Is Mazi Finance safe?

Software Index

License

Is Mazi Finance A Scam?

Introduction

Mazi Finance is a forex broker that has emerged in the trading landscape, offering a range of trading instruments including forex pairs, commodities, and cryptocurrencies. As the forex market continues to expand, the presence of numerous brokers can make it challenging for traders to identify legitimate platforms. This necessitates a careful evaluation of brokers like Mazi Finance to ensure that traders can protect their investments and make informed decisions. In this article, we will delve into Mazi Finance's regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment to determine whether Mazi Finance is safe or potentially a scam.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is crucial for assessing its legitimacy. Mazi Finance operates without regulation from any recognized financial authority, which raises significant concerns regarding its operational transparency and adherence to industry standards. Below is a summary of the regulatory information pertaining to Mazi Finance:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Mazi Finance does not have to comply with any stringent financial standards, which can lead to increased risks for traders. Regulatory bodies such as the Financial Conduct Authority (FCA) and the Commodity Futures Trading Commission (CFTC) provide essential consumer protections, including the segregation of client funds and adherence to ethical trading practices. The lack of regulation at Mazi Finance indicates a potential red flag for investors, making it imperative to proceed with caution when considering this broker.

Company Background Investigation

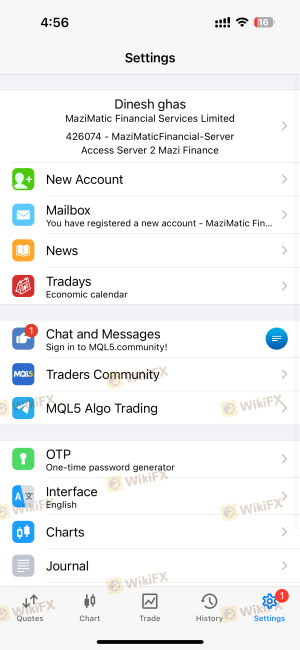

Mazi Finance is operated by Mazimatic Financial Services Ltd, which claims to be based in Saint Lucia. However, the companys registration in an offshore jurisdiction often raises concerns about its credibility and accountability. The history of Mazi Finance is relatively short, having been established in 2023, which may indicate a lack of proven operational experience in the forex industry.

The management team behind Mazi Finance has not been extensively detailed in available resources, raising questions about their expertise and experience in financial services. Transparency is a critical factor for any trading platform, and Mazi Finance's limited disclosures about its ownership and management structure may contribute to skepticism regarding its reliability. Without a strong track record or transparency in operations, traders may find it challenging to trust Mazi Finance with their investments.

Trading Conditions Analysis

When assessing whether Mazi Finance is safe, it is essential to examine its trading conditions, including fees and spreads. The broker offers a variety of account types, which can affect the overall cost of trading. Heres a comparison of core trading costs:

| Fee Type | Mazi Finance | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Structure | None | $5 per lot |

| Overnight Interest Range | Varies | Varies |

Mazi Finance advertises competitive spreads, particularly on major currency pairs, which may appeal to traders. However, the absence of a clear commission structure raises concerns about hidden fees. Traders should be cautious of any unusual or unclear fee policies, as they can significantly impact profitability. The potential for unexpected charges could indicate a lack of transparency in Mazi Finance's pricing model.

Customer Fund Safety

The safety of customer funds is a primary concern for any trader evaluating a broker. Mazi Finances lack of regulatory oversight raises questions about its fund safety measures. The broker does not provide clear information regarding the segregation of client funds, which is a standard practice among regulated brokers to protect investor assets in the event of insolvency.

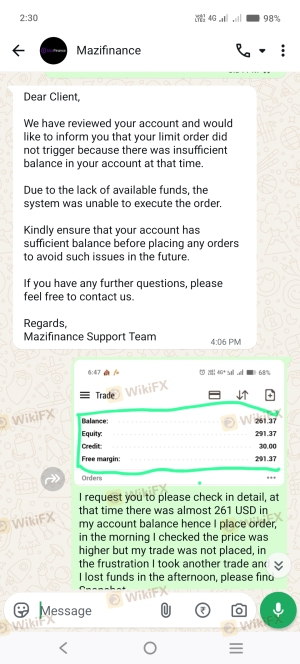

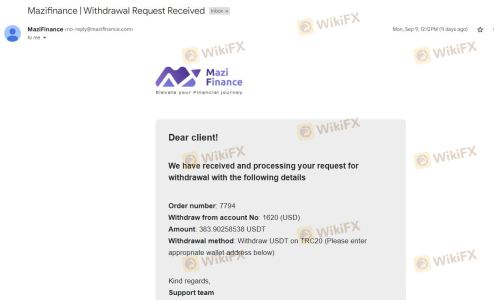

Additionally, there is no mention of investor protection schemes or negative balance protection policies, which are critical safeguards for traders. Historical reports suggest that Mazi Finance has faced issues related to fund withdrawals, with some users claiming difficulties in accessing their profits. Such incidents highlight the importance of thoroughly investigating a brokers fund safety measures before committing capital.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing the reliability of a broker. Reviews of Mazi Finance reveal a mixed bag of experiences, with several users expressing dissatisfaction with withdrawal processes and customer support. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Inconsistent |

| Misleading Information | High | Unaddressed |

Many users have reported challenges in withdrawing their funds, with some stating that their requests went unanswered for extended periods. This raises significant concerns about Mazi Finance's operational integrity and customer service quality. The lack of timely responses and resolution to complaints can undermine trust and indicate potential operational deficiencies.

Platform and Trade Execution

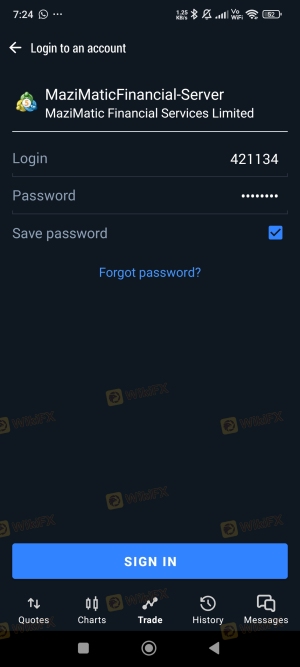

A broker's trading platform is a critical component of the trading experience. Mazi Finance offers the MetaTrader 5 (MT5) platform, known for its user-friendly interface and robust trading tools. However, user reviews indicate mixed experiences regarding platform performance. Traders have reported issues with order execution speed, slippage, and instances of rejected orders during high volatility.

The presence of these issues can significantly affect trading outcomes, especially for those employing scalping or high-frequency trading strategies. Concerns about potential platform manipulation have also been raised, which could further erode trust in Mazi Finances operations.

Risk Assessment

When evaluating whether Mazi Finance is safe, it is essential to consider the overall risk associated with trading on its platform. The following risk assessment summarizes the critical risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation increases vulnerability. |

| Fund Safety Risk | High | Lack of safeguards for client funds. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

| Platform Reliability | Medium | Reports of execution issues and slippage. |

Given these risks, traders should approach Mazi Finance with caution. It is advisable to conduct thorough due diligence and consider alternative brokers that offer stronger regulatory oversight and better customer service.

Conclusion and Recommendations

In conclusion, the findings suggest that Mazi Finance exhibits several characteristics that warrant concern. The lack of regulation, mixed customer feedback, and reported issues with fund withdrawals raise significant red flags regarding its safety and legitimacy. Therefore, it is essential for traders to exercise caution and consider alternative options.

For those seeking a safe trading environment, it is recommended to explore brokers that are regulated by recognized authorities, offer transparent fee structures, and demonstrate a commitment to customer service. Some reliable alternatives include brokers such as IG, OANDA, and Forex.com, which provide a more secure trading experience. Ultimately, thorough research and careful consideration are critical to ensuring a safe trading experience in the forex market.

Is Mazi Finance a scam, or is it legit?

The latest exposure and evaluation content of Mazi Finance brokers.

Mazi Finance Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Mazi Finance latest industry rating score is 1.92, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.92 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.