XGlobal 2025 Review: Everything You Need to Know

XGlobal Markets has established itself as a prominent player in the forex trading landscape since its inception in 2012. The broker offers a diverse range of trading instruments and robust platforms, primarily focusing on the popular MetaTrader 5. However, opinions on its reliability and service quality are mixed, with some users praising its competitive spreads and others raising concerns about withdrawal issues and regulatory status. This review aims to provide a comprehensive analysis of XGlobal Markets, highlighting both its strengths and weaknesses.

Note: It is crucial to recognize that XGlobal operates under different regulatory entities depending on the region, which can significantly affect trading conditions and safety. This review takes a balanced approach to ensure fairness and accuracy.

Ratings Overview

How We Rate Brokers: Our ratings are based on a thorough analysis of the broker's offerings, user feedback, expert opinions, and regulatory compliance.

Broker Overview

Founded in 2012, XGlobal Markets operates out of Cyprus and is regulated by the Cyprus Securities and Exchange Commission (CySEC), as well as the Vanuatu Financial Services Commission (VFSC). The broker provides access to a wide array of trading instruments including forex, commodities, indices, and cryptocurrencies. XGlobal primarily uses the MetaTrader 5 platform, which is renowned for its advanced trading tools and user-friendly interface. The minimum deposit requirement is set at $100, making it accessible for many traders.

Detailed Analysis

Regulatory Regions:

XGlobal Markets is regulated by multiple authorities, including CySEC for its European operations and VFSC for its offshore services. While CySEC offers a higher level of investor protection, the VFSC's regulations are considered less stringent, which raises concerns among some traders regarding the safety of their funds.

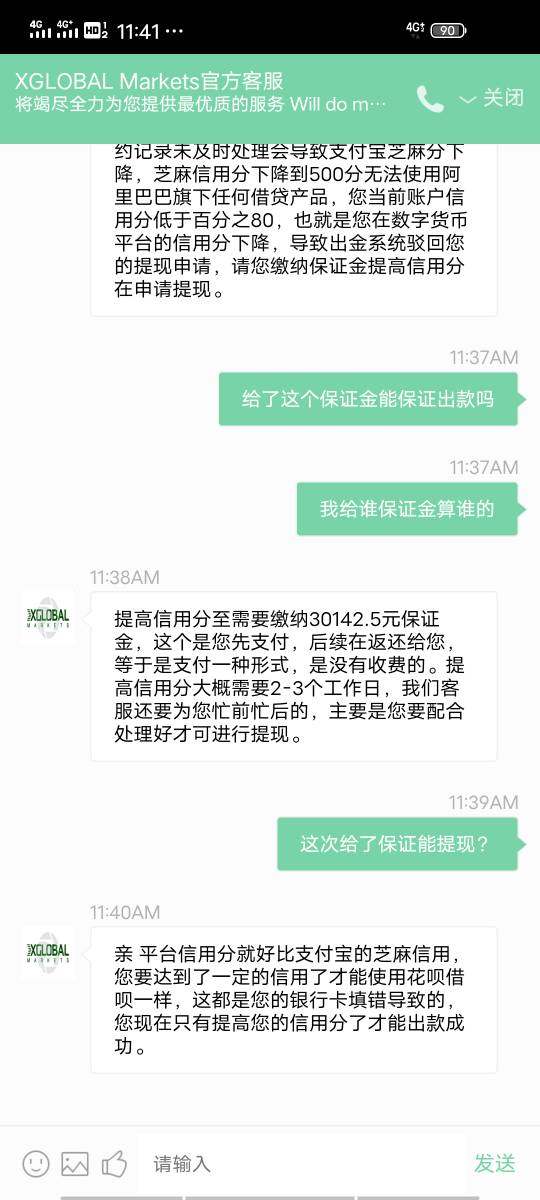

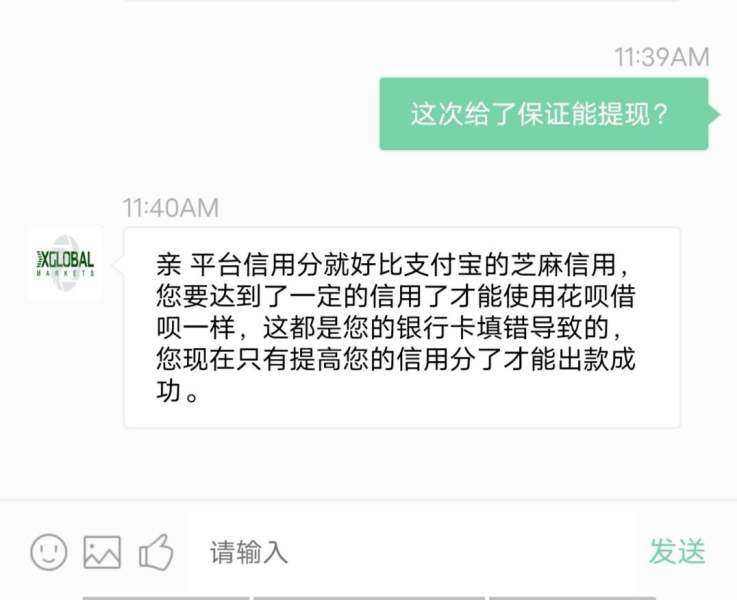

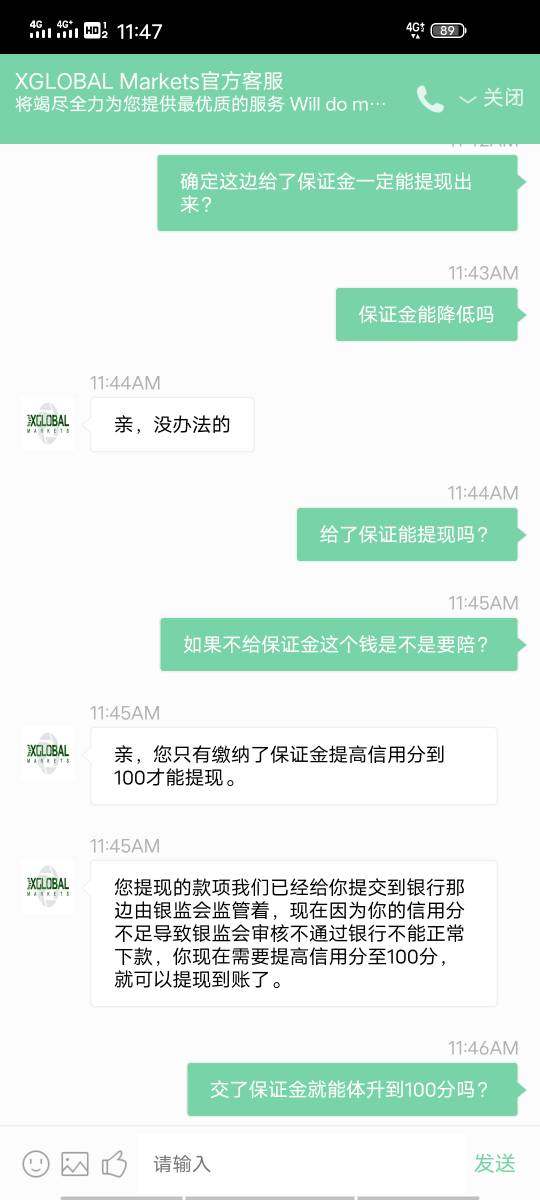

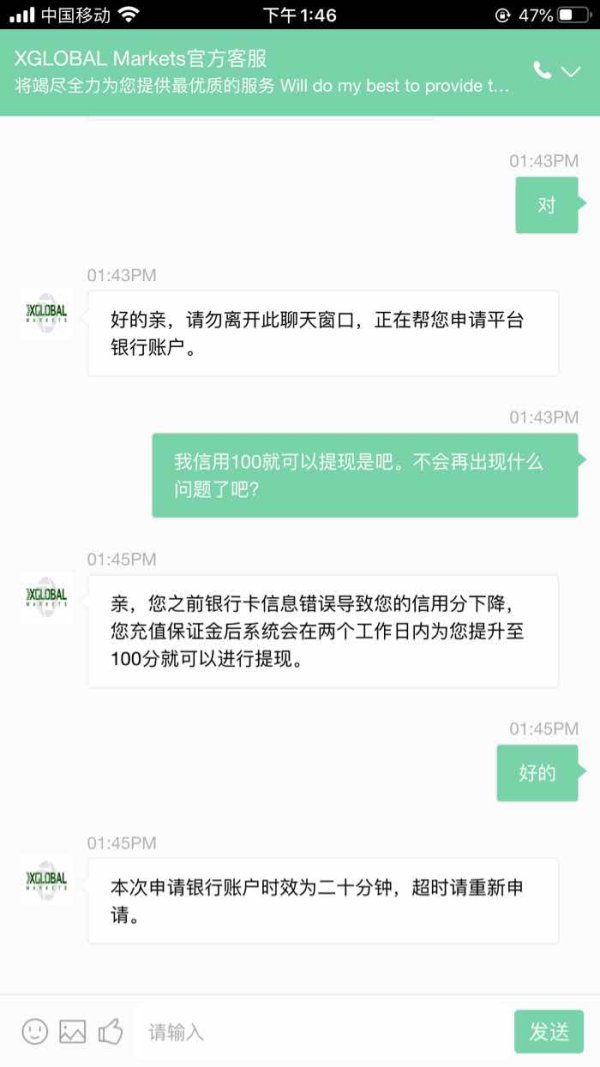

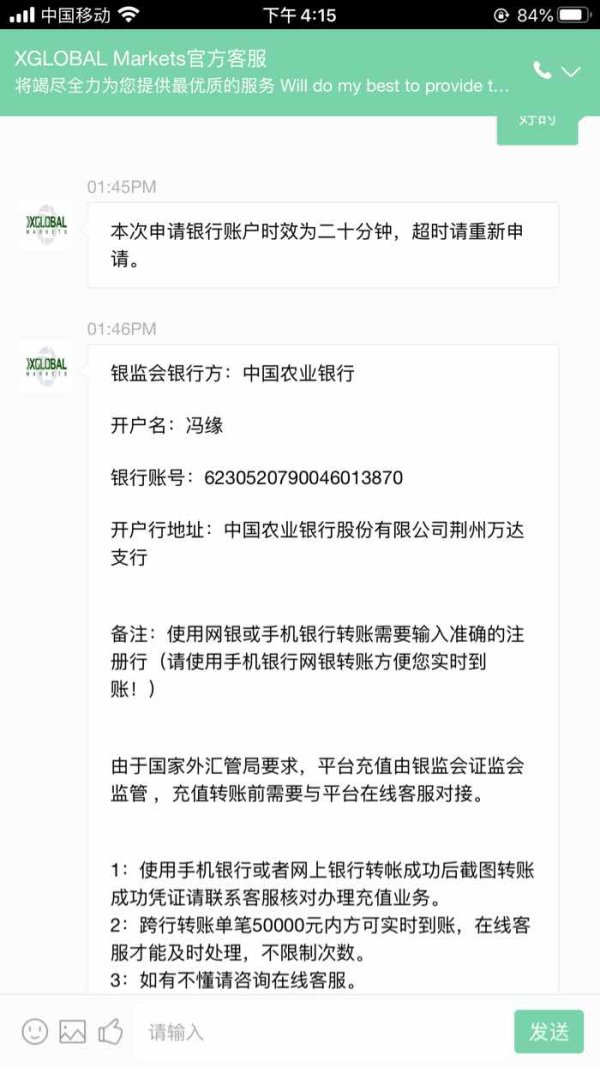

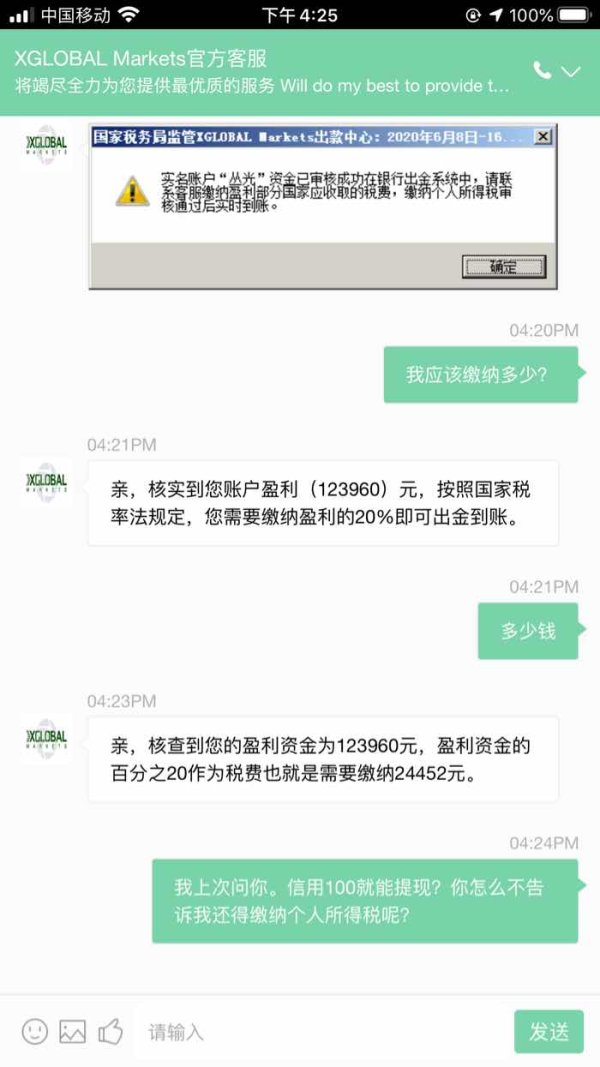

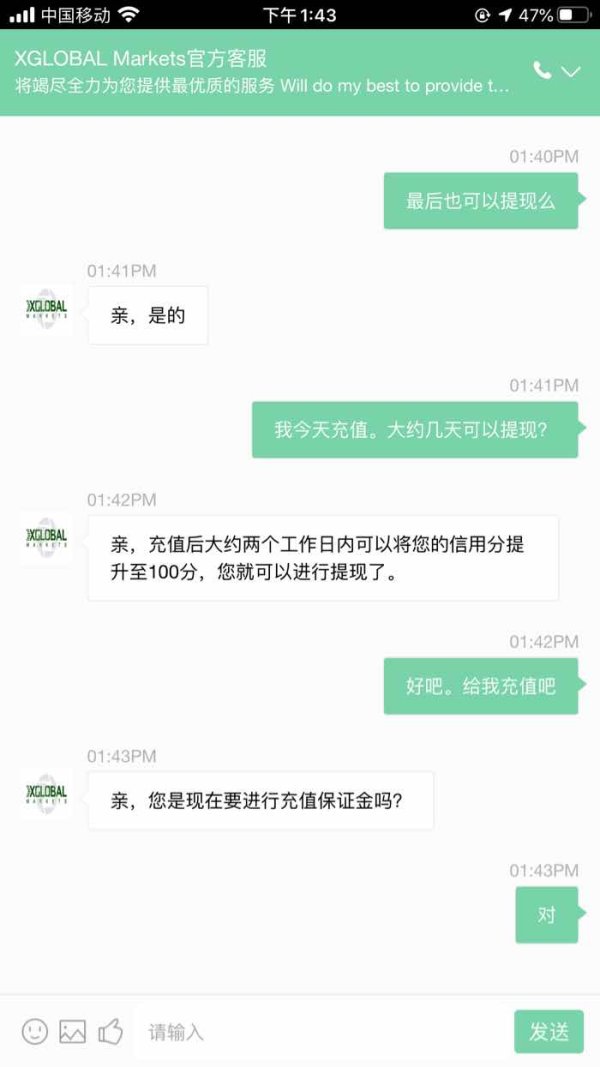

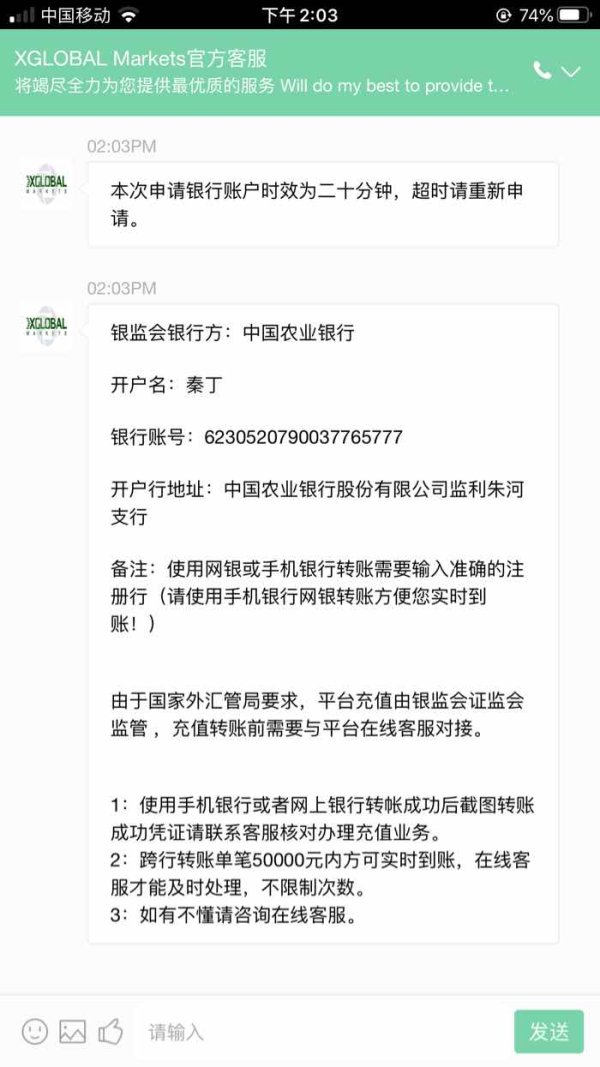

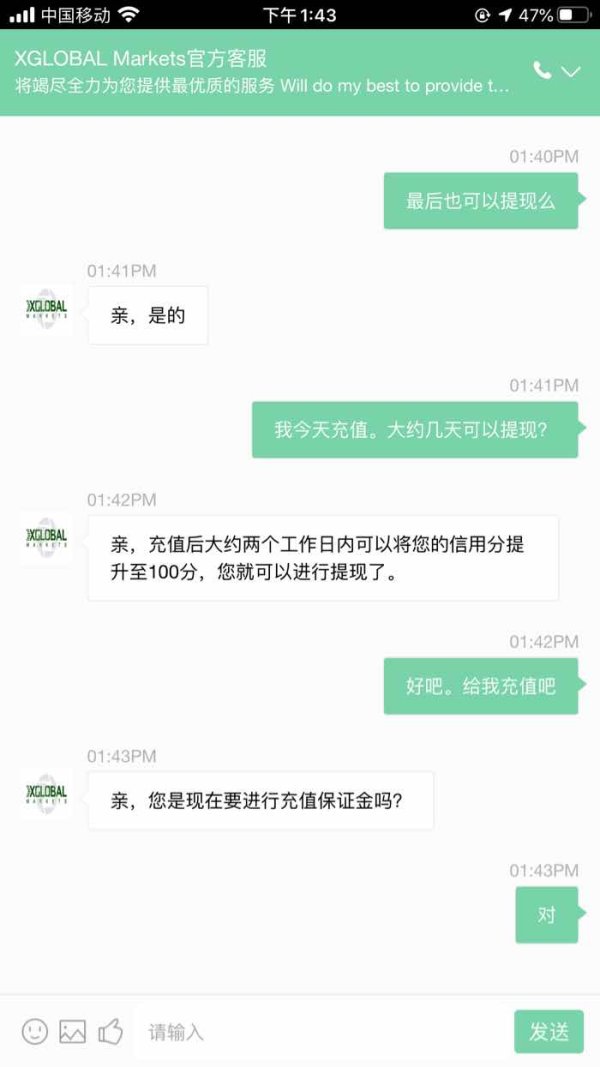

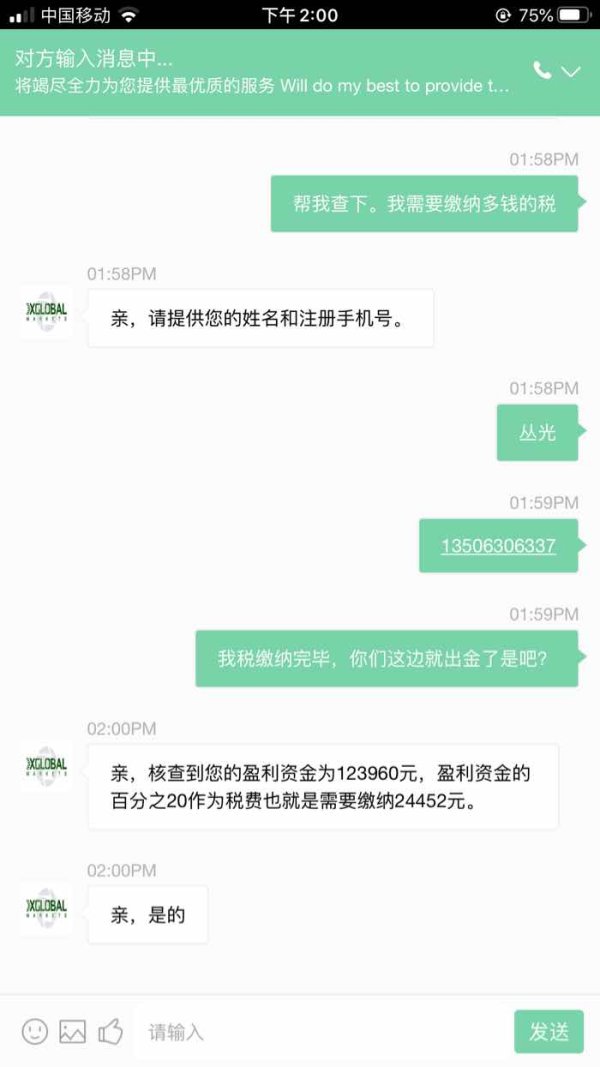

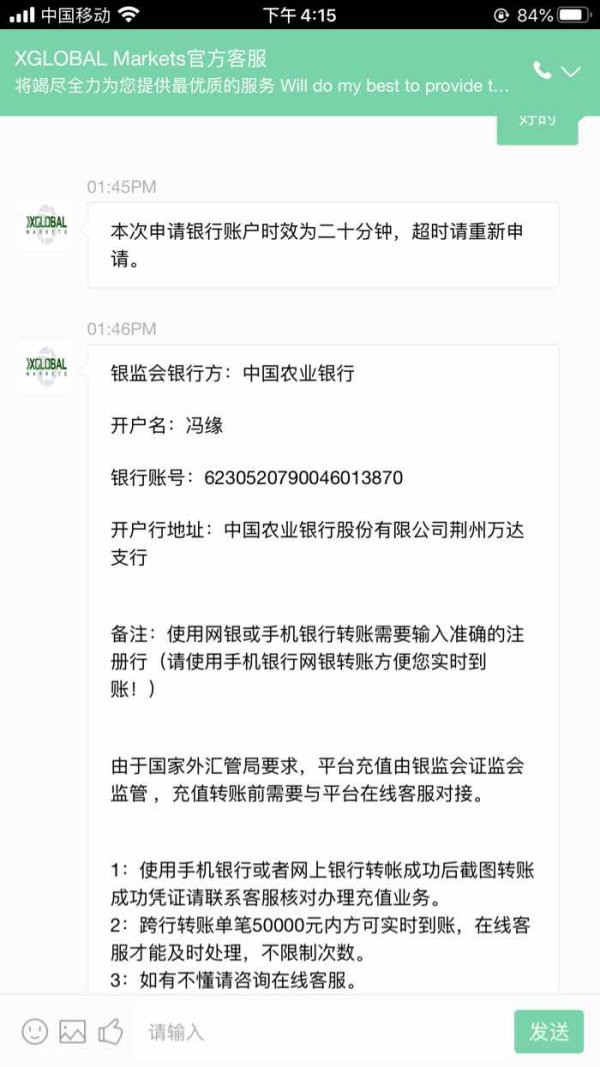

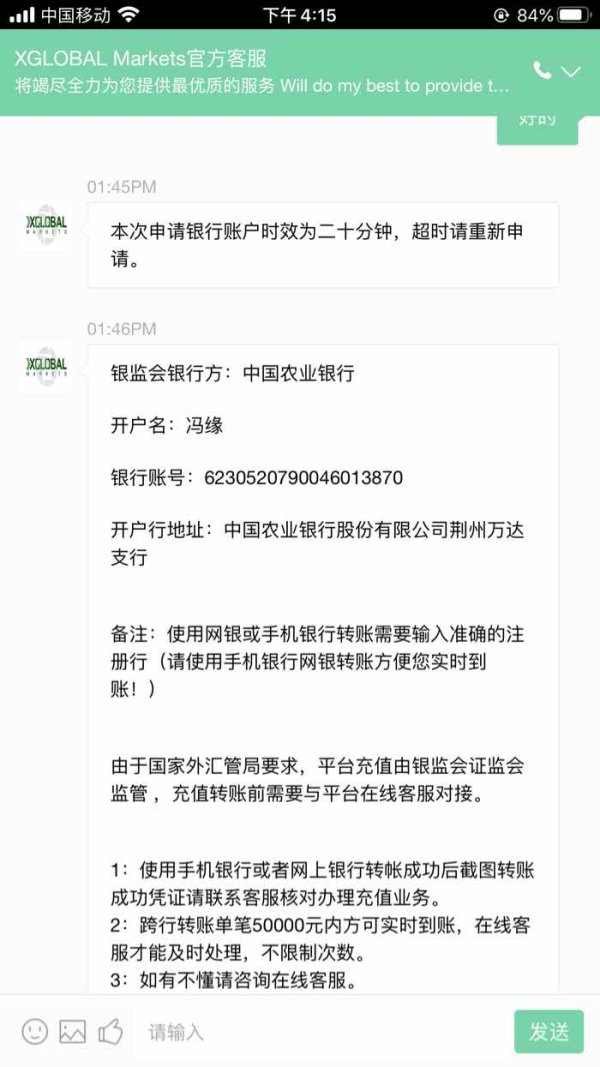

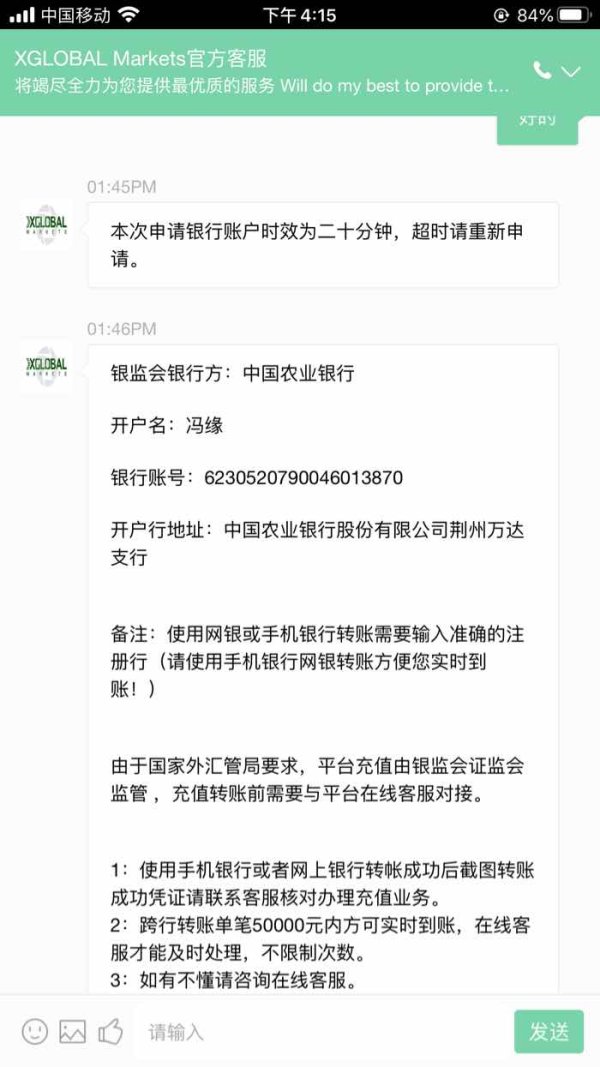

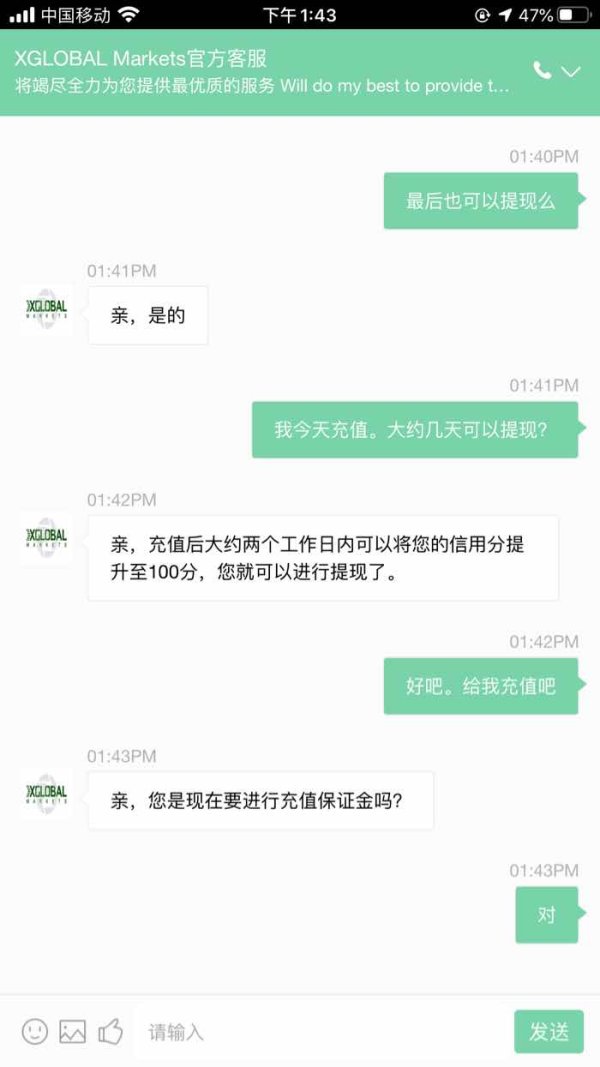

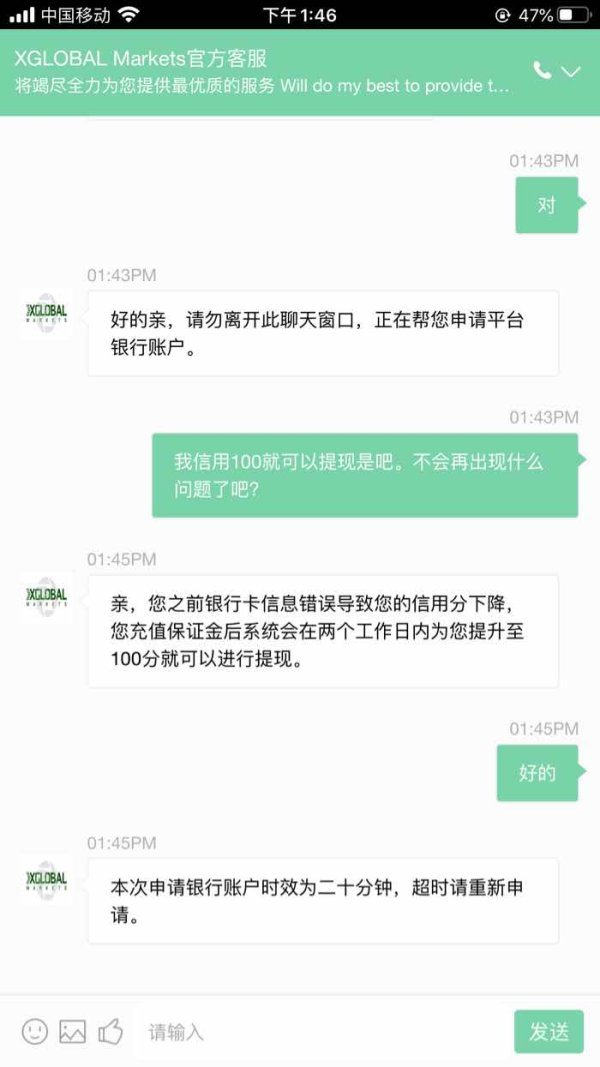

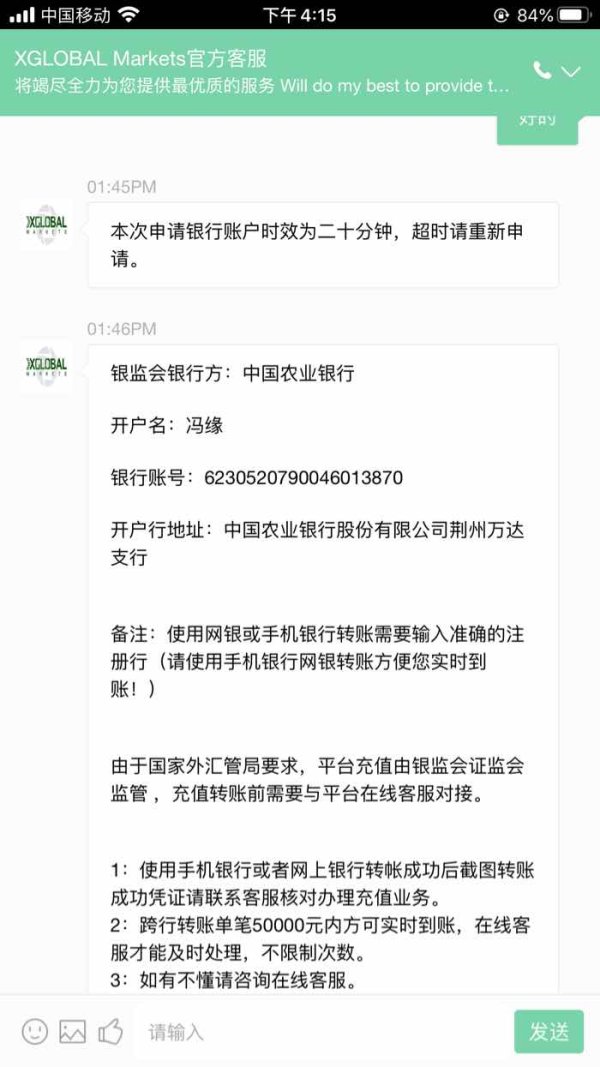

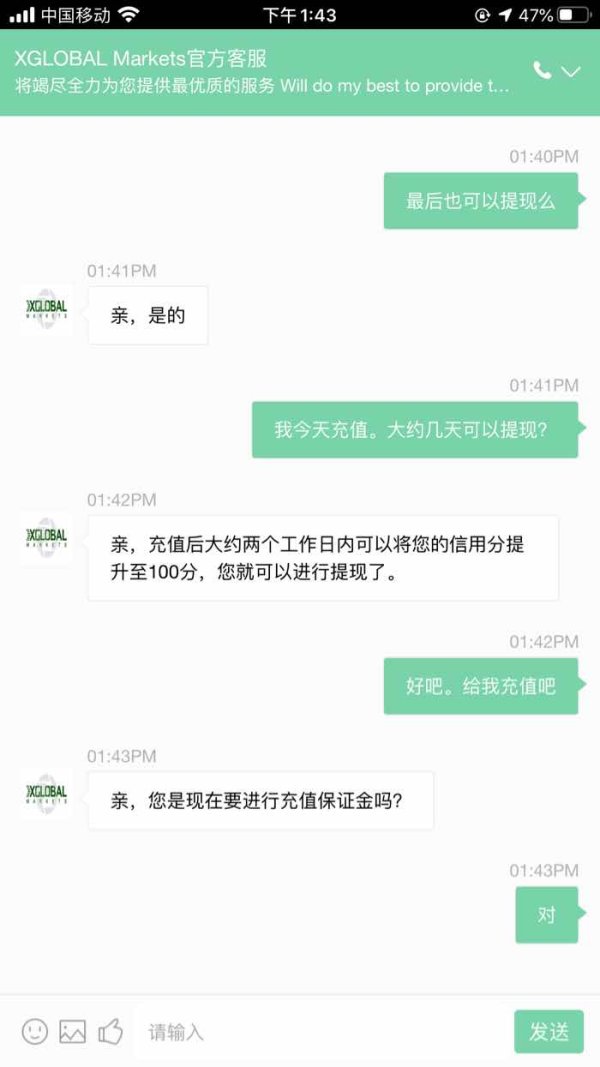

Deposit/Withdrawal Methods:

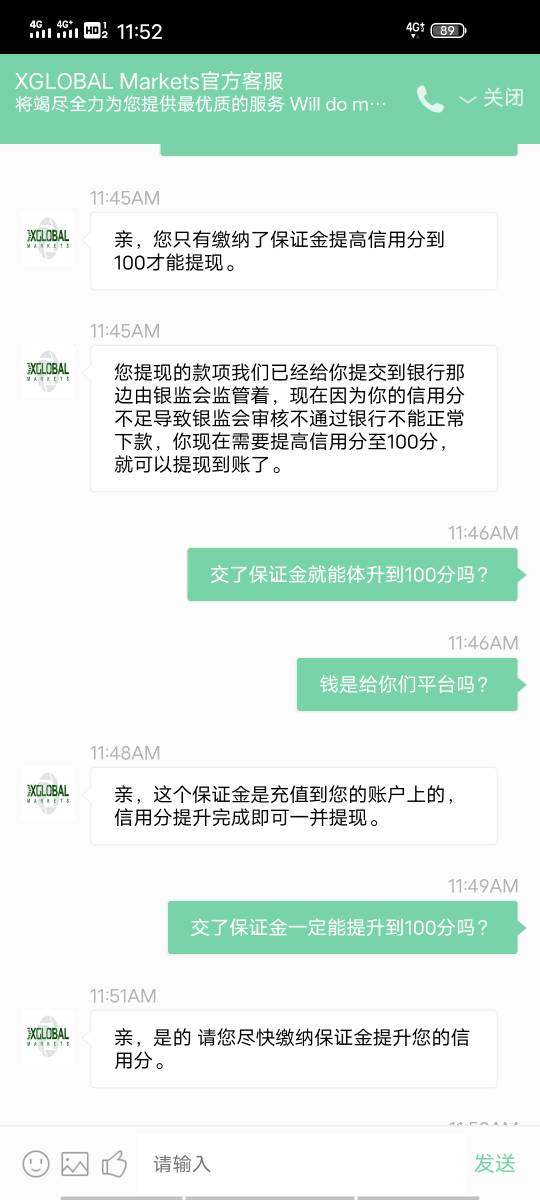

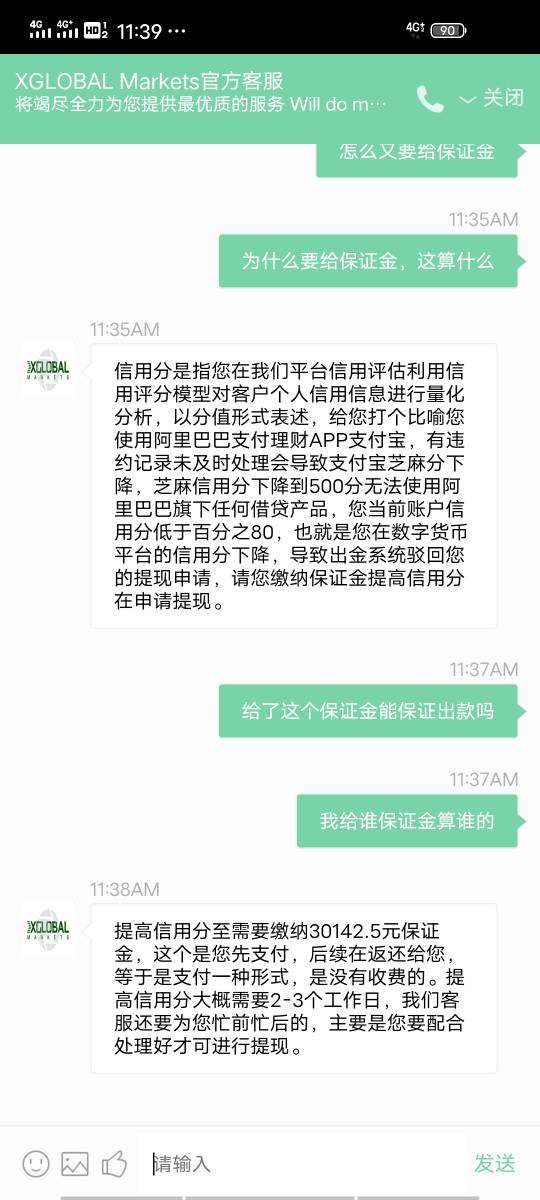

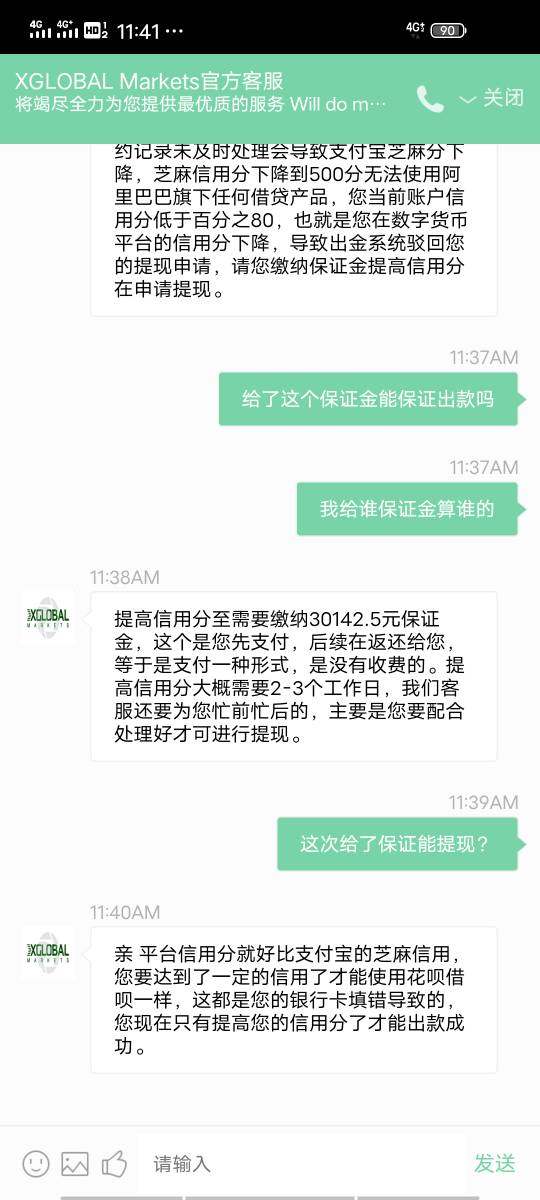

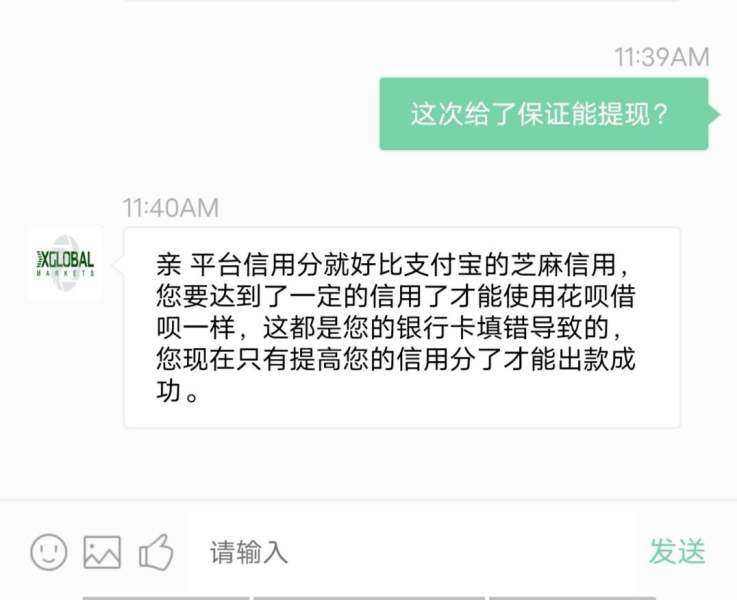

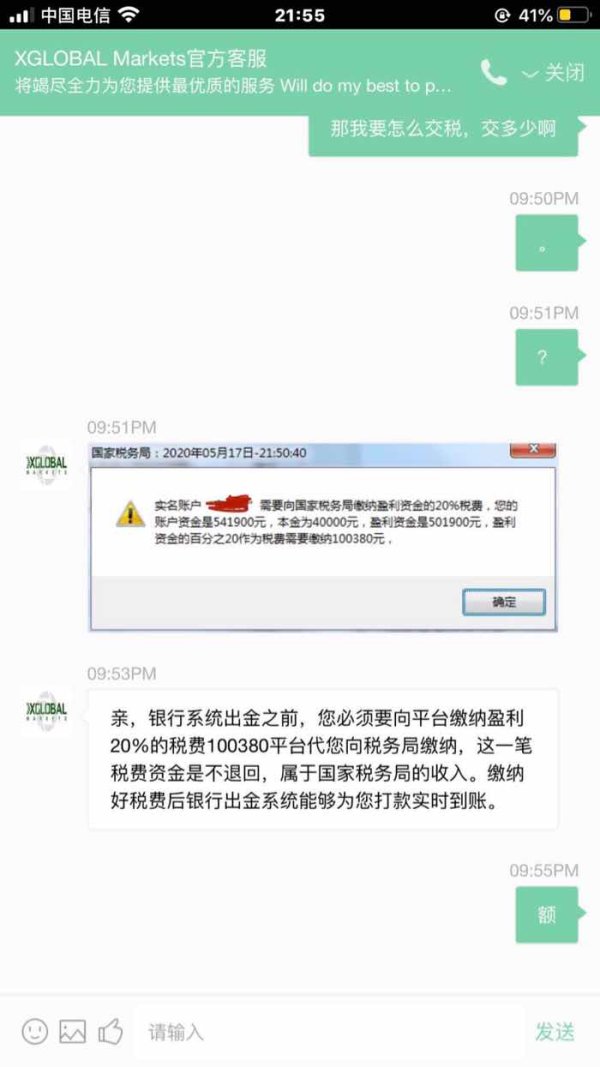

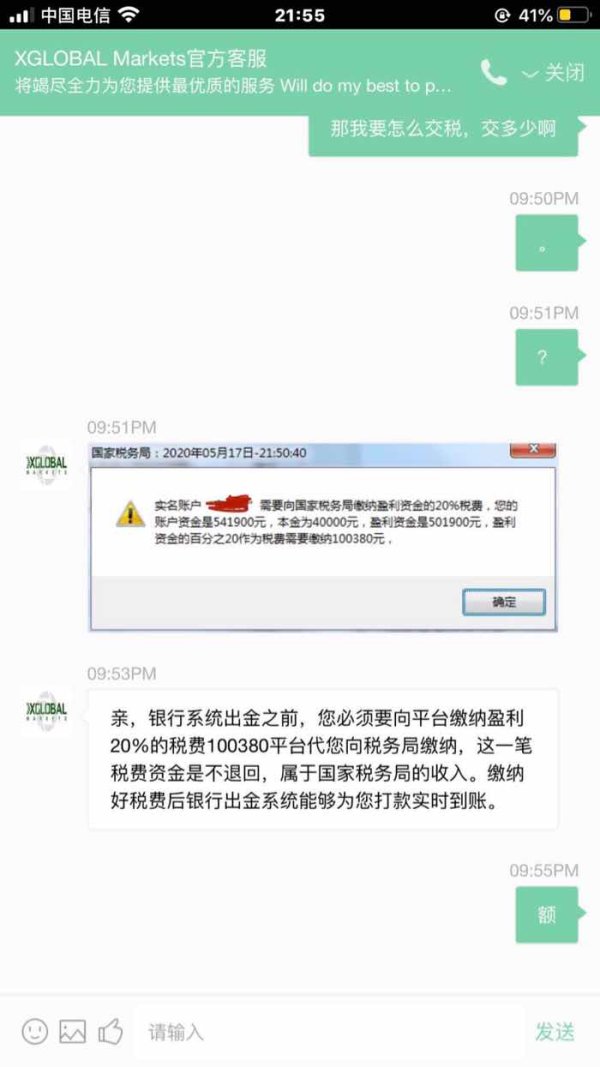

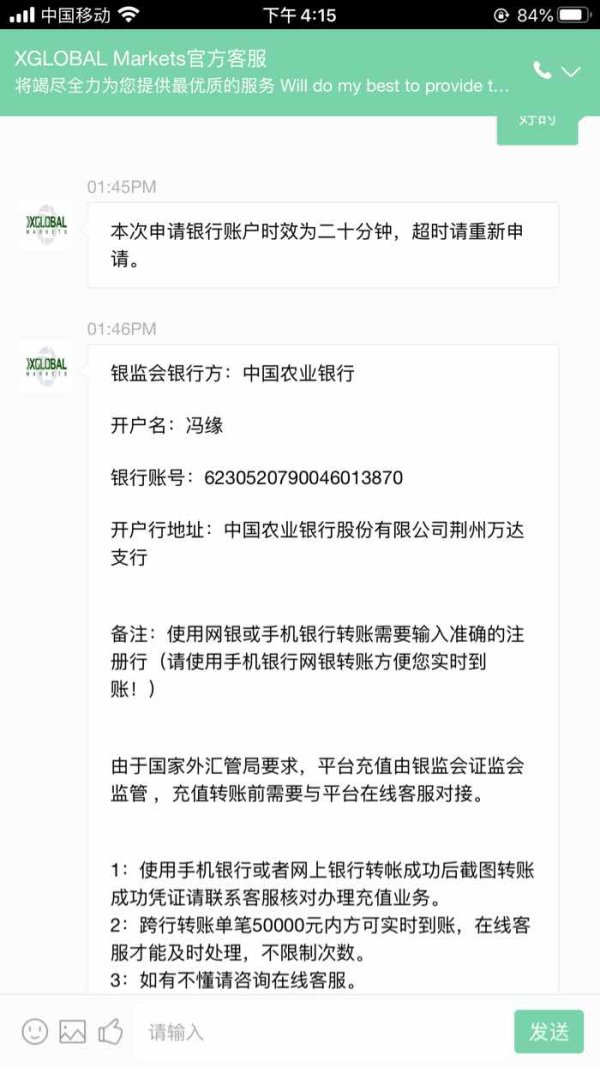

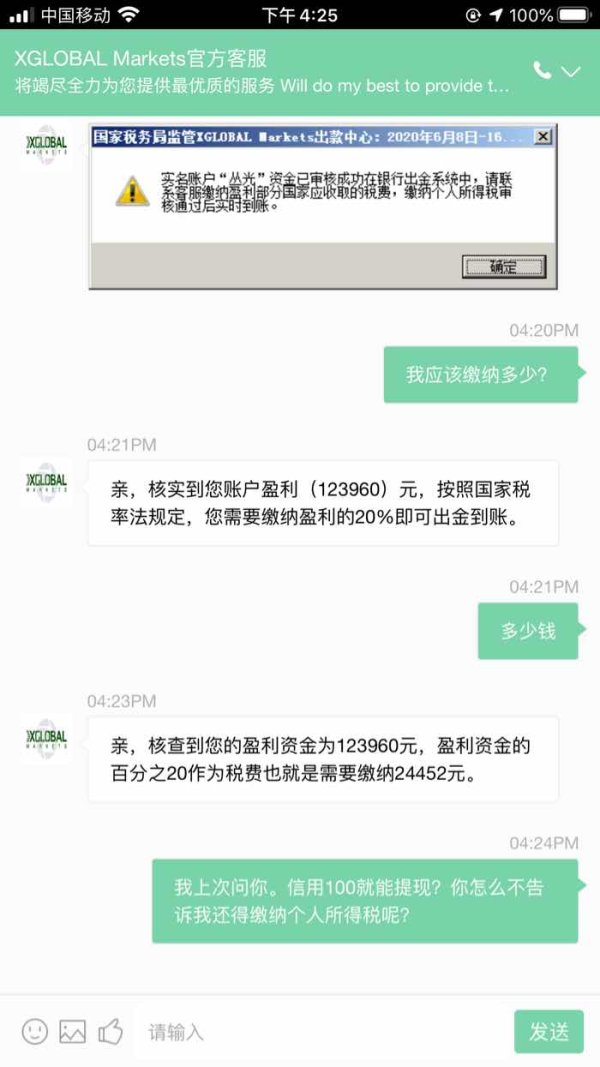

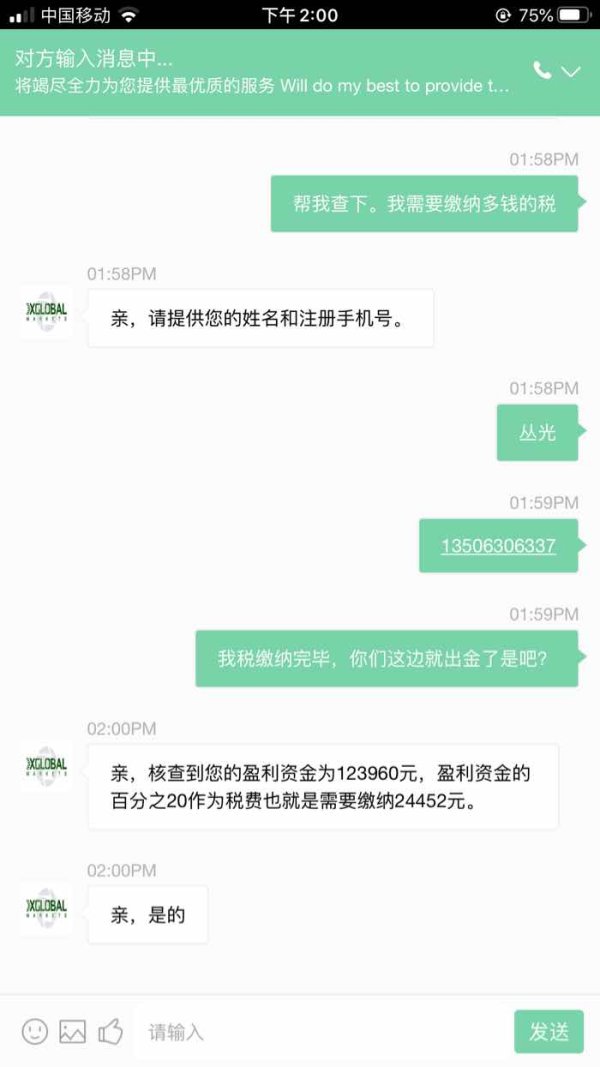

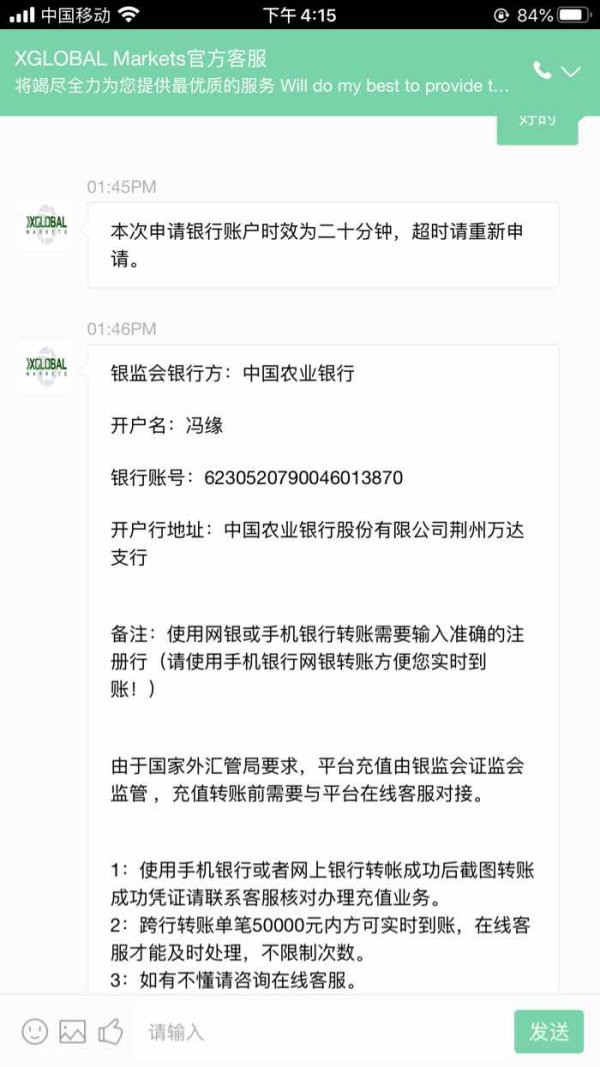

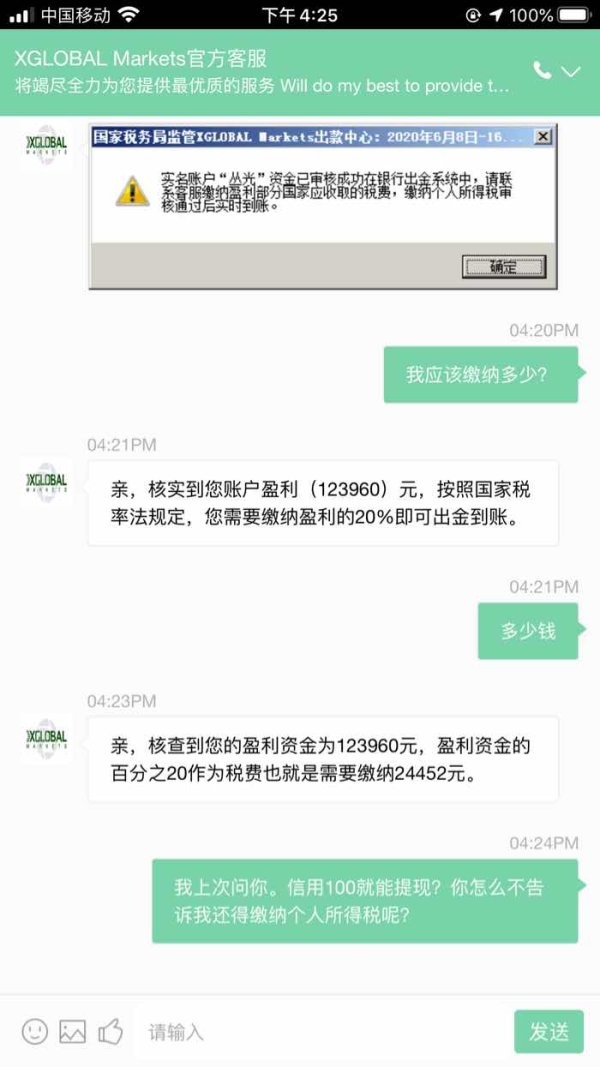

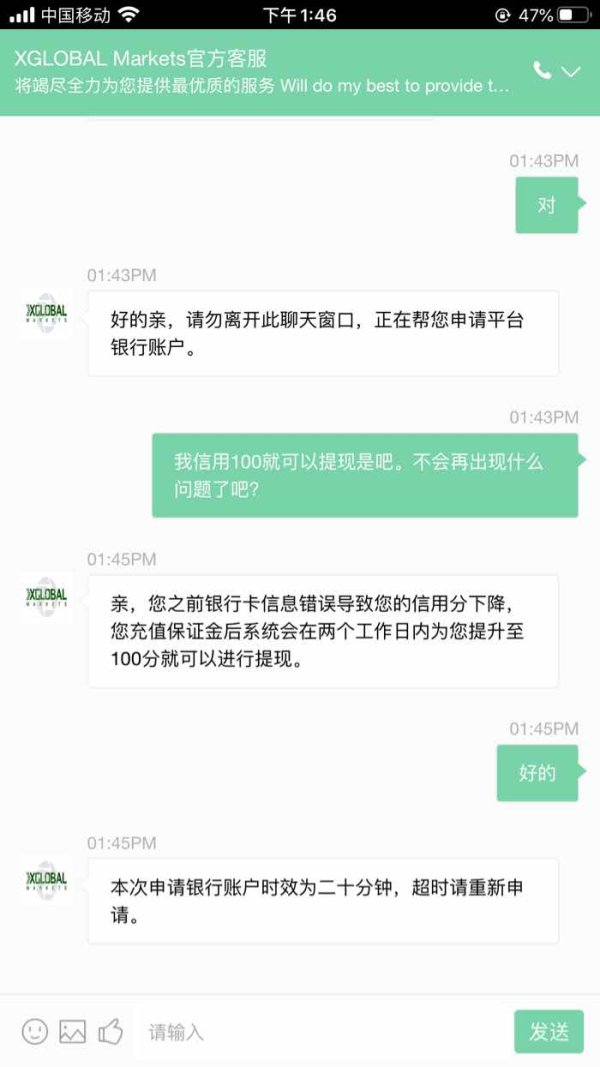

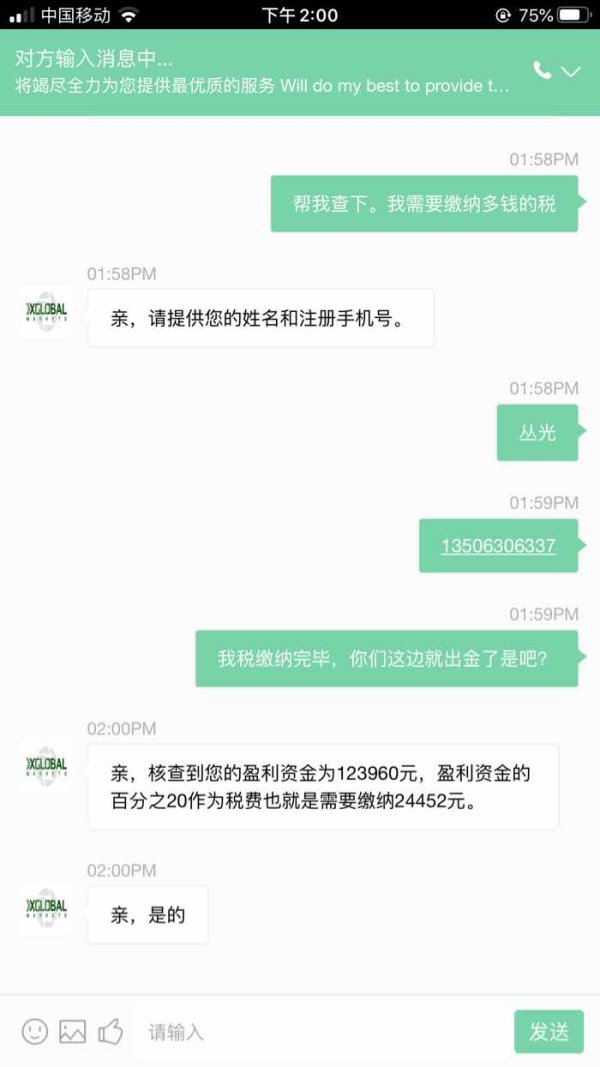

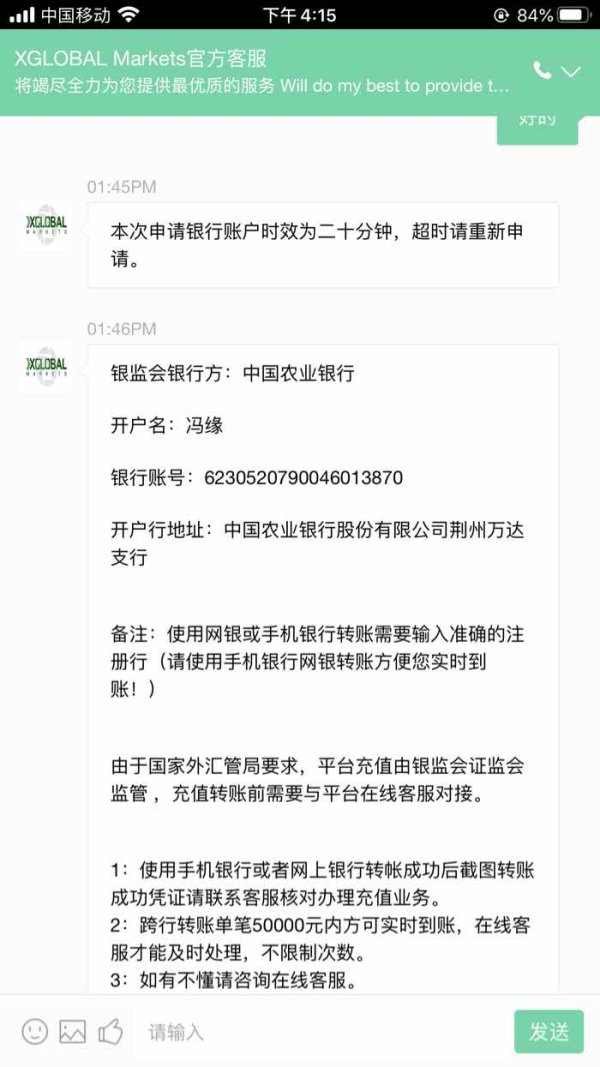

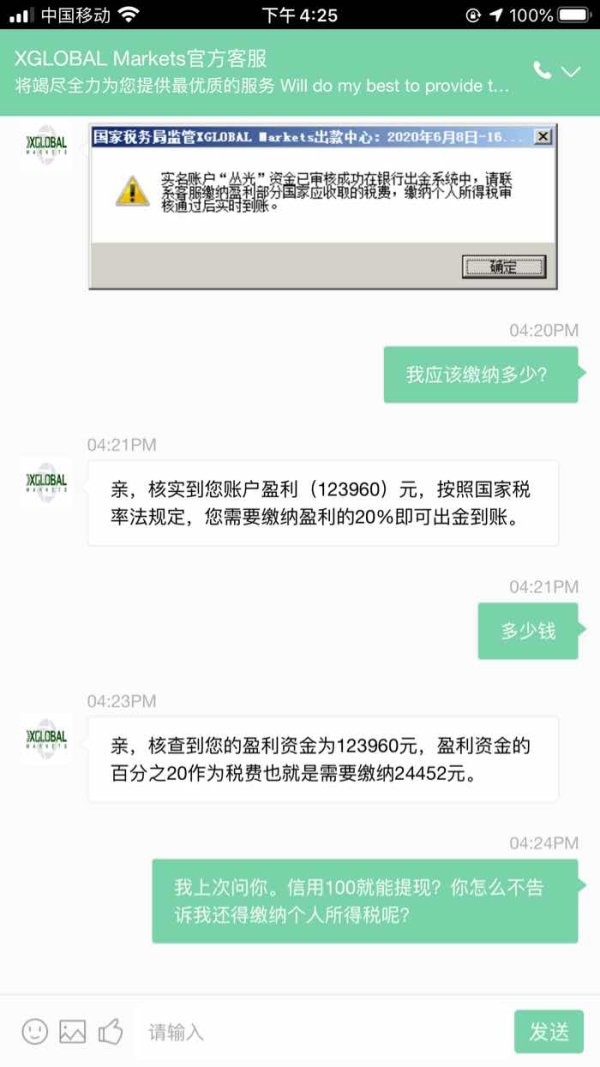

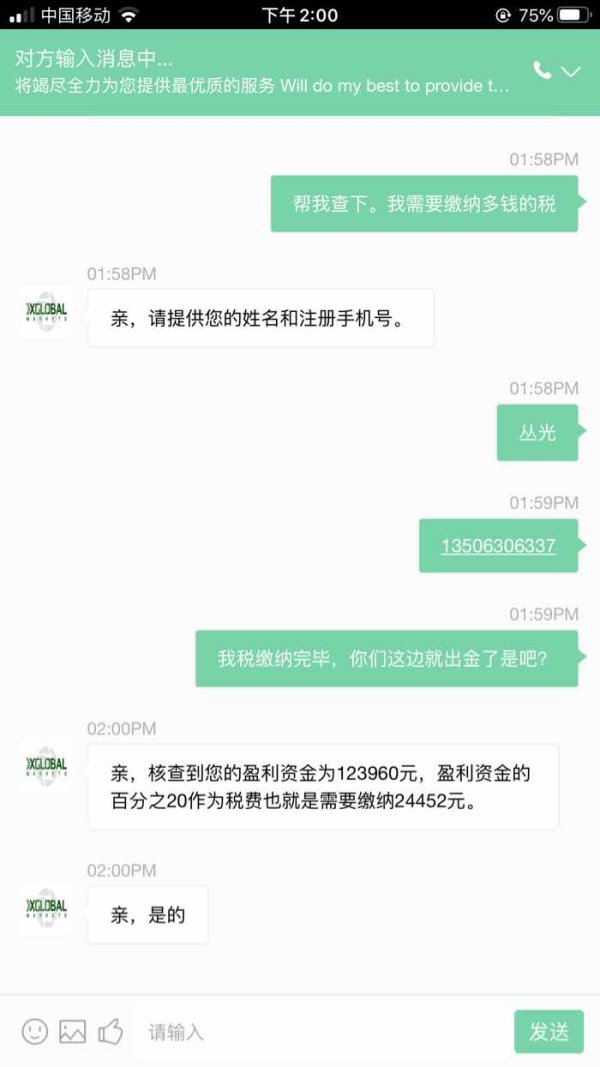

Traders can fund their accounts using various methods including credit/debit cards, bank transfers, and e-wallets such as Skrill and Neteller. Withdrawals are generally processed quickly, but some users have reported delays or issues when trying to access their funds.

Minimum Deposit:

The broker requires a minimum deposit of $100, which is relatively low compared to other brokers that often require higher initial investments.

Bonuses/Promotions:

Currently, XGlobal Markets does not offer any significant bonuses or promotions, likely due to regulatory restrictions imposed by CySEC, which limits the types of incentives brokers can provide.

Tradeable Asset Classes:

XGlobal provides a diverse portfolio of assets, including over 40 forex pairs, commodities like gold and silver, and various indices. However, some reviews indicate a lack of cryptocurrency trading options, which could deter traders interested in digital currencies.

Costs (Spreads, Fees, Commissions):

The broker offers competitive spreads starting from 0.2 pips on the XG Raw account, with a commission of $3.75 per side. The XG Zero account offers spreads from 1 pip with no commissions, catering to traders who prefer a simpler fee structure. However, some users have noted that spreads can widen significantly during volatile market conditions.

Leverage:

XGlobal offers leverage of up to 1:500 for its offshore clients, while the maximum leverage for European clients is capped at 1:30 due to ESMA regulations. This high leverage is attractive but also increases the risk of significant losses.

Allowed Trading Platforms:

The primary trading platform available is MetaTrader 5, known for its comprehensive features that support both manual and automated trading strategies. However, some users have expressed a desire for additional platforms or tools to enhance their trading experience.

Restricted Regions:

XGlobal Markets does not accept clients from several jurisdictions, including the United States, which may limit its accessibility for some traders.

Available Customer Service Languages:

Customer support is available in multiple languages, including English, Arabic, and Spanish. However, the support team operates only during business hours, which some users find restrictive, especially those trading in different time zones.

Repeated Ratings Overview

Detailed Breakdown

-

Account Conditions:

XGlobal Markets provides various account types, including XG Raw and XG Zero, catering to different trading styles. The minimum deposit is set at $100, which is favorable for beginners. However, the lack of tiered accounts may not benefit high-volume traders.

Tools and Resources:

The broker offers the MetaTrader 5 platform, which is equipped with advanced charting tools and automated trading capabilities. However, the absence of comprehensive educational resources and trading tools could be a drawback for novice traders.

Customer Service and Support:

Customer support is available through email and phone, but the absence of live chat and 24/7 support can be a limitation for users requiring immediate assistance.

Trading Setup (Experience):

The overall trading experience is generally positive, but users have reported issues with slippage and execution speed during high volatility, which can impact trading outcomes.

Trustworthiness:

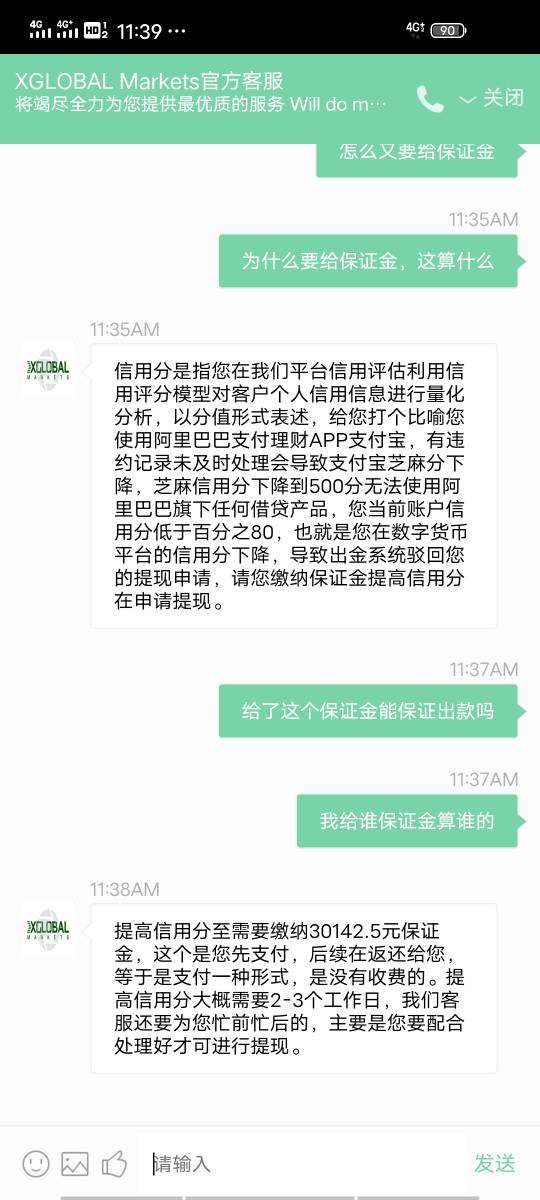

While XGlobal is regulated by CySEC, the presence of an offshore entity raises concerns about the safety of funds. User reviews indicate mixed experiences, with some reporting withdrawal issues.

User Experience:

User feedback highlights a generally satisfactory experience with the trading platform, but concerns remain about customer service responsiveness and withdrawal processes.

In conclusion, XGlobal Markets presents a mixed bag of offerings for traders. While its competitive spreads and the use of MetaTrader 5 are appealing, potential clients should weigh the risks associated with its offshore operations and the varying levels of regulatory oversight. As always, it's advisable to conduct thorough research and consider personal trading needs before engaging with any broker.