Fiper 2025 Review: Everything You Need to Know

Executive Summary

Fiper shows a complex picture in the forex brokerage world. User experiences are very different from each other, creating sharp divisions. This fiper review shows a broker that brings in traders mainly through competitive spreads starting from 0.0 pips and different types of assets they can trade. But the platform has serious trust problems that potential users need to think about carefully.

The broker works under TOB TRADING MAU LTD (Registration No. 198452). They offer trading in forex, stocks, commodities, and indices through their own Fiper Ctrader platform. Some users say Fiper gives them their "best broker experience." However, worrying feedback suggests possible fraud, which splits the user base into two groups. The lack of clear rules and oversight makes trust issues even worse.

Fiper mainly targets traders who want low-cost trading and different types of investments. But given the mixed reputation and trust concerns in various user reports, anyone thinking about this platform should be extremely careful.

Important Notice

Different regions may have different legal rules and market protections because we don't have complete regulatory information. This review uses available user feedback and market data, and it cannot promise that everything applies to all potential users. The lack of clear regulatory oversight greatly affects how reliable this assessment is and how secure users' investments might be.

Rating Framework

Broker Overview

Fiper works as a multi-asset trading platform under TOB TRADING MAU LTD with registration number 198452. We don't know when the company started from available sources, which adds to the transparency problems around this broker. The platform focuses on forex and stock trading services and tries to compete in the retail trading market through aggressive pricing.

The broker's business model centers on offering low-cost trading conditions. Spreads start from 0.0 pips and commission structures begin at $3. This approach targets traders who care about costs and want competitive trading environments. However, the lack of detailed company background and unclear corporate history raise questions about the platform's long-term stability and market commitment.

Fiper uses its own Fiper Ctrader platform, which works on multiple devices including Android, iOS, desktop, and web browsers. The platform supports trading in forex pairs, individual stocks, commodities, and market indices. Despite the technology infrastructure, the absence of specific regulatory oversight information significantly hurts the overall credibility assessment of this fiper review.

Regulatory Status: Available information doesn't specify concrete regulatory authorities watching over Fiper's operations. This creates significant compliance concerns for potential users.

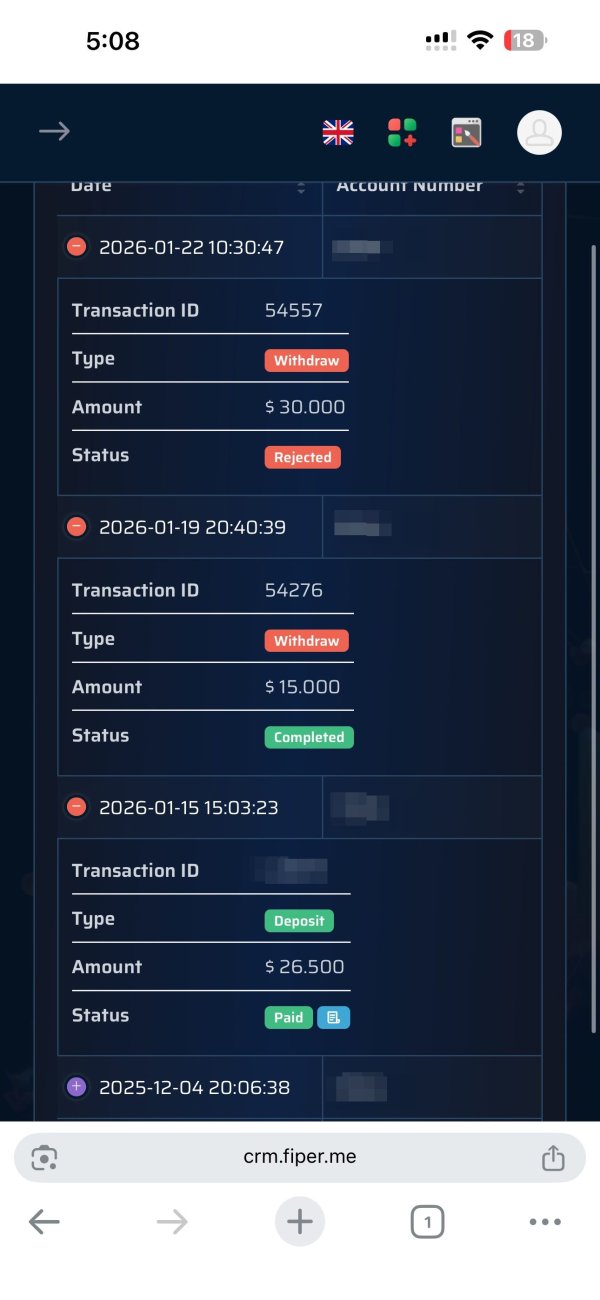

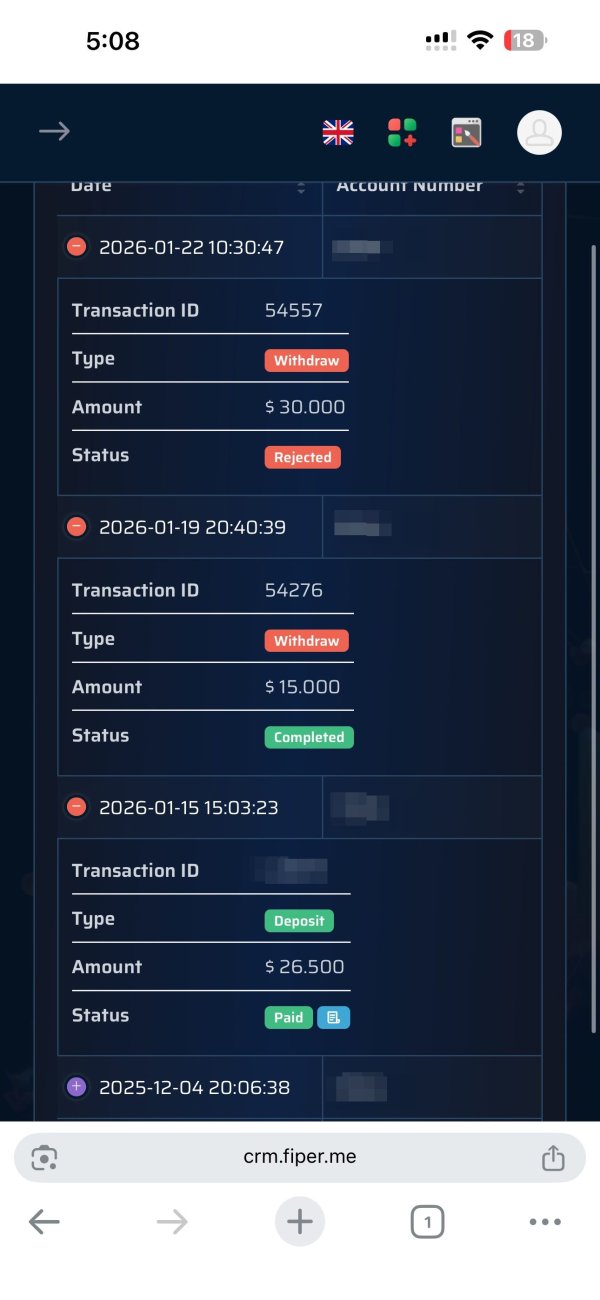

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures aren't detailed in available sources. This limits transparency about financial operations.

Minimum Deposit Requirements: The platform's entry-level investment requirements remain unspecified. This affects accessibility assessments for new traders.

Promotional Offers: Information about bonus programs or promotional incentives isn't available in current sources.

Tradeable Assets: The platform offers access to forex currency pairs, individual stock trading, commodity markets, and various market indices. This provides reasonable diversification opportunities.

Cost Structure: Competitive pricing begins with spreads from 0.0 pips and commission fees starting at $3. This positions Fiper among lower-cost market options.

Leverage Options: Specific leverage ratios available to traders aren't detailed in available documentation.

Platform Options: The Fiper Ctrader platform supports multiple device types. This ensures trading accessibility across different user preferences.

Geographic Restrictions: Specific regional limitations or availability constraints aren't clearly outlined in current information.

Customer Support Languages: Available language support options for customer service aren't specified in accessible materials.

This fiper review highlights significant information gaps that impact comprehensive evaluation capabilities.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Fiper's account structure lacks the transparency that reputable brokers should have. The absence of clear information about different account types creates uncertainty for potential users trying to understand their options. Without specified minimum deposit requirements, traders can't properly assess the platform's accessibility or plan their initial investment strategies well.

The account opening process details remain unclear. This makes it difficult for new users to understand verification requirements or timeline expectations. Also, the lack of information about specialized account options, such as Islamic accounts for Muslim traders, suggests limited accommodation for diverse trading community needs.

User feedback shows dissatisfaction with account-related conditions, though specific complaints aren't detailed in available sources. Compared to established brokers that provide complete account information upfront, Fiper's opacity represents a significant disadvantage. This fiper review emphasizes that potential users should seek complete account details before committing to the platform.

The scoring reflects these transparency issues and the potential impact on user experience and decision-making processes.

The available information about Fiper's trading tools and educational resources is very limited. While the platform operates on the Fiper Ctrader system, specific details about advanced trading tools, technical analysis features, or automated trading capabilities aren't provided in accessible sources.

Research and market analysis resources, which are crucial for informed trading decisions, aren't mentioned in available documentation. The absence of educational materials or learning resources suggests limited support for trader development, which is particularly concerning for novice traders who rely on broker-provided education.

User feedback about tool quality and functionality shows mixed responses, though specific feature evaluations aren't detailed. The platform's technology infrastructure appears functional based on multi-device support, but advanced trading features remain unclear.

Professional traders typically require sophisticated analytical tools and comprehensive market research. These are areas where Fiper's offering can't be properly assessed due to information limitations. This uncertainty significantly impacts the platform's appeal to serious traders seeking robust trading environments.

Customer Service Analysis (Score: 4/10)

Customer service quality represents a significant concern area for Fiper. User feedback indicates inconsistent support experiences. While specific communication channels aren't detailed in available sources, user reports suggest varying levels of professional competency among support staff.

Response time information isn't available. This makes it impossible to assess the platform's commitment to timely customer assistance. Service quality concerns emerge from user feedback, with some clients questioning the professionalism and effectiveness of support interactions.

The absence of information about multilingual support or customer service hours further limits the evaluation of Fiper's customer care capabilities. For international traders operating across different time zones, this lack of clarity about support availability represents a significant disadvantage.

User feedback examples highlight dissatisfaction with customer service experiences, though specific incident details aren't provided. The scoring reflects these concerns and the potential impact on user satisfaction and problem resolution effectiveness.

Trading Experience Analysis (Score: 6/10)

Fiper's trading experience centers around competitive pricing. Spreads starting from 0.0 pips represent a significant attraction for cost-conscious traders. User feedback about spread stability appears relatively positive, suggesting consistent pricing conditions during normal market periods.

Platform stability and execution speed information is limited, though the multi-device support suggests reasonable technology infrastructure. Order execution quality details, including slippage rates and requote frequency, aren't specified in available sources, which limits comprehensive performance assessment.

The Fiper Ctrader platform's functionality across different devices provides flexibility for traders preferring mobile or web-based trading. However, specific feature comparisons with industry-standard platforms like MetaTrader aren't available.

Trading environment assessment benefits from the competitive pricing structure but lacks detailed information about execution policies, market depth, or advanced order types. This fiper review notes that while cost advantages exist, comprehensive trading experience evaluation requires additional platform-specific information.

Trustworthiness Analysis (Score: 3/10)

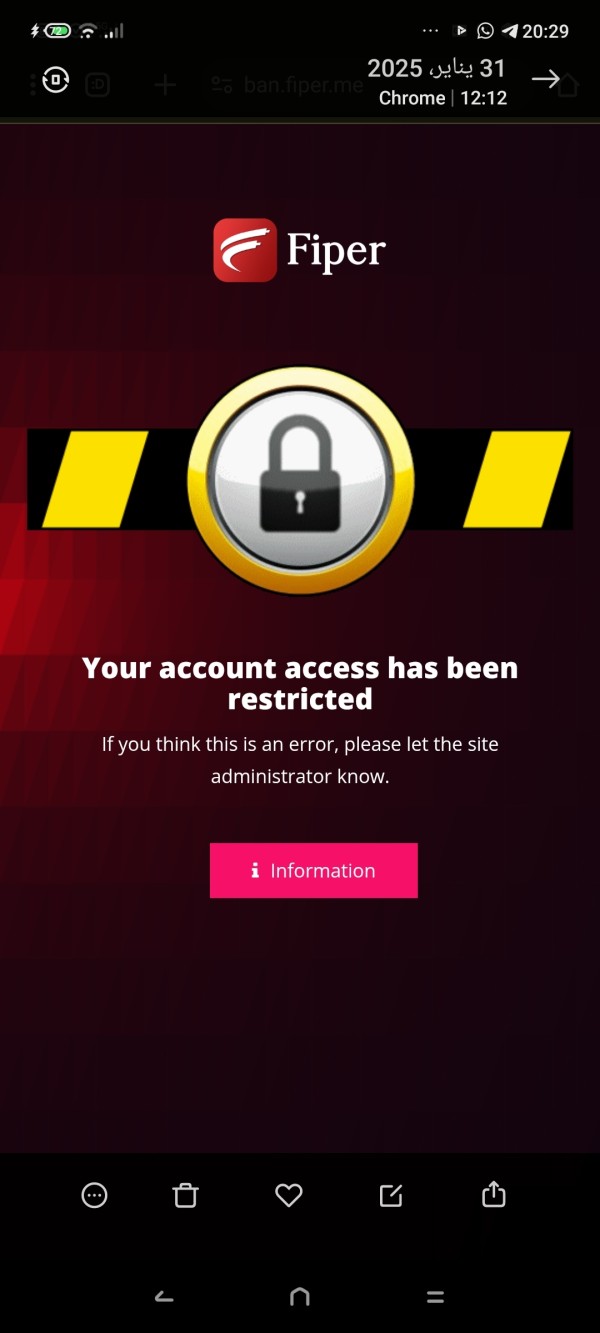

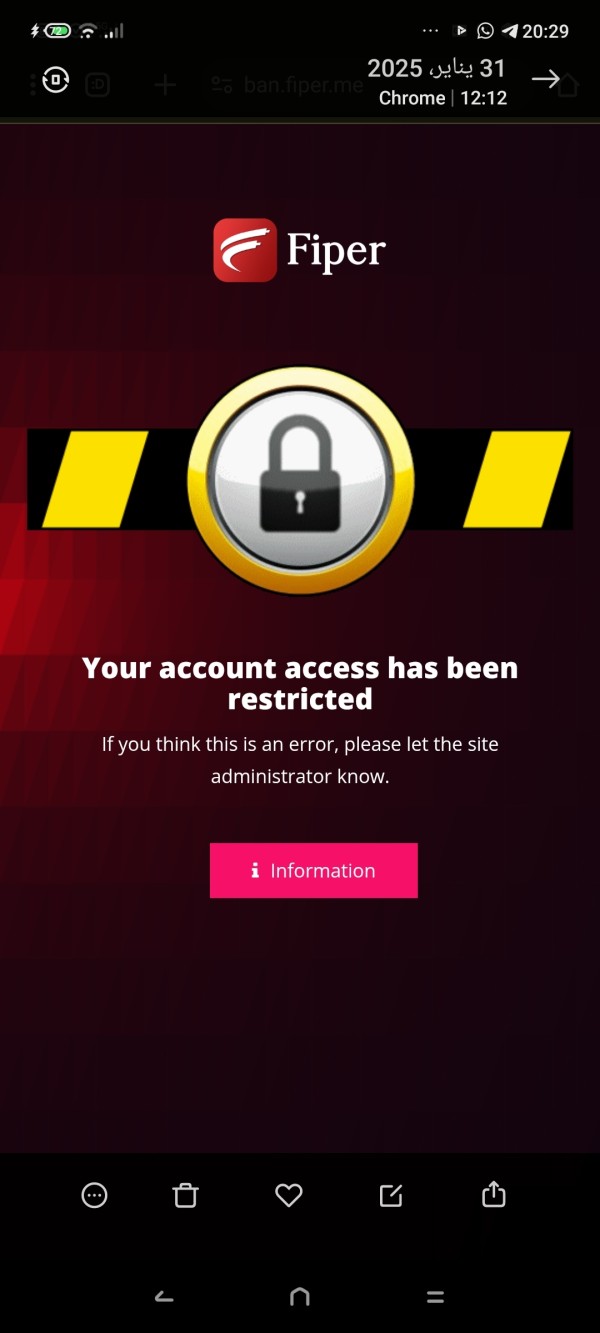

Trust represents Fiper's most significant challenge. Serious concerns about potential fraudulent activities have been reported by multiple users. The absence of clear regulatory oversight creates fundamental questions about investor protection and platform legitimacy.

Fund security measures aren't detailed in available sources. This raises concerns about client money protection and segregation practices. The lack of regulatory compliance information prevents verification of standard industry safety protocols.

Company transparency issues extend beyond regulatory concerns to include limited corporate background information and unclear operational history. Industry reputation suffers from reports labeling the platform as potentially fraudulent, which significantly impacts credibility assessments.

User trust feedback shows substantial negative sentiment, with specific warnings about potential scam activities. Third-party verification sources aren't available to confirm or refute these concerns, leaving potential users with limited reliable information for decision-making.

The extremely low scoring reflects these serious trust concerns and the potential risks associated with platform engagement.

User Experience Analysis (Score: 5/10)

Overall user satisfaction with Fiper shows significant polarization. Experiences range from excellent to highly negative. This dramatic variation suggests inconsistent service delivery or potentially different user interaction with legitimate versus problematic platform aspects.

Interface design and usability information isn't specifically detailed in available sources, though multi-platform availability suggests reasonable accessibility considerations. Registration and verification process details remain unclear, which impacts new user onboarding assessment.

Funding operation experiences aren't detailed in current information. This limits evaluation of deposit and withdrawal user satisfaction. However, the volume of negative feedback about potential fraudulent activities represents a major user experience concern.

Common user complaints center around credibility and trustworthiness rather than technical functionality. This suggests the platform may operate adequately for users who successfully engage with services. The user profile analysis indicates suitability for cost-sensitive traders, though significant risk awareness is essential.

Improvement recommendations based on user feedback emphasize the critical need for enhanced transparency and regulatory compliance to address fundamental trust concerns.

Conclusion

This comprehensive fiper review reveals a broker offering competitive trading conditions through low spreads and diverse asset access. But it faces severe credibility challenges that overshadow potential advantages. While the 0.0 pip starting spreads and multi-asset platform may attract cost-conscious traders, the absence of regulatory transparency and concerning user reports about potential fraudulent activities create significant risk factors.

Fiper may suit traders prioritizing low trading costs and willing to accept substantial risk regarding platform legitimacy. However, the lack of regulatory oversight and mixed user experiences suggest extreme caution is warranted. The platform's main advantages include competitive pricing and asset diversity, while major disadvantages encompass trust concerns, limited transparency, and inconsistent customer service quality.

Potential users should thoroughly investigate all aspects of Fiper's operations and consider alternative regulated brokers before making investment decisions. The significant information gaps and credibility concerns highlighted in this evaluation suggest that more established, regulated alternatives may provide better long-term trading environments.