Is UNforex safe?

Software Index

License

Is UNforex Safe or a Scam?

Introduction

UNforex is a forex brokerage that has emerged in the competitive landscape of online trading, positioning itself as a provider of various financial instruments, including forex, CFDs on indices, commodities, and cryptocurrencies. As the forex market continues to grow, it has become increasingly important for traders to carefully evaluate the legitimacy and safety of their chosen brokers. The prevalence of scams and unregulated entities in this space necessitates a cautious approach. In this article, we will conduct a thorough investigation into UNforex, assessing its regulatory status, company background, trading conditions, customer fund safety, and user experiences. Our evaluation will be based on a comprehensive analysis of available data, including customer reviews, regulatory records, and industry benchmarks.

Regulation and Legitimacy

The regulatory environment in which a broker operates is crucial for determining its legitimacy and safety. UNforex claims to be regulated in Australia, but various sources indicate that it exceeds the regulatory standards set by the Australian Securities and Investments Commission (ASIC). This raises red flags regarding its compliance and operational practices. The following table summarizes the core regulatory information for UNforex:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 628606897 | Australia | Exceeded regulation |

The importance of regulation cannot be overstated; it provides a framework for accountability and protection for traders. However, the fact that UNforex has been noted for exceeding regulatory standards implies potential non-compliance with established guidelines. This could expose traders to higher risks, as unregulated activities may not offer the same level of consumer protection. Furthermore, the lack of a strong regulatory oversight mechanism could lead to issues such as fund mismanagement or withdrawal difficulties.

Company Background Investigation

UNforex Pty Ltd was established in 2017 and is based in Australia. However, the company has faced scrutiny regarding its transparency and operational legitimacy. The ownership structure of UNforex is not clearly disclosed, leading to concerns about accountability and trustworthiness. Additionally, the management team's background and professional experience are not readily available, which further complicates the assessment of the company's credibility.

A transparent company typically provides detailed information about its leadership, including qualifications and experience in the financial sector. Unfortunately, UNforex falls short in this area, as there is limited information available regarding its management team. This lack of transparency can be a significant concern for potential traders, as it raises questions about the company's commitment to ethical practices and customer service.

Trading Conditions Analysis

When evaluating a forex broker, it is essential to analyze the trading conditions they offer, including fees and spreads. UNforex presents a varied fee structure, which is crucial for traders to understand before committing capital. The following table compares the core trading costs associated with UNforex against industry averages:

| Fee Type | UNforex | Industry Average |

|---|---|---|

| Spread on Major Pairs | 2.7 pips | 1.5 pips |

| Commission Model | None reported | Varies |

| Overnight Interest Range | Not specified | -0.5% to +0.5% |

UNforex's spread on major currency pairs appears to be significantly higher than the industry average, which could impact trading profitability. Furthermore, the absence of clear information regarding commissions and overnight interest raises concerns about hidden fees that could affect traders' bottom lines. Such opaque pricing structures are often indicative of less reputable brokers, making it essential for traders to remain vigilant when considering UNforex.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. UNforex claims to implement various safety measures, including fund segregation, to protect clients' assets. Segregated accounts ensure that customer funds are kept separate from the broker's operational funds, providing a layer of security in the event of insolvency. However, the effectiveness of these measures is contingent on the broker's adherence to regulatory standards.

Additionally, the absence of negative balance protection—where traders cannot lose more than their account balance—poses further risks for clients. If a broker does not offer this protection, traders could potentially face significant financial liabilities during volatile market conditions. Historical issues related to fund safety or disputes with clients could further tarnish UNforex's reputation, making it imperative for potential traders to weigh these risks carefully.

Customer Experience and Complaints

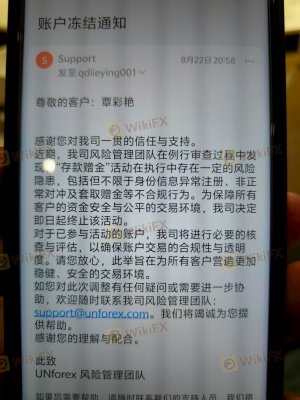

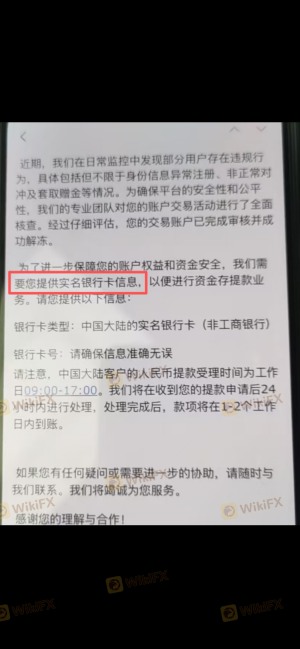

Customer feedback plays a vital role in assessing a broker's reliability. Reviews and testimonials from users can provide insights into their experiences with UNforex. Many traders have reported difficulties with fund withdrawals, which is a common complaint among less reputable brokers. The following table summarizes the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Average |

| Transparency of Fees | High | Poor |

Several users have expressed frustration over the lack of timely responses from customer support, particularly when attempting to withdraw funds. This lack of responsiveness is a significant red flag and raises concerns about the broker's commitment to customer service. In some cases, traders have reported feeling misled regarding the terms of their accounts, which further exacerbates trust issues.

Platform and Trade Execution

The trading platform's performance is another critical aspect that can affect a trader's experience. UNforex utilizes the MetaTrader 4 platform, which is widely regarded for its robust features and user-friendly interface. However, the execution quality, including slippage and rejection rates, is equally important. Traders have reported instances of poor execution quality, leading to missed opportunities and unexpected losses.

Any signs of platform manipulation, such as frequent slippage during high volatility periods, can indicate deeper issues within the broker's operational practices. A reliable broker should ensure that trades are executed at the best available prices without undue delays or interference.

Risk Assessment

Engaging with UNforex entails various risks that traders must consider. The following risk scorecard summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Exceeds ASIC regulation, indicating potential issues. |

| Fund Safety | High | Lack of negative balance protection and transparency. |

| Customer Support | Medium | Reports of poor responsiveness and support quality. |

| Trading Conditions | High | High spreads and unclear fee structures. |

To mitigate these risks, potential traders are advised to conduct thorough research and consider starting with a small capital investment. Additionally, utilizing demo accounts can provide valuable insights into the platform's functionality without the risk of losing real funds.

Conclusion and Recommendations

In conclusion, the analysis suggests that UNforex raises several concerns regarding its legitimacy and safety. The broker's regulatory status, coupled with a lack of transparency and numerous customer complaints, indicates that it may not be a reliable choice for traders. The high spreads and reported withdrawal issues further exacerbate these concerns, leading to the conclusion that UNforex may not be safe for trading.

For those considering forex trading, it is advisable to explore alternative brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback. Reputable options include brokers regulated by tier-1 authorities such as the FCA or ASIC, which can provide a safer trading environment. Ultimately, traders should prioritize their safety and due diligence when selecting a broker in the forex market.

Is UNforex a scam, or is it legit?

The latest exposure and evaluation content of UNforex brokers.

UNforex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UNforex latest industry rating score is 2.23, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.23 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.