Is OtetMarkets safe?

Pros

Cons

Is Otet Markets A Scam?

Introduction

Otet Markets is a relatively new player in the forex trading arena, positioning itself as a global forex broker that offers access to a range of financial instruments, including forex, commodities, indices, and cryptocurrencies. As the financial markets become increasingly saturated with brokers, traders must exercise caution when selecting a broker to ensure their investments are secure. The potential for scams and fraudulent activities in the forex industry necessitates thorough vetting of brokers. This article aims to provide an objective analysis of Otet Markets by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

Regulation and Legitimacy

The legitimacy of a forex broker is often tied to its regulatory status. Regulatory bodies impose strict standards that brokers must adhere to, providing a layer of security for traders. Otet Markets claims to be regulated by the Mwali International Services Authority (MISA) and holds a license from the Marshall Islands. However, these regulatory bodies are considered low-tier compared to more reputable authorities like the FCA or ASIC.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| MISA | T2023304 | Comoros | Active |

| Marshall Islands | 118922 | Marshall Islands | Active |

While Otet Markets is indeed registered with these authorities, the quality of regulation is questionable. The lack of investor protection schemes and the ability for brokers to operate with minimal oversight raise concerns about the safety of traders' funds. Furthermore, the broker's operations in offshore jurisdictions often lead to a lack of accountability, making it difficult for traders to seek recourse in case of disputes or fund mismanagement.

Company Background Investigation

Otet Markets is operated by Otet Group Ltd, which has its headquarters in Limassol, Cyprus. The company was founded in 2023, making it a relatively new entity in the financial services industry. The ownership structure and management team are not prominently disclosed on their website, which raises questions about transparency.

The absence of detailed information about the management team and their professional backgrounds can deter potential clients, as experienced leadership often correlates with better service quality and operational integrity. Furthermore, the lack of historical compliance records with reputable regulatory bodies adds to the skepticism surrounding the broker's legitimacy.

Trading Conditions Analysis

Otet Markets offers a variety of trading conditions, including high leverage of up to 1:3000 and a wide range of financial instruments. However, the fee structure appears complex and potentially disadvantageous for traders.

| Fee Type | Otet Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 0.1 - 1.5 pips |

| Commission Model | Yes | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads on major currency pairs can be higher than industry averages, particularly for accounts that do not offer commission-free trading. Additionally, the broker charges withdrawal fees ranging from 0.25% to 0.75%, which is not uncommon but may be considered excessive compared to other brokers that offer zero-fee withdrawals.

Customer Fund Security

The security of customer funds is paramount in the forex trading industry. Otet Markets claims to implement various safety measures, including segregated accounts to protect client funds. However, the absence of robust investor protection policies, such as those found with higher-tier regulators, raises concerns about the safety of funds.

The broker does not offer negative balance protection, which can expose traders to the risk of losing more than their initial investment. Historical issues regarding fund security or disputes have not been widely reported, but the lack of transparency and regulatory oversight is a significant red flag.

Customer Experience and Complaints

Customer feedback is crucial in evaluating a broker's reliability. Otet Markets has garnered mixed reviews, with several complaints regarding withdrawal delays and lack of transparency in fee structures.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Fair |

| Customer Service Issues | High | Poor |

Common complaints often revolve around difficulties in withdrawing funds, with some users reporting that their requests were either delayed or denied without adequate explanation. These issues can severely impact a trader's experience and raise questions about the broker's operational integrity.

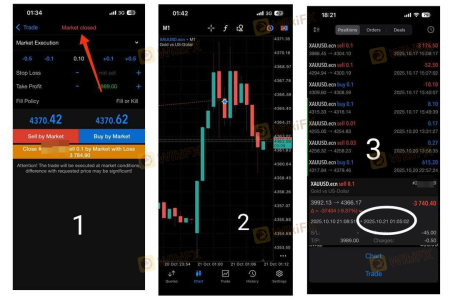

Platform and Trade Execution

Otet Markets offers trading through popular platforms like MetaTrader 5 and cTrader, both of which are known for their robust features and user-friendly interfaces. However, the execution quality and reliability of these platforms can vary.

Traders have reported instances of slippage and order rejections, which can be detrimental, especially for those employing high-frequency trading strategies. The overall user experience is a critical factor, and any signs of platform manipulation or poor execution can significantly affect a trader's profitability.

Risk Assessment

Engaging with Otet Markets involves several risks that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Low-tier regulation with minimal oversight. |

| Fund Safety Risk | High | No investor protection and potential for fund mismanagement. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

To mitigate these risks, traders are advised to start with a small investment and thoroughly understand the trading conditions and fee structures before committing significant funds.

Conclusion and Recommendations

In conclusion, while Otet Markets presents itself as a viable trading option, there are considerable risks associated with this broker. The lack of robust regulatory oversight, mixed customer feedback, and potential issues with fund safety raise red flags that traders should not ignore.

For novice traders or those who prioritize fund security, it may be prudent to consider well-regulated alternatives such as brokers licensed by the FCA or ASIC. These brokers typically offer higher levels of investor protection and a more transparent operational framework.

In summary, while Otet Markets may not be outright fraudulent, the associated risks and concerns warrant caution. Traders should conduct thorough research and consider their risk tolerance before engaging with this broker.

Is OtetMarkets a scam, or is it legit?

The latest exposure and evaluation content of OtetMarkets brokers.

OtetMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OtetMarkets latest industry rating score is 2.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.