PWM Japan Securities 2025 Review: Everything You Need to Know

Summary

PWM Japan Securities stands as a notable wealth management company. It has carved its niche in the Japanese financial landscape since 1999, building a strong reputation over more than two decades. This pwm japan securities review reveals a firm that specializes in collaborating with independent financial advisors to deliver high-quality asset management services to its clientele. The company's business model centers on prioritizing client needs and maintaining long-term relationships through personalized financial solutions that adapt to changing market conditions.

Two key characteristics distinguish PWM Japan Securities in the market. First, it maintains an extensive network of over 600 registered independent financial advisors, and second, it offers a comprehensive portfolio of investment trust products alongside complex financial instruments. The firm's approach emphasizes client-centric service delivery. It focuses on asset allocation strategies tailored to individual client requirements, ensuring that each investment plan aligns with personal financial goals and risk tolerance.

The primary target audience for PWM Japan Securities consists of high-net-worth individuals and clients seeking professional wealth management services. The company's sophisticated approach to financial planning and investment management makes it particularly suitable for investors who require comprehensive asset management solutions beyond basic trading services.

Important Notice

PWM Japan Securities operates primarily in the Japanese market. Regulatory information was not detailed in available public materials, which means potential clients should research compliance requirements independently. Potential clients should be aware that different regions may have varying regulatory requirements and service offerings. This evaluation is based on available public information and market feedback regarding the company's operations and service delivery across multiple years of operation.

Readers should note that specific terms and conditions, regulatory compliance details, and current service offerings should be verified directly through official channels. The information presented in this review reflects publicly available data and should be supplemented with direct communication with the firm for the most current and comprehensive details.

Rating Framework

Broker Overview

PWM Japan Securities was established in 1999. Since then, it has developed into a prominent wealth management company headquartered in Tokyo, serving clients across Japan's diverse financial markets. The firm has built its reputation on a foundation of client-focused service delivery and strategic partnerships with independent financial advisors. The company's business philosophy revolves around understanding and prioritizing client needs, which has become a major pillar of their operational approach throughout their decades of service.

The company's business model is distinctively centered on collaboration with independent financial advisors. This creates a network that spans across Japan's financial landscape, connecting expertise with client needs effectively. This pwm japan securities review highlights how the firm has positioned itself as a bridge between sophisticated financial products and client needs, ensuring that asset allocation strategies align with long-term client objectives. The company maintains its commitment to building lasting relationships with clients through personalized service delivery that adapts to changing financial circumstances and market conditions.

Regarding trading platforms and specific regulatory oversight, detailed information was not available in the reviewed materials. The company's asset portfolio includes diversified investment trust products, structured bonds, and other complex financial instruments designed to meet varied investment objectives across different risk profiles. While specific regulatory authorities overseeing the firm were not mentioned in available sources, the company operates within Japan's financial services framework.

Regulatory Jurisdiction: Specific regulatory information for PWM Japan Securities was not detailed in available public materials. The company operates within Japan's financial services environment, which suggests compliance with local regulations.

Deposit and Withdrawal Methods: Information regarding specific deposit and withdrawal options was not provided in accessible sources. Potential clients would require direct inquiry with the firm to understand available payment processing methods.

Minimum Deposit Requirements: Minimum deposit thresholds were not specified in available documentation.

Bonus and Promotions: Details about promotional offers or bonus programs were not mentioned in reviewed materials.

Tradeable Assets: PWM Japan Securities offers investment trust products, structured bonds, and various complex financial instruments designed for wealth management purposes. The firm's asset selection focuses on providing diversified investment opportunities suitable for different risk profiles and investment timelines.

Cost Structure: Specific fee schedules and cost structures were not detailed in available public information. Clients would need to obtain this information through direct communication with the firm to understand pricing models.

Leverage Ratios: Leverage information was not specified in accessible materials.

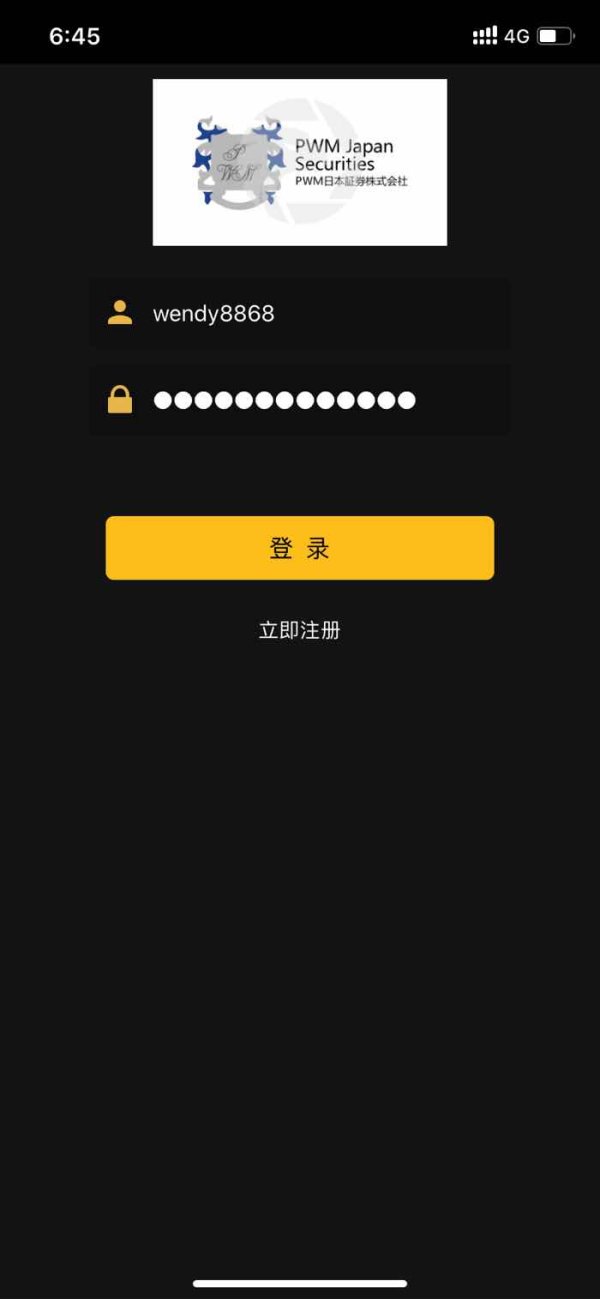

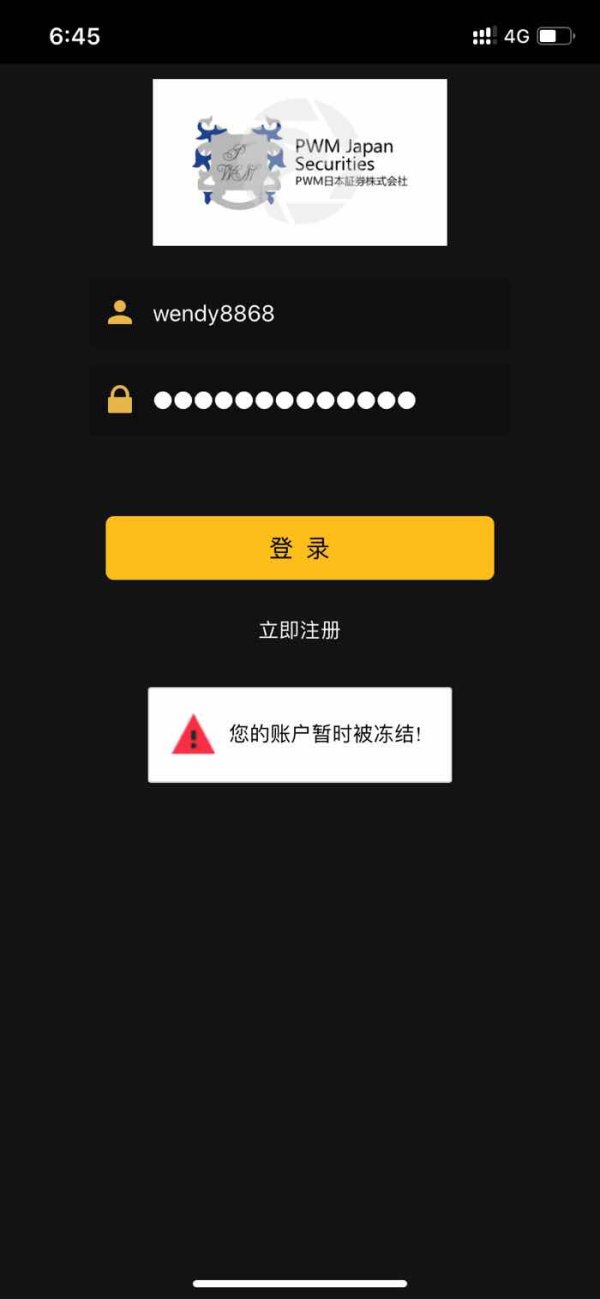

Platform Options: Trading platform details were not mentioned in available sources.

Geographic Restrictions: Regional limitations were not specified in reviewed documentation.

Customer Support Languages: Supported languages for customer service were not detailed in available materials.

This pwm japan securities review notes that many operational details require direct verification with the company for current and comprehensive information.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions for PWM Japan Securities could not be comprehensively evaluated. Limited publicly available information exists regarding specific account types, minimum deposit requirements, and account features that would help potential clients make informed decisions. What is evident from available sources is that the company focuses on wealth management services rather than traditional retail trading accounts. This suggests that their account structures are likely designed for higher-value client relationships with more personalized service offerings.

The firm's business model indicates that account opening processes likely involve consultation with independent financial advisors. This suggests a more personalized approach to account setup compared to standard online trading platforms that offer automated registration processes. However, without specific details about account tiers, Islamic account options, or special account features, a complete assessment cannot be provided. The absence of standardized account information may reflect the company's focus on customized solutions rather than one-size-fits-all account structures.

For potential clients considering PWM Japan Securities, it would be essential to engage directly with the firm or their network of independent financial advisors. Direct communication helps clients understand the specific account conditions, requirements, and features available for their particular financial situation. This pwm japan securities review emphasizes the importance of direct communication with the firm to obtain current account condition details.

The lack of readily available information about account conditions may reflect the company's focus on personalized service delivery. Account terms are likely tailored to individual client needs rather than following standardized retail account structures that are common in the industry.

The evaluation of tools and resources offered by PWM Japan Securities is limited. The absence of detailed information in publicly available materials makes it difficult to assess the full scope of available analytical and educational resources. The company's focus on wealth management through independent financial advisors suggests that their tools and resources are likely oriented toward comprehensive financial planning rather than day-to-day trading tools. This approach typically emphasizes long-term strategic planning over short-term market timing and technical analysis.

Given the firm's emphasis on investment trust products and complex financial instruments, it can be inferred that their resources would include sophisticated analysis tools for asset allocation and portfolio management. However, specific details about research capabilities, educational materials, market analysis tools, or automated trading support were not mentioned in available sources. The wealth management focus suggests that tools are probably designed for professional advisors rather than individual client use.

The company's business model, which prioritizes client needs and maintains long-term relationships, suggests that their tools and resources are likely comprehensive and professionally oriented. The network of over 600 independent financial advisors implies access to substantial analytical and advisory resources, though specific technological tools and platforms were not detailed. This extensive advisor network likely provides clients with access to diverse expertise and specialized knowledge across different investment areas.

For a complete understanding of available tools and resources, potential clients would need to engage directly with PWM Japan Securities or their affiliated advisors. The emphasis on personalized service suggests that tool availability may vary based on client needs and account types.

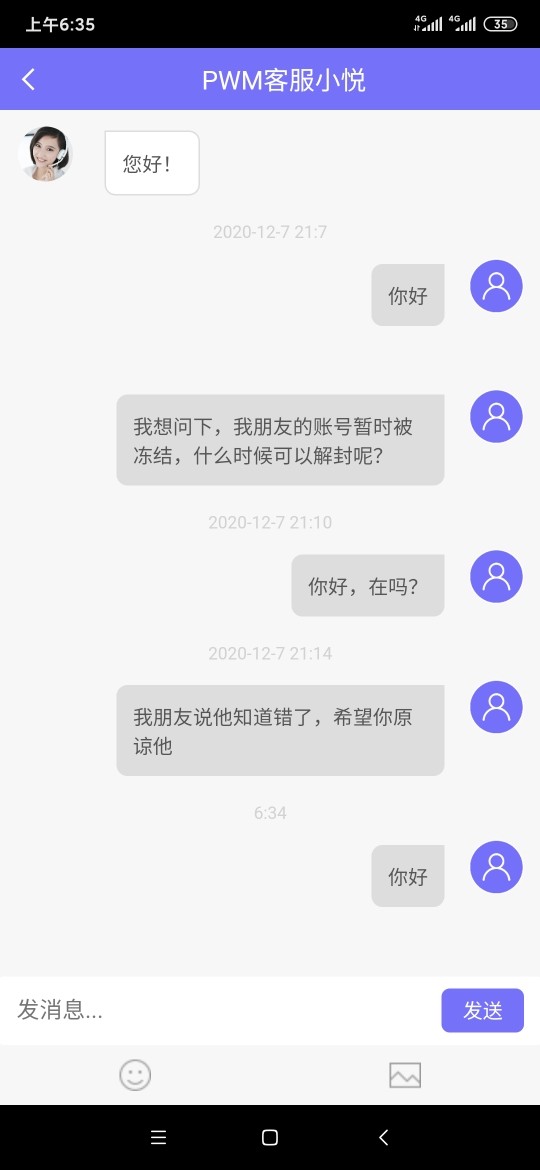

Customer Service and Support Analysis

Customer service and support evaluation for PWM Japan Securities is challenging. Limited specific information exists in available sources about response times, service channels, and support availability across different client segments. However, the company's business model provides some insights into their service approach. The firm's emphasis on working with independent financial advisors suggests a high-touch, personalized service model rather than traditional call center support that focuses on quick transaction processing.

The company's stated commitment to prioritizing client needs and maintaining long-term relationships indicates a service philosophy focused on comprehensive support. This approach emphasizes relationship building rather than transactional interactions that are common in retail trading environments. With over 600 registered independent financial advisors in their network, clients likely have access to dedicated advisory support, though specific response times, service hours, and communication channels were not detailed. The extensive advisor network suggests multiple points of contact for client support.

The wealth management focus of PWM Japan Securities suggests that customer support is likely oriented toward consultation and advisory services. This approach differs from technical trading support that focuses on platform issues and execution problems. This approach typically involves scheduled consultations, regular portfolio reviews, and ongoing financial planning assistance that adapts to changing client circumstances and market conditions.

Without specific information about customer service channels, response times, multilingual support, or service availability, a comprehensive assessment cannot be provided. Potential clients should inquire directly about service levels, communication preferences, and support availability to understand the full scope of customer service offerings.

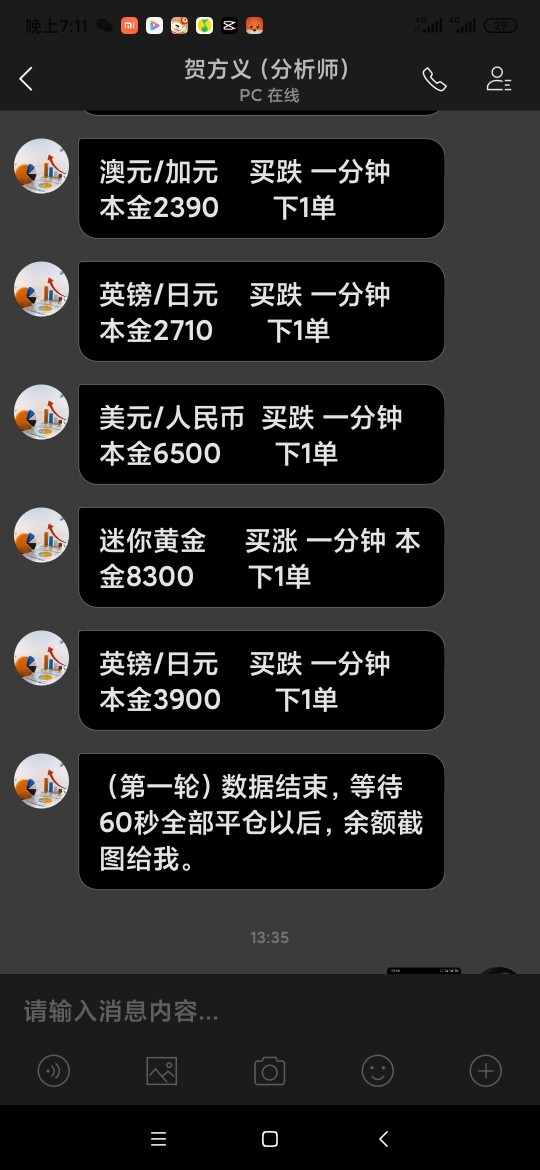

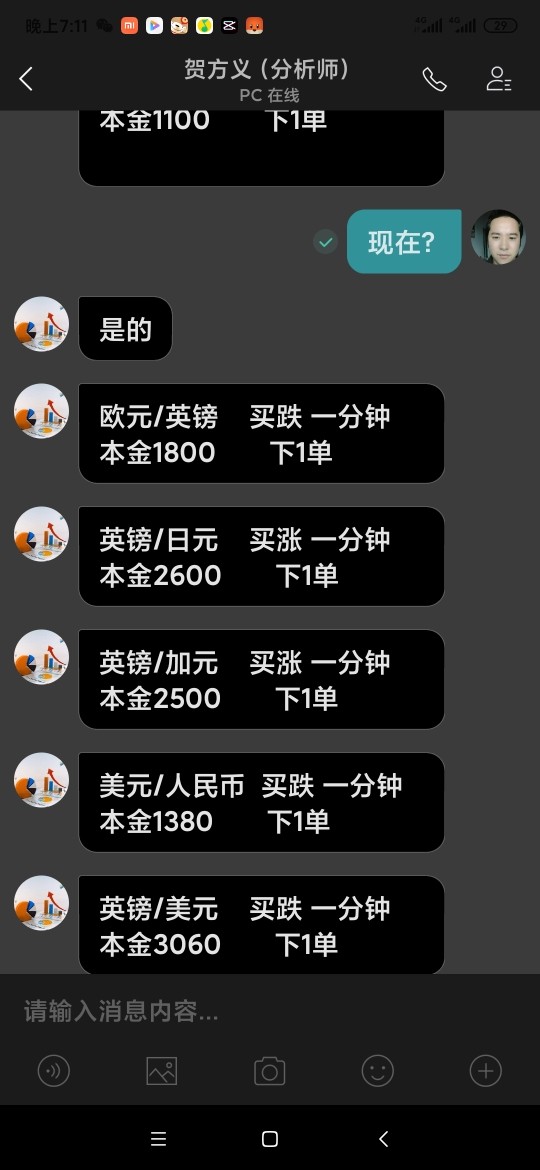

Trading Experience Analysis

The trading experience analysis for PWM Japan Securities is limited. The absence of specific information about trading platforms, execution quality, and technical performance in available materials makes it difficult to evaluate the actual trading environment. The company's focus on wealth management through independent financial advisors suggests that the trading experience is likely integrated into comprehensive portfolio management rather than self-directed trading. This approach emphasizes strategic decision-making over rapid execution and market timing.

Given the firm's emphasis on investment trust products, structured bonds, and complex financial instruments, the trading environment is presumably designed for longer-term investment strategies. This focus differs significantly from active day trading that requires real-time market data and instant execution capabilities. This approach typically involves less frequent transactions but more sophisticated investment vehicles and strategic asset allocation that considers long-term market trends and client objectives.

The company's business model indicates that trading decisions are likely made in consultation with independent financial advisors. This collaborative approach could provide enhanced decision-making support but may not offer the immediate execution capabilities sought by active traders who prefer to make rapid investment decisions. Platform stability, mobile trading options, and order execution speed details were not available in reviewed sources, making it difficult to assess technical performance.

This pwm japan securities review notes that the trading experience appears to be oriented toward wealth management clients. These clients prioritize professional guidance and comprehensive portfolio management over independent trading capabilities that focus on frequent market participation.

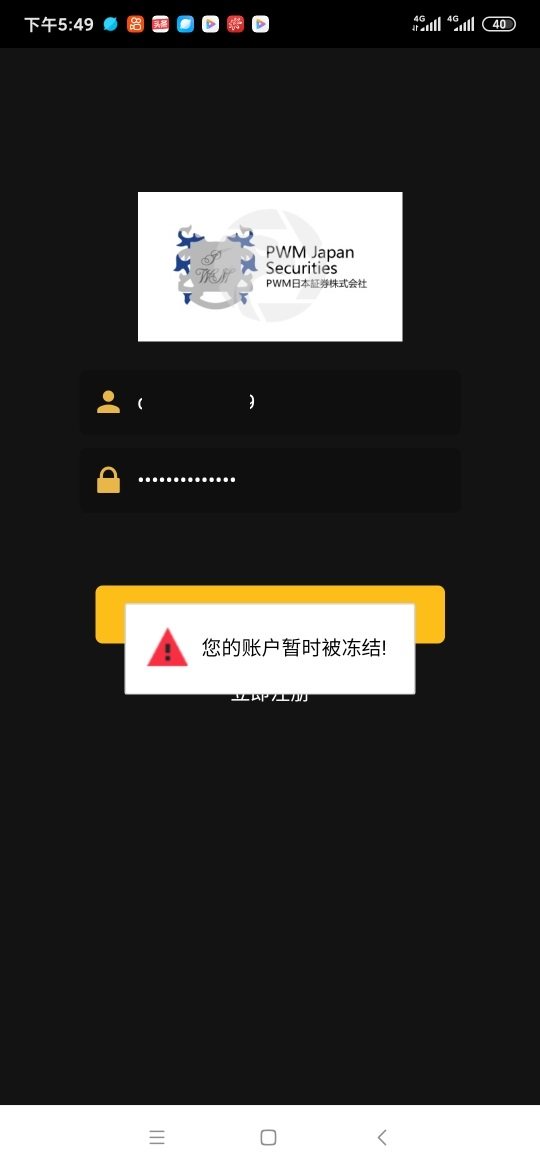

Trust and Reliability Analysis

Evaluating the trust and reliability of PWM Japan Securities presents challenges. Limited publicly available information exists about regulatory oversight, compliance measures, and security protocols that would help assess the firm's operational integrity. The company's establishment in 1999 indicates longevity in the Japanese financial services market, which suggests some level of operational stability and market acceptance. This track record of over two decades in business demonstrates the ability to navigate various market conditions and regulatory changes.

The firm's business model, centered on working with independent financial advisors and focusing on client needs, implies a commitment to professional standards and ethical practices. However, specific regulatory licenses, oversight authorities, and compliance certifications were not detailed in available sources, making a comprehensive trust assessment difficult. The emphasis on long-term client relationships suggests a business approach that prioritizes reputation and client satisfaction over short-term profits.

The company's focus on wealth management and complex financial products suggests operation within regulated frameworks. Different regulatory requirements apply to firms offering sophisticated investment products compared to basic trading services. The network of over 600 independent financial advisors implies some level of professional oversight and standards, though details about advisor qualifications and regulatory status were not provided. This extensive network suggests established relationships within Japan's financial services industry.

Without specific information about fund segregation, insurance coverage, regulatory compliance, or independent audits, potential clients should conduct direct due diligence. The absence of readily available regulatory information may reflect different disclosure practices in the Japanese market or the firm's focus on institutional and high-net-worth clients.

User Experience Analysis

The user experience analysis for PWM Japan Securities is constrained by limited information. Available sources provide insufficient details about interface design, digital platforms, and client interaction processes that would help evaluate the overall client experience. The company's wealth management focus suggests that user experience is likely centered around consultation and advisory relationships rather than self-service digital platforms. This approach emphasizes human interaction over automated processes and digital convenience features.

The firm's business model emphasizes personalized service through independent financial advisors. This indicates that user experience is probably relationship-driven rather than technology-driven, focusing on personal connections and customized service delivery. This approach typically involves scheduled meetings, regular reviews, and customized reporting rather than real-time trading interfaces or mobile applications. The emphasis on personal relationships may appeal to clients who prefer human interaction over digital self-service options.

The company's commitment to prioritizing client needs suggests attention to user satisfaction. However, specific metrics about client satisfaction, interface usability, or digital experience were not available in reviewed materials. The registration and verification processes, account management procedures, and ongoing client interaction methods were not detailed in reviewed materials, making it difficult to assess the practical aspects of client onboarding and ongoing service delivery.

Given the wealth management focus, user experience likely emphasizes comprehensive service delivery, professional consultation, and long-term relationship management. This differs from immediate transaction capabilities or self-service features that are common in retail trading platforms. Potential clients seeking to understand the user experience should engage directly with the firm to evaluate service delivery methods, communication processes, and client interaction approaches.

Conclusion

This pwm japan securities review reveals a wealth management firm with a distinctive business model. The firm focuses on client-centric service delivery through independent financial advisors, creating a personalized approach to investment management. While PWM Japan Securities demonstrates strengths in professional wealth management services and maintains an extensive advisor network, the evaluation is limited by insufficient publicly available information about operational details, regulatory oversight, and specific service terms.

The firm appears most suitable for high-net-worth individuals and investors seeking comprehensive wealth management services. It is less appropriate for clients who prefer self-directed trading capabilities and immediate market access. The emphasis on personalized consultation and long-term relationship building makes it appropriate for clients who value professional guidance and sophisticated investment strategies.

Key advantages include the extensive network of independent financial advisors and focus on client needs prioritization. However, potential limitations include limited transparency in publicly available information and unclear regulatory disclosure that may concern some prospective clients. Prospective clients should conduct direct due diligence to obtain comprehensive details about services, terms, and regulatory compliance before engagement.