nxg markets 2025 Review: Everything You Need to Know

1. Abstract

NXG Markets is a new forex and CFD broker that started in recent years. It says it follows multiple regulations. The broker claims to work under ASIC oversight, but users worry about whether it's real and safe. It offers easy trading and many different instruments. These features attract people who want regulated access to forex and CFD markets.

However, this NXG Markets review shows big problems with account details and openness. These issues make the trading community doubt the broker. New traders should know about these problems, especially those who want regulated platforms. The broker does provide good educational resources and a simple interface.

The promise of strong trading exists, but users should research carefully. User feedback is mixed and account requirements are unclear. This NXG Markets review gives a fair view based on public data and user opinions. It serves as an important resource for careful traders.

2. Caveats

NXG Markets works as an ASIC-regulated broker, but its legal status in other areas is unclear. This review uses publicly available data and user feedback. Some details about how the broker operates have not been fully checked.

The broker advertises multiple regulatory covers, but users report problems with regulations in different areas. This analysis looks at various user reports and online comments. These sometimes show different views about safety and legitimacy.

Traders should be careful with these findings and do more research before opening an account. The review method compares public data with user insights. It admits that certain details like account conditions, deposit methods, and promotions are mostly unknown in available resources.

3. Scoring Framework

4. Broker Overview

NXG Markets Pty Ltd started in 2022 and presents itself as a strong player in forex and CFD trading. The broker emphasizes its multi-body regulated status. It advocates for strong compliance measures by stating that ASIC oversees it.

From the start, NXG Markets has focused mainly on providing access to forex and CFD instruments. It leverages an approachable trading environment to attract many different traders. The company's background and business model center on offering a complete trading experience with claims of ethical practices and transparent operations.

However, there are notable concerns about the detailed operational factors that affect account legitimacy and investor protection. In terms of its operational framework, NXG Markets currently offers trading in both forex pairs and CFD instruments without naming its trading platforms. The emphasis on user-friendly features and educational tools suggests that the broker aims to serve retail traders looking for regulated environments under ASIC's watch.

Specifics about actual trading platform functionality, execution speeds, and order processing remain limited in available resources. As reported from multiple sources and user feedback, these operational gaps have fueled doubt. This makes it essential for prospective clients to weigh the benefits of regulatory oversight against insufficient clarity in core operational details.

This NXG Markets review thus serves as an important reference point for individuals examining every aspect of their trading partner.

Regulatory Regions:

NXG Markets is regulated by ASIC, which represents a significant credential for those seeking regulated brokers. However, the exact regulatory license number and full details of licensing conditions are not specified in available documentation.

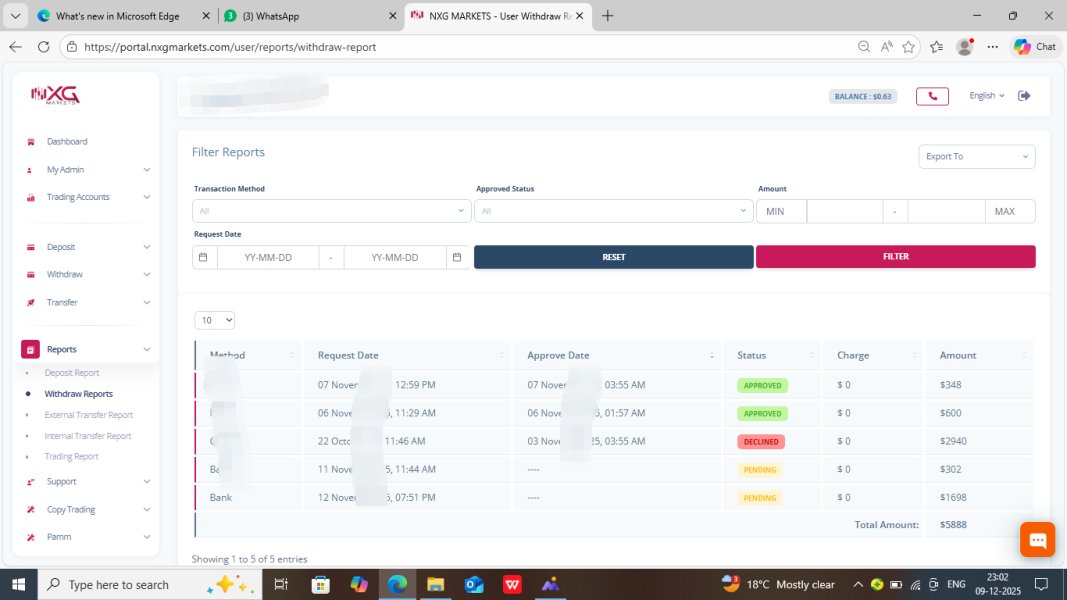

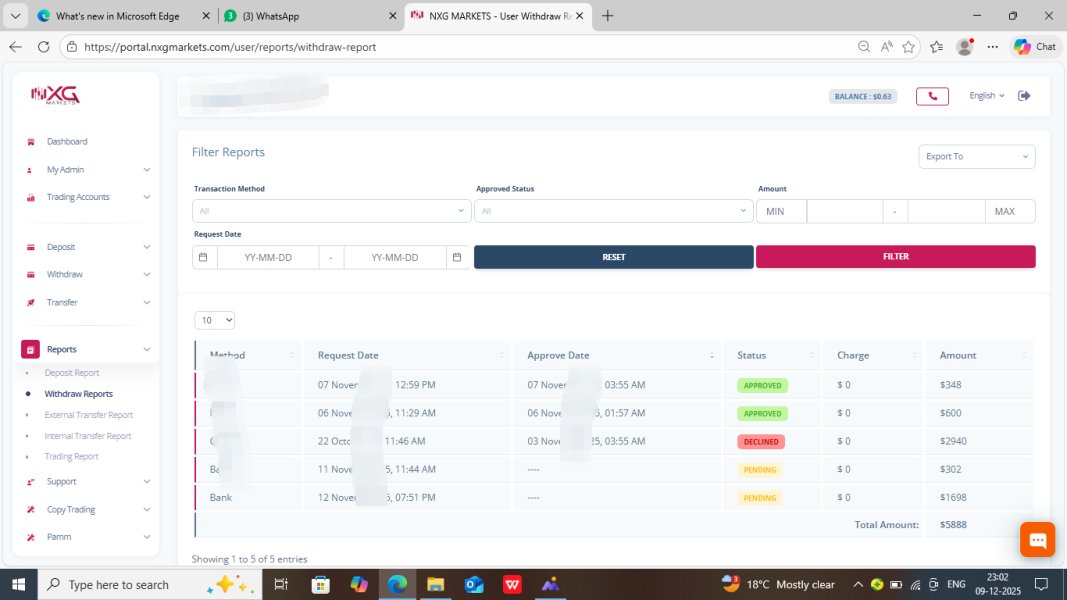

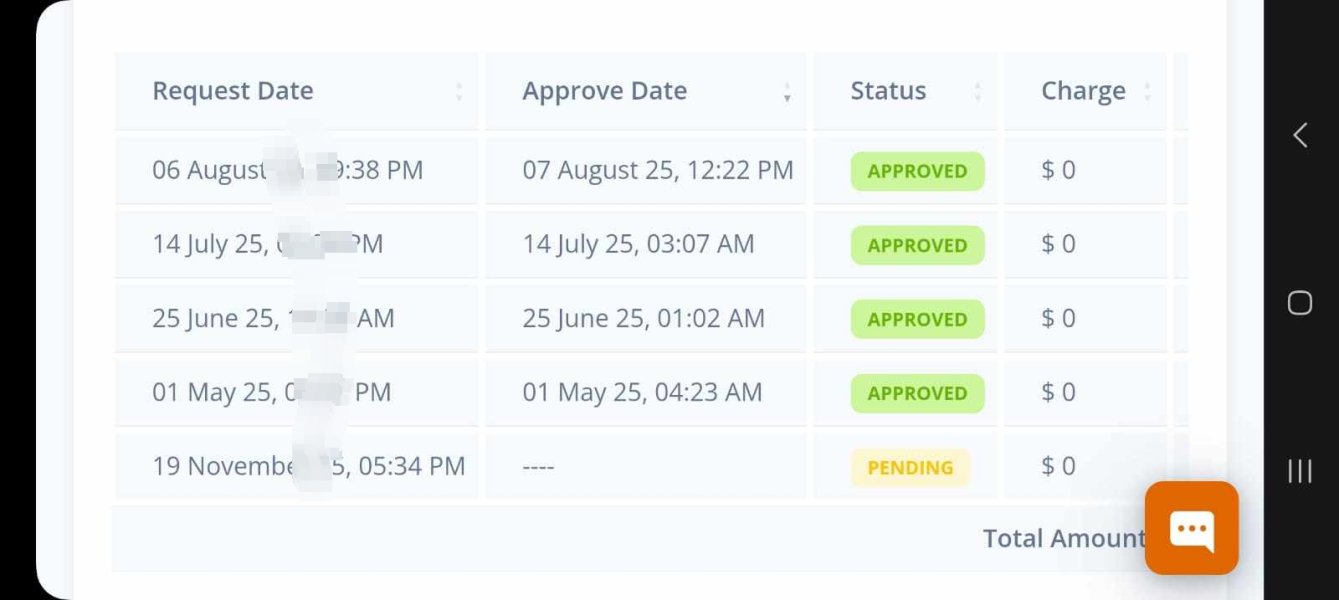

Deposit and Withdrawal Methods:

The review shows that specific deposit and withdrawal options are not explained in public sources. Traders may need to seek further clarification directly from the broker about available banking channels and processing times.

Minimum Deposit Requirement:

Details about the minimum deposit requirement have not been made clear. This area remains unspecified and should be investigated further by those considering opening an account.

Bonus Promotions:

There is no detailed promotional information available about bonus offers or promotional campaigns. Potential clients should know that bonuses, if any, have not been confirmed in accessible data.

Tradable Assets:

NXG Markets offers a range of tradable assets, including forex pairs and CFDs on various instruments. This positions it as a versatile option for traders looking to diversify their investment portfolios.

Cost Structure:

Information on the cost structure, including spreads, commissions, and other fees, is inadequate. The absence of clear information about these costs suggests that the broker needs more transparency.

Leverage Ratios:

The maximum leverage ratios provided by NXG Markets are not detailed in current documentation. This leaves a gap in understanding risk parameters from a trader's perspective.

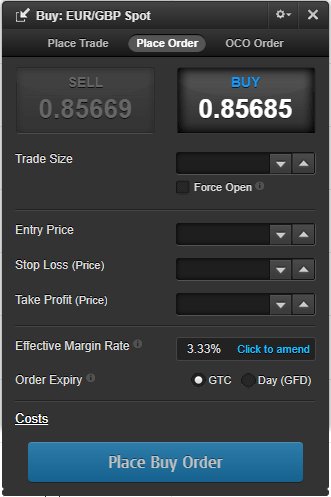

Platform Options:

The specific trading platforms provided by NXG Markets have not been clearly identified within available resources. This might involve proprietary platforms or third-party solutions, but the lack of definitive information is noteworthy.

Regional Restrictions:

No clear details have been provided about any country or regional restrictions. Interested traders should be cautious and verify their eligibility based on their local regulations.

Customer Service Languages:

Information about the languages supported by customer service, including whether multilingual support is available, is missing from accessible data. This gap might affect users in non-English speaking regions seeking prompt support.

In summary, while NXG Markets lays out a broad framework covering key aspects of trading, significant details remain unclear. Prospective traders are strongly advised to request further clarification directly from the broker before committing their funds.

6. Detailed Scoring Analysis

6.1 Account Conditions Analysis

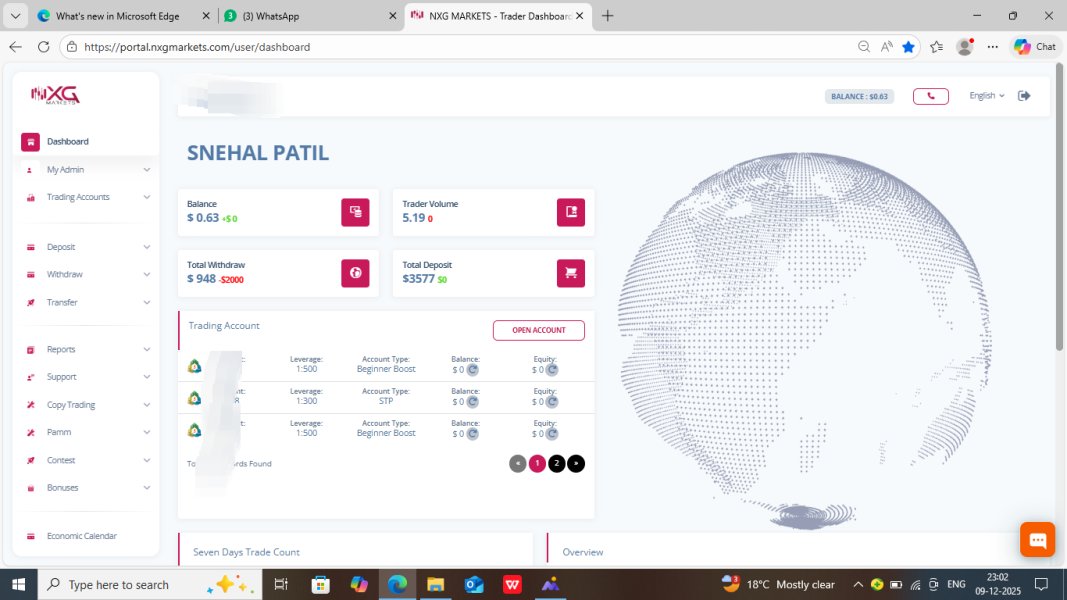

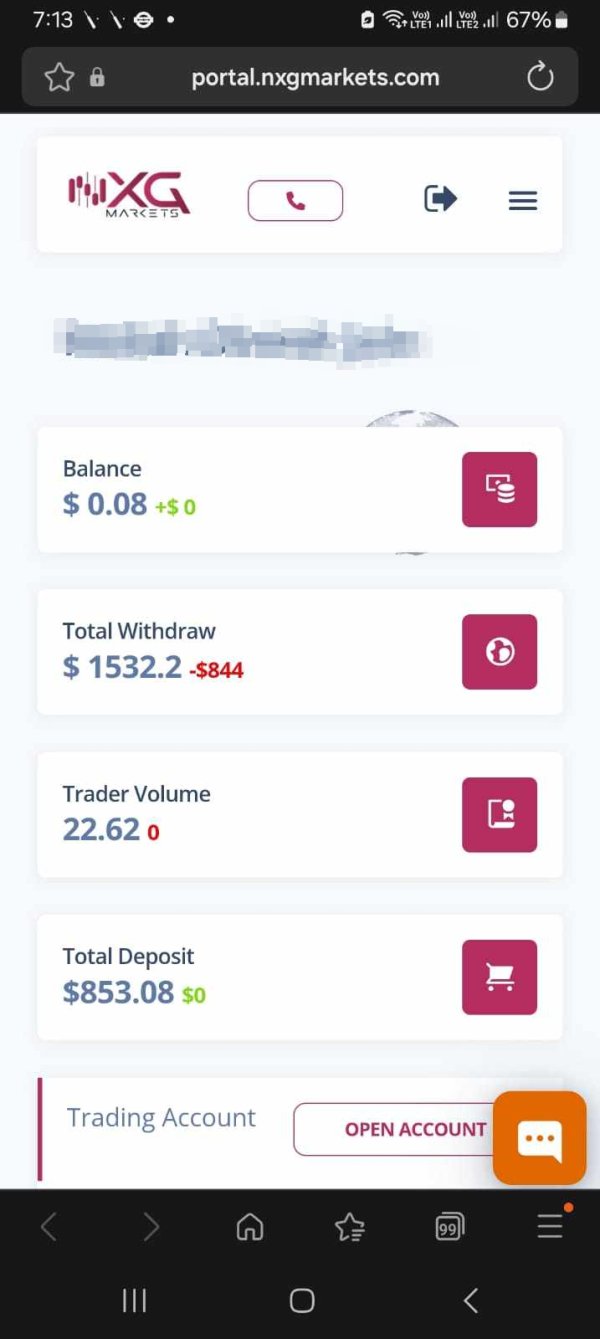

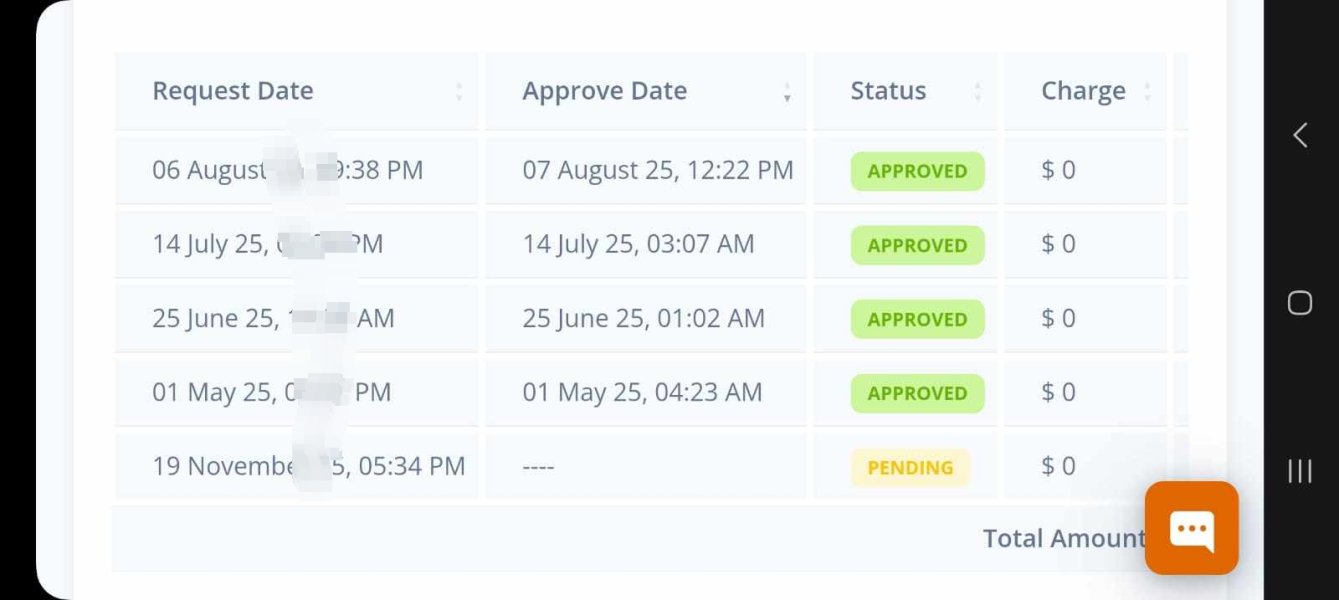

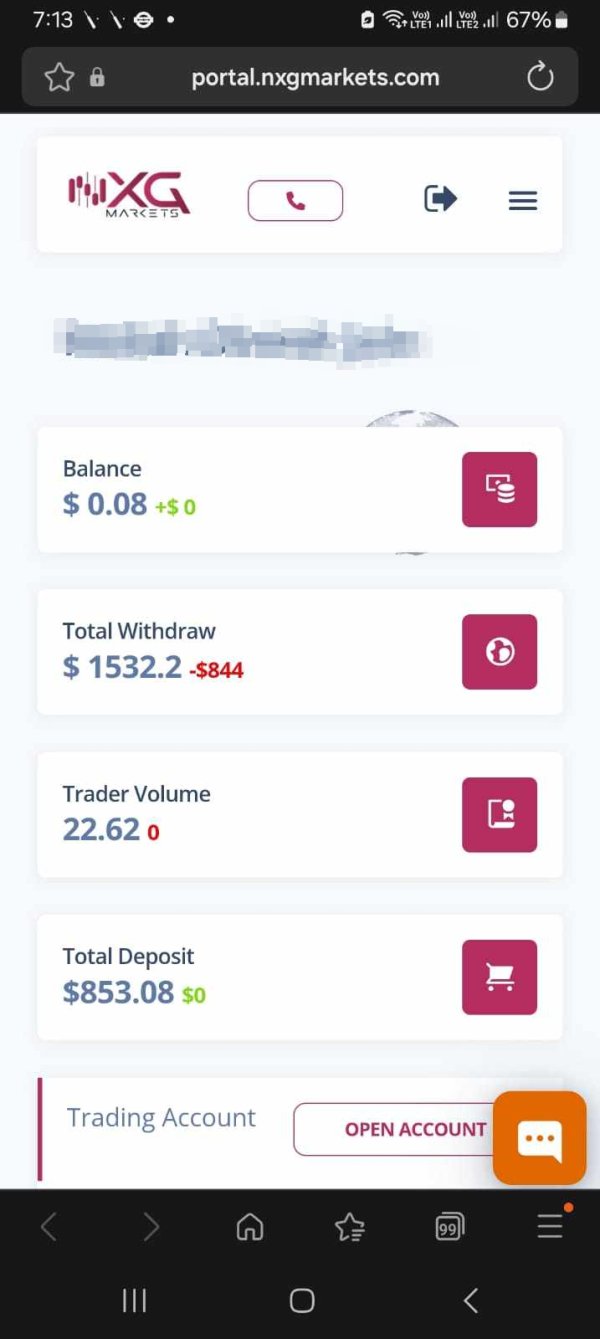

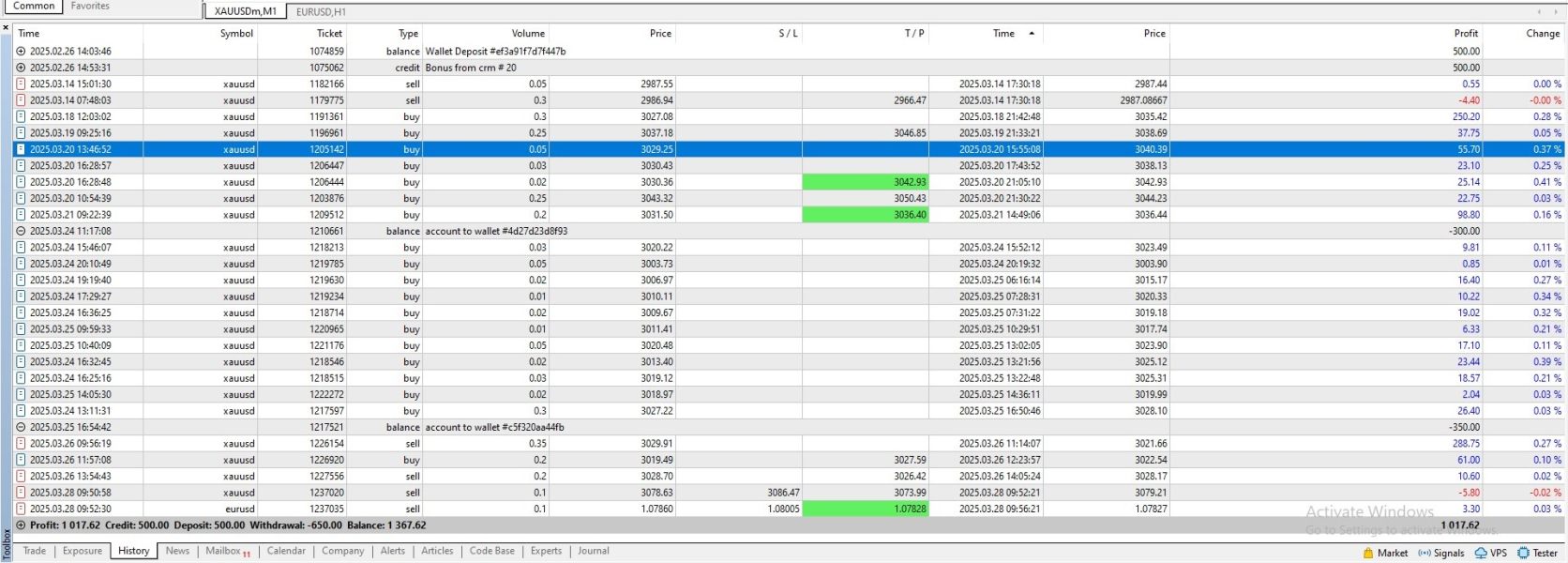

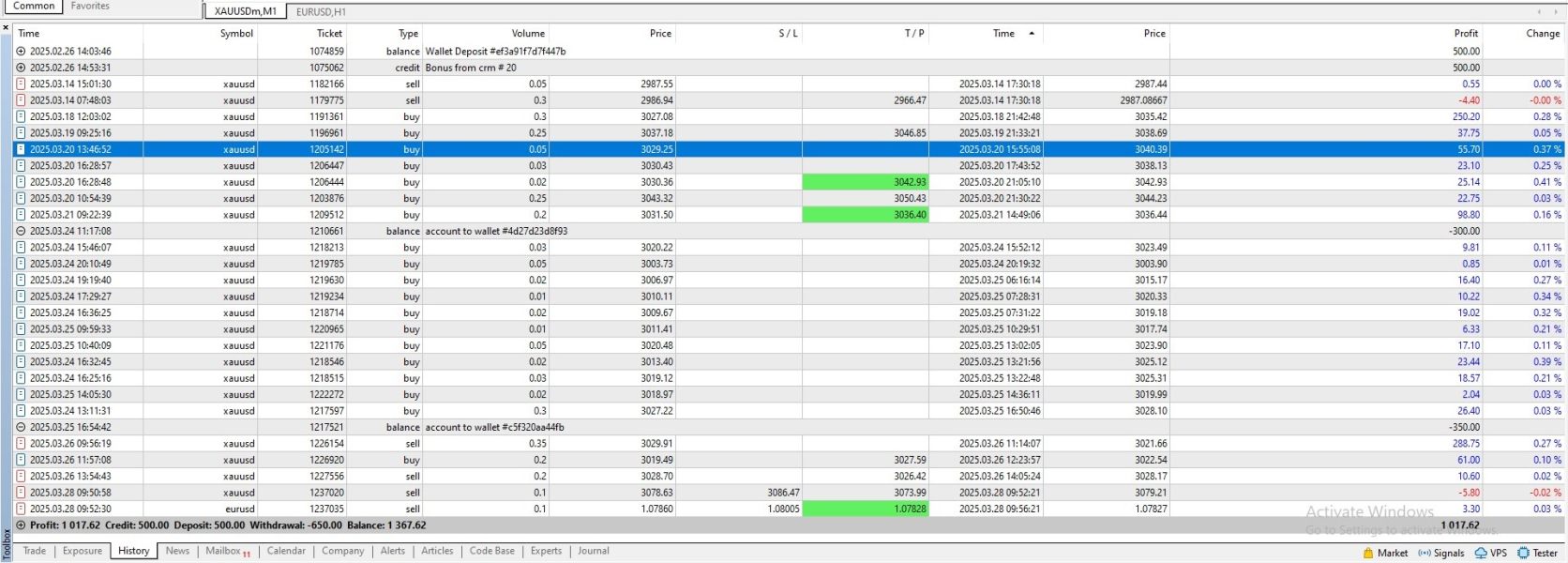

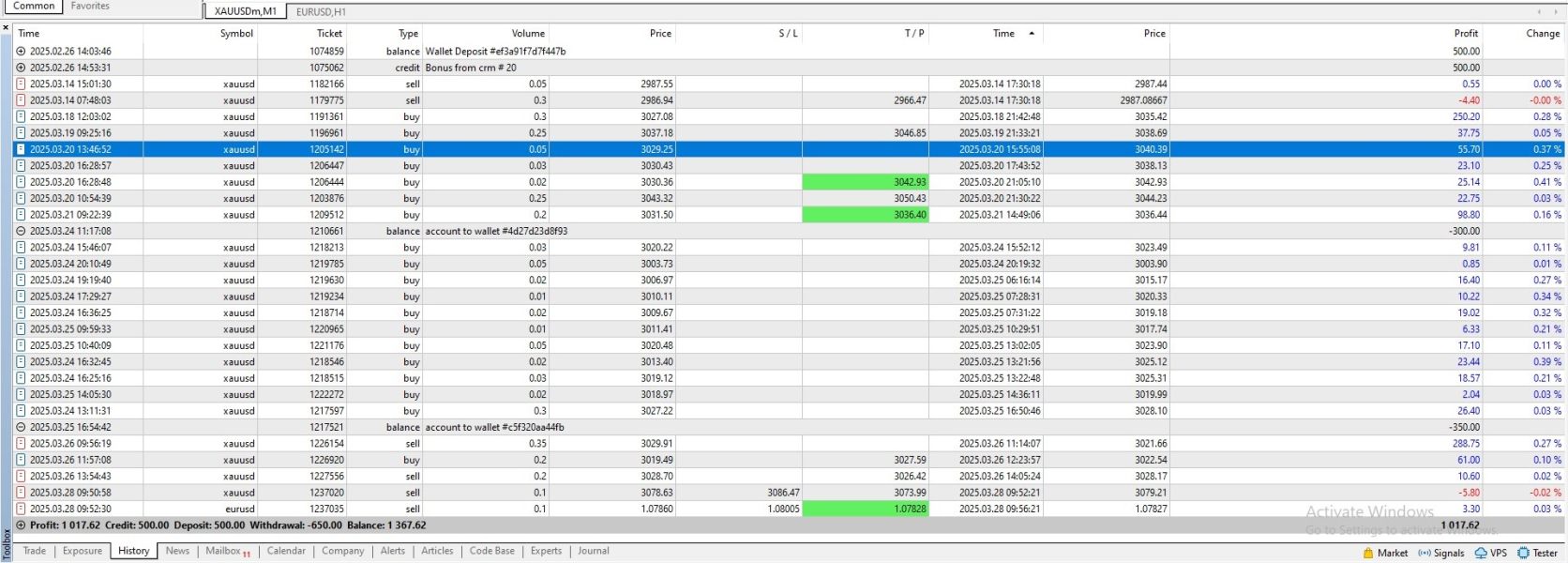

The account conditions at NXG Markets remain one of the most critical areas of concern in this review. Information about the types of accounts available, such as standard, premium, or specialized accounts for specific trader profiles, is noticeably absent. There is no concrete information on the minimum deposit requirement or the detailed account setup process.

This leaves prospective clients to rely solely on user feedback. Many users have highlighted issues surrounding the legitimacy and security of the accounts. These concerns may stem from the overall lack of clarity in trading conditions.

Compared with other brokers that provide transparent account opening procedures and clearly defined deposit requirements, NXG Markets falls short. The inconsistency in account-related data raises a red flag for those relying on comprehensive regulatory disclosure. This NXG Markets review emphasizes that traders must exercise additional caution when considering account initiation on platforms with insufficient data about account conditions.

The lack of specificity can increase risk and uncertainty.

NXG Markets claims to offer a wide array of trading tools and educational resources to help traders make informed decisions. The presence of a diversified set of trading instruments, including forex and CFD products, is a promising start. However, the exact nature and quality of these tools remain imprecise.

Current data suggests that educational resources and research materials are provided. Specifics about whether these include market analysis reports, webinars, or advanced charting software are not available. The reliability of the research tools and the ease of use of these features can vary widely.

This potentially impacts the platform's overall utility. User reviews have pointed out that while the environment appears user-friendly, the lack of detailed descriptions on the tools leaves room for speculation about their effectiveness. Without concrete evidence on the functionality of these resources, traders must be cautious in relying solely on the broker's claims.

It is essential to cross-reference these offerings with independent reviews and expert opinions before making final decisions.

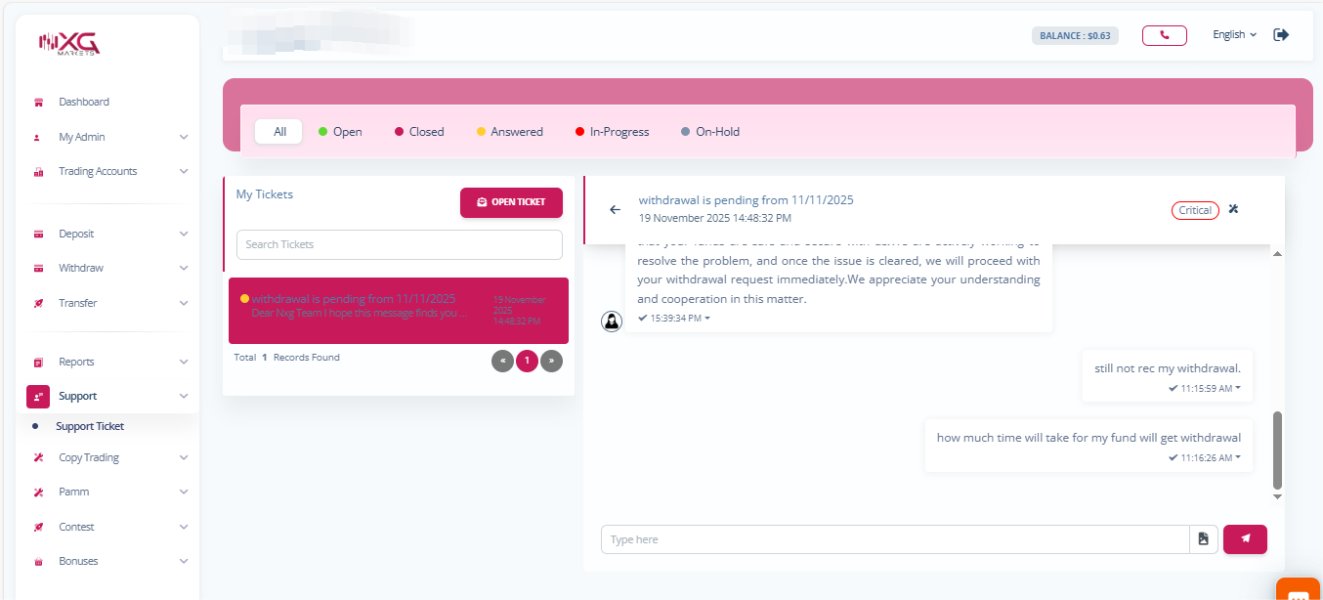

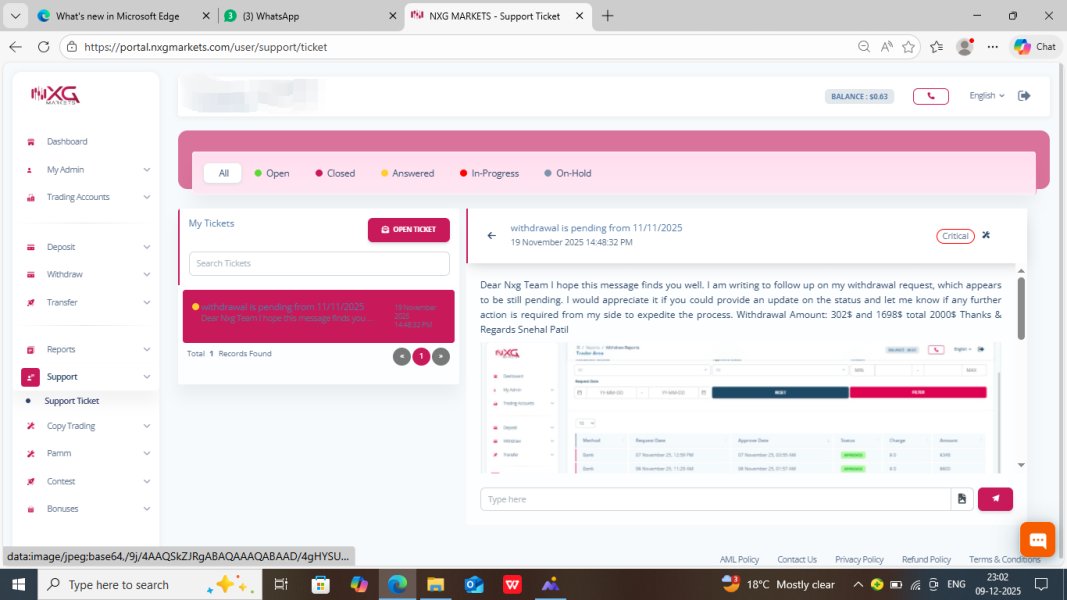

6.3 Customer Service and Support Analysis

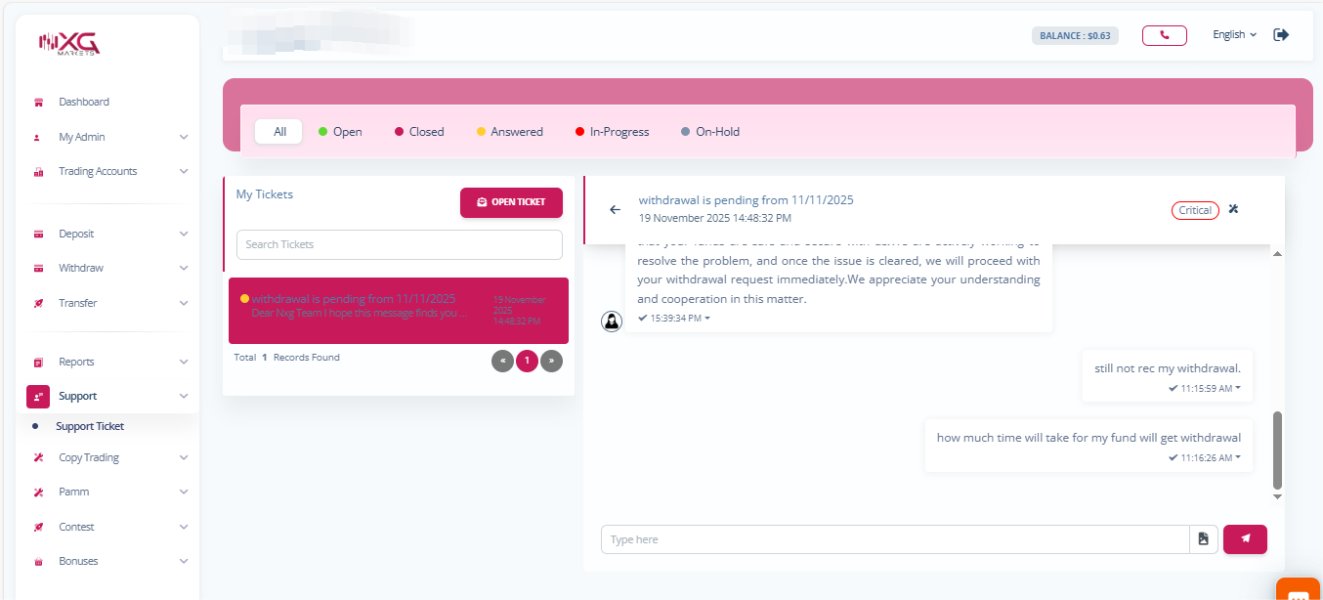

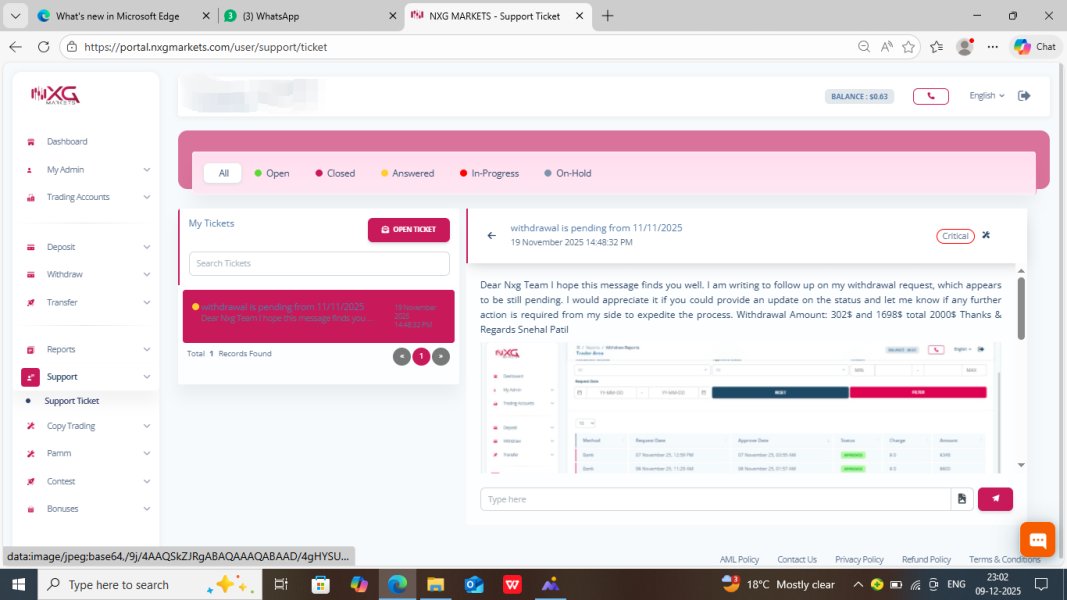

Customer service is a cornerstone of any reputable broker, yet NXG Markets shows mixed performance based on available user feedback. Various reports note that while several users have managed to obtain support, there have been significant comments about prolonged response times and inconsistent service quality. The review shows a lack of clarity on whether customer support is accessible through multiple channels such as phone, live chat, or email.

There is no information about dedicated support for high-priority inquiries during volatile market periods. There is no mention of multilingual support, which might hinder accessibility for non-English speaking clients. The absence of detailed information on support hours further complicates the picture of a broker that seems committed to client satisfaction.

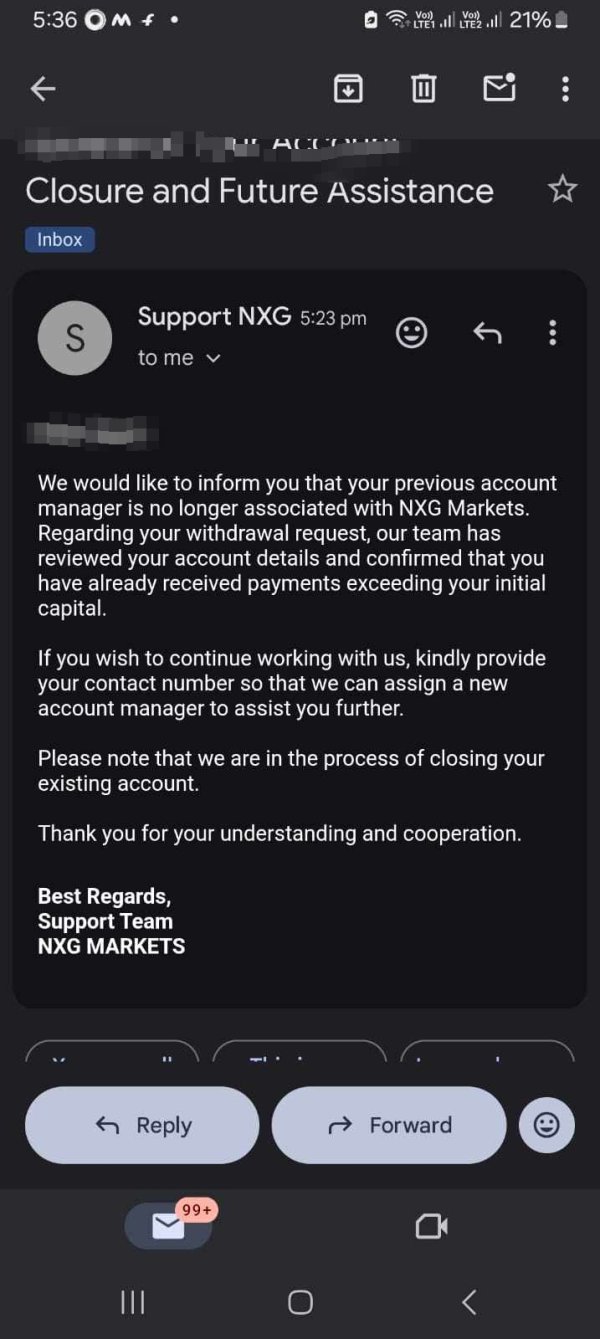

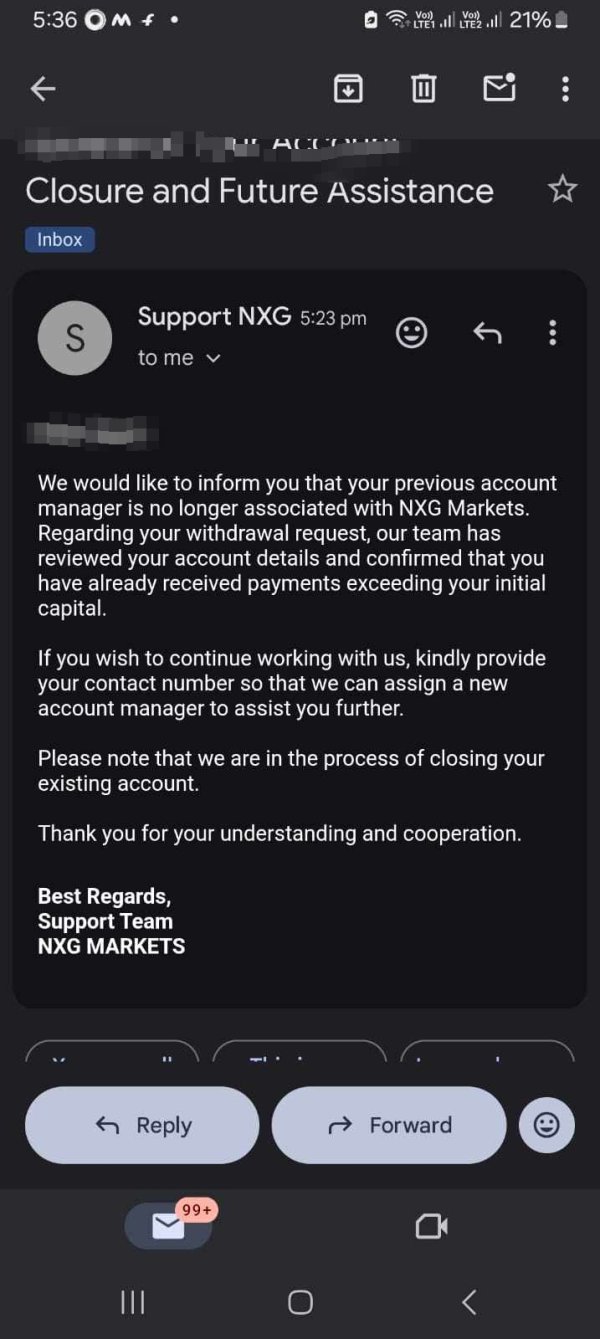

Users have reported that their concerns were met with delayed responses and occasional unfulfilled promises about issue resolution. Given these points, it becomes important for potential clients to carefully consider the overall responsiveness and efficiency of NXG Markets' customer service. This is especially true when compared against competitors who typically provide comprehensive and prompt support systems.

6.4 Trading Experience Analysis

The overall trading experience at NXG Markets is characterized by a reportedly user-friendly trading environment, yet several operational details remain unproven. While the platform is designed to facilitate access to forex and CFDs with an intuitive interface, the actual performance in terms of order execution speed and platform stability remains uncertain. There have been various reports from users showing that execution quality can be inconsistent, particularly during periods of high market volatility.

Specifics about mobile trading capabilities or any automated trading features are not outlined. This makes it difficult to assess if the platform truly meets modern trading standards. The execution of orders, spread consistency, and liquidity are key factors that directly influence traders' success.

However, the lack of transparent data on these elements invites doubt. This NXG Markets review highlights that while the broker makes promising claims about its user-friendly environment, the absence of concrete performance metrics such as latency measures or execution quality statistics poses challenges. These challenges affect traders seeking a reliable and efficient trading experience.

6.5 Trust Analysis

Trust is arguably the most crucial component in evaluating any financial services provider, and NXG Markets currently presents a mixed picture. Although the broker is regulated by ASIC, which should ideally provide a significant measure of credibility, several red flags have been raised by users about the broker's overall legitimacy and reliability. The regulatory information is only partially disclosed, with no clear details on the license number or the extent of regulatory oversight.

Multiple user testimonies have reported concerns about the safety of their funds and overall account security. The lack of transparency in key areas such as account conditions and lack of detailed financial disclosures further undermines confidence. Some reviews even hint at the possibility of fraudulent practices, although such claims are not consistently supported across all sources.

While the ASIC regulation is a positive aspect, it does not fully address the multitude of trust-related issues. This NXG Markets review thus urges potential traders to proceed with caution. They should ensure that they conduct thorough verification and due diligence before engaging with the broker.

This helps reduce potential risks associated with inadequate transparency and accountability.

6.6 User Experience Analysis

User experience remains a compelling but debatable aspect of the NXG Markets offering. A number of traders have expressed that the platform's design is relatively straightforward and that the overall interface is easy to navigate. However, many elements that contribute to an optimal user experience have not been sufficiently detailed.

These include the clarity of the registration and verification process, and the efficiency of fund transfers. The accessible layout does not compensate for the underlying uncertainties about operational features like deposit processing times and support responsiveness. User sentiment appears divided: while some appreciate the simplicity of the trading environment, others are dissatisfied with the unresolved issues about account legitimacy and customer support delays.

This feedback suggests that improvements in transparency and operational efficiency are necessary to create a more uniformly positive experience. While NXG Markets may appeal to traders looking for basic functionality in a regulated setup, the varied user experiences and negative comments about security and support indicate that further enhancements are needed. This NXG Markets review highlights the importance of balancing aesthetic and operational design with robust functionalities.

These ensure a seamless trading experience across all user touchpoints.

7. Conclusion

In conclusion, NXG Markets stands as an emerging broker that offers both potential and challenges. While the ASIC regulatory oversight and claims of a user-friendly trading environment are appealing, significant questions remain about the platform's account conditions, transparency, and overall trustworthiness. This NXG Markets review demonstrates that although the broker's educational resources and diverse instrument offerings are positive, persistent concerns about security and incomplete operational details may deter vigilant traders.

Therefore, NXG Markets might be more appropriate for those willing to trade within a regulated framework while simultaneously pursuing further independent verification of its services. Prospective clients should conduct detailed research and exercise caution before proceeding.