ModMount 2025 Review: Everything You Need to Know

Executive Summary

This modmount review gives you a detailed look at ModMount Ltd, a forex broker with mixed reviews from traders. The company gets mostly negative feedback because of problems with user experience and service quality.

ModMount has a 2.9-star rating on Sitejabber, which shows that many users are unhappy with their services. Some users have had good trading experiences, but most feedback shows the company needs to improve in many areas.

The broker targets individual retail investors who want basic forex trading services. However, potential clients should be very careful because of the documented service problems.

User feedback always points to problems with customer support response times, platform reliability, and overall service delivery. The company also lacks transparency about regulatory status and provides poor customer service support.

However, a small group of users has reported positive trading experiences. This suggests that service quality may change a lot depending on individual situations and needs.

Important Notice

Regional Entity Differences: This information summary does not mention specific regulatory details for ModMount across different regions. Users must check the terms and conditions, regulatory compliance, and service availability in their areas before using this broker.

Review Methodology Disclaimer: This evaluation uses publicly available user feedback, review platform data, and accessible company information. The assessment does not include personal trading experiences with ModMount and should be considered with other research sources when making investment decisions.

Rating Framework

Broker Overview

ModMount Ltd works as a forex trading broker. However, we don't have much information about when the company started or its corporate background.

The broker's business model and how it operates are not well documented in available sources. This creates transparency concerns for potential clients who want detailed company information.

The evidence suggests ModMount focuses on providing basic forex trading services to retail investors. However, we need more investigation into the specific scope of their business operations and corporate history.

The lack of readily available information about the company's origins and development raises questions about transparency standards. Based on user feedback analysis, ModMount appears to offer forex and CFD trading services.

The specific details about their trading platform technology and asset coverage are not well documented in available sources. The broker's primary business focus seems centered on currency trading, with potential expansion into other financial instruments based on user trading reports.

The regulatory framework governing ModMount's operations remains unclear from available information sources. This modmount review identifies the absence of specific regulatory authority mentions as a significant concern for potential clients seeking regulated trading environments.

The lack of clear regulatory oversight information represents a substantial transparency gap. Prospective users need to carefully consider this issue.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing ModMount's operations. This creates uncertainty about compliance standards and investor protection measures.

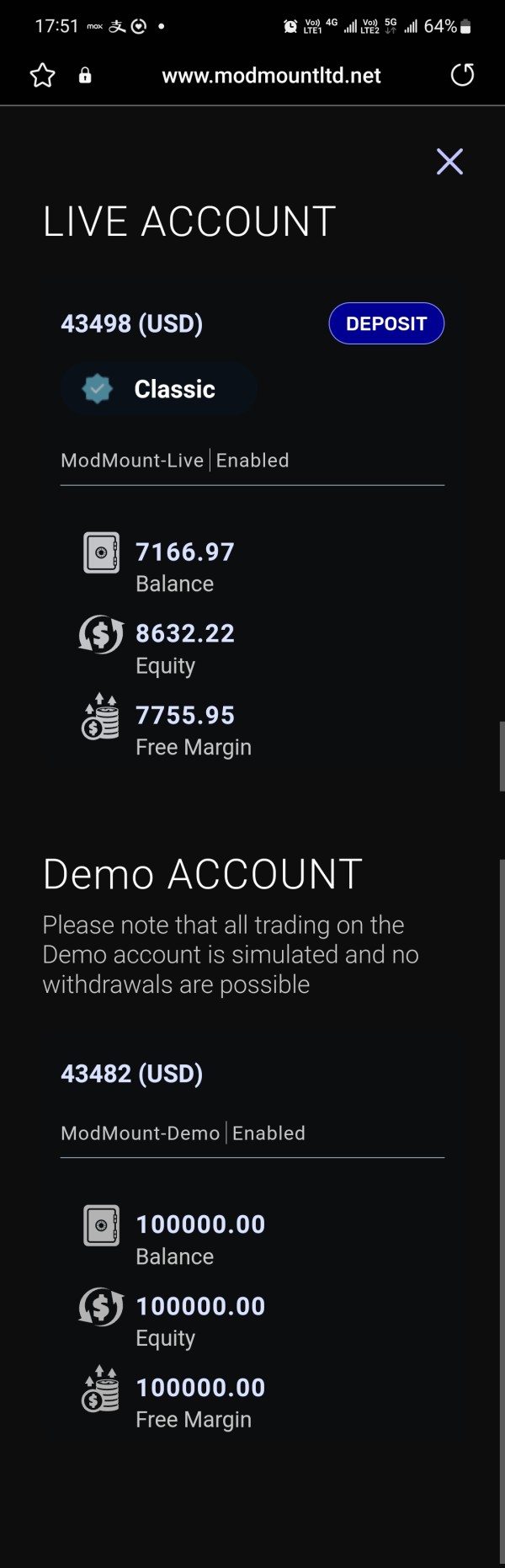

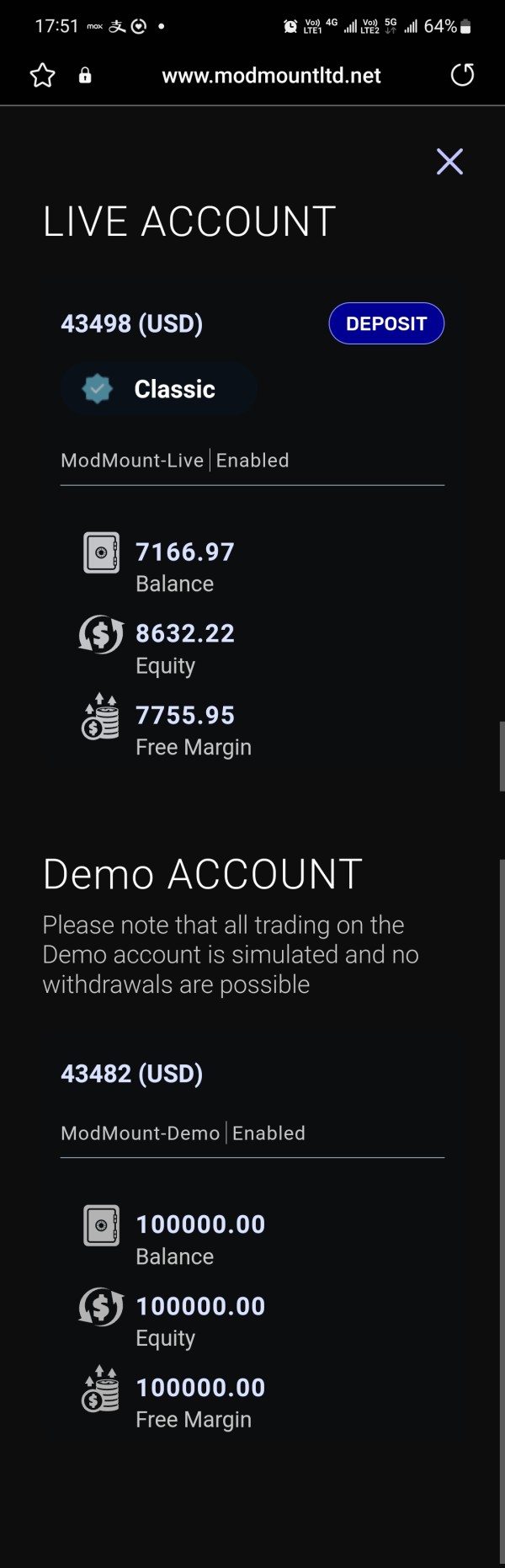

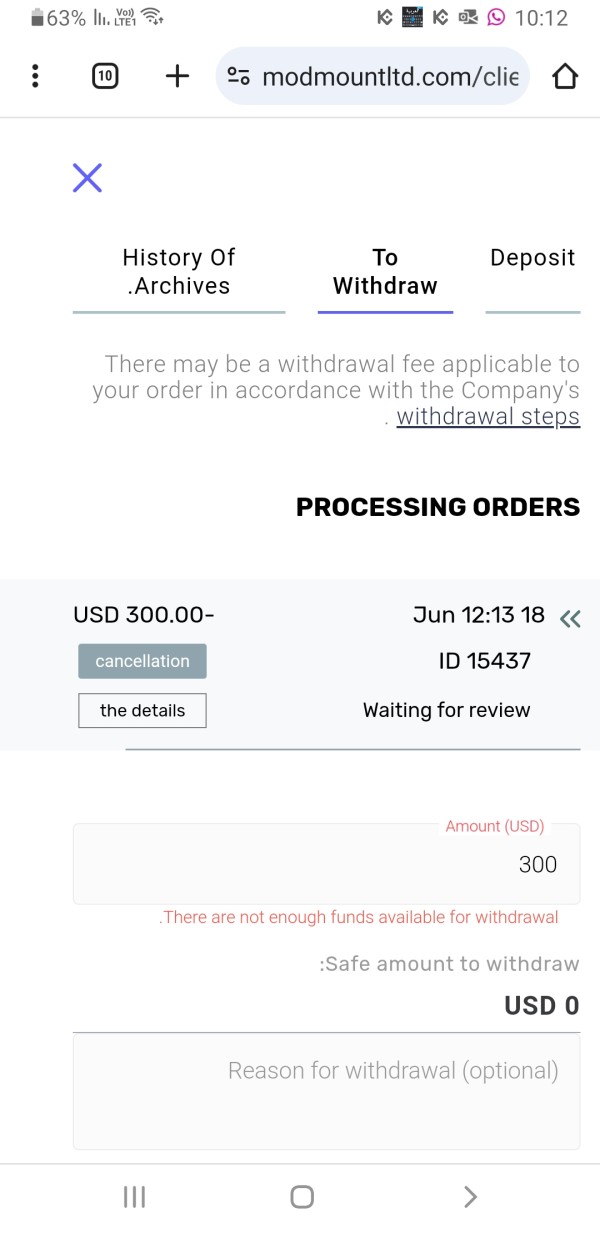

Deposit and Withdrawal Methods: We don't have specific information about available funding methods, processing times, and associated fees in accessible sources. Minimum Deposit Requirements: The information summary does not mention specific minimum deposit amounts or account funding thresholds required to begin trading.

Bonus and Promotional Offers: Details about promotional campaigns, welcome bonuses, or ongoing trading incentives are not specified in available materials. Tradeable Assets: Based on user feedback, ModMount likely offers forex currency pairs and CFD instruments, though comprehensive asset listings are not definitively confirmed in available sources.

Cost Structure: We don't have specific information about spreads, commission rates, overnight fees, and other trading costs in the information summary. You need to contact the broker directly for this information.

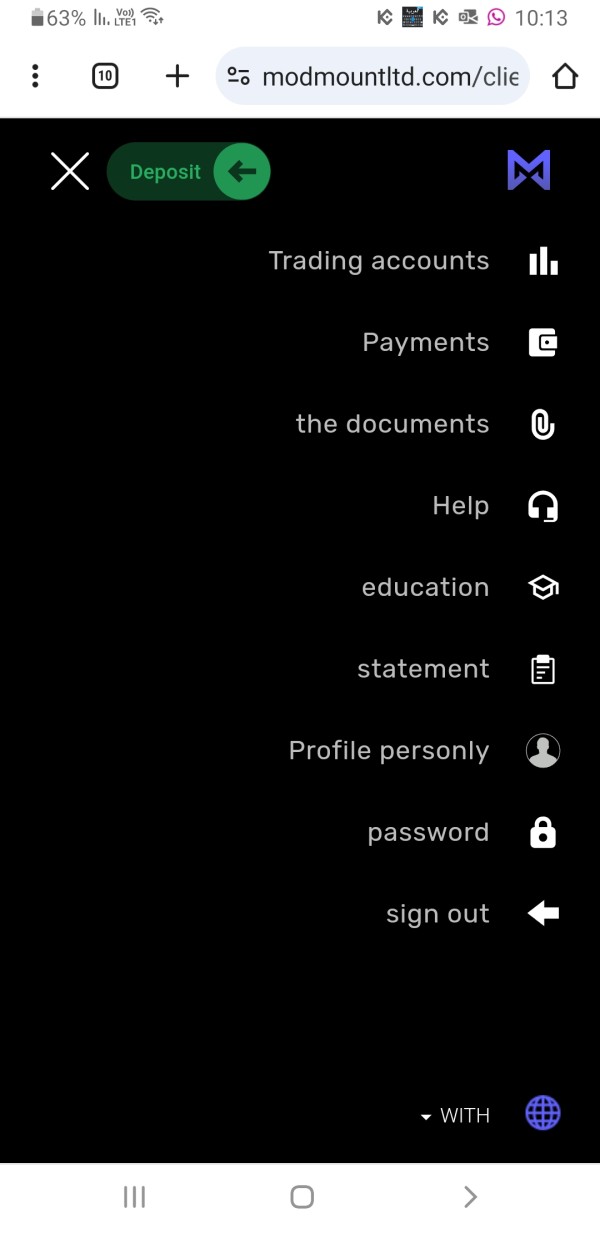

Leverage Ratios: Maximum leverage offerings and margin requirements are not specified in available documentation. Platform Options: Details about trading platform technology, software providers, and platform features are not comprehensively covered in accessible information.

Geographic Restrictions: We don't have specific information about regional availability and service restrictions in available sources. Customer Support Languages: The range of supported languages for customer service is not specified in the information summary.

This modmount review highlights significant information gaps. Potential clients should address these through direct communication with the broker before making trading decisions.

Detailed Rating Analysis

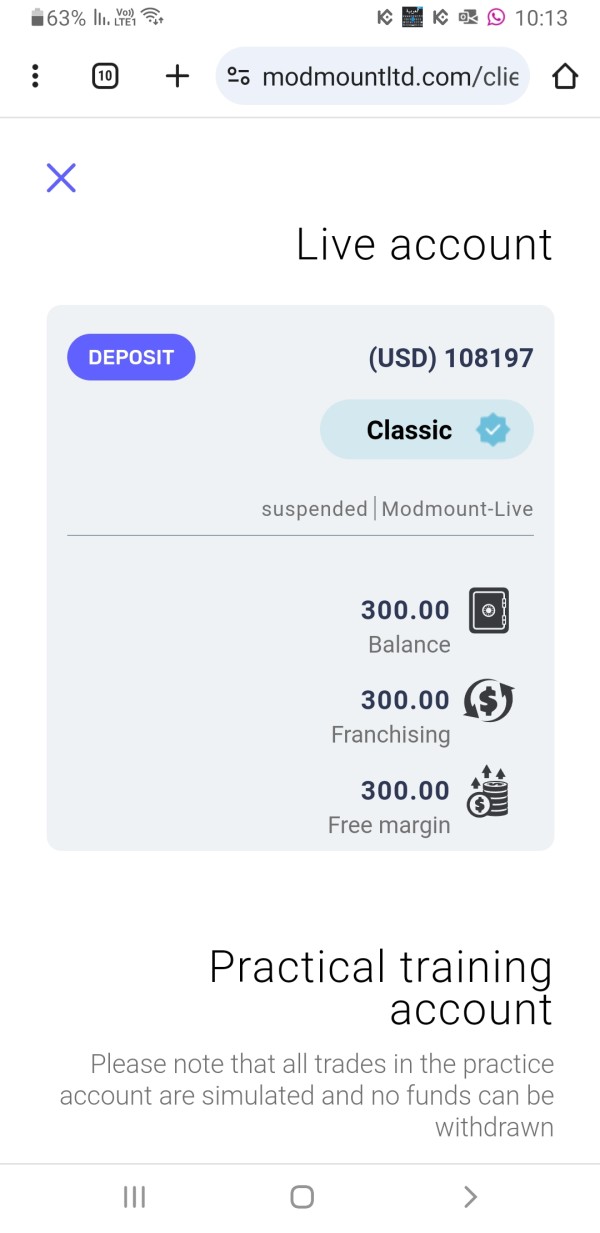

Account Conditions Analysis (3/10)

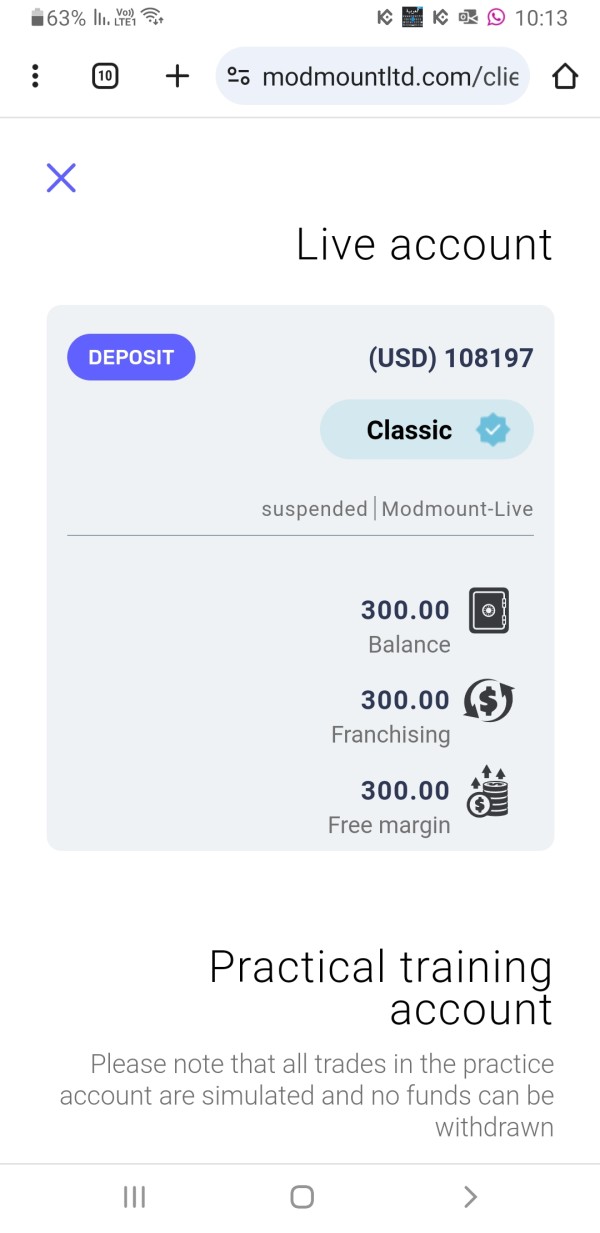

ModMount's account conditions get a low rating mainly because of the lack of clear information about account types, features, and requirements. The information summary does not provide specific details about different account categories.

This makes it difficult for potential clients to understand available options and their benefits. The absence of clear minimum deposit information creates uncertainty for traders planning their initial investment.

Without specific details about account opening requirements, funding thresholds, and account maintenance conditions, potential clients cannot make informed decisions. They can't tell if ModMount's offerings match their trading capital and objectives.

Account opening procedures and verification processes are not detailed in available sources. This leaves questions about the complexity and time requirements for establishing trading accounts.

The lack of information about special account features, such as Islamic accounts for Sharia-compliant trading, further limits the broker's appeal to diverse trading communities. The overall transparency deficit regarding account conditions contributes significantly to the low rating in this category.

This modmount review emphasizes that potential clients should request comprehensive account information directly from ModMount. They need to understand available options and requirements before proceeding with account opening procedures.

The tools and resources category gets a modest rating because of limited available information about ModMount's trading tools, analytical resources, and educational materials. The information summary does not specify particular trading tools, technical analysis features, or research resources available to clients.

Educational resources are crucial for trader development and success, but they are not mentioned in available materials. The absence of information about webinars, tutorials, market analysis, or educational content suggests potential limitations in trader support and development offerings.

Research and analysis resources, including market commentary, economic calendars, and fundamental analysis tools, are not detailed in accessible sources. These resources are essential for informed trading decisions, and their absence or limitation could significantly impact trading effectiveness.

Automated trading support, including Expert Advisor compatibility and algorithmic trading features, is not specified in available information. Modern traders increasingly rely on automated solutions, and the lack of clarity about these capabilities represents a potential service gap.

The limited information available about tools and resources prevents a more positive assessment. However, the possibility exists that ModMount offers more comprehensive features than currently documented in accessible sources.

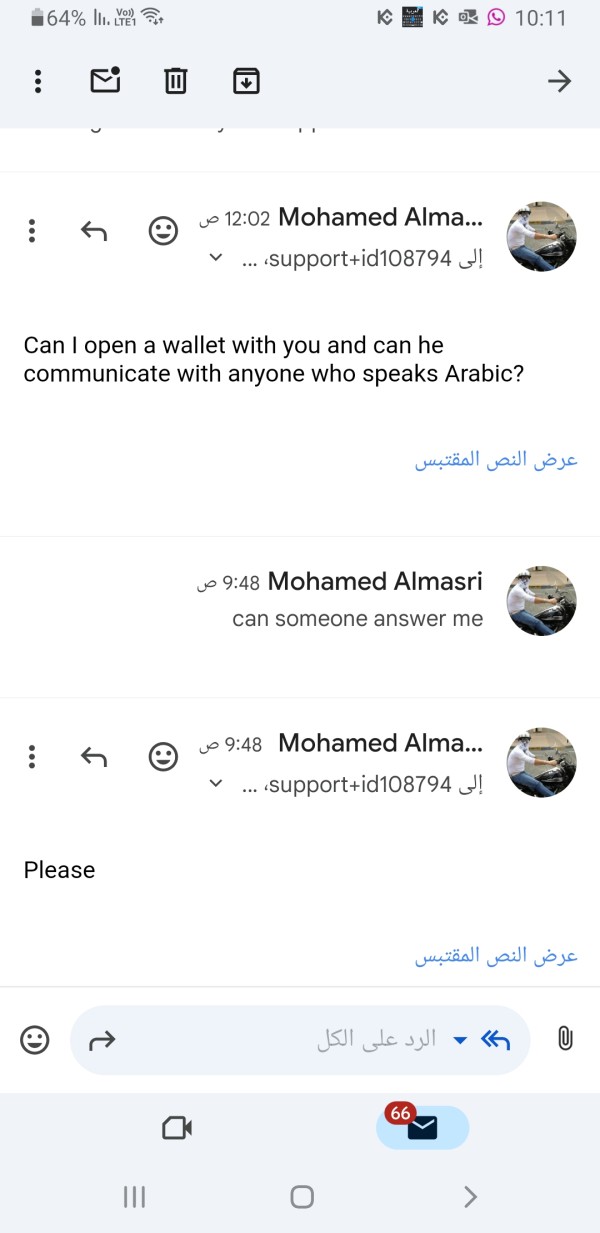

Customer Service and Support Analysis (3/10)

Customer service quality emerges as a significant concern based on user feedback from Trustpilot and Sitejabber platforms. The low rating reflects consistent user complaints about support responsiveness, service quality, and problem resolution effectiveness.

User feedback indicates slower response times than industry standards. Clients experience delays in receiving assistance for trading-related inquiries and account issues.

The quality of support interactions appears inconsistent, with many users reporting unsatisfactory experiences when seeking help with platform issues or account concerns. Available customer service channels are not specifically detailed in the information summary, creating uncertainty about contact methods and availability hours.

The absence of clear information about multilingual support capabilities may limit accessibility for international clients requiring assistance in their native languages. Problem resolution effectiveness appears limited based on user feedback, with several reports indicating difficulties in achieving satisfactory outcomes for trading disputes and technical issues.

The overall customer service experience seems to fall short of industry expectations. This contributes significantly to the negative user ratings observed across review platforms.

The customer service challenges represent a substantial area requiring improvement for ModMount to enhance client satisfaction and retention rates.

Trading Experience Analysis (5/10)

Trading experience feedback presents a mixed picture, with some users reporting satisfactory platform performance while others express significant concerns about execution quality and platform stability. This modmount review finds that trading experience varies considerably among users, suggesting inconsistent service delivery.

Platform stability and execution speed receive mixed reviews. Some users experience smooth trading operations while others report technical difficulties and performance issues.

The variability in user experiences suggests potential infrastructure challenges that may affect trading effectiveness during peak market periods. Order execution quality feedback is limited in available sources, though user reports suggest occasional issues with trade processing and execution timing.

Specific information about slippage rates, requote frequencies, and execution statistics is not available in the information summary. Mobile trading capabilities and app functionality are not detailed in accessible sources, though modern traders increasingly require robust mobile solutions for effective trading management.

The absence of specific mobile platform information represents a potential service limitation. The moderate rating reflects the mixed nature of user feedback, with positive experiences balanced against significant concerns about platform reliability and execution quality that require careful consideration by potential clients.

Trust and Reliability Analysis (2/10)

Trust and reliability receive the lowest rating due to significant concerns about regulatory transparency and overall corporate accountability. The absence of specific regulatory authority information creates substantial uncertainty about investor protection measures and compliance standards.

Regulatory credentials are not clearly specified in available sources. This raises questions about the broker's oversight and compliance with international financial services standards.

The lack of regulatory transparency represents a major concern for traders seeking secure and regulated trading environments. Fund security measures and client fund protection protocols are not detailed in accessible information, creating uncertainty about asset safety and segregation practices.

Modern traders require clear assurance about fund security, and the absence of this information significantly impacts trust levels. Company transparency appears limited based on available public information, with minimal details about corporate structure, management, and operational procedures.

The lack of comprehensive company information contributes to overall trust concerns among potential clients. Industry reputation and standing are not well-established based on available sources, with limited positive recognition from industry publications or regulatory authorities.

The overall trust profile requires significant improvement to meet modern trading industry standards.

User Experience Analysis (4/10)

Overall user satisfaction levels are notably low based on feedback from major review platforms, with the 2.9-star Sitejabber rating reflecting widespread dissatisfaction with various service aspects. The majority of user feedback indicates substantial room for improvement across multiple service areas.

Interface design and platform usability information is not specifically detailed in available sources. However, user feedback suggests potential challenges with platform navigation and functionality.

Modern traders expect intuitive and efficient platform designs that support effective trading operations. Registration and account verification processes are not comprehensively described in accessible materials, creating uncertainty about onboarding complexity and time requirements.

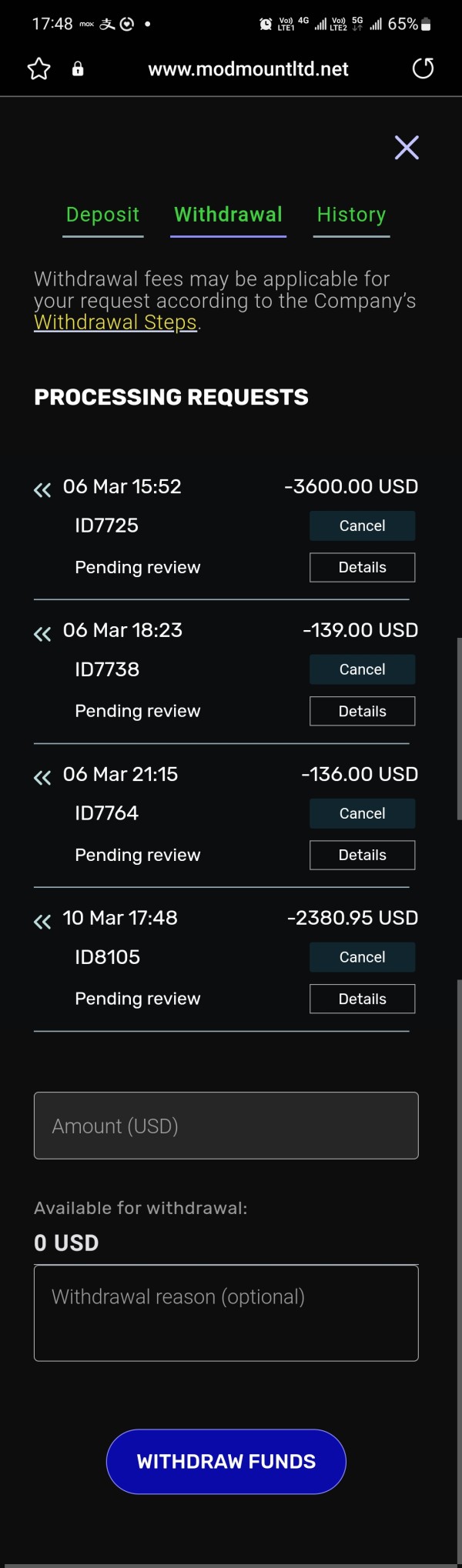

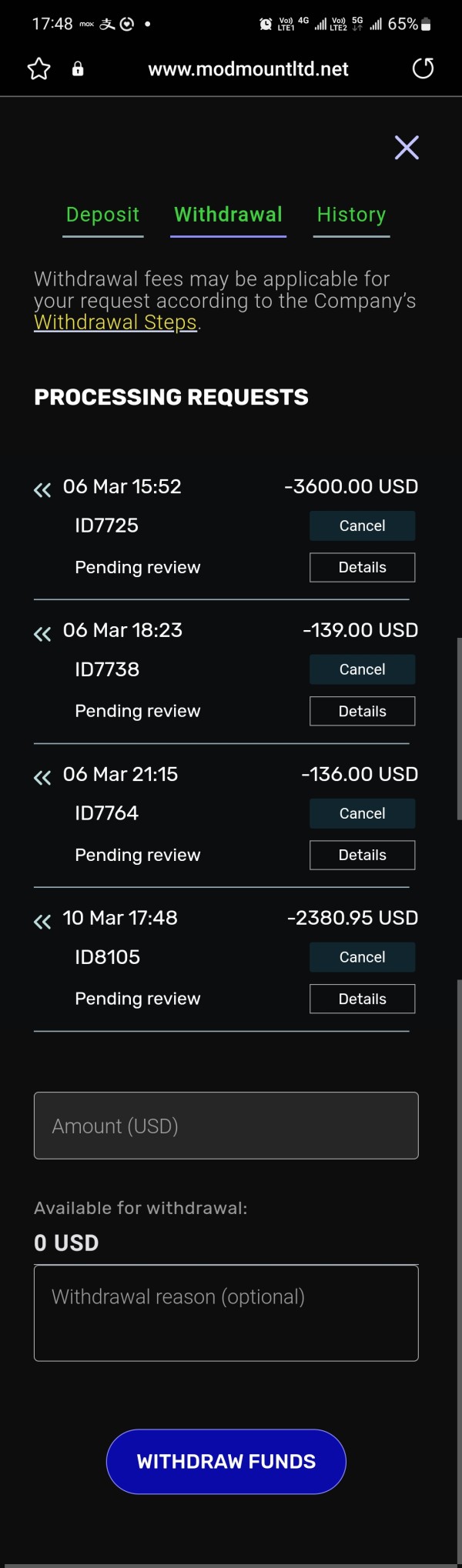

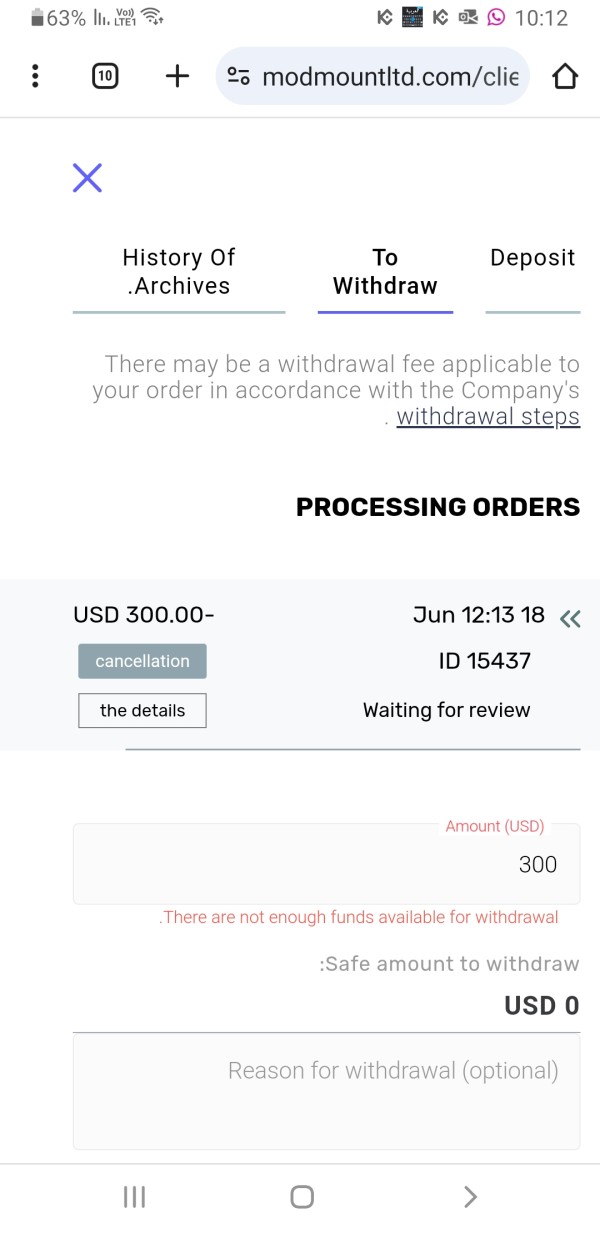

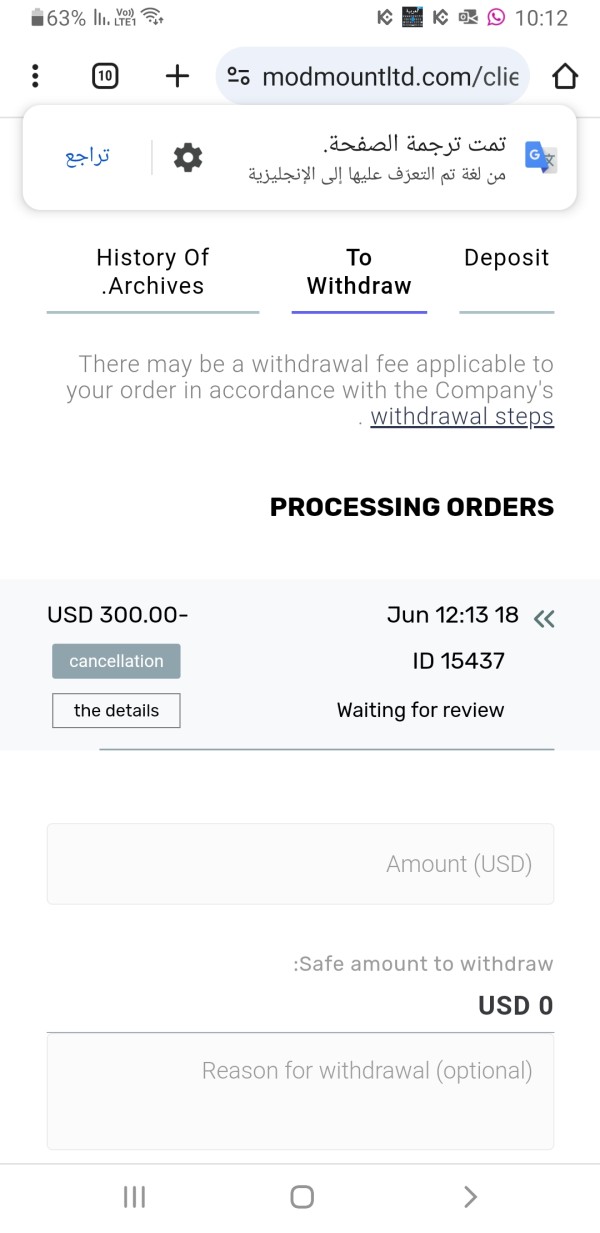

Streamlined account opening procedures are essential for positive initial user experiences. Funding operations and withdrawal experiences are not specifically detailed in user feedback, though the overall negative ratings suggest potential issues with financial transaction processing and customer support during funding operations.

Common user complaints appear to center on service quality issues and trading experience inconsistencies, based on available feedback patterns. The concentration of negative feedback in customer service and platform reliability areas indicates systemic challenges requiring comprehensive operational improvements.

Conclusion

This comprehensive modmount review reveals significant concerns about ModMount Ltd's overall service quality and operational standards. The broker receives a generally negative assessment based on user feedback analysis and transparency limitations that affect client confidence and satisfaction.

ModMount may potentially serve traders seeking basic forex trading services. However, prospective clients should exercise considerable caution and conduct thorough due diligence before engaging with this broker.

The documented service quality issues and regulatory transparency concerns require careful consideration. The primary advantages identified include occasional positive trading experiences reported by some users, suggesting potential for satisfactory service under certain circumstances.

However, these positive aspects are significantly outweighed by substantial disadvantages. These include poor customer service quality, limited regulatory transparency, and inconsistent platform performance that have generated widespread user dissatisfaction across multiple review platforms.