Regarding the legitimacy of Trade360 forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Trade360 safe?

Business

Risk Control

Is Trade360 markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 21

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Crowd Tech Ltd

Effective Date:

2013-06-14Email Address of Licensed Institution:

compliance@crowdtech.globalSharing Status:

No SharingWebsite of Licensed Institution:

www.trade360.comExpiration Time:

--Address of Licensed Institution:

116 Gladstonos Str., Michael Kyprianou House, 3rd and 4th floor, 3032, Limassol, CyprusPhone Number of Licensed Institution:

35725262200Licensed Institution Certified Documents:

Is Trade360 Safe or Scam?

Introduction

Trade360 is an online brokerage that has positioned itself as a player in the forex and CFD trading markets since its establishment in 2013. With a focus on innovative trading solutions, particularly its proprietary crowd trading platform, Trade360 aims to empower traders by providing insights based on collective market sentiment. However, as with any trading platform, it is crucial for traders to exercise caution and thoroughly evaluate brokers before investing. This article examines the safety and legitimacy of Trade360 by analyzing its regulatory status, company background, trading conditions, customer fund security, and user experiences. The evaluation is based on a comprehensive review of online resources, including expert analyses and user testimonials.

Regulation and Legitimacy

The regulation of a trading broker is paramount in determining its legitimacy and reliability. Trade360 operates under the oversight of two key regulatory bodies, which play a crucial role in ensuring that the broker adheres to industry standards and protects traders' interests.

| Regulator | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| CySEC | 202/13 | Cyprus | Verified |

| ASIC | 439907 | Australia | Verified |

Trade360 is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC). These regulators impose strict guidelines on brokers, including maintaining segregated accounts for client funds and ensuring transparency in operations. The presence of these licenses suggests that Trade360 is committed to complying with regulatory standards. However, it is important to note that while the CySEC and ASIC offer a level of protection, the existence of an unregulated entity in the Marshall Islands raises concerns about the overall safety of trading with Trade360. Historical compliance records indicate that while Trade360 has operated under these licenses, the unregulated nature of its offshore entity could expose traders to higher risks.

Company Background Investigation

Trade360 was founded by a group of trading entrepreneurs and technology experts who aimed to democratize trading and provide accessible financial markets. The company is owned by Crowd Tech Ltd., which operates under the regulatory frameworks of Cyprus and Australia. The management team consists of professionals with extensive backgrounds in finance and technology, contributing to the broker's innovative approach to trading.

Despite its positive attributes, Trade360 has faced scrutiny regarding its transparency and information disclosure. While the company provides basic information about its operations and regulatory compliance, there is limited access to detailed insights about its management team and operational practices. This lack of transparency can lead to skepticism among potential traders, emphasizing the need for thorough research before engaging with the broker.

Trading Conditions Analysis

Trade360 offers a range of trading conditions that are generally competitive, but there are notable areas of concern. The broker employs a commission-free structure, with costs primarily embedded in the spreads. However, these spreads can be relatively high compared to industry averages, which may affect profitability for active traders.

| Fee Type | Trade360 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 - 4 pips | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While Trade360 promotes its trading conditions as favorable, the higher spread rates, especially on lower-tier accounts, could present challenges for cost-conscious traders. Additionally, the broker imposes an inactivity fee of $100 after 45 days of no trading activity, which could deter casual traders from maintaining an account. It is crucial for potential users to weigh these costs against their trading strategies and frequency of trading to ensure they align with their financial goals.

Customer Fund Security

Customer fund security is a critical aspect of any trading broker's operations. Trade360 claims to prioritize the safety of client funds by maintaining segregated accounts, which ensures that client deposits are kept separate from the companys operational funds. This practice is essential for protecting traders in the event of insolvency.

Moreover, Trade360 adheres to investor protection schemes, particularly through its CySEC regulation, which provides compensation for eligible clients in case of broker failure. The broker also implements negative balance protection, ensuring that traders cannot lose more than their deposited funds. Despite these measures, there have been historical concerns regarding fund safety, particularly related to the operations of its offshore entity. Therefore, while Trade360 appears to have robust security measures in place, the existence of an unregulated branch necessitates caution.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's reliability and service quality. Reviews of Trade360 reveal a mixed bag of experiences, with some users praising the platform's innovative features and customer support, while others report significant issues.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| High Pressure Sales Tactics | Medium | Unresolved |

| Account Closure Complaints | High | Ignored |

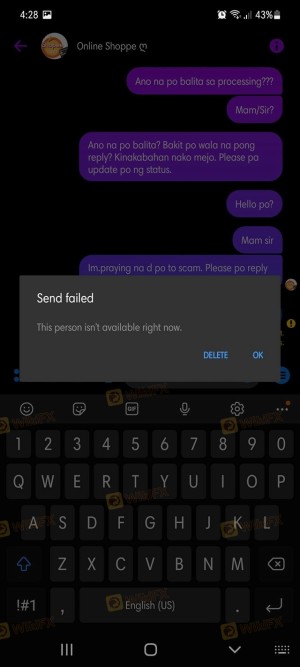

Common complaints include difficulties with the withdrawal process, where users have reported delays and unresponsive customer service. Additionally, some traders have expressed concerns about aggressive sales tactics, suggesting that representatives pressure them to invest more funds. These patterns of behavior can significantly impact the overall trading experience and raise red flags regarding the broker's practices.

Two typical case studies illustrate these points: one user reported a seamless experience with quick withdrawals and responsive support, while another faced prolonged delays in accessing their funds, leading to frustration and loss of trust in the broker. Such disparities highlight the need for potential clients to approach Trade360 with caution and to consider these experiences when making their decisions.

Platform and Trade Execution

Trade360 offers both a proprietary trading platform and access to MetaTrader 5 (MT5), which is well-regarded in the trading community. The proprietary platform incorporates crowd trading features, providing traders with insights based on collective market sentiment. However, the platform's performance and user experience have received mixed reviews.

Traders have reported that the platform is generally stable, but there are instances of slippage during high volatility periods, which can adversely affect trade execution. Additionally, the absence of the popular MetaTrader 4 (MT4) platform may deter some traders who prefer its features and familiarity. Overall, while Trade360's platform offers unique functionalities, it may not meet the expectations of all traders, particularly those accustomed to MT4.

Risk Assessment

Engaging with Trade360 presents a range of risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Presence of unregulated entity raises concerns. |

| Financial Risk | High | High spreads and inactivity fees can impact profitability. |

| Operational Risk | Medium | Mixed reviews on customer service and withdrawal processes. |

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts to familiarize themselves with the platform, and maintain awareness of their trading strategies and risk management practices.

Conclusion and Recommendations

In conclusion, the question of whether Trade360 is safe or a scam is nuanced. On one hand, the broker is regulated by reputable authorities like CySEC and ASIC, which provides a level of legitimacy and protection for traders. On the other hand, the existence of an offshore entity and mixed customer experiences raise valid concerns.

For traders considering Trade360, it is essential to weigh the benefits of its innovative crowd trading platform against the potential risks associated with higher spreads and customer service issues. If you are a novice trader or someone seeking a highly regulated environment, you might want to explore other options, such as brokers with a stronger reputation for customer service and lower trading costs.

In summary, while Trade360 is not outright a scam, potential traders should approach with caution and conduct thorough due diligence. It may be prudent to consider alternative brokers that offer similar services with a more robust track record for customer satisfaction and regulatory compliance.

Is Trade360 a scam, or is it legit?

The latest exposure and evaluation content of Trade360 brokers.

Trade360 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trade360 latest industry rating score is 4.13, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.13 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.