Regarding the legitimacy of MOGAFX forex brokers, it provides ASIC, FSPR and WikiBit, (also has a graphic survey regarding security).

Is MOGAFX safe?

Business

License

Is MOGAFX markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

SPECTRE FINANCIAL GROUP AUSTRALIA PTY LTD

Effective Date: Change Record

2018-10-23Email Address of Licensed Institution:

abdulwahab@abdulwahaboffice.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

MARK SORENSON, 20 Barbuda Way, LAKE CATHIE NSW 2445Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSPR Inst Forex Execution (STP)

Financial Service Providers Register

Financial Service Providers Register

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

MOGA INTERNATIONAL GROUP LIMITED

Effective Date:

2022-05-18Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2023-08-29Address of Licensed Institution:

18 Bestall Street, Maraenui, Napier, 4110, New ZealandPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is MogaFX A Scam?

Introduction

MogaFX is a forex broker that positions itself as a multi-asset trading platform, offering various financial instruments including forex, commodities, and indices. Established in 2021, it has gained attention in the forex market, particularly for its leverage offerings and diverse account types. However, with the proliferation of online trading platforms, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with any broker. This is particularly important given the high risks associated with forex trading and the potential for scams in the industry.

In this article, we will investigate MogaFX's regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment. Our analysis is based on a comprehensive review of various online sources, including user reviews, regulatory filings, and expert evaluations.

Regulation and Legitimacy

MogaFX claims to be regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Services Authority of Saint Vincent and the Grenadines (SVG FSA). Regulatory oversight is a critical factor in assessing a broker's legitimacy, as it provides a level of security for traders' funds and ensures that the broker adheres to established standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 501156 | Australia | Verified |

| SVG FSA | 532 LLC 2020 | Saint Vincent | Not Regulated |

While MogaFX holds a legitimate license from ASIC, concerns arise regarding its claims of regulation by the SVG FSA. This authority does not issue licenses for forex brokers, raising questions about the broker's transparency and compliance. ASIC is known for its stringent regulatory framework, which includes requirements for client fund segregation and maintaining sufficient capital reserves. However, the presence of an offshore registration in Saint Vincent, a known tax haven, may undermine the broker's credibility.

Historically, there have been no significant compliance issues reported against MogaFX under ASIC. However, the dual registration raises red flags, as traders may not receive the same level of protection when dealing with the offshore entity. This duality complicates the risk assessment for potential clients.

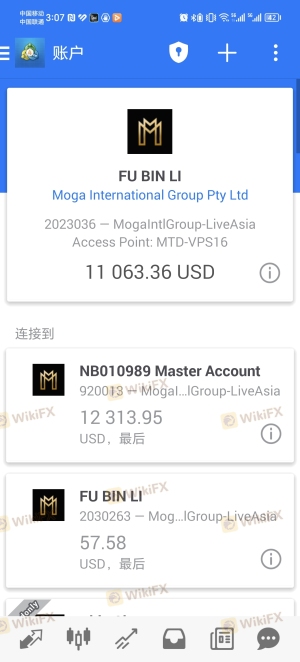

Company Background Investigation

MogaFX is operated by Moga International Group LLC, which is registered in both Australia and Saint Vincent. The company has been in operation since 2021, but its short history raises concerns about its stability and reliability. The ownership structure and management team's background play a crucial role in assessing the broker's credibility.

The management team at MogaFX is not well-documented, which limits transparency regarding their qualifications and experience in the financial markets. This lack of information can be concerning for potential clients, as a knowledgeable and experienced management team is often indicative of a broker's reliability.

Moreover, MogaFX's commitment to transparency is questionable, given the mixed reviews and limited disclosure of key operational details. A broker's transparency regarding its operations, fees, and risk management practices is essential for building trust with clients.

Trading Conditions Analysis

MogaFX offers a range of trading conditions, including various account types and leverage options. However, the overall fee structure has raised concerns among users. The minimum deposit requirement is set at $1,000, which is significantly higher than the industry average of around $100. This high entry barrier may deter novice traders and indicate a lack of accessibility.

| Fee Type | MogaFX | Industry Average |

|---|---|---|

| Spread (Major Pairs) | From 2.5 pips | From 1.0 pips |

| Commission Model | No commissions | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by MogaFX start at 2.5 pips for standard accounts, which is relatively high compared to many competitors. Additionally, while the broker claims to offer zero commissions on most accounts, the spread cost may offset any perceived savings. The high minimum deposit and spreads can make trading with MogaFX less appealing, particularly for those looking for cost-effective trading solutions.

Client Fund Security

Client fund security is paramount in the forex industry. MogaFX claims to implement several measures to protect clients' funds, including segregated accounts and negative balance protection. Segregated accounts are crucial, as they ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in the event of insolvency.

However, the effectiveness of these measures is contingent upon the broker's regulatory compliance. While ASIC's regulations provide a level of assurance, the offshore registration in Saint Vincent raises concerns about the robustness of these protections. Additionally, there have been no reported incidents of fund mismanagement or security breaches at MogaFX, but the lack of a significant operational history makes it difficult to evaluate the broker's long-term reliability.

Customer Experience and Complaints

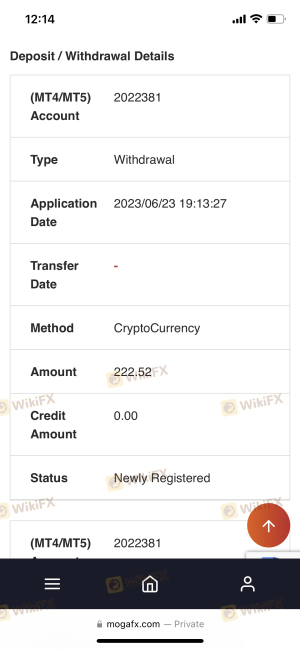

Customer feedback is an essential aspect of evaluating a broker's reputation. MogaFX has received mixed reviews, with several users reporting issues related to withdrawals and customer service. Common complaints include delays in processing withdrawal requests and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow responses |

| Customer Support Issues | Medium | Inconsistent |

One notable case involved a trader who reported difficulties withdrawing funds, citing a lack of communication from the broker's support team. Such experiences can significantly impact a trader's confidence and willingness to continue using the platform. While some users report satisfactory experiences, the prevalence of negative feedback suggests that MogaFX may have significant areas for improvement.

Platform and Execution

MogaFX offers popular trading platforms, including MetaTrader 4 and MetaTrader 5, known for their user-friendly interfaces and robust features. However, user experiences with these platforms have been mixed, with reports of occasional glitches and execution issues.

The quality of order execution is critical in forex trading, as delays or slippage can impact profitability. While MogaFX claims to provide fast execution speeds, some users have reported experiencing issues with slippage and rejected orders. Such problems can lead to frustration and financial losses for traders.

Risk Assessment

Engaging with MogaFX presents several risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | ASIC regulation exists, but offshore ties raise concerns. |

| Fund Security | Medium | Segregated accounts in place, but offshore registration poses risks. |

| Trading Costs | High | High minimum deposit and spreads compared to industry standards. |

| Customer Support | Medium | Mixed reviews; issues with responsiveness reported. |

To mitigate these risks, traders are advised to conduct thorough research, consider using demo accounts, and maintain a diversified portfolio across multiple brokers.

Conclusion and Recommendations

In conclusion, while MogaFX holds a legitimate license from ASIC, several factors raise concerns about its overall trustworthiness. The dual registration with an offshore entity, high minimum deposit requirements, and mixed customer feedback suggest that traders should approach this broker with caution.

Potential clients are encouraged to weigh the risks and consider alternative brokers with stronger regulatory oversight and better customer reviews. For those new to forex trading, it may be prudent to explore platforms with lower entry barriers and a more transparent operational history. Reliable alternatives include brokers regulated by the FCA or CySEC, which offer more robust protections for traders.

Ultimately, while MogaFX is not outrightly labeled a scam, the combination of its regulatory ambiguity and customer complaints warrants careful consideration before opening an account.

Is MOGAFX a scam, or is it legit?

The latest exposure and evaluation content of MOGAFX brokers.

MOGAFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MOGAFX latest industry rating score is 1.90, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.90 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.