Mazi Finance 2025 Review: Everything You Need to Know

Executive Summary

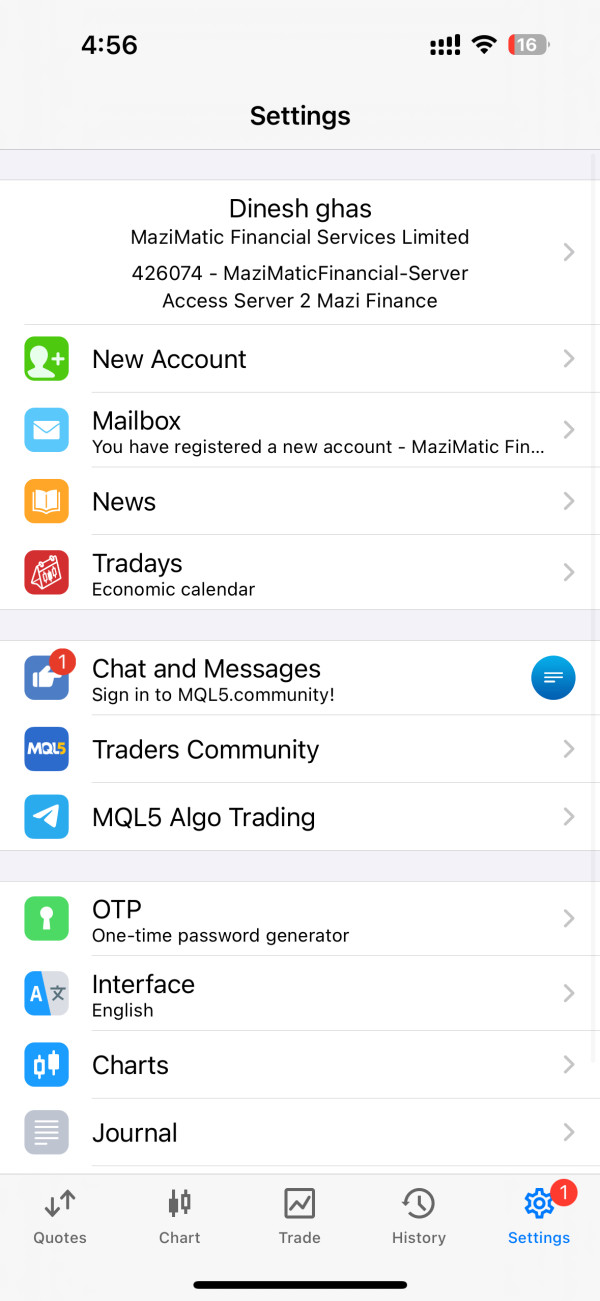

This mazi finance review gives you a complete look at a new player in online trading. Mazi Finance started in 2023 and offers trading in forex, stocks, cryptocurrencies, indices, precious metals, and commodities. The company operates from Dubai and Saint Lucia under MaziMatic Financial Services LTD. It targets investors who want to trade different types of financial markets.

Our review shows mixed results. Mazi Finance offers many asset types and has modern trading technology, but it lacks clear regulatory information and transparency about trading conditions. The platform works well for traders interested in cryptocurrency and forex markets. However, potential clients should be careful because there is not enough information about regulatory oversight and detailed trading terms.

The broker has only been operating for a short time, and there is limited public information available. This makes it hard to judge how reliable and good their service quality is. This review presents the available information fairly while pointing out areas where more transparency would help potential clients.

Important Notice

This review uses publicly available information and limited user feedback. Readers should know that Mazi Finance operates from multiple places including Dubai and Saint Lucia, which may mean different regulatory environments and client protections depending on where you live.

The company's regulatory status is unclear from available sources. Specific trading conditions have not been fully disclosed. Our evaluation uses official company communications, third-party reviews, and available regulatory databases. However, the limited operational history and sparse detailed information mean this assessment should be considered preliminary.

Potential clients should strongly consider doing independent research. They should seek clarification directly from the broker about regulatory status, trading conditions, and client protections before making any investment decisions.

Rating Framework

Broker Overview

Mazi Finance started in the online trading world in 2023. The company set up operations in Dubai and Saint Lucia and operates under MaziMatic Financial Services LTD. It positions itself as a complete trading platform that gives access to multiple financial markets.

The broker's recent start reflects how dynamic the fintech industry is. New platforms keep entering the market to serve changing trader needs. The company's business model focuses on providing multi-asset trading capabilities, allowing clients to access forex, stocks, cryptocurrencies, indices, precious metals, and commodities from one platform.

This diverse approach matches modern trading preferences where investors want exposure to various asset classes without keeping multiple brokerage relationships. The broker emphasizes cryptocurrency trading alongside traditional financial instruments, which suggests it targets modern traders who know digital assets. According to available information, Mazi Finance aims to combine traditional forex and CFD trading with emerging cryptocurrency markets.

The platform's tagline "One Broker, Many Possibilities" shows this multi-asset strategy. However, specific details about trading conditions, regulatory compliance, and platform features remain limited in public disclosures. The company keeps a professional online presence but lacks the complete transparency typically expected from established brokers.

Regulatory Status: Available sources do not give clear information about specific regulatory licenses or oversight bodies governing Mazi Finance operations. This represents a significant concern for potential clients seeking regulated trading environments.

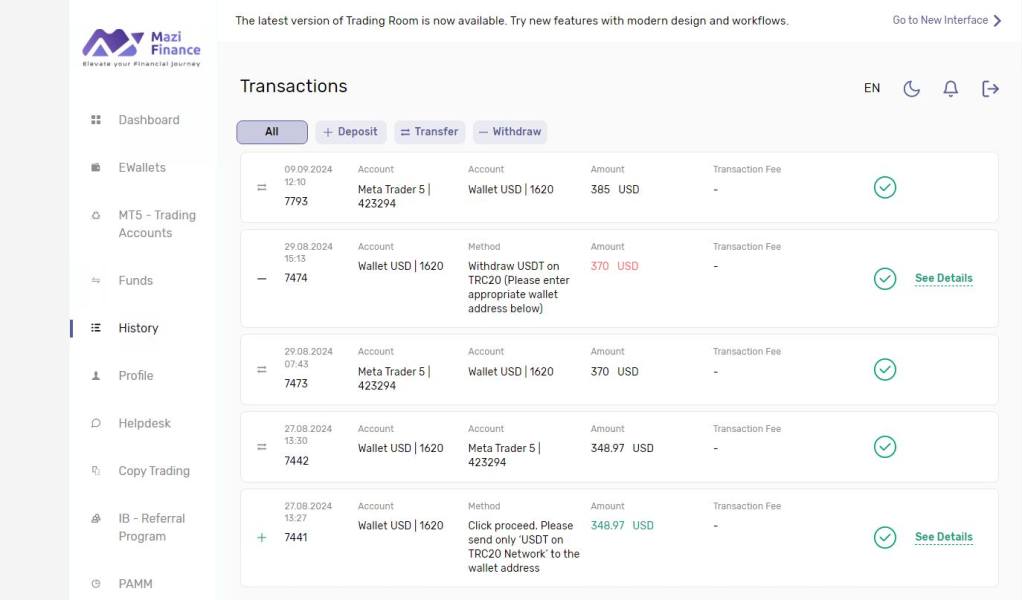

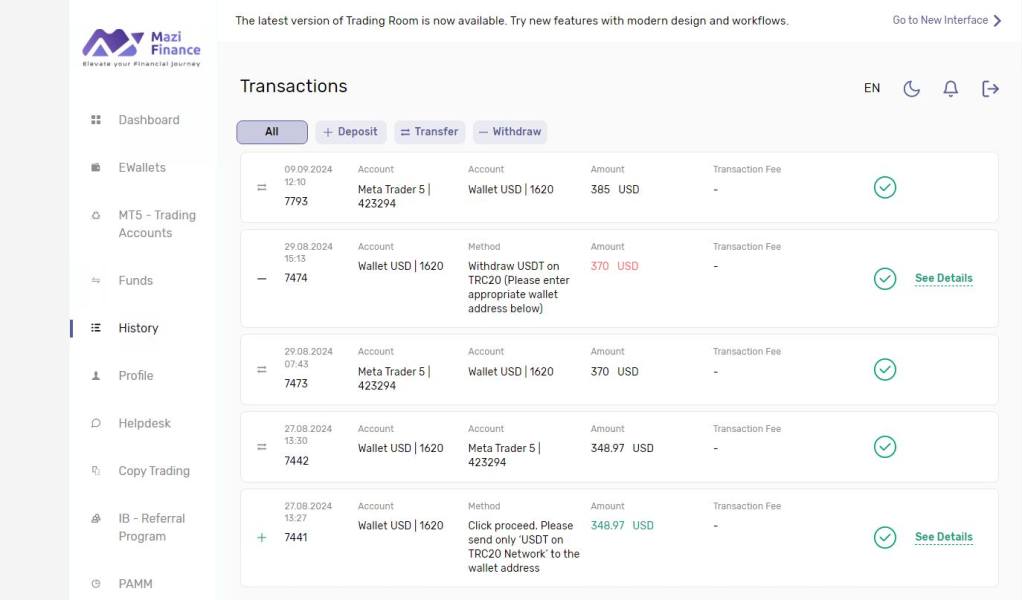

Funding Methods: Specific deposit and withdrawal options have not been detailed in available materials. The platform likely supports standard payment methods common to online brokers. Exact minimum deposit amounts are not specified in publicly available information, making it difficult to assess accessibility for different trader segments.

Promotions and Bonuses: No specific promotional offers or bonus structures have been disclosed in available sources. New brokers often provide introductory incentives though.

Available Assets: The broker offers trading in forex pairs, stock indices, individual shares, precious metals, commodities, and cryptocurrencies. This diverse asset selection represents one of the platform's key selling points for multi-asset traders. Detailed information about spreads, commissions, overnight fees, and other trading costs remains unavailable in public sources.

This lack of transparency makes it impossible to assess the broker's competitiveness regarding trading expenses. Specific leverage ratios for different asset classes have not been disclosed, though regulatory requirements typically limit maximum leverage levels.

Platform Technology: The company mentions providing trading platforms, but specific platform types, features, or technological capabilities are not detailed in available materials. Information about restricted countries or regional limitations is not available in current sources. The extent of multilingual support capabilities remains unspecified in available documentation.

This mazi finance review highlights the significant information gaps that potential clients should consider when evaluating this broker option.

Detailed Rating Analysis

Account Conditions Analysis

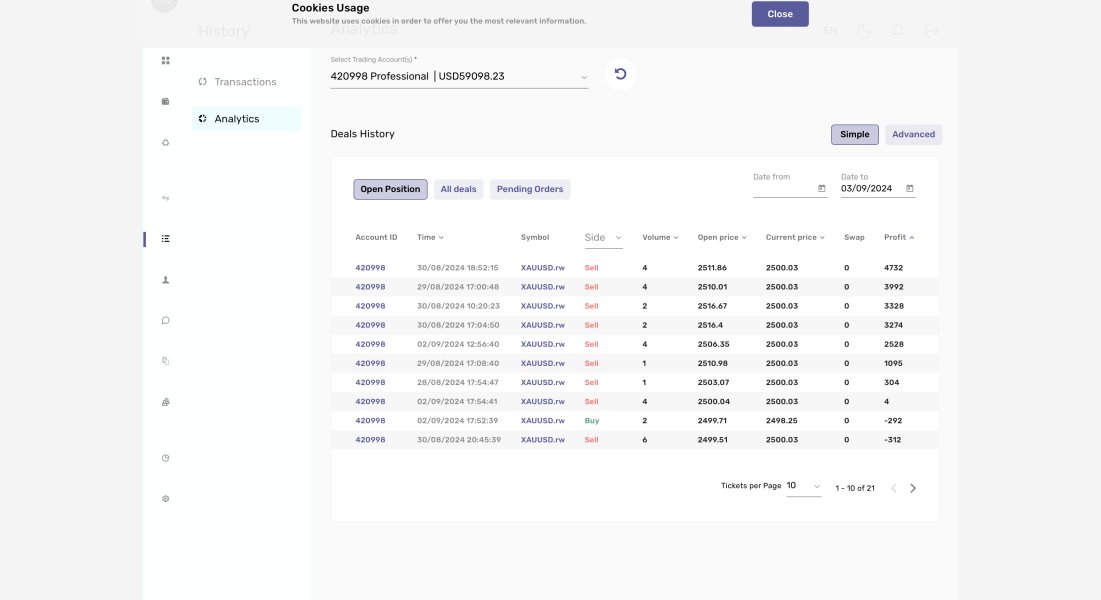

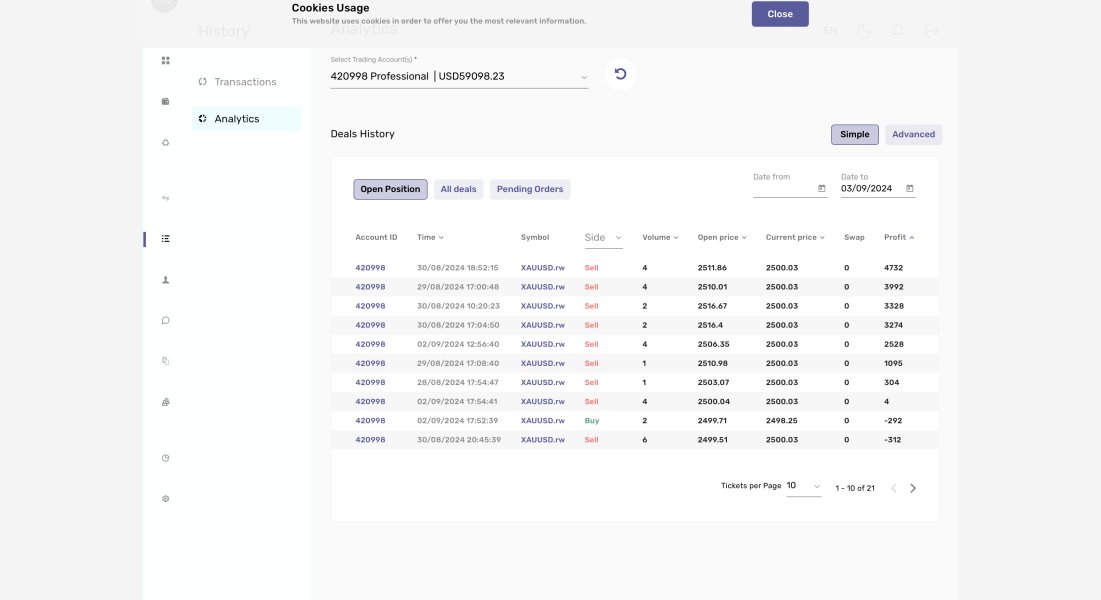

The assessment of Mazi Finance's account conditions faces significant limitations due to insufficient publicly available information. Standard industry practice involves offering multiple account tiers with varying minimum deposits, features, and trading conditions. However, specific details about Mazi Finance's account structure remain undisclosed.

Without access to comprehensive account documentation, it becomes impossible to evaluate the reasonableness of minimum deposit requirements. It also becomes impossible to assess the variety of account options available to different trader segments. Most established brokers provide clear information about account types, ranging from basic retail accounts to premium or professional trading accounts with enhanced features.

The absence of detailed account information raises concerns about transparency. It makes it difficult for potential clients to make informed decisions. Professional traders typically require information about account-specific spreads, commission structures, leverage options, and additional services before committing to a platform.

Furthermore, specialized account features such as Islamic accounts for clients requiring Sharia-compliant trading remain unaddressed in available sources. Demo accounts for strategy testing or managed account options also remain unaddressed. This mazi finance review must therefore assign a moderate rating pending disclosure of comprehensive account details.

The lack of user feedback regarding account opening procedures, verification requirements, or ongoing account management experiences further limits our ability to provide definitive assessments. We cannot properly evaluate the broker's account conditions and customer onboarding processes without this information.

Evaluating Mazi Finance's trading tools and educational resources proves challenging due to limited available information about platform features and analytical capabilities. Modern traders expect comprehensive charting tools, technical indicators, automated trading support, and educational materials to enhance their trading effectiveness.

The broker claims to offer multi-asset trading capabilities, but specific details about analytical tools, market research, economic calendars, or trading signals remain undisclosed. Professional trading platforms typically provide advanced charting packages, real-time market data, news feeds, and fundamental analysis resources. The absence of information about educational resources particularly concerns newer traders who rely on broker-provided learning materials.

These traders depend on webinars, tutorials, and market analysis to develop their trading skills. Established brokers often maintain extensive educational libraries, video tutorials, and regular market commentary to support client development.

Automated trading support represents another area where information remains unavailable. This includes Expert Advisor compatibility, algorithmic trading tools, or copy trading features. These tools have become increasingly important for modern trading strategies and platform competitiveness.

Without access to platform demonstrations, user manuals, or detailed feature lists, this evaluation cannot provide definitive assessments of the broker's technological capabilities or resource offerings. The rating reflects this uncertainty and the importance of comprehensive tool availability in modern trading environments.

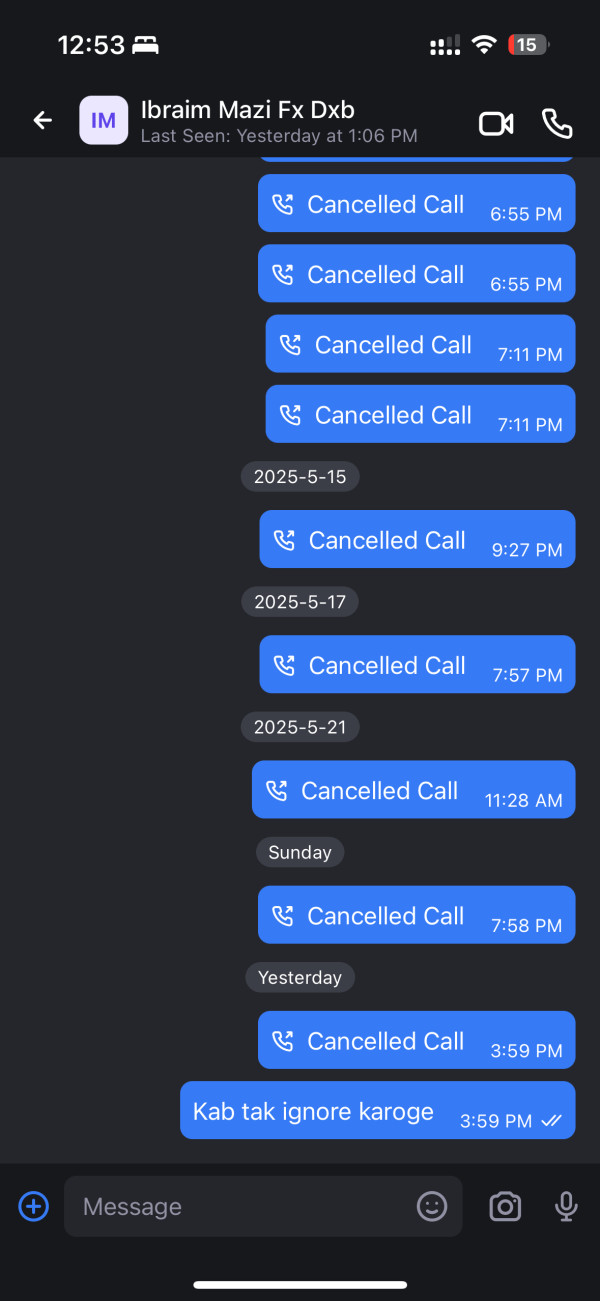

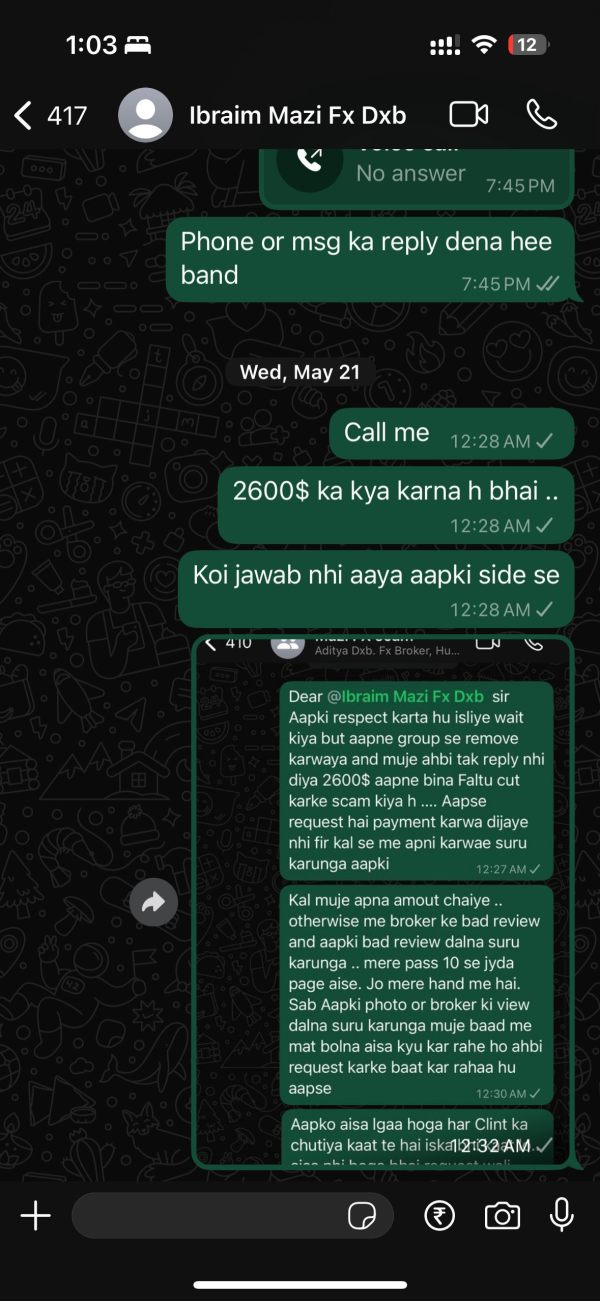

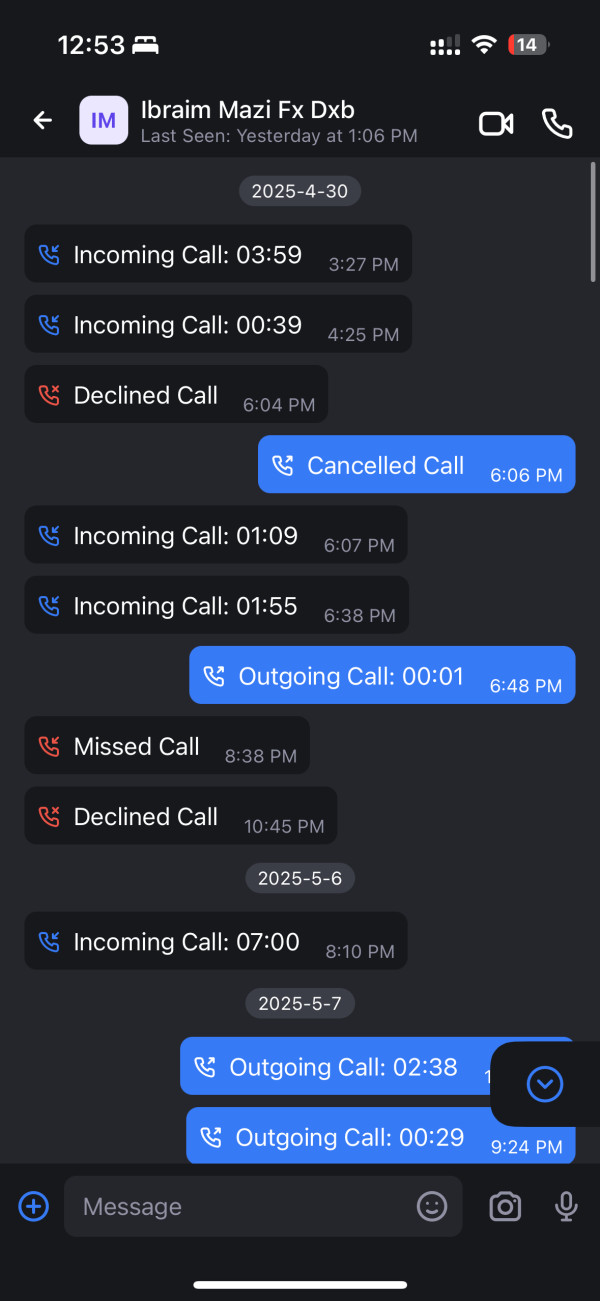

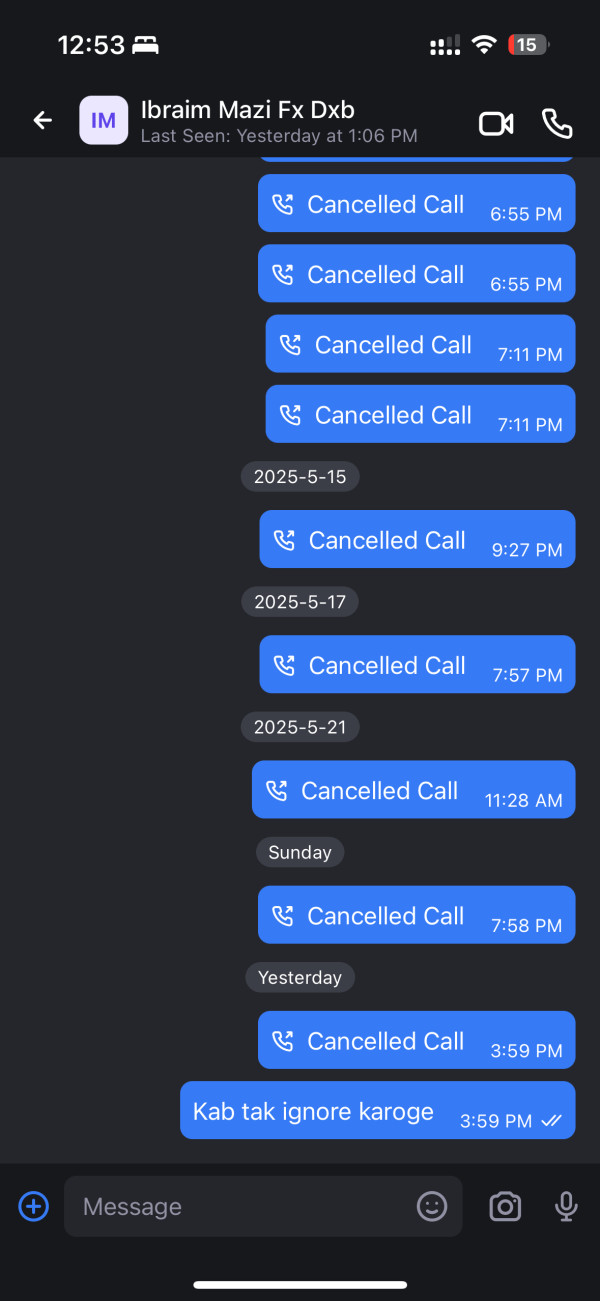

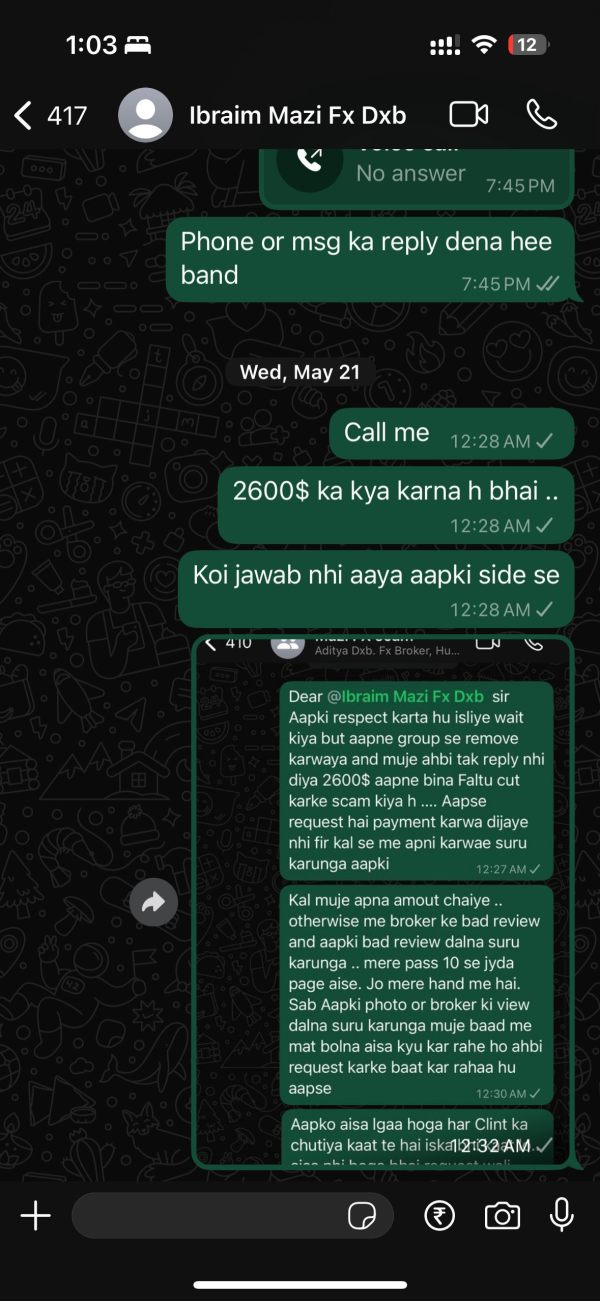

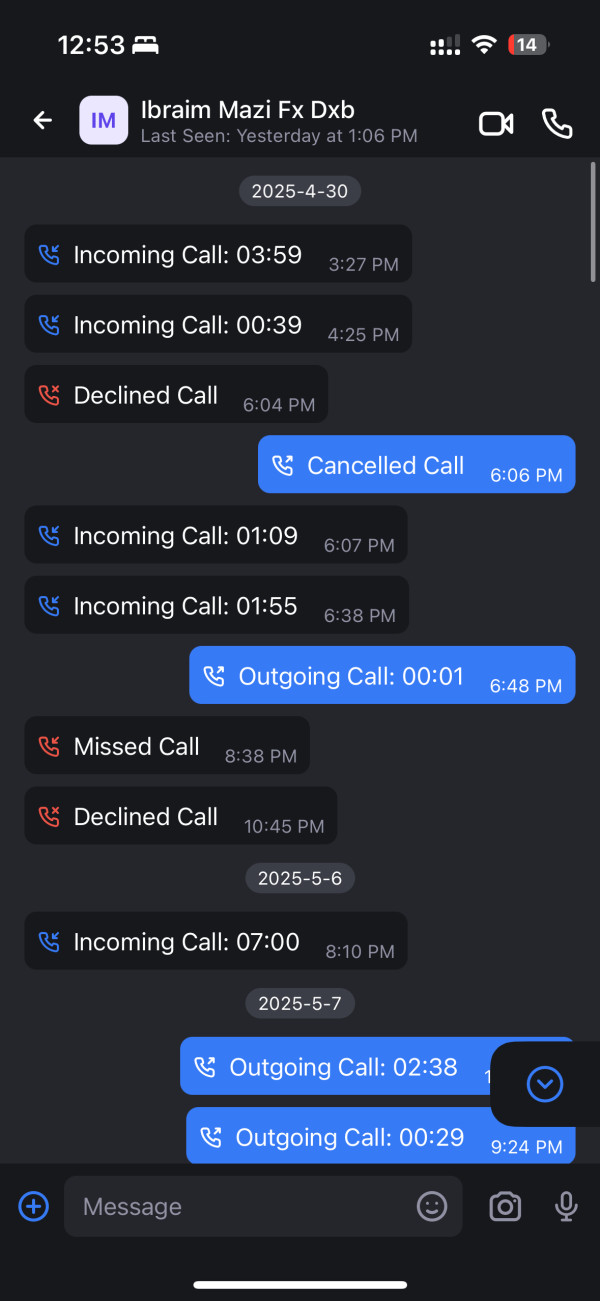

Customer Service and Support Analysis

Assessment of Mazi Finance's customer service capabilities faces limitations due to insufficient information about support channels, response times, and service quality metrics. Effective customer support represents a crucial factor in broker selection, particularly for traders encountering technical issues or requiring assistance with complex trading scenarios.

Available sources indicate basic contact information exists, but details about support availability, response time commitments, or service level agreements remain undisclosed. Modern brokers typically offer multiple communication channels including live chat, email support, phone assistance, and comprehensive FAQ sections. The quality of customer service often determines client satisfaction and retention, making it essential for brokers to maintain responsive, knowledgeable support teams.

However, without user testimonials or service quality metrics, evaluating Mazi Finance's support effectiveness becomes impossible. Multilingual support capabilities, crucial for international brokers serving diverse client bases, remain unspecified. Professional brokers often provide support in multiple languages with native speakers to ensure effective communication and problem resolution.

Additionally, information about support availability hours, regional support centers, or specialized assistance for different account types is not available. These factors significantly impact user experience and trading success, particularly for active traders requiring immediate assistance during market hours.

Trading Experience Analysis

The evaluation of Mazi Finance's trading experience encounters significant challenges due to limited information about platform performance, execution quality, and user interface design. Trading experience encompasses platform stability, order execution speed, slippage rates, and overall user interface effectiveness.

The broker mentions multi-asset trading capabilities, but specific details about platform technology, execution models, or performance metrics remain unavailable. Professional traders require information about order execution speeds, rejection rates, and slippage statistics to assess platform suitability for their strategies. Platform stability during high-volatility periods represents another crucial factor not addressed in available sources.

Reliable brokers maintain robust infrastructure capable of handling increased trading volumes without service interruptions or execution delays. Mobile trading capabilities, increasingly important for modern traders, lack detailed coverage in available materials. Information about mobile app features, synchronization with desktop platforms, or mobile-specific tools remains unspecified.

The absence of user feedback regarding actual trading experiences, platform reliability, or execution quality makes it impossible to provide definitive assessments. This mazi finance review must therefore rely on limited available information while noting the significant gaps in performance data and user testimonials.

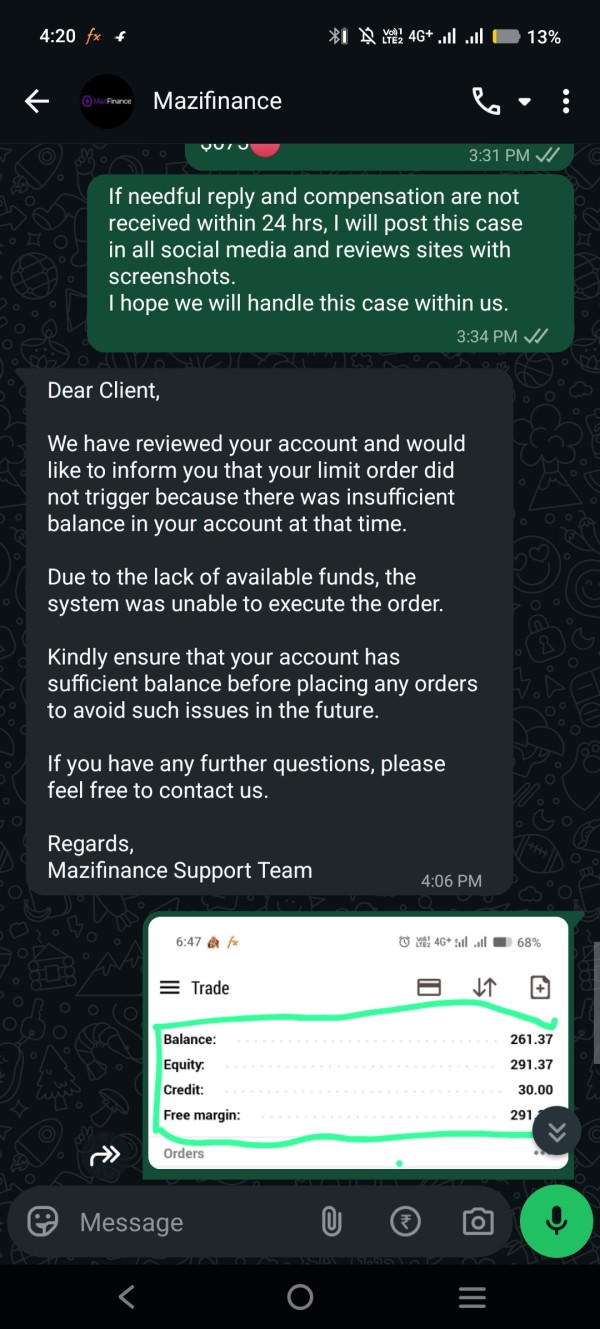

Trust and Safety Analysis

Trust assessment for Mazi Finance faces substantial challenges due to unclear regulatory status and limited transparency regarding client protection measures. Regulatory oversight provides essential safeguards for trader funds and ensures adherence to industry standards and best practices.

The absence of clear regulatory license information from recognized financial authorities raises significant concerns about client protection and fund security. Established brokers typically hold licenses from respected regulators such as FCA, CySEC, ASIC, or other recognized bodies that enforce strict operational standards. Client fund segregation, a fundamental protection mechanism ensuring trader deposits remain separate from company operational funds, lacks clear documentation in available sources.

This protection proves crucial during broker insolvency scenarios and represents a standard requirement among regulated brokers. Compensation scheme participation, which provides additional protection for client funds up to specified limits, remains unaddressed. Many regulated jurisdictions require broker participation in investor compensation programs providing safety nets for client deposits.

The broker's relatively short operational history limits the availability of long-term performance data or crisis management examples. Established track records help assess broker reliability during market stress periods or operational challenges. Without access to regulatory filings, audit reports, or independent verification of safety measures, this assessment must reflect the uncertainty surrounding client protection and regulatory compliance.

User Experience Analysis

User experience evaluation for Mazi Finance faces limitations due to sparse feedback from actual clients and limited information about platform usability and service quality. User experience encompasses registration processes, platform navigation, educational support, and overall satisfaction with broker services.

The broker's website demonstrates modern design principles and professional presentation, suggesting attention to user interface development. However, actual platform usability, navigation efficiency, and feature accessibility remain unverified through user testimonials or detailed reviews. Registration and account verification processes, crucial for initial user experience, lack detailed documentation or user feedback.

Streamlined onboarding procedures significantly impact client acquisition and satisfaction, particularly for traders seeking quick market access. Fund management experiences, including deposit and withdrawal processes, processing times, and associated fees, remain undocumented in available sources. These operational aspects significantly influence ongoing user satisfaction and platform usability.

The absence of comprehensive user reviews or satisfaction surveys makes it impossible to identify common user complaints or areas requiring improvement. Established brokers often maintain user feedback systems and regularly address identified issues to enhance service quality. Without substantial user feedback or detailed platform demonstrations, this assessment must reflect uncertainty about actual user experiences while noting the importance of user satisfaction in broker evaluation processes.

Conclusion

This mazi finance review reveals a broker with ambitious multi-asset offerings but significant transparency limitations that prevent comprehensive evaluation. Mazi Finance demonstrates modern presentation and diverse asset coverage including forex, stocks, and cryptocurrencies, but the lack of clear regulatory disclosure and detailed trading conditions raises important concerns for potential clients.

The platform may suit experienced traders comfortable with newer brokers and interested in multi-asset trading, particularly those seeking cryptocurrency exposure alongside traditional instruments. However, the absence of comprehensive regulatory information, detailed trading terms, and substantial user feedback suggests this broker may not be suitable for risk-averse traders. It also may not work for those requiring extensive regulatory protections.

Key advantages include diverse asset offerings and modern platform presentation. Significant disadvantages encompass unclear regulatory status, limited transparency regarding trading conditions, and insufficient user feedback for reliable assessment. Potential clients should conduct thorough due diligence and consider more established alternatives until Mazi Finance provides greater transparency regarding regulatory compliance and operational details.