IC Markets 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Founded in 2007, IC Markets is a distinguished ECN broker headquartered in Sydney, Australia, offering traders access to an extensive range of over 2,250 financial instruments, including currency pairs, stocks, commodities, and cryptocurrencies. The broker is particularly favored by active traders, especially scalpers and algorithmic traders, due to its ultra-fast execution speeds and competitive pricing structure, highlighted by raw spreads starting from 0 pips and leverage up to 1:500. IC Markets provides access to popular trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, which cater to diverse trading styles and preferences.

However, potential clients must tread carefully. Despite its prominent reputation, there are concerns regarding a complex fee structure, limited educational resources, and mixed reviews about the withdrawal process, raising questions about how well beginners might navigate the trading environment. IC Markets is best suited for experienced traders who prioritize execution speed and cost-effective trading conditions.

⚠️ Important Risk Advisory & Verification Steps

Before engaging in trading with IC Markets or any other broker, it's essential to conduct due diligence.

- Verify Regulatory Claims:

- Check the regulation status of IC Markets with bodies like ASIC, CySEC, and FSA.

- Use regulatory websites to confirm licensing information.

- Evaluate Security Measures:

- Ensure that the funds are held in segregated accounts.

- Investigate investor protection schemes applicable in your region.

- Examine Withdrawal Processes:

- Look for user reviews regarding the withdrawal process to understand potential delays.

- Request a trial withdrawal to assess the efficiency of the process.

Broker Ratings

Company Background and Positioning

IC Markets was established to provide retail and institutional traders with a direct connection to competitive trading solutions previously only accessible to larger financial institutions. The company operates globally, emphasizing a strong commitment to leveraging innovative technology and a wide variety of trading resources. IC Markets aims to stand out in a crowded marketplace by offering some of the fastest execution speeds—up to 40 milliseconds—made possible by its use of top-tier liquidity providers and advanced server technologies.

Core Business Overview

The main business areas of IC Markets include Forex, commodities, indices, options, stocks, and cryptocurrencies. The broker is authorized by regulatory bodies such as the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Seychelles Financial Services Authority (FSA). These licenses enable IC Markets to provide derivatives trading through Contracts for Difference (CFDs), giving traders access to significant leverage and market variety, albeit primarily for speculating rather than direct ownership of assets.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

IC Markets maintains regulatory licenses from recognized bodies, with ASIC being a top-tier regulator. However, some users have reported inconsistencies related to withdrawal processes and concerns about fund safety, especially those under less stringent regulatory protections like the Seychelles FSA.

User Self-Verification Guide

To ensure that IC Markets is trustworthy, potential clients should follow these steps:

- Visit the official websites of ASIC, CySEC, and FSA.

- Search for IC Markets or its associated entities to confirm their regulatory status.

- Review any available reports or disciplinary actions against the broker.

- Consider reading customer feedback on forums and review sites.

Industry Reputation and Summary

IC Markets has generally received positive feedback on trading platforms and execution speed. However, caution is warranted, especially with respect to fund withdrawal, as some client testimonials indicate potential delays and miscommunication.

“I have had smooth trading experiences, but my withdrawals take longer than expected, often raising red flags.” — Anonymous User

Trading Costs Analysis

Advantages in Commissions

IC Markets is recognized for having some of the lowest commission structures in the industry. Its raw spread accounts may charge around $3 to $7 per round turn, making it an appealing choice for high-volume and active traders.

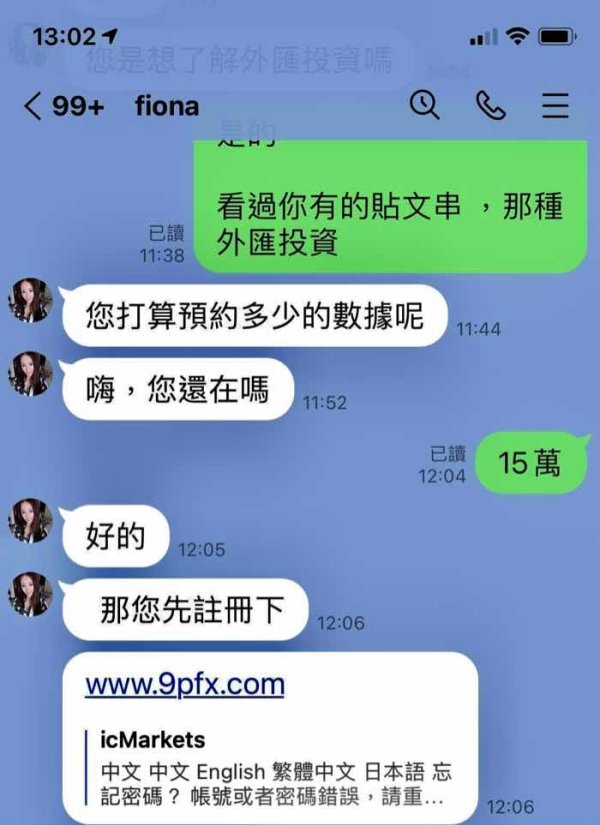

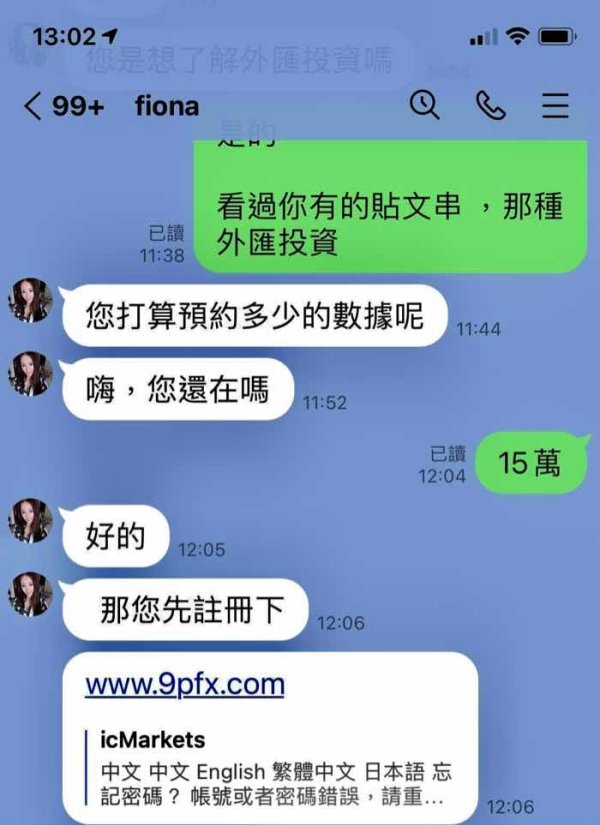

The "Traps" of Non-Trading Fees

While trading fees are competitive, users have noted potential unexpected costs associated with withdrawal methods. There may be restrictions on withdrawing through previously used payment methods, which can lead to confusion.

Cost Structure Summary

For active traders looking for low trading costs, IC Markets offers attractive conditions. However, the complex fee structures might be challenging for beginners who are not well-versed in understanding trading costs and commission models.

IC Markets supports a variety of platforms including MT4, MT5, and cTrader, which provide extensive charting tools, automation capabilities, and access to a wide range of tools.

The broker incorporates various third-party plugins to enhance trading experience, yet it lacks a proprietary trading platform which can be a downside for users looking for a single-source solution.

User feedback generally praises the performance and functionality of the trading platforms, with fast execution speeds being a recurring highlight.

User Experience Analysis

Overall Usability

Traders find the interface user-friendly; however, beginners might encounter a steeper learning curve due to the breadth of features and information available.

Customer Feedback

Positive reviews often cite the reliable performance and execution speed, although critiques mention the complexity when managing withdrawals and navigating the client area.

Customer Support Analysis

Availability and Multilingual Support

IC Markets offers solid customer service with multilingual support available 24/7. Users appreciate the responsiveness of live agents; however, experiences with chatbot assistance can vary.

User Experience Feedback

Though the company offers extensive support methods, some users express frustration with automated responses when reaching out for more nuanced trading-related queries.

Account Conditions Analysis

Account Types and Minimum Deposits

Starting at a minimum deposit of $200, IC Markets provides several account types, including standard and raw spread accounts. The spread differences and commission structures highlight its focus on catering to both beginner and seasoned traders.

Leverage Options

IC Markets provides significant leverage options, up to 1:500, but this is contingent upon regulatory guidelines applicable to the client's home country.

Conclusion

IC Markets remains a top-tier choice for experienced traders seeking a fast-paced, cost-effective trading environment. With robust trading platforms, competitive pricing, and a significant array of financial instruments, it caters effectively to active traders, particularly in the Forex and CFD markets. However, potential clients must be mindful of the complex fee structures, withdrawal processes, and learning materials, which may pose challenges, especially for beginners. Ultimately, IC Markets stands as an opportunity for those well-prepared to navigate its offerings and risks efficiently.