Regarding the legitimacy of Fiper forex brokers, it provides FSC and WikiBit, .

Is Fiper safe?

Pros

Cons

Is Fiper markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

Fiper Global MAU

Effective Date:

2023-06-29Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

33, Edith Cavell Street Port-Louis C/o IQ EQ Fund Services (Mauritius) Ltd, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Fiper A Scam?

Introduction

Fiper is an online trading platform that has recently emerged in the forex market, offering a range of financial products including forex, commodities, indices, and cryptocurrencies. As the trading environment becomes increasingly competitive, traders need to be cautious when selecting a broker. The potential for scams in the forex industry remains high, with numerous unregulated platforms posing risks to investors. Therefore, it is crucial to evaluate a broker's legitimacy, regulatory compliance, and overall reputation before committing any funds. This article investigates Fiper's safety and legitimacy by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

Regulatory oversight is a critical factor in determining the safety of a trading platform. Fiper operates under the jurisdiction of the Financial Services Commission (FSC) in Mauritius, which provides an offshore retail forex license. However, the quality of regulation and its implications for traders are worth exploring.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| FSC Mauritius | GB23201759 | Mauritius | Offshore Regulated |

The FSC is responsible for regulating non-bank financial services and global business in Mauritius. While it offers a level of oversight, it is important to note that offshore regulations often lack the stringent requirements imposed by top-tier regulatory bodies such as the FCA or ASIC. Fiper's offshore status raises concerns about the adequacy of investor protection and the potential for regulatory evasion. The absence of a robust regulatory framework could leave traders vulnerable to malpractice, as unregulated firms can operate with minimal accountability.

Company Background Investigation

Fiper was established in 2022 and is headquartered in Kagithane, Istanbul, Turkey. The company has positioned itself as a dynamic participant in the online trading landscape, but its relatively short history raises questions about its credibility. The ownership structure and management team are critical to understanding the company's operational integrity.

The management team at Fiper comprises professionals with experience in the financial services sector, yet specific details about their backgrounds remain vague. This lack of transparency can be a red flag for potential investors. A reputable broker typically provides information about its leadership, including their qualifications and previous experience in the industry. Fiper's limited disclosure may indicate an attempt to obscure its operational practices, which could be concerning for traders seeking a trustworthy platform.

Trading Conditions Analysis

Fiper offers competitive trading conditions, including low spreads and high leverage options. However, a closer examination of its fee structure reveals potential pitfalls.

| Fee Type | Fiper | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 0.0 pips | 1.0 pips |

| Commission Model | Varies | $5 - $10 per lot |

| Overnight Interest Range | High | Moderate |

While Fiper advertises spreads as low as 0.0 pips, the actual trading costs may vary significantly based on market conditions. Additionally, the commission structure could be a cause for concern, as high fees can erode profitability. Traders should be cautious of any hidden charges or unfavorable withdrawal policies that may not be clearly stated in the terms and conditions.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker. Fiper claims to implement various security measures, including fund segregation and investor protection policies. However, the effectiveness of these measures is questionable given its unregulated status.

Fiper does not provide comprehensive details about its fund protection strategies, leaving traders uncertain about the safety of their investments. The absence of a clear framework for negative balance protection further raises concerns, as traders could potentially lose more than their initial deposit. Historical data on any past incidents involving fund security issues would provide valuable insight into the broker's reliability.

Customer Experience and Complaints

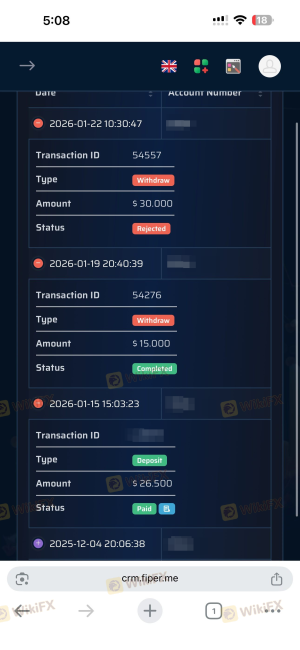

Customer feedback is an essential aspect of assessing a broker's credibility. Reviews of Fiper reveal mixed experiences, with several users reporting issues related to withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Unresponsive |

| Customer Support Quality | Moderate | Limited Availability |

| Transparency Concerns | High | Inadequate Information |

Common complaints include difficulties in withdrawing funds, which is often a significant indicator of a broker's integrity. Users have reported that Fiper's support team is slow to respond, and some inquiries go unanswered. These patterns suggest a potentially problematic relationship between the broker and its clients, raising red flags for prospective traders.

Platform and Trade Execution

Fiper provides various trading platforms, including web and mobile applications, to facilitate user access. However, the performance and reliability of these platforms are crucial for successful trading.

The quality of order execution, including slippage and rejection rates, is another factor to consider. Users have expressed concerns about delayed execution and high slippage during volatile market conditions. Such issues can significantly impact trading outcomes and may indicate underlying problems with the broker's infrastructure.

Risk Assessment

Engaging with Fiper carries inherent risks that traders should carefully evaluate.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Offshore regulation raises concerns about investor protection. |

| Fund Safety | High | Lack of transparency regarding fund protection measures. |

| Customer Support | Medium | Complaints about unresponsive support may hinder problem resolution. |

To mitigate these risks, traders should consider conducting thorough due diligence before investing. It may also be prudent to start with a smaller investment to assess the broker's reliability before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fiper presents several concerns that warrant caution. Its unregulated status, coupled with a lack of transparency and mixed customer feedback, raises significant red flags. While the platform offers competitive trading conditions, the potential risks associated with fund safety and customer support issues cannot be overlooked.

For traders considering Fiper, it is essential to weigh these factors carefully. Those who prioritize security and regulatory oversight may wish to explore alternative brokers that are well-regulated and have a proven track record of reliability. Recommended alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer better investor protection and transparency.

Is Fiper a scam, or is it legit?

The latest exposure and evaluation content of Fiper brokers.

Fiper Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Fiper latest industry rating score is 6.11, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.11 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.