Regarding the legitimacy of MSG forex brokers, it provides ASIC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is MSG safe?

Pros

Cons

Is MSG markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

KOHLE CAPITAL MARKETS PTY LTD

Effective Date: Change Record

2017-07-06Email Address of Licensed Institution:

jlau@kc-cap.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.kc-cap.com.auExpiration Time:

--Address of Licensed Institution:

L 2 673 BOURKE ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

0432260109Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

MASTER SELECT GROUP LIMITED

Effective Date:

2020-06-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is MSG A Scam?

Introduction

MSG, also known as Master Select Group, is an online forex broker that positions itself as a global trading platform offering various financial instruments, including forex, commodities, and cryptocurrencies. With the rapid growth of the forex market, traders are increasingly cautious about selecting a reliable broker. The potential for scams and fraudulent activities in this space necessitates thorough evaluations of brokers like MSG, as traders' financial security is at stake. This article aims to provide an objective analysis of MSG's credibility, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risks involved.

Regulation and Legitimacy

Regulation is a critical factor in assessing any forex broker's legitimacy. MSG claims to operate under a license from the Vanuatu Financial Services Commission (VFSC), which is often viewed as a less stringent regulatory body compared to more reputable organizations like the FCA or ASIC.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| VFSC | 40378 | Vanuatu | Unverified |

The importance of regulatory oversight cannot be overstated. A robust regulatory framework ensures that brokers adhere to strict operational guidelines, protecting traders from potential fraud. MSG's offshore regulation raises concerns about its accountability and the safety of client funds. Furthermore, a lack of transparency regarding its regulatory compliance and the absence of a solid track record in adhering to financial regulations could indicate potential risks for investors.

Company Background Investigation

MSG was established in 2023 and has since aimed to cater to a diverse clientele, offering a wide range of trading products. However, the company's brief history raises questions about its stability and reliability. The management team behind MSG is not well-documented, leading to concerns about their expertise and experience in the financial sector.

Transparency is crucial in the forex industry, and MSG's lack of detailed information regarding its ownership structure and management team may deter potential investors. A company that is open about its operations and leadership is often seen as more trustworthy, while a lack of information can be a red flag indicating possible underlying issues.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its reliability. MSG's fee structure appears to be complex, with various costs associated with trading. Traders have reported unusually high spreads and commissions, which can significantly impact profitability.

| Fee Type | MSG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 30-50 pips | 1-2 pips |

| Commission Model | Varies | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The high spreads and commission rates at MSG are concerning, as they are substantially above the industry average. Such costs can erode a trader's potential profits and may indicate a lack of competitiveness in the market. Additionally, MSG's opaque fee structure raises questions about the transparency of its pricing, which is crucial for traders looking for fair conditions.

Customer Funds Security

The safety of client funds is paramount when choosing a forex broker. MSG claims to implement various security measures, including segregated accounts for client funds. However, the effectiveness of these measures is questionable given the broker's offshore status.

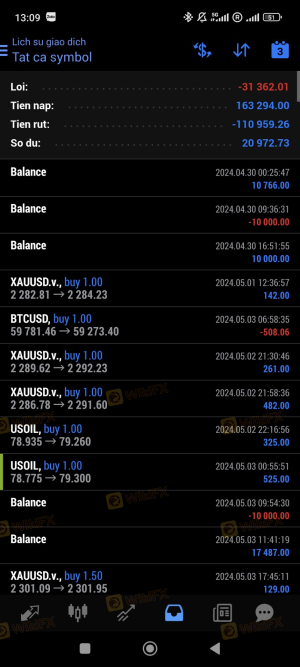

Traders should be aware of the risks associated with trading with an unregulated broker, as funds may not be protected under any financial compensation schemes. Historical issues regarding fund withdrawals and customer complaints about the inability to access their capital further exacerbate concerns about MSG's reliability.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. MSG has received numerous complaints regarding withdrawal issues, unresponsive customer service, and overall negative trading experiences.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

| Trading Platform Malfunctions | High | Poor |

Common complaints include difficulty in withdrawing funds, lack of communication from customer support, and technical issues with the trading platform. These issues not only reflect poorly on MSG's operational capabilities but also highlight significant risks for traders who may find themselves unable to access their funds when needed.

Platform and Execution

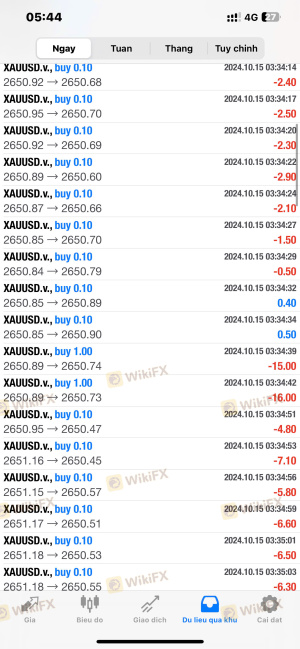

The performance of a trading platform is crucial for a seamless trading experience. MSG utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and advanced trading tools. However, reports of execution delays, slippage, and order rejections have surfaced, raising concerns about the platform's reliability.

Traders have noted instances where their orders were not executed as expected, leading to potential financial losses. These issues can indicate a lack of proper infrastructure and may suggest that MSG is not adequately equipped to handle the demands of its trading environment.

Risk Assessment

Engaging with MSG poses several risks that traders should consider. The regulatory environment, customer feedback, and trading conditions all contribute to an overall risk profile that appears unfavorable.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight |

| Financial Risk | High | High spreads and commission costs |

| Operational Risk | Medium | Complaints about platform performance |

Traders are advised to carefully evaluate these risks and consider implementing risk mitigation strategies, such as setting strict trading limits and maintaining a diversified portfolio.

Conclusion and Recommendations

In conclusion, the evidence suggests that MSG may not be a reliable choice for forex trading. The combination of its offshore regulatory status, high trading costs, and numerous customer complaints raises significant red flags.

Traders seeking to engage in forex trading should exercise extreme caution when considering MSG and may benefit from exploring alternative brokers with stronger regulatory oversight and better customer feedback. Brokers such as IG, OANDA, or Forex.com are recommended as safer options with proven track records in the industry. Ultimately, conducting thorough research and due diligence is essential for safeguarding investments in the forex market.

Is MSG a scam, or is it legit?

The latest exposure and evaluation content of MSG brokers.

MSG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MSG latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.