Is XGLOBAL safe?

Business

License

Is XGlobal Safe or a Scam?

Introduction

XGlobal is a forex and CFD broker that has been operating since 2012, primarily targeting retail traders looking for access to a variety of financial instruments, including forex, commodities, and indices. Positioned as a global brokerage, it claims to offer a user-friendly trading environment with competitive spreads and a range of account types. However, as with any financial service, especially in the volatile world of forex trading, it is essential for traders to conduct thorough due diligence. The forex market is rife with brokers that may not have the best interests of their clients at heart, making it crucial for traders to assess the credibility and safety of the brokers they choose to work with. This article aims to evaluate whether XGlobal is a trustworthy broker or if it raises red flags that potential users should consider. Our investigation will be based on a comprehensive review of regulatory compliance, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

When it comes to trading, regulation and legitimacy are paramount. A well-regulated broker is typically seen as safer because regulatory bodies impose strict guidelines to protect traders. XGlobal is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC), among other entities. However, the quality of regulation can vary significantly between jurisdictions.

Here is a summary of XGlobal's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 171/12 | Cyprus | Verified |

| VFSC | 15062 | Vanuatu | Verified |

| FCA | Revoked | United Kingdom | Revoked |

The CySEC is known for its rigorous standards, which include requirements for client fund segregation and participation in an investor compensation fund. However, the VFSC's regulations are often criticized for being less stringent, requiring only a minimal capital base to operate. The revocation of the FCA license raises concerns, as it indicates that XGlobal may have failed to meet the regulatory requirements imposed by one of the most respected financial authorities in the world.

In summary, while XGlobal does hold a CySEC license, the presence of a revoked FCA license and the offshore nature of its Vanuatu operations may suggest a higher risk for traders. As such, potential clients should carefully consider these factors before proceeding with their trading activities. This leads us to the question: Is XGlobal safe for your trading needs?

Company Background Investigation

Understanding the company's history and ownership structure provides valuable insights into its reliability. Founded in 2012, XGlobal operates under the legal entity X Global Markets Ltd, with its headquarters located in Limassol, Cyprus. The broker has positioned itself as a market maker and STP (Straight Through Processing) broker, which means it facilitates trades directly with liquidity providers without dealing desk intervention.

The management team at XGlobal comprises individuals with diverse backgrounds in finance and trading. However, specific details about their experience and qualifications are not prominently disclosed on their website, which raises questions about transparency. A lack of clear information about the management can be a red flag, as it may indicate that the company is not fully committed to maintaining an open relationship with its clients.

Moreover, XGlobal has faced scrutiny due to complaints about its operations and customer service. Reports of issues related to fund withdrawals and account management have surfaced, leading to skepticism about its commitment to customer satisfaction. This lack of transparency and customer complaints raises concerns regarding the overall trustworthiness of the broker.

Given these factors, potential traders should critically evaluate whether they feel comfortable entrusting their funds to XGlobal. Is XGlobal safe? The evidence suggests that while the broker has been operational for over a decade, its transparency and management practices may not inspire confidence.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, are critical factors that can significantly impact a trader's profitability. XGlobal offers various account types, such as the XG Raw and XG Zero accounts, each with different fee structures. The minimum deposit required to open an account is $100, which is relatively low compared to industry standards.

The overall fee structure for XGlobal is as follows:

| Fee Type | XGlobal | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.2 pips | 1.0 pips |

| Commission Model | $3.75 per lot | $5.0 per lot |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by XGlobal are competitive, it is essential to note that the commission structure may not be as favorable as some other brokers. Additionally, the broker imposes inactivity fees, which may be a concern for traders who do not engage in frequent trading activities.

Furthermore, the presence of commissions and spread charges should be carefully considered, as they can erode trading profits over time. Traders should also be aware of any potential hidden fees that may not be immediately apparent in the broker's fee structure.

Overall, while XGlobal's trading conditions may appear attractive at first glance, traders should conduct thorough research to ensure they fully understand the costs associated with trading on this platform. In light of these findings, one must ask again, Is XGlobal safe for trading?

Client Fund Security

The security of client funds is of utmost importance when evaluating a broker's reliability. XGlobal claims to implement several measures to protect client funds, including the segregation of client funds from the company's operational funds. This practice is essential for ensuring that trader deposits are protected in the event of company insolvency.

XGlobal also states that it provides negative balance protection, which prevents traders from losing more than their account balance. This feature is particularly valuable during periods of high volatility when market conditions can lead to significant losses. However, the effectiveness of these measures can only be assessed through the broker's historical performance and any past incidents related to fund security.

Despite these assurances, there have been numerous complaints from clients regarding withdrawal issues and alleged difficulties in accessing their funds. Such complaints raise serious concerns about the broker's commitment to safeguarding client assets.

In conclusion, while XGlobal outlines several protective measures, historical complaints and issues related to fund withdrawals suggest that potential clients should approach this broker with caution. The question remains: Is XGlobal safe when it comes to securing your funds?

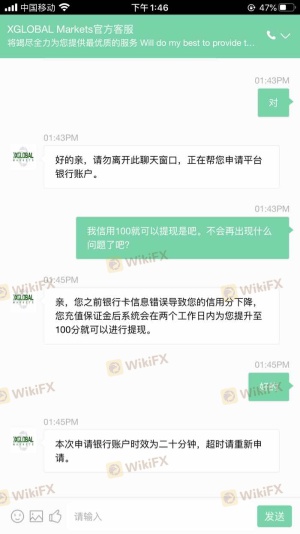

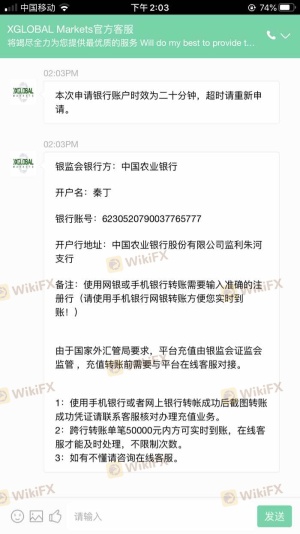

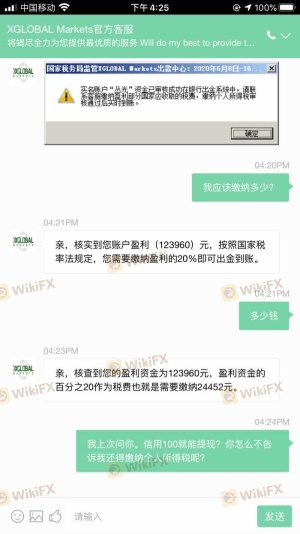

Customer Experience and Complaints

An examination of customer feedback is crucial for understanding the overall experience with a broker. Reviews of XGlobal reveal a mixed bag of customer experiences, with some users praising the trading platform's performance and customer service, while others report significant issues with withdrawals and account management.

Common complaint patterns include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Account Blocking | High | Inconsistent |

| Customer Service Quality | Medium | Average |

For instance, some users have reported that their accounts were blocked after attempting to withdraw funds, leading to frustration and a loss of trust in the broker. In some cases, clients have claimed that their documents were rejected repeatedly without clear explanations, which further exacerbated their concerns.

One notable case involved a trader who deposited a significant amount only to find themselves unable to access their funds after multiple attempts to withdraw. This situation raises serious questions about the broker's reliability and commitment to customer service.

In light of these experiences, it is essential for potential clients to consider the feedback from existing users carefully. While XGlobal may offer competitive trading conditions, the reported withdrawal issues and customer service challenges should not be overlooked. Therefore, it is fair to ask, Is XGlobal safe in terms of customer experience?

Platform and Trade Execution

The trading platform used by a broker plays a significant role in the overall trading experience. XGlobal offers the widely recognized MetaTrader 5 (MT5) platform, known for its robust features and user-friendly interface. The platform is accessible on various devices, including desktops and mobile devices, allowing traders to manage their accounts conveniently.

However, concerns have been raised regarding the quality of order execution on the XGlobal platform. Some users have reported issues with slippage and rejected orders, which can be detrimental to a trader's performance, especially in fast-moving markets.

The following factors are critical to consider when evaluating the platform's execution quality:

- Order Execution Speed: Delays in order execution can lead to missed opportunities and increased trading costs.

- Slippage: Occurs when a trade is executed at a different price than expected, which can negatively impact profitability.

- Rejection Rates: High rejection rates may indicate problems with liquidity or the broker's execution policies.

While XGlobal claims to provide a reliable trading environment, the experiences of some users suggest that there may be inconsistencies in execution quality. Therefore, it is essential for traders to consider their experiences and weigh the potential risks associated with trading on this platform. The question remains, Is XGlobal safe in terms of platform reliability?

Risk Assessment

Engaging with any broker carries inherent risks, and XGlobal is no exception. A comprehensive risk assessment is vital for traders to understand the potential pitfalls associated with using this broker.

Here is a summary of the key risk areas associated with XGlobal:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation raises concerns. |

| Fund Security Risk | Medium | Complaints about withdrawal issues. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

| Customer Service Risk | High | Mixed reviews on support responsiveness. |

To mitigate these risks, traders are advised to:

- Conduct Thorough Research: Understand the regulatory landscape and the broker's history.

- Start with a Demo Account: Familiarize yourself with the platform without risking real funds.

- Monitor Your Investments Closely: Be vigilant about your account activity and withdrawal processes.

In light of these risks, potential traders must carefully evaluate whether they are comfortable with the inherent risks of trading with XGlobal. The question persists, Is XGlobal safe for your trading activities?

Conclusion and Recommendations

In conclusion, the evaluation of XGlobal reveals a complex picture. While the broker is regulated by CySEC, the presence of a revoked FCA license and complaints regarding fund withdrawals raise significant concerns. The competitive trading conditions and robust trading platform may appeal to many traders, but the risks associated with customer service and fund security cannot be overlooked.

For potential traders, it is crucial to weigh the benefits against the risks. If you are considering trading with XGlobal, it may be wise to start with a small investment and monitor your experience closely. Additionally, traders looking for a more secure option may want to explore alternatives that offer stricter regulatory oversight and better customer service.

Ultimately, the question remains: Is XGlobal safe? The evidence suggests that while there are appealing aspects to this broker, the potential risks warrant careful consideration. For those seeking reliable alternatives, brokers with strong regulatory frameworks and positive customer reviews should be prioritized.

Is XGLOBAL a scam, or is it legit?

The latest exposure and evaluation content of XGLOBAL brokers.

XGLOBAL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XGLOBAL latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.