Regarding the legitimacy of Liquid Brokers forex brokers, it provides ASIC and WikiBit, .

Is Liquid Brokers safe?

Rating Index

Pros

Cons

Is Liquid Brokers markets regulated?

The regulatory license is the strongest proof.

ASIC Appointed Representative(AR)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Appointed Representative(AR)

Licensed Entity:

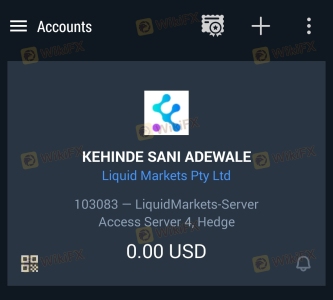

Liquid Markets Pty Ltd

Effective Date:

2023-03-09Email Address of Licensed Institution:

--53748:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1601 2015 Gold Coast Hwy Miami QLD 4220 AustraliaPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is LiquidBrokers Safe or Scam?

Introduction

LiquidBrokers is an online forex and cryptocurrency broker that has emerged in the competitive landscape of trading platforms. Established in Australia and regulated by the Australian Securities and Investments Commission (ASIC), LiquidBrokers aims to provide a reliable trading environment for both novice and experienced traders. However, with the increasing number of scams in the forex market, it is essential for traders to carefully evaluate the credibility of any broker they choose to engage with. This article aims to investigate whether LiquidBrokers is a safe platform or a potential scam by analyzing its regulatory status, company background, trading conditions, customer safety measures, and user feedback.

To conduct this evaluation, we will utilize a comprehensive framework that includes regulatory legitimacy, company history, trading conditions, customer fund safety, and user experiences. This structured approach will help us provide a balanced view of LiquidBrokers and answer the critical question: Is LiquidBrokers safe?

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial in determining its legitimacy. LiquidBrokers is regulated by ASIC, a well-respected regulatory body known for its strict oversight of financial services in Australia. Regulation by ASIC requires brokers to adhere to high standards of operation, including maintaining adequate capital reserves and ensuring the protection of client funds.

Here is a summary of LiquidBrokers' regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001302232 | Australia | Verified |

ASIC's regulatory framework is designed to protect traders by enforcing compliance and transparency. The broker's history of compliance with these regulations enhances its credibility. However, it is important to note that while regulation reduces risks, it does not eliminate them entirely. Therefore, traders should always exercise caution and conduct their own research.

Company Background Investigation

LiquidBrokers was founded with the intent to provide a robust trading platform for forex and cryptocurrency traders. The company is owned by Liquid Markets Pty Ltd, which has a clear operational structure and is based in Baringa, Australia. The management team comprises professionals with extensive backgrounds in finance and technology, which adds to the broker's credibility.

The company has undergone significant development since its inception, expanding its services to include various trading instruments and platforms. However, the transparency of its operations and the level of information disclosed to the public are crucial factors that traders should consider. LiquidBrokers maintains a user-friendly website that provides essential information about its services, but further details regarding its ownership structure and management team could enhance trust.

Trading Conditions Analysis

When evaluating a broker's safety, understanding its trading conditions is vital. LiquidBrokers offers a competitive fee structure, aiming to attract traders with low spreads and various account types. However, it is essential to scrutinize any unusual fees that may not be immediately apparent.

Here is a comparison of core trading costs:

| Fee Type | LiquidBrokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | From $3.5 per lot | From $5 per lot |

| Overnight Interest Range | Variable | Variable |

The low spreads offered by LiquidBrokers are competitive within the industry, but traders should be aware of the commission structure, which can vary significantly based on account types. It is advisable for traders to read the fine print regarding fees to avoid unexpected charges.

Customer Fund Safety

The safety of customer funds is paramount when assessing whether LiquidBrokers is safe. LiquidBrokers implements several measures to protect client funds, including segregating client accounts from the companys operational funds. This practice ensures that even in the event of insolvency, client funds remain secure.

Additionally, LiquidBrokers offers negative balance protection, which prevents traders from losing more than their initial investment. This is a significant safeguard, especially in the volatile forex and cryptocurrency markets. However, there have been no documented incidents of fund mismanagement or security breaches, which further supports the broker's claim of maintaining a secure trading environment.

Customer Experience and Complaints

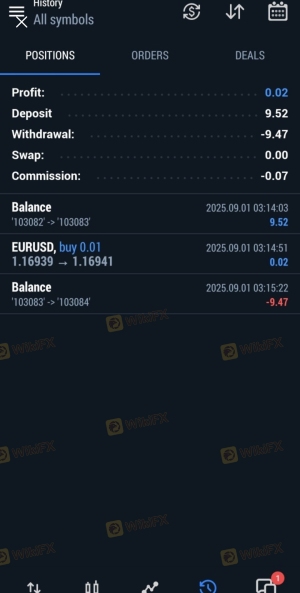

Understanding user feedback is essential in evaluating the overall reliability of a broker. Reviews for LiquidBrokers indicate a mixed experience among traders. While some users praise the platform for its low fees and user-friendly interface, others have raised concerns regarding customer support and withdrawal processes.

Here is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Customer Support Issues | Medium | Average response time |

| Platform Stability | Low | Generally stable |

Typical user experiences reveal that while the trading platform is generally stable, some traders have reported delays in fund withdrawals, raising questions about the broker's operational efficiency. Addressing these issues promptly is crucial for maintaining trader trust.

Platform and Trade Execution

The performance of the trading platform is another critical factor in assessing the safety of LiquidBrokers. The platform is designed for both novice and experienced traders, offering a range of tools and features to facilitate trading. Users have reported a generally positive experience with the platform's stability and execution speed.

However, concerns about slippage and order rejections have been noted by some users. These issues can significantly impact trading outcomes, especially in fast-moving markets. Therefore, it is essential for traders to monitor their execution quality closely.

Risk Assessment

Using LiquidBrokers comes with inherent risks, as is the case with any trading platform. While regulatory oversight and safety measures are in place, traders should be aware of potential risks associated with trading forex and cryptocurrencies.

Here is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Subject to changes in regulations |

| Operational Risk | Medium | Possible issues with withdrawals |

| Market Risk | High | High volatility in forex and crypto |

To mitigate these risks, traders should only invest what they can afford to lose and utilize risk management tools such as stop-loss orders.

Conclusion and Recommendations

In conclusion, the evidence suggests that LiquidBrokers is generally safe for trading, supported by its regulatory status and customer fund protection measures. However, potential traders should remain vigilant regarding the complaints and operational challenges reported by some users.

For traders looking for a reliable platform, LiquidBrokers offers a competitive trading environment but may not be the best fit for everyone. New traders, in particular, should consider starting with a demo account or a smaller investment to gauge their experience before committing significant capital.

If concerns persist regarding LiquidBrokers, traders may want to explore alternative brokers with strong regulatory oversight and positive user feedback, such as eToro or IG Markets, which are known for their reliability and customer service.

Is Liquid Brokers a scam, or is it legit?

The latest exposure and evaluation content of Liquid Brokers brokers.

Liquid Brokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Liquid Brokers latest industry rating score is 8.15, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.15 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.