Land Prime 2025 Review: Everything You Need to Know

Summary

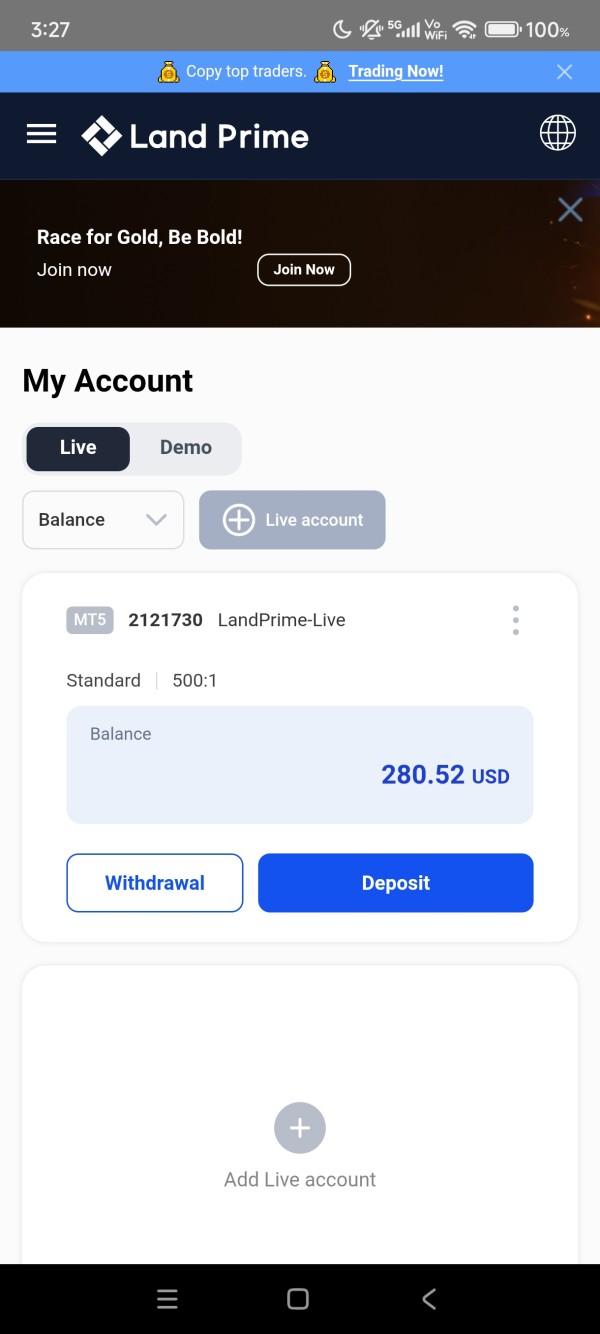

Land Prime is a forex and CFD broker that works under FCA rules. However, the company has problems with being clear about things, which makes users unhappy. This land prime review shows a broker that focuses on basic trading services instead of fancy extra features that might confuse new traders. The company gives you MT4 and MT5 trading platforms with clear fees, making it a simple choice for traders who want to trade different types of investments.

The company started in 2013. Land Prime helps traders around the world through its UK and New Zealand offices, letting people trade forex, CFDs on metals, indices, energy, stocks, and cryptocurrencies. The broker follows the rules and lets you use different amounts of leverage, but user reviews show they need to get better at helping customers and being more open about their business. Their fee structure shows $15.00 for some products when you trade 1 lot, but they don't share all their fee information clearly.

Land Prime works best for traders who care more about following rules and having stable platforms than getting lots of education or fancy support. The broker focuses on making trades work well, which makes it good for experienced traders who need reliable trading instead of lots of help and guidance.

Important Notice

This review knows that Land Prime works through different companies in the United Kingdom and New Zealand. This means they might have different rules and services depending on where you live. The FCA-regulated UK company and the New Zealand FSP-registered company may protect clients differently and have different ways of doing business.

We wrote this review by looking at user feedback, regulatory filings, and market research data from 2025. Traders should check current terms and conditions directly with Land Prime because rules and services can change over time.

Our Rating Framework

Broker Overview

Land Prime started in the forex market in 2013. The company built its business by getting licenses in important countries with good rules. Land Prime works from both the United Kingdom and New Zealand, following the rules in these markets while helping traders all over the world. The company's business focuses on giving basic trading services without making things complicated with lots of extra features, instead focusing on making trades work well and keeping platforms running smoothly.

The broker understands what traders really need, especially those who want simple access to many markets instead of lots of education programs or expensive research services. Trading Insider reports say that Land Prime positions itself as a decent player that doesn't spread itself thin with fancy added value services, instead offering the needed minimum requirements for profitable trading.

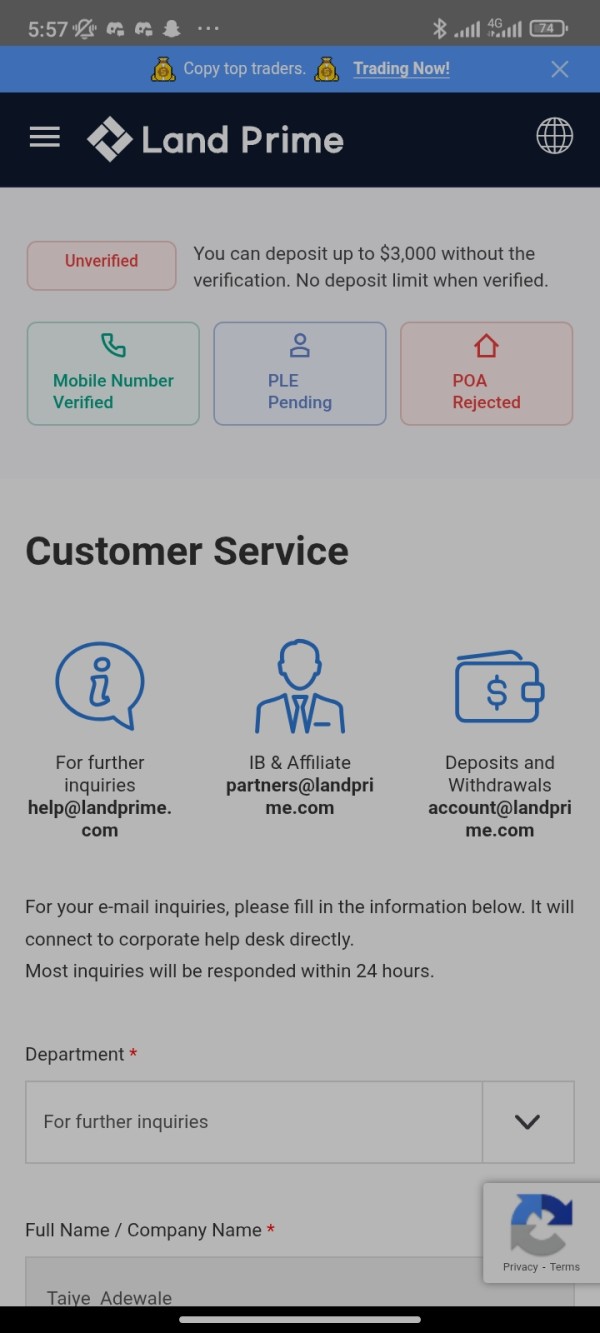

Land Prime gives you both MT4 and MT5 trading platforms. These are standard tools that most traders know how to use for looking at markets and making trades. The broker lets you trade regular forex pairs plus CFDs covering metals, indices, energy commodities, individual stocks, and cryptocurrency instruments. This land prime review finds that the company has FCA regulation under license number 709866 and New Zealand FSP registration 264385, but the company started in Asia, a region the broker says is modest about sharing information about who makes decisions.

The company follows rules from established financial authorities, which protects clients. However, users have complained about transparency problems. Land Prime charges $15.00 for certain products when you trade standard lots, but you need to ask them directly to get all their fee information.

Key Details and Features

Regulatory Jurisdictions: Land Prime works under Financial Conduct Authority (FCA) supervision in the United Kingdom with license number 709866. The company also has Financial Service Provider (FSP) registration in New Zealand under number 264385. This approach gives clients protection from established oversight frameworks, though specific client protections may be different between countries.

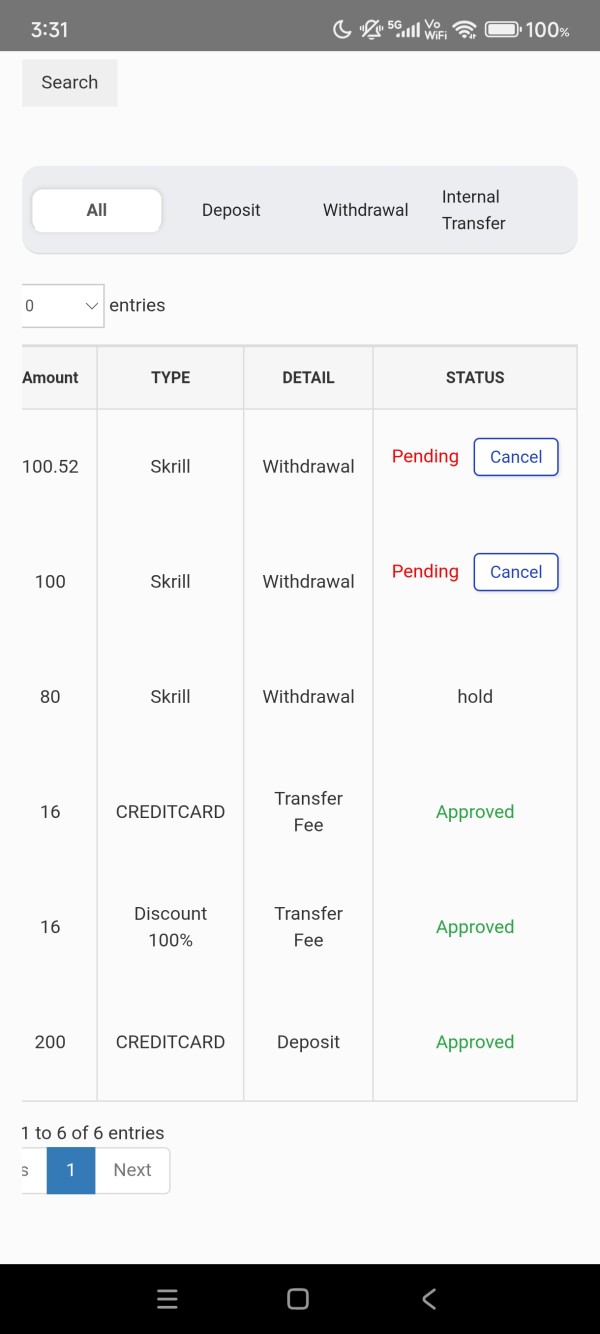

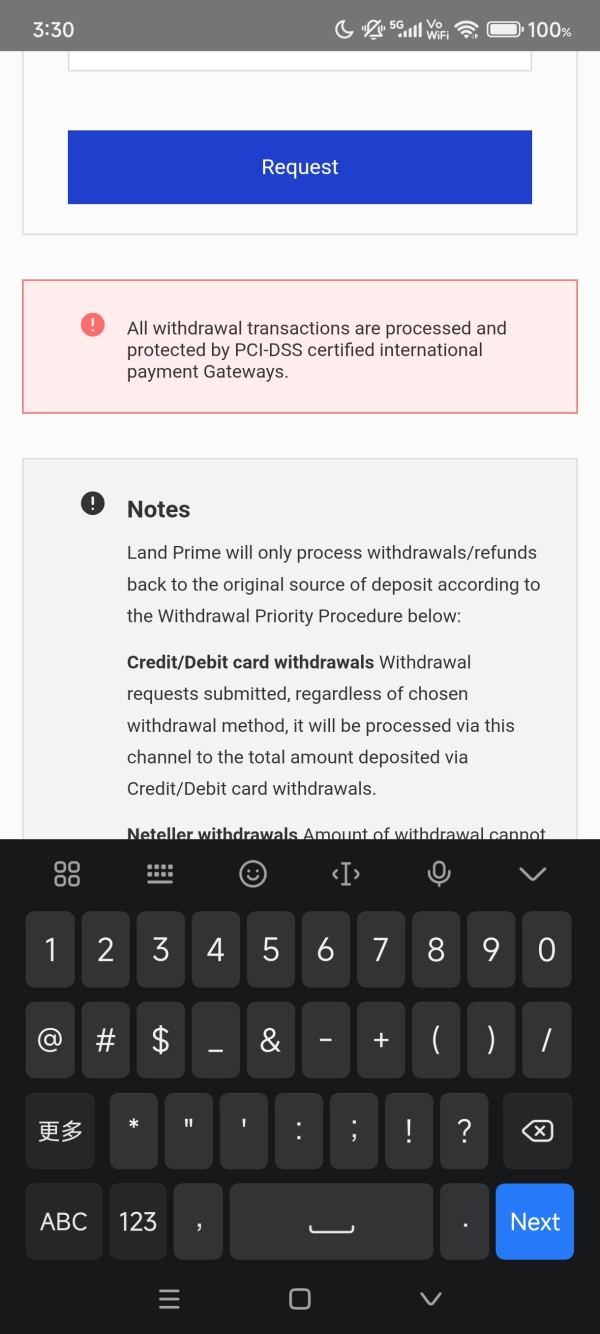

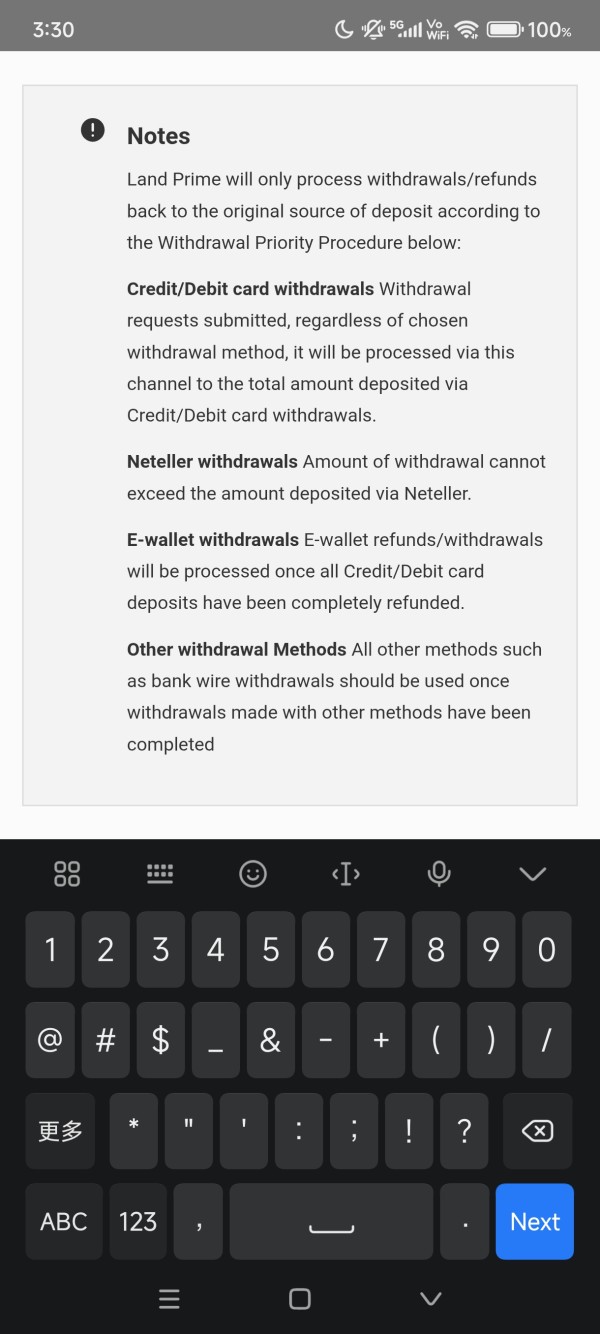

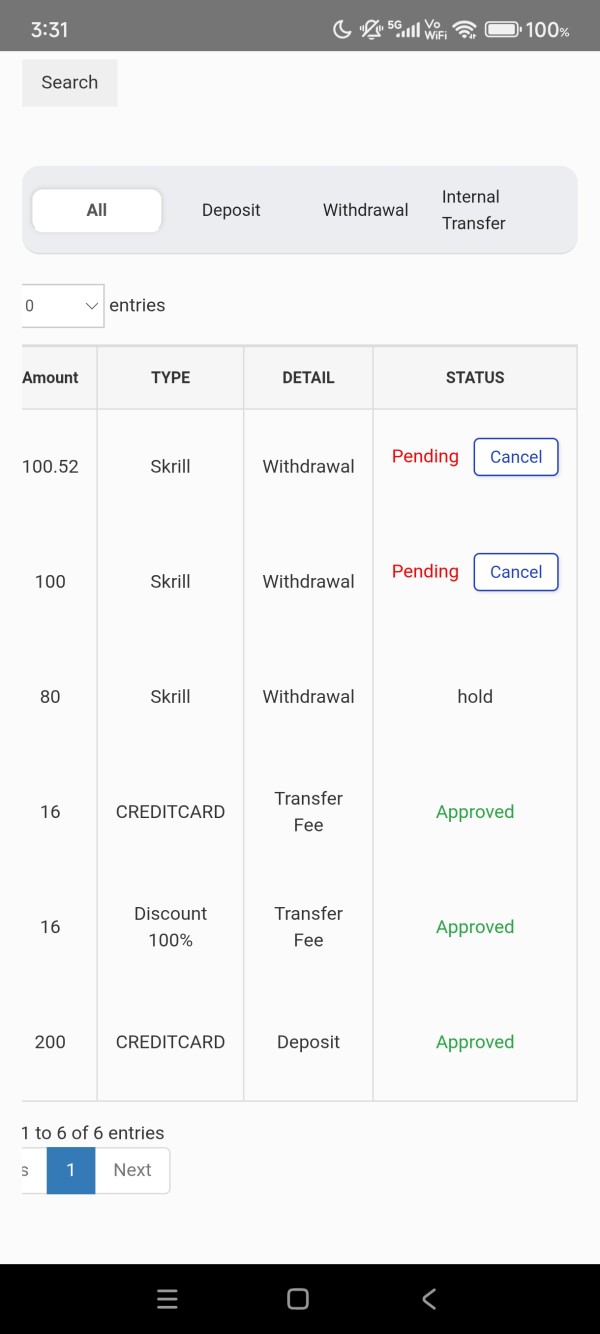

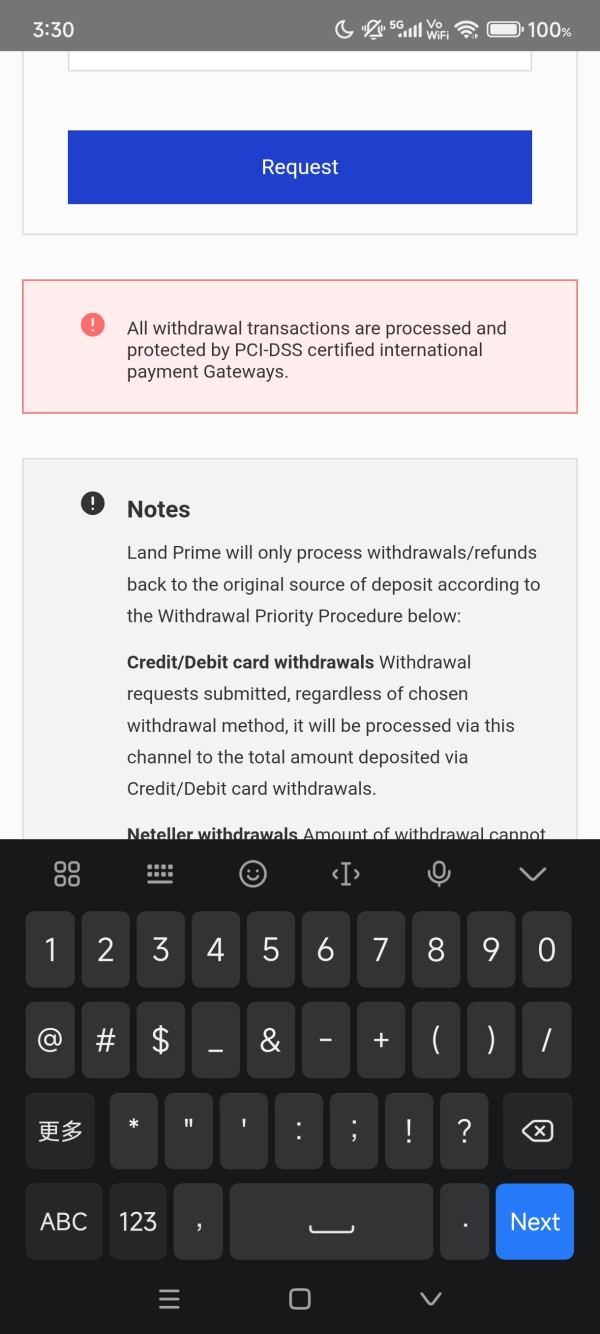

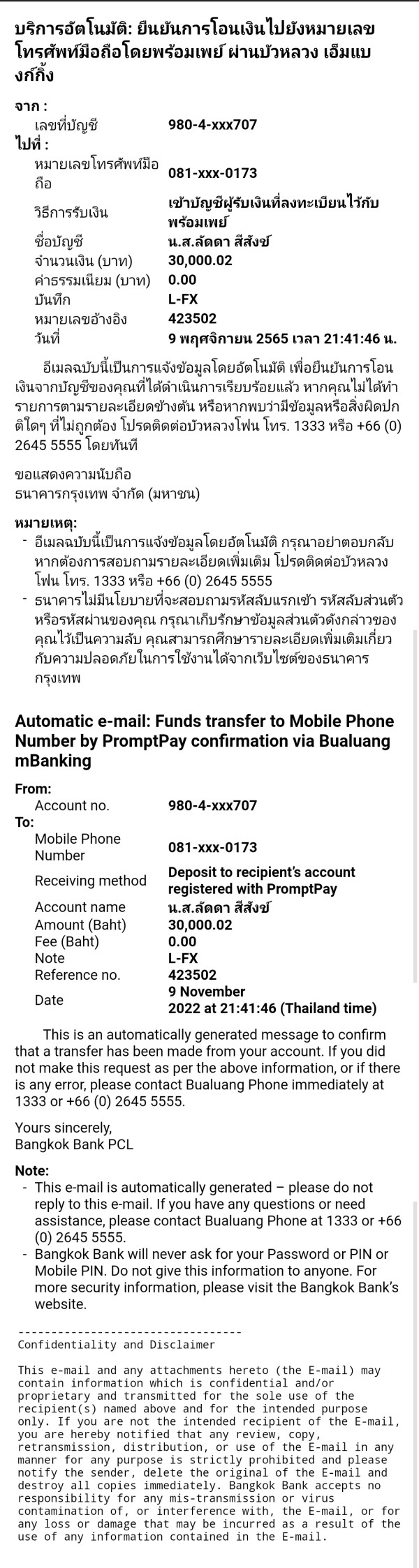

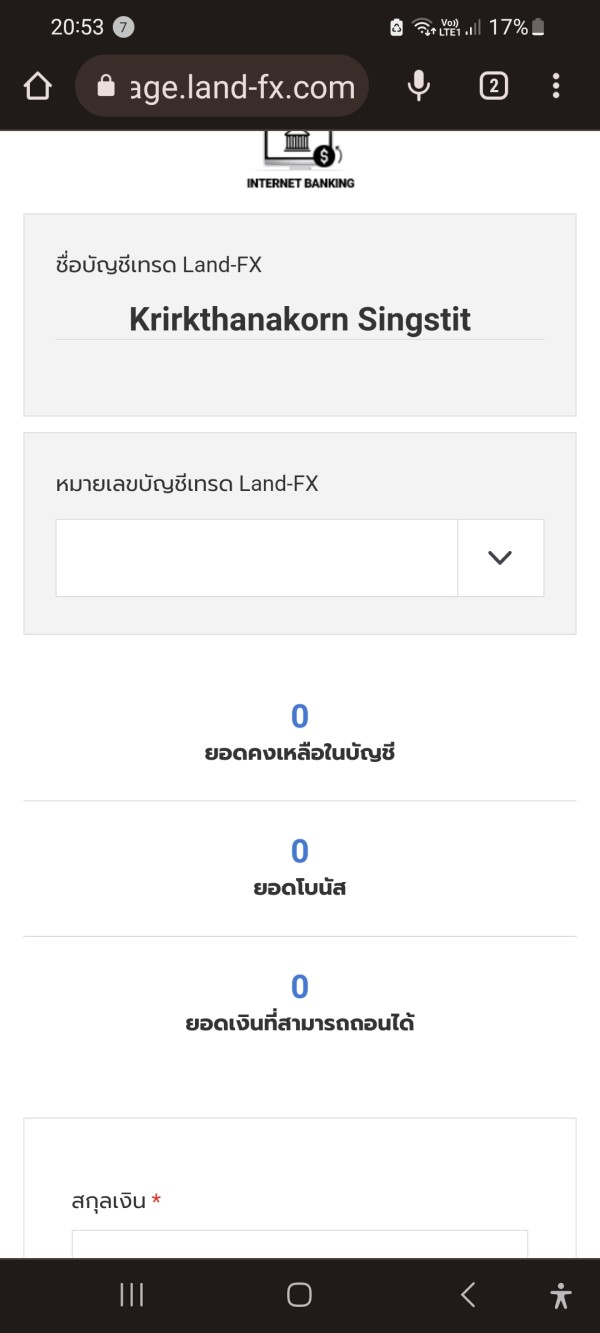

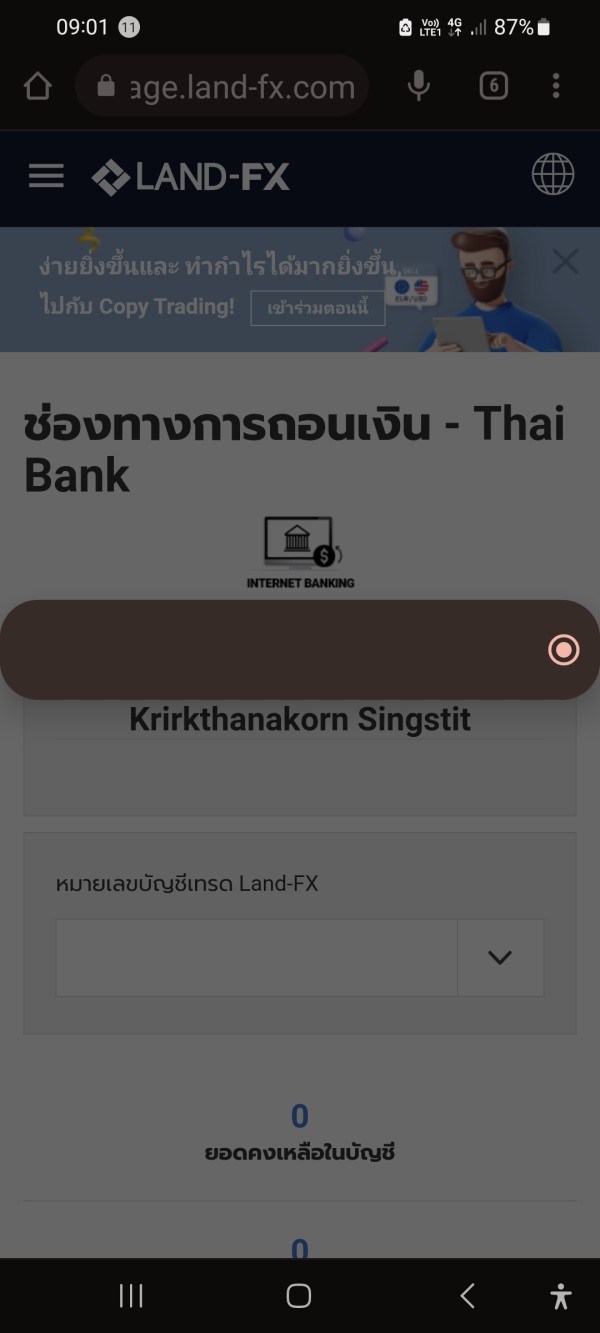

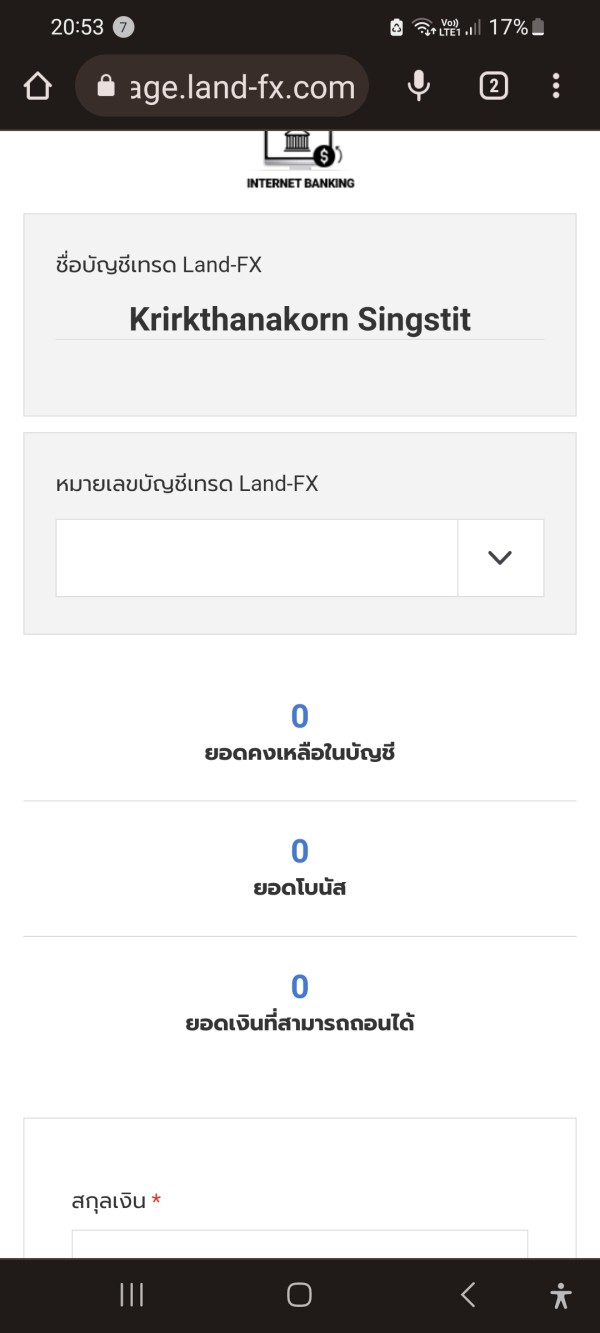

Deposit and Withdrawal Methods: We couldn't find specific information about available funding methods in the documentation we reviewed. You need to contact the broker directly to learn about all payment options.

Minimum Deposit Requirements: Current minimum deposit amounts were not listed in the materials we could access. You should ask Land Prime directly for accurate account opening requirements.

Promotional Offerings: We didn't find details about bonus structures and promotional campaigns in the materials we reviewed. Traders should contact the broker directly to learn about current incentive programs.

Tradeable Assets: Land Prime lets you trade foreign exchange pairs, CFDs on precious metals, major global indices, energy commodities, individual stock CFDs, and cryptocurrency derivatives. This wide selection of assets helps you spread risk across different market sectors.

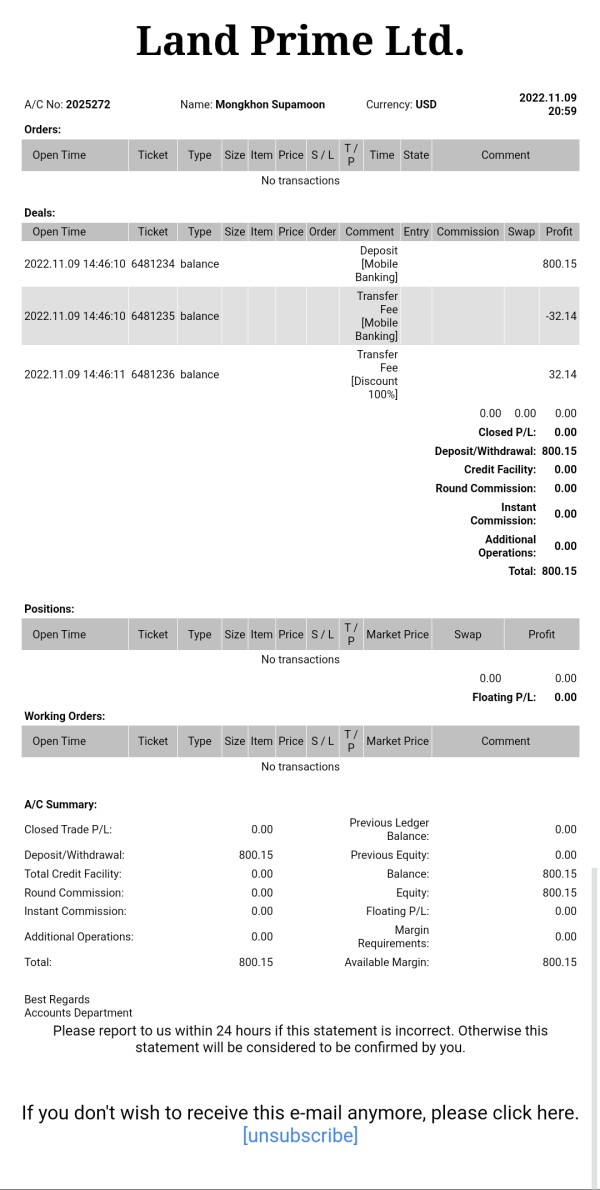

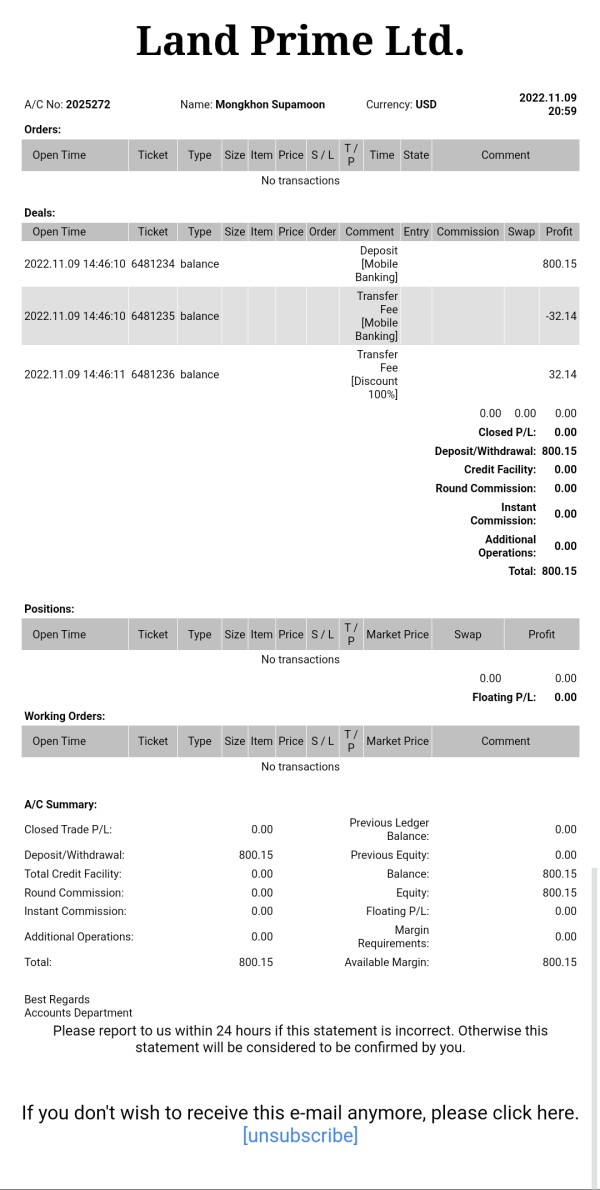

Cost Structure: Commission rates include $15.00 charges for specific products calculated on 1-lot trading volumes. You need to verify spread information and additional fee structures directly with the broker for complete cost analysis. This land prime review notes that complete pricing transparency is an area where more clarity would help potential clients.

Leverage Ratios: The broker offers flexible leverage arrangements. However, specific maximum ratios were not detailed in available documentation and may change based on where you live and what assets you trade.

Platform Options: Land Prime supports both MetaTrader 4 and MetaTrader 5 platforms. These give traders established industry-standard tools for technical analysis and automated trading strategies.

Geographic Restrictions: We didn't find specific country limitations in the materials we reviewed. However, regulatory requirements likely restrict services in certain countries.

Customer Support Languages: Available language support options were not specified in the documentation we could access. You need to contact the broker directly to learn about multilingual service availability.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

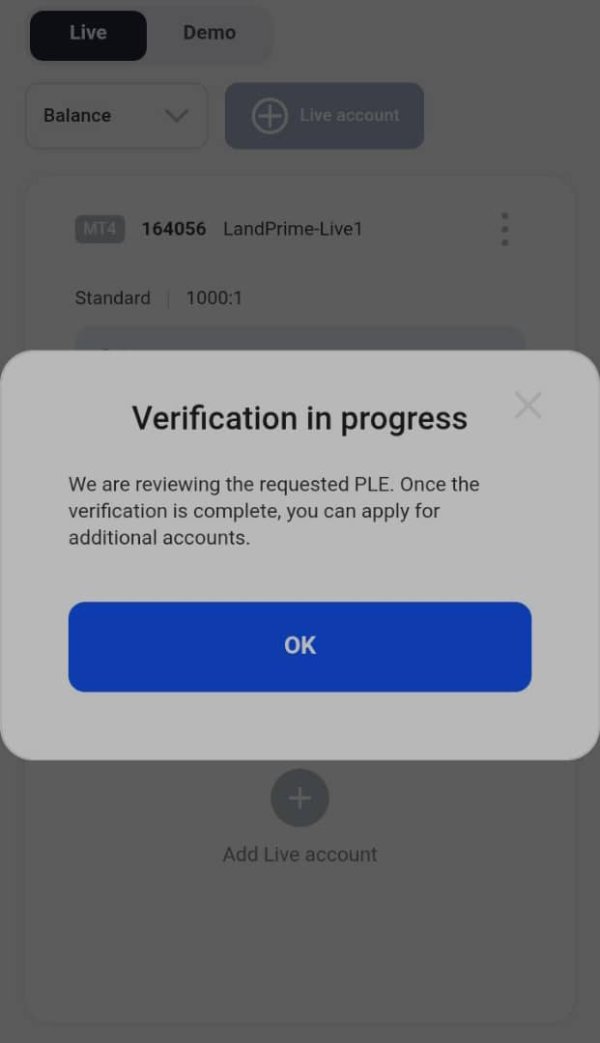

Land Prime's account structure uses a straightforward approach that experienced traders might like. However, it may limit options for beginners who need more guidance. The available information suggests the broker has standard account categories, but specific details about account types, their features, and what you need to qualify remain poorly documented in public materials.

The commission structure shows clear $15.00 charges for certain products based on 1-lot trades. This gives some pricing transparency that traders appreciate. However, the lack of detailed minimum deposit information creates uncertainty for potential clients trying to evaluate account accessibility. This lack of comprehensive account condition disclosure represents a significant limitation in this land prime review, as traders typically need complete cost structures before committing to a broker relationship.

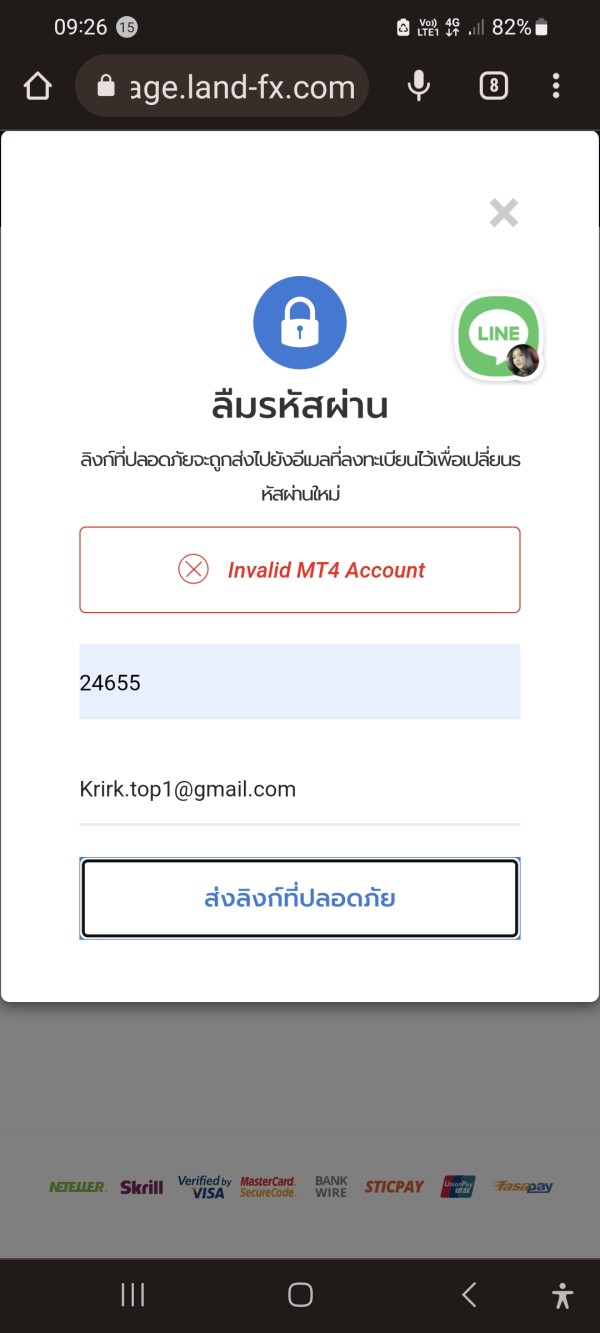

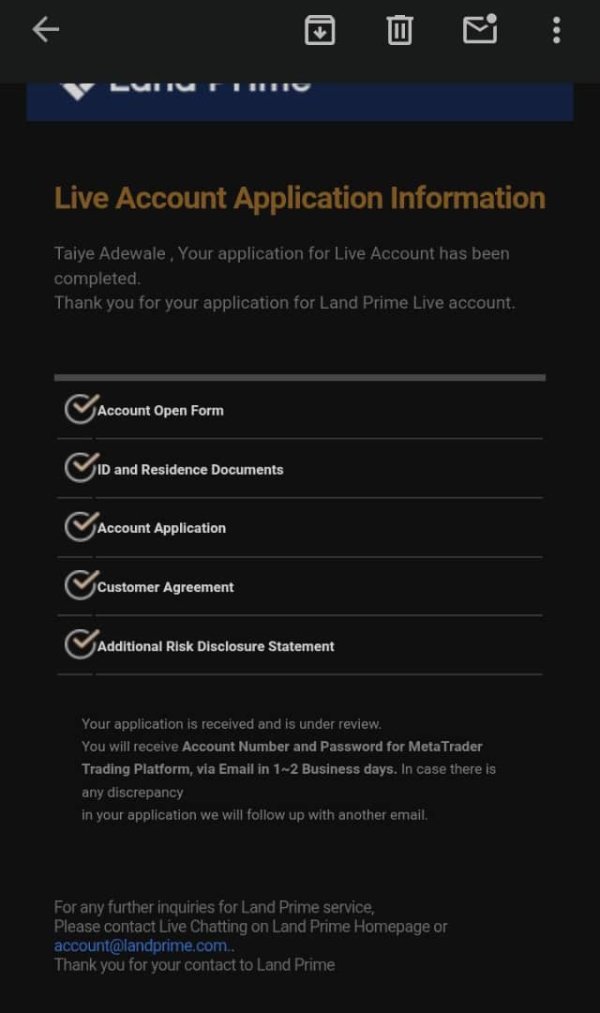

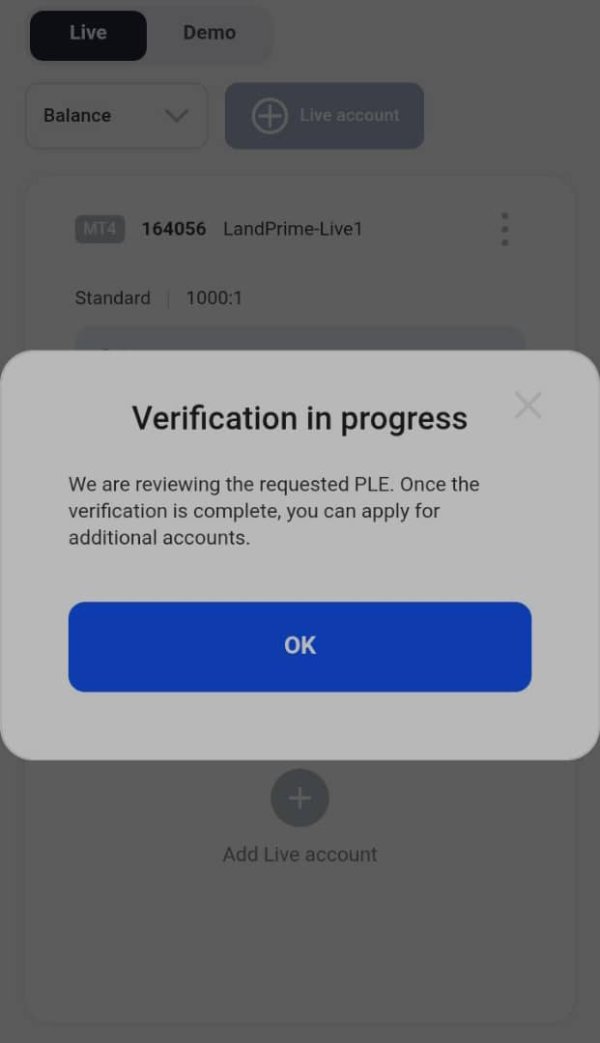

We couldn't find account opening procedures detailed in available materials. This makes it hard to assess how efficient the onboarding process is and what requirements you need to meet. The broker's approach appears to prioritize simplicity, though this may come at the expense of account customization options that some traders value. Special account features, such as Islamic-compliant accounts or professional trader classifications, were not addressed in the documentation we could access.

User feedback about account conditions has been mixed. Some traders appreciate the straightforward approach while others express frustration with limited information availability. The broker's commission transparency receives positive recognition, though the overall account condition framework would benefit from more comprehensive public disclosure to support informed decision-making.

Land Prime does well with platform offerings through its support of both MT4 and MT5 trading environments. These industry-standard platforms give traders comprehensive charting capabilities, technical analysis tools, and automated trading functionality that meets professional trading requirements. The broker's platform selection represents one of its strongest features, offering reliability and functionality that experienced traders expect.

You can trade multiple asset classes through these platforms, which makes the broker's tool offering better. This allows traders to diversify across forex, metals, indices, energy, stocks, and cryptocurrencies from unified trading interfaces. This integration supports efficient portfolio management and cross-market analysis strategies that many traders find valuable.

However, this land prime review identifies limitations in educational resources and market research offerings. Available documentation does not detail comprehensive educational programs, market analysis reports, or trading tutorials that many brokers provide to support client development. This gap may particularly impact newer traders who benefit from educational support during their learning process.

Automated trading support through the MetaTrader platforms gives you access to Expert Advisors and algorithmic trading strategies. However, specific broker policies regarding automated trading were not detailed in available materials. The platform's standard functionality includes backtesting capabilities and strategy optimization tools that support systematic trading approaches.

User feedback generally supports the platform stability and functionality. Traders acknowledge the reliability of the MT4/MT5 environment for order execution and market analysis. The broker's focus on core platform quality rather than extensive additional tools appears to work well with traders who prioritize execution over supplementary services.

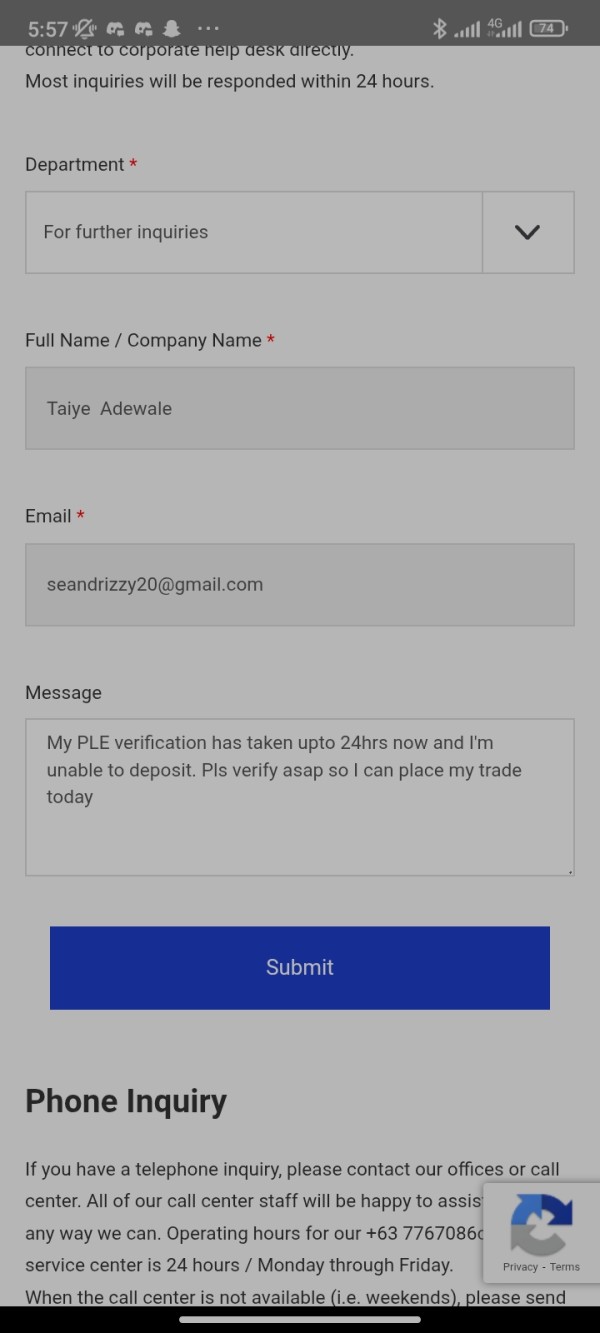

Customer Service and Support Analysis (Score: 6/10)

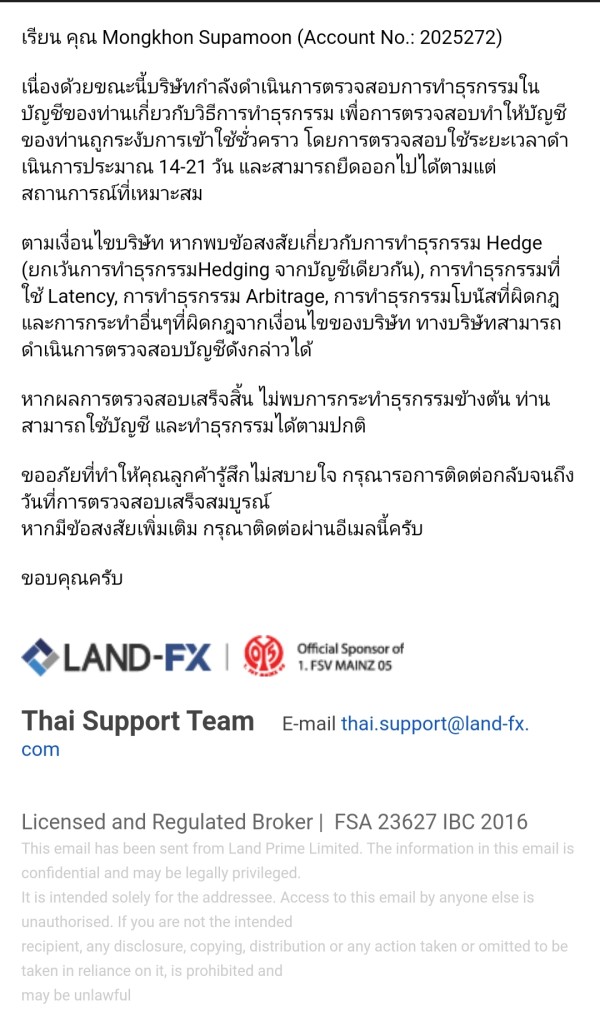

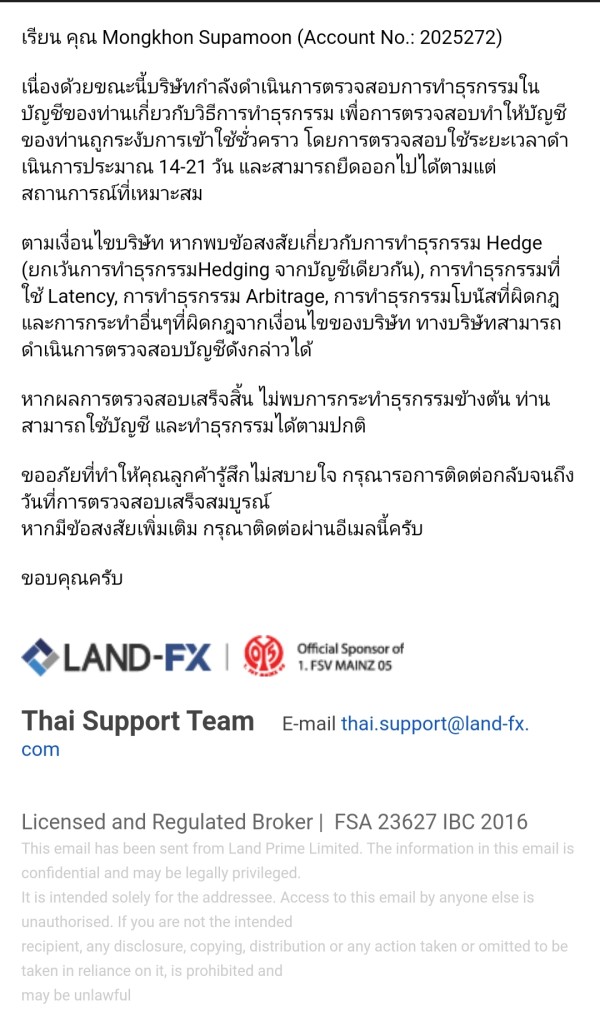

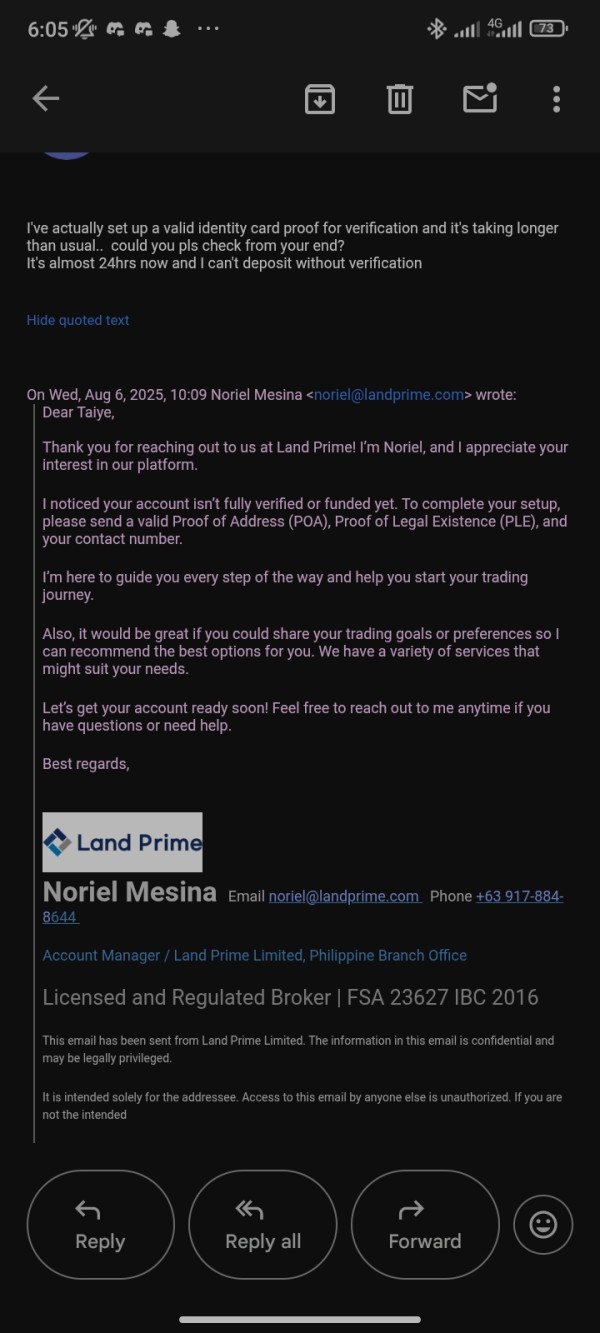

Customer service is an area where Land Prime shows mixed performance based on available user feedback. The broker has support channels, but user experiences show inconsistent response times and service quality that impact overall satisfaction levels. The variability in support experiences suggests systematic improvements could enhance client relationships significantly.

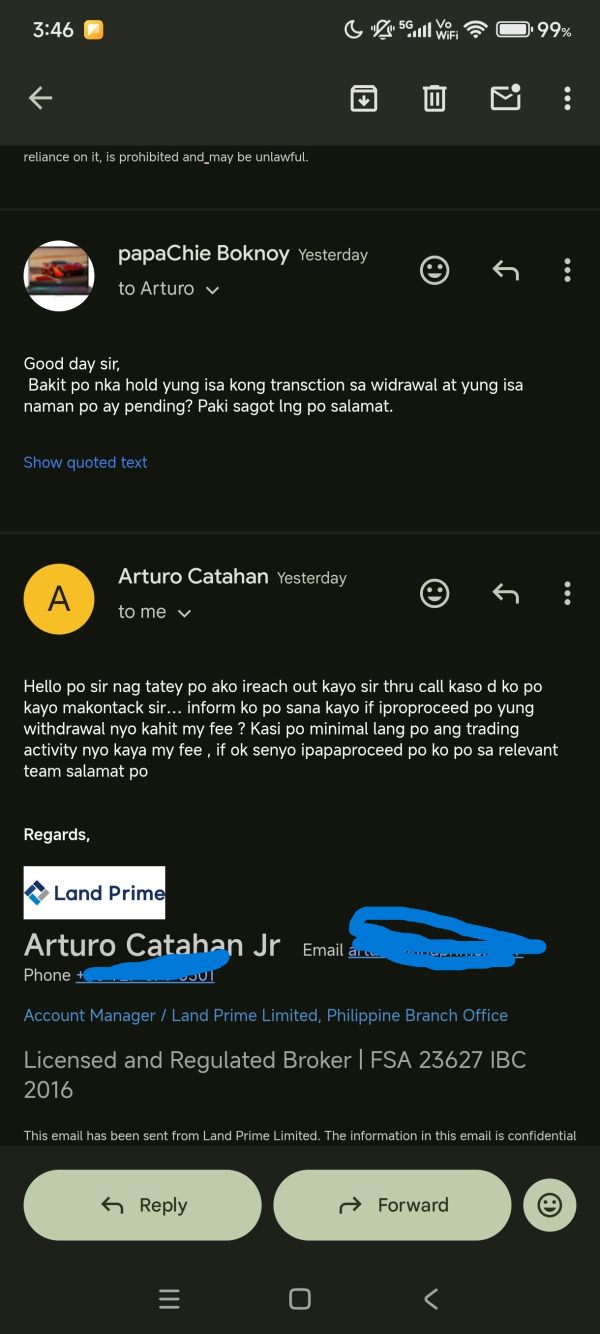

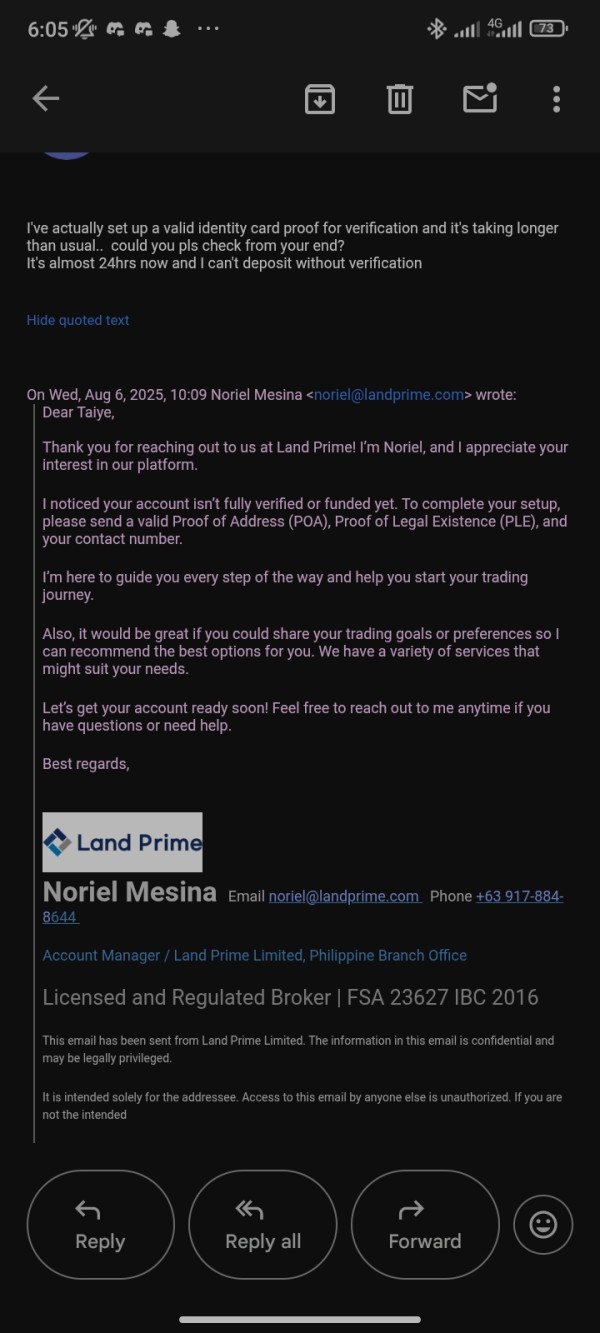

Response time concerns come up frequently in user feedback. Some clients report delays in receiving assistance for account-related inquiries and technical issues. This inconsistency in support responsiveness creates frustration for traders who need timely assistance, particularly during active trading periods when quick resolution becomes critical for maintaining trading operations.

Service quality appears to change based on inquiry complexity and support representative expertise. Some users report satisfactory problem resolution, while others have difficulty getting comprehensive answers to technical or account-related questions. This variability suggests training and standardization opportunities within the support framework.

Available documentation does not specify support channel options, operating hours, or multilingual capabilities. This creates uncertainty about accessibility for international clients. The absence of detailed support information represents a transparency concern that affects client confidence in available assistance levels.

User feedback shows that while basic support needs often get attention, more complex issues may require extended resolution periods. The broker's support framework appears adequate for routine inquiries but may struggle with sophisticated technical or regulatory questions that experienced traders occasionally encounter.

Trading Experience Analysis (Score: 7/10)

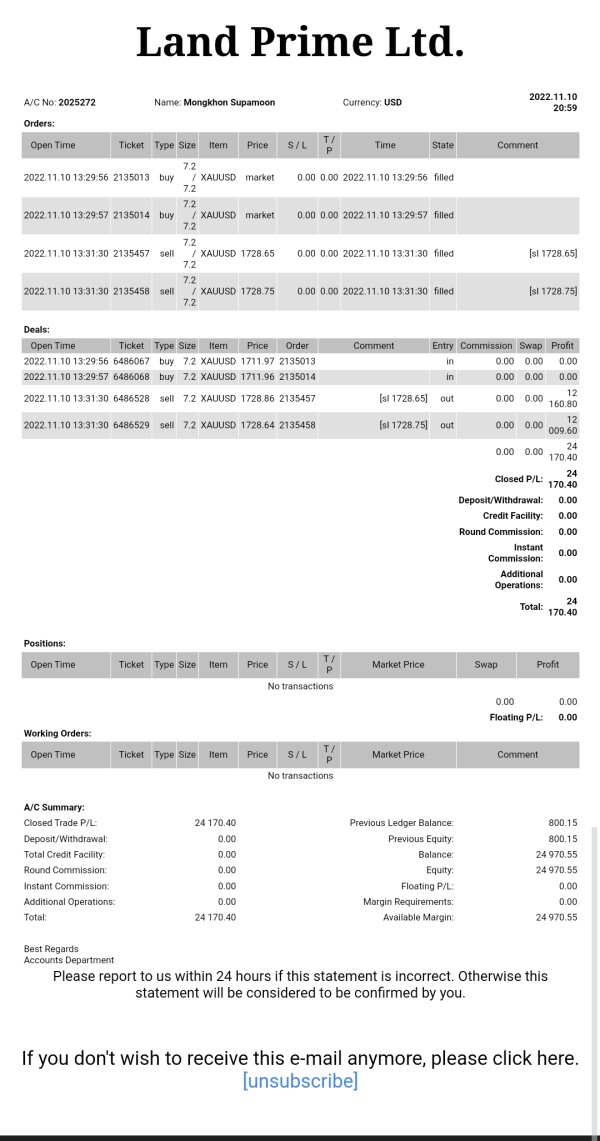

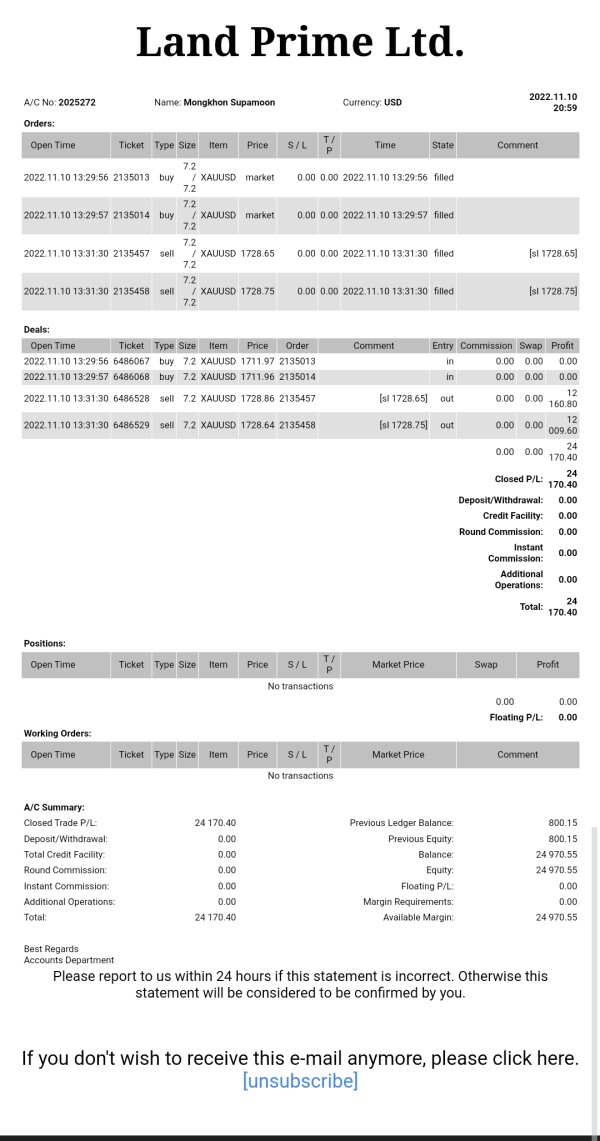

The trading experience with Land Prime focuses on platform stability and execution quality. These are areas where user feedback provides generally positive recognition. Traders acknowledge the reliability of the MT4/MT5 environment for order processing and market access, suggesting that core execution functionality meets professional standards for most trading strategies.

Platform stability receives favorable user comments. Traders note consistent access during normal market conditions. The broker's infrastructure appears capable of handling standard trading volumes without significant disruptions, though stress testing during high-volatility periods was not specifically addressed in available feedback.

Order execution quality represents a crucial component where specific performance metrics were not detailed in accessible materials. While users provide general satisfaction indicators, comprehensive execution statistics including fill rates, slippage data, and rejection frequencies would enhance evaluation accuracy for this land prime review.

The trading environment benefits from the comprehensive functionality of MetaTrader platforms. This includes advanced charting tools, technical indicators, and automated trading capabilities. These features support various trading styles from scalping to position trading, though specific broker policies regarding trading restrictions were not detailed in available documentation.

Mobile trading experience through MT4/MT5 mobile applications provides flexibility for traders requiring market access outside traditional desktop environments. However, specific mobile platform performance feedback was not extensively covered in available user comments, suggesting an area where additional user experience data would prove valuable.

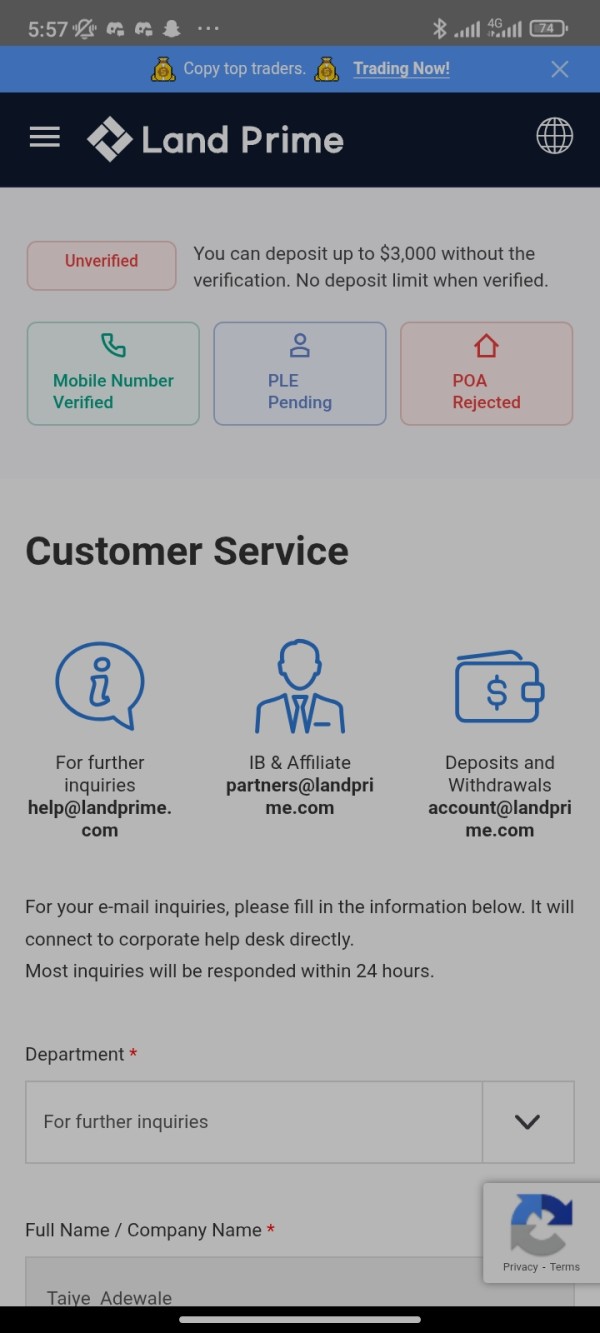

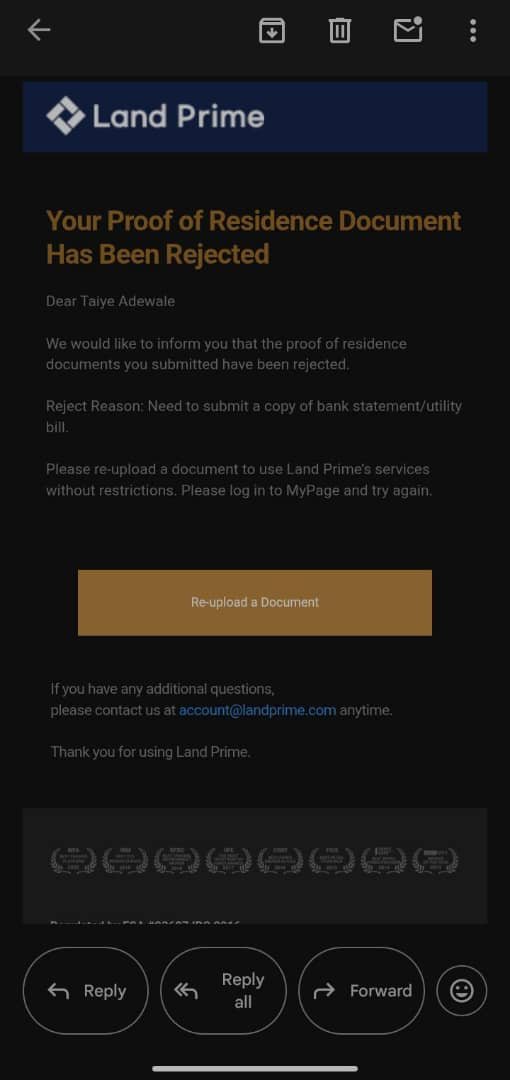

Trust and Regulation Analysis (Score: 6/10)

Land Prime's regulatory standing provides a foundation of legitimacy through FCA authorization (license 709866) and New Zealand FSP registration (264385). These regulatory relationships establish oversight frameworks that support client protection, though the effectiveness of these protections depends on specific regulatory implementations and enforcement practices.

The FCA regulation represents a significant trust factor. This authority maintains strict requirements for client fund segregation, operational transparency, and dispute resolution procedures. However, user feedback indicates concerns about overall transparency that somewhat reduce confidence despite regulatory oversight.

Fund safety measures were not comprehensively detailed in available materials. This creates uncertainty about specific client protection implementations beyond standard regulatory requirements. Clear communication about segregated account arrangements, insurance coverage, and bankruptcy procedures would strengthen trust indicators significantly.

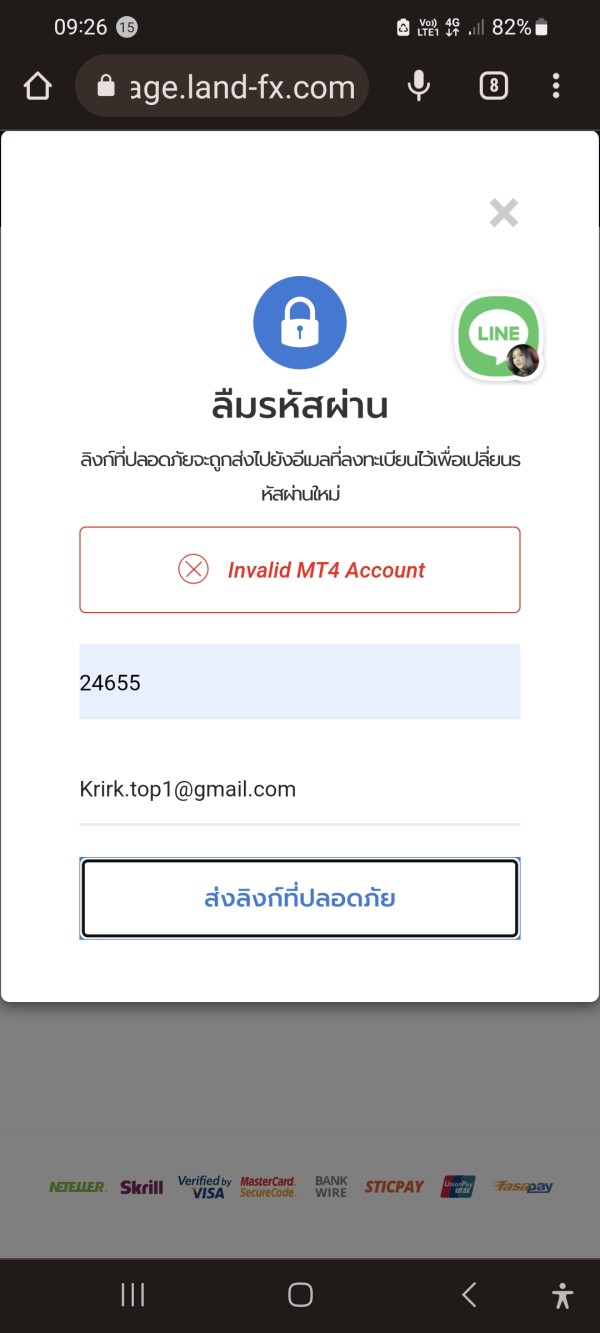

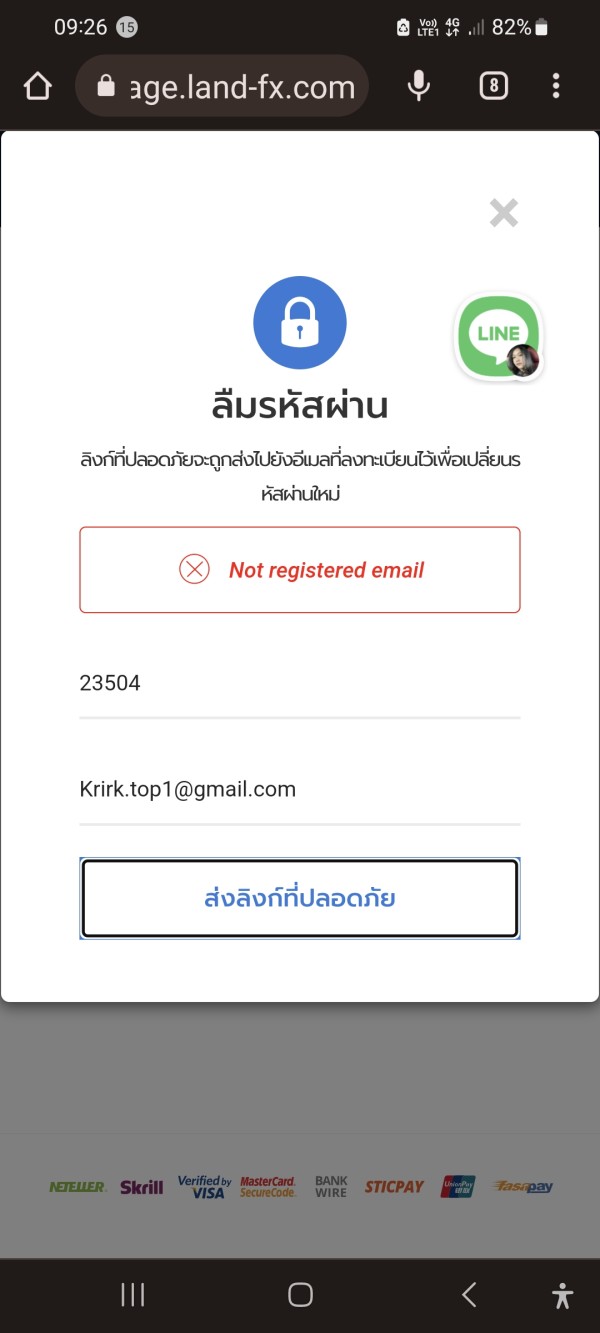

Company transparency emerges as a concern area based on user feedback. Some clients express frustration about information accessibility and communication clarity. The broker's acknowledged Asian origins and modest disclosure approach may contribute to these transparency perceptions, though regulatory compliance suggests adequate operational oversight.

Industry reputation reflects mixed indicators. Regulatory compliance supports legitimacy while user satisfaction scores suggest improvement opportunities. The broker's straightforward approach appeals to some traders while potentially limiting appeal for those seeking extensive transparency and communication.

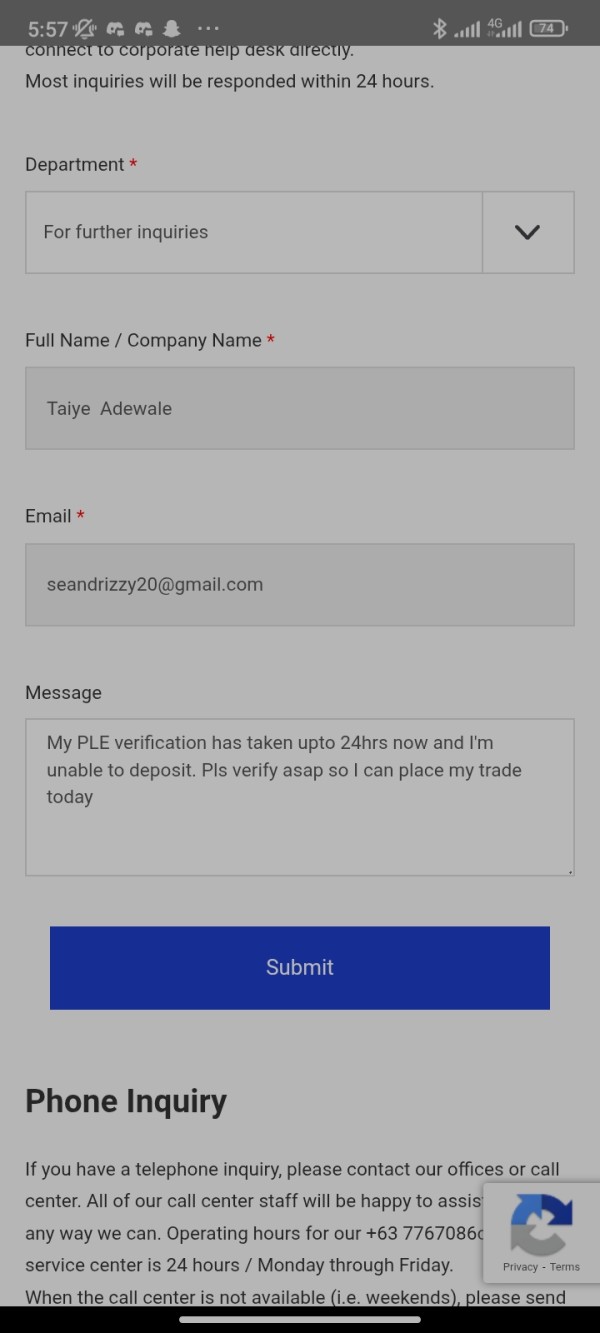

User Experience Analysis (Score: 5/10)

Overall user satisfaction with Land Prime reflects a mixed picture. The 1.9 rating from available reviews indicates significant improvement opportunities across multiple service areas. This low satisfaction score suggests systematic issues that impact client relationships and retention rates.

User feedback patterns show particular frustration with transparency and customer service responsiveness. These are areas that directly impact daily trading experiences. The combination of limited information availability and inconsistent support creates friction points that affect overall satisfaction levels significantly.

Registration and account verification processes were not detailed in available materials. However, user comments suggest these procedures may contribute to satisfaction concerns. Streamlined onboarding with clear communication would likely improve initial user experiences and set positive expectations for ongoing relationships.

The diversity of available trading assets and platform reliability receive more positive user recognition. This suggests that core trading functionality meets basic expectations even when supplementary services disappoint. This pattern indicates that Land Prime delivers on fundamental trading requirements while struggling with service quality and communication.

Common user complaints focus on transparency concerns and customer service quality. These are areas where systematic improvements could significantly enhance overall satisfaction. The broker's focus on core trading services appears insufficient to offset service quality concerns that impact user experience ratings substantially.

Conclusion

Land Prime presents a mixed proposition in the forex and CFD brokerage landscape. The company offers solid regulatory oversight and platform functionality while struggling with transparency and customer service quality. This land prime review identifies a broker that successfully delivers core trading requirements through FCA regulation and MT4/MT5 platform access, yet falls short of user expectations in communication and support areas.

The broker works best for experienced traders who care more about regulatory compliance and platform reliability than extensive educational resources or premium customer service. Land Prime's straightforward approach to trading services, combined with access to diverse asset classes, supports traders who need essential functionality without elaborate additional features.

Key advantages include established regulatory oversight, reliable trading platforms, and clear commission structures for certain products. However, significant disadvantages include limited transparency, inconsistent customer service, and low user satisfaction ratings that suggest systematic service quality concerns requiring attention.