Regarding the legitimacy of Land Prime forex brokers, it provides FSC and WikiBit, (also has a graphic survey regarding security).

Is Land Prime safe?

Pros

Cons

Is Land Prime markets regulated?

The regulatory license is the strongest proof.

FSC Securities Trading License (EP)

The Financial Services Commission

The Financial Services Commission

Current Status:

RegulatedLicense Type:

Securities Trading License (EP)

Licensed Entity:

Land Prime Ltd

Effective Date:

2024-12-31Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

6 ST DENIS STREET 1ST FLOOR RIVER COURT PORT LOUIS, MauritiusPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

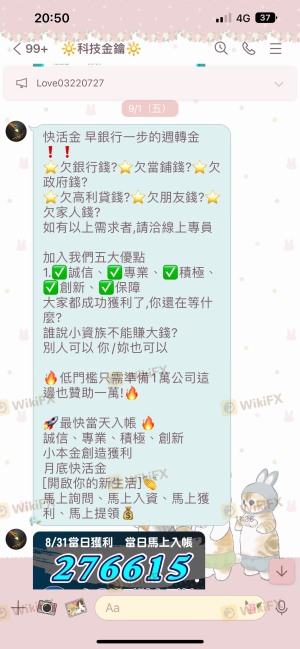

Is Land Prime A Scam?

Introduction

Land Prime is a forex broker that has gained attention in the trading community since its inception. Positioned as an international broker, it offers a variety of trading instruments, including currency pairs, commodities, and CFDs. However, with the proliferation of online trading platforms, traders must exercise caution and conduct thorough evaluations of brokers before committing their funds. The forex market is fraught with risks, and choosing the wrong broker can lead to significant financial losses. In this article, we will investigate whether Land Prime is a scam or a legitimate trading option, using a structured approach that examines its regulatory status, company background, trading conditions, customer safety, user experiences, platform performance, and associated risks.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Land Prime claims to be regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Saint Vincent and the Grenadines. The FCA is known for its stringent regulatory standards, which provide a level of security for traders. However, the FSA in Saint Vincent and the Grenadines is often viewed as a less robust regulatory authority, which raises questions about the broker's overall compliance and security measures.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 709866 | United Kingdom | Verified |

| FSA | 23627 | Saint Vincent | Verified |

The importance of regulation cannot be overstated. It ensures that brokers adhere to specific standards, such as maintaining client funds in segregated accounts and providing compensation schemes in the event of insolvency. While Land Prime is regulated by the FCA, its operations in Saint Vincent may not offer the same level of protection. Historical compliance issues, if any, should also be scrutinized to gauge the broker's reliability.

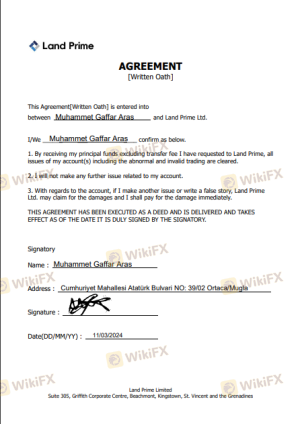

Company Background Investigation

Land Prime was established in 2013, originally operating under the name Land FX. Over the years, it has expanded its services and client base, claiming to cater to a global audience. The ownership structure of the company is not widely disclosed, which can be a red flag for potential clients. Transparency in ownership is crucial, as it often reflects the broker's accountability and ethical standards.

The management team behind Land Prime comprises individuals with extensive experience in the financial markets. However, detailed information about their backgrounds is not readily available, which may hinder the assessment of their expertise and governance. The level of transparency regarding company operations and management can significantly impact a trader's confidence in the broker.

Trading Conditions Analysis

Understanding the trading conditions offered by Land Prime is essential for evaluating its overall appeal. The broker provides several account types, including standard, ECN, and cent accounts, each with varying minimum deposits and trading conditions. The fee structure is also a critical consideration.

| Fee Type | Land Prime | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 0.9 pips | 0.5-1.0 pips |

| Commission Model | $0 | $3-5 per lot |

| Overnight Interest Range | Varies | Varies |

While Land Prime offers competitive spreads, particularly for its ECN accounts, traders should be aware of any hidden fees that may apply to deposits and withdrawals. Some users have reported unexpected fees, which could impact profitability. A transparent fee structure is vital for traders to make informed decisions.

Customer Funds Safety

The safety of customer funds is paramount in the forex industry. Land Prime claims to implement various safety measures, including the segregation of client funds from company funds. This practice is essential to ensure that client assets are protected in the event of the broker facing financial difficulties. Additionally, the broker does not offer negative balance protection, which could expose traders to unlimited losses.

Historically, there have been no major publicized incidents of fund mismanagement or security breaches associated with Land Prime. However, the lack of a comprehensive investor protection scheme raises concerns, especially for traders who may deposit significant amounts of capital.

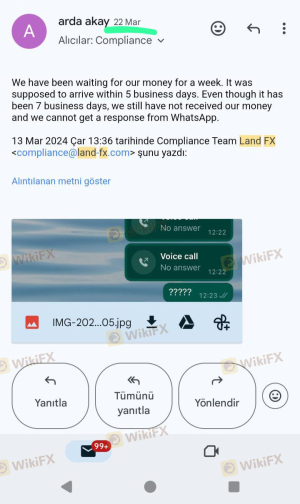

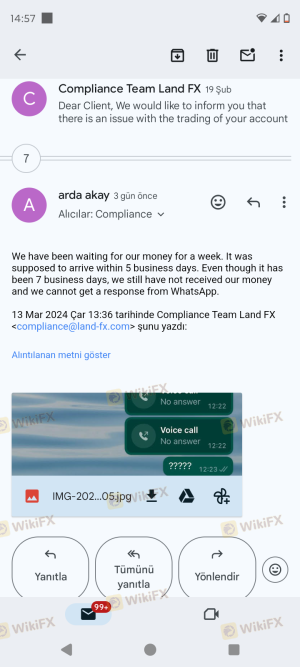

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the broker's operational effectiveness. Reviews of Land Prime reveal a mixed bag of experiences. While some clients praise the broker for its competitive trading conditions and responsive customer service, others have reported issues, particularly concerning withdrawals and account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Blocking | Medium | Inconsistent |

| Lack of Transparency | High | Limited clarity |

Typical cases include clients experiencing delays in withdrawing funds, with some reporting that their requests were either ignored or met with vague responses from customer support. Such issues can significantly impact a trader's trust in the broker and highlight the importance of responsive and effective customer service.

Platform and Execution

The trading platforms offered by Land Prime, namely MetaTrader 4 and 5, are widely recognized for their reliability and comprehensive features. However, the overall performance of these platforms, including order execution speed and slippage rates, must be critically evaluated. Users have reported instances of slippage during high volatility, which can affect trade outcomes.

The execution quality is a crucial aspect of the trading experience. Traders should be cautious of any signs of platform manipulation or excessive re-quotes, which can further erode trust in the broker.

Risk Assessment

Engaging with any broker carries inherent risks. For Land Prime, the following risk categories have been identified:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Limited oversight from FSA |

| Financial Risk | High | No negative balance protection |

| Operational Risk | Medium | Reports of withdrawal delays |

To mitigate these risks, traders should consider starting with a smaller capital investment and thoroughly testing the broker's services through a demo account before committing significant funds.

Conclusion and Recommendations

In conclusion, while Land Prime does possess certain attributes that may appeal to traders, such as competitive spreads and a variety of account types, there are significant concerns regarding its regulatory status, customer service, and overall transparency. Given the mixed reviews and potential risks, traders should approach this broker with caution.

For those seeking alternative options, brokers with strong regulatory frameworks, such as IG Markets or OANDA, may provide a more secure trading environment. Ultimately, it is crucial for traders to conduct their own due diligence and consider their risk tolerance before engaging with any broker, including Land Prime.

Is Land Prime a scam, or is it legit?

The latest exposure and evaluation content of Land Prime brokers.

Land Prime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Land Prime latest industry rating score is 4.02, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.02 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.