Summary

The review of Golday Precious Metals paints a mixed picture of this forex and precious metals broker. While it has been noted for its regulatory compliance in Hong Kong and the use of the popular MT4 trading platform, numerous user complaints highlight severe issues related to slippage, customer service, and withdrawal difficulties. Investors should approach with caution, given the range of experiences reported.

Note: It is essential to consider the different entities operating under the Golday name across various regions, as this can significantly affect user experience and regulatory oversight.

Ratings Overview

We assess brokers based on user feedback, regulatory information, and expert opinions.

Broker Overview

Established in 2014, Golday Precious Metals operates under Hong Kong Jinsheng Precious Metals Co., Ltd., focusing on trading precious metals like gold and silver. The broker is regulated by the Hong Kong Gold & Silver Exchange (CGSE), which adds a layer of credibility to its operations. Golday Precious Metals offers its clients access to the widely used MT4 trading platform, known for its robust features and user-friendly interface. The broker caters to a global audience, providing trading options in various asset classes, primarily in precious metals.

Detailed Review

Regulatory Landscape

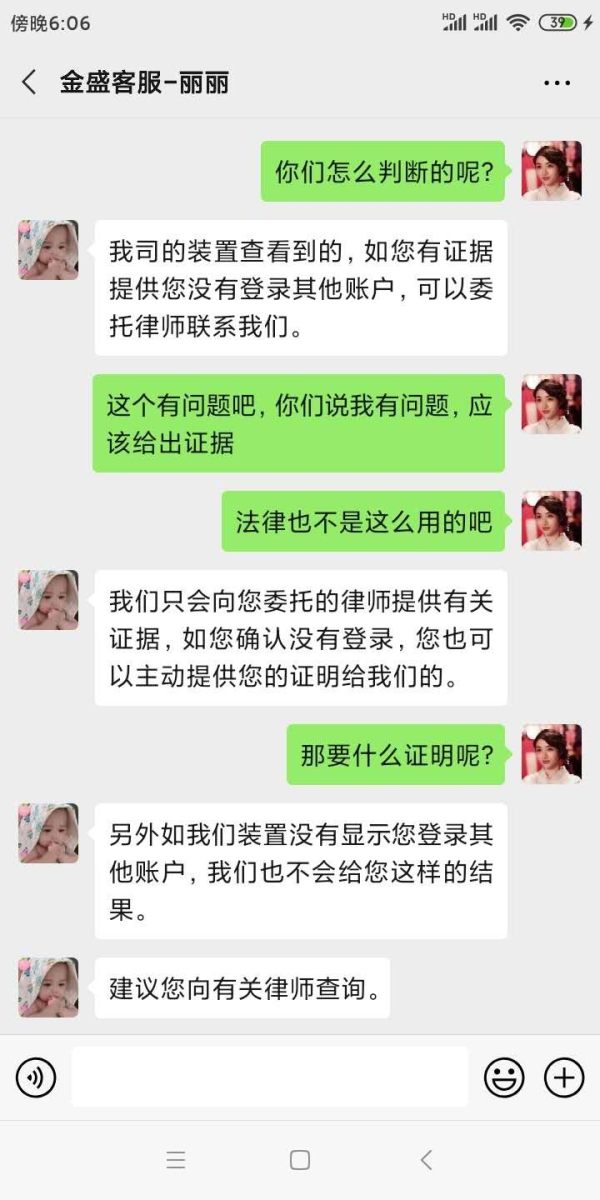

Golday Precious Metals is regulated in Hong Kong by the CGSE, which is a recognized authority for precious metals trading. However, there are concerns about the effectiveness of this regulation, as some sources indicate that the broker operates in a region where consumer protections may not be robust. This can be a significant factor for potential investors, as the regulatory framework can influence the safety of their funds.

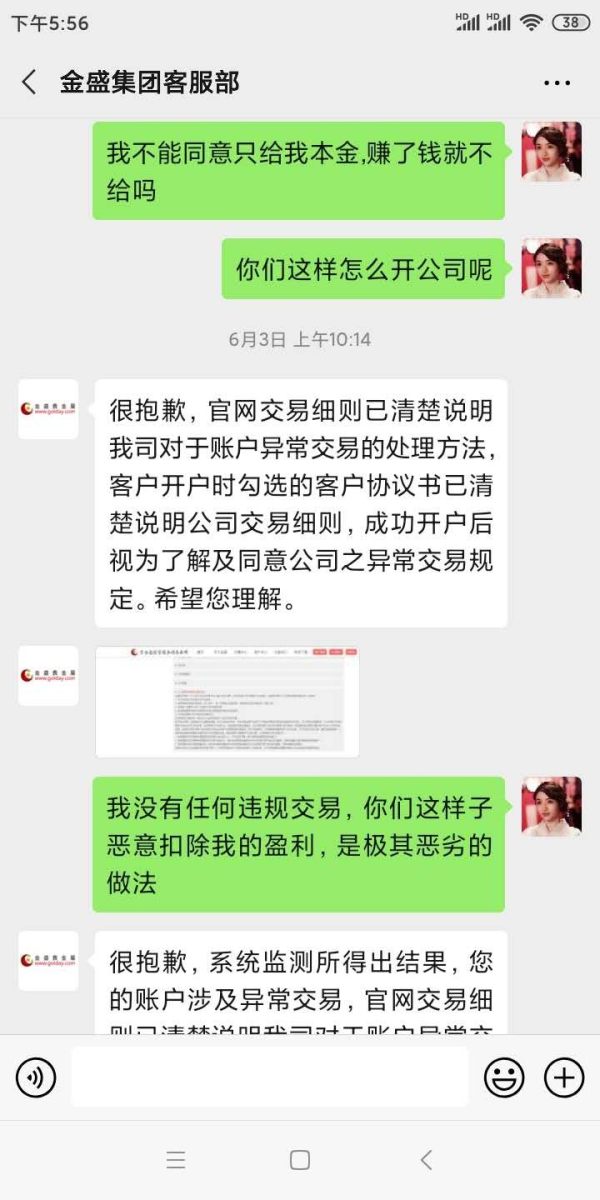

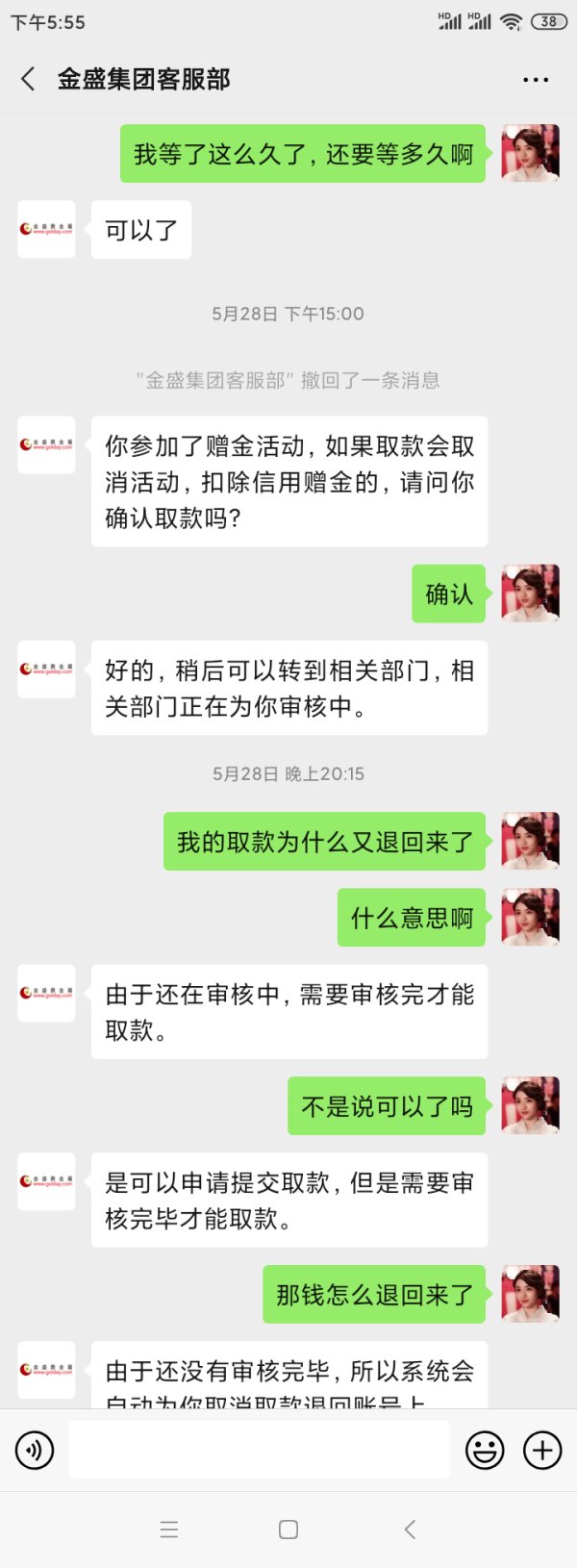

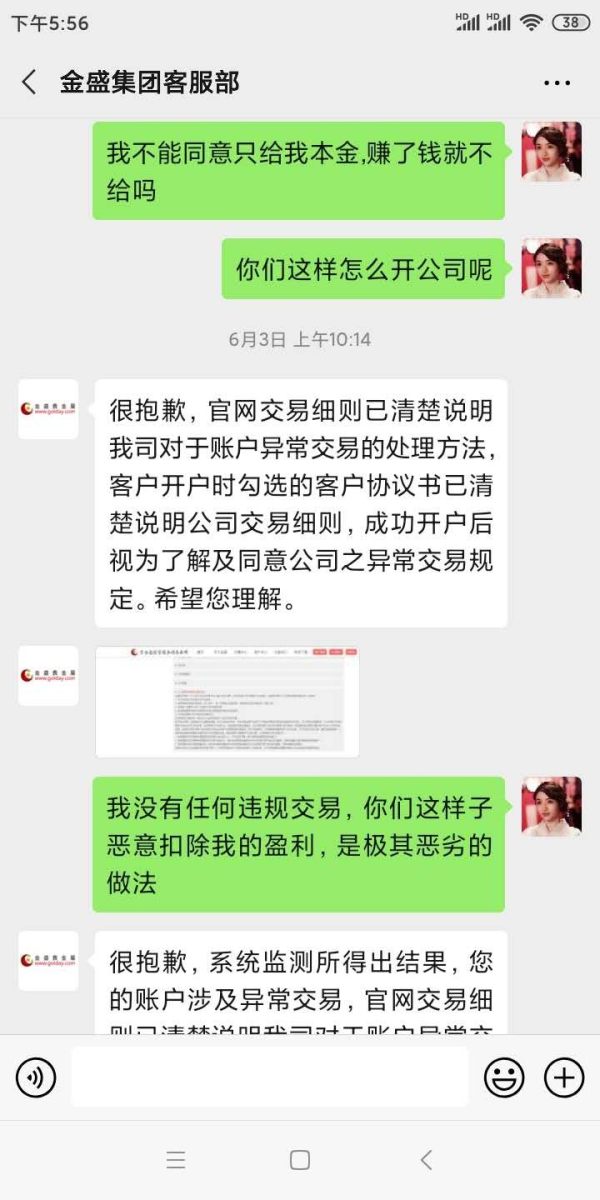

Deposit and Withdrawal Options

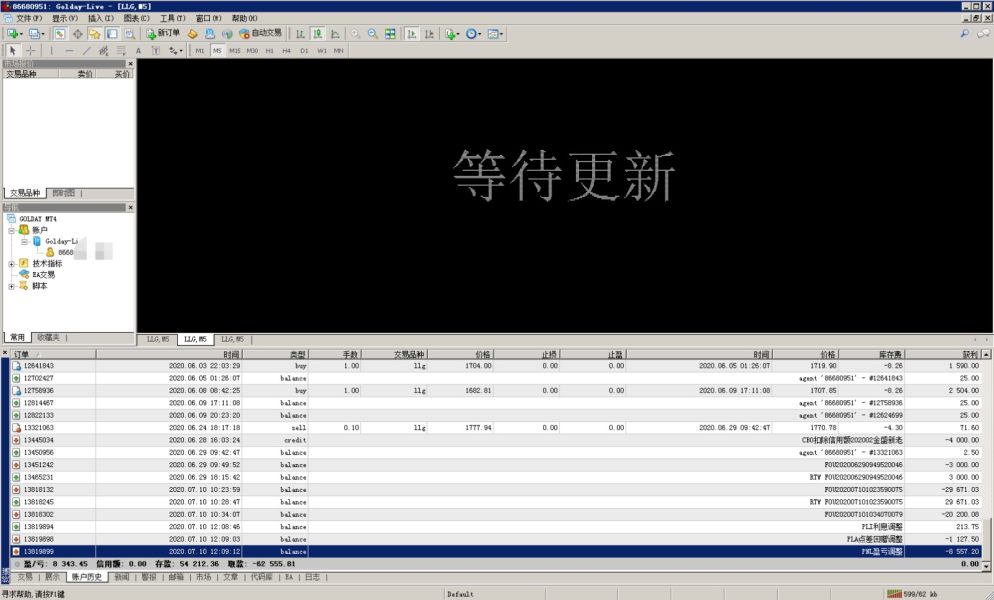

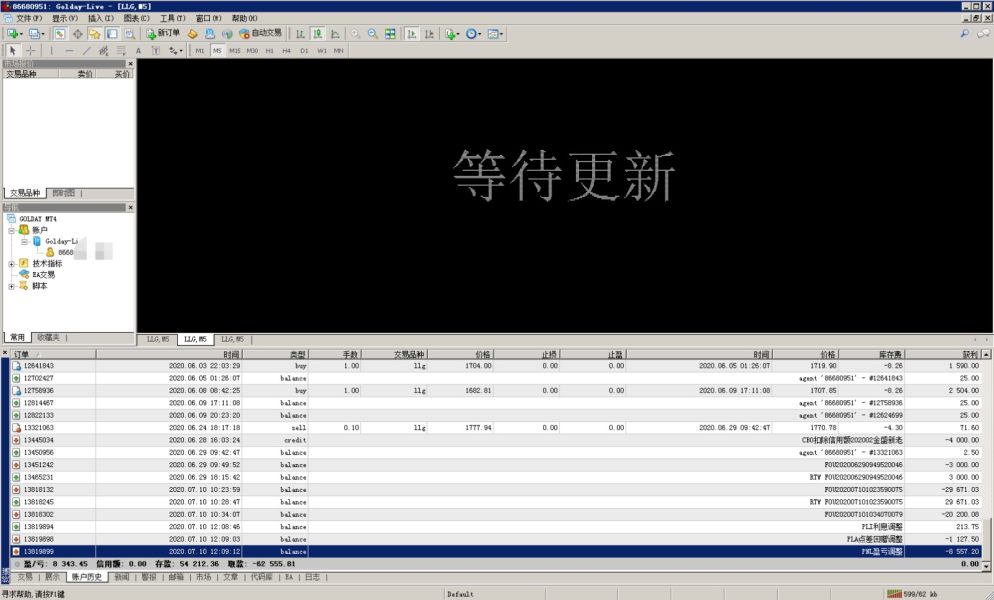

Golday Precious Metals accepts deposits primarily in USD, with a minimum deposit requirement of $200. However, it does not allow deposits from third-party accounts, which could limit accessibility for some users. Users have reported difficulties in withdrawing funds, with multiple complaints regarding the inability to access their capital. This raises serious concerns about the broker's reliability, as highlighted by several user reviews.

The broker offers two types of accounts: VIP and Standard, both requiring a minimum deposit of $200. The VIP account provides a higher spread rebate, which can be an attractive feature for active traders. However, there are no significant promotional offers or bonuses, which may deter some potential clients looking for added value.

Trading Costs

Golday Precious Metals has varying spreads based on account type and trading instruments. The standard account spread for London Gold is reported to be around $50 per contract, while the VIP account offers a reduced spread of $25. However, several users have mentioned severe slippage, which can diminish the overall trading experience and profitability. The absence of commissions on trades is a positive aspect, but the overall cost structure may still be a concern for traders.

The primary trading platform offered by Golday Precious Metals is MT4, which is favored by many traders for its comprehensive analytical tools and ease of use. The broker also has its proprietary trading app, although some users have reported issues with its functionality, raising questions about its reliability.

Restricted Areas and Customer Support

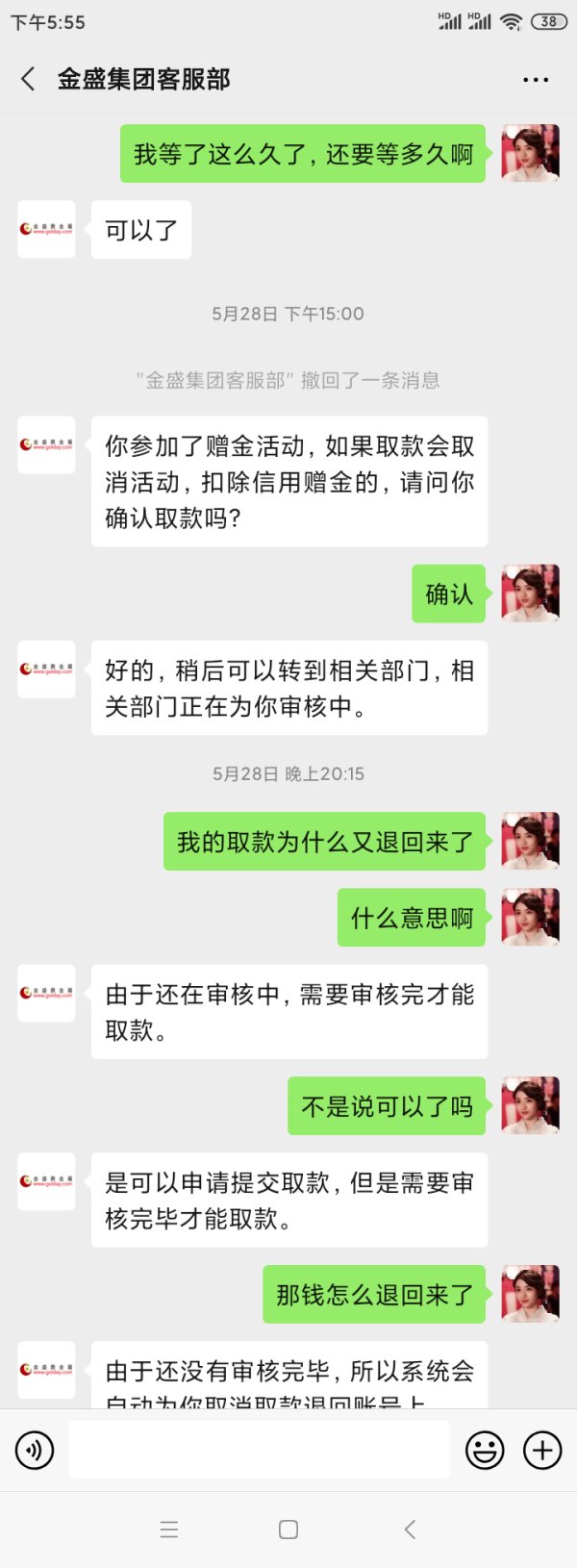

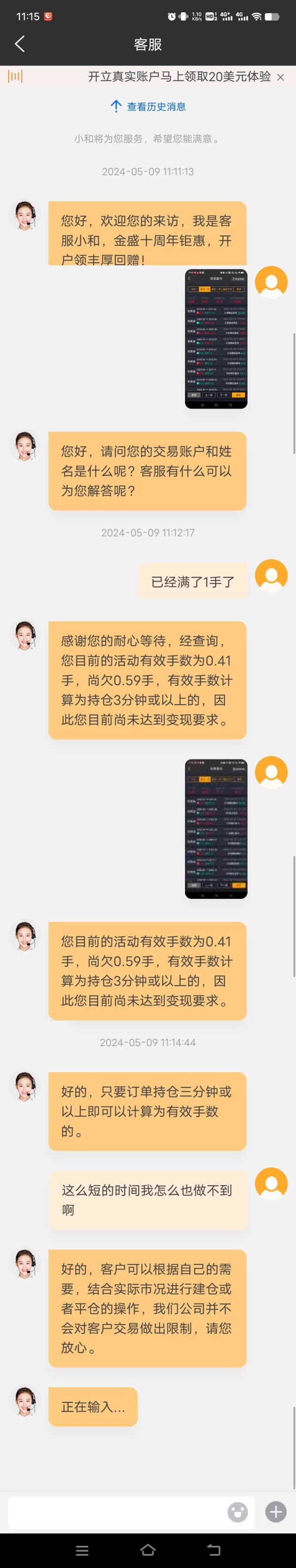

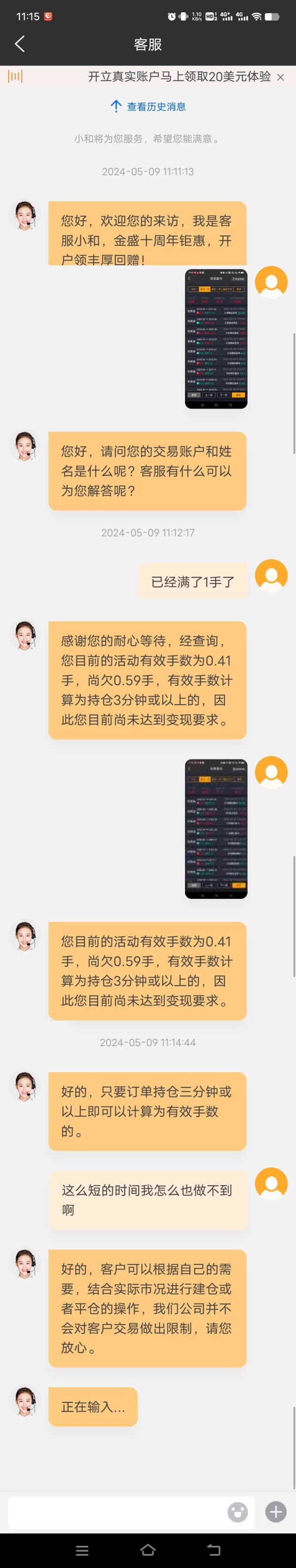

Golday Precious Metals does not provide clear information about restricted regions, which can be a drawback for potential clients. Customer support has been a significant point of contention, with many users reporting slow response times and inadequate assistance. This lack of effective support can be detrimental in the fast-paced trading environment, where timely help is crucial.

Language Support

The broker primarily offers customer service in Chinese, which may limit accessibility for non-Chinese speaking clients. This can be a disadvantage for international traders who prefer support in English or other languages.

Final Ratings Overview

Detailed Breakdown

- Account Conditions (6.0): The minimum deposit is reasonable, but limited currency options and third-party deposit restrictions are concerning.

- Tools and Resources (5.5): MT4 is a strong platform choice, but the proprietary app's functionality has been questioned.

- Customer Service and Support (4.0): Multiple complaints highlight slow response times and inadequate support.

- Trading Setup (5.0): While the trading conditions are standard, slippage issues reported by users detract from the experience.

- Trustworthiness (4.5): Regulatory oversight exists, but the lack of robust consumer protections raises concerns.

- User Experience (5.0): Mixed reviews indicate that user experiences can vary significantly, with some reporting major issues.

- Additional Features (6.0): The account types offered provide some variety, but the absence of promotional incentives may limit appeal.

In conclusion, the Golday Precious Metals review indicates that while the broker has some positive aspects, such as regulatory compliance and a user-friendly trading platform, significant concerns regarding customer service, withdrawal processes, and user experiences should not be overlooked. Potential investors are advised to conduct thorough research and consider these factors before engaging with Golday Precious Metals.