Regarding the legitimacy of SÔEGEE FUTURES forex brokers, it provides BAPPEBTI and WikiBit, (also has a graphic survey regarding security).

Is SÔEGEE FUTURES safe?

Business

License

Is SÔEGEE FUTURES markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. SOEGEE FUTURES d/h PT. HARUMDANA BERJANGKA

Effective Date: Change Record

--Email Address of Licensed Institution:

cs@soegeefutures.comSharing Status:

No SharingWebsite of Licensed Institution:

www.soegeefutures.comExpiration Time:

--Address of Licensed Institution:

Graha Selaras LT .3, Jl. K.H. Mas Mansyur No.59 JakarTa 10230Phone Number of Licensed Institution:

0213911085Licensed Institution Certified Documents:

Is Soegee Futures A Scam?

Introduction

Soegee Futures is an Indonesian forex broker that has positioned itself within the competitive landscape of online trading. Established in 2000, it claims to offer a range of financial instruments, including forex, commodities, and stock CFDs. However, the increasing number of brokers in the forex market has made it essential for traders to thoroughly assess the reliability and safety of their chosen trading platforms. This evaluation is particularly critical as the forex market is rife with both legitimate firms and potential scams that can jeopardize traders' investments.

In this article, we will conduct a comprehensive analysis of Soegee Futures, examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risks associated with trading through this broker. Our investigation will draw on various online reviews and industry reports to present an objective view of whether Soegee Futures is a safe trading option or a potential scam.

Regulation and Legitimacy

Understanding the regulatory landscape is crucial when evaluating any forex broker. Soegee Futures claims to be regulated by the Indonesian Commodity Futures Trading Regulatory Agency (Bappebti). However, the regulatory environment in Indonesia is often viewed as less stringent compared to other jurisdictions, raising questions about the level of investor protection provided.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bappebti | 42/Bappebti/SI/XII/2000 | Indonesia | Verified |

While having a license from Bappebti is better than operating without any regulation, it is important to note that the protections offered by this regulatory body are limited. Notably, Bappebti does not require brokers to maintain segregated accounts for client funds, nor does it offer negative balance protection. This lack of robust regulatory oversight can expose traders to significant risks, particularly in the event of a broker's insolvency or fraudulent practices.

Furthermore, the historical compliance of Soegee Futures with regulatory requirements has not been extensively documented, leading to concerns about its operational integrity. Traders should approach this broker with caution, recognizing that while it is regulated, the quality of that regulation may not provide the level of safety one might expect from brokers regulated in more stringent jurisdictions like the UK or Australia.

Company Background Investigation

Soegee Futures was founded in 2000 and operates out of Jakarta, Indonesia. The company claims to have a significant presence in the Indonesian financial market and is a member of the Jakarta Futures Exchange. However, details regarding its ownership structure and management team are not extensively disclosed, which raises transparency concerns.

The lack of information about the key personnel behind the company can be a red flag for potential investors. An effective management team with a strong background in finance and trading is critical for the success and reliability of a brokerage. Without this transparency, traders may find it challenging to assess the competence and trustworthiness of the firm's leadership.

Additionally, Soegee Futures' transparency regarding its operations, policies, and financial health appears to be limited. This lack of disclosure can create an environment of uncertainty for potential clients who are seeking assurance about the broker's stability and integrity.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is paramount. Soegee Futures presents itself as a competitive option with various account types and trading instruments. However, the overall fee structure and trading costs associated with the broker require careful scrutiny.

The broker advertises spreads as low as 0.1 pips for major currency pairs, but it is essential to clarify whether these are the typical spreads clients can expect or if they apply only to specific account tiers. Additionally, the presence of commission fees, which are not explicitly detailed, can lead to unexpected costs for traders.

| Fee Type | Soegee Futures | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.5-1.0 pips |

| Commission Model | Not disclosed | $5-$10 per lot |

| Overnight Interest Range | Not disclosed | Varies |

The absence of clear information about commissions and overnight interest can create confusion and dissatisfaction among traders. Moreover, if the broker employs a commission structure that is not competitive, it could significantly impact the profitability of trading activities, particularly for high-frequency traders.

Customer Fund Safety

The safety of customer funds is a primary concern when selecting a forex broker. Soegee Futures claims to adhere to standard practices for fund management; however, the lack of segregated accounts raises significant concerns. Without the requirement to separate client funds from the broker's operational funds, there is an increased risk of mismanagement or loss of funds in the event of financial difficulties faced by the broker.

Furthermore, Soegee Futures does not provide information regarding investor protection schemes, which are commonly found in more strictly regulated markets. This absence of protective measures can leave traders vulnerable should the broker encounter financial issues or insolvency.

Historically, there have been no widely reported incidents of fund mismanagement or fraud associated with Soegee Futures, but the lack of robust protective measures makes it imperative for potential clients to exercise caution when depositing funds.

Customer Experience and Complaints

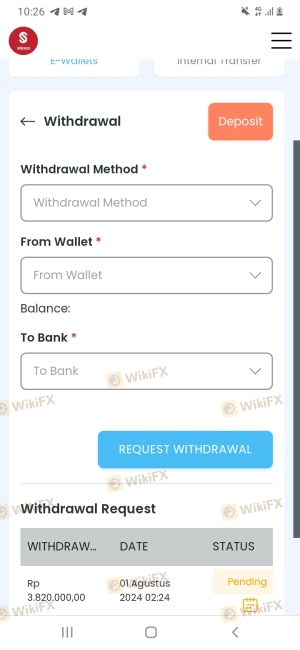

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews of Soegee Futures reveal a mixed bag of experiences among users. While some traders have reported positive experiences with the platform's execution and customer service, others have raised concerns regarding withdrawal issues and the responsiveness of support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Transparency | Medium | Limited information |

| Customer Support | Medium | Mixed reviews |

One notable case involved a trader who reported difficulties withdrawing funds, citing unresponsive customer service as a major issue. This raises questions about the broker's commitment to customer satisfaction and the reliability of its support infrastructure.

Overall, while some users have had satisfactory experiences, the prevalence of withdrawal complaints and slow customer service responses indicates potential areas of concern for prospective clients.

Platform and Trade Execution

The trading platform offered by Soegee Futures, primarily MetaTrader 4 (MT4), is widely recognized for its reliability and robust features. However, the performance and execution quality on this platform are critical factors that can significantly impact a trader's experience.

Traders have reported varying experiences regarding order execution quality, with some experiencing slippage during high volatility periods. The absence of detailed information about the broker's slippage rates and order rejection instances makes it challenging to assess the overall reliability of trade execution.

Any indications of platform manipulation or execution issues should be taken seriously, as they can lead to significant financial losses for traders. Therefore, it is essential for potential clients to consider these factors before committing to trading with Soegee Futures.

Risk Assessment

Engaging with Soegee Futures involves several risks that traders should be aware of. The regulatory environment, funding safety, and customer service issues contribute to an overall risk profile that warrants careful consideration.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Limited protections under Bappebti |

| Fund Safety | High | Lack of segregated accounts |

| Customer Support | Medium | Mixed reviews on responsiveness |

| Execution Quality | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should conduct thorough due diligence, consider starting with a small investment, and closely monitor their trading activities. Additionally, exploring alternative brokers with stronger regulatory oversight and better customer feedback may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, while Soegee Futures is a regulated broker in Indonesia, several factors raise concerns about its overall safety and reliability. The lack of stringent regulatory protections, transparency issues, and mixed customer feedback suggest that potential clients should approach this broker with caution.

For traders seeking a secure trading environment, it is advisable to consider alternative brokers that offer stronger regulatory frameworks, better customer service, and robust fund protection measures. Some reliable alternatives may include brokers regulated in jurisdictions such as the UK or Australia, where investor protections are more comprehensive.

Ultimately, the decision to trade with Soegee Futures should be based on a careful assessment of personal risk tolerance and trading objectives.

Is SÔEGEE FUTURES a scam, or is it legit?

The latest exposure and evaluation content of SÔEGEE FUTURES brokers.

SÔEGEE FUTURES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SÔEGEE FUTURES latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.