Regarding the legitimacy of Finq forex brokers, it provides CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is Finq safe?

Business

License

Is Finq markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Trade Capital Markets (TCM) Ltd

Effective Date:

2014-02-17Email Address of Licensed Institution:

info@tradecapitalmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.tradecapitalmarkets.com, www.trade.com, www.heromarkets.comExpiration Time:

--Address of Licensed Institution:

Λεωφόρος Στροβόλου 148, 1ος Όροφος, Στρόβολος 2048, Λευκωσία ΚύπροςPhone Number of Licensed Institution:

+357 22 030 446Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

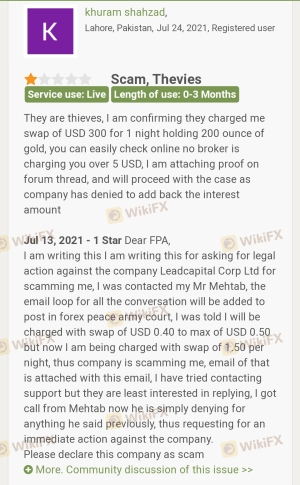

Leadcapital Corp Ltd

Effective Date:

--Email Address of Licensed Institution:

info@leadcapitalcrp.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.leadcapitalcrp.com, https://www.77markets.comExpiration Time:

--Address of Licensed Institution:

Block B, Global Village, Jivan’s Complex, Mont Fleuri, Mahe, Seychelles.Phone Number of Licensed Institution:

(+248) 4322279Licensed Institution Certified Documents:

Is Finq A Scam?

Introduction

Finq is a forex and CFD broker that has positioned itself primarily within the Asian market since its inception in 2017. As an online trading platform, it offers a wide array of financial instruments, including over 2,100 assets across various asset classes such as forex, stocks, commodities, and cryptocurrencies. Given the increasing prevalence of online trading and the associated risks, it is crucial for traders to exercise caution when selecting a broker. A thorough evaluation of a brokers legitimacy, regulatory compliance, and trading conditions can help mitigate potential risks and protect traders' investments. This article aims to provide a comprehensive analysis of Finq, examining its regulatory status, company background, trading conditions, customer safety measures, and overall user experience to determine whether Finq is safe or a potential scam.

Regulation and Legality

The regulatory framework within which a broker operates is a critical factor in assessing its legitimacy and safety. Finq is regulated by the Seychelles Financial Services Authority (FSA), which is known for its lenient regulatory environment compared to more stringent authorities like the UK's Financial Conduct Authority (FCA) or Australia's Australian Securities and Investments Commission (ASIC). The following table summarizes the core regulatory information for Finq:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 007 | Seychelles | Active |

While Finq holds a valid license from the Seychelles FSA, it is essential to note that this regulatory body does not impose as rigorous standards as top-tier regulators. This raises concerns regarding the level of protection afforded to traders. Furthermore, the FSA does not provide an investor compensation scheme, which means that in the event of a broker insolvency, traders may not have any recourse to recover their funds. Historically, brokers operating under similar jurisdictions have faced scrutiny and allegations of malpractice, leading to questions about their reliability. Therefore, while Finq is technically regulated, the quality of that regulation may not offer adequate assurance to prospective traders regarding the safety of their investments.

Company Background Investigation

Finq operates under the ownership of Dilna Investments Ltd., which is a subsidiary of Lead Capital Corp Ltd. The latter is registered in Seychelles and has a history of operating in the financial services sector. Established in 2017, Finq has gradually expanded its offerings and client base, primarily targeting Asian investors. The management team behind Finq comprises individuals with varied backgrounds in finance and trading, although specific information regarding their qualifications and experience is not extensively disclosed.

Transparency is vital for any financial institution, and Finq's approach to information disclosure raises some concerns. The lack of detailed information about the company's operations, ownership structure, and management team may lead potential clients to question the broker's credibility. Transparency in operations is a hallmark of trustworthy brokers, and Finq's somewhat opaque nature could deter cautious traders. Overall, while Finq appears to have a legitimate operational structure, the limited disclosure of essential information may lead some to question its reliability and safety.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for any trader. Finq provides a variety of account types, with the minimum deposit starting at $100 for the Silver account, going up to $100,000 for the Exclusive account. The overall cost structure appears competitive, but it is essential to analyze the specifics to determine whether Finq is safe for trading. Below is a comparison of core trading costs associated with Finq:

| Cost Type | Finq | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.9 pips | 1.0 - 1.5 pips |

| Commission Structure | $8 per lot (ECN) | $4 - $6 per lot |

| Overnight Interest Range | Varies by asset | Varies widely |

While Finq touts competitive spreads and zero commission on certain accounts, the reality is that its trading costs can be higher than industry averages, particularly for forex trading. Additionally, the commission structure, particularly on the ECN accounts, may be seen as excessive compared to other brokers. Traders should be aware of these costs, as they can significantly impact profitability over time. Therefore, while Finq's trading conditions may initially appear attractive, a closer examination reveals that they may not be as favorable as advertised.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker's reliability. Finq claims to implement robust safety measures, including segregating client funds from its operational funds and holding them in reputable banks. However, the lack of a compensation scheme from the Seychelles FSA raises concerns about the safety of deposits.

In terms of negative balance protection, Finq does provide this feature, ensuring that clients cannot lose more than their deposited amount. This is a positive aspect, particularly for traders using high leverage, as it helps mitigate the risk of significant losses. However, the absence of a comprehensive investor protection scheme means that traders may face challenges in recovering their funds in the event of broker insolvency. Overall, while Finq has some safety measures in place, the lack of regulatory oversight and investor protection schemes leaves room for concern regarding the safety of customer funds.

Customer Experience and Complaints

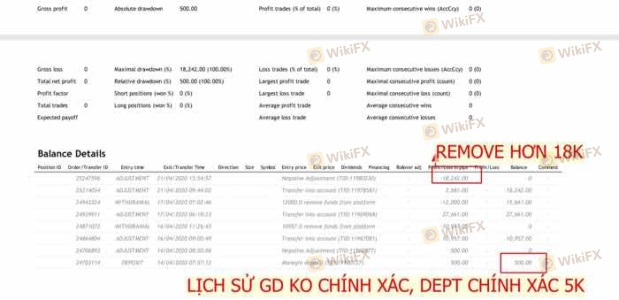

Customer feedback is an essential component in assessing a broker's reliability. Finq has received mixed reviews from users, with some praising its wide range of trading instruments and user-friendly interface, while others have reported issues with customer service and withdrawal processes. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Service | Medium | Inconsistent |

| Misleading Trading Advice | High | Unresolved |

Several users have reported experiencing delays in fund withdrawals, with some claiming that their requests took weeks to process. Additionally, there have been allegations of misleading advice from customer service representatives, which is particularly concerning for novice traders who may rely heavily on these interactions for guidance.

One notable case involved a trader who reported that their account was emptied without explanation after they attempted to withdraw funds. Such incidents raise significant red flags regarding the overall integrity of the broker and its operations. While not all traders have had negative experiences, the frequency of complaints related to withdrawals and customer service suggests that potential clients should approach Finq with caution.

Platform and Trade Execution

The trading platform is a critical aspect of any trading experience. Finq offers both the widely-used MetaTrader 4 (MT4) and its proprietary web-based platform. Users have generally reported that the platforms are reliable and easy to navigate, though some have experienced issues with execution quality.

Order execution quality is essential for successful trading, and several users have reported experiencing slippage and delays during high-volatility periods. These issues can lead to unfavorable trading outcomes, particularly for those employing short-term trading strategies. While Finq does not explicitly indicate any signs of platform manipulation, the reports of slippage and execution delays warrant attention, as they can significantly affect a trader's profitability.

Risk Assessment

Engaging with any broker carries inherent risks, and Finq is no exception. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Operates under a less stringent regulatory framework. |

| Fund Safety | Medium | Segregated funds but lacks investor compensation scheme. |

| Customer Service | High | Reports of poor service and unresolved complaints. |

| Trading Costs | Medium | Higher than average trading costs could affect profitability. |

To mitigate these risks, traders should conduct thorough research before engaging with Finq. It is advisable to start with a demo account, carefully monitor trading conditions, and maintain a risk management strategy to protect against potential losses.

Conclusion and Recommendations

In conclusion, while Finq presents itself as a legitimate broker offering a wide range of trading opportunities, there are several concerning aspects that potential traders should consider. The regulatory environment is less robust than that of top-tier brokers, raising questions about the safety of customer funds. Additionally, the mixed customer feedback regarding service quality and withdrawal processes suggests a need for caution.

For traders seeking to engage with Finq, it is essential to approach with a clear understanding of the risks involved. Beginners, in particular, may want to consider more established brokers with stronger regulatory oversight and better customer service records. Alternatives such as brokers regulated by the FCA or ASIC may provide a more secure trading environment.

Ultimately, while Finq may offer attractive trading conditions and a diverse range of assets, the potential risks and concerns highlighted in this analysis warrant careful consideration. Traders should prioritize their safety and choose brokers that align with their trading needs and risk tolerance.

Is Finq a scam, or is it legit?

The latest exposure and evaluation content of Finq brokers.

Finq Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Finq latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.