Is APTS safe?

Pros

Cons

Is APTS Safe or Scam?

Introduction

APTS is an online forex broker that claims to offer trading services in various financial markets. It positions itself as a platform catering to both novice and experienced traders, providing them with tools and resources to navigate the complex world of forex trading. However, the forex market is notoriously rife with scams, and traders must exercise due diligence when evaluating brokers. The significance of assessing a broker's credibility cannot be overstated, as it directly impacts the safety of traders' funds and the integrity of their trading experience. This article aims to investigate whether APTS is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and reliability. APTS claims to operate under specific licenses, but a closer look reveals several red flags. The broker's license from the Australian Securities and Investments Commission (ASIC) has been revoked, and it is not authorized by the National Futures Association (NFA). This lack of valid regulation raises significant concerns about the safety of trading with APTS.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001278812 | Australia | Revoked |

| NFA | 0527825 | USA | Unauthorized |

The revocation of the ASIC license indicates that APTS previously failed to comply with regulatory requirements, which is a serious warning sign for potential traders. The absence of oversight from reputable regulatory bodies means that traders may not have any recourse in the event of disputes or issues with withdrawals. Therefore, when assessing whether APTS is safe, the regulatory landscape paints a concerning picture.

Company Background Investigation

APTS was founded with the intention of catering to online traders, but its operational history is murky at best. The company is registered in Saint Vincent and the Grenadines, a location often associated with less stringent regulatory oversight. This raises questions about the legitimacy of its operations and the motivations behind its establishment.

The management team behind APTS lacks transparency, and information regarding their qualifications and experience is scarce. A reputable broker typically provides details about its leadership, including their backgrounds in finance and trading. The absence of such information can lead to skepticism among potential clients regarding the broker's credibility and intentions.

Moreover, APTS's website is currently non-functional, which further complicates the ability to gather reliable information about the company's operations and history. In the context of assessing whether APTS is safe, the lack of transparency and information disclosure is concerning and suggests potential risks for traders.

Trading Conditions Analysis

Understanding the trading conditions offered by APTS is critical for evaluating its safety. The broker claims to provide competitive trading fees and conditions, but a deeper analysis reveals potential issues. The fee structure is not clearly outlined, and there are indications of unusual or hidden costs that could catch traders off guard.

| Fee Type | APTS | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1-2 pips |

| Commission Model | Unspecified | 0-0.5% |

| Overnight Interest Range | Unspecified | Varies |

The lack of specific information regarding spreads and commissions is troubling. Transparent brokers typically provide clear details about their fee structures, allowing traders to make informed decisions. The absence of such information raises concerns about the potential for unexpected charges, which could significantly impact trading profitability.

Additionally, APTS has been reported to impose withdrawal restrictions that may be excessive or unreasonable. Such practices are often indicative of a broker that prioritizes its financial interests over those of its clients. Therefore, when considering whether APTS is safe, the unclear trading conditions and potential hidden fees warrant caution.

Customer Funds Security

The security of customer funds is paramount in the forex trading environment. APTS claims to implement various measures to protect client funds, but the specifics of these measures are not readily available. The absence of detailed information regarding fund segregation, investor protection, and negative balance protection raises concerns about the safety of traders' capital.

Traders should expect brokers to maintain segregated accounts, ensuring that client funds are kept separate from the broker's operating capital. This practice protects traders in the event of the broker's insolvency. Additionally, effective investor protection schemes can provide an added layer of security for traders. However, with APTS lacking clear information on these practices, the risk associated with trading with this broker increases.

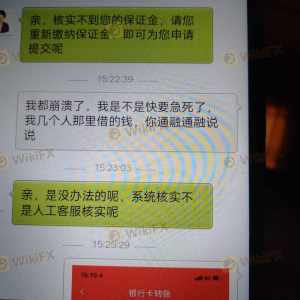

Furthermore, historical complaints about withdrawal issues and fund access further exacerbate concerns about the security of customer funds. Reports of clients being unable to withdraw their money or facing unreasonable conditions for withdrawals are significant red flags. In assessing whether APTS is safe, the lack of transparency regarding fund security measures and the presence of withdrawal complaints raise serious doubts.

Customer Experience and Complaints

Analyzing customer feedback and experiences is essential for assessing the overall reputation of APTS. Unfortunately, the feedback surrounding this broker has been predominantly negative, with numerous complaints surfacing on various platforms. Common issues reported by users include difficulties with withdrawals, poor customer service, and lack of responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Customer Service Quality | Medium | Poor |

| Transparency Concerns | High | Unaddressed |

Several users have reported being unable to access their funds after making withdrawal requests, with some even alleging that they were asked to pay additional fees before their withdrawals could be processed. Such practices are often associated with fraudulent brokers and raise serious questions about whether APTS is safe for trading.

Moreover, the company's response to these complaints has been largely inadequate, with many users citing a lack of communication and support from APTS. A reputable broker should prioritize customer service and address complaints promptly and effectively. The failure to do so further diminishes the trustworthiness of APTS.

Platform and Execution

The trading platform offered by APTS is another critical aspect to consider when evaluating its safety. A reliable broker typically provides a stable and user-friendly trading environment, but reports suggest that APTS's platform may fall short in this regard. Users have reported issues with platform stability, order execution delays, and high slippage rates.

These factors can significantly affect trading outcomes, particularly for those engaged in high-frequency trading or scalping strategies. If a broker's platform is prone to glitches or delays, it can lead to missed opportunities and financial losses. Furthermore, any signs of potential manipulation or unfair practices in order execution should raise immediate concerns for traders.

In the context of determining whether APTS is safe, the platform's performance and execution quality are critical indicators. The presence of execution issues and negative user experiences suggest that traders may face challenges that could jeopardize their trading success.

Risk Assessment

In evaluating the overall risk associated with trading with APTS, several key factors must be considered. The lack of regulation, negative customer feedback, and concerns regarding fund security all contribute to a heightened risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulation |

| Customer Fund Security | High | Lack of transparency |

| Customer Service Quality | Medium | Poor response rates |

Given the high-risk indicators associated with APTS, traders should proceed with caution. It is advisable to consider alternative, well-regulated brokers that offer greater transparency and a more favorable trading environment.

Conclusion and Recommendations

In conclusion, the investigation into APTS raises significant concerns regarding its safety and legitimacy. The absence of valid regulation, combined with negative customer experiences and unclear trading conditions, suggests that APTS may not be a trustworthy broker. Traders should be particularly wary of the potential for withdrawal issues and lack of support.

For those seeking a reliable trading experience, it is recommended to explore alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers with transparent fee structures, responsive customer service, and robust security measures will provide a safer trading environment. Ultimately, the question of whether APTS is safe leans towards a cautionary stance, advising traders to consider their options carefully before engaging with this broker.

Is APTS a scam, or is it legit?

The latest exposure and evaluation content of APTS brokers.

APTS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

APTS latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.