Regarding the legitimacy of NXG MARKETS forex brokers, it provides FinCEN and WikiBit, .

Is NXG MARKETS safe?

Risk Control

Regulation

Is NXG MARKETS markets regulated?

The regulatory license is the strongest proof.

FinCEN Currency Exchange License (MSB)

Financial Crimes Enforcement Network

Financial Crimes Enforcement Network

Current Status:

RegulatedLicense Type:

Currency Exchange License (MSB)

Licensed Entity:

NXG Markets Limited

Effective Date:

2025-07-24Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

BONOVO ROAD FOMBONI ISLAND OF MOHELIPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is NXG Markets A Scam?

Introduction

In the dynamic world of forex trading, selecting a reliable broker is crucial for ensuring a safe and profitable trading experience. NXG Markets is a relatively new online trading platform that entered the market in 2024 and is headquartered in Australia. It aims to cater to a diverse range of traders, from beginners to seasoned professionals, by offering various trading instruments and account types. However, with the rise of fraudulent schemes in the online trading industry, traders must exercise caution and conduct thorough evaluations of brokers before committing their funds.

This article aims to provide a comprehensive assessment of NXG Markets, focusing on its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. By utilizing a structured framework and factual data, we will help traders determine whether NXG Markets is a legitimate trading option or a potential scam.

Regulation and Legitimacy

The regulatory framework under which a broker operates is a key indicator of its legitimacy and trustworthiness. NXG Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC), a well-respected authority known for its stringent oversight of financial services in Australia. This regulation is crucial as it implies that the broker adheres to specific standards aimed at protecting traders' interests.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001308207 | Australia | Verified |

ASIC's regulation ensures that NXG Markets must maintain client funds in segregated accounts, conduct regular audits, and adhere to strict financial reporting standards. This regulatory oversight is designed to protect traders from potential fraud and mismanagement of funds.

However, it is important to note that NXG Markets is classified as an appointed representative (AR) under ASIC, which may indicate a more limited scope of regulatory oversight compared to brokers holding a full license. While the regulatory status of NXG Markets appears credible, potential clients should remain vigilant and conduct further due diligence to verify the broker's compliance history and any past regulatory issues.

Company Background Investigation

NXG Markets was established in 2024, positioning itself as an innovative player in the forex and CFD markets. The company is headquartered in Australia, with additional registered addresses in Dubai and Comoros. The ownership structure of NXG Markets is not extensively detailed in the available resources, which could raise concerns regarding transparency.

The management team at NXG Markets is expected to possess a background in finance and trading, but specific details about their professional experience and qualifications are not readily available. This lack of information may hinder potential clients' ability to assess the expertise and reliability of the team behind the broker.

In terms of transparency, NXG Markets provides some information about its services and offerings on its website. However, the absence of detailed disclosures regarding its management team and ownership may lead to questions about the broker's commitment to transparency and accountability. As a new entrant in the market, it is essential for NXG Markets to build trust with its clients by offering clear insights into its operations and leadership.

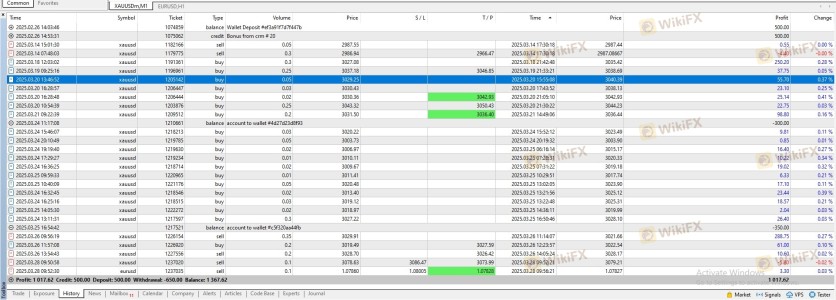

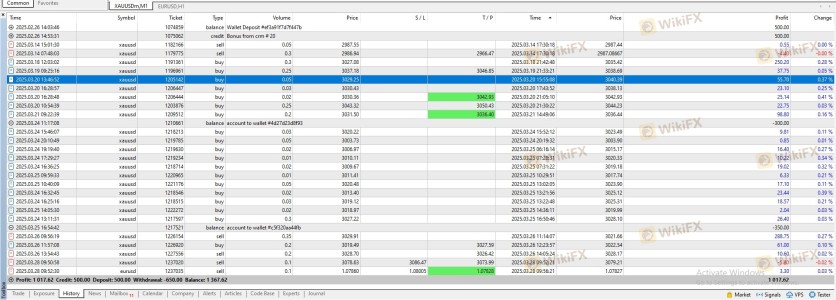

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions, including spreads, commissions, and other fees, is vital for traders. NXG Markets offers a range of account types, each with different trading conditions tailored to various trader profiles.

| Fee Type | NXG Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Starting from 2 pips | 1-3 pips |

| Commission Model | None (varies by account type) | Varies widely |

| Overnight Interest Range | Varies by asset | 0.5% - 3% |

NXG Markets provides competitive spreads, particularly for its ECN account, which offers spreads starting from 0 pips but incurs a commission. The absence of commissions on other account types can be appealing to traders seeking to minimize trading costs.

However, some user reviews and feedback indicate potential issues with hidden fees or unclear cost structures. Traders should be cautious and thoroughly review the terms and conditions associated with each account type to avoid unexpected charges. Overall, while NXG Markets presents a competitive fee structure, the lack of transparency in certain areas warrants careful consideration before opening an account.

Customer Fund Security

The safety of customer funds is paramount in the forex trading industry. NXG Markets claims to implement several security measures to protect traders' investments. These include holding client funds in segregated accounts at reputable financial institutions, ensuring that traders' funds are distinct from the company's operational funds.

Additionally, NXG Markets offers negative balance protection, which safeguards traders from incurring losses greater than their initial investment. This feature is particularly important in the volatile forex market, where sudden price movements can lead to significant losses.

Despite these assurances, it is essential for potential clients to investigate any historical issues related to fund security or disputes involving NXG Markets. A thorough review of user feedback and complaints can provide insights into the broker's track record regarding fund safety and security measures.

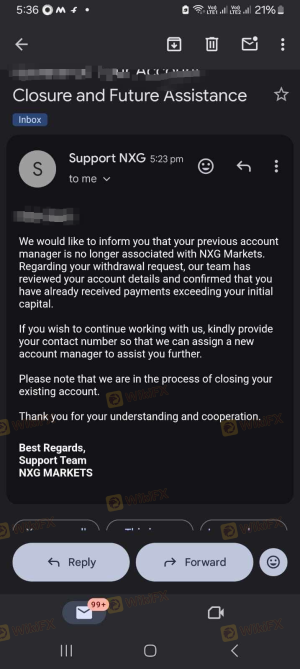

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. Reviews of NXG Markets reveal a mixed bag of experiences. While some users appreciate the broker's competitive trading conditions and user-friendly platform, others have raised concerns about customer support and account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or unresponsive |

| Account Verification | Medium | Delayed processing |

| Customer Support | High | Inconsistent quality |

Common complaints include difficulties in withdrawing funds, slow response times from customer support, and issues related to account verification. For instance, several users have reported prolonged delays in accessing their funds, leading to frustration and mistrust.

One notable case involved a trader who faced account restrictions without clear communication from the broker, highlighting potential weaknesses in customer service and account management. Such issues can significantly impact a trader's experience and overall trust in the platform.

Platform and Trade Execution

The performance of a trading platform is critical for successful trading. NXG Markets offers access to popular trading platforms such as MetaTrader 5 (MT5) and cTrader, both known for their advanced features and user-friendly interfaces. Users have generally reported positive experiences regarding the platforms' functionality and ease of use.

However, concerns have been raised about order execution quality, particularly regarding slippage and order rejections. Traders expect timely execution, especially in fast-moving markets, and any signs of manipulation or irregularities in execution can severely undermine trust in the broker.

Risk Assessment

Using NXG Markets involves several risks that traders should consider. While the broker is regulated by ASIC, its relatively new presence in the market raises questions about its long-term stability and reliability.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited history and potential compliance issues. |

| Customer Support Risk | High | Reports of slow response times and unresolved complaints. |

| Fund Security Risk | Medium | While measures are in place, historical issues may exist. |

To mitigate these risks, traders are advised to conduct thorough research, start with a demo account, and only invest what they can afford to lose. Additionally, keeping abreast of user reviews and regulatory updates can help in making informed decisions.

Conclusion and Recommendations

In conclusion, while NXG Markets presents itself as a legitimate trading platform with regulatory backing from ASIC, several factors warrant caution. The broker's relatively new presence in the market, mixed customer feedback, and potential issues with customer support and fund withdrawal raise red flags for prospective traders.

Traders should exercise due diligence and consider starting with a demo account to assess the platform's features and performance. For those seeking alternatives, brokers with a longer track record and more robust customer service may be advisable. Ultimately, while NXG Markets offers competitive trading conditions, potential clients should weigh the risks and proceed with caution.

Is NXG MARKETS a scam, or is it legit?

The latest exposure and evaluation content of NXG MARKETS brokers.

NXG MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NXG MARKETS latest industry rating score is 6.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.