MogaFX 2025 Review: Everything You Need to Know

Executive Summary

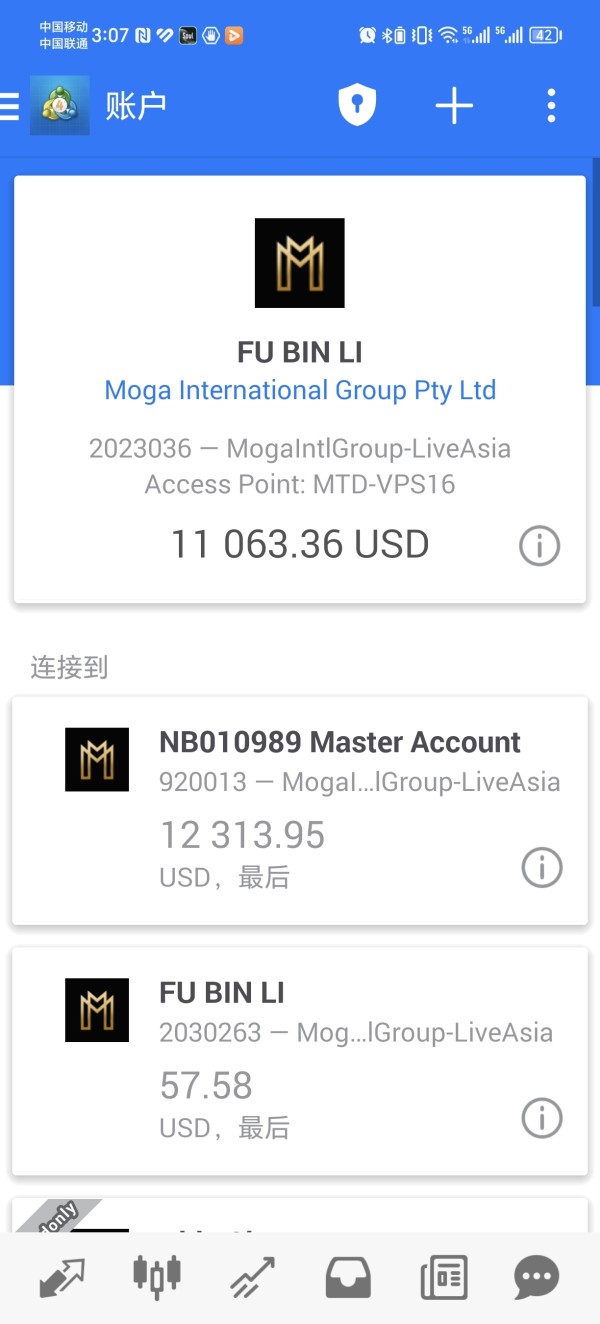

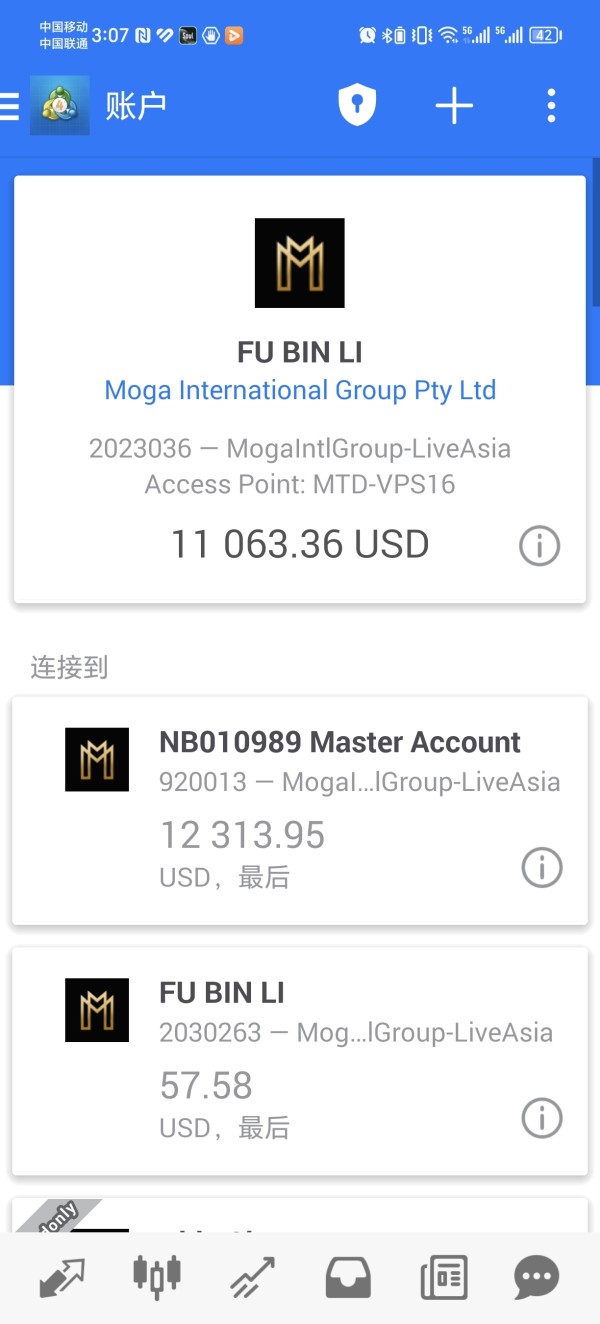

This mogafx review looks at a multi-asset broker that operates under regulation in Australia and St Vincent and the Grenadines. MogaFX works as a trading platform mainly designed for experienced traders, offering leverage up to 1:500 across multiple trading platforms including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). The broker gives access to various asset classes including forex, indices, and commodities.

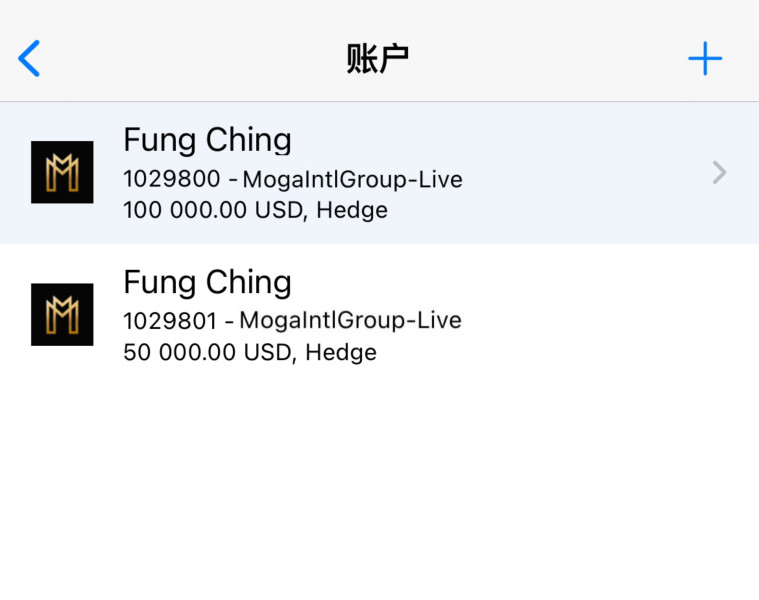

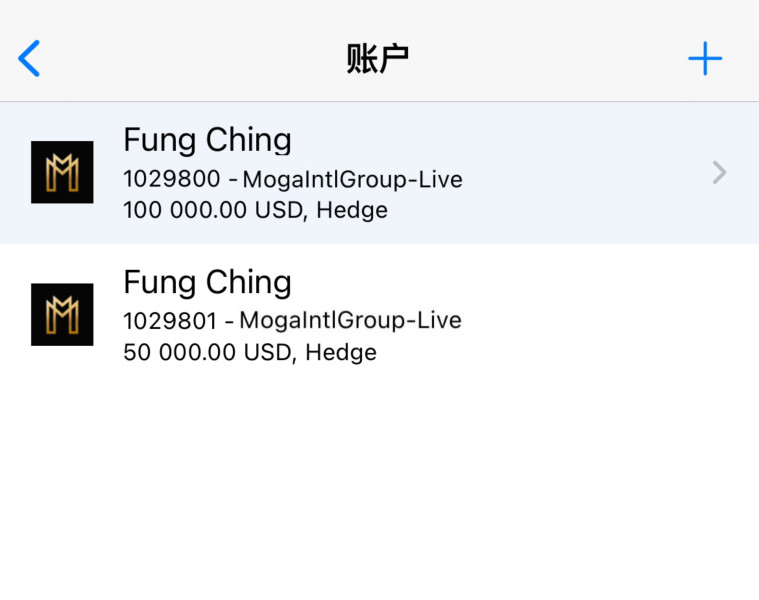

The minimum deposit starts from $1,000 across its 6 account types. MogaFX focuses on educational materials and advanced trading tools to help clients grow. However, our analysis shows mixed user feedback and some concerns about transparency that potential traders should think about carefully.

This review gives a balanced look at MogaFX's offerings based on regulatory information and user discussions from various platforms. We highlight both its strengths in platform diversity and areas where improvements may be needed, particularly regarding customer service and overall trust factors.

Important Notice

Regional Entity Differences: MogaFX operates through different entities in Australia and St Vincent and the Grenadines. This may result in varying regulatory frameworks and operational approaches depending on your location. The regulatory environment and client protections may differ significantly between these regions.

Review Methodology: This evaluation uses publicly available information, regulatory filings, and user feedback collected from various trading forums and review platforms. Given the limited detailed information available from official sources, some assessments rely on comparative industry standards and user-reported experiences.

Rating Framework

Broker Overview

MogaFX operates as a multi-asset brokerage firm with regulatory oversight in Australia through the Australian Securities and Investments Commission (ASIC) and in St Vincent and the Grenadines. The company targets experienced traders through its platform offerings and account structures. The broker's business model focuses on providing access to forex, indices, and commodities trading across multiple professional trading platforms.

The brokerage stands out through its platform diversity, offering traders access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms. This mogafx review finds that the broker's approach emphasizes advanced trading tools and educational resources. The company's regulatory presence in Australia provides a foundation of oversight, though the dual-jurisdiction structure may create complexity for some traders regarding applicable protections and regulations.

Regulatory Jurisdictions: MogaFX operates under regulation from the Australian Securities and Investments Commission (ASIC) and is also registered in St Vincent and the Grenadines. This provides a dual-regulatory framework for its operations.

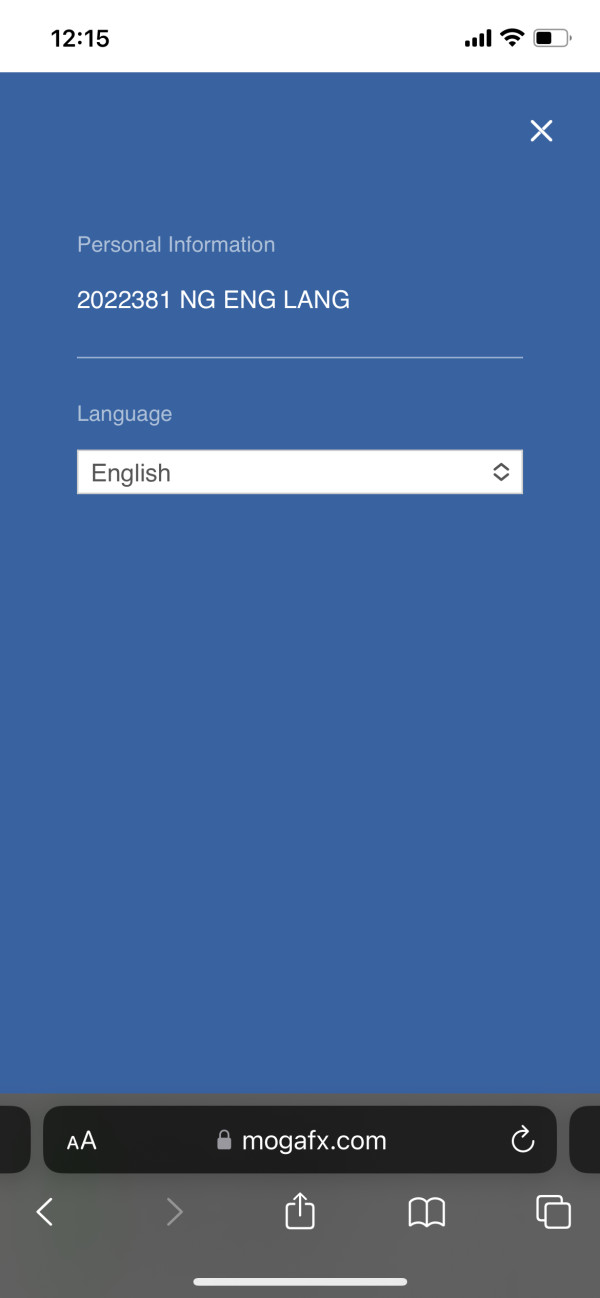

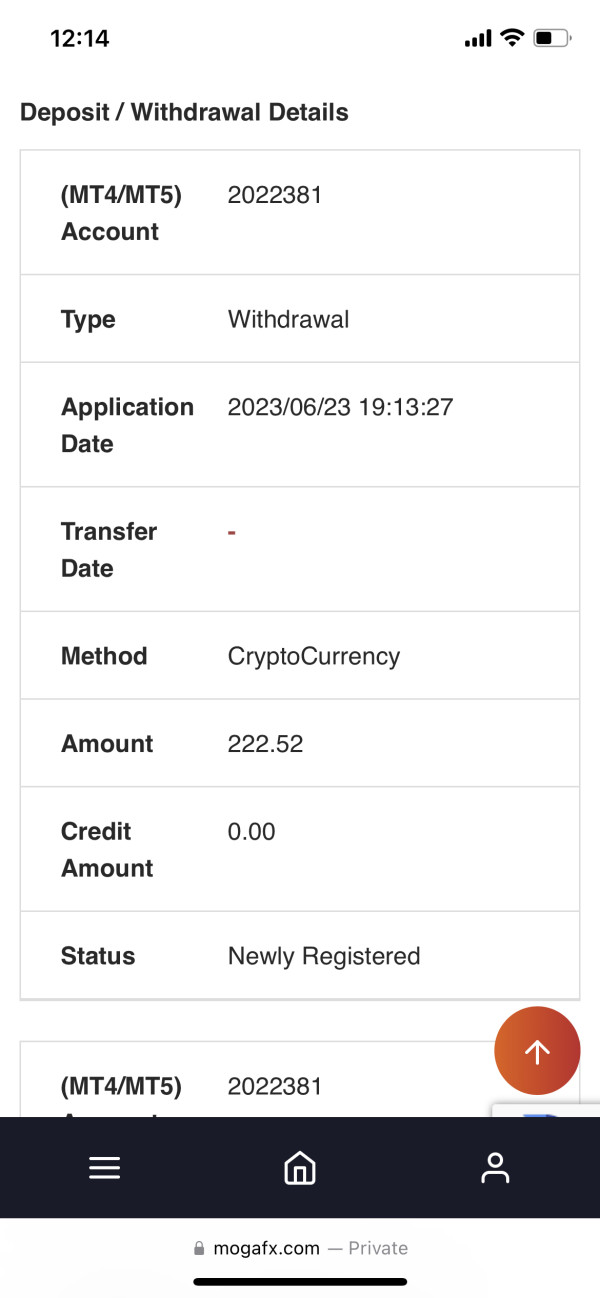

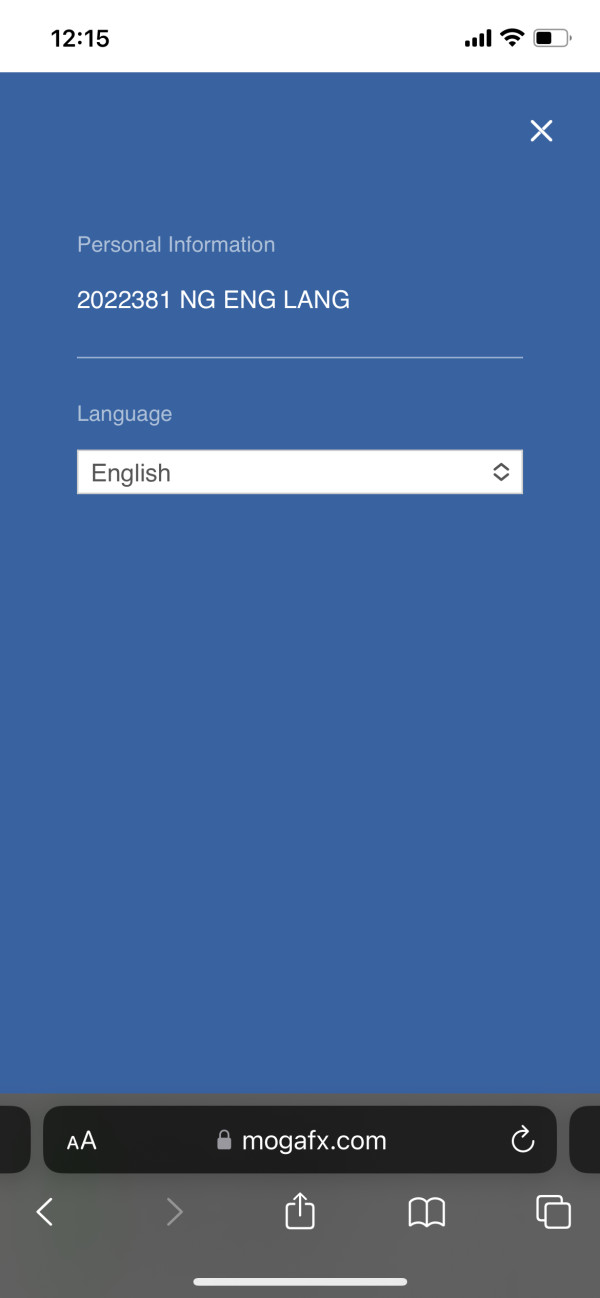

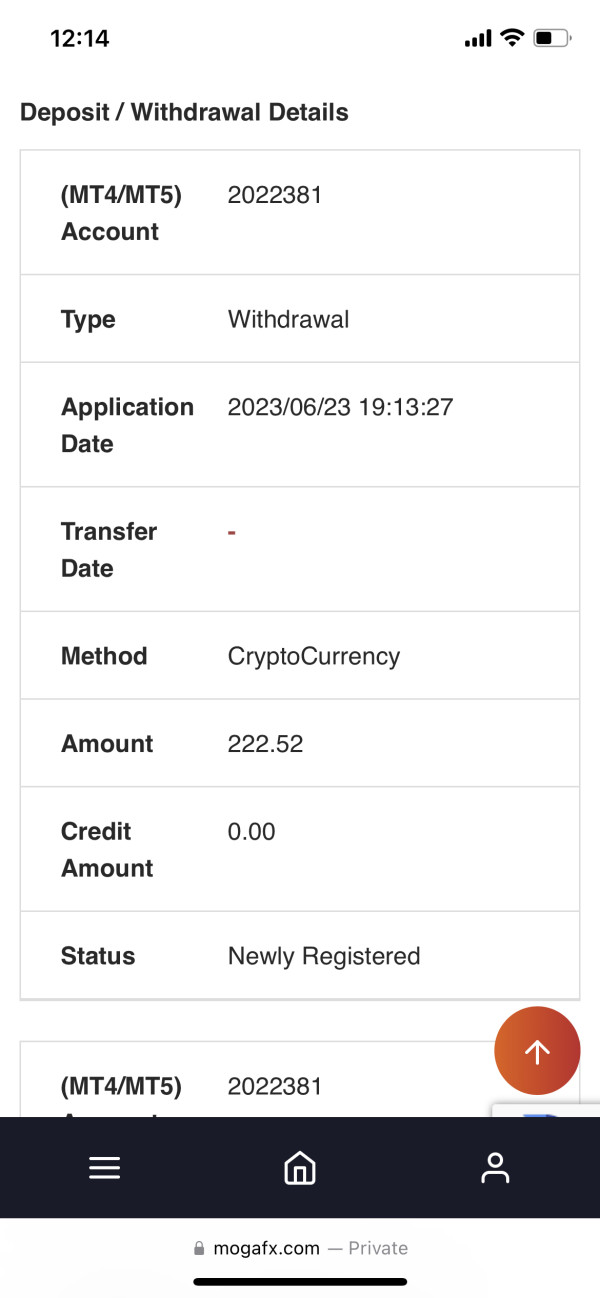

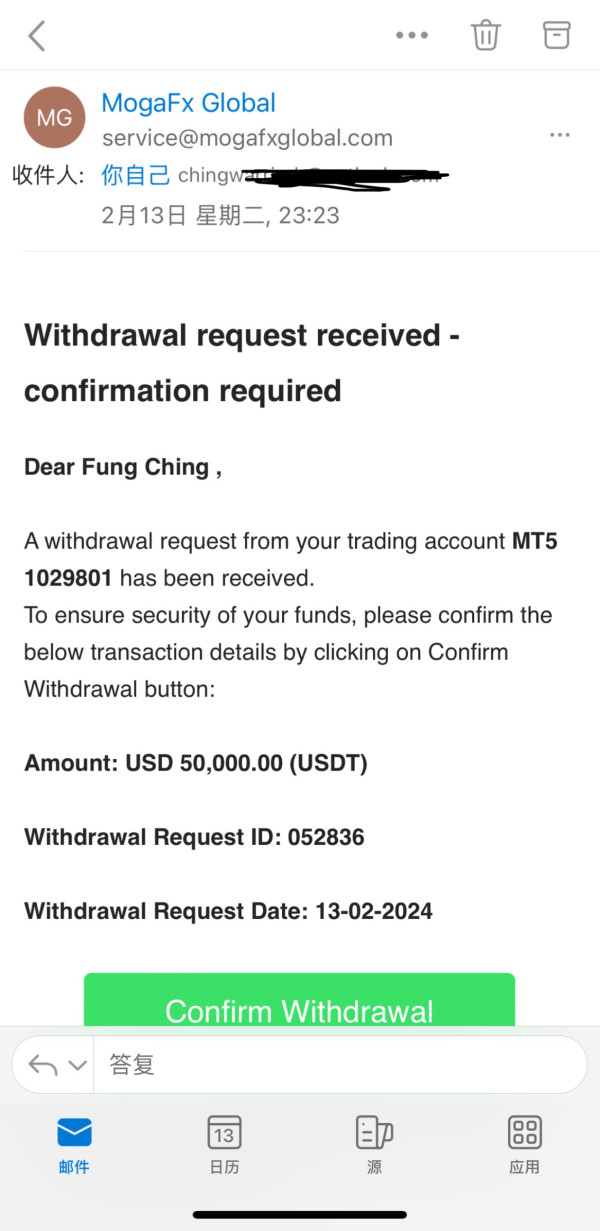

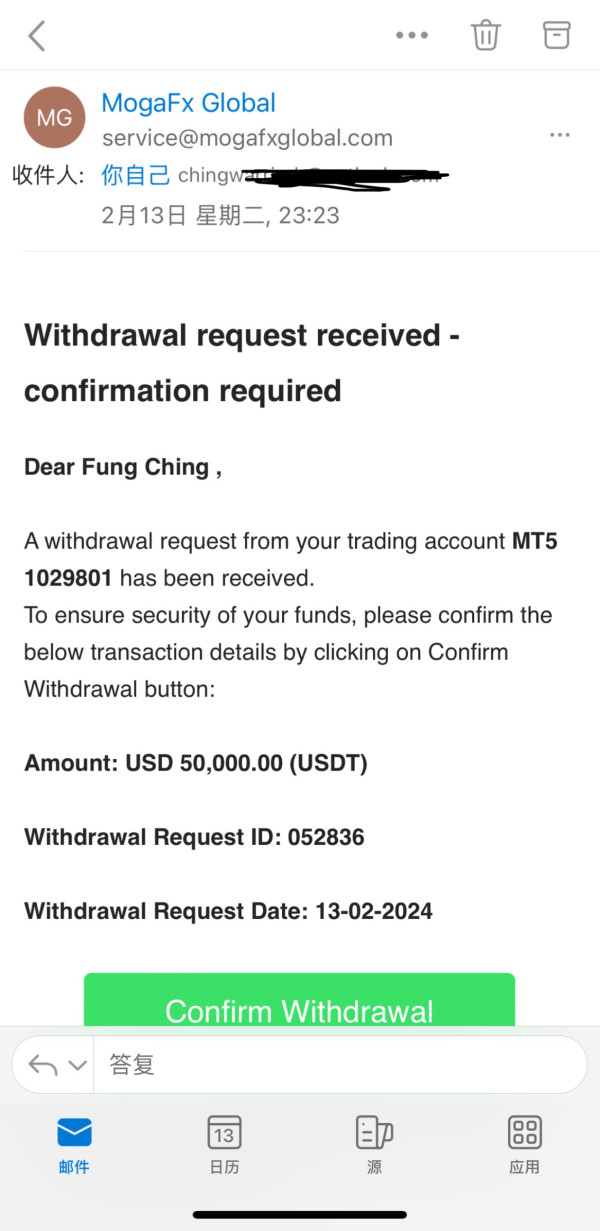

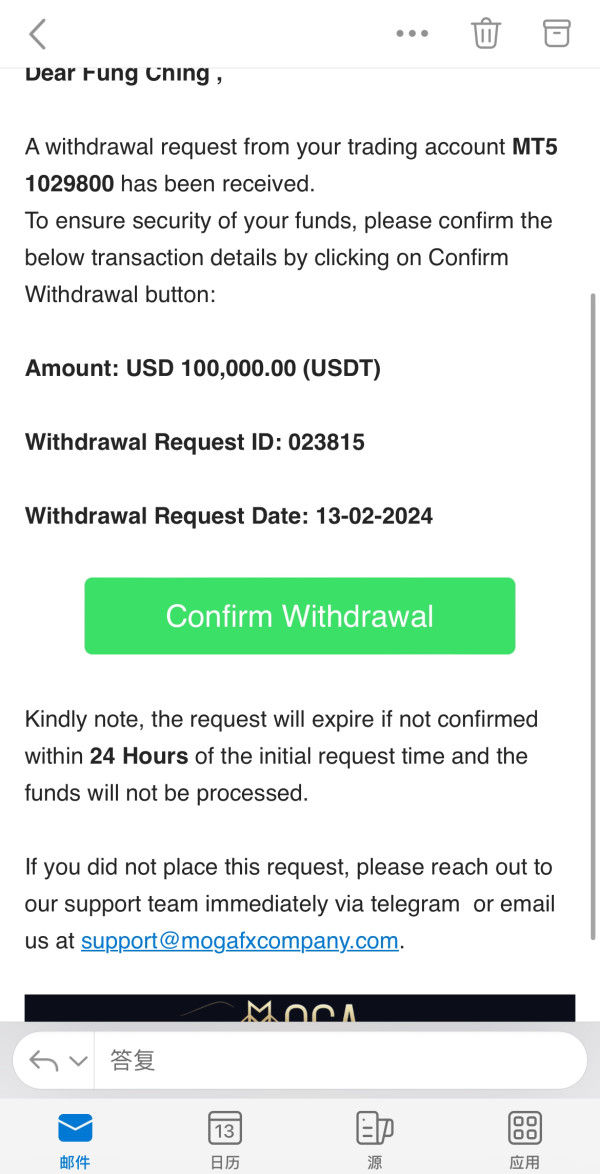

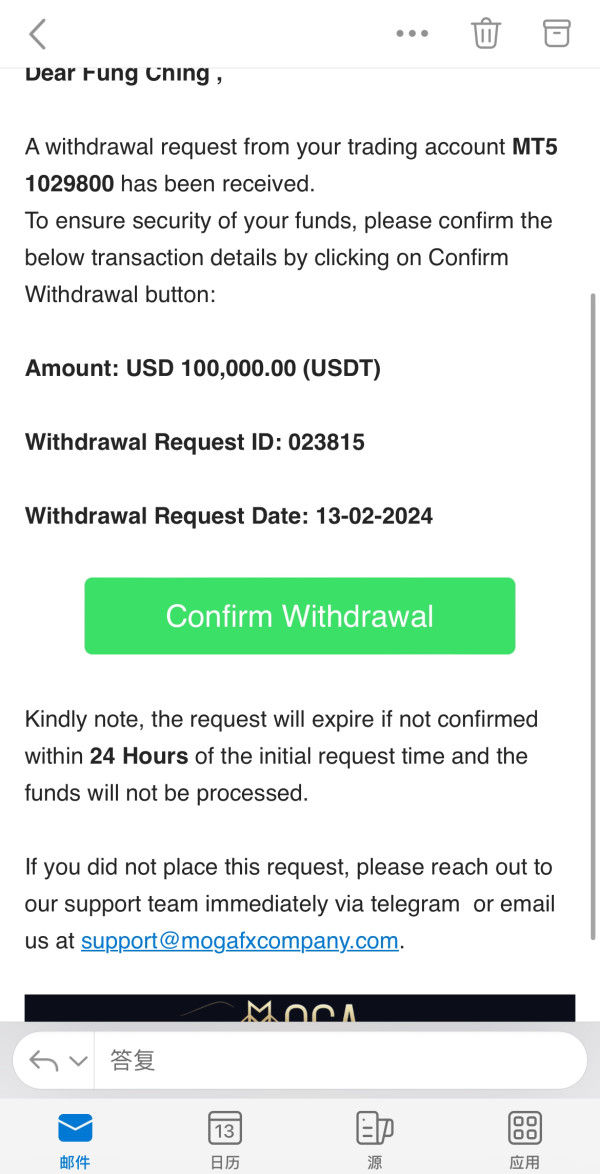

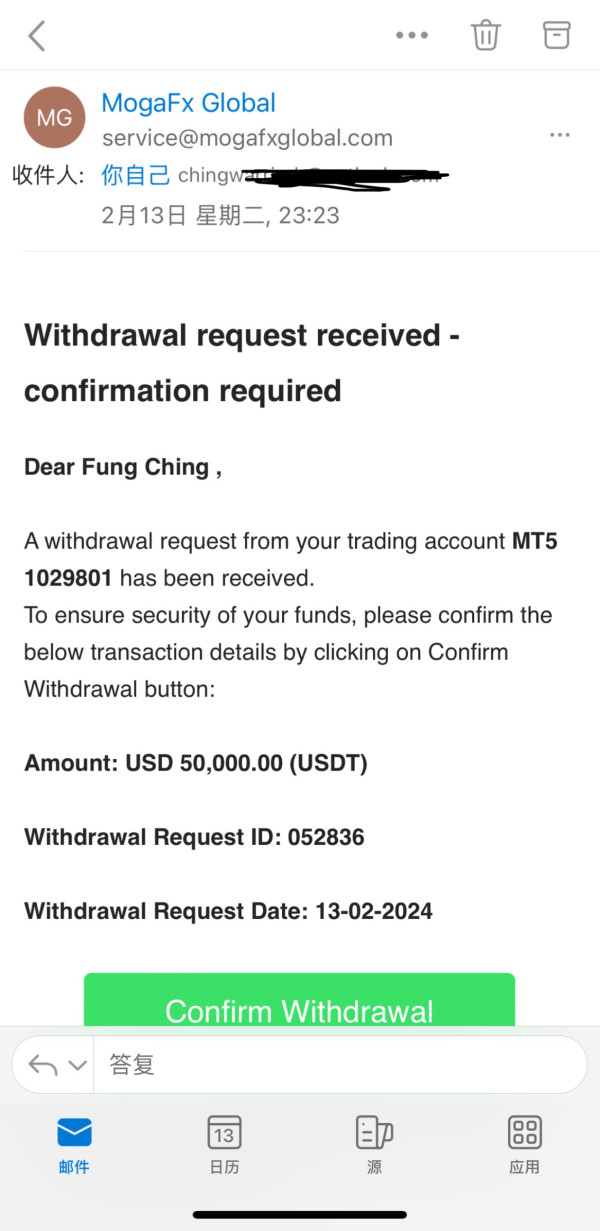

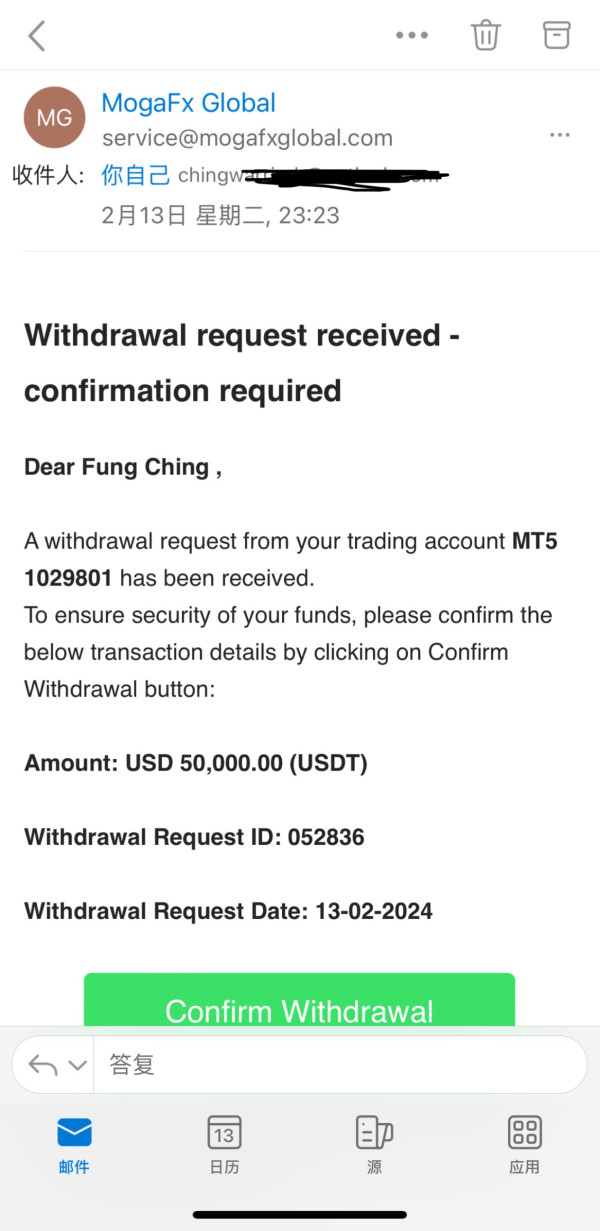

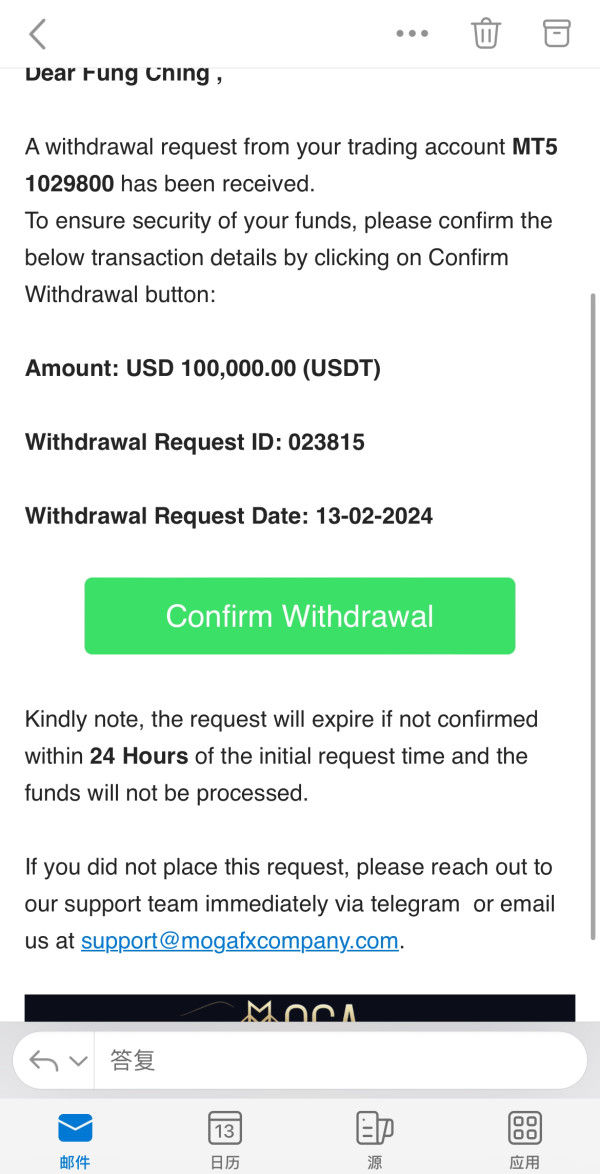

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods was not detailed in available sources. This represents an area where potential clients should seek direct clarification from the broker.

Minimum Deposit Requirements: The broker requires a minimum deposit of $1,000 across its account offerings. This positions it toward more serious traders rather than casual retail participants.

Bonus and Promotional Offers: Current promotional offerings and bonus structures were not specified in available documentation. This suggests either limited promotional activity or lack of public disclosure.

Tradeable Assets: MogaFX provides access to multiple asset classes including foreign exchange (forex), stock indices, and commodity markets. This offers diversification opportunities for traders.

Cost Structure: Detailed information regarding spreads, commissions, and other trading costs was not comprehensively available in public sources. This represents a significant transparency gap for this mogafx review.

Leverage Ratios: The broker offers leverage up to 1:500. This aligns with industry standards for professional trading accounts while requiring careful risk management from users.

Platform Options: Trading is supported through MT4, MT5, and cTrader platforms. This provides traders with professional-grade tools and functionality across different interface preferences.

Geographic Restrictions: Specific geographic limitations were not detailed in available sources.

Customer Service Languages: Supported languages for customer service were not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

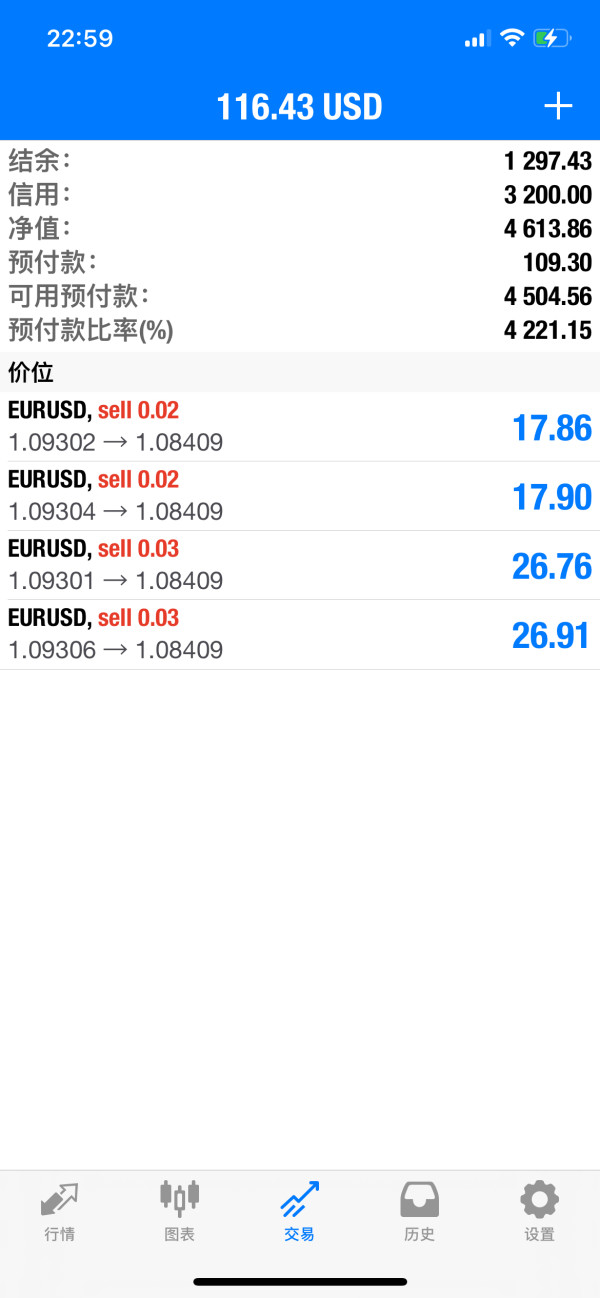

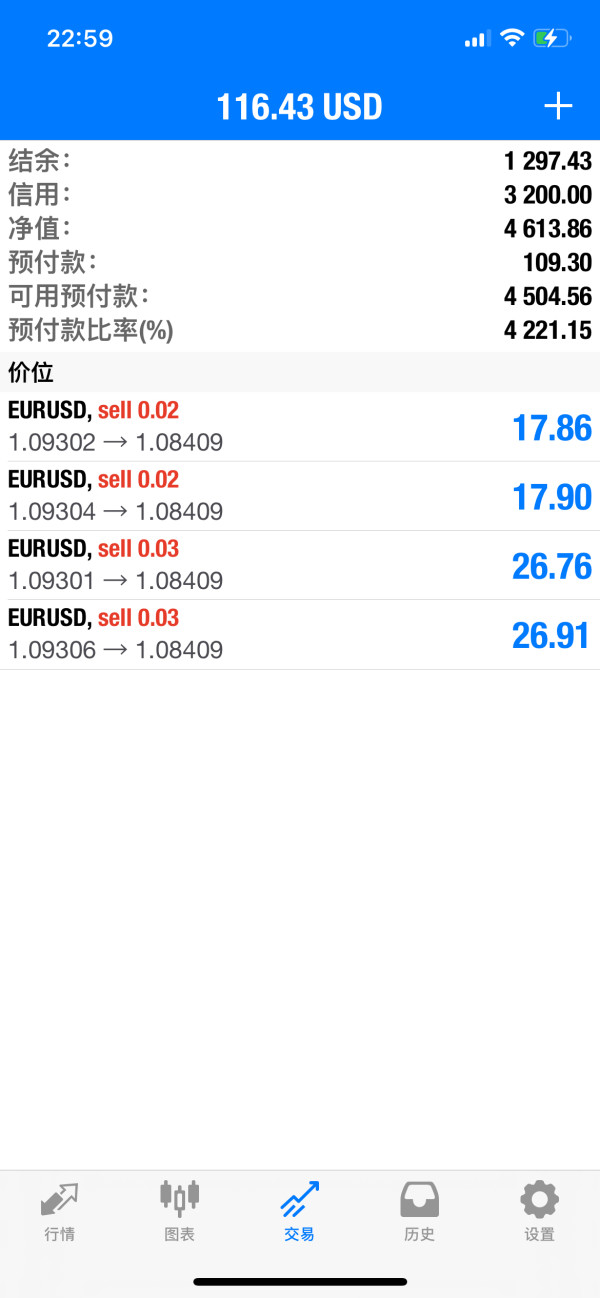

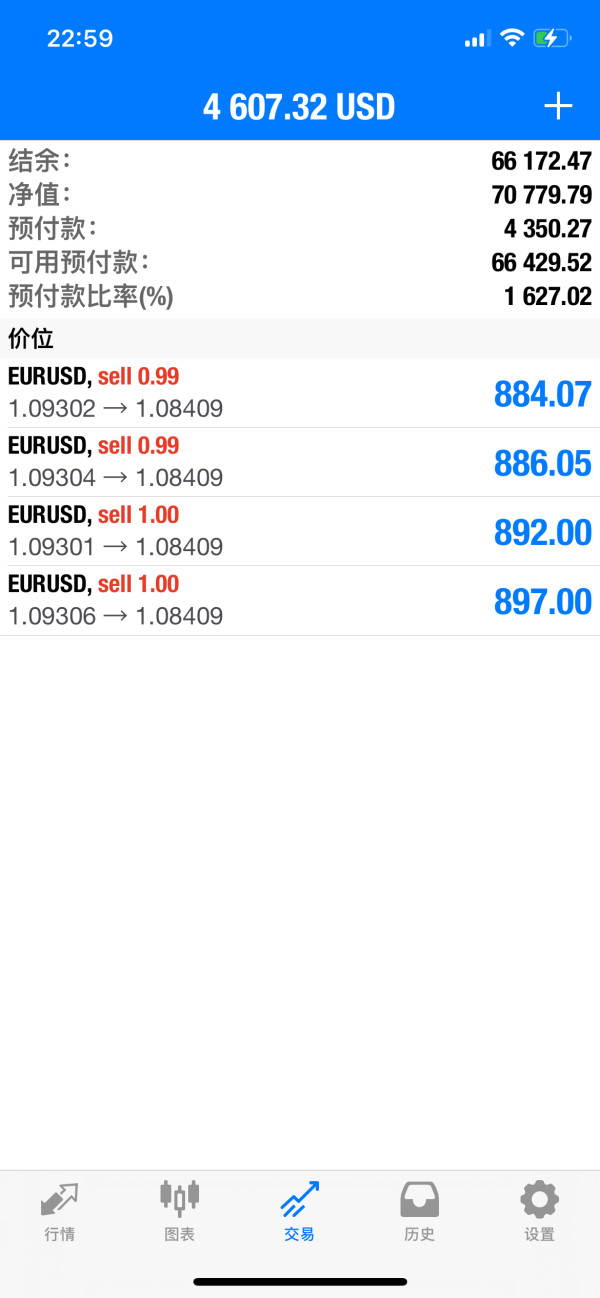

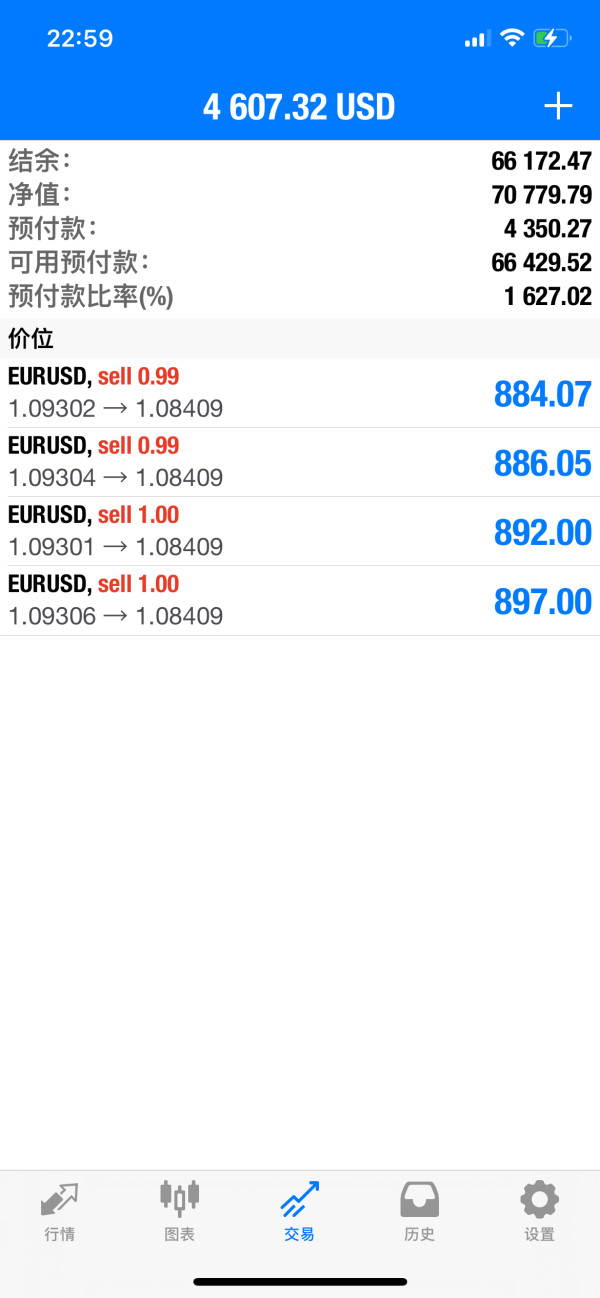

MogaFX's account structure reflects its positioning toward experienced traders. The minimum deposit requirement of $1,000 may present barriers for newer or smaller-scale traders. The broker offers 6 different account types, though specific details about the features and benefits of each tier were not comprehensively available in public sources.

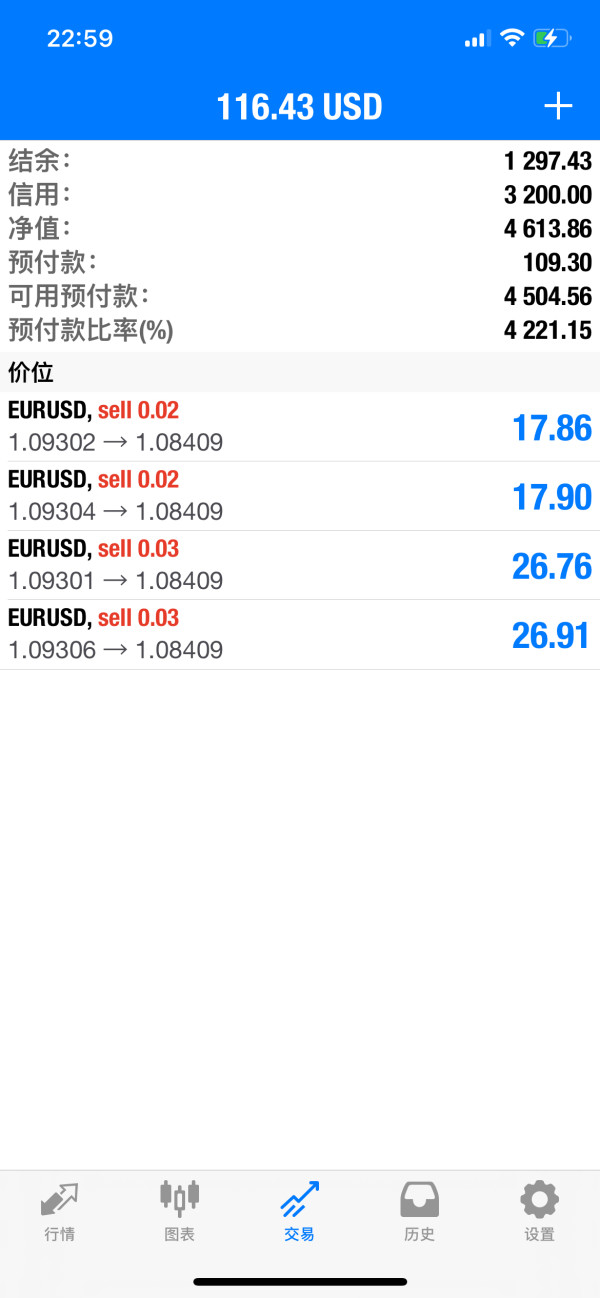

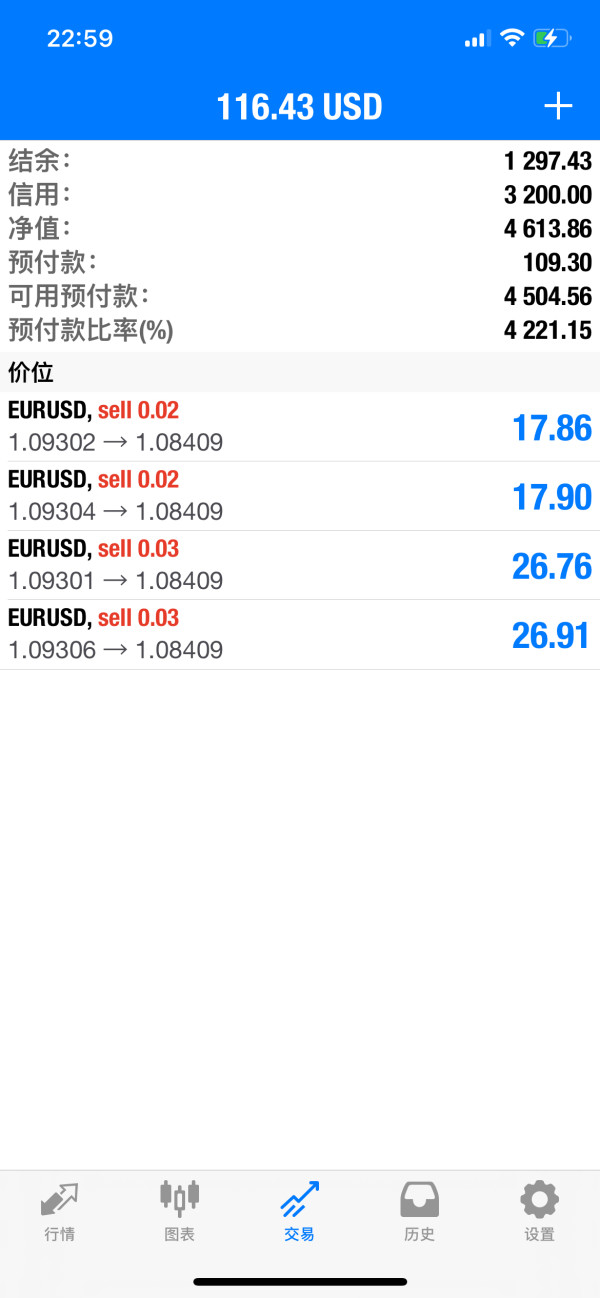

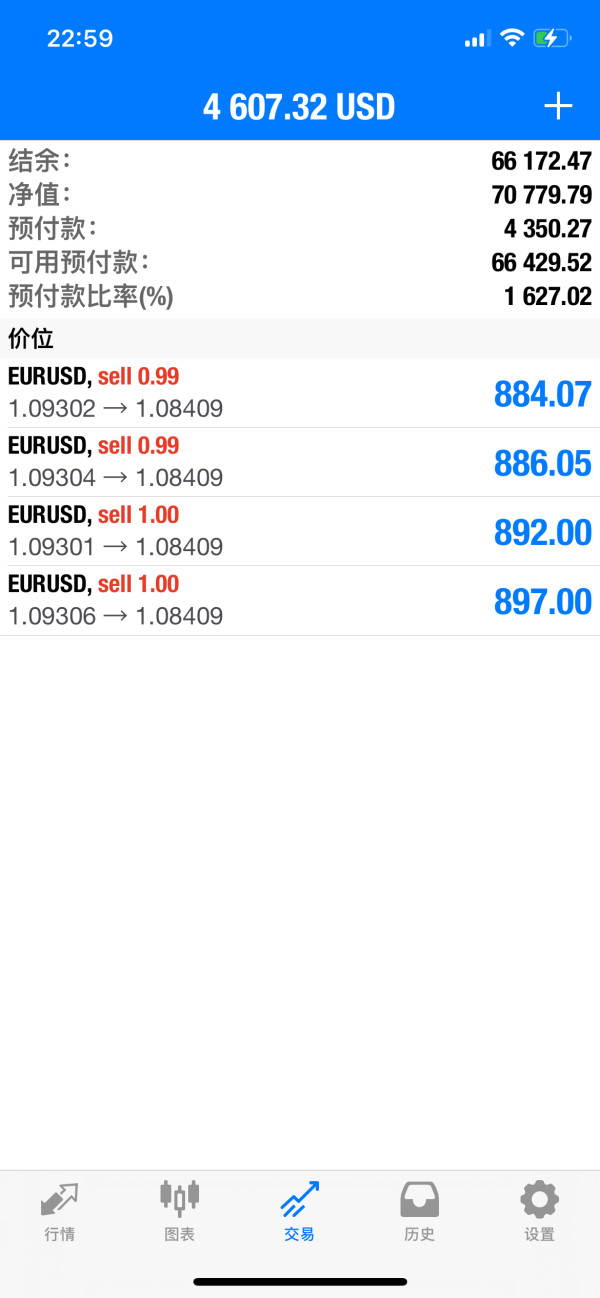

The leverage offering of up to 1:500 aligns with industry standards for professional accounts and provides flexibility for various trading strategies. However, this mogafx review notes that higher leverage also increases risk exposure. This makes it particularly important for traders to understand the associated margin requirements and risk management tools available.

The lack of detailed information about account-specific features represents a transparency concern. Features such as minimum trade sizes, special account benefits, or Islamic account availability were not clearly documented. Potential clients seeking to evaluate account suitability may need to contact the broker directly for comprehensive account comparison information.

The platform offering represents one of MogaFX's stronger aspects. The broker supports three major professional trading platforms: MetaTrader 4, MetaTrader 5, and cTrader. This diversity allows traders to select platforms based on their specific needs, experience levels, and preferred trading styles.

MT4 and MT5 provide extensive technical analysis capabilities, automated trading support through Expert Advisors, and robust charting tools. MogaFX emphasizes educational materials and advanced trading tools designed to support client development. This focus on education can be particularly valuable for traders looking to enhance their skills and market understanding.

The inclusion of cTrader adds institutional-level functionality for traders requiring advanced order types and market depth information. However, this mogafx review notes that specific details about proprietary tools, research resources, or unique analytical offerings were not extensively documented in available sources.

Customer Service and Support Analysis (5/10)

Customer service information represents a significant gap in publicly available documentation about MogaFX. Specific contact methods, response time commitments, and service availability hours were not detailed in the sources reviewed for this analysis. This lack of transparency regarding customer support infrastructure raises concerns about accessibility when traders need assistance.

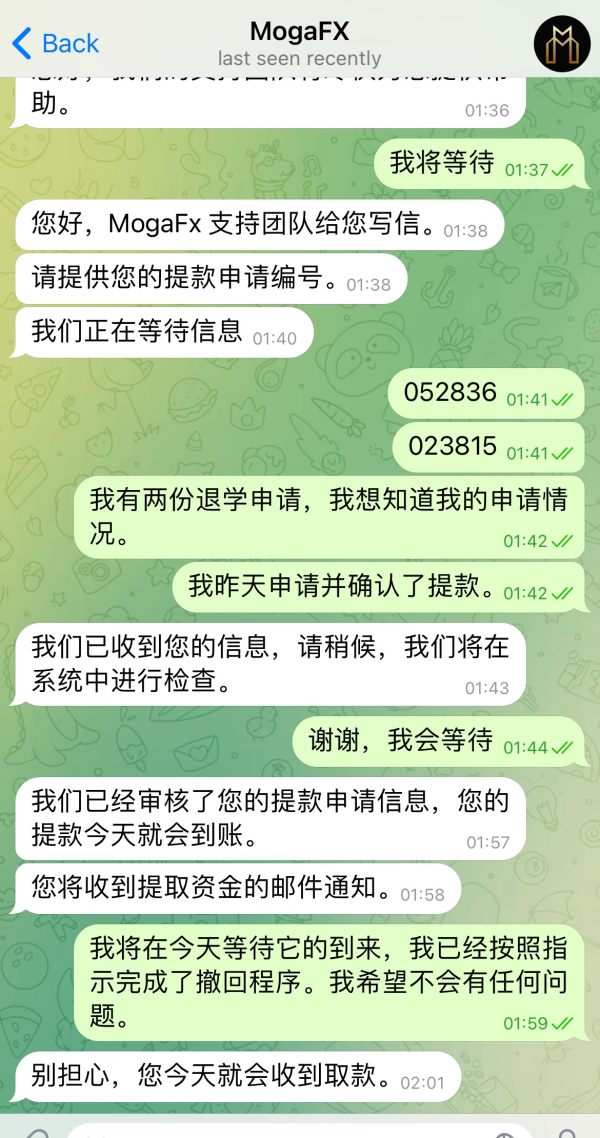

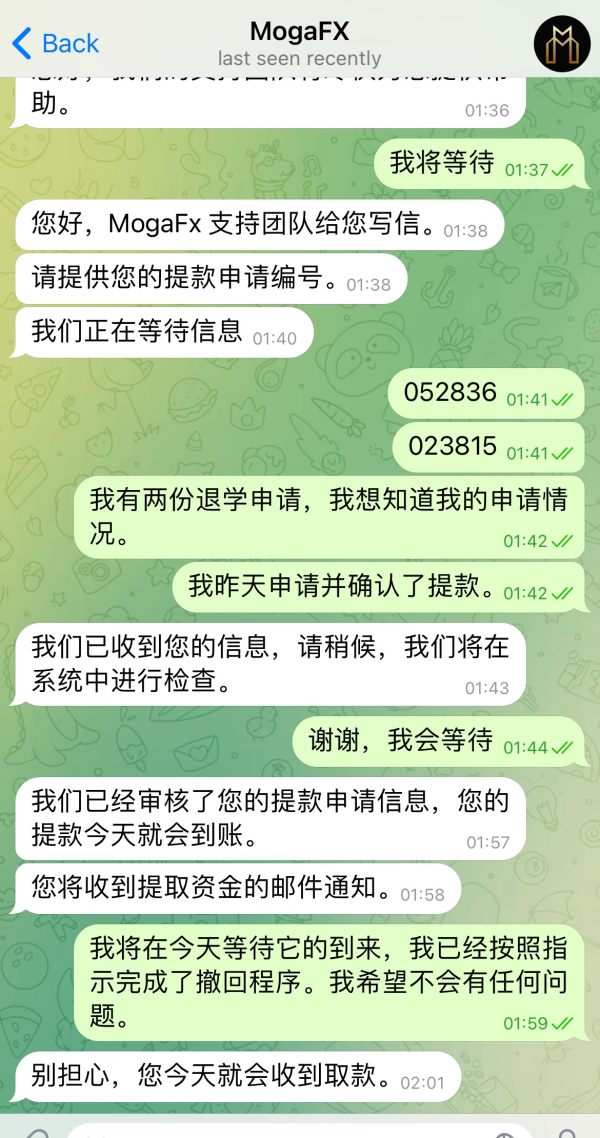

User discussions found in various trading forums indicate mixed experiences with customer service. Some references to complaints and service-related concerns were noted. The absence of comprehensive customer service information makes it difficult for potential clients to evaluate the level of support they can expect.

The broker's dual-jurisdiction operation may also create complexity in customer service delivery. Different regulatory environments might require different support protocols. This mogafx review emphasizes the importance of understanding which jurisdiction's customer protection frameworks apply to individual accounts and what recourse mechanisms are available for dispute resolution.

Trading Experience Analysis (6/10)

The trading experience at MogaFX benefits from the professional platform options available. MT4, MT5, and cTrader each offer distinct advantages for different trading approaches. These platforms provide comprehensive technical analysis tools, automated trading capabilities, and professional-grade order management systems that can support various trading strategies.

However, critical aspects of the trading experience such as execution speed, spread consistency, and order slippage were not detailed in available sources. User feedback regarding actual trading conditions, platform stability during volatile market periods, and overall execution quality remains limited in public discussions. This makes it challenging to assess real-world trading performance.

The leverage offering up to 1:500 provides flexibility for position sizing and capital efficiency. However, it requires sophisticated risk management understanding. This mogafx review notes that while the platform infrastructure appears professionally oriented, the lack of detailed performance metrics and user experience data limits the ability to fully evaluate the trading environment quality compared to industry benchmarks.

Trust Factor Analysis (4/10)

Trust represents a significant concern area for MogaFX based on available information and user discussions. The broker maintains regulatory oversight through ASIC in Australia, which provides some foundation for operational standards. However, user discussions in trading communities have raised questions about the broker's practices and reliability.

The regulatory presence in Australia offers certain client protections under ASIC oversight, including segregated client funds and dispute resolution mechanisms. However, the additional registration in St Vincent and the Grenadines creates questions about which regulatory framework applies to different clients and circumstances. St Vincent and the Grenadines is known for lighter regulatory requirements.

User discussions found in various forums include references to potential scam concerns and service complaints. However, specific details and resolution outcomes were not comprehensively documented. This mogafx review emphasizes that potential clients should thoroughly verify regulatory status and understand applicable protections before committing funds.

User Experience Analysis (5/10)

The overall user experience at MogaFX appears mixed based on available feedback and structural analysis. The broker's focus on experienced traders through its account minimums and platform offerings suggests a more sophisticated user base. However, this positioning may limit accessibility for newer traders seeking to develop their skills.

The platform diversity with MT4, MT5, and cTrader support provides flexibility for users with different preferences and experience levels. However, specific information about user interface design, account management tools, and overall platform usability was not extensively available in public sources. This limits comprehensive user experience evaluation.

User discussions in trading communities present mixed perspectives. Some references to educational resource quality exist while others raise concerns about service delivery and transparency. The minimum deposit requirement of $1,000 may provide a more serious trading environment but could also limit the broker's appeal to traders seeking lower entry barriers.

Conclusion

This mogafx review reveals a broker that positions itself toward experienced traders through its account structure, platform offerings, and minimum deposit requirements. MogaFX provides professional trading tools through MT4, MT5, and cTrader platforms and emphasizes educational resources. However, significant concerns exist regarding transparency and user trust factors.

The broker's regulatory presence in Australia through ASIC provides some foundation for operational oversight. However, mixed user feedback and limited public information about key operational aspects create uncertainty for potential clients. MogaFX may be suitable for experienced traders who prioritize platform diversity and can conduct thorough due diligence, but the trust and transparency concerns make it less appropriate for traders seeking clearly documented service standards and comprehensive public information about trading conditions.