Regarding the legitimacy of WINPROFX forex brokers, it provides FSRA and WikiBit, (also has a graphic survey regarding security).

Is WINPROFX safe?

Pros

Cons

Is WINPROFX markets regulated?

The regulatory license is the strongest proof.

FSRA Legal Opinion (LO)

The Financial Services Regulatory Authority

The Financial Services Regulatory Authority

Current Status:

RegulatedLicense Type:

Legal Opinion (LO)

Licensed Entity:

Winprofx Limited

Effective Date:

2023-05-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is WinproFX A Scam?

Introduction

WinproFX is a relatively new player in the forex trading market, positioning itself as a modern and user-friendly platform aimed at traders of all levels. Founded in 2023 and registered in Saint Lucia, the broker claims to offer competitive trading conditions and a wide array of financial instruments, including forex, cryptocurrencies, and commodities. However, the rapid growth of online trading has also given rise to numerous scams, making it crucial for traders to thoroughly assess the legitimacy of any brokerage before committing their funds. This article aims to provide an in-depth analysis of WinproFX, examining its regulatory status, company background, trading conditions, customer experiences, and potential risks. The investigation is based on a review of multiple sources, including expert assessments and user feedback.

Regulation and Legitimacy

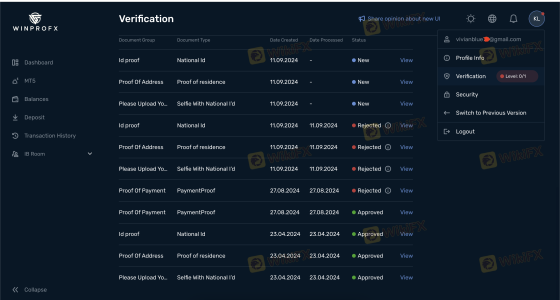

The regulatory environment is a critical factor in determining the safety and legitimacy of a forex broker. WinproFX is officially registered in Saint Lucia, a jurisdiction often associated with less stringent regulatory oversight. While it holds a registration number (2023-00197), it is important to note that the broker is not regulated by any recognized financial authority. This lack of regulation raises significant concerns regarding the safety of traders' funds and the overall credibility of the broker.

| Regulatory Authority | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| None | N/A | Saint Lucia | Not Verified |

The absence of a regulatory framework means that WinproFX is not held to any legal standards that protect investors. Regulated brokers are required to adhere to strict guidelines that ensure the security of client funds, including maintaining segregated accounts and providing transparency in operations. Without such oversight, traders may find themselves vulnerable to potential fraud or mismanagement.

Company Background Investigation

WinproFXs brief history raises questions about its credibility. The company claims to have over three decades of market presence, yet it was only registered in 2023. This discrepancy suggests that the broker may be misleading potential clients about its experience and reputation. Furthermore, the company's ownership structure is not publicly disclosed, which is a red flag for transparency.

The management team behind WinproFX also lacks visibility. While the broker claims to have a dedicated team of industry experts, there is no verifiable information about their qualifications or professional backgrounds. This lack of transparency can lead to skepticism regarding the broker's operational integrity and commitment to client service.

Trading Conditions Analysis

WinproFX offers a range of trading conditions, including high leverage of up to 1:500, which can be appealing to experienced traders looking to maximize their potential returns. However, such high leverage also poses significant risks, especially for novice traders who may lack the experience to manage their positions effectively.

The fee structure is another critical aspect to consider. WinproFX advertises tight spreads and low commissions, but the lack of explicit details on fees raises concerns about hidden costs that could impact profitability.

| Fee Type | WinproFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding trading costs can lead to confusion and unexpected charges for traders, making it essential to approach this broker with caution.

Customer Funds Safety

The safety of client funds is paramount in the forex trading industry. WinproFX claims to implement various security measures, but the lack of regulation means that there are no guarantees for fund protection. The broker does not provide details on whether client funds are kept in segregated accounts or if there is any form of investor protection.

Additionally, the absence of negative balance protection policies raises concerns about the potential for clients to lose more than their initial investment. Historical data regarding any past financial disputes or fund safety issues related to WinproFX is not readily available, further complicating the assessment of its reliability.

Customer Experience and Complaints

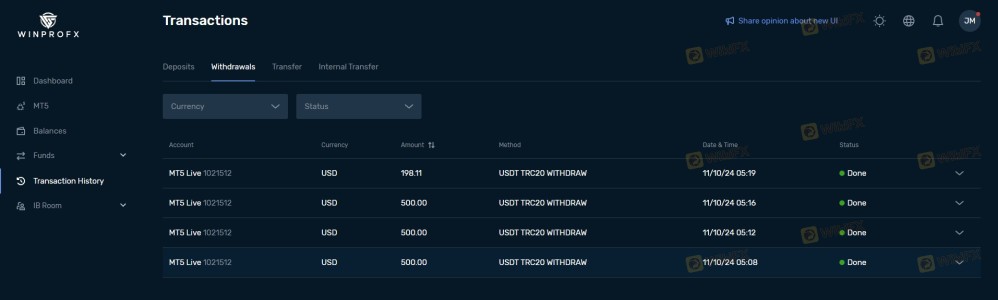

Customer feedback is a crucial indicator of a broker's reliability. Reviews for WinproFX are mixed, with some users reporting positive experiences related to fast withdrawals and a user-friendly platform. However, there are also numerous complaints regarding withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Fair |

Common complaints include difficulties in withdrawing funds, with users alleging that the broker employs tactics to delay or deny withdrawal requests. These patterns can indicate potential issues with the broker's operational practices and should be taken seriously by prospective clients.

Platform and Trade Execution

The trading platform offered by WinproFX is MetaTrader 5 (MT5), a widely recognized platform known for its advanced features and user-friendly interface. However, the performance of the platform, including order execution quality and slippage, is crucial for traders.

Reports of execution delays and slippage have been noted by some users, which can significantly impact trading outcomes. Additionally, any signs of platform manipulation, such as the broker altering prices or rejecting trades, would raise serious ethical concerns.

Risk Assessment

Using WinproFX comes with inherent risks, primarily due to its lack of regulation and transparency. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection |

| Financial Risk | High | Potential for fund mismanagement |

| Operational Risk | Medium | Reports of withdrawal issues and poor support |

To mitigate these risks, traders should conduct thorough research, limit their exposure, and consider using regulated brokers that provide greater security and transparency.

Conclusion and Recommendations

In conclusion, WinproFX presents several red flags that warrant caution. Its lack of regulation, questionable company history, and mixed customer feedback suggest that it may not be a safe option for traders. While the platform offers some attractive features, the potential risks associated with trading through an unregulated broker outweigh the benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider alternative brokers that are regulated by recognized financial authorities. Brokers like IG, OANDA, or Forex.com provide robust regulatory oversight and a proven track record of customer satisfaction, making them safer choices for forex trading. Always prioritize safety and transparency when selecting a trading platform to protect your investments.

Is WINPROFX a scam, or is it legit?

The latest exposure and evaluation content of WINPROFX brokers.

WINPROFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WINPROFX latest industry rating score is 4.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.