Regarding the legitimacy of AAAFx forex brokers, it provides FSCA and WikiBit, .

Is AAAFx safe?

Software Index

Risk Control

Is AAAFx markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

SIKHULA VENTURE CAPITAL (PTY) LTD

Effective Date:

2018-05-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

3RD FLOOR34 WHITELEY BOULEVARDMELROSE ARCH2196Phone Number of Licensed Institution:

000 0827872298Licensed Institution Certified Documents:

Is AAAFx A Scam?

Introduction

AAAFx, established in 2008 and headquartered in Greece, positions itself as a competitive player in the forex and CFD trading market. The broker claims to offer a range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, with a focus on low-cost trading and high leverage options. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The significance of regulatory compliance, transparency, and customer feedback cannot be overstated. This article aims to provide a comprehensive analysis of AAAFx's legitimacy by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

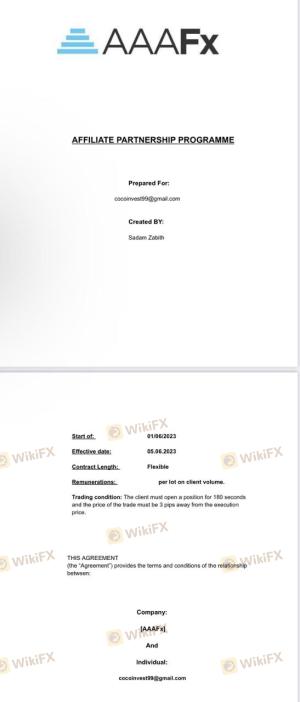

Understanding the regulatory environment in which a broker operates is crucial for assessing its legitimacy. AAAFx is regulated by the Hellenic Capital Market Commission (HCMC) in Greece and the Financial Sector Conduct Authority (FSCA) in South Africa. The presence of these regulatory bodies suggests a level of oversight that can enhance trader confidence. However, it is essential to scrutinize the quality of this regulation.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| HCMC | 2/540/17 | Greece | Verified |

| FSCA | 2017/315029 | South Africa | Verified |

The HCMC is known for its stringent regulatory framework, which mandates compliance with European Securities and Markets Authority (ESMA) guidelines. This includes provisions for negative balance protection and limits on leverage for retail clients. However, some reviews indicate that AAAFx has faced warnings from other regulatory bodies, such as the Cyprus Securities and Exchange Commission (CySEC), regarding its operational practices. This raises questions about the broker's adherence to regulatory requirements and its overall legitimacy.

Company Background Investigation

AAAFx has a relatively long history in the forex market, having been founded in 2008. The broker operates under the ownership of Triple A Experts Investment Services S.A., which is registered in Greece. The management team comprises individuals with extensive experience in the financial services sector, contributing to the broker's operational credibility. However, the company's transparency regarding its ownership structure and operational practices has been questioned by some traders.

The broker's website provides basic information about its services but lacks in-depth disclosures that would enhance transparency. For instance, while it mentions regulatory compliance, it does not provide comprehensive details about its financial standing or operational history. This lack of transparency can be a red flag for potential investors.

Trading Conditions Analysis

AAAFx promotes itself as a low-cost trading platform, offering zero-commission trading and competitive spreads. However, traders should be aware of the overall fee structure and any hidden costs that may arise.

| Fee Type | AAAFx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 - 1.5 pips |

| Commission Model | $2.5 per $100k | $5 per $100k |

| Overnight Interest Range | Varies | Varies |

While the broker claims to offer tight spreads starting from 0.0 pips, some reviews highlight complaints about wider spreads during volatile market conditions. Additionally, the commission structure, while lower than many competitors, may still be perceived as high by some traders, particularly those engaging in high-frequency trading. It is crucial for traders to thoroughly understand these costs before committing to a trading account.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. AAAFx claims to maintain segregated accounts for client funds, ensuring that traders' deposits are kept separate from the broker's operational capital. This practice is essential for protecting clients in the event of financial difficulties faced by the broker. Furthermore, the broker offers negative balance protection, which prevents traders from losing more than their deposited amount.

However, historical complaints regarding fund withdrawals have surfaced, with some traders reporting difficulties in accessing their funds or facing unexpected withdrawal fees. These issues raise concerns about the broker's reliability in handling client funds and may deter potential investors.

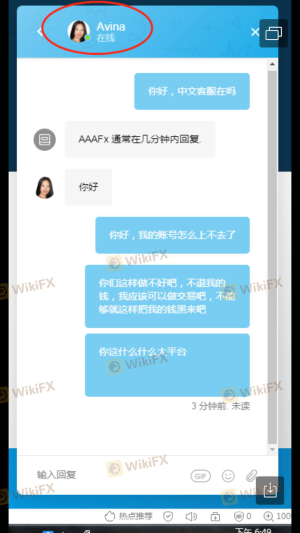

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into a broker's operational practices and overall reputation. AAAFx has received mixed reviews, with some traders praising its low fees and responsive customer support, while others have reported significant issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Spread Manipulation | Medium | Unresolved |

| Customer Support Delays | Medium | Average |

Common complaints include difficulties in withdrawing funds, with some traders stating that their requests were met with delays or additional fees. Additionally, allegations of spread manipulation during high volatility periods have raised eyebrows among the trading community. While some users report positive experiences with customer support, others have noted that response times can be slow, particularly during peak trading hours.

Platform and Execution

AAAFx offers several trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), known for their user-friendly interfaces and robust trading functionalities. However, the performance of these platforms can vary, with some users reporting issues related to order execution and slippage.

The broker claims to provide fast execution speeds and minimal slippage; however, anecdotal evidence suggests that traders may experience slippage during volatile market conditions. Additionally, there have been reports of rejected orders, which can significantly impact trading outcomes. These issues warrant careful consideration for traders who prioritize execution quality.

Risk Assessment

Trading with AAAFx involves several risks that traders must be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Mixed reviews on adherence to regulations |

| Fund Withdrawal Issues | High | Reports of delayed or problematic withdrawals |

| Platform Stability | Medium | Occasional execution issues reported |

| Customer Support Responsiveness | Medium | Varying response times noted |

To mitigate these risks, traders should ensure they fully understand the broker's terms and conditions, maintain realistic expectations regarding withdrawal times, and consider starting with a demo account to assess the platform's performance before committing significant capital.

Conclusion and Recommendations

In conclusion, while AAAFx has established itself as a player in the forex market, several factors warrant caution. The broker is regulated by credible authorities; however, mixed reviews regarding its operational practices, particularly concerning fund withdrawals and customer support, raise concerns about its reliability.

Traders should approach AAAFx with a degree of caution, particularly those new to trading or those who may be sensitive to issues related to fund security and customer service. For those seeking alternatives, brokers with a stronger regulatory reputation and more transparent practices, such as FP Markets or IC Markets, may be worth considering.

Ultimately, while AAAFx may offer attractive trading conditions, potential investors should conduct thorough due diligence and consider their risk tolerance before opening an account.

Is AAAFx a scam, or is it legit?

The latest exposure and evaluation content of AAAFx brokers.

AAAFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AAAFx latest industry rating score is 4.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.