Regarding the legitimacy of JFX forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is JFX safe?

Pros

Cons

Is JFX markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

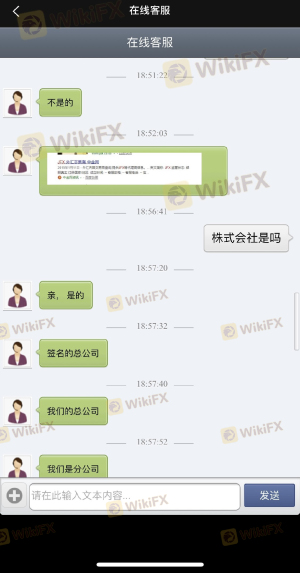

JFX株式会社

Effective Date:

2007-09-30Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

東京都中央区新富1-12-7Phone Number of Licensed Institution:

03-5541-6401Licensed Institution Certified Documents:

Is JFX Safe or Scam?

Introduction

JFX, a forex broker based in Japan, has established itself in the competitive landscape of the foreign exchange market since its inception in 2007. As a platform that facilitates trading in various currency pairs, JFX appeals to both novice and experienced traders. However, the forex market is fraught with risks, and it is crucial for traders to thoroughly evaluate the credibility and reliability of brokers before committing their funds. This article aims to provide an objective analysis of JFX, focusing on its regulatory compliance, operational history, trading conditions, and customer experiences. The investigation is based on a comprehensive review of various sources, including user feedback, regulatory information, and industry assessments.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of a broker's credibility. JFX is regulated by the Financial Services Agency (FSA) in Japan, which is a recognized authority in the financial sector. Regulatory bodies play a crucial role in ensuring that brokers adhere to strict operational guidelines, thereby safeguarding investors' interests.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Agency (FSA) | Kanto Finance Bureau Director (No. 238) | Japan | Verified |

The significance of JFX being regulated by the FSA cannot be understated. This regulation implies that JFX is subject to regular audits and must comply with stringent financial standards, such as maintaining client funds in segregated accounts and ensuring transparency in its operations. Notably, during the evaluation period, there were no negative disclosures reported against JFX, indicating a history of compliance. However, potential investors should remain vigilant, as not all regulatory bodies enforce the same level of scrutiny, and some brokers may exploit loopholes.

Company Background Investigation

JFX Corporation, established in 2007, has a relatively short yet significant history in the forex market. The company was founded with the aim of providing innovative trading solutions and has since expanded its offerings to include a variety of trading instruments. The ownership structure of JFX appears to be straightforward, with no indications of complex ownership arrangements that might obscure accountability.

The management team at JFX comprises experienced professionals with backgrounds in finance and trading, which enhances the broker's credibility. However, the level of transparency regarding the company's operations and financial health could be improved, as there is limited publicly available information about the company's financial standing or any awards received.

Overall, while JFX seems to have a solid foundation, potential clients may want to seek further transparency in terms of corporate governance and operational disclosures.

Trading Conditions Analysis

When evaluating a broker, the trading conditions offered are critical. JFX presents a competitive fee structure, but a closer look reveals some areas that may raise concerns. The overall cost of trading with JFX includes spreads, commissions, and overnight interest rates.

| Fee Type | JFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.3 pips (EUR/USD) | 1.0 pips |

| Commission Model | None | Varies by broker |

| Overnight Interest Range | Varies | Varies |

JFX's spreads are notably lower than the industry average, which is an attractive feature for traders. However, the absence of a clear commission structure may lead to hidden costs that are not immediately apparent. It is essential for traders to understand all potential fees associated with trading on this platform, as unexpected costs can significantly affect profitability.

Client Funds Security

The security of client funds is paramount in the forex trading environment. JFX implements several measures to protect clients' investments, including segregating client funds from the company's operational funds. This practice is essential in ensuring that client money is not misused and is available for withdrawal at all times.

Additionally, JFX does not currently offer negative balance protection, which means clients could potentially lose more than their initial investment in volatile market conditions. There have been no significant historical incidents reported concerning the security of funds at JFX, but clients should remain aware of the inherent risks in trading.

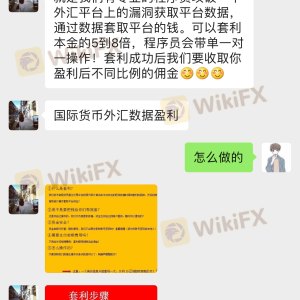

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of JFX reveal a mixed bag of experiences. While some users report satisfactory trading experiences, others have raised concerns regarding the responsiveness of customer service and difficulties in fund withdrawals.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support | Medium | Limited availability |

| Platform Performance | Low | Generally stable |

Two notable cases highlight these issues: one trader reported being unable to withdraw funds after achieving a profit, citing a lack of communication from customer support. Another user mentioned delays in receiving responses to inquiries, leading to frustration. These complaints suggest that while JFX may be a legitimate broker, traders should be prepared for potential challenges in customer service.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. JFX primarily utilizes the MetaTrader 4 (MT4) platform, which is widely regarded for its user-friendly interface and robust analytical tools. Users have reported that the platform performs well, with stable execution and minimal slippage. However, there are concerns regarding the lack of advanced security features, such as two-factor authentication.

The execution quality at JFX is generally satisfactory, with most orders being filled at the requested price. Nevertheless, traders should remain vigilant for any signs of platform manipulation or issues that could affect trade execution.

Risk Assessment

Using JFX as a trading platform carries certain risks that potential clients should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Regulated by FSA, but awareness of potential loopholes is necessary. |

| Financial Risk | High | Absence of negative balance protection poses a risk to traders. |

| Operational Risk | Medium | Customer service issues could affect trading experience. |

To mitigate these risks, traders should conduct thorough research, maintain a diversified portfolio, and consider using risk management tools such as stop-loss orders.

Conclusion and Recommendations

In conclusion, while JFX is a regulated broker with competitive trading conditions, there are areas of concern that potential clients should carefully consider. The absence of negative balance protection, mixed customer feedback, and potential challenges in customer service warrant caution.

For traders seeking a reliable platform, it may be prudent to explore alternatives that offer more robust regulatory oversight and customer support. Brokers such as OANDA, IG, or CMC Markets may provide more comprehensive services and protections. Ultimately, traders should weigh their options carefully and ensure they are comfortable with the risks involved before proceeding with JFX or any other broker.

Is JFX a scam, or is it legit?

The latest exposure and evaluation content of JFX brokers.

JFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JFX latest industry rating score is 6.87, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.87 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.