Trade360 2025 Review: Everything You Need to Know

Trade360 has established itself as a notable player in the online trading landscape since its inception in 2013. The broker is recognized for its innovative "crowd trading" platform, which leverages collective trader sentiment to inform trading decisions. However, user reviews present a mixed picture, with both positive experiences regarding the platform's unique features and negative feedback concerning high spreads and withdrawal issues. This review synthesizes insights from various sources to provide a comprehensive overview of Trade360's offerings, regulatory status, and user experiences.

Note: It is crucial to consider that Trade360 operates through multiple entities across different jurisdictions, which can significantly impact the trading experience. This review aims to fairly represent the broker's offerings while acknowledging these variations.

Rating Overview

We evaluate brokers based on a combination of user feedback, expert analysis, and factual data from reputable sources.

Broker Overview

Founded in 2013, Trade360 operates under the umbrella of Crowd Tech Ltd, with its primary regulatory oversight from the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC). The broker offers a variety of trading platforms, prominently featuring MetaTrader 5 (MT5) and its proprietary "Crowd Trader" platform. Trade360 provides access to a diverse range of assets, including forex, CFDs, commodities, and indices.

Detailed Breakdown

Regulatory Regions

Trade360 is regulated in multiple jurisdictions, primarily under CySEC in Cyprus and ASIC in Australia. However, it is essential to note that some users may be serviced by the unregulated entity based in the Marshall Islands, which can lead to varying levels of security and trading conditions.

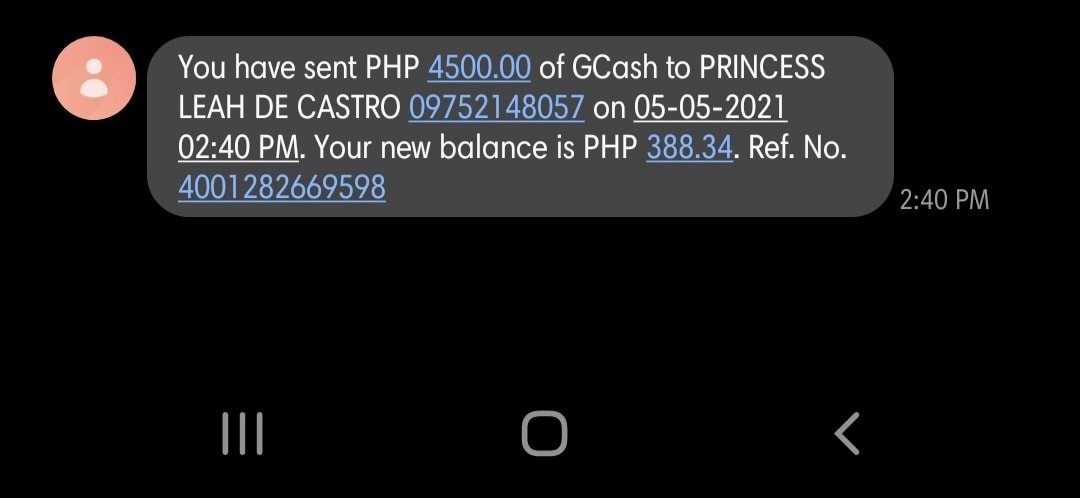

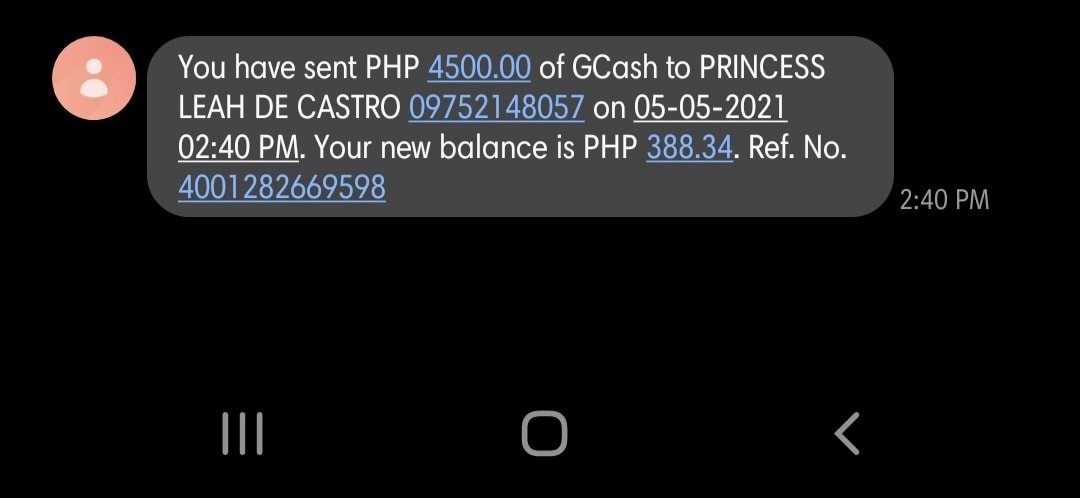

Deposit/Withdrawal Currencies and Cryptocurrencies

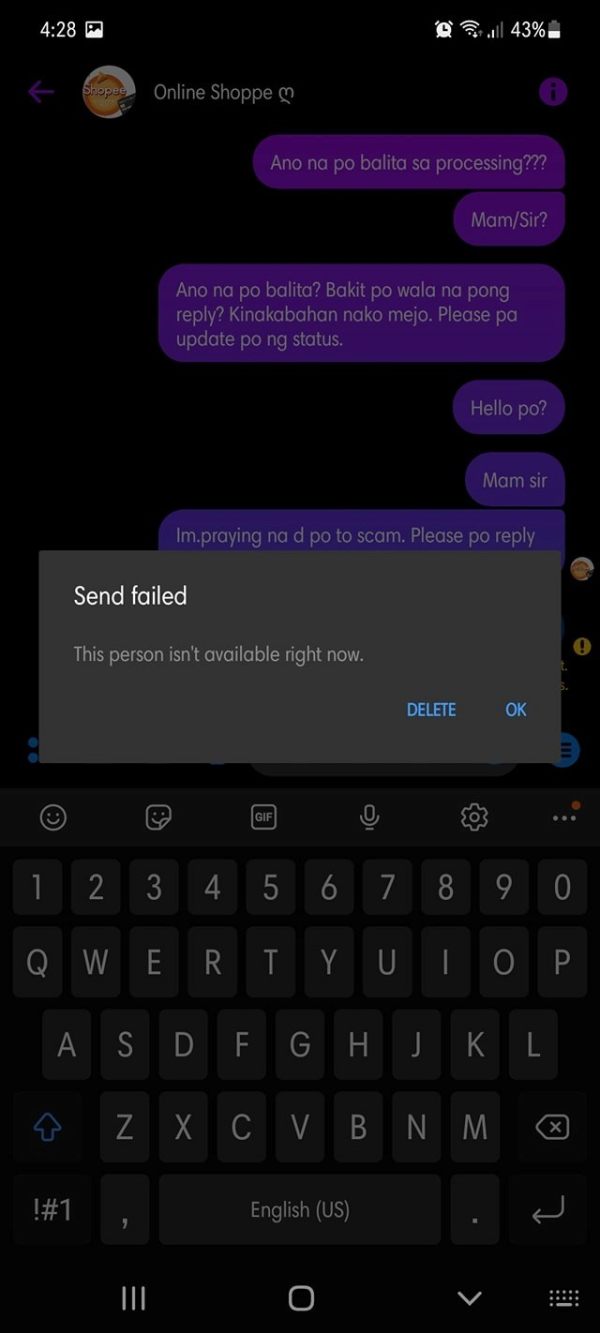

The broker supports various deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets like Skrill and Neteller. Notably, Trade360 does not currently offer cryptocurrency trading, which may limit options for traders interested in digital assets.

Minimum Deposit

The minimum deposit to open an account with Trade360 varies by account type, starting from $250 for the Mini account to $100,000 for the VIP account.

Trade360 offers various promotions, including cash back on trades for active users. However, the availability of these promotions can depend on the specific account type and region.

Tradable Asset Classes

Trade360 provides access to a wide array of trading instruments, including 49 forex pairs, various CFDs on commodities, indices, and stocks. However, it lacks cryptocurrency offerings, which may deter some traders.

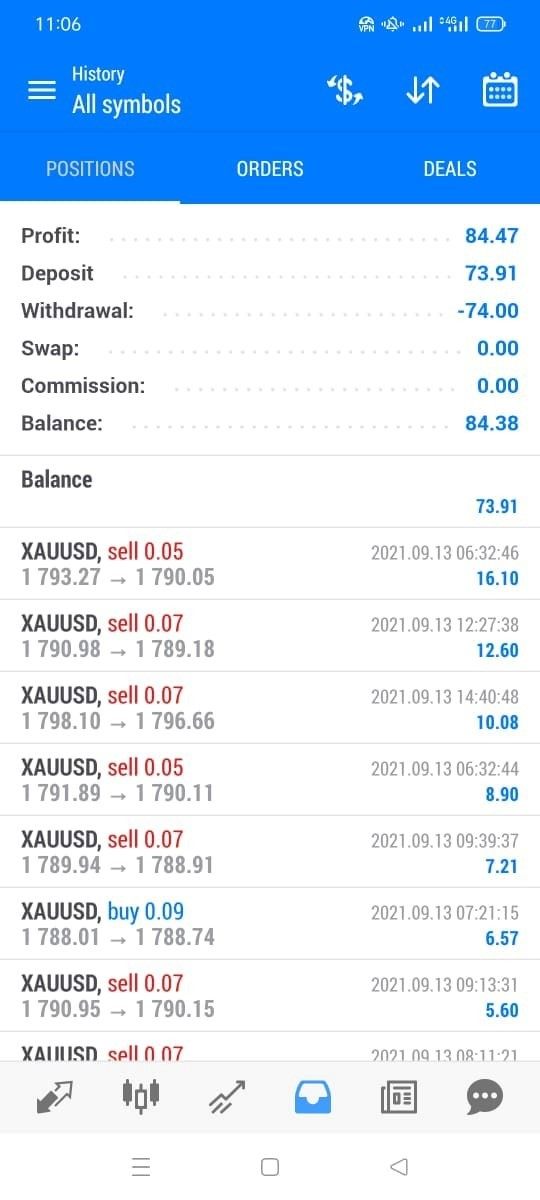

Costs (Spreads, Fees, Commissions)

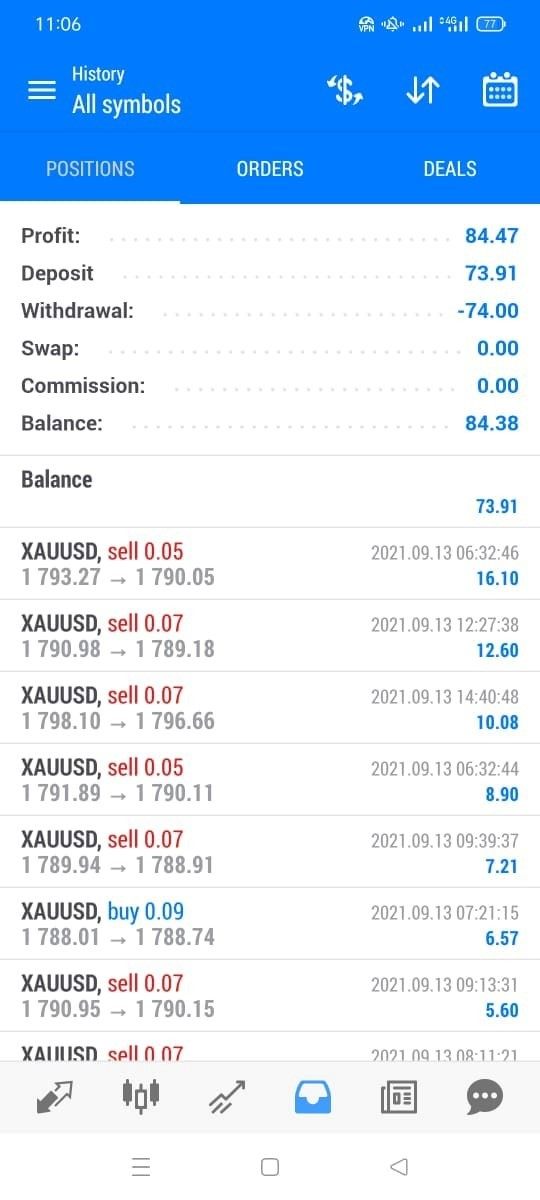

The broker's spreads are reported to be relatively high, ranging from 1.8 to 4 pips for major currency pairs like EUR/USD, depending on the account type. This can significantly impact profitability, especially for active traders. Additionally, Trade360 imposes an inactivity fee of $100 after 45 days of no trading activity.

Leverage

Leverage options vary across jurisdictions, with a maximum of 1:30 for retail clients in Europe and up to 1:500 for professional clients in Australia. This flexibility can be advantageous for experienced traders but poses increased risks.

Trade360 offers both its proprietary Crowd Trader platform and MetaTrader 5, providing users with a choice of trading environments. The Crowd Trader platform is particularly noted for its unique crowd sentiment analysis feature, which can assist traders in making informed decisions.

Restricted Regions

Trade360 does not accept clients from the United States, which may limit its appeal to a significant segment of the trading community.

Available Customer Support Languages

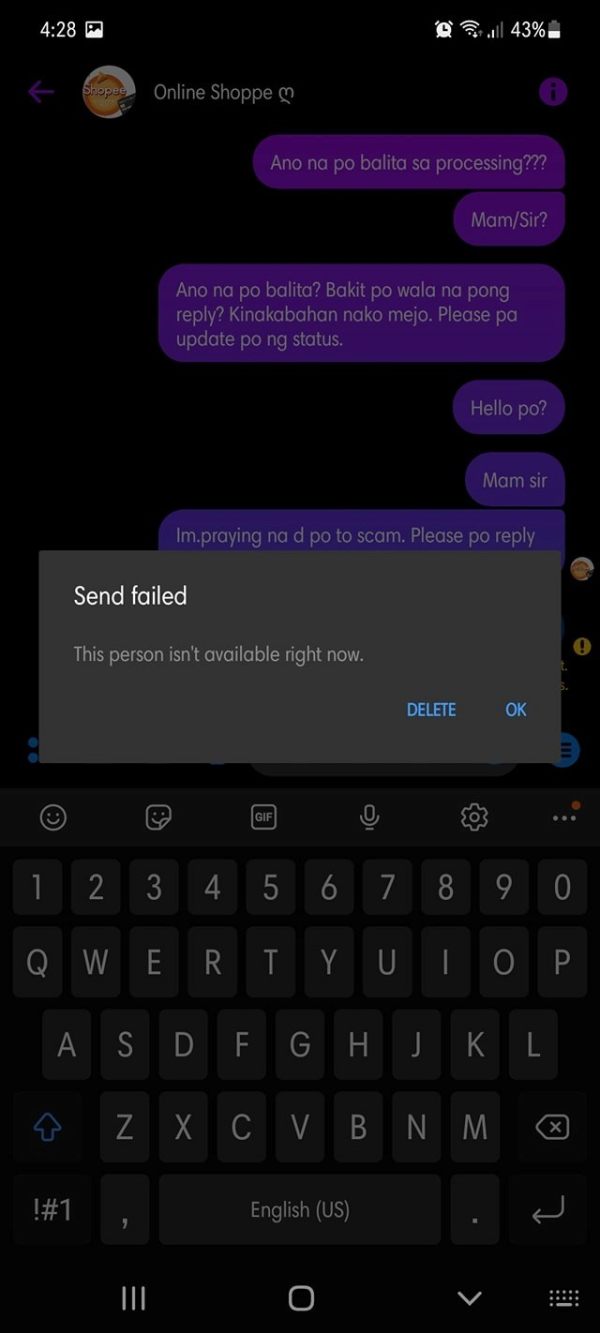

The broker provides customer support in several languages, including English, German, Spanish, and French. Support is accessible via live chat, email, and phone, though some users have reported delays in response times.

Repeated Rating Overview

Detailed Rating Breakdown

-

Account Conditions (6/10): The minimum deposit requirement is relatively accessible at $250, but the higher-tier accounts demand significant capital. The spreads are considered high compared to industry standards, which may deter cost-sensitive traders.

Tools and Resources (7/10): Trade360 offers innovative tools like crowd trading and integrates Trading Central for market analysis. However, the educational resources are limited, which may not suffice for beginners.

Customer Service and Support (6/10): While support is available through multiple channels, user experiences suggest that response times can be inconsistent.

Trading Experience (5/10): The trading platforms provide essential functionalities, but the high spreads and occasional withdrawal issues can detract from the overall experience.

Trustworthiness (6/10): Trade360 is regulated by reputable authorities, but the existence of unregulated entities raises concerns about the safety of funds for some users.

User Experience (5/10): The user interface is generally well-received, but the lack of educational materials and high fees can negatively impact the experience for novice traders.

In conclusion, Trade360 presents a mixed bag of features and user experiences. While its innovative crowd trading technology and regulatory oversight are notable strengths, high spreads and withdrawal issues may pose challenges for potential clients. Traders should carefully consider their individual needs and preferences before engaging with this broker.