Vittaverse 2025 Review: Everything You Need to Know

Executive Summary

This vittaverse review looks at a forex broker that has caught attention in financial markets. Vittaverse offers many trading options and focuses on helping users succeed in their trading goals. The company works as a multi-asset broker, giving traders access to currencies, cryptocurrencies, indices, metals, energies, stocks, and ETFs through advanced trading platforms including MetaTrader 5, cTrader, and TradingView.

The broker joined the Financial Commission as an approved member. This membership makes the company more trustworthy from a regulatory standpoint. Vittaverse offers competitive crypto leverage of up to 1:150, which beats many other companies in the cryptocurrency trading space significantly. User feedback shows the platform delivers solid trading execution with an average trading speed of 0ms. This speed indicates the system processes orders very efficiently.

Vittaverse works well for traders who want to trade multiple types of assets. The broker especially helps those who want to combine traditional forex trading with cryptocurrency investments at the same time. The platform choices work for different trading styles, from algorithmic traders who like MetaTrader 5 to those who prefer TradingView's advanced charting tools. User ratings show a score of 74 points, which means there's room to get better. However, traders give positive feedback about execution speed and how stable the platform runs.

Important Notice

Different regional entities may work under different regulatory rules and service conditions. This review uses currently available information and user feedback to provide neutral reference material for traders who might be interested. Regulatory requirements and available services may be different depending on where you live, so users should check the specific terms and conditions that apply to their region before opening an account. The information here reflects how the broker operated in early 2025 and may change later.

Rating Framework

Broker Overview

Vittaverse works as a multi-asset brokerage firm that focuses on delivering complete trading solutions across traditional and digital financial markets. The company has set itself up to serve the changing needs of modern traders who want access to both regular forex markets and new cryptocurrency opportunities that are emerging. According to [Newsfile Corp], Vittaverse made its services better in August 2023 by increasing crypto leverage to 1:150 and adding 100 new cryptocurrency pairs to its platform significantly. This shows the company wants to expand its digital asset offerings.

The broker's business model focuses on providing institutional-grade trading infrastructure while keeping things accessible for retail traders. Vittaverse offers trading across seven major asset categories: currencies, cryptocurrencies, indices, precious metals, energy commodities, individual stocks, and exchange-traded funds (ETFs). This strategy allows traders to build complete portfolios within a single trading environment. It reduces the complexity of managing multiple brokerage relationships at the same time.

Platform Technology and Infrastructure

Vittaverse supports three leading trading platforms, and each one works for different trader preferences and strategies. MetaTrader 5 serves algorithmic traders and those who need advanced automated trading capabilities, while cTrader appeals to traders who prefer easy order management and level II pricing data. TradingView integration gives access to advanced charting tools and social trading features. According to [WikiBit], the broker keeps an average trading speed of 0ms, which shows robust technical infrastructure that can handle high-frequency trading demands. This vittaverse review finds that the platform selection shows the broker wants to work with diverse trading styles and technical requirements.

Regulatory Framework

Vittaverse works as an approved member of the Financial Commission. This provides an extra layer of trader protection and dispute resolution mechanisms. This regulatory association makes sure the company follows industry standards and offers help for client complaints through established arbitration processes.

Asset Coverage and Leverage

The broker gives access to seven major asset classes with particularly competitive terms for cryptocurrency trading. [Newsfile Corp] reports that crypto leverage reaches up to 1:150, which is much higher than industry averages. The platform supports over 100 cryptocurrency pairs following the August 2023 expansion. This includes major digital assets and emerging altcoins.

Trading Platforms

Three professional-grade platforms are available: MetaTrader 5 for complete trading tools and expert advisors, cTrader for advanced order management and market depth analysis, and TradingView for superior charting and technical analysis capabilities. Each platform offers unique advantages depending on what trading style and strategy requirements you have.

Cost Structure

Specific information about spreads, commissions, and other trading costs is not detailed in available sources. However, user feedback suggests transparent pricing without hidden fees. Traders should check current pricing structures directly with the broker.

Account Requirements

Minimum deposit requirements and specific account tier information are not specified in current documentation. Prospective clients should contact Vittaverse directly for detailed account opening requirements and funding specifications.

Geographic Availability

Regional restrictions and service availability by jurisdiction are not clearly detailed in available sources. This requires direct verification with the broker for specific geographic limitations.

This complete vittaverse review shows that while the broker offers solid technical infrastructure and diverse asset access, some operational details need direct clarification with the company.

Account Conditions Analysis

Vittaverse's account structure information stays limited in publicly available sources. This creates challenges for complete evaluation. User feedback suggests that the account opening process is relatively straightforward, and traders report positive experiences during onboarding.

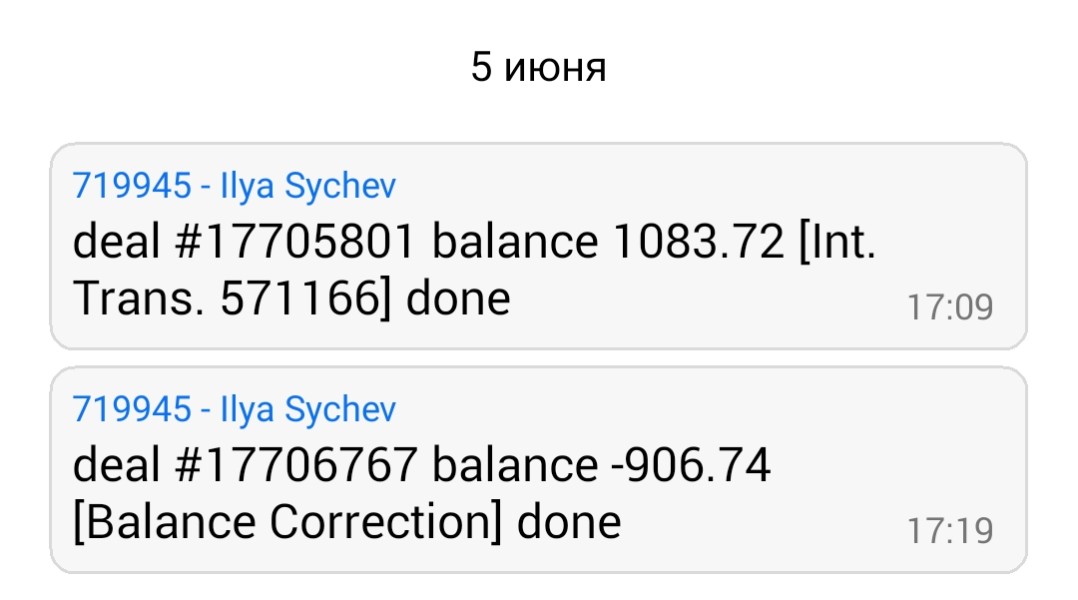

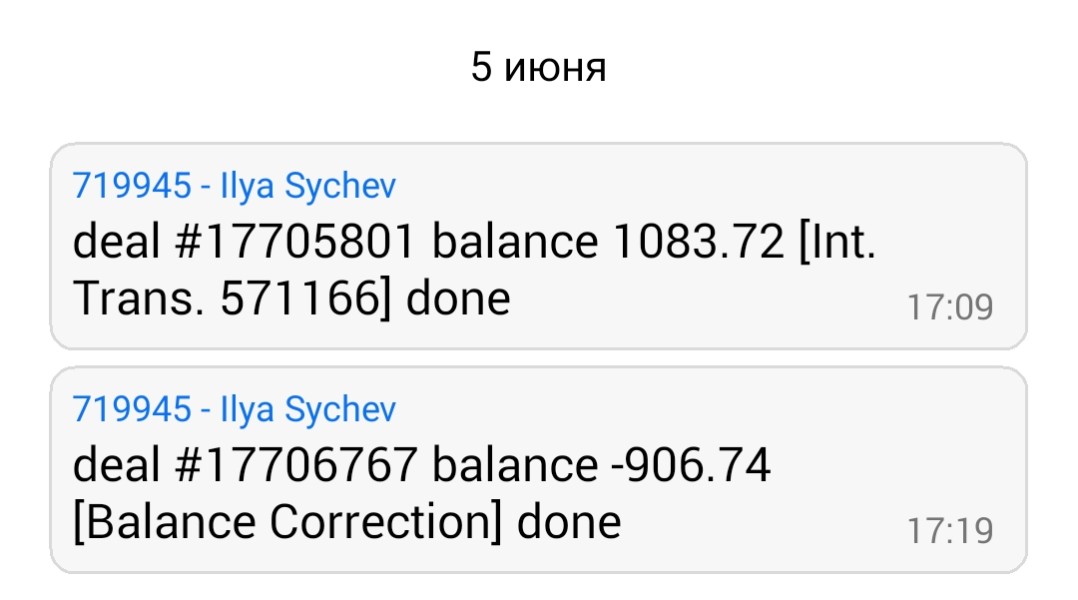

However, specific details about account tiers, minimum deposit requirements, and tiered pricing structures are not extensively documented in current materials. The lack of detailed account information represents a transparency gap that potential clients should address through direct communication with the broker. While this limits our ability to provide specific comparisons with industry standards, user testimonials show that account holders generally find the terms acceptable for their trading needs.

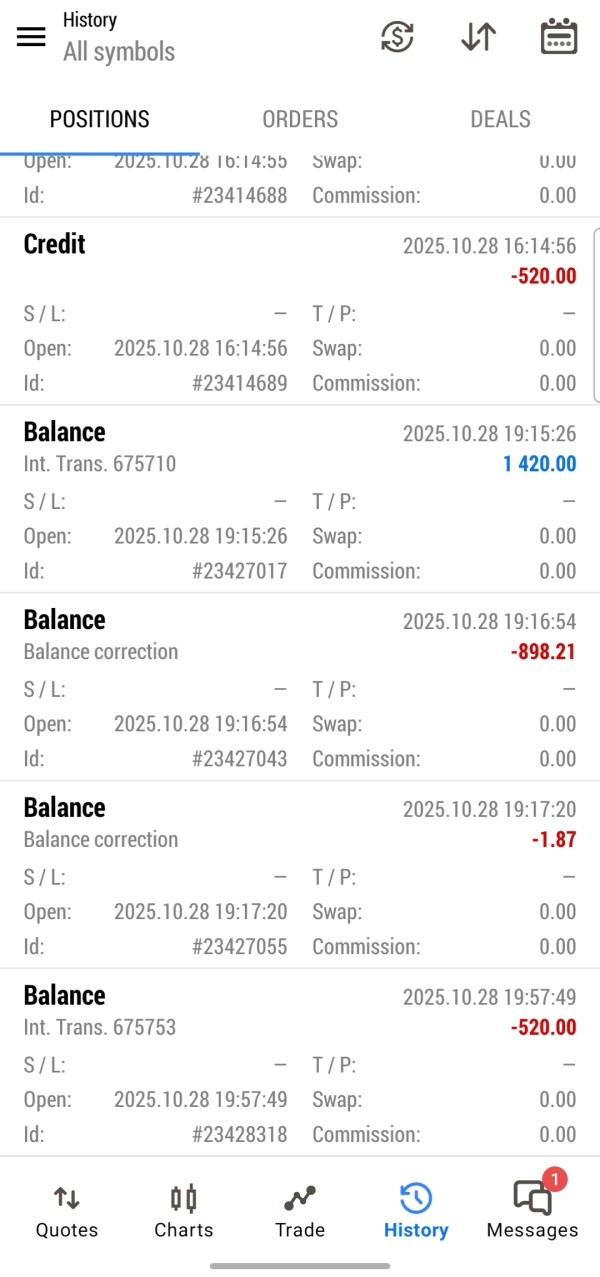

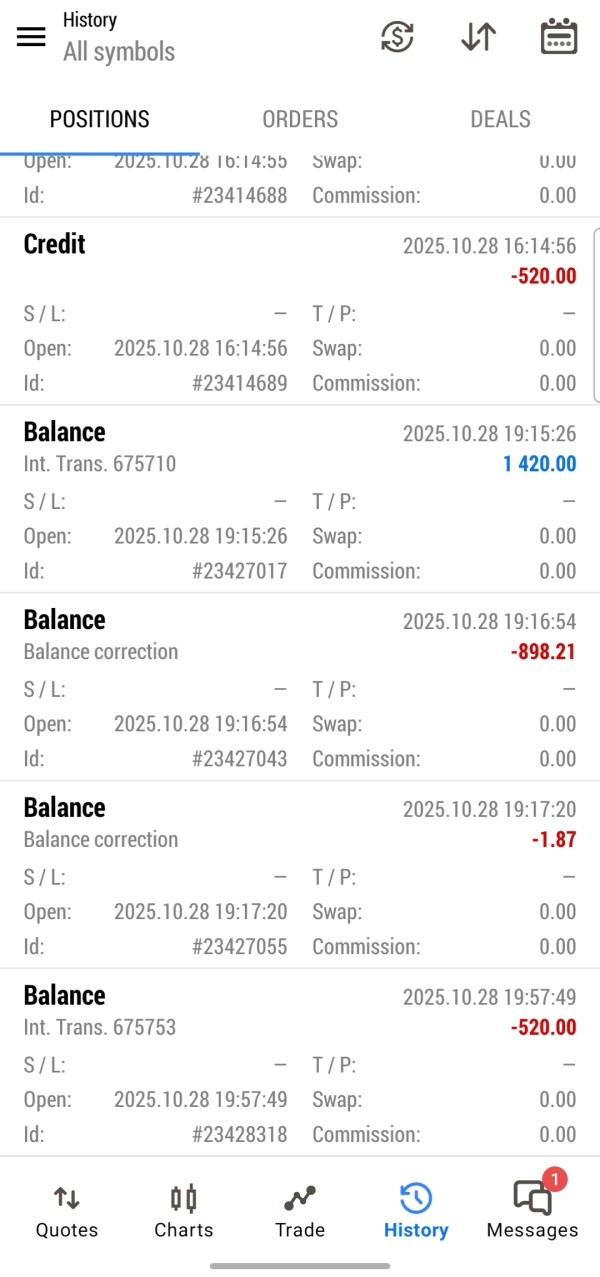

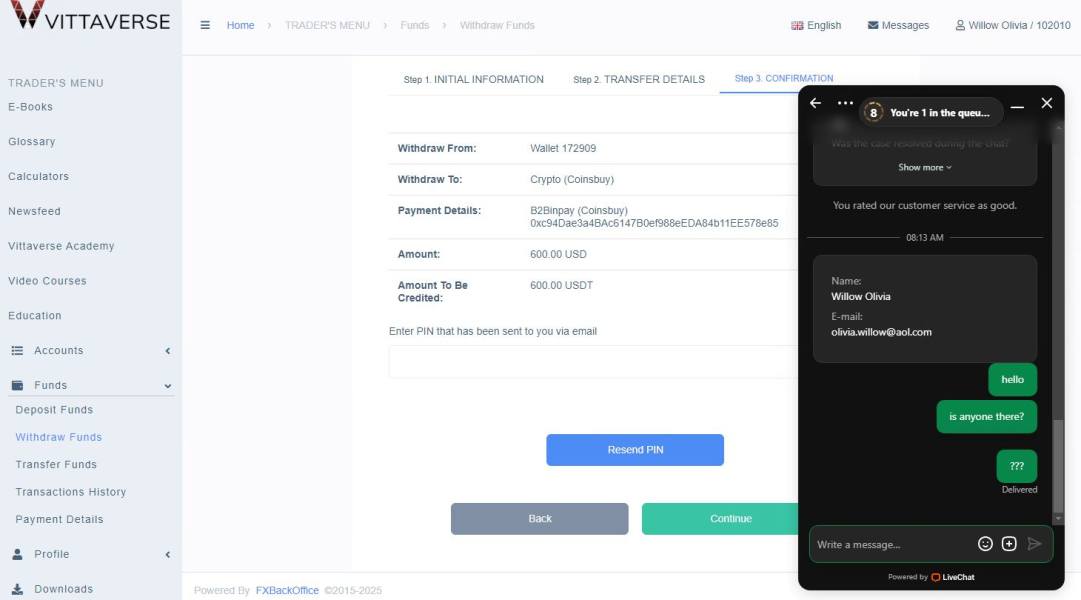

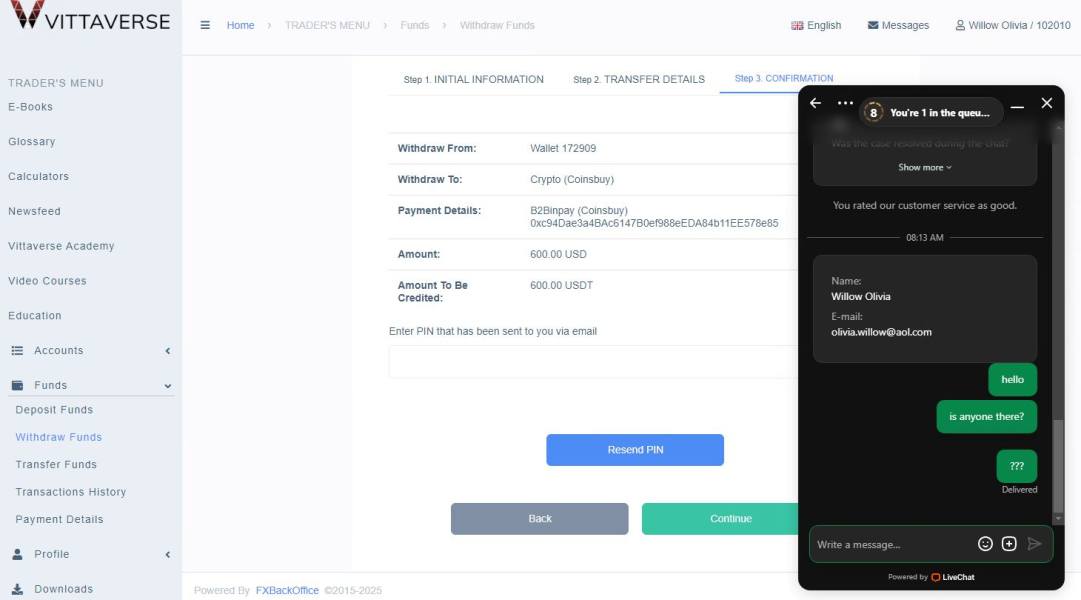

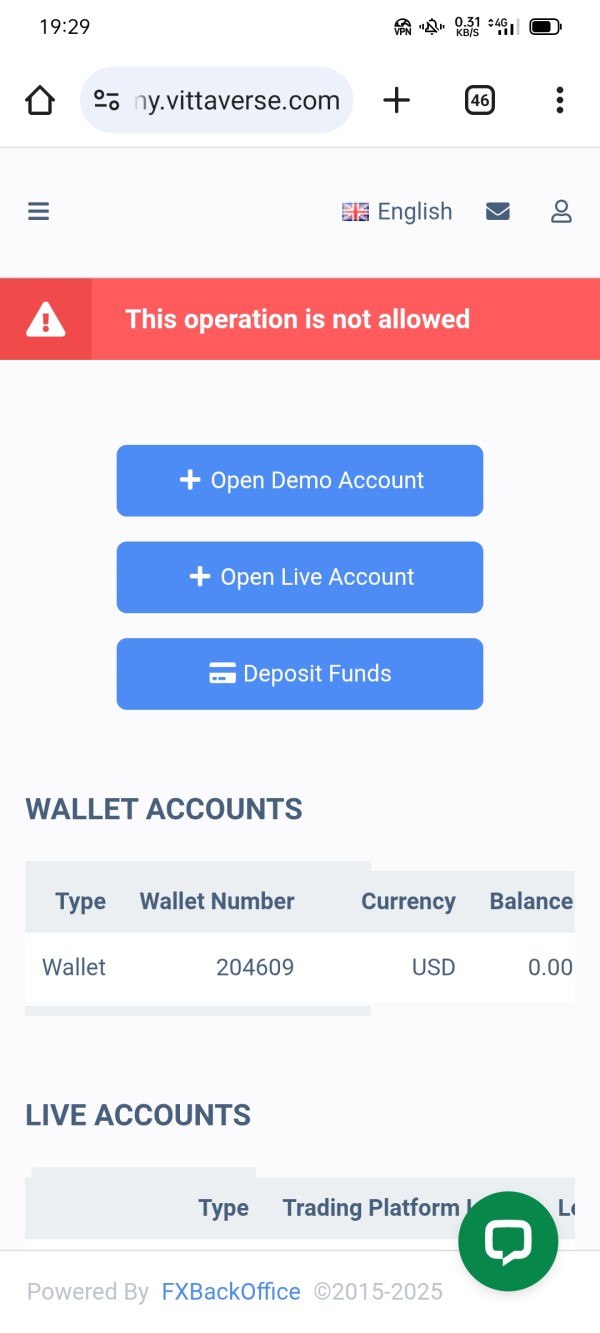

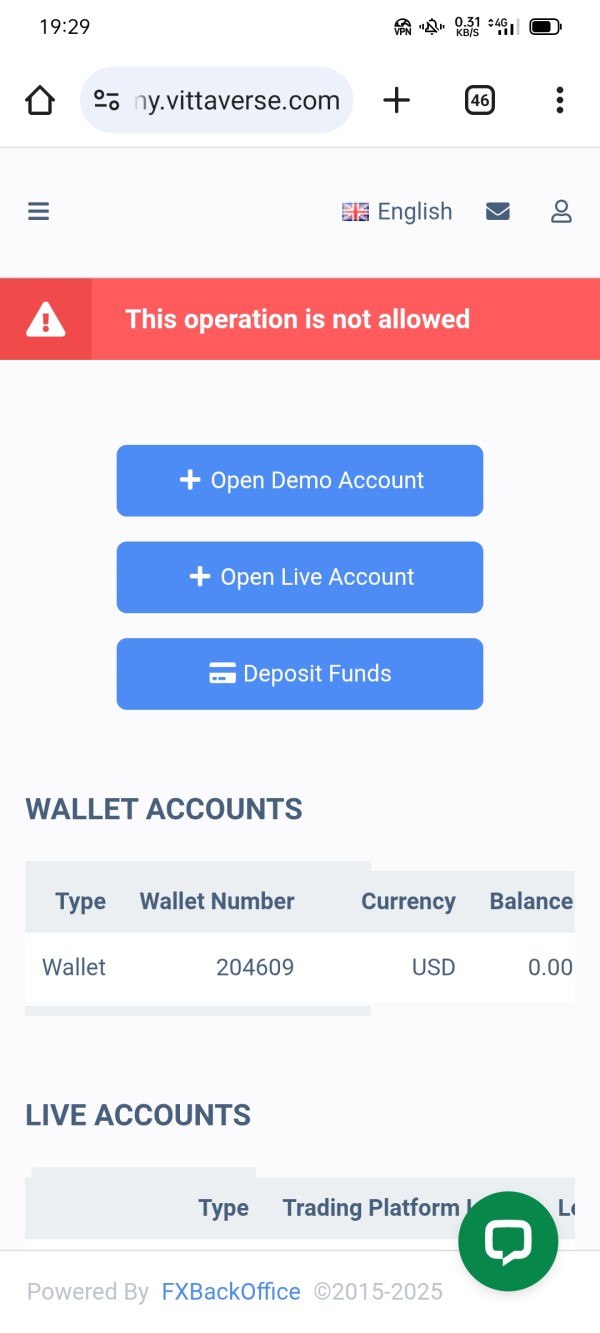

The absence of complaints about hidden fees or unexpected charges in user feedback suggests reasonable account conditions. However, verification of specific terms remains necessary. Account functionality appears robust based on user reports, with traders noting smooth deposit and withdrawal processes, though specific methods and timeframes are not detailed.

The broker's Financial Commission membership provides additional confidence in account security and dispute resolution capabilities. Islamic account availability and other specialized account features are not mentioned in available documentation. This requires direct inquiry for traders with specific religious or regulatory requirements.

This vittaverse review recommends that prospective clients directly verify all account conditions, including minimum deposits, maintenance fees, and inactivity charges, before committing to the platform. The generally positive user experience suggests that while information transparency could improve, actual account conditions likely meet reasonable trader expectations.

Vittaverse shows strong performance in trading tools and platform offerings. The company provides access to three industry-leading trading environments. The MetaTrader 5 integration offers complete automated trading capabilities, extensive technical indicators, and expert advisor support, making it suitable for algorithmic traders and those requiring advanced order management.

cTrader provides institutional-grade execution with level II pricing data and advanced order types. This appeals to professional traders requiring precise market access. TradingView integration represents a significant advantage, offering superior charting capabilities, social trading features, and extensive technical analysis tools.

This combination allows traders to use TradingView's advanced analytics while executing trades through Vittaverse's infrastructure. The platform diversity makes sure that traders can select tools matching their specific strategy requirements and technical preferences. Research and educational resources are not extensively detailed in available sources, representing an area where information transparency could improve.

User feedback suggests that the platform interfaces are easy to use and well-designed. Traders appreciate the clean layout and responsive functionality. The technical infrastructure supporting these platforms appears robust, with [WikiBit] reporting 0ms average execution speeds indicating efficient order processing capabilities.

The broker's expansion of cryptocurrency pairs to over 100 options shows commitment to keeping pace with digital asset market developments. This extensive crypto coverage, combined with traditional asset access across six additional categories, provides complete market exposure within a single trading environment. However, specific details about analytical tools, market research, and educational content require direct verification with the broker.

Customer Service and Support Analysis

Customer service evaluation for Vittaverse relies mainly on user feedback. Specific support channel details are not completely documented in available sources. User testimonials show generally responsive customer support, with traders reporting satisfactory resolution times for inquiries and technical issues.

This positive feedback suggests that while support channel specifics may not be extensively publicized, the actual service delivery meets reasonable client expectations. The absence of detailed information about support availability hours, multilingual capabilities, and specific contact methods represents an area where transparency could improve. Professional brokers typically offer multiple support channels including live chat, email, and telephone support, though Vittaverse's specific offerings in these areas require direct verification.

The broker's Financial Commission membership provides additional help for dispute resolution. This offers clients alternative channels for addressing more complex issues. Response quality appears adequate based on user reports, with no significant complaints about support effectiveness in available feedback.

However, the limited documentation of support infrastructure makes it difficult to assess capabilities during high-volume periods or for complex technical issues. Traders requiring extensive support or having specific language requirements should verify availability before opening accounts. The overall customer service picture suggests functional support delivery despite limited public information about specific channels and capabilities.

This pattern shows that while the broker may provide adequate support in practice, improved transparency about support offerings would benefit potential clients in making informed decisions about the platform's suitability for their needs.

Trading Experience Analysis

Vittaverse delivers excellent trading experience based on technical performance metrics and user feedback. The most impressive aspect is the reported 0ms average trading speed from [WikiBit], which shows institutional-grade execution infrastructure capable of processing orders with minimal delay. This performance level is particularly important for scalping strategies and high-frequency trading approaches where execution speed directly impacts how much money traders can make.

Platform stability receives positive user feedback. Traders report consistent performance during both normal and high-volatility market conditions. The availability of three professional trading platforms allows users to select environments best suited to their trading styles, from MetaTrader 5's complete automation capabilities to TradingView's advanced charting and analysis tools.

This flexibility makes sure that technical traders, fundamental analysts, and automated system users can all find suitable environments. Order execution quality appears robust based on user testimonials, with traders noting reliable fills and stable spreads. The broker's expansion to over 100 cryptocurrency pairs provides extensive opportunities for digital asset traders, while traditional forex and CFD offerings cover major global markets.

User feedback shows good liquidity across major asset classes. However, specific details about execution policies and slippage statistics are not publicly documented. Mobile trading experience details are not extensively covered in available sources, though the platform selection suggests that mobile access is available through MetaTrader 5 and potentially other platforms.

The overall trading environment appears well-suited to both active day traders and longer-term position traders. The technical infrastructure supports diverse trading approaches effectively. This vittaverse review finds that trading experience represents one of the broker's strongest aspects, particularly for traders who prioritize execution speed and platform reliability.

Trust and Safety Analysis

Vittaverse's trust profile centers on its approved membership with the Financial Commission. This provides regulatory oversight and dispute resolution mechanisms for client protection. This association shows the broker's commitment to industry standards and offers traders help through established arbitration processes.

The Financial Commission membership, while not the same as top-tier regulatory licenses, provides meaningful trader protections and operational oversight. Fund security measures are not extensively detailed in available public documentation, representing an area where transparency could improve. Professional brokers typically implement segregated client accounts, insurance coverage, and other protective measures, though Vittaverse's specific arrangements require direct verification.

The absence of negative publicity or significant complaints about fund security in available sources suggests adequate protective measures. However, formal documentation would enhance confidence. Company transparency about ownership, operational history, and financial backing remains limited in publicly available information.

While this is not uncommon among newer brokers, established operators typically provide more complete corporate information. The broker's expansion activities, such as the August 2023 cryptocurrency pair additions reported by [Newsfile Corp], show ongoing business development and investment in platform capabilities. Industry reputation appears neutral to positive based on available feedback, with no significant negative events or regulatory actions documented in current sources.

User testimonials suggest satisfactory experiences with fund handling and account security. However, the limited sample size requires careful interpretation. The Financial Commission membership provides additional confidence in the broker's commitment to industry standards and client protection protocols.

User Experience Analysis

User experience evaluation reveals a mixed but generally positive picture. Traders rate the platform at 74 points according to available feedback. This score shows good performance with room for improvement, suggesting that while core functionality meets user needs, some aspects could be enhanced.

The platform interface receives praise for being clean and easy to use. Traders appreciate the straightforward navigation and responsive design elements. Account opening processes appear streamlined based on user reports, with traders noting relatively simple onboarding procedures.

However, specific details about verification timeframes, document requirements, and approval processes are not extensively documented. The availability of multiple trading platforms allows users to select environments matching their experience levels and technical requirements, from beginner-friendly interfaces to advanced professional tools. Funding and withdrawal experiences receive generally positive feedback, though specific processing times and available methods are not detailed in current sources.

The absence of significant complaints about payment processing suggests adequate handling of financial transactions. However, formal documentation of procedures would benefit transparency. Users appear satisfied with the overall account management experience, indicating functional back-office systems and procedures.

Common user suggestions focus on expanding educational resources and providing more detailed information about trading conditions and procedures. The broker's responsiveness to market developments, such as the cryptocurrency pair expansion, shows attention to user demands and market trends. However, improved communication about platform features, costs, and procedures could enhance the overall user experience significantly.

The user experience profile suggests a functional platform that meets basic trading needs while offering room for enhancement in information transparency and educational support.

Conclusion

This complete vittaverse review reveals a broker with solid technical infrastructure and competitive offerings. The company particularly excels in cryptocurrency trading with leverage up to 1:150 and over 100 digital asset pairs. The platform's strength lies in its execution capabilities, with 0ms average trading speeds and robust technical infrastructure supporting diverse trading strategies across multiple asset classes.

Vittaverse appears well-suited for traders seeking multi-asset exposure, especially those combining traditional forex trading with cryptocurrency investments. The three-platform approach works with different trading styles, from automated strategies through MetaTrader 5 to advanced charting via TradingView integration. The Financial Commission membership provides regulatory oversight and dispute resolution capabilities, enhancing trader protection.

However, the broker faces transparency challenges with limited public information about account conditions, costs, and operational procedures. While user feedback suggests satisfactory actual experiences, improved documentation of trading terms, support channels, and company background would benefit potential clients. The 74-point user rating shows good but improvable performance, particularly in areas of information accessibility and educational resources.

Overall, Vittaverse shows potential as a multi-asset trading platform with strong technical capabilities. However, prospective clients should conduct thorough research about specific terms and conditions before opening accounts.