FX Broadnet 2025 Review: Everything You Need to Know

Executive Summary

FX Broadnet is a forex broker that started in 2016. It works under Japan's Financial Services Agency (FSA) supervision. This fx broadnet review shows a broker with both good and bad points in the forex trading world.

The company offers some nice features, including zero-spread trading that targets individual and corporate clients. However, it has big problems with being clear about its services and keeping users happy. The broker's main selling point is zero-spread trading, which appeals to traders who want to save money on trades.

Our detailed study shows several areas where FX Broadnet does not meet industry standards. The company does not share enough information about important trading conditions. Mixed user feedback also raises questions about how reliable and good their service really is.

FX Broadnet mainly serves traders who want low-cost forex trading solutions. But potential clients should think carefully about the broker's problems before using their platform. Japan's FSA provides some protection, but this alone may not fix all the issues found in user reviews and our analysis.

Important Notice

This review uses public information and user feedback from different sources. Traders should know that clients in different regions may face different leverage rules and standards based on where they live. According to available information, leverage conditions change based on the client's location, but the broker does not clearly explain these differences.

The assessment in this review reflects conditions and information available when we wrote it. Potential clients should check all trading conditions, regulatory status, and service terms directly with FX Broadnet before making investment decisions. Broker policies and market conditions can change quickly.

Rating Framework

Broker Overview

FX Broadnet entered the forex trading market in 2016 as a Japan-based company. It specializes in foreign exchange margin trading services for both individual retail traders and corporate clients who want access to forex markets. Despite working for almost ten years, FX Broadnet keeps a low profile in the global forex industry.

The company focuses mainly on its home market while offering services to international clients under specific conditions. The broker's business model centers on providing forex trading platforms that allow margin trading across different currency pairs. However, detailed information about their platform technology, special tools, or unique trading features is hard to find in public sources.

This lack of clear information is one of the main problems potential clients face when comparing FX Broadnet to competitors. According to our research for this fx broadnet review, the company works under Japan's Financial Services Agency (FSA) rules, which provides oversight and compliance standards. The main service offered is foreign exchange trading, but specific details about currency pairs, exotic options, or other financial tools are not clear from available documents.

The regulatory supervision from Japan's FSA suggests the company follows certain operational and financial standards. However, how well this oversight protects international clients may vary.

Regulatory Jurisdiction: FX Broadnet operates under Japan's Financial Services Agency (FSA) supervision. This provides regulatory oversight within the Japanese financial framework and offers some protection for clients. However, the specific license details and compliance measures are not well explained in available sources.

Deposit and Withdrawal Methods: Information about specific deposit and withdrawal methods is not clearly shown in available documents. This represents a big transparency gap for potential clients who want to evaluate the broker's accessibility and convenience.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in public information. This makes it hard for potential traders to assess how accessible FX Broadnet's services are compared to industry standards.

Promotional Offers: Details about bonuses, promotional campaigns, or special offers for new clients are not mentioned in available sources. This suggests either a lack of such programs or poor marketing transparency.

Tradeable Assets: The broker focuses mainly on forex trading. However, the specific range of currency pairs, major, minor, and exotic options available to clients is not well detailed in accessible information.

Cost Structure: FX Broadnet advertises zero-spread trading conditions, which is their main competitive advantage. However, information about commission structures, overnight fees, or other potential charges is not clearly disclosed. This creates uncertainty about the true cost of trading.

Leverage Options: According to available information, leverage ratios vary based on the client's location. But specific maximum leverage amounts or how these variations are determined is not clearly explained in public documents.

Platform Choices: Specific information about trading platforms is not detailed in available sources. Whether they use proprietary or third-party solutions like MetaTrader represents another big information gap.

Geographic Restrictions: Details about which countries or regions face restrictions in accessing FX Broadnet's services are not clearly outlined in available documents.

Customer Service Languages: Information about the languages supported by customer service representatives is not specified. Given the Japanese regulatory base, Japanese support is likely available.

This fx broadnet review highlights big gaps in publicly available information that potential clients should consider. When evaluating this broker against more transparent alternatives in the market, these gaps become important factors.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

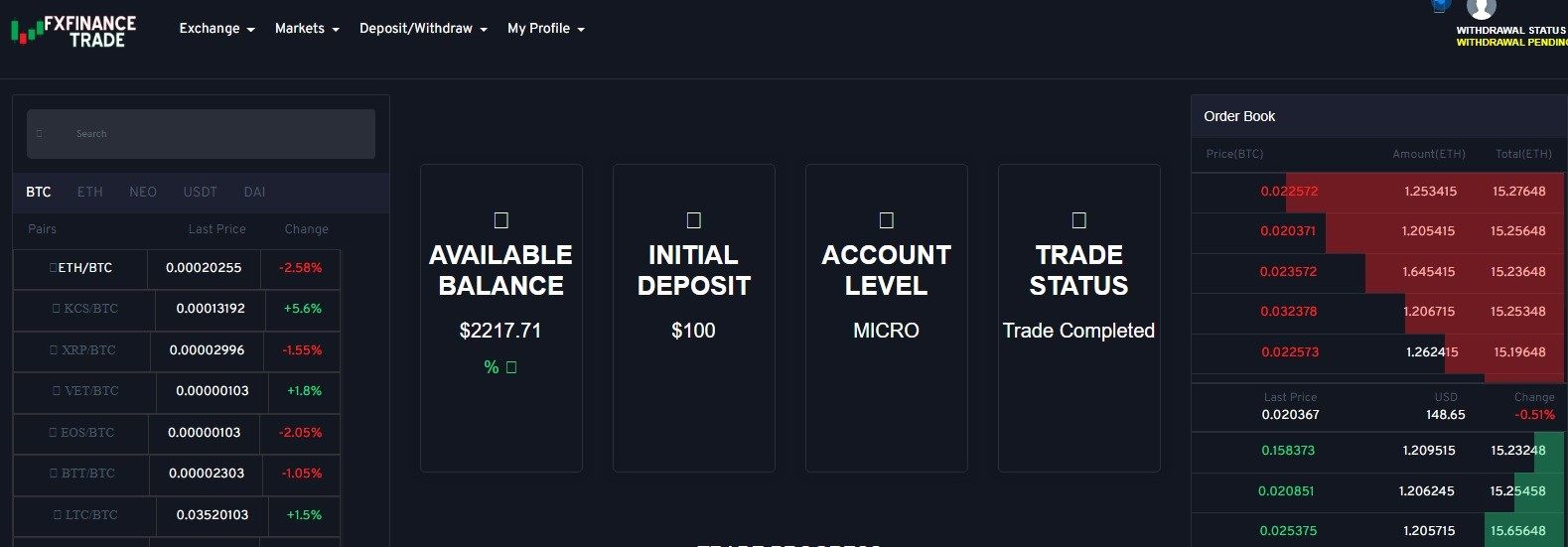

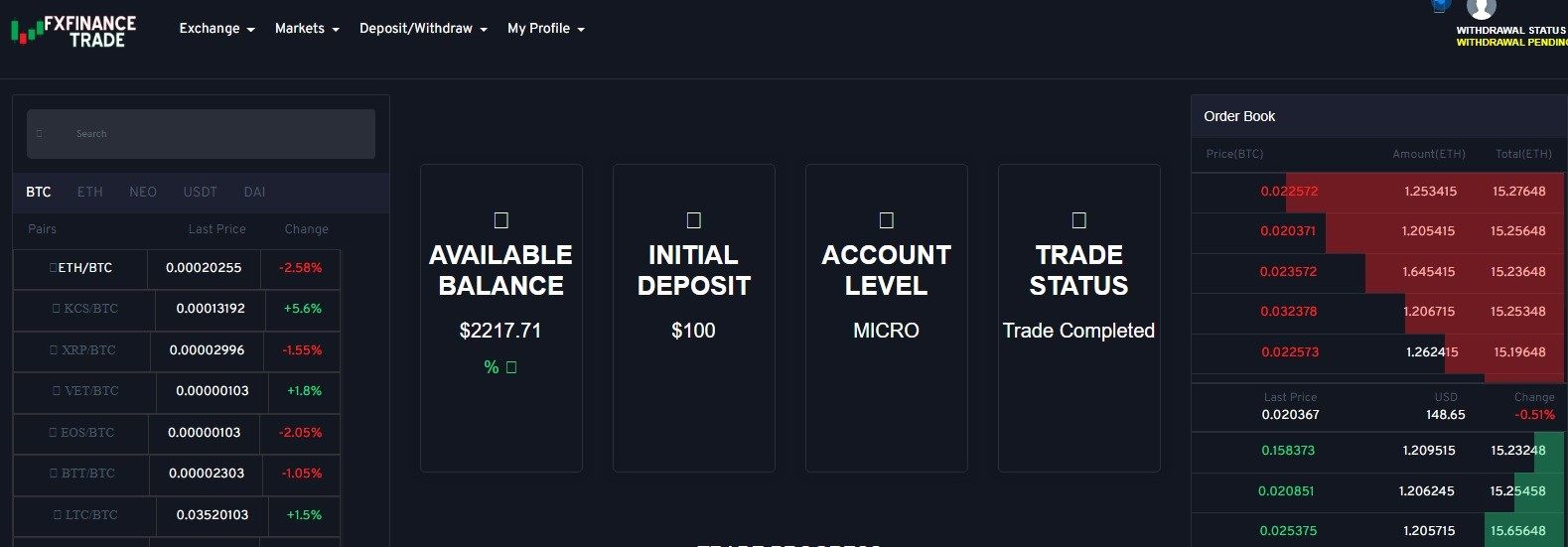

FX Broadnet's account conditions show both potential advantages and big transparency concerns. The broker fails to clearly disclose basic account information such as minimum deposit requirements, account types, and specific terms. This creates immediate challenges for potential clients trying to evaluate their services objectively.

The absence of detailed information about different account tiers makes it impossible to assess whether FX Broadnet offers graduated services. Most reputable brokers provide clear distinctions between basic, premium, and professional account types, each with specific benefits and requirements. The lack of such transparency from FX Broadnet suggests either a simplified account structure or poor marketing communication.

User feedback shows mixed experiences with account-related services. Some positive reviews suggest satisfactory basic account functionality, while negative feedback points to concerns about account management and transparency. The account opening process details are not readily available, which could indicate either a streamlined approach or lack of proper documentation for potential clients.

The fx broadnet review data suggests that while the broker may offer functional trading accounts, the lack of clear information about account features significantly impacts the overall rating. Special account features such as Islamic accounts, demo accounts, or professional trading accounts are not mentioned in available sources. This further limits the appeal for diverse trading communities.

The tools and resources category represents one of FX Broadnet's weakest areas. Minimal information is available about trading tools, analytical resources, or educational materials. Modern forex trading requires sophisticated tools for market analysis, trade execution, and risk management.

Yet FX Broadnet's offerings in this area remain largely undocumented in publicly available sources. Trading tools such as economic calendars, market analysis platforms, charting software capabilities, or proprietary analytical instruments are not clearly described or promoted by the broker. This absence of information suggests either a limited toolkit or poor communication of available resources to potential clients.

Competitive brokers typically highlight their analytical capabilities, research teams, and technological advantages as key differentiators. Educational resources, which are increasingly important for retail traders, appear to be absent or minimally promoted by FX Broadnet. The lack of webinars, trading guides, market commentary, or educational partnerships represents a big disadvantage in attracting and retaining clients who value learning opportunities.

Automated trading support, including Expert Advisor compatibility, algorithmic trading tools, or API access for professional traders, is not mentioned in available documentation. This limitation could significantly impact the broker's appeal to more sophisticated trading strategies and professional clients who rely on automated systems.

Customer Service and Support Analysis (Score: 6/10)

FX Broadnet's customer service infrastructure shows some positive elements. Hotline and email support channels are available to clients. However, the overall customer service experience appears limited compared to industry leaders who offer comprehensive, multi-channel support systems with extended availability and specialized assistance.

The availability of telephone and email support provides basic communication channels. Details about response times, service quality metrics, or customer satisfaction measures are not publicly available. User feedback presents mixed experiences, with some clients reporting satisfactory support interactions while others express concerns about response effectiveness and problem resolution.

The lack of information about additional support channels such as live chat, social media support, or dedicated account management suggests a relatively basic support infrastructure. Modern forex traders often expect 24/7 support availability, particularly given the global nature of forex markets. Yet FX Broadnet's service hours and availability are not clearly communicated.

Multilingual support capabilities are not clearly outlined, which could limit accessibility for international clients. Given the broker's Japanese regulatory base, Japanese language support is likely available. But support for other major trading languages remains uncertain based on available information.

Trading Experience Analysis (Score: 7/10)

The trading experience category represents FX Broadnet's strongest performance area. This is primarily due to their advertised zero-spread trading conditions. This feature addresses one of the most significant concerns for active forex traders: transaction costs that can significantly impact profitability over time.

Zero-spread trading, if consistently delivered, provides substantial value for high-frequency traders and those implementing scalping strategies. However, the sustainability and consistency of this offering across different market conditions and trading sessions requires verification through extended use. Market volatility can impact spread stability even with zero-spread promises.

Order execution quality, while not extensively documented, appears to benefit from the cost-effective trading environment. User feedback suggests generally positive experiences with trade execution, though specific performance metrics such as slippage rates, execution speeds, or rejection rates are not publicly available for objective assessment.

Platform stability and functionality, while not comprehensively detailed, seem adequate based on user feedback. The lack of specific technical performance data makes it difficult to compare against industry benchmarks. Mobile trading capabilities and platform accessibility across different devices are not clearly outlined in available sources.

This fx broadnet review indicates that while the trading experience benefits from competitive cost structures, the lack of comprehensive technical specifications limits assessment. The absence of performance data makes it hard to fully evaluate the trading environment quality.

Trust and Security Analysis (Score: 5/10)

FX Broadnet's trust and security profile presents a complex picture. It combines regulatory oversight with transparency concerns that impact overall confidence levels. The broker's supervision by Japan's Financial Services Agency (FSA) provides a foundation of regulatory compliance and operational oversight.

This represents a positive factor for client protection and operational standards. However, technical security concerns have been identified, including issues with SSL certificate validity that could impact website security and data protection. These technical vulnerabilities, combined with limited transparency about client fund protection measures, create uncertainty about the comprehensive security framework protecting client interests.

The presence of negative user feedback and exposure reviews indicates that some clients have experienced difficulties. These experiences have impacted their trust in the broker's services. While regulatory oversight provides some protection, the effectiveness of complaint resolution and client protection measures in practice appears to vary based on user experiences.

Company transparency regarding ownership structure, financial health, operational procedures, and business practices remains limited based on publicly available information. Reputable brokers typically provide comprehensive information about their corporate structure, financial backing, and operational transparency to build client confidence.

User Experience Analysis (Score: 5/10)

The overall user experience with FX Broadnet reflects the mixed nature of client feedback. Both positive testimonials and concerning negative reviews create an inconsistent picture of service quality and client satisfaction. The balance between positive and negative feedback suggests that user experiences may vary significantly depending on individual circumstances and expectations.

Positive user reviews highlight appreciation for the zero-spread trading conditions and basic functionality of the platform. This suggests that the core trading experience meets some client expectations. However, the limited number of reviews and the presence of exposure complaints indicate that user satisfaction is not consistently achieved across the client base.

Interface design and platform usability are not extensively documented or reviewed. This makes it difficult to assess the user-friendliness of the trading environment. Modern traders expect intuitive interfaces, customizable features, and seamless navigation, yet FX Broadnet's capabilities in these areas remain unclear from available sources.

The registration and account verification processes are not clearly outlined, which could impact new client experiences and onboarding efficiency. Streamlined account opening with clear verification requirements typically contributes to positive initial user experiences. But the lack of detailed information about these processes represents a potential concern.

Common user complaints focus on transparency issues and concerns about information disclosure. This suggests that improvements in communication and client information provision could significantly enhance the overall user experience. The broker's responsiveness to user feedback and continuous improvement efforts are not clearly documented in available sources.

Conclusion

This comprehensive fx broadnet review reveals a broker that offers some competitive advantages, particularly in transaction costs. However, it faces significant challenges in transparency, information disclosure, and consistent user satisfaction. While FX Broadnet's zero-spread trading conditions provide genuine value for cost-conscious traders, the numerous information gaps and mixed user feedback create substantial concerns for potential clients.

FX Broadnet may be suitable for experienced traders who prioritize low transaction costs and can navigate the limitations in transparency and support services. However, traders seeking comprehensive broker information, extensive educational resources, or consistently high-quality customer service may find better alternatives in the competitive forex market.

The broker's main strengths lie in its competitive cost structure and regulatory oversight from Japan's FSA. Its primary weaknesses include limited transparency, insufficient information disclosure, and inconsistent user experiences that impact overall reliability and trustworthiness in the global forex trading environment.