Regarding the legitimacy of MultiBank Group forex brokers, it provides ASIC, CYSEC, CMA, MAS, CIMA, VFSC, FSC, VFSC, FSA and WikiBit, (also has a graphic survey regarding security).

Is MultiBank Group safe?

Pros

Cons

Is MultiBank Group markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

MEX AUSTRALIA PTY LTD

Effective Date: Change Record

2012-03-20Email Address of Licensed Institution:

courtney@mexmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

MEX AUSTRALIA PTY LTD 'MLC CENTRE' SE 03 L 61 19-29 MARTIN PL SYDNEY NSW 2000Phone Number of Licensed Institution:

0291954001Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP) 15

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

MEX Europe Ltd

Effective Date:

2023-05-22Email Address of Licensed Institution:

info@mexeurope.comSharing Status:

No SharingWebsite of Licensed Institution:

www.mexeurope.comExpiration Time:

--Address of Licensed Institution:

Feidiou 1, Flat 2, 3075 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 263 408Licensed Institution Certified Documents:

CMA Forex Trading License (EP)

Capital Market Authority

Capital Market Authority

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

MEX GLOBAL FINANCIAL SERVICES L.L.C

Effective Date:

2022-06-02Email Address of Licensed Institution:

Salem@mex.aeSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

الطابق ال19 ، Ubora Towe ، الخليج التجاري ، دبي ، الامارات العربية المتحدةPhone Number of Licensed Institution:

971-800203040Licensed Institution Certified Documents:

MAS Market Making License (MM)

Monetary Authority of Singapore

Monetary Authority of Singapore

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

MEX GLOBAL MARKETS PTE. LTD

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.mexglobalmarkets.comExpiration Time:

--Address of Licensed Institution:

3 CHURCH STREET #13-03B SAMSUNG HUB 049483Phone Number of Licensed Institution:

+65 60135970Licensed Institution Certified Documents:

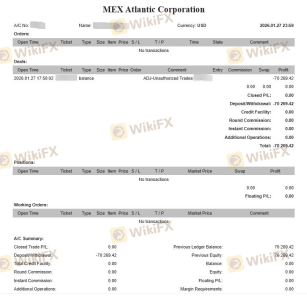

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

MEX Atlantic Corporation

Effective Date:

2021-07-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

MEX PACIFIC (V) LTD

Effective Date:

2023-07-12Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSC Market Making License (MM)

British Virgin Islands Financial Services Commission

British Virgin Islands Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

MultiBank FX International Corporation

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

EUROPEAN FINANCE LIMITED

Effective Date: Change Record

2021-04-19Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

MB Group (Seychelles) Ltd

Effective Date:

--Email Address of Licensed Institution:

corpgov@multibank.govSharing Status:

No SharingWebsite of Licensed Institution:

https://www.mex-d.comExpiration Time:

--Address of Licensed Institution:

Office 2, 2nd Floor, Olivier Maradan Building, Victoria, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4326692Licensed Institution Certified Documents:

Is MultiBank Group A Scam?

Introduction

MultiBank Group, established in 2005, has positioned itself as a significant player in the forex and CFD trading market. With its headquarters in Dubai, the broker operates globally, providing access to a wide array of financial instruments, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, traders must navigate a landscape filled with various brokers, making it essential to evaluate their credibility and reliability. This article aims to provide an objective analysis of MultiBank Group, assessing its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk. The evaluation is based on a comprehensive review of multiple sources, including regulatory databases, customer feedback, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is a crucial indicator of its legitimacy and safety. MultiBank Group claims to be regulated by several reputable financial authorities across different jurisdictions. Below is a summary of its core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 416279 | Australia | Verified |

| BaFin | 73406 | Germany | Verified |

| CySEC | 430/23 | Cyprus | Verified |

| MAS | CMS 101174 | Singapore | Verified |

| CIMA | 1811316 | Cayman Islands | Verified |

| VFSC | 700443 | Vanuatu | Verified |

| ESCA | Not available | UAE | Verified |

These regulatory bodies enforce strict compliance standards to protect traders' interests. For instance, ASIC and BaFin are considered tier-1 regulators, known for their rigorous oversight and investor protection measures. MultiBank Group's adherence to these regulations indicates a commitment to maintaining transparency and safeguarding client funds. However, it is essential to note that some of the licenses, such as those from CIMA and VFSC, are classified as tier-3, which may not provide the same level of protection as tier-1 regulators.

Company Background Investigation

MultiBank Group was founded by Naser Taher in California, USA, and has since expanded its operations to over 25 offices worldwide. The company has grown significantly, boasting a paid-up capital of over $322 million and serving more than 320,000 clients globally. The ownership structure is transparent, with its operations clearly defined under various subsidiaries authorized in different jurisdictions.

The management team at MultiBank Group comprises experienced professionals with substantial backgrounds in finance and trading. This expertise is crucial in navigating the complexities of the financial markets and ensuring that the broker maintains high operational standards. Transparency regarding company operations and financial stability is vital for building trust with clients, and MultiBank Group appears to prioritize this aspect.

Trading Conditions Analysis

MultiBank Group offers a variety of trading accounts, including Standard, Pro, and ECN accounts, each with different fee structures. The overall cost of trading is a critical factor for traders, and MultiBank Group aims to provide competitive pricing. Below is a comparison of their core trading costs:

| Fee Type | MultiBank Group | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0.0 pips | 1.0 - 1.5 pips |

| Commission Model | $3 per lot (ECN) | $6 per lot |

| Overnight Interest Range | Varies | Varies |

The Standard account has a minimum deposit requirement of $50, with spreads starting from 1.5 pips, which is relatively high compared to industry standards. The Pro account requires a $1,000 deposit, offering tighter spreads of 0.8 pips, while the ECN account requires a $5,000 deposit with the tightest spreads starting from 0.0 pips but incurs a commission of $3 per lot traded.

While the absence of deposit and withdrawal fees is a positive aspect, the inactivity fee of $60 charged after three months of inactivity is notably high and could be a deterrent for infrequent traders.

Customer Fund Safety

The safety of customer funds is paramount for any broker. MultiBank Group employs several measures to ensure the security of client funds, including segregated accounts and negative balance protection. This means that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of financial difficulties faced by the broker.

Furthermore, MultiBank Group is covered by an excess loss insurance policy from Lloyd's of London, offering protection of up to $1 million per account. This insurance adds an extra layer of security for clients, ensuring that their investments are safeguarded.

However, it is essential to remain vigilant, as there have been historical concerns regarding fund safety in the forex market. MultiBank Group has not reported any significant issues or controversies related to fund safety, but potential clients should always conduct thorough due diligence.

Customer Experience and Complaints

Customer feedback is a valuable resource for evaluating a broker's performance. MultiBank Group has received mixed reviews from users, with many praising its competitive spreads and range of trading instruments. However, common complaints include issues with customer support response times and difficulties in account verification processes.

Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Slow Customer Support | Moderate | Generally responsive but with delays |

| Account Verification Issues | High | Lengthy verification process reported |

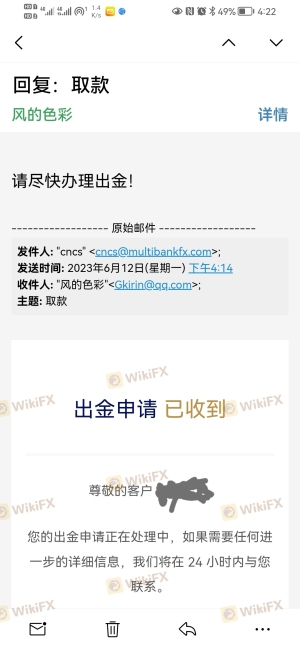

| Withdrawal Delays | Moderate | Some users report delays in processing |

For instance, several users have reported delays in the withdrawal process, which can be frustrating, especially for traders requiring quick access to their funds. In contrast, others have highlighted the broker's effective resolution of issues through live chat and email support.

Platform and Trade Execution

The performance of the trading platform is a critical factor for traders. MultiBank Group offers the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, both known for their user-friendly interfaces and advanced trading features. The platforms provide access to a variety of trading tools and allow for automated trading through Expert Advisors (EAs).

The order execution quality at MultiBank Group is generally regarded as reliable, with many users reporting minimal slippage and fast execution speeds. However, some traders have expressed concerns about occasional delays during high volatility periods.

Overall, the platforms provide a robust trading environment, but traders should remain aware of potential execution issues, particularly during major market events.

Risk Assessment

Using MultiBank Group comes with inherent risks, as with any trading platform. Below is a risk assessment summary:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Multiple regulations, but some tier-3 licenses may pose risks. |

| Fund Security Risk | Low | Strong safety measures in place, including insurance coverage. |

| Customer Support Risk | Medium | Mixed reviews on support responsiveness; potential delays noted. |

| Trading Conditions Risk | Medium | High inactivity fees and potential withdrawal delays could impact traders. |

To mitigate these risks, it is advisable for traders to maintain regular trading activity to avoid inactivity fees and to fully understand the withdrawal processes and timelines. Utilizing demo accounts can also help traders familiarize themselves with the platform before committing real funds.

Conclusion and Recommendations

Based on the evidence presented, MultiBank Group appears to be a legitimate broker with a solid regulatory framework and a commitment to client fund safety. While there are some concerns regarding customer support and trading conditions, the overall assessment indicates that it is a reliable option for traders.

However, potential clients should remain cautious and conduct their own research before opening an account. For beginners, it may be beneficial to start with the Standard account, while experienced traders may prefer the Pro or ECN accounts for tighter spreads and lower commissions.

If you are looking for alternatives, consider brokers with strong regulatory oversight, excellent customer support, and favorable trading conditions, such as IG, OANDA, or Forex.com. These brokers offer similar services with a proven track record of reliability and customer satisfaction.

Is MultiBank Group a scam, or is it legit?

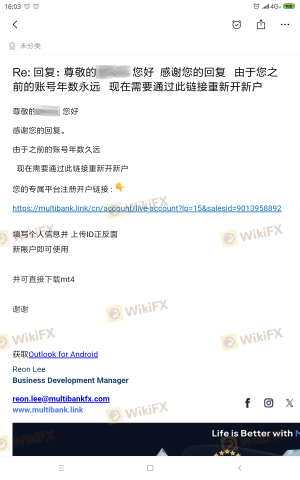

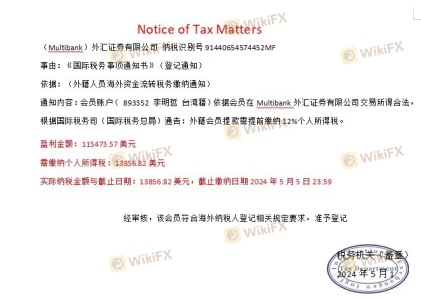

The latest exposure and evaluation content of MultiBank Group brokers.

MultiBank Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MultiBank Group latest industry rating score is 2.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.