JFX 2025 Review: Everything You Need to Know

Executive Summary

This jfx review gives you a complete look at JFX, a Cyprus-based forex broker that ran from 2011 until it closed. JFX once offered good features like very tight spreads and multiple trading platforms, but its closed status now hurts its overall rating. The broker had rules from several European authorities including CySEC, FSA, CNMV, BaFin, and ACP, and it worked under the European Union's MiFID directive.

JFX's main features included ECN accounts with very tight spreads and access to both MetaTrader 4 and their own JFX Trader platform. The broker mainly went after experienced forex traders who wanted low-cost trading options. However, the lack of full information about account conditions, customer service quality, and the broker's current closed status creates big concerns for potential users. This review tries to give a fair assessment based on available information while pointing out the problems caused by the broker's closed operations.

Important Notice

Regional Entity Differences: JFX worked under multiple rule frameworks across European areas, including oversight from CySEC in Cyprus and FSA regulations. Users should know that different regional entities may have different legal effects and service availability depending on their location and the applicable regulatory environment.

Review Methodology: This evaluation uses available historical information and market feedback from the period when JFX was working. It should be noted that user ratings and full user reviews are not included in this assessment due to limited available data and the broker's current inactive status.

Rating Framework

Broker Overview

JFX started in 2011 as a forex brokerage firm with its main office in Limassol, Cyprus. The company worked as a European Union-regulated entity, following the Markets in Financial Instruments Directive (MiFID) framework. During its working period, JFX positioned itself as a provider of competitive trading conditions, particularly focusing on offering tight spreads through ECN account structures and multiple platform options for forex trading.

The broker's business model centered around giving access to the foreign exchange markets through both the popular MetaTrader 4 platform and their own JFX Trader system. This jfx review shows that the company kept regulatory compliance across multiple European areas, including authorizations from CySEC, FSA, CNMV, BaFin, and ACP. However, the broker's current closed status significantly impacts its accessibility and ongoing service provision, making it unavailable for new client acquisition or continued trading operations.

Regulatory Jurisdictions: JFX kept regulatory oversight from multiple European financial authorities, including the Cyprus Securities and Exchange Commission (CySEC), Financial Services Authority (FSA), Spain's CNMV, Germany's BaFin, and Portugal's ACP, ensuring compliance across various EU markets.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available resources, limiting our ability to assess the convenience and variety of funding options previously offered by the broker.

Minimum Deposit Requirements: The minimum deposit amounts for different account types are not specified in available documentation, making it difficult to evaluate the accessibility of the broker's services for traders with varying capital levels.

Bonus and Promotional Offers: Information about promotional offers, welcome bonuses, or ongoing incentive programs is not mentioned in available materials, suggesting either limited promotional activities or insufficient documentation.

Tradable Assets: JFX focused only on forex trading, providing access to major, minor, and exotic currency pairs without diversification into other asset classes such as commodities, indices, or cryptocurrencies.

Cost Structure: The broker emphasized very tight spreads, particularly for ECN account holders, positioning itself competitively in terms of trading costs. However, specific commission structures and additional fees are not detailed in available information.

Leverage Options: Specific leverage ratios and margin requirements are not mentioned in accessible documentation, limiting our assessment of the broker's risk management parameters and trading flexibility.

Platform Selection: JFX offered two primary trading platforms: the industry-standard MetaTrader 4 and their own JFX Trader platform, providing clients with both familiar and specialized trading environments.

Geographic Restrictions: Specific information about geographic limitations or restricted territories is not available in current documentation.

Customer Service Languages: The range of languages supported by customer service representatives is not specified in available materials.

This jfx review highlights the significant information gaps that exist due to the broker's closed status and limited available documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions evaluation for JFX shows significant limitations mainly coming from the broker's closed status and not enough available information. While the broker previously offered ECN accounts, which typically provide direct market access and competitive pricing, the lack of detailed information about account types, minimum deposit requirements, and specific account features severely hurts a comprehensive assessment.

The absence of clear information about account opening procedures, verification requirements, and special account features such as Islamic accounts creates uncertainty for potential users. Additionally, the broker's inactive status means that even if favorable account conditions existed historically, they are no longer accessible to new clients. The limited documentation available suggests that while JFX may have offered competitive account structures during its operational period, the current unavailability and lack of transparency significantly impact the overall account conditions rating.

This jfx review emphasizes that without active operations and comprehensive account information, the practical value of any previously favorable account conditions is effectively nullified for prospective traders.

JFX's tools and resources offering showed moderate capability through its dual-platform approach, providing both MetaTrader 4 and the proprietary JFX Trader platform. MetaTrader 4, being an industry standard, offered clients access to comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors. The inclusion of a proprietary platform suggested the broker's commitment to providing specialized trading solutions tailored to specific client needs.

However, the evaluation is limited by the absence of detailed information about additional research and analysis resources, educational materials, or advanced trading tools beyond the basic platform offerings. The lack of information about market analysis, economic calendars, trading signals, or educational resources suggests either limited provision of such services or insufficient documentation of these features.

The moderate rating reflects the solid foundation provided by MetaTrader 4's comprehensive toolset, balanced against the uncertainty surrounding additional resources and the current inaccessibility of these tools due to the broker's closed status.

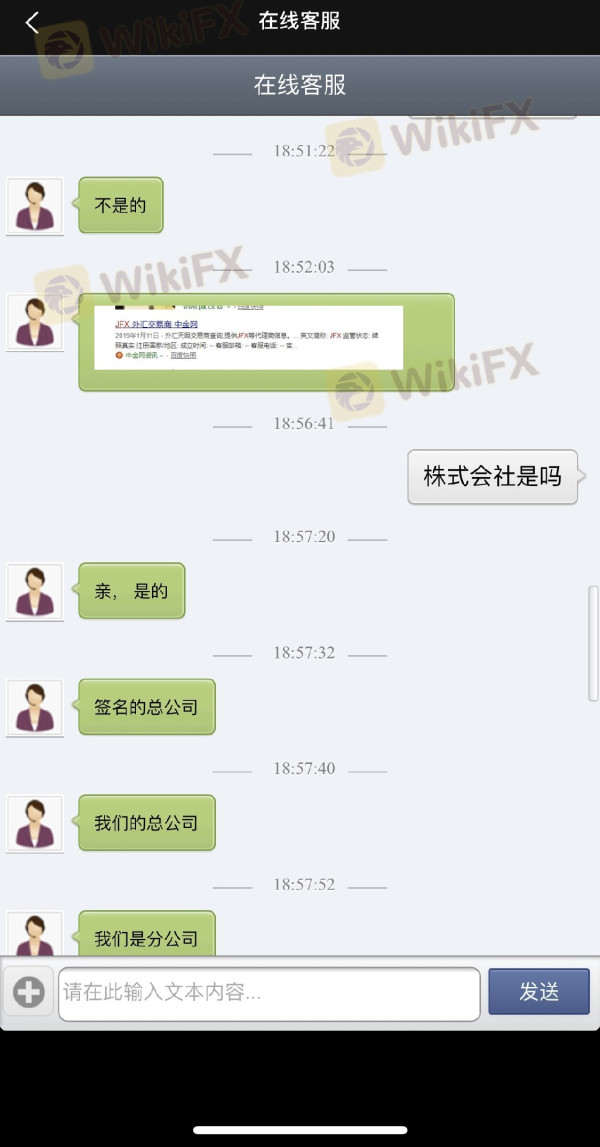

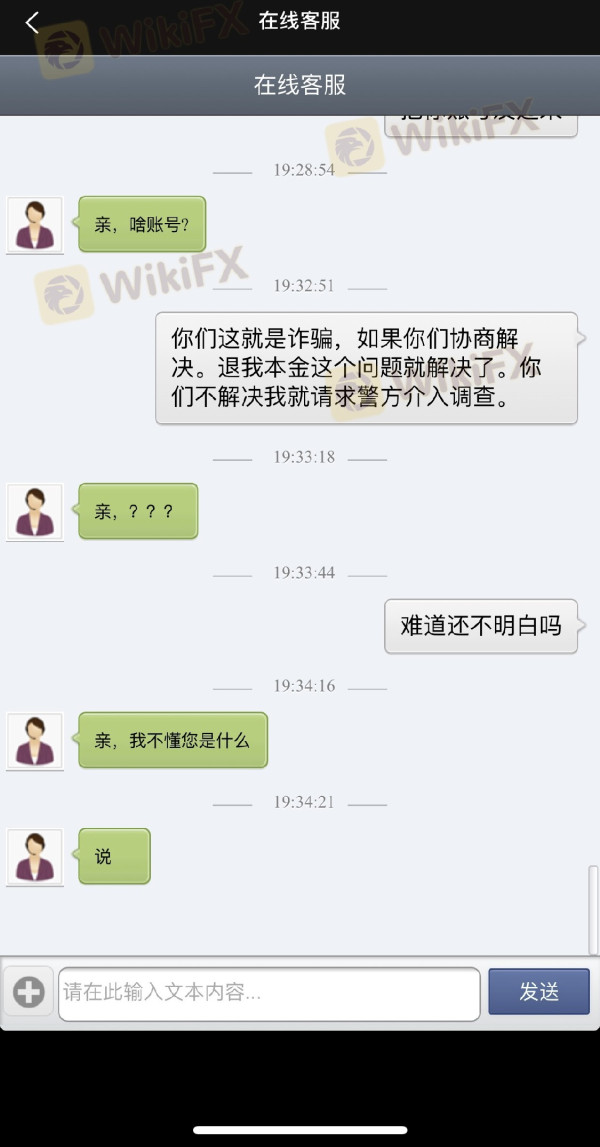

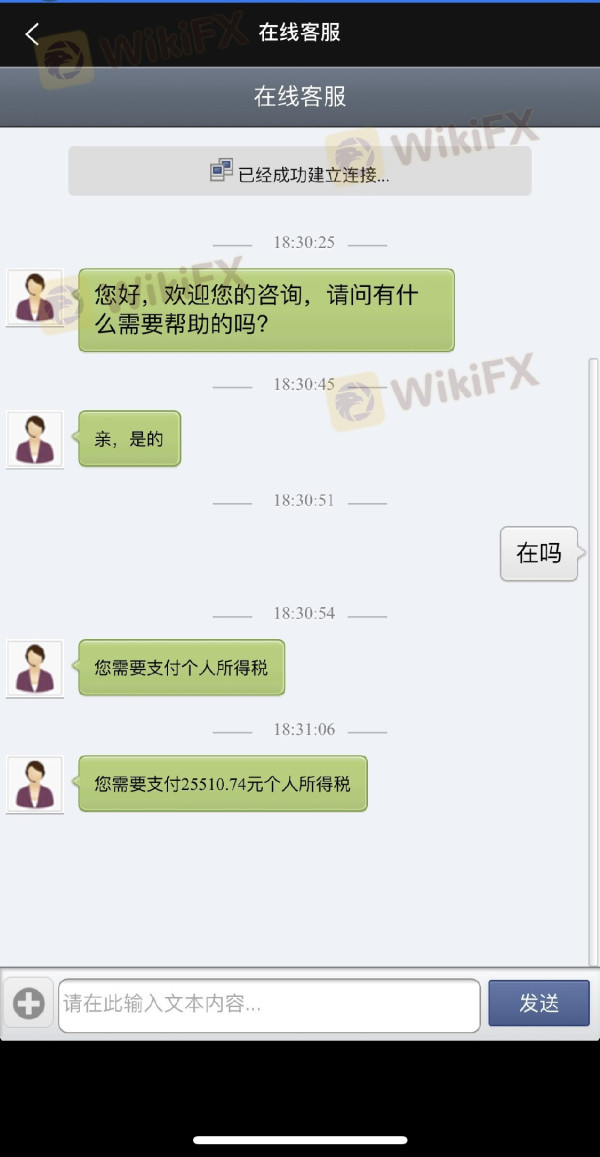

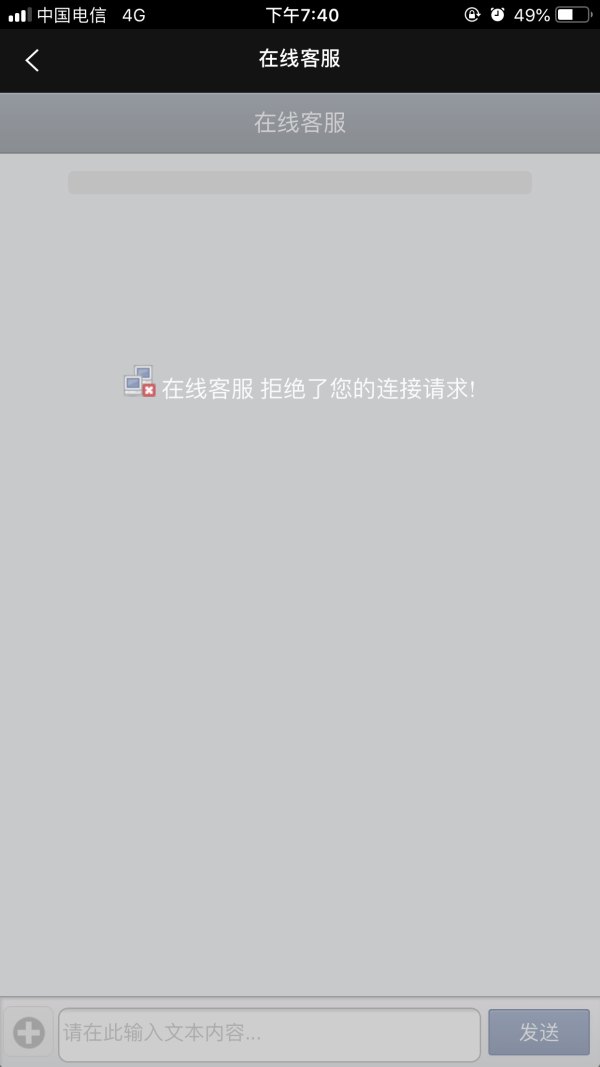

Customer Service and Support Analysis (Score: 3/10)

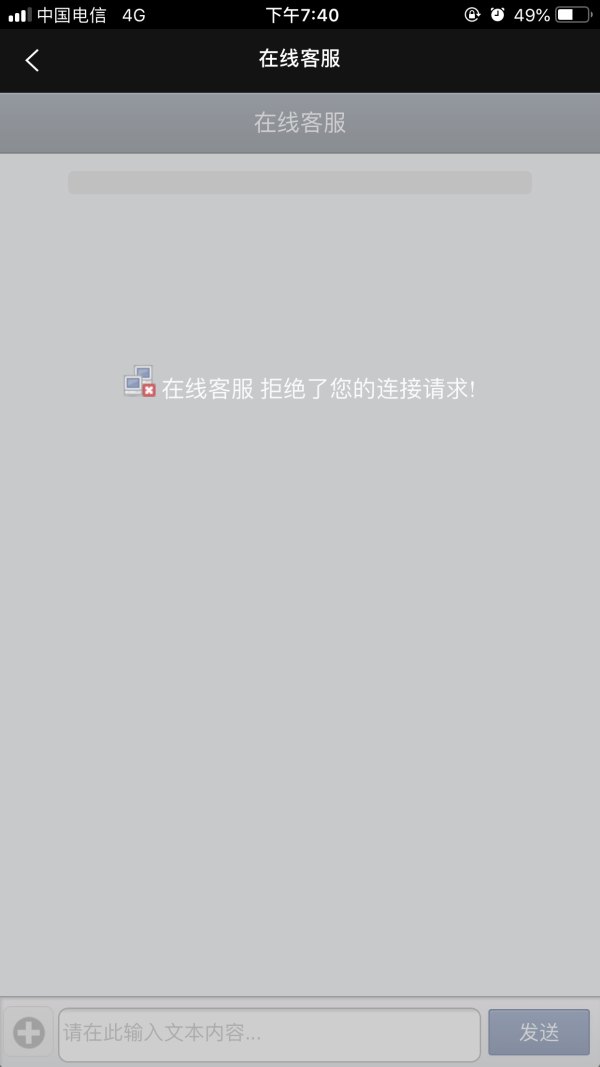

The customer service and support evaluation for JFX faces significant challenges due to the complete absence of specific information about service channels, availability, response times, and service quality. Without details about customer support mechanisms such as live chat, telephone support, email assistance, or help desk operations, it becomes impossible to assess the effectiveness of client service provision.

The lack of information about multilingual support capabilities, operating hours, or regional support variations further complicates the evaluation. Additionally, no user feedback or testimonials regarding customer service experiences are available in the accessible documentation, preventing any assessment based on client satisfaction or service quality metrics.

The low rating mainly reflects the unavailability of customer service due to the broker's closed status, combined with the absence of historical information that could provide insights into previous service quality. For any financial services provider, customer support represents a critical component of service delivery, and the complete lack of information in this area significantly impacts the overall evaluation.

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation for JFX presents a mixed assessment based on limited available information. The broker's offering of both market execution and instant execution options suggests flexibility in order processing methods, potentially accommodating different trading strategies and preferences. The emphasis on very tight spreads, particularly for ECN accounts, indicates a focus on providing competitive trading conditions that could enhance the overall trading experience.

The availability of MetaTrader 4 provides traders with a familiar and robust trading environment, including advanced charting capabilities, technical analysis tools, and automated trading support. However, the assessment is constrained by the absence of specific information about platform stability, execution speeds, slippage rates, or mobile trading capabilities.

This jfx review notes that while the fundamental elements for a decent trading experience appeared to be in place, including competitive spreads and professional platforms, the lack of detailed performance metrics and current inaccessibility significantly limit the practical relevance of these features for prospective traders.

Trustworthiness Analysis (Score: 2/10)

The trustworthiness evaluation of JFX reveals significant concerns mainly related to the broker's current closed status, which fundamentally undermines client confidence and operational reliability. While the broker maintained regulatory oversight from multiple respected European authorities including CySEC, FSA, CNMV, BaFin, and ACP during its operational period, the absence of specific license numbers or detailed regulatory compliance information limits verification of these claims.

The closed status of the broker raises immediate questions about client fund protection, withdrawal processing, and overall business continuity. Without information about fund segregation practices, deposit protection schemes, or bankruptcy procedures, clients face uncertainty regarding asset security. The lack of transparency about the circumstances surrounding the broker's closure further compounds trustworthiness concerns.

Additionally, the absence of third-party evaluations, industry recognition, or detailed corporate governance information prevents a comprehensive assessment of the company's historical reliability and professional standing within the forex industry.

User Experience Analysis (Score: 2/10)

The user experience evaluation for JFX is severely limited by the complete absence of user feedback, satisfaction surveys, or detailed interface assessments in available documentation. Without access to client testimonials, user reviews, or satisfaction metrics, it becomes impossible to gauge the actual user experience during the broker's operational period.

The lack of information about website functionality, account management interfaces, registration processes, and fund management procedures prevents any meaningful assessment of user-facing services. Additionally, the absence of details about mobile accessibility, platform responsiveness, or user interface design limits the evaluation of overall user experience quality.

The poor rating mainly reflects the current inaccessibility of services due to the broker's closed status, combined with the complete lack of user experience data that could provide insights into historical service quality and client satisfaction levels.

Conclusion

This comprehensive jfx review reveals a broker that, while potentially offering competitive features during its operational period, now presents significant limitations due to its closed status. JFX's historical strengths included very tight spreads, particularly for ECN accounts, and the provision of both MetaTrader 4 and proprietary trading platforms. However, these advantages are effectively nullified by the broker's current unavailability and the substantial information gaps that prevent a thorough evaluation.

The broker is not recommended for any traders, whether novice or experienced, due to its inactive status and the inability to access services. The primary advantages of competitive spreads and platform variety are overshadowed by the critical disadvantages of business closure, limited transparency, and unavailable customer support. Prospective traders should seek active, well-documented brokers with transparent operations and comprehensive service information.