Soegee Futures 2025 Review: Everything You Need to Know

Executive Summary

This soegee futures review looks at a real Indonesian broker that helps retail traders. Soegee Futures has been an offshore broker since 2011, giving traders access to forex, commodities, stocks, indices, and CFDs.

The broker offers tight spreads starting from 0.00001 pips and leverage up to 1:200. This makes it great for small and medium traders who want more market exposure. Indonesia's Commodity Futures Trading Regulatory Agency (Bappebti) watches over the broker's operations.

The platform uses MT4 and their own Soegeefx App for desktop and mobile trading. With just a $100 minimum deposit, Soegee Futures makes trading easy for new traders while keeping professional conditions for experienced ones.

However, clients should know that offshore brokers may have different protections than major financial centers. Information about customer service and educational resources is also limited.

Important Notice

Regional Entity Differences: Soegee Futures works as an offshore broker based in Indonesia. This means rules and client protections may be very different from brokers licensed in the UK, EU, or Australia. Potential clients should think carefully about trading with an offshore company.

Review Methodology: This review uses public information, regulatory filings, and user feedback from online sources. We have not tested the platform's services directly, so readers should do their own research before making trading decisions.

Rating Overview

Broker Overview

Soegee Futures started in 2011 and became a major player in Indonesia's forex and derivatives trading market. The company works from Indonesia and provides trading services for forex and other financial derivatives to clients worldwide. As an offshore broker, Soegee Futures offers diverse trading opportunities while keeping competitive trading conditions.

The broker built its reputation by providing easy trading solutions for retail traders. These traders want professional-grade trading conditions without high entry barriers. The company has run for over ten years, which shows some stability in the competitive forex brokerage sector.

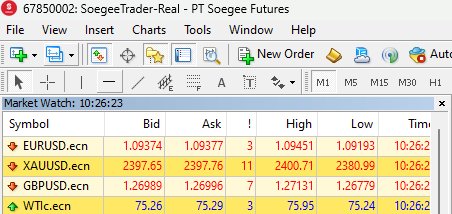

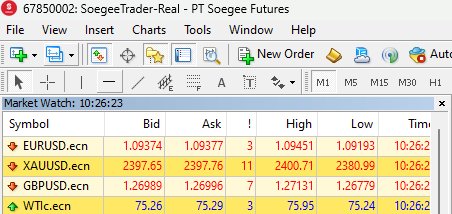

Soegee Futures supports multiple trading platforms, including MetaTrader 4 (MT4) and their own Soegeefx App. This meets different trader preferences and technical needs. The broker offers access to many tradeable assets, including major and minor forex pairs, commodities like gold and oil, stock indices from global markets, individual stocks, and contracts for difference (CFDs) across multiple asset classes.

The company operates under Indonesia's Commodity Futures Trading Regulatory Agency (Bappebti). This provides a framework for its operations within Indonesia's financial services sector. This regulatory relationship sets certain operational standards and compliance requirements that the broker must maintain.

Regulatory Jurisdiction: Soegee Futures operates under Bappebti supervision, which provides regulatory oversight within Indonesia's financial services framework.

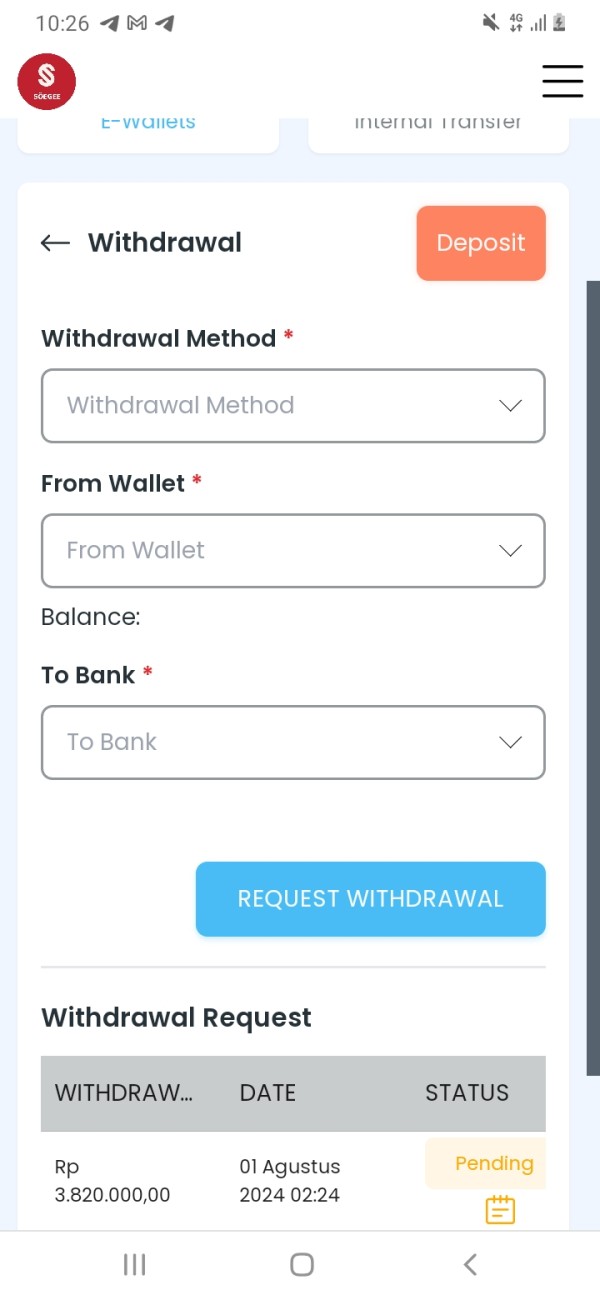

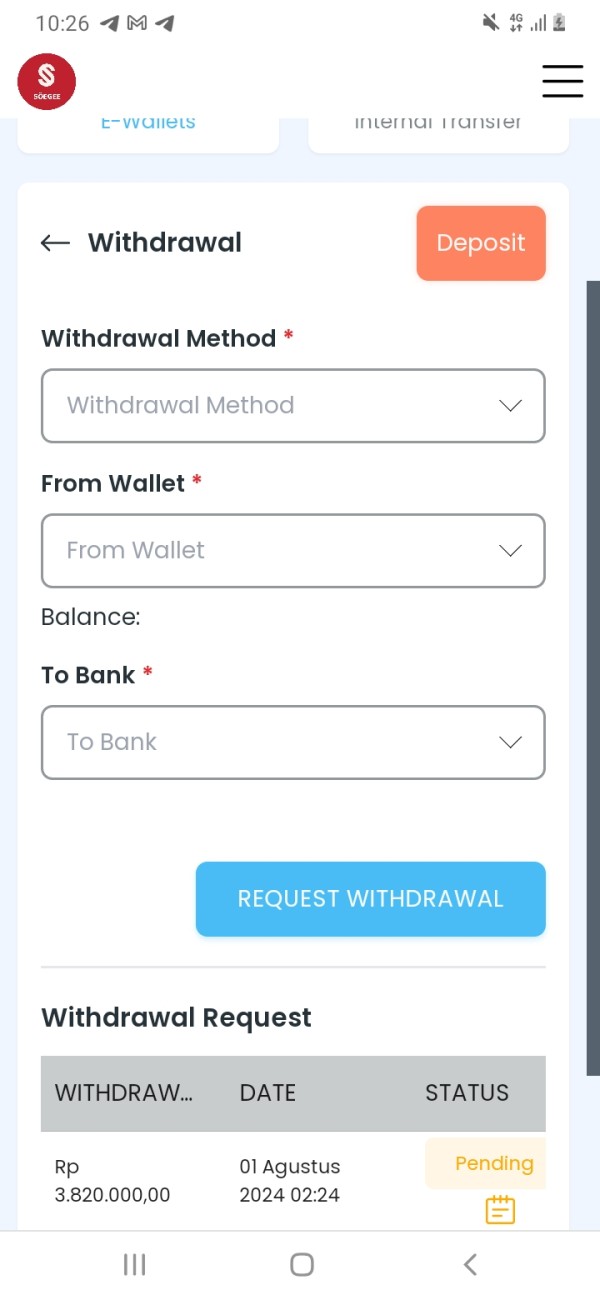

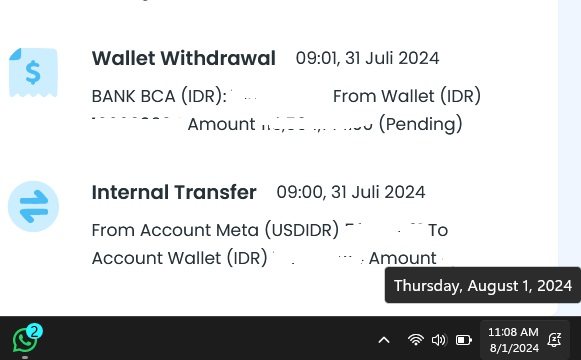

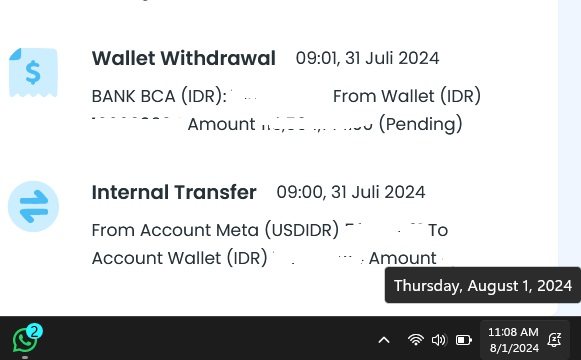

Deposit and Withdrawal Methods: The source materials did not include specific information about available deposit and withdrawal methods.

Minimum Deposit Requirements: The broker requires just $100 minimum deposit, making it good for retail traders and beginners.

Bonus and Promotions: The available source materials did not specify information about promotional offers and bonus structures.

Tradeable Assets: The platform gives access to many financial instruments including forex currency pairs, commodities, individual stocks, major global indices, and contracts for difference (CFDs) across multiple asset classes.

Cost Structure: Spreads start from an impressive 0.00001 pips, but the reviewed materials did not detail specific commission structures and additional fees.

Leverage Ratios: Maximum leverage reaches 1:200, giving significant market exposure potential for qualified traders while requiring proper risk management.

Platform Options: Trading works through MetaTrader 4 (MT4) and the broker's own Soegeefx App, supporting both desktop and mobile trading environments.

Geographic Restrictions: The source materials did not include specific information about regional restrictions or prohibited jurisdictions.

Customer Support Languages: The reviewed documentation did not specify details about available customer service languages.

This soegee futures review shows that while the broker offers competitive basic trading conditions, some operational details remain unclear from public sources.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Soegee Futures shows strong performance in account conditions, earning an 8/10 rating based on several competitive features. The broker's $100 minimum deposit requirement is an accessible entry point for both new traders testing the waters and experienced traders seeking additional trading accounts. This threshold is much lower than many international brokers, making it particularly attractive for the Southeast Asian market.

The leverage offering of up to 1:200 provides substantial market exposure potential. Traders should approach high leverage with proper risk management strategies. This leverage level matches industry standards for retail forex trading and offers flexibility for various trading strategies, from conservative position sizing to more aggressive approaches.

Spread conditions starting from 0.00001 pips show highly competitive pricing. The specific conditions under which these minimum spreads are available need further clarification. Such tight spreads, if consistently available, would position Soegee Futures favorably against many competitors in the retail forex space.

However, the lack of detailed information about different account types, Islamic accounts, or professional trader classifications prevents a perfect score. Also, specific information about account opening procedures and verification requirements was not available in the reviewed materials, which impacts the overall assessment of account conditions.

This soegee futures review finding suggests that while basic account conditions appear competitive, potential clients would benefit from direct communication with the broker to understand the full scope of available account options.

The platform selection at Soegee Futures gets a 7/10 rating, showing a solid but not exceptional offering in trading tools and resources. The availability of MetaTrader 4 represents a significant strength, as MT4 remains the most widely used and trusted trading platform in the retail forex industry. MT4's robust charting capabilities, extensive technical analysis tools, and support for automated trading through Expert Advisors provide professional-grade functionality.

The inclusion of the proprietary Soegeefx App shows the broker's commitment to mobile trading solutions and platform innovation. Mobile trading apps have become essential for modern traders who require market access and position management capabilities while away from their primary trading stations. However, specific details about the app's features, functionality, and user interface quality were not available in the source materials.

The rating is limited by the absence of information about research and analysis resources. These have become increasingly important differentiators among forex brokers. Modern traders expect access to market analysis, economic calendars, trading signals, and educational content. The lack of detailed information about these supplementary resources prevents a higher rating.

Also, no information was available about automated trading support beyond the standard MT4 capabilities, advanced charting tools beyond the platform defaults, or integration with third-party analysis services. These factors contribute to the moderate rating despite the solid platform foundation.

Customer Service and Support Analysis (Rating Withheld)

A comprehensive rating for customer service and support cannot be provided due to insufficient information in the available source materials. This represents a significant gap in the evaluation process, as customer service quality is crucial for trader satisfaction and problem resolution.

Key areas that require assessment but lack available information include the range of customer service channels (phone, email, live chat), service availability hours, response time expectations, and the quality of support provided. Also, information about multilingual support capabilities, which would be particularly relevant for an Indonesian broker serving international clients, was not available.

The absence of user testimonials or reviews specifically addressing customer service experiences further complicates any attempt at evaluation. Professional forex brokers typically provide multiple contact methods, extended service hours, and knowledgeable support staff capable of addressing both technical and account-related inquiries.

Without concrete information about support infrastructure, response times, or user satisfaction with customer service, any rating would be speculative. Potential clients are advised to directly test customer service responsiveness and quality before committing significant funds to the platform.

Trading Experience Analysis (8/10)

Based on available user feedback, Soegee Futures receives an 8/10 rating for trading experience, reflecting generally positive platform performance and execution quality. User reports suggest that the trading platforms maintain good stability during normal market conditions, which is essential for consistent trading operations and strategy implementation.

Order execution quality appears to meet user expectations, with feedback showing reliable order processing and minimal slippage under standard market conditions. This is particularly important for active traders and those using scalping or short-term trading strategies where execution precision directly impacts profitability.

The combination of MT4 and the Soegeefx App provides trading flexibility across different devices and environments. MT4's proven reliability and extensive functionality contribute significantly to the positive trading experience, while the mobile app ensures continuity of trading operations for users who require market access while mobile.

Spread stability appears to be a strength based on available information, with users not reporting significant issues with spread widening during normal trading hours. However, specific performance data during high-volatility periods or major news events was not available in the reviewed materials.

The rating reflects the generally positive user feedback while acknowledging the limitations of available performance data. A perfect score is withheld due to the lack of comprehensive performance metrics and detailed user experience analysis across different market conditions.

This soegee futures review suggests that the basic trading experience meets industry standards, though more detailed performance data would strengthen the assessment.

Trustworthiness Analysis (6/10)

Soegee Futures receives a 6/10 rating for trustworthiness, reflecting a mixed assessment based on available regulatory and operational information. The broker's regulation by Bappebti (Indonesia's Commodity Futures Trading Regulatory Agency) provides a legitimate regulatory framework, though this jurisdiction may not offer the same level of client protection as major financial centers like the UK's FCA or Australia's ASIC.

The company's operational history since 2011 suggests a degree of business continuity and market presence. Over a decade of operations indicates some level of business stability and client satisfaction, though specific information about the company's financial stability or capital adequacy was not available.

However, the rating is significantly impacted by the lack of detailed information about client fund protection measures, segregation of client accounts, or insurance coverage for client deposits. These factors are crucial for assessing the safety of client funds and overall broker reliability.

Also, limited transparency about company ownership, financial statements, or third-party audits affects the trustworthiness evaluation. Modern traders increasingly expect comprehensive disclosure about broker operations, risk management procedures, and financial health.

The offshore nature of the broker's operations, while not inherently negative, does introduce considerations about dispute resolution procedures and regulatory recourse options that may differ significantly from major regulatory jurisdictions.

User Experience Analysis (Rating Withheld)

A comprehensive user experience rating cannot be provided due to limited specific feedback available in the source materials. User experience includes multiple factors including platform interface design, account management procedures, overall satisfaction levels, and common user concerns, none of which were adequately detailed in the available information.

While general feedback suggests that the interface design is user-friendly, specific details about navigation ease, customization options, account management functionality, and mobile app user experience were not available. These factors are crucial for determining overall user satisfaction and platform usability.

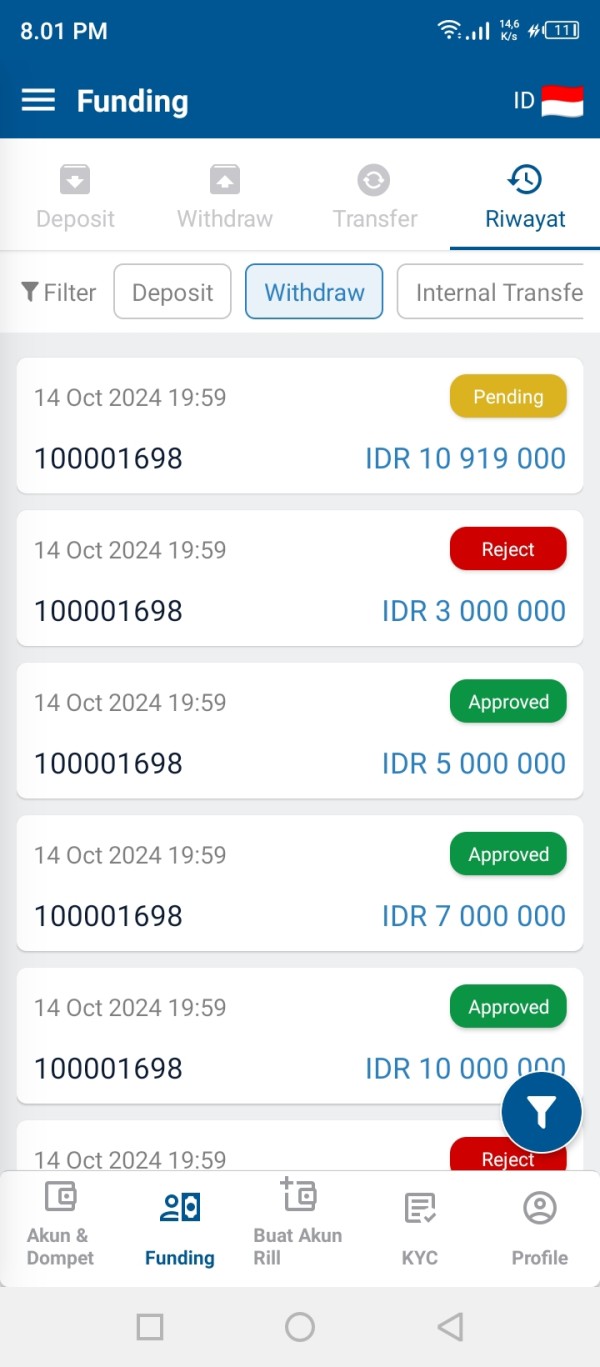

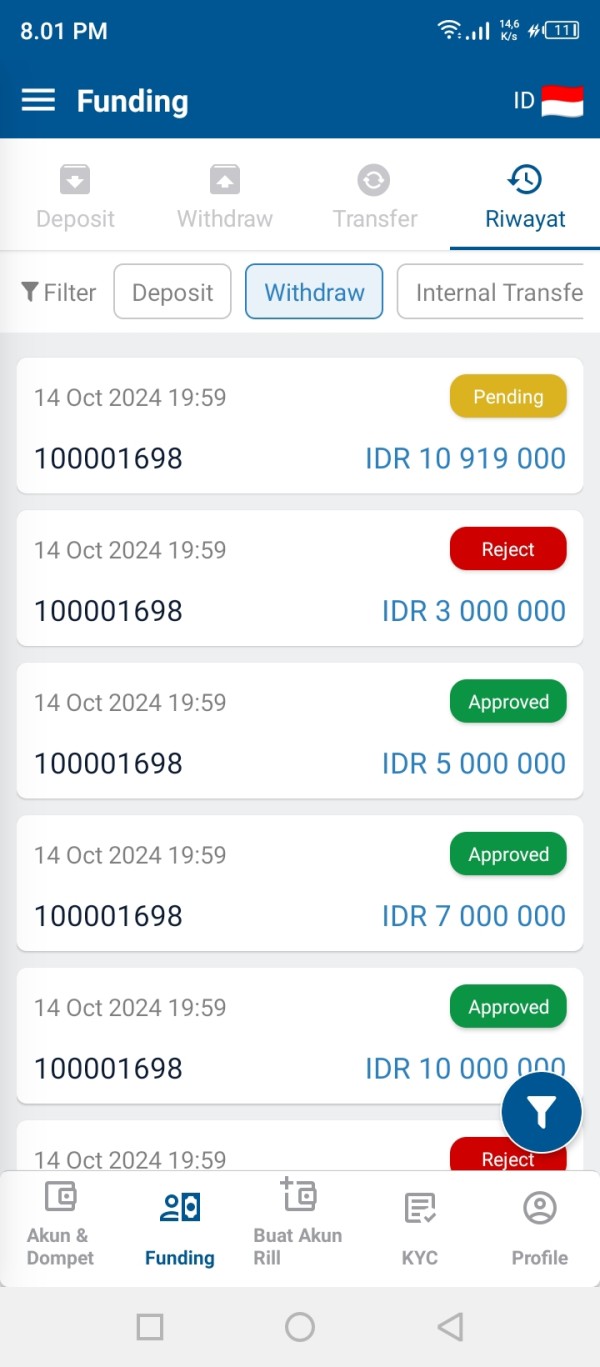

Information about the registration and verification process, which significantly impacts initial user experience, was not detailed in the reviewed materials. Similarly, user feedback about deposit and withdrawal experiences, which often represent key satisfaction factors, was not available.

The absence of comprehensive user surveys, detailed testimonials, or systematic user experience studies prevents any meaningful rating in this category. Also, information about common user complaints or areas for improvement was not present in the source materials.

Potential clients are advised to seek additional user reviews and possibly test the platform through demo accounts to assess user experience factors that are important to their individual trading requirements.

Conclusion

Soegee Futures emerges as a legitimate forex broker that offers competitive trading conditions for retail traders. This is especially true for those seeking accessible entry requirements and diverse asset selection. The broker's strengths include low minimum deposits, tight spreads starting from 0.00001 pips, and substantial leverage up to 1:200, making it particularly suitable for small to medium-sized traders.

Recommended User Types: This broker appears well-suited for retail traders seeking high leverage opportunities, new traders requiring low entry barriers, and those interested in trading multiple asset classes including forex, commodities, and CFDs. The platform combination of MT4 and proprietary mobile solutions caters to both traditional and mobile-first trading approaches.

Key Advantages: Competitive spreads, accessible minimum deposit requirements, regulatory oversight by Bappebti, and platform variety represent the primary strengths. The decade-long operational history also suggests business continuity.

Notable Limitations: Limited transparency about customer service infrastructure, educational resources, and detailed security measures represent areas for improvement. The offshore regulatory jurisdiction may also present considerations for some traders regarding client protection levels.

Overall, while this soegee futures review identifies a legitimate trading option with competitive basic conditions, potential clients should conduct thorough due diligence regarding service aspects not fully detailed in available public information.