Regarding the legitimacy of Modmount forex brokers, it provides FSA, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Modmount safe?

Pros

Cons

Is Modmount markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Modmount Services Limited

Effective Date: Change Record

--Email Address of Licensed Institution:

info@modmountltd.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.modmountltd.com, https://www.sycoa.comExpiration Time:

--Address of Licensed Institution:

House of Francis, Office 102, Ile Du Port, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 2630995, (+248) 2608375Licensed Institution Certified Documents:

CYSEC Derivatives Trading License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (STP)

Licensed Entity:

Peaksight Ltd

Effective Date:

2023-12-11Email Address of Licensed Institution:

compliance@peaksightltd.comSharing Status:

No SharingWebsite of Licensed Institution:

www.peaksightltd.comExpiration Time:

--Address of Licensed Institution:

Office 204, P. Lordos Center, Block B, Corner Makarios Avenue 240 & Vyronos 1 Street, 3105 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 008 330Licensed Institution Certified Documents:

Is ModMount A Scam?

Introduction

ModMount, a relatively new entrant in the forex trading landscape, has been gaining attention for its diverse offerings in the CFD market. Established in 2022 and headquartered in Seychelles, ModMount positions itself as a broker catering to both novice and experienced traders. However, with the proliferation of online trading platforms, the necessity for traders to conduct thorough due diligence before engaging with any broker has never been more critical. This article aims to provide an objective analysis of ModMount's legitimacy, regulatory status, trading conditions, and overall safety for potential investors. We will employ a structured framework based on regulatory compliance, company background, trading conditions, customer experiences, and risk assessments to arrive at a well-informed conclusion.

Regulation and Legitimacy

Understanding a broker's regulatory status is paramount in assessing its legitimacy and the safety of client funds. ModMount claims to operate under the oversight of the Financial Services Authority (FSA) in Seychelles, a regulatory body responsible for ensuring that financial institutions adhere to necessary standards and protect investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority | SD 119 | Seychelles | Verified |

The FSA is considered a tier-4 regulator, which means it lacks the stringent oversight seen with tier-1 or tier-2 regulators like the FCA (UK) or ASIC (Australia). While being regulated by the FSA provides some level of assurance, it is essential to note that offshore regulators often have less rigorous compliance requirements. Therefore, while ModMount is regulated, the quality and historical compliance of this regulation warrant cautious optimism.

To date, there have been no significant reports of misconduct or regulatory breaches associated with ModMount, which is a positive indicator. However, potential traders should remain vigilant and verify the broker's claims with the regulatory body to ensure ongoing compliance.

Company Background Investigation

ModMount operates under the banner of ModMount Services Limited, which was established in 2022. The company's relatively short history raises questions about its stability and long-term viability. The management team, although not extensively publicized, is crucial for understanding the broker's operational integrity.

The companys transparency regarding its ownership structure and management team is limited. A lack of comprehensive information can be a red flag for potential investors. The absence of detailed disclosures about the management's professional backgrounds and expertise can lead to uncertainty about their capability to manage client funds effectively.

In terms of information disclosure, ModMount provides basic details about its regulatory status and trading conditions on its website. However, more in-depth insights, such as financial statements or customer satisfaction metrics, would enhance the broker's credibility.

Trading Conditions Analysis

ModMount offers various trading conditions that are essential for traders to consider. The broker has a commission-free trading model, but it is important to scrutinize the overall fee structure and any hidden costs that may impact profitability.

| Fee Type | ModMount | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.5 - 0.9 pips | 1.0 - 1.5 pips |

| Commission Model | Commission-Free | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads at ModMount range from 2.5 pips for its classic account to as low as 0.9 pips for its VIP account. While these spreads are competitive, they are higher than the industry average for major currency pairs, which typically ranges from 1.0 to 1.5 pips. Additionally, ModMount imposes inactivity fees that can escalate significantly if accounts are dormant for extended periods, which may deter casual traders.

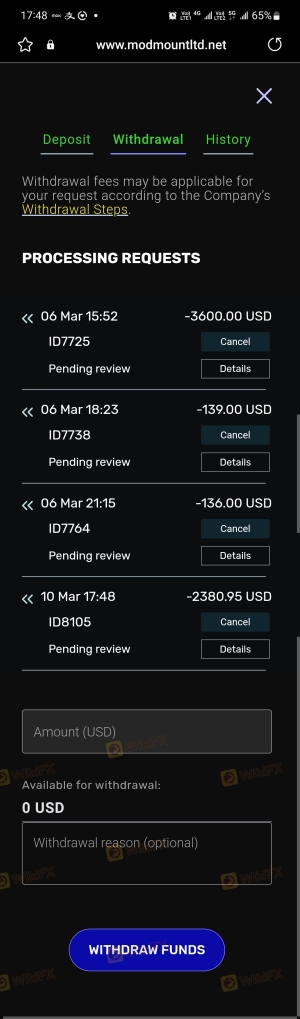

Traders should also be aware of the withdrawal fees, which include a $30 charge for bank transfers. Such fees can add up, especially for traders who frequently withdraw funds. Therefore, understanding the complete cost structure is vital for managing trading expenses effectively.

Customer Funds Security

The security of client funds is a crucial aspect of any trading platform. ModMount employs several measures to safeguard client assets, including segregated accounts, which ensure that client funds are kept separate from the broker's operational funds. This practice is essential for protecting clients in the event of financial difficulties faced by the broker.

Furthermore, ModMount offers negative balance protection, which prevents traders from losing more than their initial investment. This feature is particularly important in highly volatile markets, where rapid price fluctuations can lead to significant losses.

Despite these measures, potential investors should remain cautious and inquire about any historical issues related to fund security or disputes that may have arisen. Transparency in how client funds are managed and protected is essential for building trust.

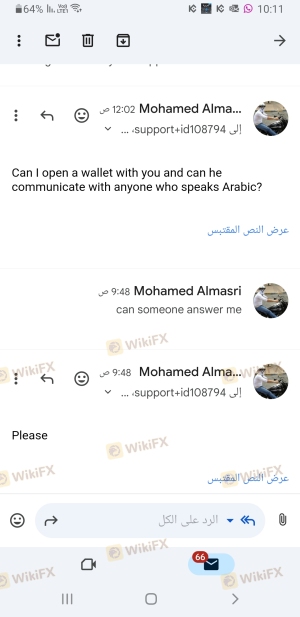

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. ModMount has garnered mixed reviews from users, with some praising its user-friendly platform and responsive customer support, while others have expressed frustration over withdrawal processes and high inactivity fees.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Inactivity Fees | Medium | Notified |

| Customer Support Quality | Medium | Mixed Reviews |

A common theme in customer complaints centers around withdrawal delays, with some users reporting difficulties in accessing their funds. This issue can be particularly concerning, as timely access to funds is crucial for traders. The companys response to these complaints has been described as slow, which can exacerbate frustrations among clients.

Additionally, the high inactivity fees have drawn criticism, especially for traders who may not be active every month. This fee structure could discourage long-term investors who prefer to hold positions without incurring additional costs.

Platform and Trade Execution

ModMount utilizes a proprietary web-based trading platform that aims to offer a user-friendly experience. The platform's features include one-click trading, advanced charting tools, and access to over 350 CFDs across various asset classes. However, the absence of popular trading platforms like MetaTrader 4 or 5 may deter some traders who prefer those environments.

The execution quality on the platform is reported to be satisfactory, with average execution speeds of around 0.08 seconds. However, traders should remain vigilant for any signs of slippage or order rejections, which can negatively impact trading outcomes.

Risk Assessment

Using ModMount as a trading platform involves several risks that potential traders should consider carefully.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may lack robustness. |

| Fund Security Risk | Medium | While funds are segregated, past controversies can arise. |

| Service Quality Risk | Medium | Mixed reviews on customer support and withdrawal processes. |

Traders should mitigate these risks by conducting thorough research, starting with smaller investments, and monitoring their trading experiences closely. It is advisable to diversify investments and not to allocate all funds to a single broker.

Conclusion and Recommendations

In conclusion, while ModMount is regulated by the Seychelles Financial Services Authority (FSA) and offers several protective measures for client funds, potential traders should approach this broker with caution. The higher-than-average spreads, mixed customer reviews, and the challenges surrounding withdrawals may raise red flags for some investors.

For those seeking a broker with a more robust regulatory framework, it may be prudent to consider alternatives such as brokers regulated by tier-1 authorities like the FCA or ASIC. Overall, ModMount may be suitable for traders who prioritize a user-friendly platform and are willing to accept the associated risks, but it is essential to remain vigilant and informed.

Is Modmount a scam, or is it legit?

The latest exposure and evaluation content of Modmount brokers.

Modmount Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Modmount latest industry rating score is 3.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 3.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.