker operates mainly as a CFD provider, offering clients access to global financial markets through advanced trading platforms. NAG Markets has built its business model around providing competitive trading conditions while maintaining regulatory compliance through its Vanuatu Financial Services Commission oversight. This nag markets review shows that the company has focused on developing strong technological capabilities and diverse asset offerings to compete effectively in the crowded brokerage space.

NAG Markets provides trading access through industry-standard MetaTrader 4 and MetaTrader 5 platforms. This ensures traders have access to familiar and powerful trading environments. The broker's asset coverage spans major financial markets including foreign exchange, precious metals, energy commodities, and equity indices. The company operates under VFSC regulation with license number 41699, providing clients with regulatory oversight and compliance standards established by the Vanuatu Financial Services Commission.

Regulatory Jurisdiction: NAG Markets operates under the regulatory authority of the Vanuatu Financial Services Commission (VFSC) with license number 41699. This regulatory framework provides oversight for client fund protection and trading practices, though traders should understand the specific protections available under Vanuatu jurisdiction.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods was not detailed in available documentation. Prospective clients should contact the broker directly for complete information about funding options, processing times, and any associated fees.

Minimum Deposit Requirement: The broker establishes a minimum deposit threshold of USD 500 for account opening. This positions itself in the mid-range category for initial funding requirements.

Promotional Offers: Current promotional activities and bonus structures are not specified in available broker information. Traders interested in potential incentives should inquire directly with NAG Markets about any available promotional programs.

Tradeable Assets: NAG Markets provides access to four primary asset categories: foreign exchange pairs, precious metals (including gold and silver), energy commodities (such as crude oil), and major equity indices from global markets. The broker implements a commission-free trading model for its standard account offerings.

Cost Structure: Major currency pairs feature starting spreads from 1.2 pips, providing competitive pricing for forex trading activities. This nag markets review notes that the transparent pricing structure appeals to traders seeking predictable trading costs.

Leverage Capabilities: NAG Markets offers maximum leverage ratios up to 1:400. This provides significant buying power for qualified traders while requiring appropriate risk management practices.

Platform Options: Clients can choose between MetaTrader 4 and MetaTrader 5 platforms, both offering complete charting, analysis tools, and automated trading capabilities. Specific information about geographic restrictions and service availability by region was not detailed in available documentation.

Geographic Restrictions: Available customer service languages and support options require direct inquiry with the broker for current information.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

NAG Markets presents a balanced approach to account conditions that serves intermediate traders effectively. However, some aspects may present barriers for beginning traders. The broker's minimum deposit requirement of USD 500 positions it above many entry-level brokers, potentially limiting accessibility for new traders with smaller initial capital. This threshold reflects the broker's focus on serious traders who can benefit from the advanced features and higher leverage options available.

The commission-free trading structure represents a significant advantage in the broker's account conditions. It eliminates per-trade costs that can accumulate significantly for active traders. Combined with competitive spreads starting at 1.2 pips for major currency pairs, the cost structure provides transparency and predictability for trading expenses. This nag markets review recognizes that the absence of commission charges particularly benefits scalpers and high-frequency traders who execute numerous daily transactions.

User feedback about account conditions shows mixed responses, with experienced traders appreciating the competitive costs and leverage options. Newer traders express concern about the higher entry threshold. The broker's focus on standard account offerings without extensive account tier variations simplifies the selection process but may limit customization options for traders with specific requirements.

Account opening procedures and verification requirements, while not detailed in available documentation, appear to follow standard industry practices based on regulatory compliance needs. The broker's regulatory status under VFSC requires appropriate know-your-customer procedures and documentation verification for account activation.

NAG Markets shows strong performance in providing complete trading tools and analytical resources that enhance the trading experience for its clients. The broker's integration of Autochartist represents a significant value addition, offering automated pattern recognition and trading opportunity identification that saves traders considerable analysis time. This sophisticated tool helps traders identify potential entry and exit points across multiple timeframes and asset classes.

The economic calendar functionality provides essential fundamental analysis support. It keeps traders informed about market-moving events and economic releases that could impact their positions. Market news and commentary services offer additional insight into current market conditions and potential trading opportunities, helping traders make more informed decisions based on both technical and fundamental analysis.

User feedback consistently highlights the quality and usefulness of the provided trading tools, with particular appreciation for the integration quality between third-party tools and the MetaTrader platforms. The combination of MT4 and MT5 platform options ensures traders have access to complete charting capabilities, technical indicators, and automated trading functionality through Expert Advisors.

However, educational resources and trader development materials appear limited based on available information. This could represent a gap for traders seeking to improve their skills and market knowledge. The broker's focus appears mainly on providing analysis tools rather than complete educational programs for trader development.

Customer Service and Support Analysis (Score: 6/10)

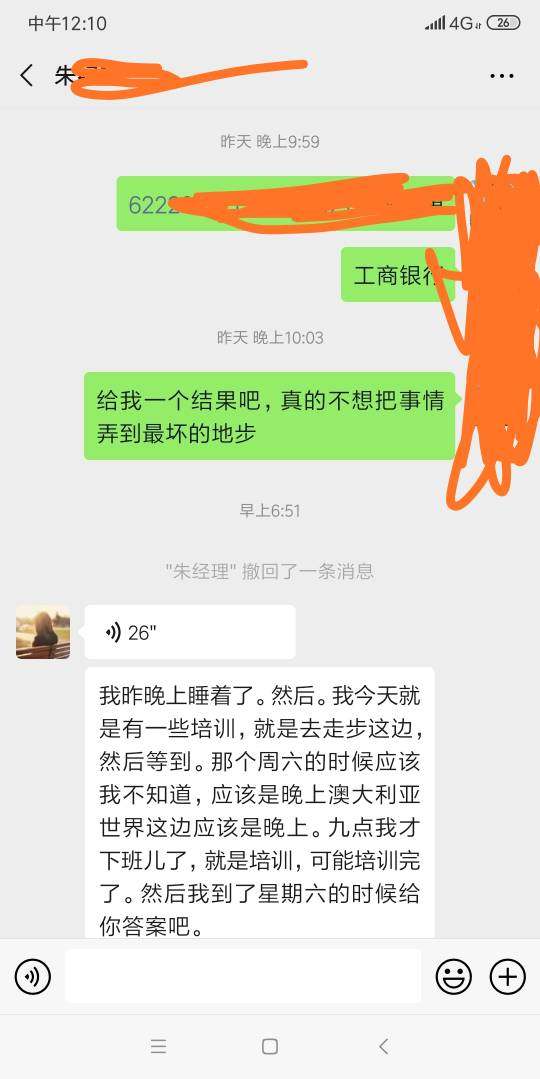

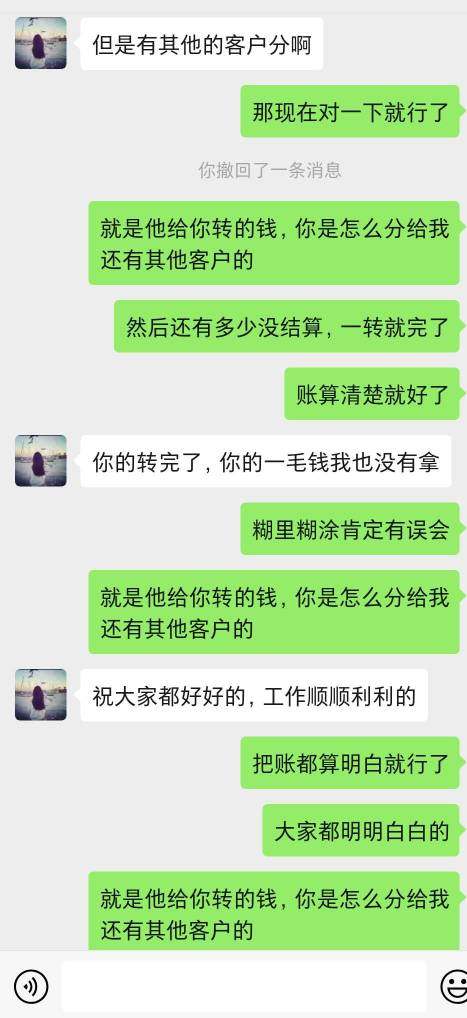

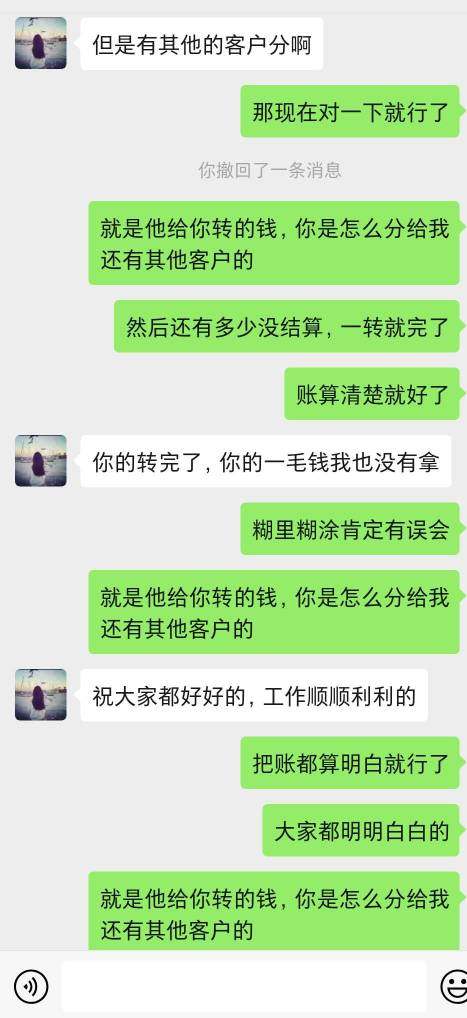

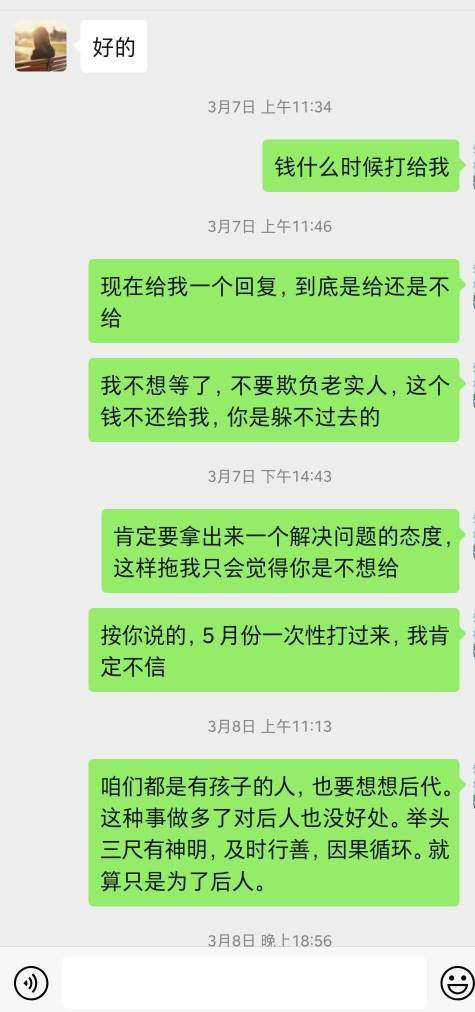

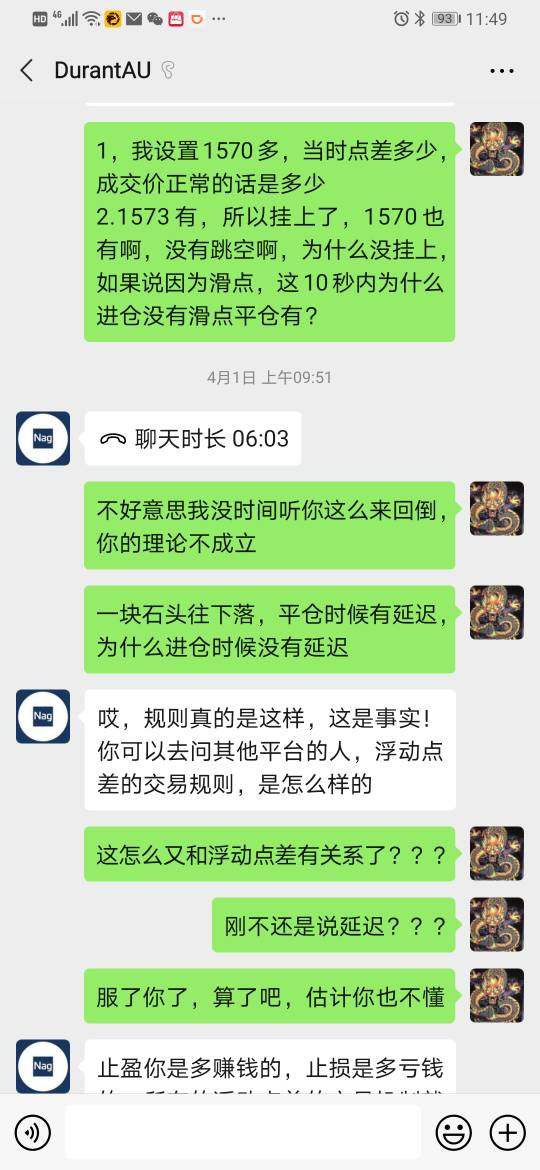

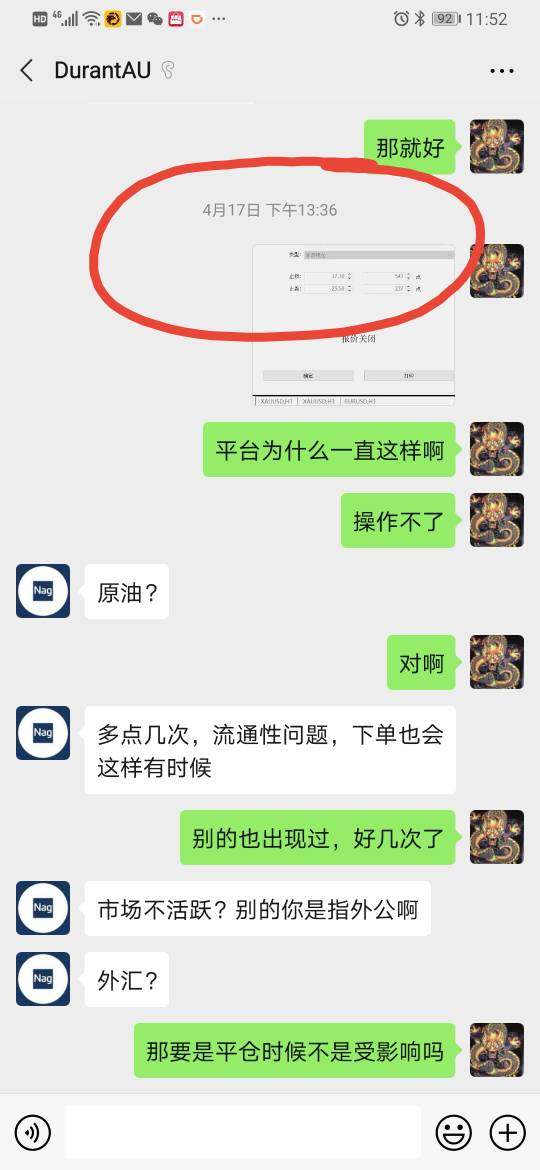

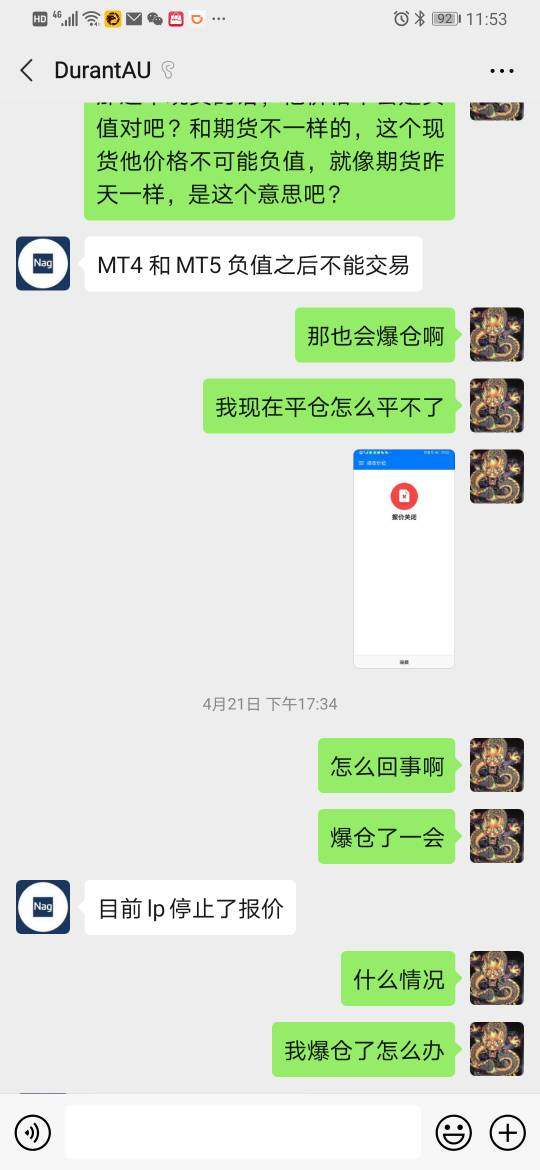

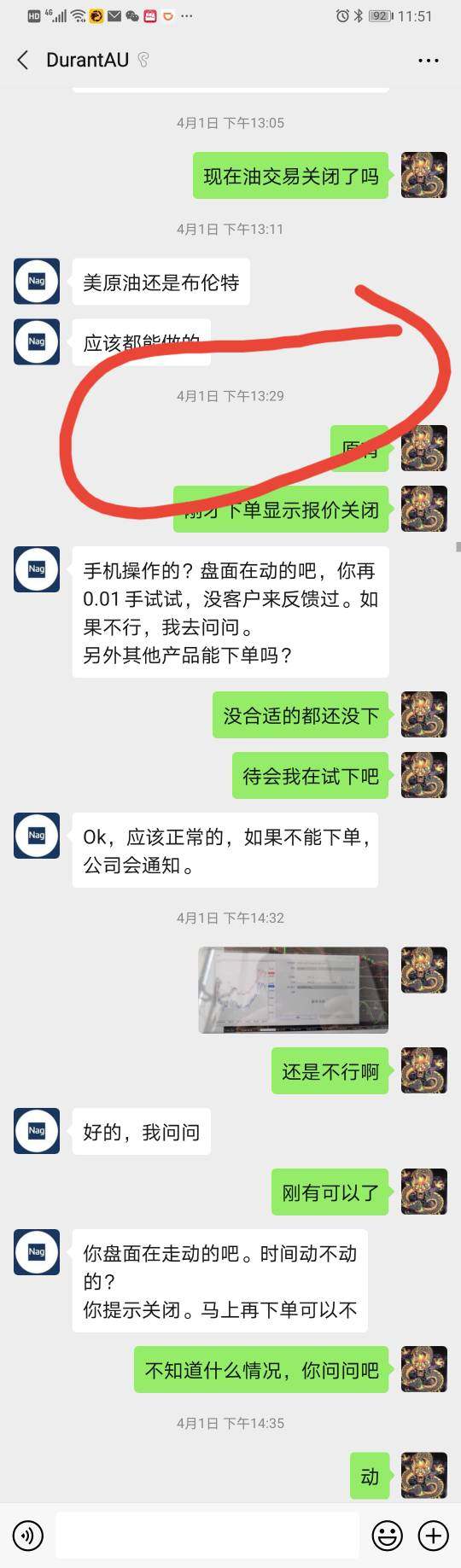

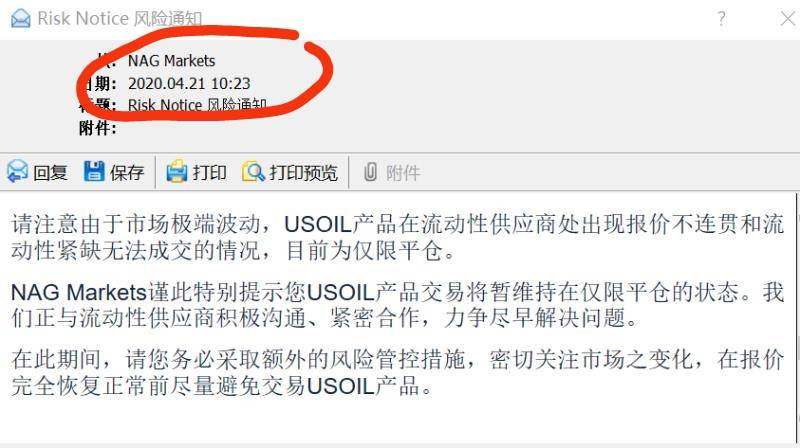

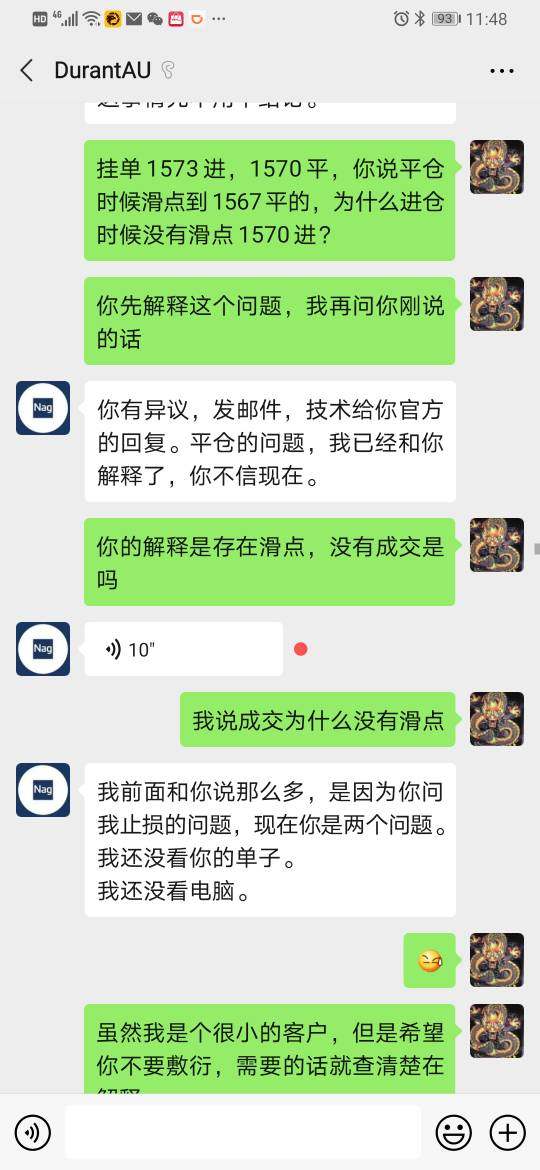

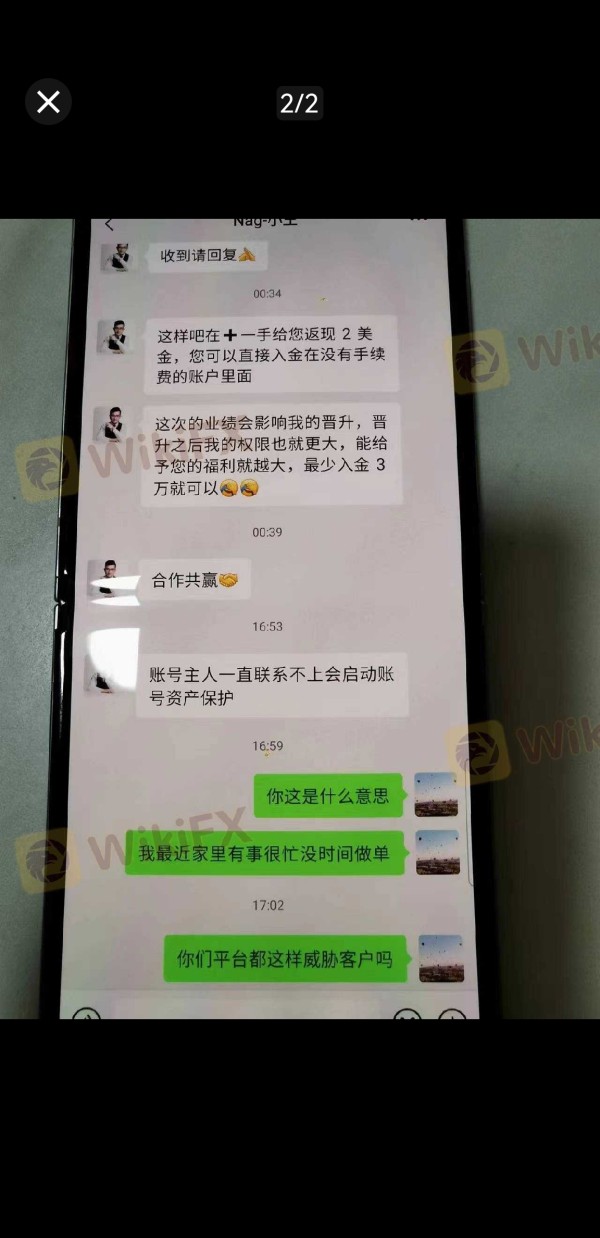

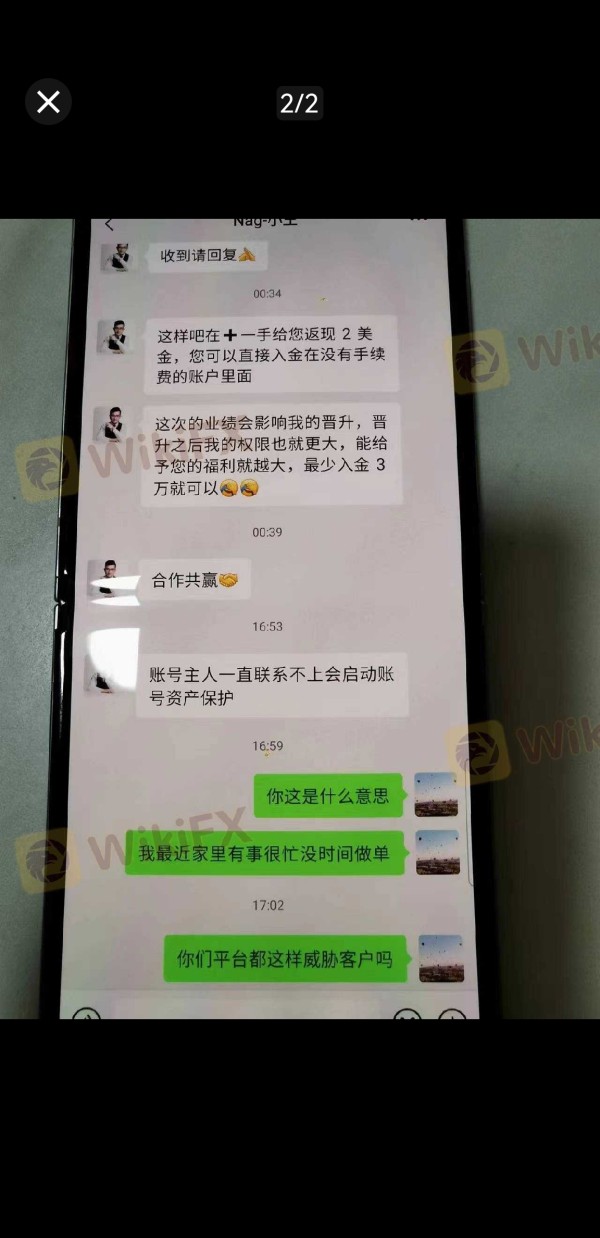

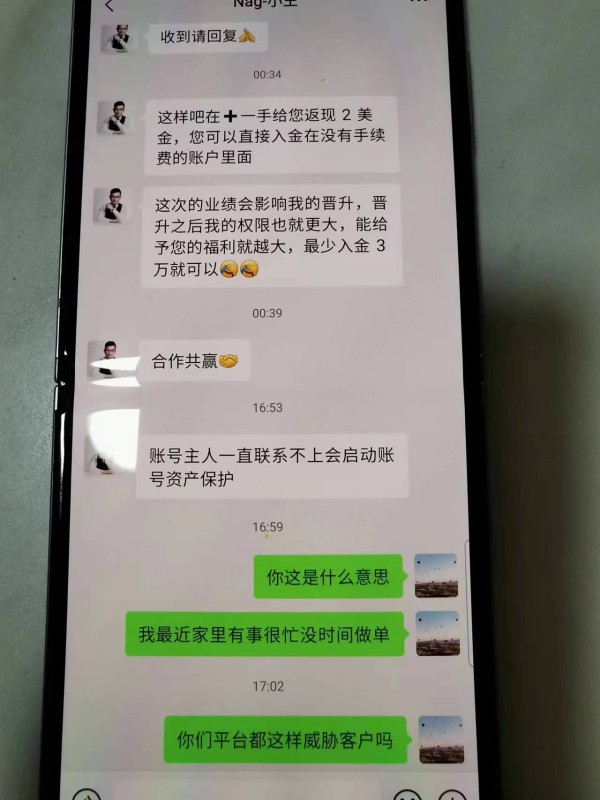

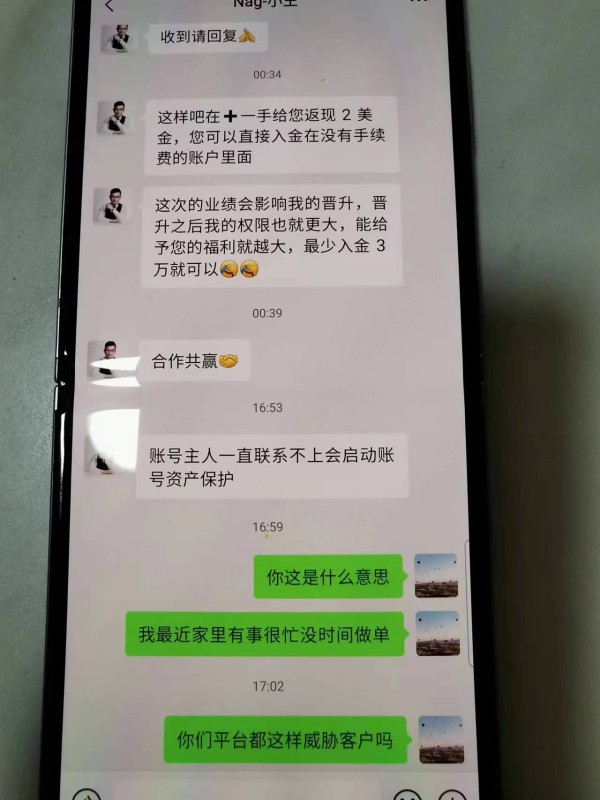

Customer service represents an area where NAG Markets faces challenges. User feedback indicates concerns about service quality and responsiveness that impact the overall client experience. While specific details about available support channels are not well documented, user reports suggest inconsistencies in service delivery and response times that fall short of industry standards.

The concerns raised by users mainly focus on the professional competency of support staff and their ability to effectively resolve trading-related issues and account inquiries. Some clients report experiencing delays in receiving responses to critical questions, particularly during active trading periods when immediate assistance may be crucial for position management or technical issues.

Language support availability and operating hours for customer service are not clearly specified in available documentation. This itself indicates potential communication gaps that could affect international clients. The broker's global aspirations require strong multilingual support capabilities to serve diverse client bases effectively.

Despite these challenges, some users report satisfactory experiences with customer support, suggesting that service quality may be inconsistent rather than universally poor. The broker appears to recognize these concerns and may be working to improve support capabilities, though concrete evidence of systematic improvements is not readily available in current user feedback.

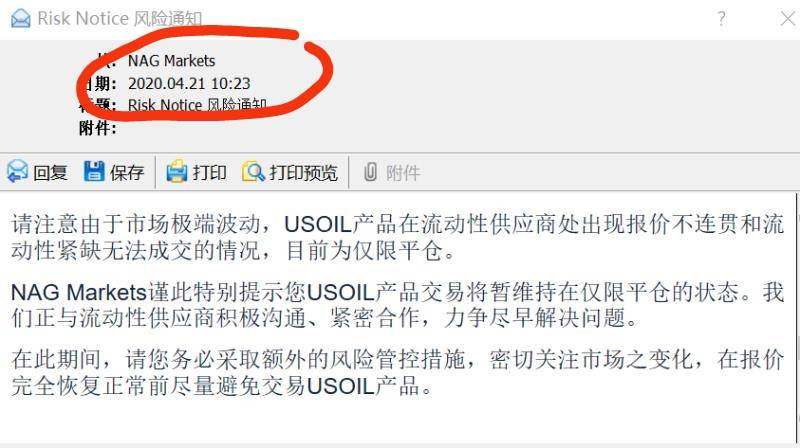

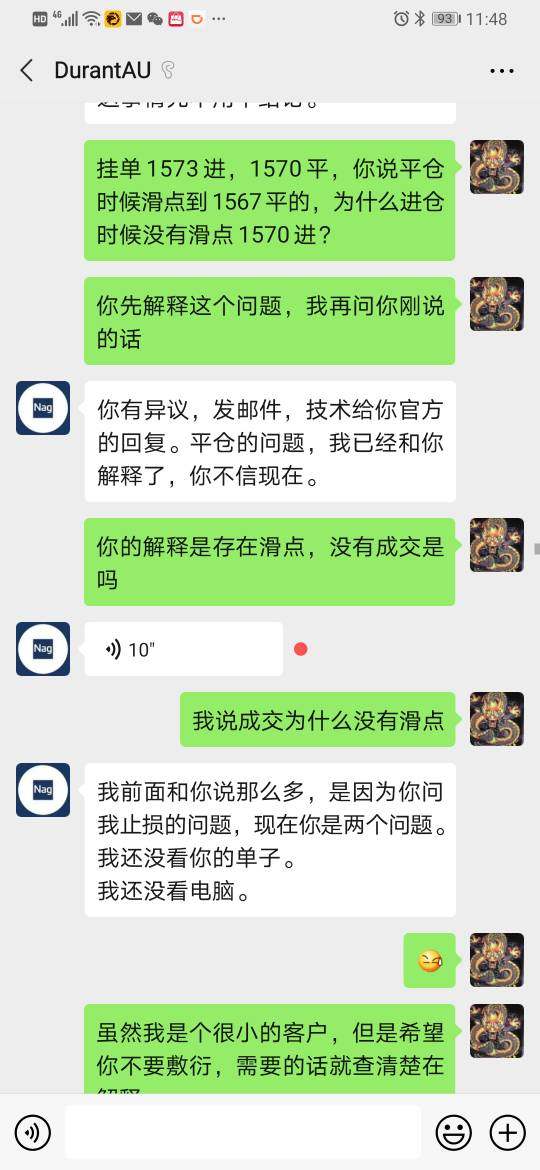

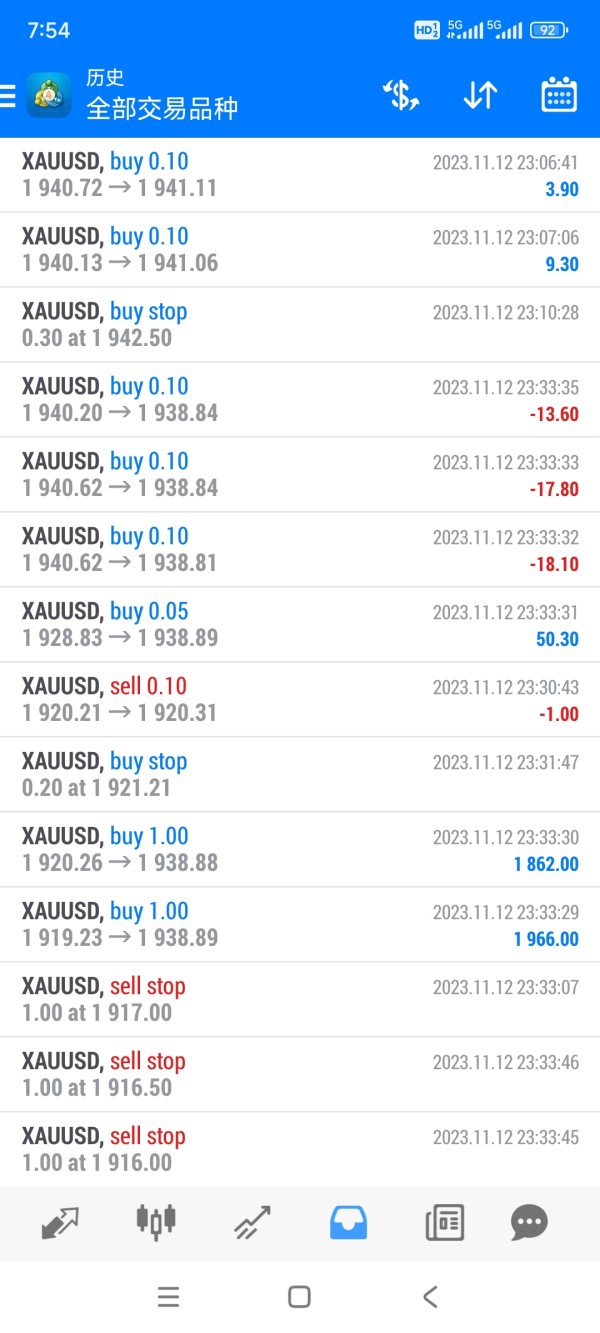

Trading Experience Analysis (Score: 7/10)

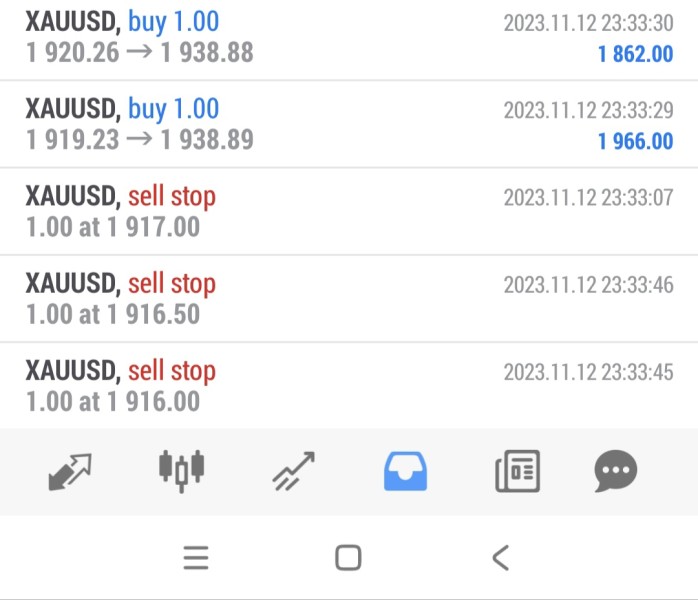

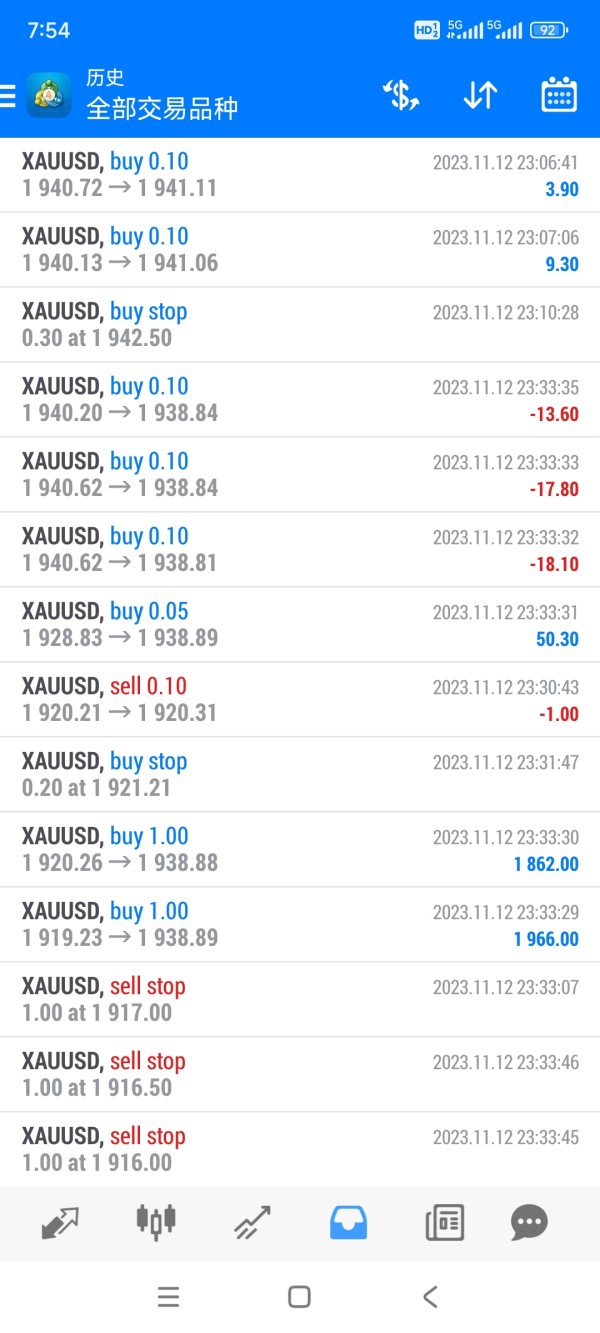

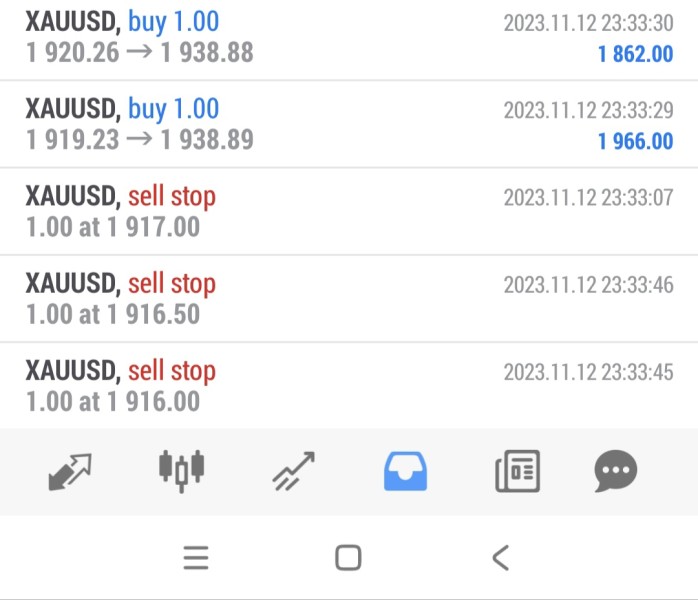

The trading experience provided by NAG Markets receives generally positive feedback from users, particularly about platform stability, execution speed, and overall functionality. Traders consistently praise the reliability of both MetaTrader 4 and MetaTrader 5 platforms, noting smooth operation and minimal technical disruptions during active trading sessions. The platform's response time and order execution quality contribute to a professional trading environment that meets the needs of active traders.

Order execution quality appears to be a strength for NAG Markets. Users report minimal slippage issues and fair execution pricing that aligns with quoted market rates. This nag markets review finds that the broker's execution model provides transparency and reliability that builds trader confidence in the platform's integrity. The absence of significant negative slippage reports suggests effective liquidity management and proper execution protocols.

Platform functionality receives high marks for completeness and ease of use, with traders appreciating the full range of technical analysis tools, charting capabilities, and customization options available through the MetaTrader platforms. The ability to implement automated trading strategies through Expert Advisors adds significant value for systematic traders and those seeking to implement algorithmic trading approaches.

Mobile trading experience, while not extensively detailed in available feedback, appears to maintain the quality standards established by the desktop platforms. The MetaTrader mobile applications provide complete functionality that allows traders to monitor positions and execute trades effectively while away from their primary trading stations.

Trust and Safety Analysis (Score: 7/10)

NAG Markets' regulatory status under the Vanuatu Financial Services Commission provides a foundation for trust and safety. However, the regulatory environment differs from major financial centers that some traders may prefer. The VFSC license number 41699 ensures compliance with established financial services regulations and provides oversight for client fund protection and business conduct standards.

The broker's relatively recent establishment in 2021 means that its long-term track record remains under development. This requires continued observation to fully assess reliability and stability over extended periods. However, the backing of DBG Group provides additional corporate structure and resources that support the broker's operational stability and regulatory compliance capabilities.

Fund security measures and client money protection protocols, while not extensively detailed in available documentation, should follow VFSC requirements for segregation of client funds from operational capital. Traders should verify current fund protection arrangements directly with the broker to understand the specific protections available for their deposits and account balances.

The absence of significant negative incidents or regulatory actions in available public records suggests appropriate business conduct and compliance with regulatory requirements. However, the broker's newer establishment means that its crisis management capabilities and long-term reliability remain to be fully tested through various market conditions and operational challenges.

User Experience Analysis (Score: 7/10)

Overall user experience with NAG Markets reflects a generally positive assessment. The broker earns an 8/10 satisfaction rating from its client base. Users particularly appreciate the platform's interface design and navigation convenience, which contribute to efficient trading workflows and reduced learning curves for new clients transitioning to the broker's services.

The registration and account verification processes, while not extensively detailed in available information, appear to follow industry standards based on user feedback patterns. The broker's onboarding experience seems to balance regulatory compliance requirements with user convenience, though specific turnaround times and documentation requirements should be verified directly with the broker.

Trading platform usability receives strong endorsements from users who value the familiar MetaTrader environment combined with the broker's specific enhancements and tool integrations. The seamless integration of third-party tools like Autochartist enhances the overall user experience by providing additional analytical capabilities within the standard trading interface.

However, user experience is significantly impacted by the customer service concerns previously identified in this nag markets review. The disconnect between strong trading platform performance and weaker support services creates an inconsistent overall experience that affects user satisfaction ratings. Improvement in support quality would likely result in substantially higher user experience scores and increased client retention rates.

Conclusion

NAG Markets presents itself as a competent CFD broker that delivers solid trading conditions and platform functionality. It is particularly suited for intermediate to advanced traders seeking competitive costs and sophisticated trading tools. The broker's commission-free structure, competitive spreads, and high leverage options create an attractive proposition for active traders who can navigate the higher minimum deposit requirement.

The primary strengths identified in this nag markets review include reliable trading platform performance, complete analytical tools, and transparent pricing structures that support effective trading strategies. However, the broker must address customer service quality concerns to fully realize its potential and improve overall client satisfaction.

NAG Markets appears most suitable for experienced traders who prioritize trading conditions and platform functionality over extensive educational resources or premium customer support. The broker's regulatory status under VFSC provides adequate oversight while the backing of DBG Group offers additional operational stability for continued service delivery.